Breath Analyzer Market Size, Share, Trends and Forecast by Technology, Application, End-User, and Region, 2025-2033

Breath Analyzer Market Size and Overview:

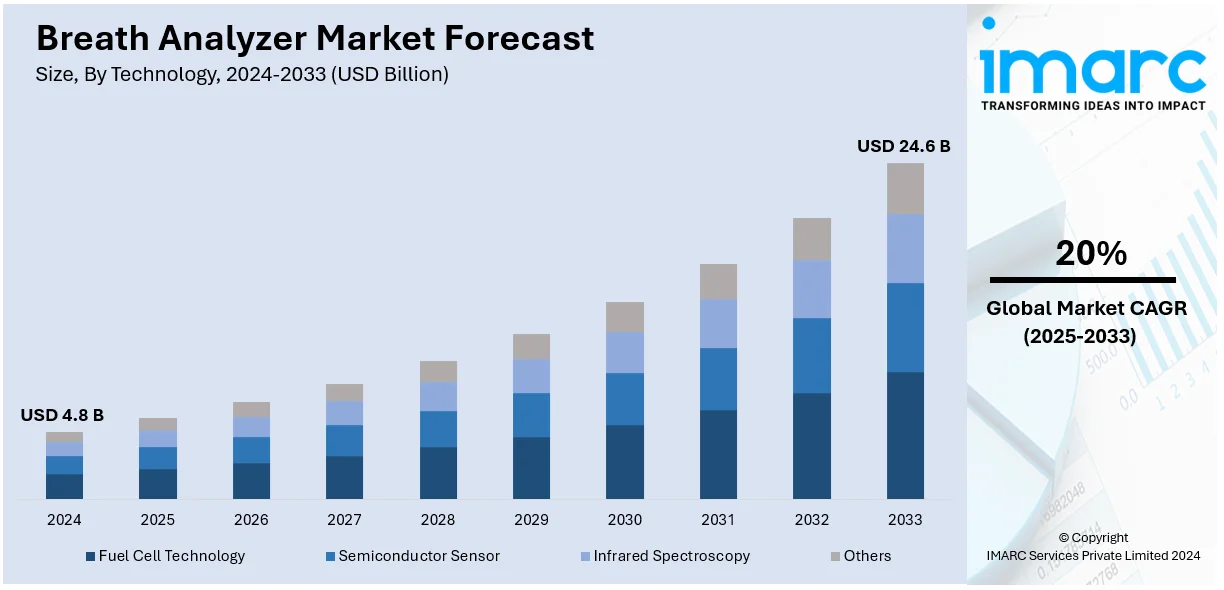

The global breath analyzer market size was valued at USD 4.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.6 Billion by 2033, exhibiting a CAGR of 20% during 2025-2033. North America currently dominates the market, holding a significant market share of over 43.3% in 2024. The market is experiencing significant growth mainly driven by rising awareness of alcohol safety, advancements in technology, and increased law enforcement initiatives. Expanding adoption across sectors coupled with regulatory mandates is propelling the market demand across the world.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.8 Billion |

|

Market Forecast in 2033

|

USD 24.6 Billion |

| Market Growth Rate (2025-2033) | 20% |

Key drivers in the breath analyzer market include increasing awareness of alcohol safety and strict enforcement of drunk-driving laws worldwide. For instance, in June 2024, the central government released draft regulations aimed at standardizing breath analyzer devices to enhance their accuracy and reliability in combating drunken driving. These rules mandate the verification and stamping of devices under the Legal Metrology Act, thereby fostering public trust and preventing wrongful penalties. Rising adoption in healthcare for diagnosing conditions like asthma and gastric disorders is boosting demand. The convenience of portable, non-invasive devices and advancements in sensor technology are enhancing accuracy and reliability. Additionally, workplace safety initiatives and the integration of breath analyzers with digital platforms for data tracking are further accelerating market growth across various applications.

Key drivers in the United States breath analyzer market include strict enforcement of DUI laws and heightened public awareness of alcohol-related safety measures. The growing need for non-invasive diagnostic tools in healthcare, particularly for conditions such as asthma and metabolic disorders, is boosting adoption. For instance, in June 2024, the National Institute of Standards and Technology (NIST) announced its partnership with the Bill & Melinda Gates Foundation to create breathalyzers for malaria and tuberculosis diagnosis. This collaboration seeks to establish precise testing standards and instruments, facilitating affordable and dependable breath-based diagnostics to enhance global health responses to these illnesses. Advancements in sensor technology are enhancing device accuracy and reliability, making them suitable for diverse applications. Workplace safety regulations and substance abuse monitoring programs are driving usage in corporate settings. Additionally, integration with digital platforms for data tracking and analysis, along with increasing demand for portable and user-friendly devices, is propelling the market growth in the U.S.

Breath Analyzer Market Trends:

Growing Demand for Non-Invasive Health Monitoring

With increasing demands for non-invasive diagnostic equipment, breath analyzers are witnessing acceptance across various sectors, and one major area where their adoption is high is healthcare. According to an industrial report, the need for preventive healthcare and the desire of consumers for user-friendly, non-invasive monitoring tools are significant growth drivers in the breath analyzer market. North America currently represents around 40% of all sales in the world. The advantage lies in monitoring critical health indicators on time, without blood sampling, and through less invasive procedures. Medical practice, for instance, adopts the early diagnosis of diseases like lung cancer, asthma, and diabetes by detecting the specific biomarkers in exhaled breath through breath analyzers. For instance, acetone measurement using breath analyzers can monitor diabetes management since elevated acetone levels usually point to poor glycemic control. In addition, alcohol detection breath analyzers are increasingly used in transport industries, where frequent monitoring is required to ensure safety standards. The growth of interest in preventive healthcare and consumer preference to monitor conveniently and non-invasively contributes to the growth of breath analyzer markets across all regions.

Advancements in Sensor Technology

Advancements in sensor technology are also seen in optical and gas sensors, driving innovations in wearable devices, such as breath analyzers. Optical CO2 sensors based on luminescent materials, such as lanthanum oxide, provide a promising route for improved selectivity in the detection of CO2 in wearable applications. These sensors work based on metal oxide semiconductors that, upon exposure to UV light, produce free electron-hole pairs, which enhances the sensitivity and accuracy of devices. For example, an oxysulfide:europium (La2O2S:Eu) phosphor-based sensor developed by Escobedo et al. was reported with a precise emission response to UV irradiation and, accordingly to CO2 concentration. In another case, the sensors composed of TiO2/Al2O3 heterostructures utilize UV light irradiation to enhance conductivity to achieve higher accuracy. Along these lines, in breath analyzers, similar technological advancements are fueling further precision and portability. Metal oxide semiconductors, which are used in the detection of gases such as acetone and ammonia in exhaled breath, are miniaturized for handheld devices. This miniaturization results in portable, battery-powered devices that are more user-friendly and also open the possibility of their integration with wearables and mobile applications in monitoring metabolism, stress, and hydration.

Expansion of Applications in Various Industries

Breath analyzers are expanding beyond the medical field, finding applications in several other industries, including automotive, sports, and wellness. In the automotive industry, breath analyzers are widely used for alcohol testing, ensuring that drivers are not impaired before operating vehicles. Ignition interlock devices, designed to prevent a vehicle from starting if alcohol is detected in the driver's breath, have been developed by companies such as Alcolock. For instance, just as an expired service appointment activates a reminder and results in a lockout after 5 to 7 days, the breath alcohol detection systems may lock out a vehicle in case the needed safety requirements are not achieved. In fact, according to one research, ignition interlock devices have cut down the rate of recidivism among drunk drivers by 70%. In the sports and wellness sector, breath analyzers are being used to monitor athletes' metabolic health, hydration levels, and performance. Devices like the Lumen, which analyzes breath to determine the body's metabolic state (fat-burning or carb-burning), are becoming increasingly popular among fitness enthusiasts. Additionally, breath analyzers are being explored for use in wellness apps, where they can help users track stress levels, sleep patterns, and overall health, providing more personalized insights into their lifestyle choices and fitness goals.

Breath Analyzer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global breath analyzer market report, along with forecasts at the global, regional, and country level from 2025-2033. Our report has categorized the market based on technology, application, and end-user.

Analysis by Technology:

- Fuel Cell Technology

- Semiconductor Sensor

- Infrared Spectroscopy

- Others

Fuel cell technology leads the market with around 33.2% of the breath analyzer market share in 2024. Fuel cell technology dominates the breath analyzer market due to its high accuracy, reliability, and sensitivity in detecting alcohol levels. Unlike semiconductor-based sensors, fuel cell sensors offer precise results, even at low alcohol concentrations, making them the preferred choice for law enforcement and professional applications. The devices function by oxidizing the alcohol in the breath, generating an electric current that corresponds to the alcohol concentration. This technology is also less prone to false positives caused by environmental factors, enhancing its appeal. Its compact size, low power consumption, and extended lifespan further drive its adoption, solidifying its leadership in breath analyzer technology advancements.

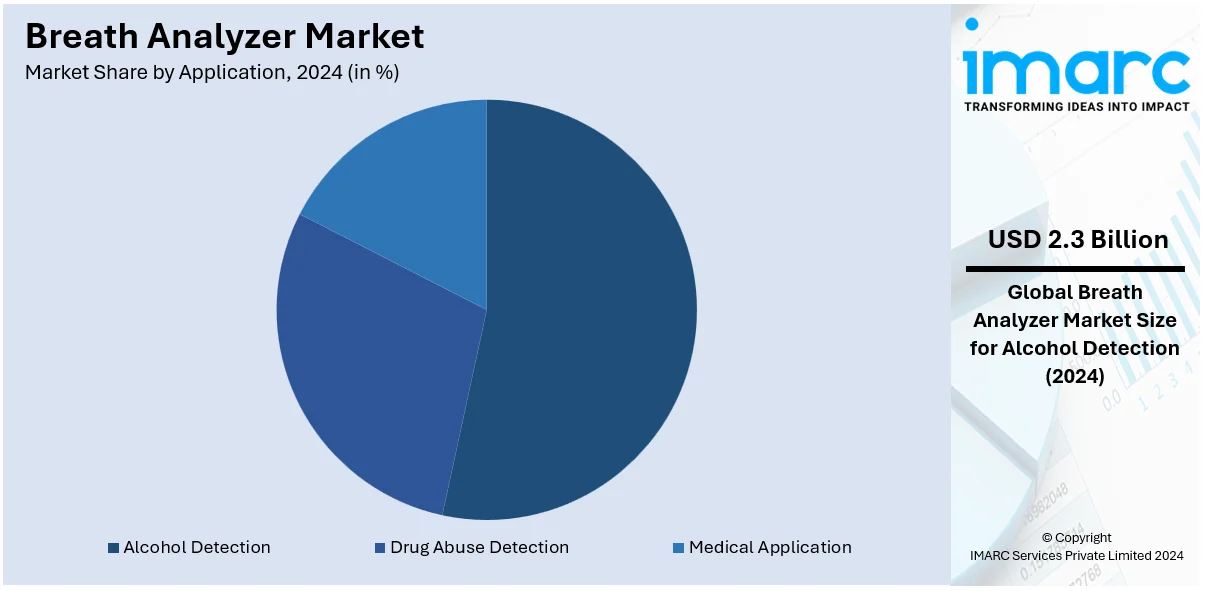

Analysis by Application:

- Alcohol Detection

- Drug Abuse Detection

- Medical Application

Alcohol detection leads the market with around 48.9% of market share in 2024. Alcohol detection leads the breath analyzer market by application due to its widespread use in law enforcement, workplace safety, and personal monitoring. Strict government regulations on impaired driving and increasing awareness of alcohol-related risks have heightened the demand for accurate and reliable devices. Alcohol detection breath analyzers are valued for their portability, ease of use, and non-invasive operation. They are extensively adopted by law enforcement agencies for roadside sobriety tests and by organizations implementing workplace alcohol testing policies, making this segment the largest contributor to the market’s growth. Continuous advancements in sensor technology further enhance their efficiency and market penetration.

Analysis by End-User:

- Law Enforcement Agencies

- Enterprises

- Others

Law enforcement agencies are the primary end users driving the breath analyzer market, owing to strict regulations and intensified efforts to curb drunk driving. These agencies rely on breath analyzers for roadside testing and enforcing legal limits on blood alcohol concentration (BAC). The portability, quick response time, and high accuracy of modern devices make them indispensable tools for ensuring public safety. Increasing government funding and adoption of advanced technologies, such as fuel cell-based breath analyzers, further strengthen their application in law enforcement, solidifying this sector’s leadership in the market by end-user category.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 43.3%. North America holds the largest share of the breath analyzer market, driven by stringent regulations on drunk driving and robust law enforcement initiatives. The region’s advanced healthcare infrastructure supports the adoption of breath analyzers for medical diagnostics, including conditions like asthma and metabolic disorders. High public awareness about alcohol safety and workplace substance abuse policies further bolster demand. Additionally, technological advancements, such as fuel cells and infrared-based analyzers, along with increased government funding and research, contribute to the region's market dominance. The presence of leading manufacturers and the widespread availability of advanced devices also play a critical role in sustaining this leadership.

Key Regional Takeaways:

United States Breath Analyzer Market Analysis

In 2024, the United States accounted for a share of 83.70% of the North America market. The US breath analyzer market is gaining tremendous traction as impaired driving and workplace safety are increasingly being concerns for many. According to NHTSA (National Highway Traffic Safety Administration), in 2022, 13,524 people lost their lives in motor vehicle traffic crashes that included at least one driver impaired by alcohol, which was the cause of 32% of all fatalities from traffic crashes in the United States. The demand in the workplace is high, where routine alcohol testing is necessary, especially in the transport and construction sectors. Technological innovation, such as portable and smartphone-integrated breath analyzers, is also driving demand in the U.S. market. The market has been dominated by companies like AlcoPro and BACtrack, which have been expanding their R&D investments to bring out non-invasive highly accurate devices. Growing government regulation and a rising focus on public safety are also fueling the demand for these devices across industries. The U.S. remains a leading player in the global market, and export opportunities are increasing.

Europe Breath Analyzer Market Analysis

Stricter driving laws and workplace safety concerns have fueled the breath analyzer market in Europe. Alcohol consumption has been reported to cause over 25% of fatalities in road accidents in Europe by the European Transport Safety Council. Reliable testing equipment has, therefore, found more need in Europe due to this alarming statistic, hence propelling market growth in countries such as Germany and the UK. The technological innovation is also driven by companies like Dräger and AlcoDigital, which are shifting towards portable and disposable breath analyzers. High awareness about alcohol-related accidents and the focus of the European Union on safety regulations enhance the demand for these devices. The steady market demand in the industries of aviation and logistics is ensured by workplace alcohol testing policies, with increasing attention to reducing alcohol-related risks.

Asia Pacific Breath Analyzer Market Analysis

The Asia Pacific breath analyzer market is witnessing rapid growth with the emergence of increasing traffic fatalities, stricter regulations, and growing awareness about alcohol consumption. According to the Chinese Ministry of Public Security, the number of alcohol-related traffic accidents is at a significant rate in comparison to road fatalities, therefore, the demand for breath analyzers is likely to increase. For instance, in 2023, in China, about 34.1% of road accidents are caused by alcohol. Growth in India is spurred by the rising number of traffic accidents and the government's push for improved law enforcement. Japan and South Korea are also concentrating on improving road safety, which boosts the demand for breath analyzers. Increased adoption of breath analyzers in transport and logistics work environments also adds to the market. The demand for more advanced alcohol testing devices is supported by investment in smart technology and regional government regulations.

Latin America Breath Analyzer Market Analysis

The breath analyzer market in Latin America is seeing an increase because of surging traffic accidents, heightened levels of alcohol consumption awareness, and effective law enforcement. The Inter-American Development Bank recently released a report stating that road accident incidents have been increasing significantly within the region, largely resulting from alcohol-induced attacks. According to a survey report, drinking and driving kills 1.2 Brazilians an hour. Brazil's government established strong regulations against driving drunk by making it compulsory for anyone suspected of doing it to undergo testing. Countries like Mexico and Argentina are now looking to improve public safety by increasing the use of breath analyzers. The industrial development in the region, especially mining and transportation, increases the demand for workplace alcohol testing. Large companies like Alcohol Countermeasure Systems (ACS) expand their presence in the market, helping to fill the local demand while pushing technology in the market.

Middle East and Africa Breath Analyzer Market Analysis

The breath analyzer market is growing in the Middle East and Africa mainly due to government regulations, growing concerns about road safety, and acceptance in the workplace. As reported by the International Transport Forum, the UAE has been investing highly in its road safety and, in turn, increasing the demand for breath analyzers. According to an industrial report, in 2023, the number of injuries in traffic accidents in Dubai was estimated to be about 2.2 thousand, out of which 14.33% of crashes were due to drunken drivers, making alcohol testing important. In South Africa, also, government programs against drunk driving are contributing to the growing demand for alcohol testing devices. Companies like AlcoCheck are introducing portable solutions, which are picking popularity in countries with high consumption rates of alcohol. On top of that, oil-gas industries are the ever-growing industries where alcohol is tested for safety, adding to the demand for markets. The awareness among the masses and government policies make it a key contributor region toward the global breath analyzer market.

Competitive Landscape:

The breath analyzer market is highly competitive, with numerous players focusing on innovation and technological advancements to strengthen their market position. Companies are emphasizing research and development to improve device accuracy, portability, and usability, catering to both professional and personal use. The market is characterized by continuous product launches featuring advanced technologies like fuel cells and infrared sensors, enhancing performance and reliability. Price competitiveness and the expansion of distribution channels are also key strategies employed to capture a broader customer base. Additionally, the integration of digital connectivity for data tracking and monitoring is emerging as a crucial differentiator. Partnerships with healthcare and law enforcement agencies further enable market players to expand their reach and application scope. For instance, in July 2024, Intoximeters announced its partnership with Responsibility.org to combat alcohol- and drug-impaired driving. The collaboration aims to promote responsible alcohol choices through education, advocacy, and innovative breath testing technology.

The report provides a comprehensive analysis of the competitive landscape in the breath analyzer market with detailed profiles of all major companies, including:

- AK GlobalTech Corporation

- Alcohol Countermeasure Systems Corp.

- Alcolizer Pty Ltd

- AlcoPro

- BACtrack

- Bedfont Scientific Ltd.

- C4 Development Ltd

- Dragerwerk AG & Co. KGaA

- Intoximeters Inc.

- Lifeloc Technologies, Inc.

- Lion Laboratories

- Shenzhen Ztsense Hi-Tech Co., Ltd

- TANITA Health Equipment H.K. Limited

Latest News and Developments:

- In May 2024, Cannabix Technologies launched its latest product the Breath Logix Workplace Series a streamlined alcohol breathalyzer intended for indoor environments. This device focuses on improving workplace safety and operational efficiency.

- In August 2024, Bedfont Scientific Ltd. announced its partnership with Geratherm Group to manufacture a Fractional exhaled Nitric Oxide (FeNO) testing device for Latin America. This collaboration aims to enhance asthma diagnosis and treatment in the region, leveraging Bedfont’s technology and Geratherm’s manufacturing expertise to improve respiratory health management.

Breath Analyzer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Fuel Cell Technology, Semiconductor, Sensor, Infrared Spectroscopy, Others |

| Applications Covered | Alcohol Detection, Drug Abuse Detection, Medical Application |

| End-Users Covered | Law Enforcement Agencies, Enterprises, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AK GlobalTech Corporation, Alcohol Countermeasure Systems Corp., Alcolizer Pty Ltd, AlcoPro, BACtrack, Bedfont Scientific Ltd., C4 Development Ltd, Dragerwerk AG & Co. KGaA, Intoximeters Inc., Lifeloc Technologies, Inc., Lion Laboratories, Shenzhen Ztsense Hi-Tech Co., Ltd, TANITA Health Equipment H.K. Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the breath analyzer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global breath analyzer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the breath analyzer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

A breath analyzer is a non-invasive diagnostic device used to measure and analyze components in exhaled breath, primarily alcohol concentration. These devices are widely employed in law enforcement, healthcare, and workplace settings for applications like detecting alcohol, drug abuse, and certain medical conditions.

The breath analyzer market was valued at USD 4.8 Billion in 2024.

IMARC estimates the global breath analyzer market to exhibit a CAGR of 20% during 2025-2033.

The market is driven by rising awareness of alcohol safety, stricter drunk-driving laws, advancements in sensor technology, increasing healthcare applications, and the growing need for workplace safety measures.

In 2024, fuel cell technology represented the largest segment by technology, driven by its high accuracy and reliability.

Alcohol detection leads the market by application owing to its extensive use in law enforcement and workplace safety.

Law enforcement agencies are the leading segment by end-user, driven by stringent regulations and widespread adoption for roadside alcohol testing.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global breath analyzer market include AK GlobalTech Corporation, Alcohol Countermeasure Systems Corp., Alcolizer Pty Ltd, AlcoPro, BACtrack, Bedfont Scientific Ltd., C4 Development Ltd, Dragerwerk AG & Co. KGaA, Intoximeters Inc., Lifeloc Technologies, Inc., Lion Laboratories, Shenzhen Ztsense Hi-Tech Co., Ltd, TANITA Health Equipment H.K. Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)