Brine Concentration Technology Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Brine Concentration Technology Market Size and Share:

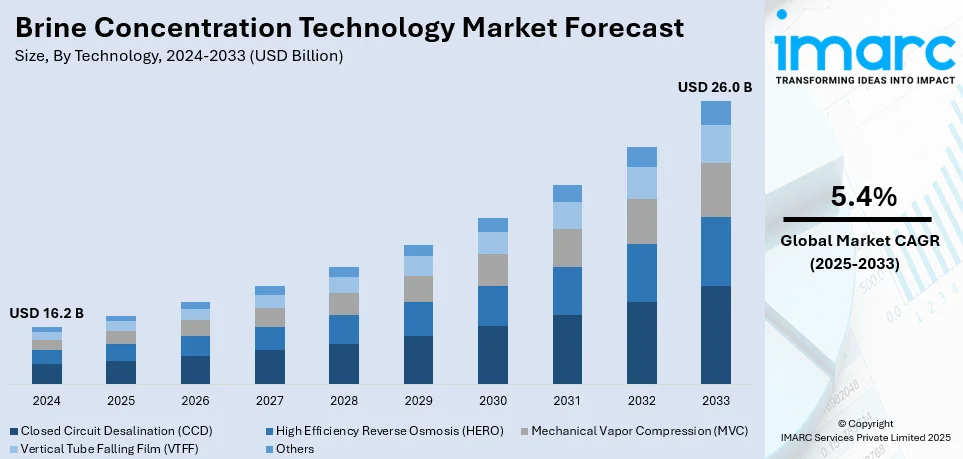

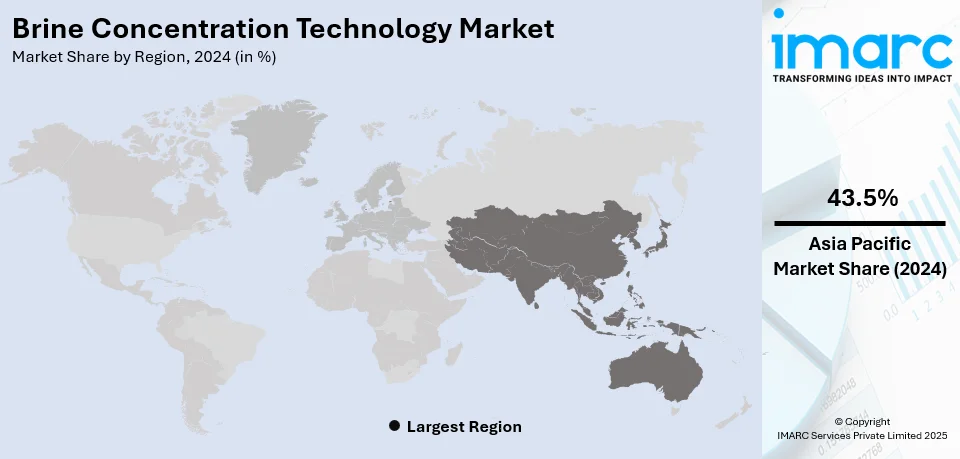

The global brine concentration technology market size was valued at USD 16.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 26.0 Billion by 2033, exhibiting a CAGR of 5.4% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 43.5% in 2024. The growth of the Asia Pacific region is driven by the growing demand for sustainable water solutions, government investments in infrastructure, rising environmental awareness, and advancements in technology. These factors are significantly increasing the brine concentration technology market share in the region, as industries adopt more efficient and eco-friendly solutions for water treatment and waste management.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 16.2 Billion |

| Market Forecast in 2033 | USD 26.0 Billion |

| Market Growth Rate (2025-2033) | 5.4% |

As water resources become increasingly scarce, particularly in regions facing droughts or growing populations, effective management of water waste becomes critical. Brine concentration technologies help in treating wastewater and managing brine disposal effectively. Additionally, the implementation of stringent regulations on water discharge, especially for industries that produce brine, are encouraging companies to adopt more efficient brine management solutions. Besides this, continuous innovation in desalination, wastewater treatment, and other water purification technologies is making brine concentration more efficient and economically viable. Furthermore, the growing industrial activities in sectors like chemical production, mining, and power generation, is creating large volumes of brine waste. This is driving the demand for solutions that can treat and recycle this waste in a sustainable way.

The United States is a crucial segment in the market, driven by improvements in desalination techniques like reverse osmosis. This is resulting in the development of efficient brine concentration technologies to manage the byproduct and prevent environmental harm. Moreover, collaborations between industry leaders and advancements in extraction technologies are leading to the development of more efficient brine management solutions, enhancing both the economic and environmental viability of resource recovery from brine. In 2024, Occidental Petroleum formed a joint venture with Berkshire Hathaway to commercialize direct lithium extraction (DLE) from geothermal waste brine in California's Salton Sea. Oxy’s subsidiary TerraLithium developed the technology, which captures lithium from brine with over 99% efficiency.

Brine Concentration Technology Market Trends:

Increasing Demand for Fresh Water

The market is primarily driven by the escalating demand for fresh water, which has been further intensified by population growth, rapid urbanization, and industrial development. A stark warning was issued by the World Economic Forum stating that global freshwater demand will be exceeded by 40% in 2030. Brine concentration technologies play a vital role in addressing this demand by enabling the efficient recovery and reuse of water from brine solutions. By extracting and concentrating water from brine, these technologies provide industries and communities with an alternative water source, alleviating the pressure on traditional freshwater supplies. This not only helps address water scarcity challenges but also promotes sustainable water management practices, reducing the overall strain on freshwater ecosystems and ensuring long-term water resource sustainability. The versatility of these technologies makes them applicable across various sectors, including desalination plants, food processing, chemical manufacturing, and wastewater treatment, further enhancing their significance in meeting the rising demand for fresh water.

Adoption of Desalination Processes

Desalination has gained prominence in water-scarce regions as well as coastal areas facing challenges in accessing fresh water sources. On average, there are 50 to 75 significant desalination projects per year in the United States, with an average capacity of approximately 1 million gallons per day, according to 2021 industry reports. Brine concentration technologies play a crucial role in desalination plants by effectively removing excess water from brine solutions, thus increasing the concentration of dissolved salts. As the demand for fresh water continues to rise, desalination projects are expanding globally, driving the need for efficient brine concentration technologies. These technologies enhance the overall desalination process, enabling higher water recovery rates, reducing energy consumption, and ensuring the production of high-quality freshwater. The brine concentration technology market growth is further propelled by advancements in desalination technologies, such as reverse osmosis and multi-stage flash, which rely on effective brine concentration methods to optimize water purification and resource utilization.

Stringent Environmental Regulations and Waste Management

Stringent environmental regulations and the need for effective waste management practices are driving industries to invest in brine concentration technologies. The Bipartisan Infrastructure Law brings more than USD 50 billion to the EPA to enhance the United States' drinking water, wastewater, and stormwater infrastructure. Disposal of brine waste can have a harmful impact on water bodies and ecosystems. Governments and environmental agencies worldwide have implemented strict regulations regarding brine discharge. Brine concentration technologies offer an environmentally responsible solution by treating and managing brine waste effectively. Industries are increasingly adopting these technologies to comply with regulations, reduce environmental footprint, and minimize the impact of brine disposal on aquatic ecosystems and surrounding environments.

Brine Concentration Technology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global brine concentration technology market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on technology and application.

Analysis by Technology:

- Closed Circuit Desalination (CCD)

- High Efficiency Reverse Osmosis (HERO)

- Mechanical Vapor Compression (MVC)

- Vertical Tube Falling Film (VTFF)

- Others

Vertical tube falling film (VTFF) represents the largest segment due to its superior efficiency and scalability in brine concentration processes. VTFF technology is widely recognized for its ability to handle large volumes of water with lower energy usage compared to other methods. The design of vertical tubes allows for enhanced heat transfer, which significantly improves the evaporation process, making it more energy-efficient. Additionally, VTFF systems offer reduced fouling, ensuring better long-term performance and minimal maintenance costs. This makes it highly attractive for industries like desalination and water treatment plants, where reducing operational costs is essential. The ability to scale up easily for large-scale operations further contributes to its dominance in the market. Moreover, the technology’s adaptability to various environmental conditions and its proven track record in handling brine efficiently are key factors driving its widespread adoption, making VTFF a leading choice in brine concentration technology.

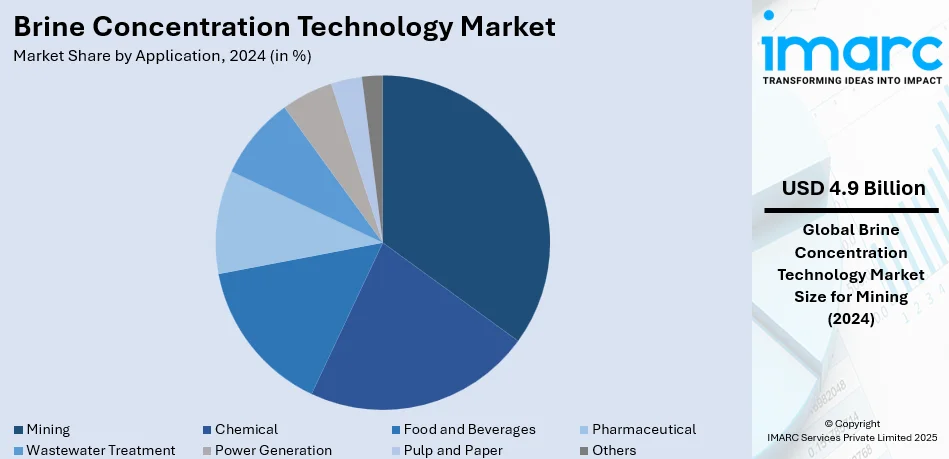

Analysis by Application:

- Mining

- Chemical

- Food and Beverages

- Pharmaceutical

- Wastewater Treatment

- Power Generation

- Pulp and Paper

- Others

Mining exhibits a clear dominance in the market attributed to its significant need for water treatment and efficient waste management solutions. The mining industry generates substantial amounts of brine as a byproduct, particularly from processes such as mineral extraction and ore processing. As water scarcity becomes a critical issue, mining companies are adopting advanced technologies to manage brine disposal and concentrate it for reuse. Brine concentration technologies, such as VTFF, offer effective solutions to reduce environmental impact by minimizing brine discharge and enabling water recovery. Moreover, the implementation of stringent environmental regulations governing water quality and waste disposal in mining operations are driving the demand for sustainable, efficient brine concentration systems. The ability to recycle water in mining operations supports environmental sustainability and also enhances operational efficiency by lowering water procurement costs, making brine concentration a crucial component of modern mining practices.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market due to its strong focus on sustainable water management practices, coupled with the region's growing brine concentration technology market demand. With increasing environmental concerns and the rising need for effective water treatment, countries in this region are investing heavily in advanced technologies to manage brine disposal and recover valuable resources. The presence of key industries such as mining, desalination, and power generation further contributes to the region's dominance in the market. Additionally, the region’s vast geographical diversity, including both coastal and inland areas with varying water scarcity levels, also drives demand for desalination and water treatment systems. Furthermore, the development of large-scale infrastructure projects across Asia Pacific continues to push the adoption of cutting-edge technologies, making it a leading hub for the brine concentration technology market. For instance, in 2024, India fast-tracked 208 large-scale infrastructure projects worth Rs 15.39 lakh crore under the PM GatiShakti initiative. The projects, spanning road, railway, urban, and energy sectors.

Key Regional Takeaways:

United States Brine Concentration Technology Market Analysis

The United States brine concentration technology market is intended to expand with a surge in urbanization and massive investments in infrastructures. The 2020 U.S. Census reported an increase of 6.4% of the urban population between 2010 and 2020. This has placed greater demand on efficient water and wastewater treatment solutions. With growing urban populations, it is essential to concentrate more on wastewater and desalination processes through brine concentration technology. Another factor is that the U.S. Bipartisan Infrastructure Law injects more than USD 50 Billion into the EPA, emphasizing upgrading drinking water, wastewater, and stormwater systems. All these strategies support the increased adoption of advanced water treatment technologies. With the fast-growing need for sustainable and efficient water solutions, brine concentration technology is increasingly recognized as achieving key benefits in reducing brine disposal costs, increasing water recovery rates, and improving the quality of wastewater treatment processes. This is the perfect combination of population growth and government investment in a robust environment for the expansion of brine concentration technology in the U.S. market.

Europe Brine Concentration Technology Market Analysis

Europe brine concentration technology market outlook is positive due to regulatory frameworks and huge investments in water infrastructure. The European Union's Water Framework Directive (WFD) has been the cornerstone of water protection since 2000, focusing on improving water quality and ensuring sufficient water availability. With water management becoming increasingly critical, the WFD encourages the adoption of innovative technologies to address water pollution and optimize water use. In addition, the socio-economic study by Water Europe requires investments of over Euro 255 Billion (USD 264 Billion) in the water domain within the next six years, thus accelerating the demand for efficient water treatment solutions. Technologies like brine concentration are thus expected to benefit from this investment, with a reduction in brine disposal issues and better efficiency in the treatment of water. The European Commission's commitment to achieving sustainability and resource recovery within the water sector also supports the growing need for brine concentration technologies, making this market an essential focus for Europe's future water infrastructure and environmental goals.

Asia Pacific Brine Concentration Technology Market Analysis

The growth of brine concentration technology in the Asia Pacific region is being driven by the increasing demand for water treatment solutions and sustainable energy practices. According to the PIB, the Indian government has set a target to raise the share of natural gas in the energy mix to 15% by 2030, promoting cleaner energy alternatives and driving demand for effective water management in industrial and urban sectors. Also, over 54% of the worldwide urban population-about 2.2 billion people-inhabits Asia (UN Habitat). So, fast urbanization puts many pressures on water resources, and sewage and waste treatment infrastructures. Concentration of brines plays a critical role in managing the by-products of desalination processes and improving water recovery efficiency. With concerns over water scarcity increasing and the need to enhance water quality in urban areas, the adoption of advanced brine concentration technologies is poised to increase across the Asia Pacific region to support both sustainable water and energy management initiatives.

Latin America Brine Concentration Technology Market Analysis

The increasing urbanization, water scarcity, and investments in water infrastructure around the region boost the growth of brine concentration technology in Latin America. While over 80% of the LAC population lives in urban areas, as reported by UNDP, this increases the demand for water. The largest country in the region is Brazil, and it is implementing 48 water and sewage projects in the structuring phase as of 2024 industry reports. The development of water infrastructure projects has accelerated with the increasing need to resolve water management problems in areas suffering from saline water and wastewater conditions. Alongside, the water treatment market of Latin America is growing. By 2025, the water sector in Brazil is expected to attract USD 6.4 billion in investments, as declared by the Brazilian Ministry of Regional Development. Overall, these contribute to the reasons for the application of advanced technologies for brine concentration to facilitate efficient brine treatment and a sustainable water resource management system that will cater to the increasing Latin American urbanization.

Middle East and Africa Brine Concentration Technology Market Analysis

The growth of brine concentration technology in the Middle East and Africa is spurred by the region's urgent problems with water scarcity and the need for sustainable solutions to manage water quality. According to a report in 2024 by UNICEF, there were about 319 million people in sub-Saharan Africa lacking access to clean sources of drinking water, which emphasizes the need for effective water treatment technologies. Hence, most countries in the region are working towards the development of better water infrastructure and wastewater management. The Middle East, due to its arid nature, has been highly investing in desalination and water treatment plants. Brine concentration technology, thus, assumes significant importance for managing the by-products of the desalination processes. Furthermore, with increased urban populations and a rise in the industrial requirements of water, brine concentration technology is also turning out to be a matter of great concern. Combined efforts toward addressing water scarcity and improving access to clean water in these regions are creating tremendous opportunities for the adoption of advanced brine concentration solutions.

Competitive Landscape:

The key players in the market are actively engaged in various strategic initiatives to strengthen their market presence and meet the evolving industry demands. These initiatives include research and development activities to enhance the efficiency and effectiveness of these technologies. Key players are investing in the development of advanced membrane filtration systems, innovative evaporation techniques, and integrated systems for improved brine concentration processes. Additionally, market players are emphasizing sustainable solutions, such as resource recovery and energy-efficient processes, to align with environmental regulations and cater to the growing demand for environmentally conscious technologies. They are also focusing on expanding their geographical reach through partnerships, collaborations, and acquisitions to tap into new market opportunities. In 2024, Standard Lithium announced the successful commissioning of North America's first commercial-scale Direct Lithium Extraction (DLE) column at its Demonstration Plant in El Dorado, Arkansas. The Li-ProTM LSS unit extracts lithium from Smackover Formation brine, achieving a 97.3% lithium recovery rate and over 99% contaminant rejection. This milestone supports sustainable lithium production from brine in North America.

The report provides a comprehensive analysis of the competitive landscape in the brine concentration technology market with detailed profiles of all major companies, including:

- Advent Envirocare Technology Pvt. Ltd.

- Enviro Water Minerals

- Fluid Technology Solutions Inc.

- Hyrec

- IDE Technologies

- Memsys

- Modern Water plc (DeepVerge plc)

- Saltworks Technologies Inc.

- Veolia Water Technologies

Latest News and Developments:

- January 2024: Livent expanded its capacity for lithium and increased its emphasis on Argentina for the production of lithium-ion battery demand. As well, Livent is searching for opportunities in new markets where it can enhance its product range beyond lithium.

- March 2023: Albemarle increased its lithium production capacity to meet the rising demand for lithium-ion batteries. The company has invested in new lithium extraction and processing projects, especially in Australia and South America, while focusing on sustainability initiatives, such as water consumption reduction and minimizing environmental footprint.

- January 2023: Veolia Water Technologies has partnered with OLI Systems to develop solutions in water treatment and management.

Brine Concentration Technology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Closed Circuit Desalination (CCD), High Efficiency Reverse Osmosis (HERO), Mechanical Vapor Compression (MVC), Vertical Tube Falling Film (VTFF), Others |

| Applications Covered | Mining, Chemical, Food and Beverages, Pharmaceutical, Wastewater Treatment, Power Generation, Pulp and Paper, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advent Envirocare Technology Pvt. Ltd., Enviro Water Minerals, Fluid Technology Solutions Inc., Hyrec, IDE Technologies, Memsys, Modern Water plc (DeepVerge plc), Saltworks Technologies Inc., Veolia Water Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the brine concentration technology market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global brine concentration technology market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the brine concentration technology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The brine concentration technology market was valued at USD 16.2 Billion in 2024.

IMARC estimates the brine concentration technology market to exhibit a CAGR of 5.4% during 2025-2033, reaching a value of USD 26.0 Billion by 2033.

The brine concentration technology market is driven by increasing water scarcity, the growing demand for desalination plants, and environmental concerns regarding brine disposal. Technological advancements, cost-effectiveness, and the need for sustainable solutions in water management also contribute to the market growth, as industries seek to minimize environmental impacts and optimize resource utilization.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the brine concentration technology market include Advent Envirocare Technology Pvt. Ltd., Enviro Water Minerals, Fluid Technology Solutions Inc., Hyrec, IDE Technologies, Memsys, Modern Water plc (DeepVerge plc), Saltworks Technologies Inc., Veolia Water Technologies, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)