Brazil Third-Party Logistics Market Size, Share, Trends and Forecast by Transport, Service Type, End Use, and Region, 2026-2034

Brazil Third-Party Logistics Market Summary:

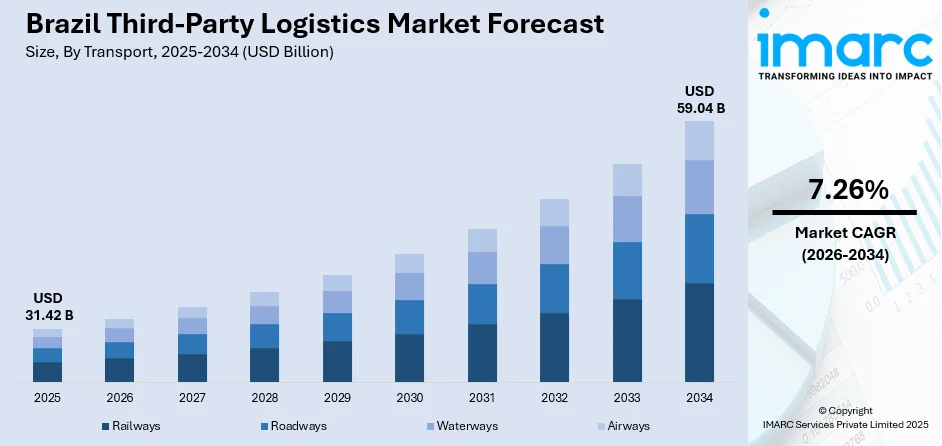

The Brazil third-party logistics market size was valued at USD 31.42 Billion in 2025 and is projected to reach USD 59.04 Billion by 2034, growing at a compound annual growth rate of 7.26% from 2026-2034.

In Brazil, the market expansion is propelled by the country's robust e-commerce growth, increasing urbanization rates, and rising demand for efficient supply chain solutions across diverse industries. Manufacturing sector expansion, agricultural export requirements, and government infrastructure investments are further stimulating outsourcing of logistics functions, while digital transformation initiatives enhance operational capabilities and service delivery, fueling the market share.

Key Takeaways and Insights:

- By Transport: Roadways dominate the market with a share of 59% in 2025, owing to Brazil's extensive highway network that forms the backbone of national freight movement. The segment benefits from flexible point-to-point delivery capabilities and established trucking infrastructure connecting industrial hubs to distribution centers nationwide.

- By Service Type: Domestic transportation management leads the market with a share of 52% in 2025, reflecting the critical importance of internal logistics coordination across Brazil's vast territory. Growing e-commerce penetration and rising consumer expectations for faster deliveries are intensifying demand for sophisticated domestic logistics solutions.

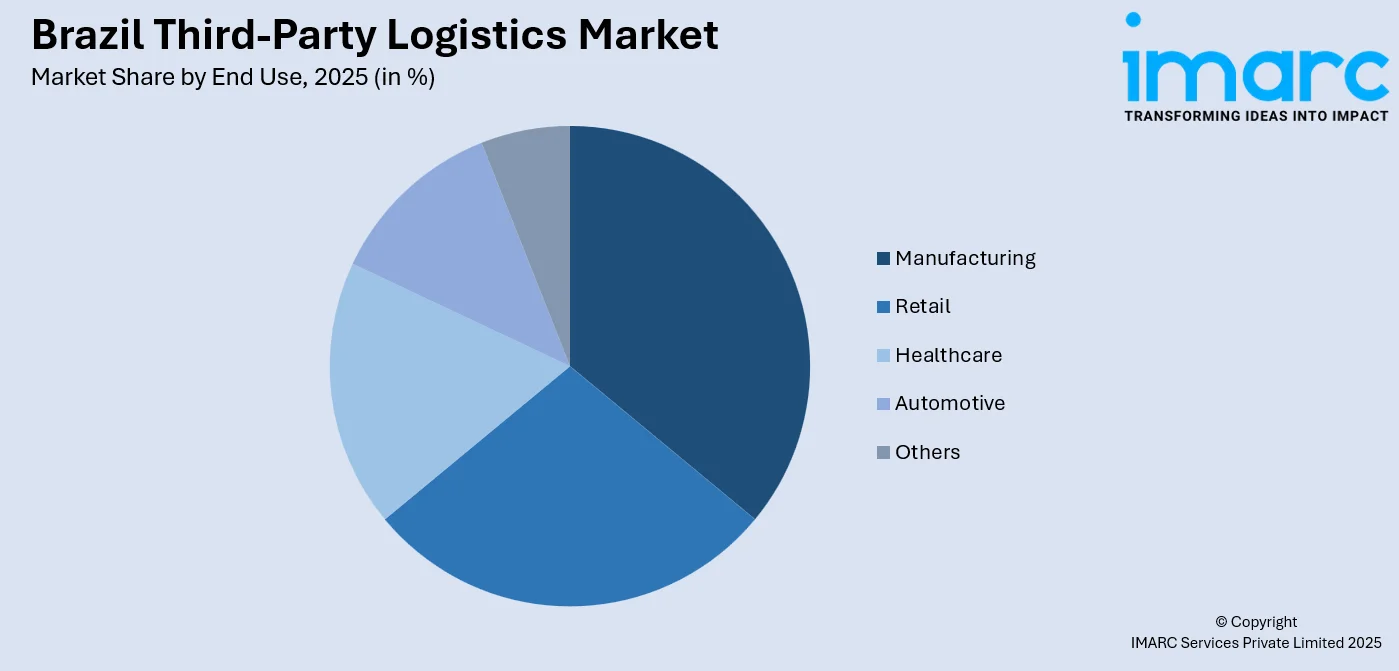

- By End Use: Manufacturing comprises the largest segment with a market share of 25% in 2025, driven by the country's expanding industrial base across the automotive, electronics, and food processing sectors. Manufacturers increasingly outsource logistics operations to concentrate on core competencies while leveraging specialized provider expertise.

- By Region: Southeast represents the largest region with 41% share in 2025, driven by the concentration of Brazil's industrial clusters in São Paulo and Rio de Janeiro metropolitan areas, superior port connectivity through Santos, and higher economic activity levels supporting robust logistics infrastructure.

- Key Players: Key players drive the Brazil third-party logistics market by expanding service portfolios, investing in warehouse automation technologies, and strengthening nationwide distribution networks. Their focus on digital logistics platforms, sustainability initiatives, and strategic acquisitions accelerates market consolidation and enhances competitive positioning across diverse industry verticals.

To get more information on this market Request Sample

The Brazil third-party logistics market continues to experience substantial transformation, driven by accelerating e-commerce adoption, manufacturing sector expansion, and increasing demand for specialized supply chain solutions. The country's strategic position as Latin America's largest economy creates significant opportunities for logistics providers offering comprehensive transportation, warehousing, and distribution services. Rising urbanization, with 87% of Brazil's population residing in urban areas in 2024, generates concentrated demand for efficient last-mile delivery networks and urban fulfillment capabilities. Government infrastructure initiatives, including substantial investments in road, rail, and port modernization, are improving logistics corridor efficiency and reducing transportation bottlenecks. The agricultural sector's export strength intensifies requirements for integrated cold chain and bulk cargo logistics. Digital transformation through artificial intelligence (AI), real-time tracking systems, and warehouse automation is reshaping provider capabilities, enabling enhanced visibility, operational efficiency, and customer service delivery across the expanding logistics ecosystem.

Brazil Third-Party Logistics Market Trends:

Digital Transformation and Technology Integration

The adoption of advanced digital technologies is fundamentally reshaping the Brazil third-party logistics landscape. Providers are increasingly implementing AI-driven route optimization, real-time tracking platforms, and automated warehouse management systems to enhance operational efficiency. Cloud-based logistics platforms enable seamless coordination across supply chain stakeholders, improving visibility and decision-making capabilities. The integration of the Internet of Things (IoT) facilitates predictive maintenance and asset monitoring, reducing downtime and operational costs while meeting rising customer expectations for transparency and speed. As per IMARC Group, the Brazil IoT market is set to attain USD 100.7 Billion by 2034.

E-Commerce Fulfillment Network Expansion

The explosive growth of online retail is driving significant investments in e-commerce fulfillment infrastructure across Brazil. Third-party logistics providers are establishing micro-fulfillment centers and dark stores in urban areas to support same-day and next-day delivery requirements. Strategic warehouse positioning near population centers reduces last-mile delivery distances and costs. The rise of omnichannel retail strategies is pushing providers to develop integrated fulfillment solutions that seamlessly manage inventory across physical stores and online channels, enhancing customer satisfaction.

Sustainability and Green Logistics Initiatives

Environmental sustainability is becoming a critical differentiator in the market, with providers implementing comprehensive green logistics strategies. Fleet electrification programs are expanding as companies invest in electric delivery vehicles to reduce urban carbon emissions. Sustainable packaging solutions and reverse logistics capabilities for recycling and returns management are gaining prominence. Providers are adopting renewable energy sources for warehouse operations and implementing carbon tracking systems to meet growing corporate sustainability requirements and environmental regulations.

Market Outlook 2026-2034:

The Brazil third-party logistics market demonstrates strong growth prospects, driven by sustained e-commerce expansion, manufacturing sector recovery, and continued infrastructure modernization. The market generated a revenue of USD 31.42 Billion in 2025 and is projected to reach a revenue of USD 59.04 Billion by 2034, growing at a compound annual growth rate of 7.26% from 2026-2034. Government investments in multimodal transportation corridors and port capacity expansion will enhance logistics efficiency, while digital transformation initiatives enable providers to deliver superior service quality. Rising agricultural exports and manufacturing output will sustain demand for specialized supply chain solutions across the forecast period. Additionally, increasing adoption of value-added services, such as last-mile delivery optimization and warehouse automation, will strengthen the competitive position of third-party logistics providers in Brazil.

Brazil Third-Party Logistics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Transport |

Roadways |

59% |

|

Service Type |

Domestic Transportation Management |

52% |

|

End Use |

Manufacturing |

25% |

|

Region |

Southeast |

41% |

Transport Insights:

- Railways

- Roadways

- Waterways

- Airways

Roadways dominate with a market share of 59% of the total Brazil third-party logistics market in 2025.

Brazil's roadway transportation segment maintains commanding market leadership, supported by the nation's extensive highway infrastructure spanning 2 Million kilometers of federal roads in 2024. The country possessed the fourth-largest road network globally, enabling comprehensive geographic coverage from industrial centers to remote agricultural regions. Road freight handles a major portion of Brazil's ton-mile cargo nationally, reflecting the mode's unparalleled flexibility for door-to-door deliveries. Third-party logistics providers leverage road transport's adaptability to serve diverse industry requirements, ranging from automotive component sequencing to perishable food distribution.

Roadways continue to lead, due to their cost-effectiveness and ability to connect production hubs with consumption centers efficiently. The flexibility of trucking allows logistics providers to customize routes, manage variable shipment sizes, and respond quickly to demand fluctuations. Roadways also play a critical role in first-mile and last-mile connectivity, particularly in regions with limited rail or inland waterway access. Ongoing investments in highway upgrades, toll road concessions, and fleet modernization are improving transit times and reliability, further reinforcing road transport’s central role in the country’s third-party logistics operations.

Service Type Insights:

- Dedicated Contract Carriage

- Domestic Transportation Management

- International Transportation Management

- Warehousing and Distribution

- Value Added Logistics Services

Domestic transportation management leads with a share of 52% of the total Brazil third-party logistics market in 2025.

Domestic transportation management dominates the market, driven by Brazil's vast geographic territory requiring sophisticated internal logistics coordination. The segment encompasses freight brokerage, carrier management, route optimization, and shipment consolidation services essential for efficient goods movement across the nation. E-commerce expansion has intensified demand for domestic logistics capabilities, with sales growing 18.7% in the first half of 2024 to reach BRL 160.3 Billion. Rising consumer expectations for faster delivery windows compel retailers and manufacturers to partner with specialized domestic logistics providers.

Third-party logistics providers offering domestic transportation management deliver significant value through consolidated shipping networks, negotiated carrier rates, and advanced transportation management systems enabling real-time visibility. The service type segment benefits from increasing outsourcing trends, as businesses recognize efficiency gains from specialized logistics expertise. Manufacturing clients utilize domestic transportation management for just-in-time delivery coordination and vendor-managed inventory programs, while retailers depend on these services for seamless omnichannel fulfillment and seasonal demand management across Brazil's diverse regional markets.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Manufacturing exhibits a clear dominance with a 25% share of the total Brazil third-party logistics market in 2025.

Manufacturing represents the largest end use segment for third-party logistics services, driven by the nation's diversified industrial base spanning automotive, electronics, food processing, and chemical production. Manufacturers increasingly outsource inbound logistics, component distribution, and finished goods delivery to focus on core production competencies. Government industrial incentives, particularly in the South and Southeast regions, encourage factory modernization and expansion. This outsourcing trend is further supported by the need to manage complex, multi-tier supply chains efficiently while maintaining cost control and production continuity in a competitive industrial environment.

Third-party logistics providers serving manufacturing clients offer value-added services, including just-in-time delivery coordination, vendor-managed inventory programs, and returnable packaging management, which are essential for lean production operations. The automotive industry's significant presence, with Brazil's vehicle sales reaching 2.6 Million units in 2024, generates substantial demand for sequenced component delivery and finished vehicle logistics. Food and beverage (F&B) manufacturing requires temperature-controlled storage and distribution capabilities, while chemical sector clients depend on specialized handling and regulatory compliance support from logistics partners.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the leading region with a 41% share of the total Brazil third-party logistics market in 2025.

Southeast maintains dominant market position, anchored by São Paulo's industrial clusters and Rio de Janeiro's commercial activities, together generating the majority of Brazil's GDP. The region benefits from superior infrastructure, including the Port of Santos, Latin America's largest container terminal. It also hosts a dense concentration of manufacturing facilities, corporate headquarters, and financial institutions that drive consistent freight movement. Strong urbanization and high consumer purchasing power further elevate logistics demand.

Third-party logistics providers concentrate operations in the Southeast to serve concentrated consumer markets and manufacturing hubs requiring efficient supply chain solutions. Major e-commerce platforms prioritize fulfillment center expansion in this region, with leading players investing billions in warehouse infrastructure. The region's advanced highway network, port connectivity, and rail links enable multimodal transportation options essential for domestic distribution and international trade across diverse industry sectors. Additionally, the availability of skilled logistics professionals and advanced digital infrastructure supports efficient warehouse management and real-time supply chain visibility.

Market Dynamics:

Growth Drivers:

Why is the Brazil Third-Party Logistics Market Growing?

Rapid E-Commerce Expansion and Last-Mile Delivery Demands

The explosive growth of Brazil's e-commerce sector is fundamentally driving third-party logistics market expansion by generating unprecedented demand for warehousing, fulfillment, and last-mile delivery services. Online retail penetration continues to accelerate, as consumers increasingly prefer digital shopping channels, creating substantial volume growth for logistics providers. The expansion of omnichannel retail strategies compels businesses to outsource complex logistics operations to specialized providers capable of managing integrated inventory across multiple sales channels. Rising consumer expectations for faster delivery windows, including same-day and next-day options, require significant investment in urban fulfillment infrastructure that third-party providers can offer more efficiently than individual retailers. Mercado Libre revealed its intention to establish 11 additional distribution centers in Brazil by the end of 2025, demonstrating the scale of infrastructure development underway. Micro-fulfillment centers, dark stores, and automated sorting facilities are proliferating in major metropolitan areas to support rapid delivery requirements. The seasonal demand variability inherent in e-commerce, particularly during promotional events, drives retailers toward flexible third-party logistics partnerships that provide scalable capacity without fixed cost burdens.

Government Infrastructure Investments and Policy Support

Substantial government investments in transportation infrastructure are creating favorable conditions for the Brazil third-party logistics market growth by improving freight movement efficiency and reducing operational costs. The federal government's commitment to modernizing highways, railways, and port facilities addresses longstanding infrastructure bottlenecks that constrained logistics sector development. Brazil's National Logistics Plan targets comprehensive transportation network improvements enabling faster, more reliable goods movement across the nation's vast territory. Road infrastructure enhancement programs, including the February 2025 announcement of USD 12 Billion investment in grain harvest logistics infrastructure covering roads, railways, and ports, demonstrate sustained commitment to logistics sector support. Port modernization initiatives, including dredging projects and container terminal expansion at Santos and other major facilities, enhance international trade capabilities essential for export-oriented industries. Railway development programs improve bulk cargo efficiency while reducing highway congestion, creating multimodal transportation options for logistics providers.

Manufacturing Sector Expansion and Supply Chain Outsourcing Trends

Brazil's manufacturing sector expansion is generating substantial demand for sophisticated third-party logistics services, as companies increasingly outsource supply chain functions to specialized providers. Industrial growth across the automotive, electronics, food processing, and pharmaceutical sectors requires efficient inbound logistics, component distribution, and finished goods delivery capabilities. Manufacturers adopt lean production models that depend on just-in-time delivery precision achievable through experienced logistics partners with established carrier networks. The trend of production facility modernization, supported by government incentives particularly in South and Southeast regions, creates demand for value-added logistics services, including vendor-managed inventory, sequenced delivery, and returnable packaging management. Rising export opportunities, particularly for the agricultural processing and automotive sectors, require international logistics capabilities that third-party providers can deliver more cost-effectively than captive operations.

Market Restraints:

What Challenges is the Brazil Third-Party Logistics Market Facing?

Infrastructure Deficiencies and Regional Disparities

Persistent infrastructure gaps across Brazil's vast territory create operational challenges for third-party logistics providers. Inadequate road conditions, particularly in North and Northeast regions, increase vehicle maintenance costs and extend delivery times. Port congestion at major terminals causes shipment delays and revenue losses for exporters. Limited rail network development restricts multimodal transportation options, forcing continued dependence on costlier road freight for long-distance cargo movement.

Labor Shortages and Rising Operational Costs

The logistics sector faces significant workforce challenges as the licensed driver pool ages while new entrant rates decline. Wage inflation pressures profit margins for carriers and third-party logistics providers dependent on labor-intensive operations. Recruiting and retaining skilled warehouse personnel remains difficult amid competition from other sectors. Diesel price volatility and toll road expenses further increase transportation costs, compelling providers to invest in automation and efficiency improvements.

Complex Regulatory Environment and Tax Burden

Brazil's complex tax structure and regulatory requirements create administrative burdens for logistics operations. Interstate tax variations complicate pricing and route planning across regional boundaries. Customs procedures for international shipments require specialized expertise and documentation management. Compliance with environmental regulations, labor laws, and transportation safety standards demands substantial administrative resources that increase operational costs and reduce competitive flexibility.

Competitive Landscape:

The Brazil third-party logistics market exhibits moderate fragmentation with participation from global integrators, regional specialists, and local operators serving diverse customer segments. International providers leverage global networks and technology platforms to deliver comprehensive end-to-end supply chain solutions. Domestic players maintain competitive positions through regional expertise, established carrier relationships, and customer service capabilities. Strategic mergers and acquisitions are reshaping market structure as participants pursue scale advantages and expanded service portfolios. Technology investment differentiates leading providers through enhanced visibility, automation capabilities, and digital customer interfaces. Sustainability initiatives and green logistics solutions increasingly influence competitive positioning among environmentally conscious clients.

Brazil Third-Party Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Transports Covered | Railways, Roadways, Waterways, Airways |

| Service Types Covered | Dedicated Contract Carriage, Domestic Transportation Management, International Transportation Management, Warehousing and Distribution, Value Added Logistics Services |

| End Uses Covered | Manufacturing, Retail, Healthcare, Automotive, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil third-party logistics market size was valued at USD 31.42 Billion in 2025.

The Brazil third-party logistics market is expected to grow at a compound annual growth rate of 7.26% from 2026-2034 to reach USD 59.04 Billion by 2034.

Roadways dominated the market with a share of 59%, driven by Brazil's extensive highway network enabling comprehensive geographic coverage and flexible door-to-door delivery capabilities essential for diverse industry requirements.

Key factors driving the Brazil third-party logistics market include rapid e-commerce expansion generating fulfillment demands, government infrastructure investments, manufacturing sector growth, and increasing outsourcing trends among businesses seeking operational efficiency.

Major challenges include infrastructure deficiencies in remote regions, labor shortages affecting driver availability, volatile fuel costs impacting transportation expenses, complex regulatory requirements, and interstate tax variations complicating operational planning.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)