Brazil Minimally Invasive Surgery Devices Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Brazil Minimally Invasive Surgery Devices Market Summary:

The Brazil minimally invasive surgery devices market size was valued at USD 1,240.10 Million in 2025 and is projected to reach USD 2,474.83 Million by 2034, growing at a compound annual growth rate of 7.98% from 2026-2034.

The Brazil minimally invasive surgery devices market is growing at a considerable rate owing to the rising investment in healthcare infrastructure, rising demand for minimally invasive surgeries, and growing prevalence of diseases that require surgeries. Advances in technology for endoscopes and laparoscopes further improve the efficacy of surgeries, and greater access to advanced healthcare technology in hospitals and rural areas strengthen the minimally invasive surgeries devices market.

Key Takeaways and Insights:

- By Product: Endoscopic and laparoscopic devices dominate the market with a share of 32% in 2025, due to their extensive use in a variety of surgical specialties, improved viewing features, and increased accuracy capabilities. Demand is still being driven by increasing urological, gynecological, and gastrointestinal treatments.

- By Application: Gastrointestinal leads the market with a share of 25% in 2025. This dominance is driven by the high prevalence of digestive disorders, colorectal conditions, and growing national screening initiatives that necessitate routine colonoscopies and endoscopic diagnostic procedures across healthcare facilities.

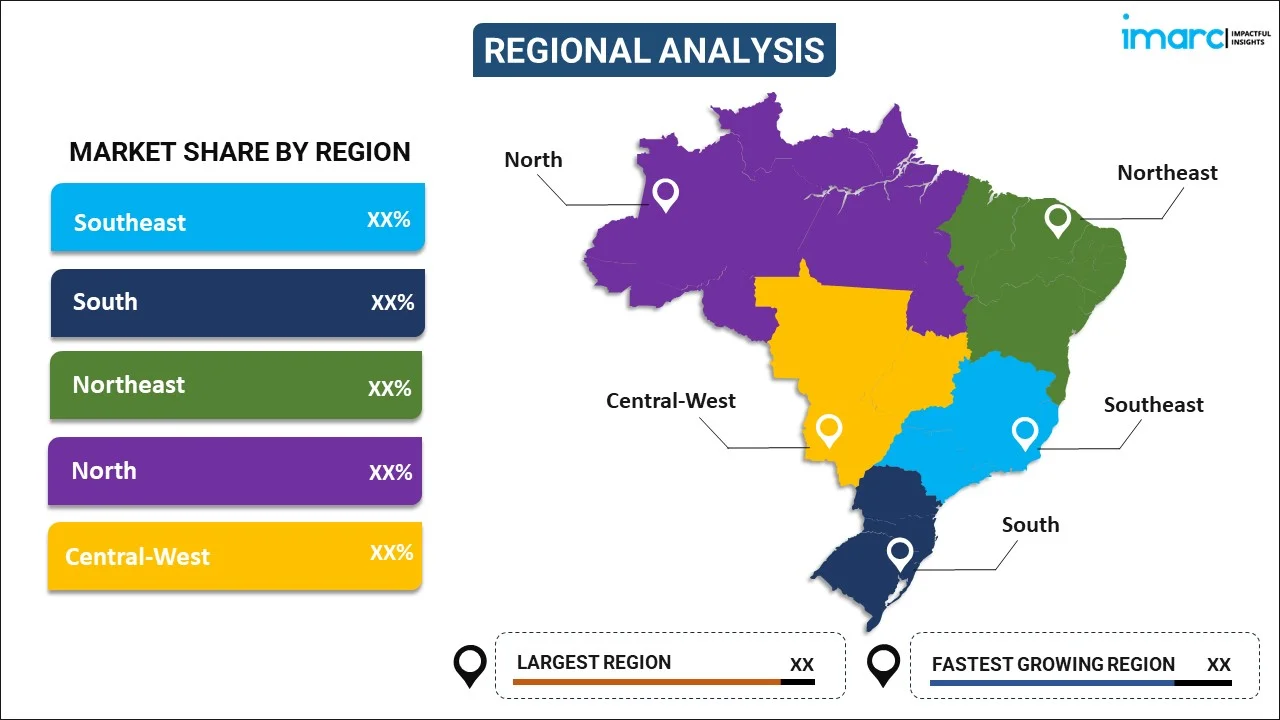

- By Region: Southeast represents the largest region with 40% share in 2025, driven by concentration of advanced healthcare facilities in metropolitan areas, higher disposable incomes, established medical infrastructure in major urban centers, and significant presence of specialized surgical training programs.

- Key Players: Key players drive the Brazil minimally invasive surgery devices market by expanding product portfolios, advancing surgical technology innovations, and strengthening nationwide distribution networks. Their investments in training programs, affordability initiatives, and partnerships with healthcare institutions boost awareness, accelerate adoption, and ensure consistent product availability across diverse healthcare segments.

The Brazil minimally invasive surgery devices market continues gaining momentum as healthcare providers increasingly prioritize advanced surgical technologies that deliver superior patient outcomes. Rising adoption of robotic-assisted surgical systems, enhanced endoscopic visualization equipment, and precision laparoscopic instruments reflects the growing sophistication of surgical practices nationwide. According to research published by the National Center for Biotechnology Information in September 2023, approximately 118,000 robotic-assisted surgical procedures were performed in Brazil, demonstrating significant procedural adoption growth. Government initiatives aimed at modernizing public healthcare infrastructure, coupled with private sector investments in specialized surgical centers, are expanding access to minimally invasive procedures beyond traditional urban strongholds. The integration of advanced imaging technologies, single-use instrumentation, and specialized training programs positions Brazil as a leading emerging market for minimally invasive surgical innovation, with sustained growth anticipated across all product categories and clinical applications.

Brazil Minimally Invasive Surgery Devices Market Trends:

Expanding Robotic Surgery Adoption Across Surgical Specialties

The development and increased adoption of robotic-assisted surgical platforms are changing the way minimally invasive surgery is performed in Brazil. There is adoption and integration of multi-port and single-port robotic surgical platforms across all major Brazilian healthcare settings. The platforms are offering the much-needed accuracy and visualization capabilities to the surgical team. The newer robotic platforms have modular design configurations which enable the flexibility of ports and the ability to perform the surgery with a smaller operating room. Such platforms are now being adopted across various specialties such as urology, gynecology, and colorectal surgery.

Digital Healthcare Integration and Telemedicine Connectivity

The Brazilian healthcare industry is experiencing an intensified merge of minimally invasive surgery technologies and digital health platforms. Modern surgery systems are now embedding artificial intelligence functionalities, data analytics functionalities in real time, and cloud-connectivity functionalities. The smart hospital development programs initiated by the Brazilian government highlight the development of surgery robotics systems that can be perfectly meshed with telemedicine systems to facilitate remote surgical guidance capabilities. Such a digital revolution in surgery allows skilled surgery manpower to be accessible to remote areas across Brazil.

Growing Preference for Single-Use Surgical Instrumentation

The shift toward the use of disposable endoscopic and laparoscopic tools is also a key development in the surgical trends found in Brazil. This is mainly driven by the increasing reliance on disposable surgical tools to avoid cross-contamination and the costs associated with the sterilization of surgical tools, among other factors. To meet the demand caused by the rising use of laparoscopic techniques, there is an increase in the development of disposable laparoscopic tools, which include trocars, graspers, and other surgical tools.

Market Outlook 2026-2034:

Brazil minimally invasive surgery devices market has very strong fundamental growth drivers because of favorable demographic factors and advancements. The increasing prevalence of chronic diseases, aging population, and the shift of patients toward procedures that provide speedy recovery are acting as strong growth drivers. Government efforts in upgrading the healthcare infrastructure of the public sector and the development of surgical centers and training of a greater number of surgeons are expected to contribute greatly to the development of the Brazil minimally invasive surgery devices market. The market generated a revenue of USD 1,240.10 Million in 2025 and is projected to reach a revenue of USD 2,474.83 Million by 2034, growing at a compound annual growth rate of 7.98% from 2026-2034.

Brazil Minimally Invasive Surgery Devices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Endoscopic and Laparoscopic Devices |

32% |

|

Application |

Gastrointestinal |

25% |

|

Region |

Southeast |

40% |

Product Insights:

To get more information on this market, Request Sample

- Handheld Instruments

- Guiding Devices

- Electrosurgical Devices

- Endoscopic and Laparoscopic Devices

- Monitoring and Visualization Devices

- Ablation and Laser Based Devices

- Others

Endoscopic and laparoscopic devices dominate with a market share of 32% of the total Brazil minimally invasive surgery devices market in 2025.

Endoscopic and laparoscopic devices maintain market leadership through their fundamental role across virtually all minimally invasive surgical specialties. These instruments enable surgeons to perform complex diagnostic and therapeutic procedures through small incisions with enhanced visualization capabilities and improved precision. The versatility of laparoscopes and endoscopes across gastroenterology, urology, gynecology, and orthopedic applications ensures consistent demand from healthcare facilities seeking comprehensive minimally invasive surgical capabilities. Growing procedural volumes and technological advancements further reinforce segment dominance.

The segment benefits from continuous technological advancement in high-definition imaging, flexible scope design, and sophisticated instrument integration capabilities that significantly enhance procedural outcomes and overall surgical efficiency. In October 2024, Purple Surgical officially launched operations in Brazil during the 72nd Brazilian Congress of Coloproctology held in Goias, introducing advanced laparoscopic instruments, surgical stapling solutions, and trocars to Brazilian healthcare professionals, demonstrating sustained international manufacturer interest in expanding product availability throughout the Brazilian market.

Application Insights:

- Aesthetic

- Cardiovascular

- Gastrointestinal

- Gynecological

- Orthopedic

- Urological

- Others

Gastrointestinal leads with a share of 25% of the total Brazil minimally invasive surgery devices market in 2025.

Gastrointestinal applications command market leadership driven by the substantial burden of digestive disorders affecting Brazilian populations. High prevalence of colorectal conditions, inflammatory bowel diseases, gastroesophageal reflux, and hepatobiliary disorders generates sustained demand for endoscopic diagnostic and therapeutic procedures. National screening initiatives promoting routine colonoscopies for early cancer detection further strengthen procedural volumes across public and private healthcare facilities nationwide. The growing emphasis on preventive care and early intervention continues reinforcing gastrointestinal segment dominance throughout Brazil.

Growing healthcare awareness and improved access to specialized gastroenterology services continue expanding the addressable patient population requiring minimally invasive interventions. Rising incidence of colorectal cancer and other gastrointestinal malignancies necessitates comprehensive endoscopic surveillance and therapeutic intervention capabilities across healthcare networks. Government initiatives promoting cancer screening programs and early detection protocols further drive procedural demand, reinforcing sustained growth for gastrointestinal focused minimally invasive surgery devices throughout public and private healthcare settings in Brazil.

Regional Insights:

To get more information on this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 40% share of the total Brazil minimally invasive surgery devices market in 2025.

The Southeast is also home to undisputed market leadership, reflecting its concentration of advanced healthcare infrastructure, specialized surgical centers, and medical training institutions. Most tertiary care facilities equipped with state-of-the-art minimally invasive surgical technologies are located in metropolitan areas such as Sao Paulo and Rio de Janeiro, where there are higher regional disposable incomes to afford access to private health services.

The dominance of regions cuts across both public and private healthcare; Southeast states have the highest number of robotic surgical platforms in the country. A study published in 2023 estimated that about 60% of da Vinci robotic systems installed in Brazil are concentrated in the Southeast region, mainly in Sao Paulo state, attesting to a high degree of regional concentration for advanced minimally invasive surgical capabilities serving both domestic and medical tourism patient populations.

Market Dynamics:

Growth Drivers:

Why is the Brazil Minimally Invasive Surgery Devices Market Growing?

Rising Prevalence of Chronic Diseases Requiring Surgical Intervention

The escalating burden of chronic diseases across Brazil creates sustained demand for minimally invasive surgical procedures offering improved therapeutic outcomes with reduced patient morbidity. Increasing incidence of cancer, cardiovascular conditions, gastrointestinal disorders, and metabolic diseases necessitates growing volumes of diagnostic and therapeutic surgical interventions. Healthcare systems increasingly recognize minimally invasive approaches as preferred treatment modalities delivering superior clinical outcomes, shorter hospital stays, and faster patient recovery compared to traditional open surgical techniques. The aging demographic profile of the Brazilian population amplifies demand for surgical interventions addressing age-related conditions while favoring approaches that minimize physiological stress on elderly patients. Growing obesity prevalence further drives demand for bariatric procedures performed using minimally invasive techniques, expanding the addressable market across multiple clinical specialties requiring advanced surgical device technologies.

Government Initiatives Expanding Healthcare Infrastructure and Technology Access

Brazilian federal and state governments demonstrate sustained commitment to modernizing healthcare infrastructure through targeted investment programs enhancing access to advanced surgical technologies. Public health initiatives increasingly prioritize integration of minimally invasive surgical capabilities within the Unified Health System network, expanding technology availability beyond traditional private healthcare settings. The Ministry of Health announced development of a National Network of Smart Hospitals and High-Precision Medicine Services incorporating artificial intelligence, telemedicine connectivity, and robotic surgery capabilities scheduled for phased implementation. These infrastructure modernization programs encompass establishment of smart intensive care units across multiple states, hospital facility upgrades, and construction of specialized technological institutes designed to serve as national reference centers for advanced surgical practice. Such governmental prioritization creates favorable market conditions supporting expanded adoption of minimally invasive surgery devices throughout both public and private healthcare sectors.

Technological Advancement and Surgical Training Program Expansion

Continuous technological innovation in minimally invasive surgical equipment combined with expanding surgeon training infrastructure strengthens market growth fundamentals throughout Brazil. Advanced robotic platforms featuring enhanced visualization systems, haptic feedback capabilities, and ergonomic console designs improve surgical precision while reducing operator fatigue during complex procedures. Proliferation of specialized surgical training centers offering structured certification programs in laparoscopic, endoscopic, and robotic techniques expands the qualified surgeon workforce capable of utilizing advanced surgical technologies. Manufacturers support market development through comprehensive training partnerships with leading hospitals and educational institutions ensuring proper technique dissemination. Simulation-based training technologies enable surgeons to develop proficiency before performing procedures on patients, accelerating learning curves and supporting broader technology adoption. The combination of equipment advancement and human capital development creates self-reinforcing growth dynamics as improved surgical outcomes drive increased patient and physician preference for minimally invasive approaches.

Market Restraints:

What Challenges the Brazil Minimally Invasive Surgery Devices Market is Facing?

High Equipment Costs Limiting Broader Market Penetration

The substantial capital investment required for advanced minimally invasive surgical systems creates significant barriers to broader market adoption, particularly within resource-constrained public healthcare settings. Robotic surgical platforms, sophisticated visualization equipment, and specialized instrumentation represent major acquisition costs that challenge budget allocations for many healthcare institutions. Ongoing expenses for instrument maintenance, consumable supplies, and software licensing further elevate total cost of ownership beyond initial purchase prices, limiting technology accessibility primarily to well-resourced private hospitals and select public tertiary care centers.

Geographic Disparities in Technology Availability and Access

Pronounced regional disparities in minimally invasive surgical technology distribution create uneven market development patterns across Brazil. Concentration of advanced surgical capabilities within Southeast metropolitan areas leaves substantial populations in Northern, Northeastern, and Central-Western regions with limited access to minimally invasive procedures. This geographic imbalance reflects underlying healthcare infrastructure inequalities, economic development disparities, and specialized workforce distribution challenges that constrain market expansion potential in underserved areas despite significant unmet clinical need.

Skilled Surgeon Shortages and Training Requirements

The specialized training requirements for minimally invasive and robotic-assisted surgical techniques create workforce constraints affecting market development velocity. Surgeons must complete rigorous certification programs and accumulate supervised procedure experience before independently performing complex minimally invasive operations. Limited availability of accredited training programs, particularly outside major urban centers, restricts the qualified surgeon pipeline supporting expanded technology adoption. Learning curves associated with advanced platforms require significant time investment that challenges procedure throughput during the transition period from conventional surgical techniques.

Competitive Landscape:

The Brazil minimally invasive surgery devices market exhibits moderately concentrated competitive dynamics with established multinational medical device manufacturers maintaining substantial market presence alongside emerging regional participants. Market leaders leverage comprehensive product portfolios spanning endoscopic systems, laparoscopic instruments, electrosurgical equipment, and robotic surgical platforms to serve diverse healthcare facility requirements. Competition increasingly centers on technological differentiation, service infrastructure development, and surgeon training program partnerships. Companies pursue market expansion through direct sales operations, strategic distributor relationships, and collaboration agreements with leading healthcare institutions. Product innovation addressing Brazilian market requirements, competitive pricing strategies accommodating diverse customer segments, and comprehensive after-sales support capabilities represent critical competitive success factors. The regulatory environment requiring ANVISA registration and Brazilian Good Manufacturing Practice certification creates meaningful barriers to entry that favor established participants with mature compliance infrastructure.

Recent Developments:

- In September 2025, Brazilian surgeons successfully completed the first telesurgery procedure conducted between two Brazilian cities, connecting the Scolla Surgical Training Center in Campo Largo with CEONC Hospital in Cascavel, Parana, approximately 600 kilometers apart. The robotic cholecystectomy procedure utilized high-performance fiber optic technology with 5G redundancy, demonstrating advancing telemedicine capabilities supporting remote surgical expertise delivery.

Brazil Minimally Invasive Surgery Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic and Laparoscopic Devices, Monitoring and Visualization Devices, Ablation and Laser Based Devices, Others |

| Applications Covered | Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil minimally invasive surgery devices market size was valued at USD 1,240.10 Million in 2025.

The Brazil minimally invasive surgery devices market is expected to grow at a compound annual growth rate of 7.98% from 2026-2034 to reach USD 2,474.83 Million by 2034.

Endoscopic and laparoscopic devices dominated the market with a share of 32%, driven by widespread utilization across multiple surgical specialties, enhanced visualization capabilities, and versatile application in gastrointestinal, urological, and gynecological procedures.

Key factors driving the Brazil minimally invasive surgery devices market include rising prevalence of chronic diseases, government healthcare infrastructure investments, technological advancements in surgical equipment, expanding surgeon training programs, and growing patient preference for minimally invasive procedures.

Major challenges include high equipment acquisition and maintenance costs, geographic disparities in technology availability between metropolitan and rural areas, skilled surgeon shortages, specialized training requirements, regulatory compliance complexities, and limited public healthcare budget allocations for advanced surgical technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)