Breast Pump Market Size, Share, Trends and Forecast by Type, Technology, Application, and Region, 2025-2033

Breast Pump Market Size and Share:

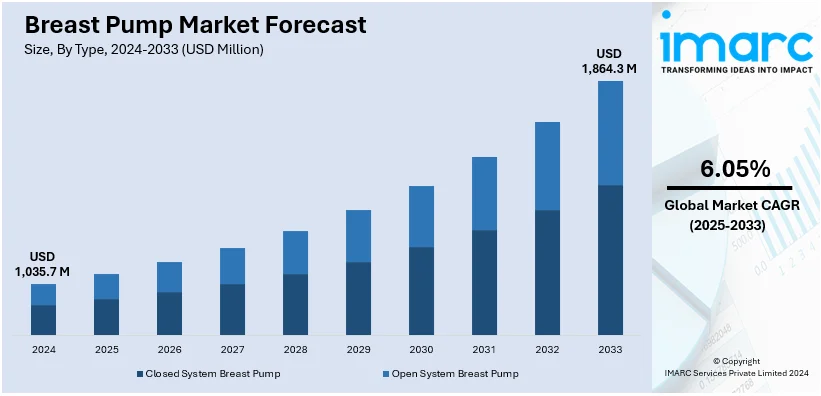

The global breast pump market size was valued at USD 1,035.7 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,864.3 Million by 2033, exhibiting a CAGR of 6.05% during 2025-2033. North America currently dominates the market in 2024. The rising awareness and emphasis on breastfeeding, increasing working women population, significant technological innovations, increasing urbanization, growing disposable incomes, supportive healthcare policies, and rapid expansion in online retail and e-commerce sector are some of the major factors facilitating the expansion of the breast pump market share. As per the National Institutes of Health, over 85% of mothers with healthy newborn infants in the United States express milk within the first four months postpartum, with the majority using a breast pump.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,035.7 Million |

| Market Forecast in 2033 | USD 1,864.3 Million |

| Market Growth Rate 2025-2033 | 6.05% |

The global breast pump market is shaped by several significant elements, including the increasing awareness about the benefits of breastfeeding and the expanding number of working mothers around the world, leading to a greater demand for efficient and convenient milk extraction solutions. Advancements in breast pump technology, including lower noise levels, greater portability, and improved comfort, have greatly boosted market acceptance. Additionally, government initiatives and workplace policies that promote breastfeeding have encouraged the use of breast pumps. The rising occurrence of lactation issues, such as mastitis and low milk supply, has further driven breast pump market growth, as breast pumps effectively address these problems. Moreover, increasing healthcare expenditures, rising disposable incomes, and the availability of breast pumps on online retail platforms are enhancing market accessibility.

The United States stands out as a key market disruptor, driven by an increasing number of working mothers desiring convenient ways to blend breastfeeding with their professional responsibilities. As per the U.S. Department of Labor Blog, in February 2024, the percentage of working mothers in the United States climbed to 71.7%. Due to growing worries about the health advantages for mothers and infants, the use of breast pumps has risen significantly. Moreover, favorable policies such as the Affordable Care Act, which mandate insurance coverage for breast pumps, have benefited the market. Notable advancements in technology have led to the development of lightweight, compact, and intelligent breast pumps, enhancing user convenience and driving demand. Rising occurrences of lactation issues such as engorgement and insufficient milk supply act as another driver for breast pump demand.

Breast Pump Market Trends:

Rising awareness and emphasis on breastfeeding

As per the breast pump market report, increasing awareness about the long-term health benefits of breastfeeding for both infants and mothers has ignited a renewed emphasis on breastfeeding. According to the Our World in Data, 132.59 Million babies are expected to be born by 2027. Breast milk is rich in essential nutrients, antibodies, and enzymes that contribute to a baby's healthy development and immune system. As medical and scientific communities continue to highlight these advantages, mothers are now more inclined to opt for breastfeeding. This heightened awareness has led to a rise in demand for breast pumps, which facilitate milk expression and storage, ensuring a steady supply of breast milk even in scenarios where direct nursing is not feasible. The breast pump market research indicates a growing demand for advanced, user-friendly models tailored to the needs of mothers.

Women workforce participation

The changing landscape of the workforce, with more women actively engaged in careers, has created a need for breastfeeding solutions that accommodate professional commitments. According to the Periodic Labour Force Survey, Labour Force Participation Rate (LFPR) in usual status (ps+ss) for persons of age 15 years and above was 60.1% during July 2023-June 2024. The same for female was 41.7% in India. Breast pumps offer an efficient way to express breast milk, allowing working mothers to provide their infants with the benefits of breast milk even while they are away. This factor has significantly expanded the breast pump market share, as mothers seek convenient and reliable devices that align with their busy schedules, enabling them to maintain their milk supply and bond with their babies.

Technological innovations

Technological advancements have transformed the breast pump market, enhancing user experience and functionality. Electric breast pumps equipped with adjustable suction levels, multiple pumping modes, and even smartphone connectivity have revolutionized milk expression. As per reports, the number of smartphone users is anticipated to reach 6 Billion by 2027 worldwide. These innovations cater to the preferences of modern parents who seek efficient and comfortable breastfeeding solutions. Additionally, the development of quieter and more discreet pumps allows mothers to express milk discreetly and without disruption. As technology continues to evolve, breast pumps become increasingly convenient and tailored to the specific needs of users, thereby accelerating the breast pump market size and encouraging more mothers to opt for breastfeeding.

Breast Pump Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global breast pump market, along with forecasts at the global and regional levels from 2025-2033. The market has been categorized based on type, technology, and application.

Analysis by Type:

- Closed System Breast Pump

- Open System Breast Pump

As per the breast pump market report, closed system breast pump stands as the largest component in 2024. The closed system breast pump has the largest number of shares on account of its natural benefits that tackle issues concerning hygiene, contamination, and upkeep. A closed system breast pump includes a barrier that keeps breast milk from touching the pumping mechanism, maintaining a sealed environment. This design greatly lowers the chances of mold, bacteria, and viruses forming inside the pump, thus improving the safety and quality of milk. Mothers emphasize the cleanliness of expressed milk, and closed system pumps provide a certain degree of confidence regarding this factor. The growth of this segment can also be linked to heightened consumer awareness regarding the advantages of closed system pumps, influenced by healthcare professionals and lactation consultants highlighting the significance of preserving the purity of expressed breast milk. Moreover, regulatory norms and guidelines enhancing milk hygiene have boosted the demand for closed system breast pumps, making them the favored option for mothers desiring dependable and contamination-free milk expression methods.

Analysis by Technology:

- Battery-Powered Breast Pump

- Electric Breast Pump

- Manual Breast Pump

Battery-powered breast pump leads the market in 2024. Battery-operated breast pumps provide the convenience of pumping without being connected to a power source, making them perfect for hectic routines, traveling, and circumstances with restricted electricity access. The expansion of this segment is also fueled by improvements in battery efficiency, allowing for extended pumping durations without sacrificing power. Moreover, battery-operated pumps are usually small and lightweight, which increases their compatibility with contemporary living. As mothers look for adaptable and easy-to-use options, the battery-operated breast pump has become more popular, providing the convenience to uphold breastfeeding practices while fitting into diverse daily tasks.

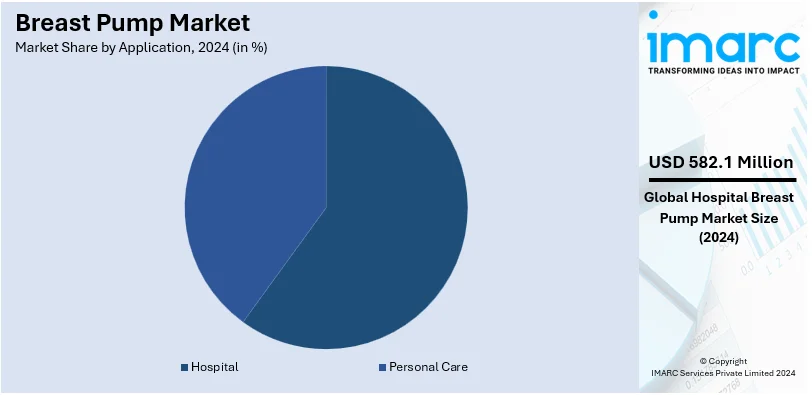

Analysis by Application:

- Hospital

- Personal Care

Hospital leads the market in 2024. Hospitals act as the main locations for childbirth, frequently offering thorough care for mothers and newborns during the postpartum phase. Breast pumps in hospitals serve multiple purposes, such as assisting premature babies needing specialized feeding, helping mothers with difficulties in latching, and enabling milk expression when mothers are momentarily apart from their infants for medical reasons. Additionally, hospitals employ lactation consultants and healthcare experts who assist new mothers with breastfeeding methods and the proper use of breast pumps. The focus on ideal infant nutrition and breastfeeding assistance in hospital settings has driven the use of breast pumps for medical and lactation-related reasons. With hospitals increasingly focusing on maternal and neonatal care, the necessity for breast pumps as essential elements of postpartum care has strengthened the leading position in the market.

Regional Analysis:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

North America accounted for the largest breast pump market share in 2024. In North America, there is a rising focus on maternal and infant health, accompanied by greater awareness about the advantages of breastfeeding for mothers and their babies. This has resulted in an increased need for breastfeeding products such as breast pumps. Moreover, the robust healthcare system in the region bolsters breastfeeding programs, as hospitals and medical professionals frequently promote breastfeeding and provide lactation assistance. The rise of working mothers and the demand for effective solutions to manage work and childcare has increased the need for breast pumps, establishing them as vital tools for contemporary parenting. North America's advanced e-commerce and retail systems offer convenient access to a variety of breast pump products, enabling consumers to make educated decisions. The area's disposable income levels also allow parents to purchase higher-end breast pump models that match their lifestyle requirements. As these elements converge, North America continues to be a flourishing market for breast pumps, addressing the needs of knowledgeable and health-oriented parents.

Key Regional Takeaways:

United States Breast Pump Market Analysis

The United States breast pump market is driven by various factors reflecting societal, economic, and technological shifts. The increasing awareness among individuals about breastfeeding benefits for infant health and maternal well-being is encouraging higher adoption of breast pumps among new mothers. This awareness is reinforced by healthcare organizations and campaigns promoting breastfeeding as the optimal choice for infant nutrition. In addition, rising participation of women in the workforce is a significant driver. Working mothers are seeking efficient ways to continue breastfeeding while managing professional commitments, and breast pumps provide the flexibility needed to balance both. Federal and state-level policies supporting lactating mothers, such as workplace accommodations for pumping, is bolstering the market growth. Besides this, technological advancements in breast pump design and functionality also play a pivotal role. Compact, portable, and quiet devices, alongside smart pumps with app integration for tracking milk production, cater to the modern mother’s needs. Enhanced comfort features and ease of use are making these devices appealing to a wider audience. Furthermore, insurance coverage for breast pumps under the Affordable Care Act (ACA) is another critical factor. Many insurance plans now fully or partially cover the cost of breast pumps, making them accessible to a larger demographic, including lower-income families. Additionally, rising urbanization and nuclear family setups often require mothers to rely on breast pumps for convenience and time management. According to the CIA, urban population in the country was 83.3% of total population in 2023.

Asia Pacific Breast Pump Market Analysis

The breast pump market in the region is driven by diverse factors shaped by cultural, economic, and technological changes. The increasing awareness among individuals about the health benefits of breastfeeding, driven by government initiatives and non-governmental campaigns, is a significant factor encouraging the adoption of breast pumps. Countries such as China, India, and Japan are actively promoting breastfeeding through educational programs, which have positively influenced market dynamics. In addition, the growing number of working mothers is offering a favorable market outlook. As urbanization and workforce participation among women rise, particularly in emerging economies, the demand for breast pumps that facilitate breastfeeding while managing work commitments is growing substantially. This trend is further supported by evolving workplace policies in some countries, offering facilities for nursing mothers. Moreover, economic development in the region is leading to higher disposable incomes, enabling families to invest in advanced breastfeeding equipment. Alongside this, the availability of cost-effective breast pumps by local and international manufacturers makes these devices accessible to a broader audience. Moreover, the wide availability of breast pumps via online channels is supporting the market growth. The India Brand Equity Foundation (IBEF) states that the Indian e-commerce industry is projected to reach USD 325 Billion by 2030. Moreover, technological advancements in breast pump design also fuel the market. Modern pumps featuring improved suction mechanisms, portability, and quiet operation cater to the needs of mothers seeking convenience and comfort.

Europe Breast Pump Market Analysis

Shifting demographics, societal norms, and technological advancements are few factors that are propelling the market growth. The increasing awareness among individuals about breastfeeding’s health benefits for both infants and mothers remain a key driver. Public health campaigns and guidelines from organizations, such as the World Health Organization (WHO) and UNICEF, widely endorsed in Europe, are encouraging breastfeeding and support the adoption of breast pumps. In line with this, the rising participation of women in the workforce across Europe is a significant factor fueling demand. As more women balance careers with motherhood, breast pumps offer a practical solution to maintain breastfeeding routines while managing professional responsibilities. Supportive workplace policies in many European countries, including provisions for lactation breaks and breastfeeding-friendly spaces, further boost this trend. Furthermore, innovations in breast pump design contribute to market growth. Advanced features, such as silent operation, compact size, and user-friendly interfaces, meet the needs of modern mothers seeking comfort and efficiency. Smart breast pumps with app connectivity, which track and monitor milk production, are gaining popularity in tech-forward regions. Besides this, Europe’s robust healthcare infrastructure and comprehensive insurance systems play a vital role in making breast pumps accessible. In 2023, more than 9 out of every 10 regions in the EU had a majority of their population living within 15 minutes driving time of a hospital, according to the reports.

Latin America Breast Pump Market Analysis

The Latin America breast pump market is driven by increasing awareness about breastfeeding’s benefits, supported by health initiatives from governments and organizations such as UNICEF. Campaigns promoting exclusive breastfeeding are encouraging more mothers to adopt breast pumps as a tool for convenience and continuity. Rising urbanization and workforce participation among women are significant contributors. In 2023, the urban population was 81.6% of total population in Mexico, as per the CIA. Working mothers are seeking efficient breastfeeding solutions to balance professional and personal responsibilities, thereby increasing the demand for portable and user-friendly breast pumps. In line with this, economic growth in the region is allowing families to invest in quality breastfeeding equipment. The expansion of healthcare systems and insurance coverage in countries such as Brazil and Mexico further supports accessibility. E-commerce platforms are also crucial, offering a wide variety of products and competitive pricing.

Middle East and Africa Breast Pump Market Analysis

The Middle East and Africa breast pump market is influenced by growing awareness about breastfeeding benefits as well as supported by government and international health organization initiatives. Educational campaigns emphasize exclusive breastfeeding, encouraging mothers to adopt breast pumps for convenience and flexibility. In addition, rising preferences for breast pumps via online channels in the region is contributing to the market growth. Saudi Arbia’s e-commerce industry generated USD 10 Billion in revenue in 2023, as per reports. Furthermore, rapid urbanization, coupled with the rising participation of women in the workforce, are significant drivers. Working mothers in urban settings rely on breast pumps to maintain breastfeeding while managing professional responsibilities. Improved workplace policies in some countries, offering lactation rooms is impelling the market growth. Besides this, the expansion of healthcare infrastructure and insurance coverage for maternity products is bolstering the market growth.

Competitive Landscape:

Key players in the breast pump market are using multiple strategic initiatives for the growth of the market as well as the strengthening of their position in the competition. Companies are investing heavily in research and development to introduce technologically advanced breast pumps, such as wearable, hands-free, and app-connected devices, which can offer greater convenience and efficiency for users. Innovations in noiseless and portable pumps have also gained significant momentum. Market leaders are also expanding their product lines, for instance, to include hospital-grade pumps and manual options, to meet a diverse range of consumer demands. Strategic partnerships and collaborations with healthcare providers, lactation consultants, and online retailers have helped market reach and improved accessibility for consumers.

The report provides a comprehensive analysis of the competitive landscape in the breast pump market with detailed profiles of all major companies, including:

- Philips Avent

- Pigeon Corporation

- Medela AG

- Ameda Inc

- Hygeia Medical Group II

Latest News and Developments:

- October 2024: Elvie launched the Elvie Stride 2, a hands-free breast pump. It features hospital-grade suction of approximately 270 mmHG and includes six nipple sizes for optimal fit. Weighing under 160g per cup, it is designed for discreet use with noise reduction technology. The pump is controlled via a smart app, allowing users to track milk volume and adjust settings.

- August 2024: Annabella, a leading femtech brand, revealed the release of its FDA-cleared double pump. A direct extension of its ground-breaking single pump, this double pump continued to set the new standard in breast pump technology, emphasizing features and benefits as regards comfort, efficiency, and user satisfaction.

- May 2024: Medela broadened availability of breastfeeding resources with a new feature designed to simplify and improve the breastfeeding journey. The compact and portable design of the Medela easy single electric breast pump enables mothers to express their breastmilk effectively whenever it suits them.

- May 2024: Eufy announced the launch of a novel product series of advanced wearable breast pumps which are discreet and comfortable.

- April 2024: Momcozy announced the launch of the Momcozy Mobile Style™ Hands-free Breast Pump, which is a unique system that provides a new pumping experience to mothers.

Breast Pump Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Closed System Breast Pump, Open System Breast Pump |

| Technologies Covered | Battery-Powered Breast Pump, Electric Breast Pump, Manual Breast Pump |

| Applications Covered | Hospital, Personal Care |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Philips Avent, Pigeon Corporation, Medela AG, Ameda Inc., Hygeia Medical Group II etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the breast pump market from 2019-2033.

- The breast pump market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the breast pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Breast pump is a medical device designed to extract breast milk from lactating mothers, providing a convenient solution for feeding infants when breastfeeding directly is not possible.

The global breast pump market was valued at USD 1,035.7 Million in 2024.

IMARC estimates the global breast pump market to exhibit a CAGR of 6.05% during 2025-2033.

The global breast pump market is driven by increasing awareness about breastfeeding benefits, the rising number of working mothers, advancements in breast pump technology, supportive government initiatives, and the growing prevalence of lactation challenges.

According to the report, closed system breast pump represented the largest segment by type, driven by their hygienic design that prevents milk contamination, ensuring safety and convenience for users.

Battery-powered breast pump leads the market by technology due to their portability, convenience, and suitability for working mothers and on-the-go usage.

Hospital represents the largest segment due to their high demand for hospital-grade breast pumps, which are preferred for their efficiency, durability, and ability to support multiple users in maternity and neonatal care settings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global breast pump market include Philips Avent, Pigeon Corporation, Medela AG, Ameda Inc., Hygeia Medical Group II, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)