Brazil ROV Market Size, Share, Trends and Forecast by Vehicle Type, Application, and Region, 2026-2034

Brazil ROV Market Summary:

The Brazil ROV market size was valued at USD 57.93 Million in 2025 and is projected to reach USD 146.15 Million by 2034, growing at a compound annual growth rate of 10.83% from 2026-2034.

The Brazil ROV market is experiencing significant growth, driven by expanding offshore oil and gas exploration activities in pre-salt deepwater fields. Increasing investments in subsea infrastructure development, rising demand for inspection, maintenance, and repair services, and technological advancements in underwater robotics are propelling market expansion. The defense sector is also contributing through maritime security applications, fueling the Brazil ROV market share.

Key Takeaways and Insights:

- By Vehicle Type: Work class ROVs dominate the market with a share of 56% in 2025, owing to their advanced capabilities for performing complex subsea tasks, including pipeline inspection, equipment maintenance, and construction support in ultra-deepwater environments.

- By Application: Oil and gas lead the market with a share of 60% in 2025. This dominance is driven by Brazil's extensive pre-salt offshore reserves requiring sophisticated subsea technologies for exploration, drilling support, infrastructure installation, and maintenance operations.

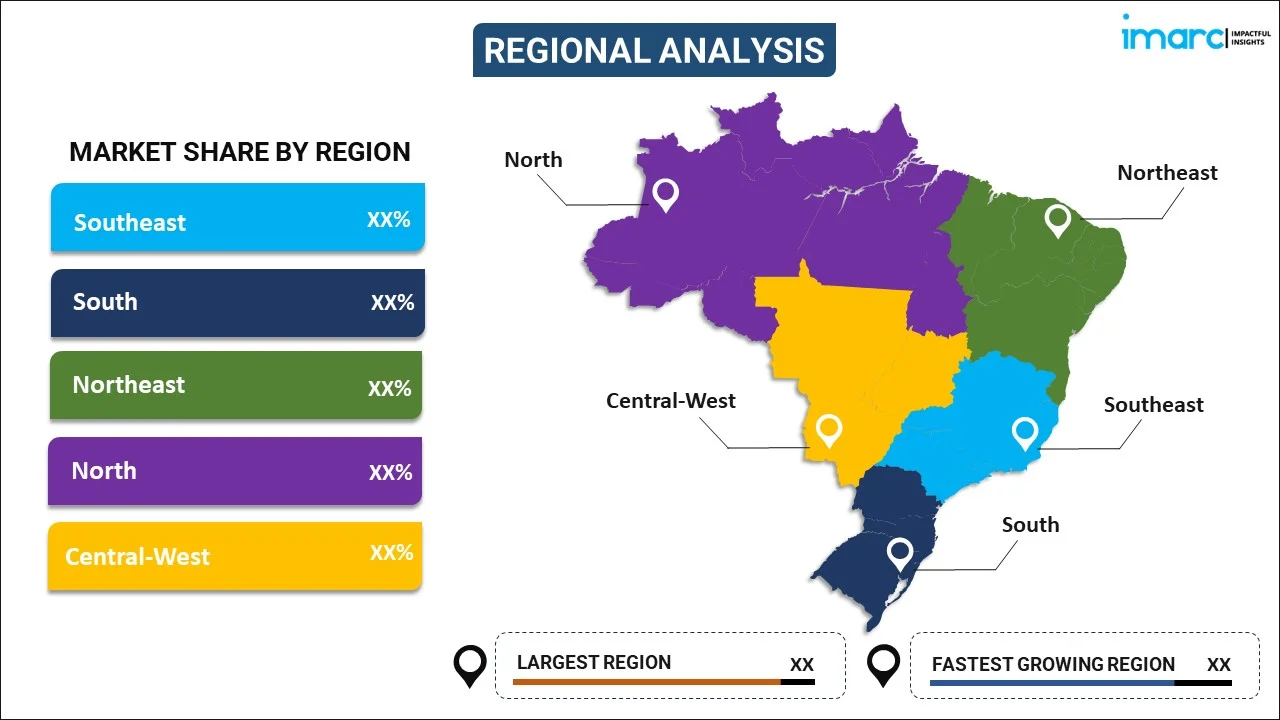

- By Region: Southeast represents the largest region with 34% share in 2025, driven by the concentration of Brazil's major offshore oil and gas fields in the Santos and Campos Basins. Rio de Janeiro and São Paulo states host critical subsea infrastructure, ROV service providers, and operational centers, supporting the nation's deepwater energy production.

- Key Players: Key players drive the Brazil ROV market by expanding service capabilities, investing in advanced underwater robotics technologies, and strengthening partnerships with major offshore operators. Their focus on remote operations, enhanced imaging systems, and deepwater intervention tools ensures reliable performance across complex subsea environments.

The Brazil ROV market is advancing, as the country solidifies its position among the world's leading offshore oil producers, driving substantial demand for sophisticated underwater robotics solutions. The expansion of pre-salt exploration activities in the Santos and Campos Basins creates significant opportunities for ROV service providers, as ultra-deepwater operations increasingly rely on remotely operated vehicles for inspection, maintenance, and intervention tasks. In August 2025, Oceaneering International, Inc. revealed that its Brazilian subsidiary, Marine Production Systems do Brasil LTDA (MPS), received several Subsea Robotics contracts worth USD 180 Million from Petróleo Brasileiro S.A, demonstrating the robust demand for work-class ROV services supporting offshore Brazil operations. Government initiatives aimed at promoting domestic energy production, combined with substantial investments from international oil companies, are accelerating market development.

Brazil ROV Market Trends:

Adoption of Remote Operations and Shore-Based Piloting

The Brazil ROV market is witnessing accelerated adoption of remote operations capabilities, enabling shore-based piloting of underwater vehicles. This approach relocates ROV pilots from offshore vessels to onshore control centers, enhancing operational safety while reducing carbon emissions associated with personnel transport. In December 2024, Fugro pioneered fully remote subsea inspections for Petrobras in Brazil, using its Blue Essence uncrewed surface vessel and Blue Volta electric ROV technology, achieving emission reductions by 95% compared to conventional methods.

Expansion of Ultra-Deepwater Exploration Activities

Brazil's pre-salt oil fields are driving unprecedented demand for ROVs capable of operating at extreme depths. The Santos Basin hosts some of the world's most productive deepwater reservoirs, requiring specialized vehicles with enhanced depth ratings and advanced intervention capabilities. In October 2025, the Buzios field, operated by Petrobras in the Santos Basin, achieved production of 1 Million barrels per day, highlighting the scale of offshore operations requiring continuous ROV support for infrastructure monitoring and maintenance activities.

Integration of Advanced Imaging and Sensor Technologies

In Brazil, ROV manufacturers and operators are increasingly integrating high-definition cameras, advanced sonar systems, and sophisticated sensors into underwater vehicles serving Brazil's offshore sector. These technological enhancements improve inspection accuracy, enable real-time data transmission, and support predictive maintenance programs. The integration of artificial intelligence (AI) algorithms for data analysis accelerates decision-making processes, while enhanced imaging capabilities support comprehensive assessments of subsea infrastructure integrity in challenging deepwater conditions.

Market Outlook 2026-2034:

The Brazil ROV market outlook remains positive, as the country continues to expand offshore oil and gas production capacity through substantial infrastructure investments. Growing emphasis on deepwater exploration, coupled with increasing subsea maintenance requirements from aging offshore installations, creates sustained demand for advanced remotely operated vehicles. The market generated a revenue of USD 57.93 Million in 2025 and is projected to reach a revenue of USD 146.15 Million by 2034, growing at a compound annual growth rate of 10.83% from 2026-2034. Defense sector applications and emerging offshore renewable energy developments present additional expansion opportunities. Technological advancements in navigation, imaging, and robotic manipulation are further enhancing ROV operational efficiency and reliability in complex subsea environments.

Brazil ROV Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Work Class ROVs |

56% |

|

Application |

Oil and Gas |

60% |

|

Region |

Southeast |

34% |

Vehicle Type Insights:

To get detailed segment analysis of this market, Request Sample

- Observation ROVs

- Work Class ROVs

- Others

Work class ROVs dominate with a market share of 56% of the total Brazil ROV market in 2025.

Work class ROVs represent the backbone of Brazil's subsea operations, delivering essential capabilities for complex underwater tasks across the nation's extensive offshore oil and gas infrastructure. These heavy-duty vehicles are equipped with powerful hydraulic systems, sophisticated manipulator arms, and advanced tooling packages enabling precise intervention at depths. Their robust construction allows sustained operations during long deployment cycles without performance degradation. High payload capacity enables integration of multiple tools simultaneously, improving operational efficiency and reducing vessel time.

The segment's dominance reflects the demanding requirements of Brazil's pre-salt deepwater fields, where work class ROVs perform critical functions, including pipeline inspection, wellhead monitoring, subsea equipment installation, and maintenance activities. These vehicles offer redundant electro-hydraulic power systems ensuring operational reliability in challenging underwater environments. Brazilian offshore operators increasingly deploy work class ROVs equipped with high-definition cameras, imaging sonar, and specialized intervention tools to support continuous production from ultra-deepwater facilities across the Santos and Campos Basins.

Application Insights:

- Oil and Gas

- Defense

- Others

Oil and gas lead with a share of 60% of the total Brazil ROV market in 2025.

Oil and gas drive the Brazil ROV market through extensive deepwater exploration and production activities concentrated in the pre-salt regions. ROVs are deployed for inspection, maintenance, and repair operations supporting floating production storage and offloading (FPSO) vessels, subsea manifolds, flowlines, and wellheads. Harsh offshore conditions and extreme water depths make human intervention impractical, reinforcing reliance on advanced ROV systems in the oil and gas industry. Continuous operational uptime requirements further increase demand for ROV-based monitoring and intervention solutions.

Brazil's position as one of the largest oil producers in Latin America, with yield reaching 3.7 Million barrels per day in June 2025, necessitates continuous ROV deployment across hundreds of offshore platforms and subsea installations. The segment benefits from Petrobras' strategic investment plan allocating substantial resources toward upstream operations. ROV services support drilling operations, decommissioning activities, mooring inspections, and pile installations essential for maintaining Brazil's growing offshore production capacity in challenging ultra-deepwater environments.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 34% share of the total Brazil ROV market in 2025.

Southeast commands the largest share of the Brazil ROV market, owing to the concentration of major offshore oil and gas operations in the Santos and Campos Basins off the coasts of Rio de Janeiro and São Paulo states. This region hosts the majority of Brazil's pre-salt production facilities, including the prolific Buzios, Mero, and Tupi fields that collectively produce a large volume of oil equivalent daily. The dense clustering of subsea assets in these basins requires frequent inspection, maintenance, and intervention activities, intensifying reliance on ROV services.

The region benefits from established port infrastructure, specialized service providers, and proximity to offshore installations requiring continuous ROV support. Rio de Janeiro serves as the operational hub for major subsea service companies, with facilities in Macaé and Niterói supporting work-class ROV operations, umbilical manufacturing, and survey services. The Southeast's dominance is reinforced by ongoing FPSO deployments in the Santos Basin, where vessels like the Almirante Tamandaré achieved record production exceeding 270,000 barrels per day in October 2025, generating sustained demand for ROV inspection and maintenance services.

Market Dynamics:

Growth Drivers:

Why is the Brazil ROV Market Growing?

Expansion of Pre-Salt Deepwater Exploration and Production

Brazil’s pre-salt oil fields rank among the world’s most complex offshore developments, generating sustained demand for remotely operated vehicles throughout exploration, drilling, and production stages. Located mainly in the Santos and Campos Basins, these reservoirs lie at extreme water depths and beneath thick salt layers, requiring advanced subsea engineering and continuous underwater support. ROVs play a critical role in installing subsea equipment, connecting wells to floating production units, and supporting commissioning activities. As new FPSOs are brought online, ROVs remain essential across the full asset lifecycle, from initial installation to routine inspections and interventions. Ongoing field development programs and long-term upstream investment strategies ensure a steady pipeline of projects requiring high-capability work-class ROVs. This sustained activity underpins strong demand for subsea robotics services in Brazil’s offshore energy sector.

Rising Demand for Subsea Infrastructure Inspection and Maintenance

In Brazil, the rapidly expanding offshore infrastructure is intensifying the need for ROV-based inspection, maintenance, and repair services to ensure operational safety and production reliability. A growing network of subsea pipelines, manifolds, mooring systems, and wellheads requires regular monitoring in harsh deepwater environments where human intervention is impractical. ROVs enable detailed visual inspections, non-destructive testing, cleaning, and light intervention tasks that support asset integrity management. The coexistence of aging offshore assets and newly commissioned facilities further increases inspection frequency and service complexity. Operators are increasingly prioritizing predictive maintenance strategies to reduce unplanned downtime and extend asset life, driving consistent ROV utilization. These trends position inspection and maintenance services as a long-term growth pillar within the Brazil ROV market.

Government Support for Domestic Energy Production Enhancement

Brazilian government policies promoting domestic oil and gas production create favorable conditions for ROV market expansion by stimulating offshore exploration and development activities. Regulatory frameworks supporting pre-salt development, combined with strategic partnerships between Petrobras and international energy companies, drive substantial investments in subsea operations requiring advanced underwater robotics. In October 2025, Petrobras revealed the chartering of four RSV (ROV Support Vessel) ships, intended for subsea operation support, in agreements amounting to R$10.2 Billion. The units are set to be constructed at the Navship shipyard in Navegantes, Santa Catarina, with deliveries planned for between 2029 and 2030. This demonstrates governmental commitment to strengthening offshore operational capacity. The vessels feature hybrid propulsion systems, achieving efficiency gains while supporting ROV-based inspection, maintenance, and installation services. National policies encouraging technology transfer and local content development further strengthen the domestic ROV services ecosystem.

Market Restraints:

What Challenges the Brazil ROV Market is Facing?

High Capital Investment and Operational Costs

The substantial capital requirements for acquiring and operating work-class ROV systems present significant market challenges, particularly for smaller service providers. Advanced ROV equipment, specialized support vessels, and shore-based infrastructure demand considerable upfront investments, while operational expenses, including vessel day rates, maintenance, and personnel costs, compound financial burdens. These cost barriers can limit market participation and consolidate services among larger operators with established capital resources.

Shortage of Skilled ROV Pilots and Technical Personnel

The availability of qualified ROV pilots and technical specialists remains a constraining factor for market growth as offshore operations expand rapidly. Deepwater ROV operations require extensive training and experience in piloting complex underwater vehicles, operating sophisticated tooling systems, and maintaining equipment reliability in challenging environments. The specialized skill sets required for advanced subsea intervention tasks create workforce development challenges that can limit operational capacity expansion across the Brazilian market.

Technical Challenges in Ultra-Deepwater Environments

Operating ROVs in Brazil’s ultra-deepwater pre-salt fields involves considerable technical and operational challenges due to harsh subsea conditions. Extreme hydrostatic pressure, strong and unpredictable currents, and low-visibility environments place significant stress on equipment and control systems. Ensuring reliable performance under these conditions requires advanced engineering, reinforced components, and redundant safety features, which add complexity and cost to operations. The demanding environment can reduce operational efficiency, increase maintenance requirements, and prolong deployment schedules.

Competitive Landscape:

The Brazil ROV market features a moderately fragmented competitive landscape with established international subsea service providers and specialized regional operators competing for offshore contracts. Market participants differentiate through technological capabilities, fleet size, operational track records, and partnership relationships with major oil and gas operators. Companies are investing in advanced ROV systems, featuring enhanced depth ratings, improved sensor packages, and remote piloting capabilities to strengthen competitive positioning. Strategic alliances between equipment manufacturers and service providers enable comprehensive solution offerings, addressing diverse customer requirements. The market structure reflects concentrated demand from Petrobras and international operators, driving competition based on technical expertise, service reliability, and cost efficiency across inspection, maintenance, and intervention segments.

Recent Developments:

- In October 2025, Forum Energy Technologies secured a contract with DOF for delivery of an XLX-C24 work-class ROV system featuring the advanced ICE Unity Control system with full remote operations capability for extensive subsea operations in Brazil.

Brazil ROV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Observation ROVs, Work Class ROVs, Others |

| Applications Covered | Oil and Gas, Defense, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil ROV market size was valued at USD 57.93 Million in 2025.

The Brazil ROV market is expected to grow at a compound annual growth rate of 10.83% from 2026-2034 to reach USD 146.15 Million by 2034.

Work class ROVs dominated the market with a share of 56%, driven by their advanced capabilities for complex subsea operations in ultra-deepwater environments supporting Brazil's pre-salt offshore developments.

Key factors driving the Brazil ROV market include expanding pre-salt deepwater exploration, rising subsea infrastructure maintenance demands, government support for offshore energy production, and technological advancements in underwater robotics.

Major challenges include high capital investment and operational costs, shortage of skilled ROV pilots and technical personnel, technical difficulties in ultra-deepwater environments, and equipment reliability concerns at extreme depths.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)