Brazil Two Wheeler Market Size, Share, Trends and Forecast by Type, Propulsion Type, End User, Distribution Channel, and Region, 2026-2034

Brazil Two Wheeler Market Summary:

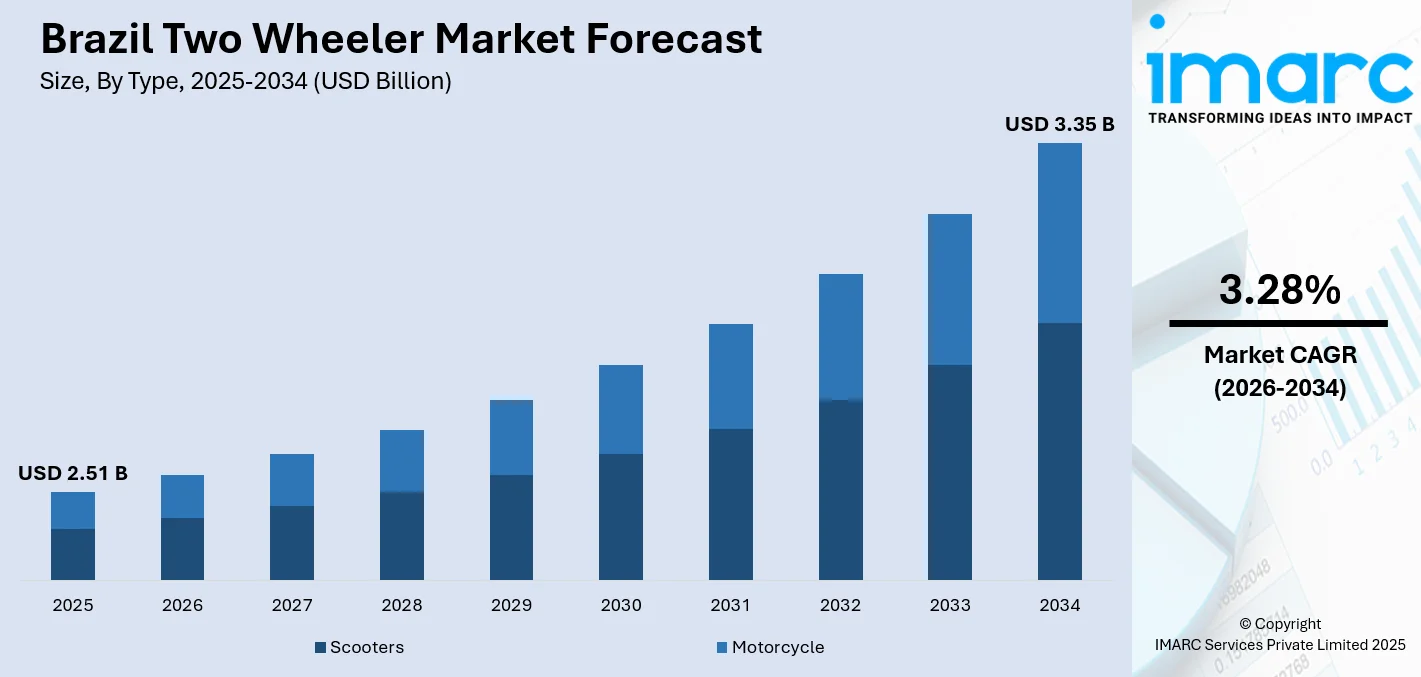

The Brazil two wheeler market size was valued at USD 2.51 Billion in 2025 and is projected to reach USD 3.35 Billion by 2034, growing at a compound annual growth rate of 3.28% from 2026-2034.

The market is driven by accelerating urbanization across metropolitan regions, the explosive growth of e-commerce and last-mile delivery services requiring the efficient transportation solutions, favorable financing schemes making ownership accessible to middle-income consumers, and the practical advantages of fuel economy and maneuverability in congested urban environments. The market demonstrates strong momentum as the two wheeler sector continues expanding its foothold across diverse regional markets, strengthening Brazil two wheeler market share.

Key Takeaways and Insights:

- By Type: Motorcycle dominates the market with a share of 62% in 2025, driven by superior fuel efficiency, versatile applications spanning personal and commercial delivery, robust terrain handling, and strong Brazilian consumer acceptance.

- By Propulsion Type: ICE leads the market with a share of 89% in 2025, owing to established nationwide fueling infrastructure, flex-fuel ethanol technology offering cost advantages, immediate refueling convenience, and extensive regional maintenance networks.

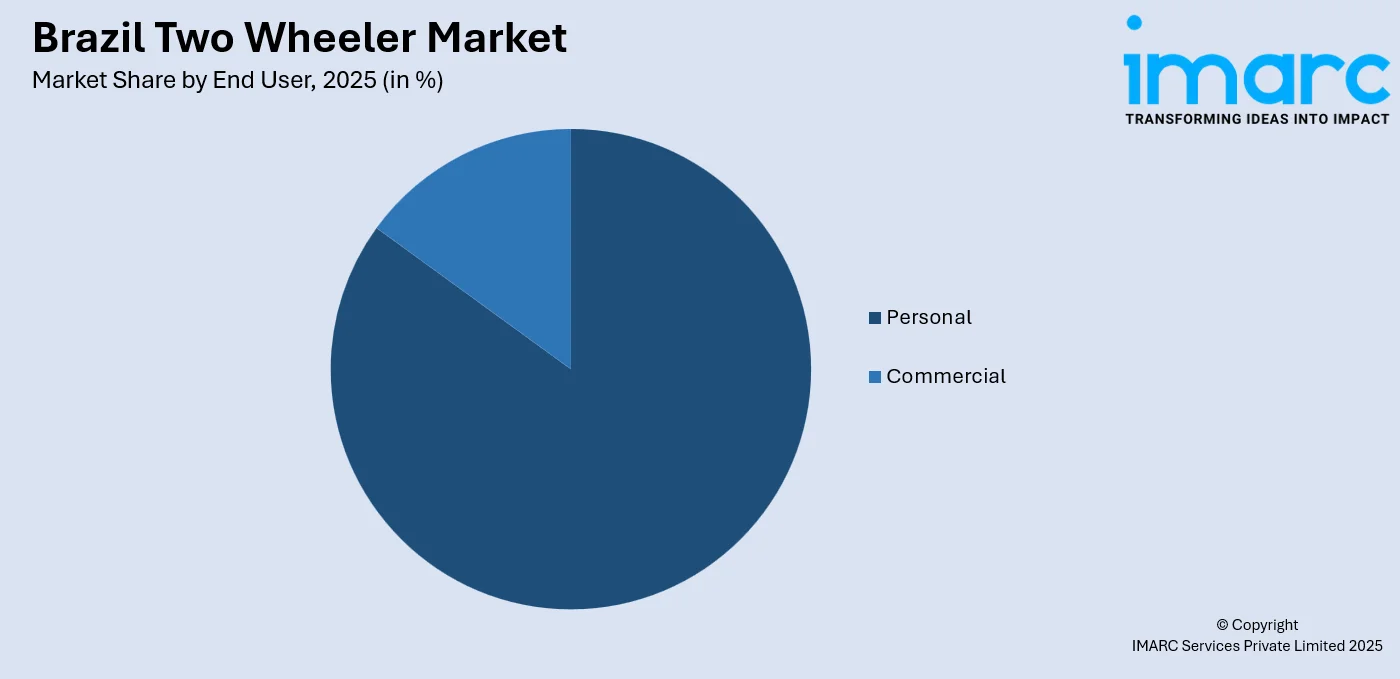

- By End User: Personal represents the largest segment with a market share of 85% in 2025, driven by growing middle-class mobility aspirations, inadequate public transportation coverage in metropolitan areas, automobile ownership cost advantages, and practical traffic congestion benefits.

- By Distribution Channel: Offline dominates the market with a share of 80% in 2025, owing to strong consumer preference for physical vehicle inspection before purchase, dealer financing facilitation, comprehensive after-sales service availability, and traditional retail trust.

- Key Players: The market exhibits concentrated competitive dynamics with multinational manufacturers leveraging scale economies and distribution networks alongside regional players. Manufacturers differentiate through portfolio breadth, innovation, delivery partnerships, and competitive pricing strategies.

To get more information on this market Request Sample

The Brazil two wheeler market experiences robust expansion propelled by multiple converging factors transforming urban mobility patterns across the nation. Rapid urbanization concentrates populations in densely populated metropolitan areas where severe traffic congestion creates mounting demand for nimble transportation alternatives capable of navigating crowded streets efficiently. According to reports, in July 2025, Brazil sold 193,165 motorcycles, registering 23.18% year-on-year growth, underscoring accelerating urban and commercial reliance on two wheelers nationwide. Moreover, the explosive surge in e-commerce activities and food delivery platforms has generated substantial commercial demand for motorcycles as essential tools for last-mile logistics operations supporting the digital economy. Favorable consumer financing programs have democratized access to vehicle ownership among middle-income households previously constrained by prohibitive upfront costs. Additionally, rising fuel prices relative to household incomes amplify the appeal of fuel-efficient two wheelers as economically rational substitutes for automobiles, particularly for daily commuting and small business operations requiring frequent mobility within congested urban environments where time efficiency directly impacts productivity and profitability.

Brazil Two Wheeler Market Trends:

Integration of Digital Connectivity and Smart Technologies

The two wheeler market is witnessing progressive adoption of connected vehicle technologies transforming traditional motorcycles into smart mobility platforms. Manufacturers are incorporating digital instrumentation clusters displaying navigation assistance, bluetooth connectivity for smartphone integration, and onboard diagnostics enabling predictive maintenance alerts. As per sources, in November 2025, ride-hailing company 99 officially rolled out its telemetry-based “Relatório de Direção” tool across Brazil, using sensor data to analyze riding behavior and improve safety for partner motorcyclists. Furthermore, fleet operators serving delivery platforms particularly value telematics systems providing real-time location tracking, route optimization, and performance analytics supporting operational efficiency improvements. These technological enhancements appeal to younger consumer demographics expecting digital integration across all aspects of daily life while supporting commercial users seeking productivity gains through data-driven fleet management capabilities.

Expansion of Subscription and Shared Mobility Models

Alternative ownership models are gaining traction as consumers and businesses explore flexible mobility solutions beyond traditional purchase arrangements. Motorcycle subscription services offering monthly access without long-term commitments are emerging in major metropolitan areas, appealing to urban professionals seeking convenience without maintenance responsibilities. In April 2025, mobility rental provider Mottu announced it had deployed over 100,000 rented motorcycles across Brazil, surpassing BRL 1 Billion in revenues and underscoring strong uptake of rental-based access models. Shared mobility platforms deploying motorcycle fleets for short-term rentals address occasional transportation needs for non-owners while supporting tourism activities. These business models particularly resonate with younger demographics prioritizing access over ownership and businesses managing seasonal demand fluctuations requiring scalable transportation capacity without capital investment commitments in vehicle acquisition.

Growing Emphasis on Safety Equipment and Rider Training

Safety consciousness is rising among riders, authorities, and manufacturers responding to elevated accident rates associated with increasing motorcycle adoption. Premium helmet manufacturers are expanding presence with advanced protective equipment featuring improved impact absorption, ventilation systems, and integrated communication capabilities. According to reports, Brazil’s Ministry of Transport held the National Motorcycle Safety Conference focusing on enhanced protective measures after data showed motorcycles were involved in over 13,057 traffic deaths in 2024, prompting integrated actions on equipment, training, and infrastructure. Moreover, insurance providers are introducing premium discounts incentivizing certified rider training program participation, driving enrollment growth in defensive riding courses. Manufacturers are incorporating advanced braking systems, improved lighting visibility, and stability control technologies as standard features. This safety-focused evolution reflects market maturation as stakeholders recognize sustainable growth requires addressing accident prevention through comprehensive approaches combining equipment, education, and engineering improvements.

Market Outlook 2026-2034:

The Brazil two wheeler market is positioned for sustained revenue growth through the forecast period as favorable macroeconomic conditions, infrastructure development initiatives, and evolving mobility preferences support continued adoption across consumer segments. Urbanization trends will intensify demand for efficient transportation alternatives in expanding metropolitan regions while delivery economy expansion generates commercial fleet procurement opportunities. Electric propulsion technology adoption will accelerate as charging infrastructure deployment expands and battery costs decline, though internal combustion engines will retain dominance throughout the forecast horizon. The market generated a revenue of USD 2.51 Billion in 2025 and is projected to reach a revenue of USD 3.35 Billion by 2034, growing at a compound annual growth rate of 3.28% from 2026-2034.

Brazil Two Wheeler Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Motorcycle |

62% |

|

Propulsion Type |

ICE |

89% |

|

End User |

Personal |

85% |

|

Distribution Channel |

Offline |

80% |

Type Insights:

- Scooters

- Motorcycle

Motorcycle dominates with a market share of 62% of the total Brazil two wheeler market in 2025.

The motorcycle commands the leading position within Brazil two wheeler market, representing the overwhelming majority of unit sales and revenue generation across the market. This leadership stems from motorcycles' superior versatility accommodating diverse use cases ranging from daily commuting to commercial delivery operations and recreational riding activities. As per sources, in October 2025, Honda held a 67 percent market share in Brazil and announced a $300 Million investment to expand its Manaus factory, reflecting both the brand’s dominance and strong consumer demand for practical commuter motorcycles. Furthermore, the consumers particularly value motorcycles' robust construction enabling operation across varied terrain conditions including paved urban roads and unpaved rural pathways.

The motorcycle market dominance reflects practical needs over aspirational preferences, as Brazilian consumers prioritize functional transportation. Models with 100–125 cc engine displacements balance affordability, operational efficiency, and adequate performance for typical use. Robust manufacturer supply chains ensure cost-competitive pricing while maintaining quality for demanding conditions. Growth remains positive as urban population expansion and delivery economy proliferation drive sustained personal and commercial demand, despite emerging competition from scooters targeting niche urban applications.

Propulsion Type Insights:

- ICE

- Electric

ICE leads with a share of 89% of the total Brazil two wheeler market in 2025.

ICE commands overwhelming market dominance within Brazil’s two-wheeler sector, reflecting entrenched infrastructure advantages and established consumer preferences. Ubiquitous fuel station availability across urban and rural areas ensures convenient refueling. Flex-fuel technology allows motorcycles to operate on gasoline-ethanol blends, offering cost flexibility and supporting government renewable fuel policies. Consumers are confident with ICE technology due to decades of experience and extensive mechanic networks that provide affordable maintenance and repair services throughout the country, reinforcing sustained adoption.

The sustained dominance of ICE is driven by practical considerations beyond technology preference. Lower purchase prices established supply chains, and minimal operating range anxiety due to widespread fuel infrastructure make ICE motorcycles economically advantageous. Quick refueling and a mature secondhand market further enhance value retention and upgrade pathways. Despite growing environmental awareness, immediate economic practicality and convenience continue to favor internal combustion motorcycles for most Brazilian consumers, even as interest in electric alternatives gradually increases.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Personal

- Commercial

Personal exhibits a clear dominance with 85% share of the total Brazil two wheeler market in 2025.

The personal commands the largest market share, reflecting two wheelers' fundamental role as affordable transportation solutions enabling mobility independence for Brazilian households across socioeconomic strata. Middle-income families prioritize motorcycle acquisition as first vehicle purchases given cost advantages over automobiles while delivering essential transportation functionality for employment access, education, and daily activities. According to reports, in 2025, Honda CG 160 led Brazil’s two‑wheeler market with 41,456 units sold, while Honda captured 67 % market share, followed by Yamaha at 14.38 % and Shineray 5.82 %. Moreover, inadequate public transportation coverage in expanding peripheral urban zones and rural areas creates dependency on personal vehicles for basic mobility needs.

The personal dominance reflects essential transportation needs rather than lifestyle choices for most Brazilian consumers. Motorcycles enable access to employment across areas poorly served by public transit. Flexible financing through manufacturer and retail partnerships has expanded ownership among previously excluded populations. Robust second hand markets offer upgrade options while ensuring affordability at multiple price points. Ongoing urbanization and middle-class growth support continued demand, as mobility independence remains a key aspiration for economically advancing households.

Distribution Channel Insights:

- Offline

- Online

Offline leads with a market share of 80% of the total Brazil two wheeler market in 2025.

The offline commands overwhelming market share, reflecting established consumer preferences for physical vehicle inspection and traditional retail relationship trust in significant purchase decisions. In April 2025, Honda’s dealer consolidation formed a network of 54 physical Honda motorcycle dealerships across Paraná and Rio de Janeiro, strengthening traditional showroom presence and consumer trust. Furthermore, authorized dealer networks provide comprehensive pre-purchase services including test rides enabling performance evaluation, financing arrangement facilitation through manufacturer finance divisions, and trade-in value assessments for existing vehicle upgrades. Consumers value face-to-face consultation with sales personnel explaining technical specifications, maintenance requirements, and warranty coverage terms. Physical dealerships provide tangible brand presence and after-sales service accessibility essential for ongoing maintenance and repair needs throughout vehicle ownership lifecycles.

Offline reflects cultural preferences and practical considerations beyond mere technological resistance to digital commerce. Two wheeler purchases represent substantial financial commitments for middle-income households warranting careful evaluation impossible through online product descriptions alone. Physical inspection enables quality assessment and fit evaluation particularly important given diverse rider sizes and usage requirements. Dealer networks provide essential warranty claim processing and parts availability supporting long-term vehicle operation. Financing approval rates typically exceed online alternatives given in-person documentation review and relationship lending practices common among Brazilian financial institutions.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast benefits from major cities like São Paulo and Rio, where population density creates high transportation demand. Higher incomes support purchasing power, while the delivery economy drives commercial fleet requirements. Established manufacturing ensures competitive pricing, and quality road infrastructure enables motorcycles to navigate urban traffic and intercity routes efficiently.

South sees strong consumer adoption for both recreational and practical purposes. Developed road networks connect urban centers, supporting intercity travel, while agriculture creates rural demand for utilitarian motorcycles. European heritage encourages premium segment adoption, and local manufacturing helps maintain competitive pricing, making motorcycles accessible across urban, intercity, and rural areas.

Northeast has high motorcycle-to-automobile ratios due to economic constraints. Affordable entry-level motorcycles meet personal transportation needs, while limited public transit increases reliance on personal vehicles. Urban delivery activity expands, supporting commercial requirements, whereas rural markets primarily use motorcycles for essential personal mobility, highlighting their crucial role in regional transportation networks.

North has geographic challenges and limited infrastructure which encourage motorcycle use. Scattered Amazon settlements and unpaved roads make motorcycles more practical than cars. Sparse populations limit public transit, increasing personal vehicle reliance. Resource extraction industries drive commercial demand, contributing to high motorcycle-to-automobile ratios and reflecting practical transportation needs.

Central-West market is shaped by agribusiness, requiring motorcycles for farm operations, equipment monitoring, and worker transport. Urban growth and the delivery economy increase commercial fleet use. Strategic geography connects economic regions, but lower population density limits total market scale compared to coastal areas, sustaining steady demand for motorcycles.

Market Dynamics:

Growth Drivers:

Why is the Brazil Two Wheeler Market Growing?

Explosive Growth of E-Commerce and Last-Mile Delivery Ecosystem

The phenomenal expansion of e-commerce activities and food delivery platforms has fundamentally transformed Brazil two wheeler market by creating substantial commercial demand for motorcycles as essential logistics infrastructure. As per sources, in September 2025, Didi’s 99Food announced a $2 Billion investment backed by the Brazilian government to expand delivery fleet access and financing for motorcycle and e‑bike riders nationwide. Moreover, online shopping penetration continues accelerating as digital payment infrastructure improves and internet connectivity expands into secondary cities. Delivery platforms have deployed extensive motorcycle fleets while platform-based gig economy opportunities enable income generation for millions purchasing motorcycles as capital equipment. This delivery economy maturation has created entirely new market segments, with food delivery expansion into previously underserved regions supporting infrastructure development including maintenance networks and financing availability tailored to commercial users.

Accelerating Urbanization Creating Traffic Congestion and Mobility Demands

Brazil's ongoing urbanization trajectory concentrates populations in expanding metropolitan areas where inadequate infrastructure development creates severe traffic congestion necessitating alternative transportation solutions. According to reports, Brazil had about 35 Million registered motorcycles, representing roughly 28 % of the total vehicle fleet, highlighting the growing reliance on two‑wheelers amid urban traffic pressures. Furthermore, major cities experience multi-hour commute times as automobile traffic overwhelms road capacity, creating powerful incentives for adopting motorcycles capable of navigating congested conditions efficiently. Urban populations in peripheral neighbourhoods poorly served by public transportation depend on personal vehicles for employment access, with two wheelers providing affordable mobility independence. Low-density peripheral expansion creates extensive distances between residential and employment centers while public transportation investments fail to match geographic sprawl, leaving populations dependent on motorcycles for economic participation.

Favorable Financing Accessibility Democratizing Vehicle Ownership

The proliferation of consumer financing programs specifically structured for two wheeler purchases has dramatically expanded market accessibility by enabling vehicle acquisition among middle-income populations previously excluded by capital constraints. As per sources, in August 2024, 170,000 motorcycles were financed (126,000 new), up 10.3% YoY, while total vehicle sales reached 622,000 units. Car and light vehicle financing declined 4.5%, trucks down 15.9%. Furthermore, manufacturer finance divisions and retail partnerships offer extended payment terms with minimal down payment requirements, transforming purchases into manageable monthly obligations. Digital lending platforms supplement traditional channels through rapid credit decisions and alternative assessment methodologies. Financing availability has fundamentally altered market dynamics by separating purchase decisions from immediate capital availability, with competitive markets driving interest rate reductions and term extensions while manufacturer subsidies reduce effective borrowing costs, creating sustainable growth.

Market Restraints:

What Challenges the Brazil Two Wheeler Market is Facing?

Elevated Safety Concerns and Accident Rates Affecting Market Perception

The Brazil two wheeler market confronts serious safety challenges as motorcycle-related fatalities create negative public perception and regulatory scrutiny. Motorcyclists account for disproportionate traffic fatalities, generating healthcare burdens and emotional trauma. Helmet non-compliance, reckless riding, and insufficient enforcement exacerbate risks. Potential regulatory responses including urban restrictions and mandatory equipment requirements could constrain growth trajectories.

Economic Volatility and Currency Fluctuations Impacting Affordability

Brazil's macroeconomic instability characterized by inflation volatility, interest rate fluctuations, and currency depreciation creates uncertainty affecting consumer purchasing power. Economic downturns reduce household incomes while interest rate increases raise financing costs. Currency depreciation increases import costs, forcing price increases. Lower-income segments lack financial buffers, making vehicle purchases discretionary expenses readily deferred during uncertainty.

Infrastructure Limitations and Maintenance Network Gaps in Interior Regions

The two wheeler market faces operational challenges from inadequate road infrastructure and limited service networks in interior regions. Unpaved roads and poor surface conditions accelerate vehicle deterioration while limited parts availability forces extended repair downtime. Infrastructure deficits particularly impact commercial users dependent on reliability. Geographic challenges in Northern and Northeastern regions create total ownership concerns deterring adoption.

Competitive Landscape:

The Brazil two wheeler market demonstrates concentrated competitive structure where established multinational manufacturers command dominant positions through decades of market presence, extensive distribution networks, and strong brand recognition. Market leaders leverage manufacturing scale enabling cost-competitive pricing while maintaining quality standards and comprehensive product portfolios from entry-level through premium segments. Competition extends beyond specifications into financing attractiveness, dealer network coverage, and accumulated brand equity. Regional manufacturers and Chinese brands compete on price positioning targeting cost-sensitive segments though facing distribution and quality perception challenges.

Recent Developments:

- In June 2024, Bajaj Auto inaugurated its first motorcycle manufacturing facility in Manaus, Brazil, producing the Dominar family with an initial capacity of 20,000 units per year. The 9,600‑sqm plant includes engine and vehicle assembly lines, with plans to expand production and eventually roll out Pulsar models locally.

Brazil Two Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Scooters, Motorcycle |

| Propulsion Types Covered | ICE, Electric |

| End Users Covered | Personal, Commercial |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Southeast, South, Northeast, North, and Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil two wheeler market size was valued at USD 2.51 Billion in 2025.

The Brazil two wheeler market is expected to grow at a compound annual growth rate of 3.28% from 2026-2034 to reach USD 3.35 Billion by 2034.

Motorcycle held the largest share driven by superior versatility accommodating commuting to commercial delivery applications, robust construction for varied terrain, strong cultural preferences for practical transportation, and extensive model availability spanning entry-level through premium categories addressing diverse consumer segments.

Key factors driving the Brazil two wheeler market include explosive e-commerce and delivery platform expansion creating substantial commercial fleet demand, accelerating urbanization generating traffic congestion requiring efficient mobility solutions, favorable financing programs democratizing vehicle ownership accessibility, and fuel efficiency advantages relative to automobiles.

Major challenges include elevated accident rates generating safety concerns and regulatory restrictions, macroeconomic volatility affecting consumer purchasing power and financing availability, infrastructure limitations in interior regions constraining operational reliability, and inadequate road conditions accelerating vehicle deterioration and increasing maintenance requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)