Brazil Sodium Reduction Agents Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Brazil Sodium Reduction Agents Market Summary:

The Brazil sodium reduction agents market size was valued at USD 125.40 Million in 2025 and is projected to reach USD 182.78 Million by 2034, growing at a compound annual growth rate of 4.28% from 2026-2034.

The Brazil sodium reduction agents market is experiencing sustained growth driven by increasing consumer awareness of health risks associated with excessive sodium consumption. The rising prevalence of hypertension and cardiovascular conditions among the Brazilian population is prompting food manufacturers to reformulate products with reduced sodium content. Government initiatives promoting healthier dietary habits and front-of-pack warning label regulations are further accelerating the adoption of sodium reduction solutions across the processed food industry.

Key Takeaways and Insights:

- By Product Type: Amino acids and glutamates dominate the market with a share of 33% in 2025, owing to their natural umami-enhancing properties and capacity to substantially reduce sodium in processed foods, meeting the rising demand for clean-label formulations.

- By Application: Condiments, seasonings and sauces lead the market with a share of 24% in 2025, as these product categories traditionally contain high sodium levels and face increasing reformulation pressure from regulatory requirements and health-conscious consumers.

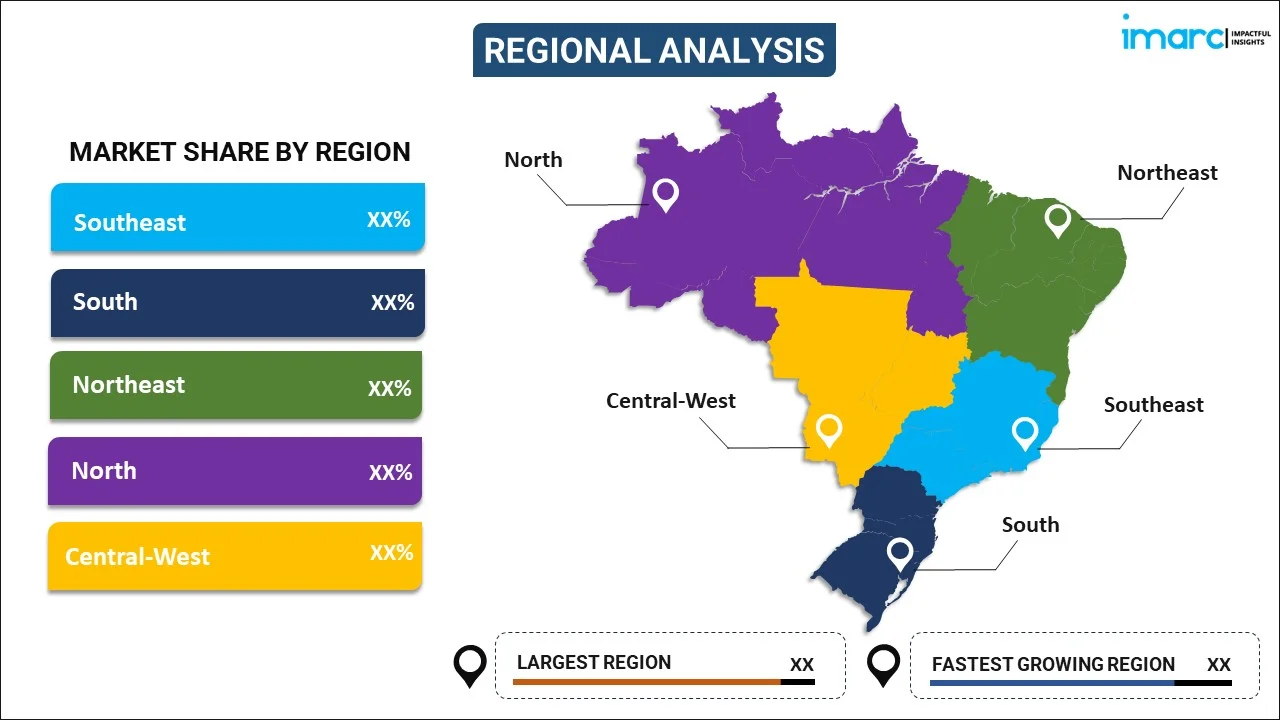

- By Region: Southeast represents the largest segment with a market share of 35% in 2025, supported by the concentration of major food processing facilities in São Paulo and Rio de Janeiro, higher disposable incomes, and greater health awareness among urban populations.

- Key Players: The Brazil sodium reduction agents market exhibits moderate competitive intensity, with multinational ingredient manufacturers competing alongside regional specialty suppliers. Market participants focus on product innovation, clean-label solutions, and strategic partnerships with food processors to expand market presence.

The sodium reduction agents market in Brazil covers a broad spectrum of solutions, such as potassium-based mineral salts, amino acids, yeast extracts, and seaweed-derived ingredients, which help food producers lower sodium levels without compromising taste. Rising health awareness among Brazilian consumers is encouraging demand for products with improved nutritional profiles, prompting manufacturers to actively reformulate existing offerings. Regulatory oversight by ANVISA, particularly front-of-pack labeling requirements that highlight high sodium content, has further reinforced this shift by increasing transparency and influencing purchasing decisions. As a result, processed food producers are increasingly integrating sodium reduction technologies to align with public health objectives, meet regulatory expectations, and maintain product appeal in a competitive market environment.

Brazil Sodium Reduction Agents Market Trends:

Clean-Label and Natural Ingredient Preference

Brazilian consumers are placing greater emphasis on clear food labeling and the use of natural ingredients, which is accelerating the uptake of clean-label sodium reduction solutions. Manufacturers are increasingly favoring yeast extracts and seaweed-derived compounds as effective substitutes for synthetic additives, aligning product formulations with evolving consumer preferences. This shift reflects a broader movement toward natural flavor enhancers that support sodium reduction while preserving taste and product integrity. As awareness around health and ingredient transparency grows, clean-label approaches are becoming central to building consumer confidence and strengthening the appeal of processed food products.

Regulatory-Driven Product Reformulation

ANVISA’s front-of-pack warning label requirements are prompting widespread reformulation across multiple food categories in Brazil. The use of prominent symbols to alert consumers about high sodium content has increased scrutiny of nutritional profiles and influenced purchasing behavior. In response, food manufacturers are prioritizing sodium reduction strategies to improve label outcomes and align with growing health awareness. Investments in reformulation technologies and alternative ingredients are helping companies enhance product perception, reduce regulatory risk, and preserve competitiveness in segments where nutrition, transparency, and healthier positioning play an increasingly important role.

Technological Innovation in Flavor Enhancement

Advances in food processing technologies are supporting more effective sodium reduction while maintaining the taste and mouthfeel consumers expect. Manufacturers are increasingly formulating advanced blends that pair potassium chloride with bitterness-masking agents to improve palatability, while yeast extracts are used to boost umami and overall flavor intensity. In Brazil, demand for these solutions is supported by a well-established fermentation base and expanding snack and meat processing sectors, where flavor enhancement is critical. Together, these innovations are helping food producers achieve sodium reduction goals without compromising sensory quality or consumer acceptance.

Market Outlook 2026-2034:

The Brazil sodium reduction agents market outlook remains positive, supported by continued regulatory emphasis on reducing population sodium intake and growing consumer demand for healthier food options. The Brazilian Ministry of Health's ongoing collaboration with the food industry association to improve nutritional profiles of processed foods provides a favorable policy environment for market expansion. Technological advancements in fermentation-derived ingredients and precision formulation techniques are expected to enhance product efficacy while reducing production costs. The market generated a revenue of USD 125.40 Million in 2025 and is projected to reach a revenue of USD 182.78 Million by 2034, growing at a compound annual growth rate of 4.28% from 2026-2034.

Brazil Sodium Reduction Agents Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Amino Acids and Glutamates | 33% |

| Application | Condiments, Seasonings and Sauces | 24% |

| Region | Southeast | 35% |

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Amino Acids and Glutamates

- Mineral Salts

- Yeast Extracts

- Others

Amino acids and glutamates dominates with a market share of 33% of the total Brazil sodium reduction agents market in 2025.

Amino acids and glutamates represent the leading product category due to their dual functionality as flavor enhancers and sodium reduction agents. These compounds naturally enhance umami taste perception, allowing manufacturers to reduce salt content while maintaining savory flavor profiles that Brazilian consumers expect. Glutamate-based ingredients are particularly effective in processed meat products, snacks, and ready-to-eat meals where flavor intensity is essential for consumer acceptance.

The segment benefits from growing consumer acceptance of naturally-derived flavor enhancers and increasing demand for clean-label ingredients across the Brazilian food industry. Major food processors are incorporating amino acid blends into reformulation strategies to meet voluntary sodium reduction targets established through agreements with the Brazilian Ministry of Health. Product innovation focuses on developing customized amino acid combinations that address specific flavor challenges in low-sodium formulations while maintaining cost competitiveness.

Application Insights:

- Bakery and Confectionery

- Condiments, Seasonings and Sauces

- Dairy and Frozen Foods

- Meat and Seafood Products

- Snacks and Savoury Products

- Others

Condiments, seasonings and sauces leads with a share of 24% of the total Brazil sodium reduction agents market in 2025.

Condiments, seasonings, and sauces represent a critical application segment due to their traditionally high sodium content and central role in Brazilian culinary traditions. Salt-based condiments account for over three-quarters of daily sodium intake in the Brazilian diet, making this category a primary target for reformulation efforts. The Brazil condiments and sauces market is projected to grow substantially through 2030, with manufacturers actively seeking sodium reduction solutions that preserve authentic flavor characteristics.

Product reformulation in this segment faces unique challenges due to the functional role of salt in preservation, texture, and flavor development. Manufacturers are adopting multi-component sodium reduction systems combining mineral salts with yeast extracts and amino acids to address these technical requirements. The segment benefits from the rising popularity of premium and artisanal sauces among health-conscious consumers, creating opportunities for differentiated low-sodium product offerings that command price premiums in retail channels.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits clear dominance with a 35% share of the total Brazil sodium reduction agents market in 2025.

The Southeast region maintains market leadership driven by the concentration of food processing facilities, major metropolitan populations in São Paulo and Rio de Janeiro, and higher consumer health awareness. The region accounts for the largest share of processed food production in Brazil, creating substantial demand for sodium reduction ingredients across multiple food categories. Higher disposable incomes in southeastern urban centers enable premium positioning of reduced-sodium products.

Hypertension prevalence tends to be higher in the Southeast and South regions compared to other areas of Brazil, intensifying consumer demand for healthier food alternatives. The concentration of multinational food manufacturers and ingredient suppliers in the region facilitates technology transfer and the adoption of advanced sodium reduction solutions. Distribution networks and retail infrastructure in southeastern markets support broader availability of reformulated low-sodium products to health-conscious consumers.

Market Dynamics:

Growth Drivers:

Why is the Brazil Sodium Reduction Agents Market Growing?

Rising Prevalence of Hypertension and Cardiovascular Diseases

Brazil faces a significant public health challenge with hypertension affecting approximately one-third of the adult population aged thirty years and over. Cardiovascular disease represents the leading cause of mortality in the country, responsible for nearly one-third of all deaths. Findings from global health research highlight a rising burden of deaths linked to high blood pressure in Brazil, with excessive dietary sodium identified as a key contributing factor. Average salt intake remains well above recommended healthy levels, intensifying cardiovascular risks. This growing public health concern is prompting stronger regulatory oversight and heightened consumer awareness, encouraging food manufacturers to adopt sodium reduction solutions as part of broader efforts to improve nutritional quality and address diet-related health challenges.

Regulatory Requirements and Front-of-Pack Labeling Implementation

ANVISA’s introduction of mandatory front-of-pack warning labels marks a major regulatory shift influencing sodium reduction efforts in Brazil. The prominent symbols highlighting high sodium content have increased consumer scrutiny and reshaped purchasing behavior. Restrictions on the use of nutrition and health claims for products carrying these warnings further encourage manufacturers to improve product formulations. To protect brand positioning and remain competitive, food producers are increasingly prioritizing reformulation strategies. This regulatory approach, aligned with broader regional practices, is strengthening the role of sodium reduction solutions across a wide range of processed food categories.

Expanding Processed Food Industry and Changing Consumer Preferences

Brazil’s food processing sector plays a central role in the national economy and agricultural value chain, supporting a wide range of packaged and ready-to-eat food products. Ongoing urbanization and evolving lifestyles are increasing reliance on processed and convenience foods, expanding the scope for sodium reduction applications. At the same time, growing health awareness is reshaping consumer preferences toward products with improved nutritional profiles and cleaner labels. In response, food manufacturers are increasingly prioritizing lower-sodium formulations, viewing investment in sodium reduction technologies as a strategic opportunity to strengthen brand positioning and appeal to wellness-focused consumer segments.

Market Restraints:

What Challenges the Brazil Sodium Reduction Agents Market is Facing?

Technical Challenges in Flavor Maintenance

Lowering the sodium level without hindering the organoleptic properties is a technical challenge for the food industry. Although salt is a major contributor in terms of organoleptic properties, its technical functionality encompasses preservation, texture enhancement, and other qualities associated with the mouthfeel of the food. The presence of potassium chloride and other salt substitutes possesses bitter or metallic notes that need masking.

Higher Production Costs and Price Sensitivity

The cost of sodium reduction ingredients is usually higher than that of normal salt, which affects the economics of products in competitive food lines. There are specialty ingredients like yeast extracts and blends of amino acids, which are also charged high price increments over commodity sodium chloride. The consumers of Brazil are sensitive to prices, especially in the mass-market food areas, where the rises in prices can influence the buying behavior. Manufacturers are forced to make trade-offs in reformulation versus competitive pricing needs in price-sensitive market segments.

Consumer Acceptance and Taste Adaptation Requirements

Consumer acceptance of reduced-sodium products remains variable, with established taste preferences creating barriers to rapid market transition. Gradual sodium reduction strategies require sustained commitment and investment over extended timeframes to allow consumer palates to adapt. Products with immediately noticeable flavor differences risk consumer rejection and brand damage. Manufacturers must implement careful reformulation approaches that balance health benefits against consumer acceptance requirements.

Competitive Landscape:

The Brazil sodium reduction agents market shows a moderate level of competition, shaped by the presence of both global ingredient suppliers and regional specialty producers. Companies differentiate themselves through continuous product innovation, strong technical support, and well-established distribution networks serving food processors. Larger suppliers tend to benefit from integrated research and development capabilities, enabling the introduction of more advanced sodium reduction solutions. At the same time, regional players focus on tailored formulations suited to local culinary preferences and cost-sensitive applications. Collaboration between food manufacturers and ingredient suppliers is becoming more prevalent, supporting effective reformulation efforts that balance regulatory compliance with taste and consumer acceptance.

Recent Developments:

- February 2025: ANVISA approved new rules streamlining evaluation of food-related petitions by accepting supporting documentation from equivalent foreign regulatory authorities, facilitating faster market entry for innovative sodium reduction ingredients developed internationally.

- February 2025: The Brazilian government announced reductions in ultra-processed food limits in public school menus from twenty percent to fifteen percent through the National School Meals Programme, creating additional demand for healthier ingredient formulations in institutional food service.

Brazil Sodium Reduction Agents Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Amino Acids and Glutamates, Mineral Salts, Yeast Extracts, Others |

| Applications Covered | Bakery and Confectionery, Condiments, Seasonings and Sauces, Dairy and Frozen Foods, Meat and Seafood Products, Snacks and Savoury Products, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil sodium reduction agents market size was valued at USD 125.40 Million in 2025.

The Brazil sodium reduction agents market is expected to grow at a compound annual growth rate of 4.28% from 2026-2034 to reach USD 182.78 Million by 2034.

Amino acids and glutamates dominated the market with a 33% share in 2025, driven by their effectiveness in enhancing umami flavor while enabling significant sodium reduction in processed food formulations.

Key factors driving the Brazil sodium reduction agents market include rising prevalence of hypertension and cardiovascular diseases, implementation of front-of-pack warning label regulations by ANVISA, growing consumer health awareness, and expanding processed food industry investment in reformulation technologies.

Major challenges include technical difficulties in maintaining flavor profiles during sodium reduction, higher production costs compared to conventional salt, consumer taste adaptation requirements, limited availability of cost-effective natural alternatives, and variable consumer acceptance of reformulated products across market segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)