Bridge Construction Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2026-2034

Bridge Construction Market Size and Share:

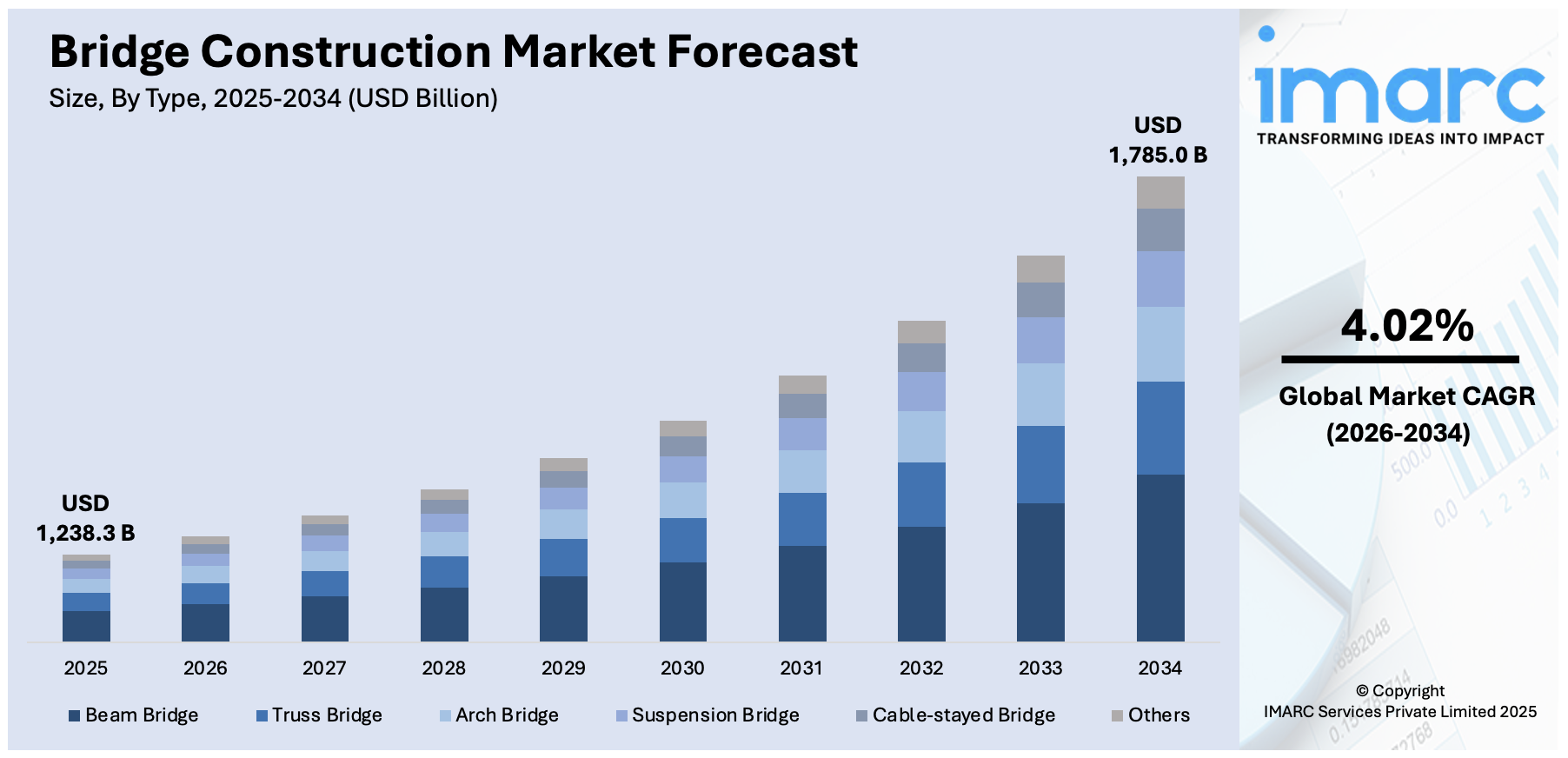

The global bridge construction market size was valued at USD 1,238.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,785.0 Billion by 2034, exhibiting a CAGR of 4.02% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 49.5% in 2025. The bridge construction market share is growing because of extensive infrastructure development, high urban population, government-led mega projects, and strong investments in road and rail connectivity across major economies.

Key Insights:

- In terms of region, Asia Pacific held the leading position in revenue with a share of 49.5% in 2025.

- Among types, beam bridge generated the highest revenue with a share of 36.6% in 2025.

- The concrete segment was the leading material with a share of 48.6% in 2025.

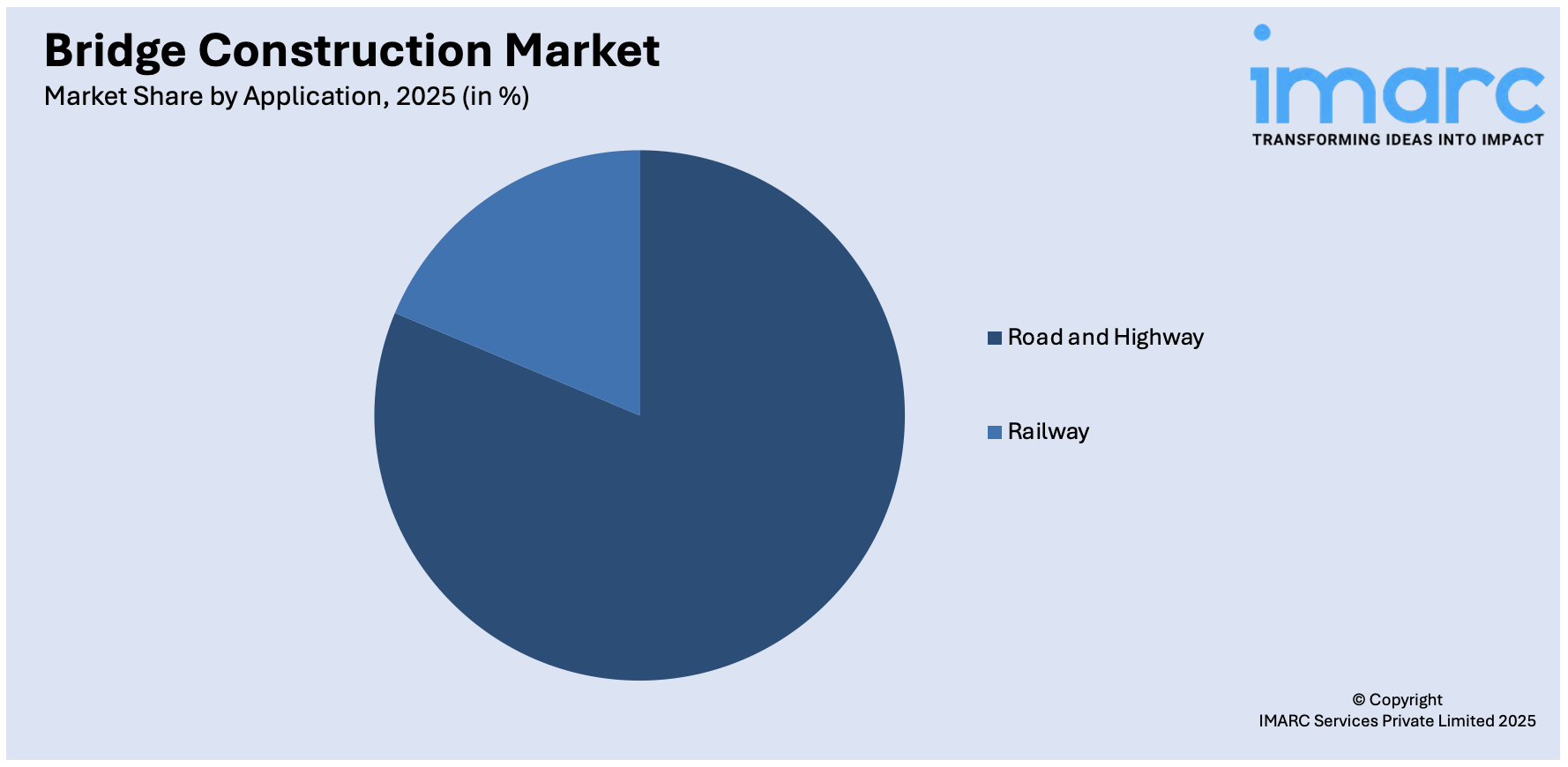

- In 2025, the road and highway segment led the market with a share of 80.5% among all other applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1,238.3 Billion |

|

Market Forecast in 2034

|

USD 1,785.0 Billion |

| Market Growth Rate 2026-2034 | 4.02% |

The increasing number of personal vehicles, commercial transport fleets, and trains is overwhelming existing infrastructure. Bridges play a vital role in easing this burden by enabling continuous movement across obstacles like rivers, valleys, and dense urban areas. Moreover, railways are expanding for both high-speed passenger travel and freight logistics. As these lines cross geographical barriers, dedicated railway bridges become crucial. These bridges are engineered for heavy loads, speed, and safety, especially for double-stacked or electrified rail operations. Additionally, public authorities are allocating substantial budgets to improve transportation networks, especially in developing economies. National highway programs and strategic connectivity missions are key contributors to bridge const project approvals. Besides this, modern construction technologies, including prefabricated bridge elements, segmental construction, and high-performance materials, enable faster builds with improved safety and quality. Digital tools like building information modeling (BIM), drone surveying, and artificial intelligence (AI)-based structural monitoring streamline planning and reduce delays.

To get more information on this market Request Sample

The United States is a vital part of the market, propelled by the expansion of cross-border trade infrastructure, especially at key trade routes. The rise in freight transport between the US and its neighboring countries is boosting the need for robust, secure rail and road bridges to enhance logistics, decrease delays, and uphold economic and security goals at border crossings. In 2024, Canadian Pacific Kansas City (CPKC) finished building the second span of the Patrick J. Ottensmeyer International Railway Bridge connecting Laredo, Texas, and Nuevo Laredo, Tamaulipas. This expansion more than doubled the cargo capacity at the biggest US-Mexico trade port. The $100 million initiative improved trade effectiveness and border safety. Besides this, the growing incidents of flooding, hurricanes, and seismic activity in the country are reshaping bridge design standards. New projects prioritize resilience through elevated decks, flexible joints, reinforced foundations, and improved drainage systems. These features help ensure structural integrity, minimize disruptions, and protect communities during extreme weather and natural disasters. This includes projects like temporary road bridge constructions after disasters.

Bridge Construction Market Trends:

Rising Road Traffic

The increasing volume of road traffic is a crucial factor bolstering the bridge building market growth, as authorities and city planners aim to reduce congestion and improve connectivity. As road systems are more heavily strained by passenger and cargo vehicles, the demand for effective transport infrastructure, especially bridges, keeps growing. Bridges are essential for overcoming physical barriers like rivers, valleys, railways, and crowded urban areas, facilitating continuous traffic movement and cutting down travel durations. Furthermore, the UK Government reports that car traffic increased by 3.0% compared to 2022, totaling 251.3 billion vehicle miles in 2023. The continuous rise in vehicle traffic not only exerts considerable strain on current infrastructure but also hastens surface wear, necessitating both new construction and the repair and enhancement of old bridges. The growth of urban areas, alongside increased suburban travel and logistics needs, is encouraging officials to focus on building multi-lane flyovers, interchanges, and elevated routes. These initiatives seek to enhance traffic flow, reduce congestion, and support anticipated traffic increases. Focus is being directed towards sturdy materials, adaptable designs, and intelligent monitoring systems to guarantee bridges are more secure, enduring, and better equipped for modern traffic levels. For example, in July 2025, ACCIONA, in partnership with Sacyr and Plenary Americas, won the "Innovation of the Year" award from ARTBA for the I-10 Calcasieu Bridge project in Louisiana. Separately, ACCIONA and Meridiam received the "Community Impact of the Year" award for the SR400 Express Lanes highway in Atlanta, Georgia. These accolades highlight the increasing value of innovative public-private partnerships (P3s) in the US bridge and highway construction market, including steel bridge construction for major infrastructure.

Growing Urban Populations Driving Bridge Construction

Rapid urbanization and a rising global population are pushing governments and private players to invest heavily in new bridge infrastructure. Expanding cities require better connectivity to ease traffic congestion and support efficient transport of goods and people. Mega cities, particularly in Asia-Pacific, are prioritizing large-scale bridge projects to link urban hubs with emerging suburbs and industrial areas. Increased demand for public transit systems, highway expansions, and cross-river links is prompting both new construction and upgrades of aging structures. This surge in urban development is fueling opportunities for advanced construction techniques, including modular bridge components and faster assembly methods, helping projects keep pace with the pressing needs of growing metropolitan regions.

Emphasis on Green and Resilient Bridge Solutions

The bridge construction sector is adopting materials and design practices that enhance durability while minimizing environmental impact. Governments and developers are setting stricter sustainability goals, promoting low-carbon materials, recyclable components, and energy-efficient construction methods. Resilience against extreme weather, earthquakes, and flooding is a key priority, with advanced engineering solutions like smart monitoring systems and corrosion-resistant materials gaining traction. Innovations such as self-healing concrete, fiber-reinforced composites, and renewable energy-powered maintenance systems are becoming mainstream. These efforts not only improve bridge lifespan but also align with global climate commitments, creating a market shift towards eco-friendly and future-ready infrastructure solutions.

Expansion of Railway Networks

The growing demand for railway infrastructure is driving the construction of bridge market demand. As countries expand their rail networks to improve regional connectivity and reduce road congestion, the need for railway bridges is increasing sharply. These structures are essential for traversing rivers, highways, and uneven terrains, ensuring seamless rail movement and operational efficiency. Governing bodies are actively investing in railway corridors to support freight and passenger transit, while public-private partnerships (PPPs) are playing a vital role in financing and executing complex bridge projects. Improved coordination between public authorities and private firms is streamlining construction timelines and encouraging the adoption of modern engineering practices. In 2023, China reported that its operational railway network reached 159,000 kilometers, underlining the pace of infrastructure development in major economies. The growing demand for robust, long-span, and durable railway bridges to support high-speed rail, urban metro systems, and inter-regional transit is offering a favorable bridge construction market outlook. This trend is not only creating opportunities for construction companies but also encouraging innovation in bridge design, materials, and construction methods tailored to railway applications, including the specialized need for footbridge construction in urban areas and small bridge construction for local connectivity.

Bridge Construction Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bridge construction market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, material, and application.

Analysis by Type:

- Beam Bridge

- Truss Bridge

- Arch Bridge

- Suspension Bridge

- Cable-stayed Bridge

- Others

Beam bridge stand as the largest component in 2025, holding 36.6% of the market. Beam bridge represents the largest segment because of its straightforward design, affordability, and appropriateness for short to medium spans. Its simple construction method enables quick setup, making it suitable for highway overpasses, rural road crossings, and temporary structures. The presence of pre-stressed concrete and steel beams increases load-bearing strength and longevity, while minimizing maintenance requirements. Beam bridge needs little formwork and can be built using regular construction tools, reducing both labor and material expenses. Its modular design enables simple adaptation according to terrain and load needs. Governments and private contractors favor beam bridge for projects with strict timelines and limited finances because of its rapid installation and minimal complexity. Moreover, innovations in pre-cast technologies are facilitating enhanced quality control and speeding up bridge construction schedules. These characteristics render beam bridge as the favored option in both developing and developed areas, particularly in undertakings requiring efficiency, dependability, and scalability.

Analysis by Material:

- Steel

- Concrete

- Composite Materials

Concrete dominates the market, holding a 48.6% share in 2025. The popularity of concrete is attributed to its cost-efficiency, widespread availability, and low maintenance needs. Concrete structure, particularly pre-stressed and reinforced designs, ensure superior load distribution and longevity, making it ideal for various infrastructure applications. Short to medium-span bridges, especially those on highways and urban overpasses, often rely on concrete for its strength and durability. Additionally, ongoing advancements in high-performance concrete formulations are enhancing its resistance to environmental factors and mechanical stress. On-site casting techniques further contribute to streamlined construction processes, reducing project timelines and costs. Innovations such as self-healing concrete and carbon-capturing materials are also gaining traction, promoting sustainability in the construction sector. As governments and private entities prioritize infrastructure development, concrete remains a preferred choice, supported by its adaptability to diverse engineering requirements and ability to meet modern design and performance standards.

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Road and Highway

- Railway

Road and highway lead the market with 80.5% of market share in 2025. Road and highway hold the biggest market share attributed to the continuous expansion of national and regional transportation systems designed to alleviate congestion and enhance logistics. Governments are emphasizing the building and upgrading of highways to support the increasing volumes of passenger and freight traffic. Strategic infrastructure initiatives aim to improve links between isolated and economic areas, facilitating quicker transportation of goods and services. Funding distributions for national highway improvement, border road connections, and rural road enhancements are continually increasing. Sophisticated planning tools and geotechnical methods are facilitating better alignment of bridges with road networks, particularly in challenging landscapes. Moreover, numerous areas are adopting intelligent roadway technologies, necessitating integration with bridge designs for future growth. PPP are further aiding the implementation of toll roads, bypasses, and expressways where bridges are essential elements. These factors collectively make road and highway development the leading application segment in bridge construction activities.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia-Pacific accounted for the largest market share of 49.5%. The Asia Pacific region leads the market due to continuous government funding in infrastructure, extensive transportation initiatives, and a rising need for better connectivity between rural and urban areas. Nations in the area are focusing on expanding national highways, enhancing cross-border road connections, and building expressways to facilitate trade and shorten travel durations. For example, in 2025, the construction of the Taoyaomen highway-railway bridge in Zhejiang achieved a significant milestone with the finishing of the second layer of concrete pouring for the foundation cap of Pier 5. This bridge, measuring 1,531 meters in length with a central span of 666 meters, is crucial for the Ningbo-Zhoushan Railway. The project is currently moving into the primary tower stage. In addition to this, increasing vehicle ownership and expanding freight movement are stressing the current transport infrastructure, leading to enhancements and new bridge building. Moreover, the presence of a substantial, adept labor force and affordable raw materials facilitates project expansion.

Key Regional Takeaways:

United States Bridge Construction Market Analysis

In North America, the market portion held by the United States was 85.10% of the overall total. United States is experiencing a surge in bridge construction adoption due to growing investment in infrastructure, which is driving the development of advanced transportation networks. For instance, in a series of bills passed by Congress, over USD 1.2 Trillion will be spent between 2021 and 2030 to modernize aging U.S. infrastructure. Increasing budget allocations for modernizing aging bridges and expanding highway connectivity are accelerating large-scale construction projects. Efforts to enhance traffic movement, decrease congestion, and improve road safety are prompting authorities to focus on durable materials and innovative engineering solutions. Infrastructure investment is also fueling smart bridge technologies that incorporate real-time monitoring and predictive maintenance to extend lifespan. Rising public and private sector funding is leading to new bridge projects that enhance intercity and interstate connectivity. The push for sustainable infrastructure is further promoting the adoption of environmentally friendly construction methods. With infrastructure investment playing a pivotal role in economic growth, the increasing need for structurally sound and resilient bridges is propelling construction activity across urban and rural areas.

Europe Bridge Construction Market Analysis

Europe is witnessing accelerated bridge construction adoption due to growing investment in road network, which is enhancing regional connectivity and transportation efficiency. For instance, The European Road network consists of 5.5 Million Km. Increasing budget allocations for upgrading existing roads and developing new expressways are driving demand for structurally advanced bridge solutions. Authorities are prioritizing infrastructure projects that reduce congestion, enhance road safety, and support seamless intercity travel. Road network expansion is promoting the construction of robust bridges capable of withstanding high traffic loads and extreme weather conditions. The need for durable and resilient bridge structures is leading to innovations in material usage, including high-performance concrete and corrosion-resistant steel. Growing public and private sector involvement in infrastructure development is propelling large-scale bridge projects. The emphasis on sustainable road infrastructure is driving investment in energy-efficient bridge designs. With road network investment playing a crucial role in transportation enhancement, bridge construction is gaining momentum across urban and rural areas.

Asia Pacific Bridge Construction Market Analysis

Asia-Pacific is witnessing an upsurge in bridge construction adoption due to growing expansion of railway networks, fostering the development of new and upgraded crossings to accommodate rising transportation demands. For instance, India has the fourth largest railway network in the world, with a total length of 92,952 kilo meters. It is the world's largest passenger railway network, carrying over 23 Million passengers each day. Expanding railway connectivity across diverse terrains necessitates the construction of resilient bridges capable of supporting high-speed rail systems and freight corridors. The push for efficient rail transport is leading to investments in long-span and cable-stayed bridge structures to enhance load-bearing capacities. The need for seamless urban mobility and improved intercity transit is accelerating the demand for modernized bridge solutions. Authorities are prioritizing railway network expansion to reduce travel times and enhance economic productivity, driving large-scale bridge projects. Innovations in bridge design, including seismic-resistant structures, are addressing regional challenges while supporting railway infrastructure. Growing railway network expansion is reinforcing bridge construction initiatives aimed at improving accessibility, facilitating trade, and ensuring efficient passenger and freight movement.

Latin America Bridge Construction Market Analysis

Latin America is seeing a rise in bridge construction adoption due to growing rapid urbanization, which is fueling the demand for enhanced transportation infrastructure. For instance, 85.2 % of the Latin America population is urban (565,084,260 people in 2024). Expanding urban populations are increasing the need for well-connected road and bridge networks to support mobility and economic activities. The construction of new bridges is aimed at reducing congestion and improving intercity access. Urban expansion is also leading to the adoption of advanced engineering techniques to construct resilient and long-lasting structures. Governments are prioritizing infrastructure projects to accommodate increasing urban mobility, reinforcing bridge development across key metropolitan areas.

Middle East and Africa Bridge Construction Market Analysis

Middle East and Africa is witnessing rising bridge construction adoption due to growing expanding construction industry, which is driving large-scale infrastructure projects. According to reports, Saudi Arabia's construction sector is booming, with over 5,200 projects currently underway, valued at USD 819 Billion. Increasing demand for improved transportation networks is leading to investments in bridge development to enhance regional connectivity. Rapid expansion of urban and industrial areas is fostering the construction of modern bridge structures. The construction industry is integrating advanced materials and engineering methods to build resilient and efficient bridges. Infrastructure projects are prioritizing bridge development to support growing economic activities and intercity transportation.

Top Bridge Construction Companies in the World:

Key players in the market are focusing on expanding their project portfolios through domestic and international contracts. They are adopting advanced construction technologies to improve project efficiency, safety, and timelines. Emphasis is being placed on sustainability, with growing employment of environment-friendly materials and energy-efficient practices. Companies are also strengthening their design and engineering capabilities through digital tools such as BIM and project management software. Strategic partnerships and joint ventures are being used to access new markets and share technical expertise. To maintain competitiveness, firms are investing in workforce training and automation. Continuous R&D efforts aim to enhance structural durability, cost control, and adaptability to challenging environments and complex project demands. In 2024, China made significant strides in large-span arch bridge construction, with the Tian’e Longtan Bridge setting a new world record at 600 meters. Jielian Zheng’s research highlighted innovations in CFST and SRC bridge construction, improving efficiency and safety. These breakthroughs marked a new chapter in global bridge engineering.

The report provides a comprehensive analysis of the competitive landscape in the bridge construction market with detailed profiles of all major companies, including:

- AECOM

- Balfour Beatty

- Bouygues Construction

- China Communications Construction Company Limited

- China Railway Group Limited

- China State Construction Engineering Corporation (CSCEC)

- Fluor Corporation

- Grupo ACS

- Hochtief

- Kiewit Corporation

- Samsung C&T

- Skanska

- VINCI Concessions

Latest News and Developments:

- April 2025: India’s prime minister inaugurated the New Pamban Bridge in Tamil Nadu, marking Ram Navami. India's first vertical lift sea bridge sets a new standard in infrastructure and maritime connectivity. The bridge’s history dates back to 1914, when the original Pamban Bridge, a cantilever structure, was built to link Rameswaram Island with mainland India. This new bridge showcases India’s engineering excellence and infrastructure growth.

- March 2025: The Kharagpur Division completed a 6-meter-wide foot over bridge (FOB) at Jhargram Railway Station, enhancing commuter safety and convenience. Built at an estimated cost of INR 4 Crore in collaboration with RVNL and Railway authorities, the FOB connects all six platforms. It features wide walkways, non-slip flooring, improved lighting, and two lift facilities, streamlining foot traffic and reducing accident risks, especially during peak hours.

- December 2024: Amtrak completed a key milestone for the Susquehanna River Bridge Project by removing the final remnant pier from the river. This cleared the way for major construction of two new bridges with four tracks, replacing the existing 1906 two-track bridge. Contractor Fay Construction safely removed 10 leftover piers from an 1866 railroad bridge earlier in the year. The project remained on schedule, marking significant progress in modernizing rail infrastructure.

- November 2024: The U.S. Department of Transportation announced nearly USD 635 million for 22 bridge projects nationwide under the Bridge Investment Program. Funded by the Bipartisan Infrastructure Law, the initiative aimed to enhance safety, boost economic competitiveness, and strengthen supply chains. These projects improved connections for commuters, emergency responders, and transit users. The USD 40 billion program spanned five years to address critical bridge repairs.

- September 2024: The Hindon River bridge, linking Noida and Greater Noida, was set for completion by December 2026, with 30% of work completed. The approximately USD 7.8 million project aimed to reduce travel time by 40 minutes and ease congestion. Funded by Noida and Greater Noida authorities, construction was managed by UP State Bridge Corporation Limited. Work resumed in November 2023 after delays.

- September 2024: Construction of the Huajiang Grand Canyon Bridge in Guizhou, China, progressed, with workers seen on-site. Set to be the world's highest bridge at 625 meters above the Beipanjiang River, it began in 2022 and was expected to complete in 2025. Spanning 2,890 meters, the bridge connected Liuzhi special district and Anlong County via an expressway. Located in Guanling’s Bouyei-Miao Autonomous County, it enhanced regional connectivity.

- September 2024: PNC Infratech secured a USD 46 million contract for a highway and bridge construction project on the Ganga River, linking Buxar and Bharauli via NH-922. The project followed the hybrid annuity model, reinforcing PNC Infratech’s expertise in infrastructure development. The company specialized in expressways, bridges, flyovers, and airport runways across India. With a strong track record, PNC Infratech offered end-to-end solutions, including EPC, DBFOT, and O&M services.

Bridge Construction Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Beam Bridge, Truss Bridge, Arch Bridge, Suspension Bridge, Cable-stayed Bridge, Others |

| Materials Covered | Steel, Concrete, Composite Materials |

| Applications Covered | Road and Highway, Railway |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AECOM, Balfour Beatty, Bouygues Construction, China Communications Construction Company Limited, China Railway Group Limited, China State Construction Engineering Corporation (CSCEC), Fluor Corporation, Grupo ACS, Hochtief, Kiewit Corporation, Samsung C&T, Skanska, VINCI Concessions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bridge construction market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bridge construction market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bridge construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bridge construction market was valued at USD 1,238.3 Billion in 2025.

The bridge construction market is projected to exhibit a CAGR of 4.02% during 2026-2034, reaching a value of USD 1,785.0 Billion by 2034.

The bridge construction market is growing due to rising infrastructure investments and increasing demand for efficient transportation networks. Government initiatives, public-private partnerships, and budget allocations for road and rail connectivity are supporting project development. Technological advancements in materials and construction methods are further enabling faster execution, improved durability, and cost-effective maintenance of bridges.

Asia Pacific currently dominates the bridge construction market, accounting for a share of 49.5%. The dominance of the region is because of extensive infrastructure development, high urban population, government-led mega projects, and strong investments in road and rail connectivity across major economies.

Some of the major players in the bridge construction market include AECOM, Balfour Beatty, Bouygues Construction, China Communications Construction Company Limited, China Railway Group Limited, China State Construction Engineering Corporation (CSCEC), Fluor Corporation, Grupo ACS, Hochtief, Kiewit Corporation, Samsung C&T, Skanska, VINCI Concessions, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)