Brazil Micronutrient Fertilizer Market Size, Share, Trends and Forecast by Product, Application Mode, Crop Type, and Region, 2026-2034

Brazil Micronutrient Fertilizer Market Summary:

The Brazil micronutrient fertilizer market size was valued at USD 132.13 Million in 2025 and is projected to reach USD 280.87 Million by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

The Brazil micronutrient fertilizer market is gaining momentum due to the increased modernization of the country’s farming sector. The increasing focus on soil management and adoption of precision farming technologies are some of the key factors that are making the Brazil micronutrient fertilizer market trends change. The increased land use for the growth of soya beans, corn, and sugarcane, along with the efforts of the Brazilian government to practice sustainable farming methods, is boosting the Brazil micronutrient fertilizer market.

Key Takeaways and Insights:

- By Product: Zinc dominates the market with a share of 31% in 2025, owing to its critical role in addressing widespread soil deficiencies across Brazilian agricultural regions, particularly in the Cerrado. Its importance in enzyme activation and carbohydrate metabolism drives strong farmer adoption for high-value crops.

- By Application Mode: Fertigation leads the market with a share of 38% in 2025, driven by decades of investment in drip and pivot irrigation systems that deliver nutrients precisely to root zones. This method ensures efficient nutrient uptake and minimizes waste across intensive cropping operations.

- By Crop Type: Field crops hold the largest segment with a market share of 50% in 2025, reflecting Brazil's leadership in the production of sugarcane, corn, and soybeans worldwide. For these crops to sustain optimal yields over large cultivated areas, significant nutritional supplementation is necessary.

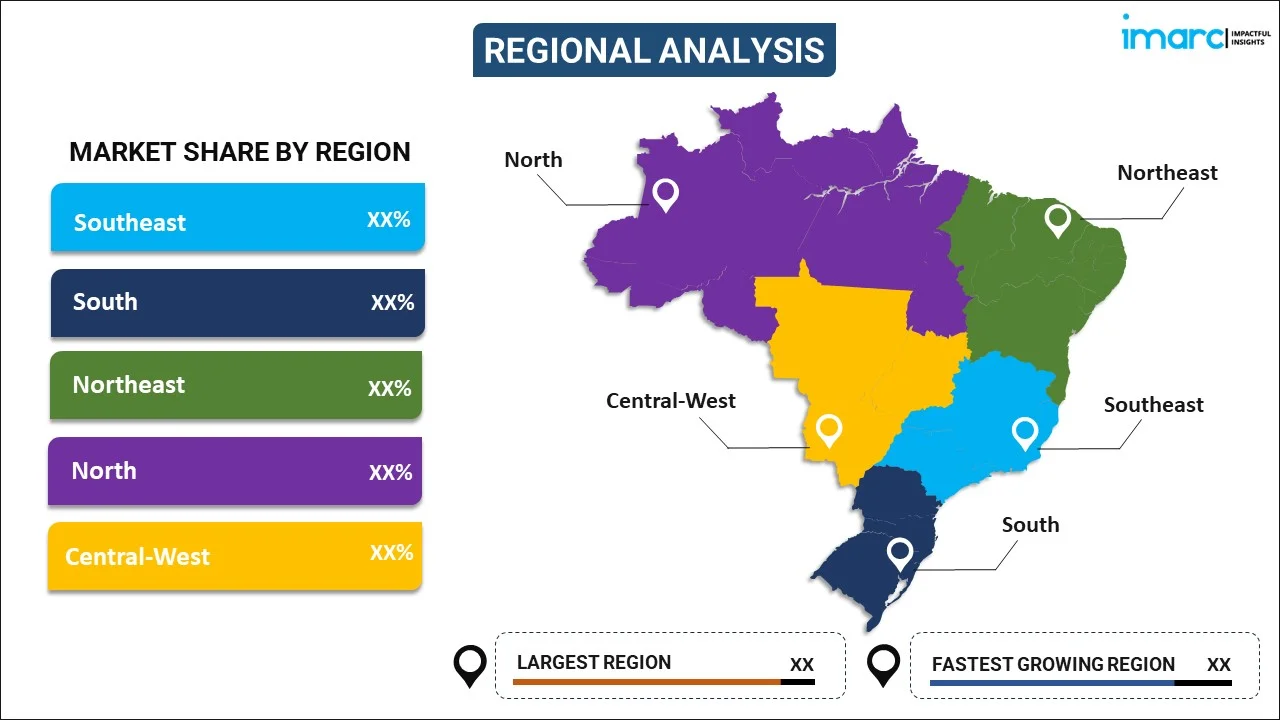

- By Region: Southeast represents the largest region with 29% share in 2025, driven by its high agricultural productivity, established distribution networks, and concentration of farming operations requiring specialized nutrient management solutions for diverse crop portfolios.

- Key Players: Key players drive the Brazil micronutrient fertilizer market by expanding product portfolios, developing advanced formulations, and strengthening distribution networks. Their investments in precision agriculture technologies, strategic partnerships, and localized manufacturing facilities boost accessibility and accelerate adoption across diverse farming segments.

The Brazil micronutrient fertilizer market is moving ahead as farmers are realizing the significance of a balanced diet being provided to crops to enable the attainment of maximum yield and optimal product quality. Soils being deficient in micronutrients such as zinc and boron in major cropping areas such as the Cerrado region of Brazil are increasing the need for customized fertilizer technologies. Precision agriculture technology adoption is making way for efficient fertilizer use methods that allow farmers to address the nutrient needs of different areas of their land. Government assistance provided via rural credit and agriculture financing projects is making the purchasing power of farmers stronger and motivating them to opt for advanced fertilizer management solutions. Increasing foreign market demand for Brazilian agricultural exports is inducing producers to follow integrated fertilizing practices aimed at increasing product quality and ability to comply with tough export criteria. Domestic capability development and infrastructure development via partnerships and projects are making fertilizers accessible and widely available at a different level.

Brazil Micronutrient Fertilizer Market Trends:

Growing Adoption of Precision Agriculture Technologies

Brazil's farming sector is increasingly embracing precision agriculture technologies to enhance nutrient management efficiency and sustainability. Advanced tools including IoT soil sensors, satellite imaging, and data analytics platforms are guiding site-specific fertilizer applications. For instance, in January 2024, Deere and Company partnered with SpaceX to use Starlink satellite internet for connecting rural farms and powering real-time precision farming operations. These innovations help farmers optimize micronutrient use, minimize environmental impact, and boost productivity across major crop areas.

Expansion of Fertigation and Irrigation-Based Nutrient Delivery

Fertigation systems are gaining significant momentum as farmers seek efficient nutrient delivery methods that maximize uptake and minimize waste. Brazil's irrigated land expanded to approximately 8.2 million hectares in June 2025, with drip systems representing the fastest-growing segment. This expansion is driving demand for water-soluble micronutrient formulations compatible with fertigation equipment, supporting Brazil micronutrient fertilizer market growth. Liquid formulations are becoming essential for intensive horticultural and field crop operations across expanding irrigation networks.

Rising Focus on Sustainable Agricultural Practices

Brazilian farmers continue to adopt sustainable fertilization approaches that balance productivity with environmental stewardship. The country's ABC+ Plan, with its promotion of low-carbon agriculture, accelerates specialty and micronutrient fertilizer adoption through subsidies and technical assistance. Government-backed programs for sustainable farming practices continue to drive key investments in advanced nutrient solutions across major agricultural regions. Controlled-release formulations and bio-based micronutrient products are gaining traction as farmers seek solutions that minimize nutrient losses while maintaining soil health and meeting growing environmental compliance requirements.

Market Outlook 2026-2034:

The Brazilian market for micronutrient fertilizer is on the verge of making further progressive strides, thanks to agricultural expansion, a deepening awareness of soil health, as well as enhanced precision agriculture technology adoption. A boost in soybean production, together with a development in the production of corn, as well as the government's strategy to enhance sustainable agricultural initiatives via agricultural loans, will help drive demand for micronutrient fertilizer in the market. Enhancing the production capacity for the making of this product will ensure a mature market for the agricultural sector. The market generated a revenue of USD 132.13 Million in 2025 and is projected to reach a revenue of USD 280.87 Million by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

Brazil Micronutrient Fertilizer Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Zinc |

31% |

|

Application Mode |

Fertigation |

38% |

|

Crop Type |

Field Crops |

50% |

|

Region |

Southeast |

29% |

Product Insights:

To get detailed segment analysis of this market Request Sample

- Boron

- Copper

- Iron

- Manganese

- Molybdenum

- Zinc

- Others

Zinc dominates the market with a share of 31% of the total Brazil micronutrient fertilizer market in 2025.

Zinc retains its leading position in the Brazilian market for micronutrient fertilizers, as it is essential for filling the deficiency in Brazilian soils, especially in sandy soils and Latosols in the Cerrado region. The nutrient plays an essential role in enzyme systems in plants, activating different enzymes and improving carbohydrate metabolism. This deficiency mostly occurs in economic crops, such as soybean, maize, and wheat, which result in stunted growth.

The segment's leadership is further reinforced by increasing awareness among Brazilian farmers about zinc's positive impact on crop yields and its essential role in enhancing crop quality and resilience. Research initiatives on zinc biofortification in Brazil have demonstrated significant improvements in both crop productivity and nutritional quality of produce, particularly for tropical soils where deficiencies are prevalent. Advanced chelated zinc formulations offer enhanced nutrient availability and efficient absorption by plants across diverse cropping systems.

Application Mode Insights:

- Fertigation

- Foliar

- Soil

Fertigation leads the market with a share of 38% of the total Brazil micronutrient fertilizer market in 2025.

Fertigation has the biggest market share because of the efforts that have been put into drip and pivot irrigation projects that supply micro-nutrients directly to the root zone. This technology is very ideal where crop production is involved because nutrient uptake is very crucial to optimize production. The compatibility of the technology with the water-soluble micronutrient allows tank mixes that supply the crops at their peak stage. The increased land area under irrigation in the horticultural areas is driving the market.

Brazil's irrigated land expansion has significantly strengthened fertigation adoption, with drip systems representing the fastest-growing irrigation segment across fruit and vegetable belts. For instance, in 2025, Mosaic entered Brazil's fertigation market with its HydroBalance product line, offering controlled-release and liquid specialty fertilizers designed for precise nutrient delivery through irrigation systems. Government-backed irrigation loans continue expanding pivot acreage, further anchoring liquid micronutrient demand across the country's agricultural regions.

Crop Type Insights:

- Field Crops

- Horticultural Crops

- Turf and Ornamental

Field crops hold the largest share at 50% of the total Brazil micronutrient fertilizer market in 2025.

Field crops represent the largest share of the market, considering that Brazil is one of the leading producers of soybean, corn, and sugarcane in the world, for which special micronutrient products bring about increased yields and quality. The domination of the segment is very much prominent, as these crops have specific micronutrient needs in each phase of growth, which must be supplemented with precision due to soil deficiencies and a continuous need for optimal productivity. Extensive farming in various agroclimatic zones of large areas of land requires an integrated nutrient management approach for crops.

Ongoing intensive grain rotations in Brazil exacerbate micronutrient depletion, increasing demand for zinc and boron products to supplement primary fertilizer blends. The usage of specialty fertilizers in soybean and corn farms has increased significantly over the last few years in Brazil, showing a greater awareness of micronutrients' role in maintaining the health and optimizing the yield of crops. Segment growth will continue to be driven by the expansion into these underutilized areas, especially in frontier agricultural areas, and the intensification of the existing production systems through the adoption of precision agriculture as farmers seek to have comprehensive nutrient products for soil fertility.

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 29% share of the total Brazil micronutrient fertilizer market in 2025.

The Southeast holds the largest market share, driven by its high agricultural productivity, established distribution networks, and concentration of diverse farming operations. The region's prominence in sugarcane cultivation, coffee production, and horticultural crops necessitates specialized micronutrient solutions for maintaining crop quality and yields. São Paulo and Minas Gerais serve as key agricultural hubs with advanced farming infrastructure supporting precision nutrient management across intensive cropping systems. Well-developed logistics networks and proximity to major ports facilitate efficient fertilizer distribution throughout the region.

The sophisticated farming operations of the Southeast, anchoring balanced crop nutrition and adopting advanced agricultural technologies, further strengthen its leading position. Strong extension services and technical support networks improve farmer knowledge of micronutrient needs for different crops. The diversified agricultural base in the region, comprising field crops, fruits, vegetables, and ornamental plants, ensures sustained demand for micronutrient portfolios encompassing a broad spectrum. Ongoing irrigation infrastructure and controlled-environment agriculture investments continue to expand the possibilities of fertigation-based micronutrient applications throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Brazil Micronutrient Fertilizer Market Growing?

Expanding Agricultural Production and Cultivated Area

Brazil's agricultural sector continues to expand significantly, driving substantial demand for micronutrient fertilizers across diverse cropping systems. The country's position as the world's leading soybean producer, with planted areas expanding steadily to meet both domestic and international demand, necessitates comprehensive micronutrient supplementation to maintain soil fertility and crop productivity. Corn plantings have risen substantially, with widespread second-crop systems sustaining fertilizer application across two calendar windows annually. For instance, Brazil's agricultural sector recorded approximately 12.2% growth in the first quarter of 2025 compared to the previous quarter, demonstrating robust expansion. The intensification of farming practices and continuous grain rotations deplete soil micronutrients, creating sustained demand for zinc, boron, and other trace element fertilizers that complement primary nutrient programs across expanding cultivation areas.

Rising Awareness about Soil Health and Micronutrient Deficiencies

Increasing awareness about deficiencies of micronutrients in Brazilian agricultural regions is pushing the market towards faster growth as farmers are adopting focused fertilizer plans to counteract specific deficiencies. Zinc and boron deficiencies, which are widespread in major agricultural regions, such as the Cerrado biome and tropical regions, are pushing the adoption of specialized nutrient solutions that are capable of improving crop yields as well as quality. Education initiatives are spreading awareness among farmers about well-balanced nutrients that are needed by plants to grow. Sophisticated diagnostic tools are allowing farmers to address specific deficiencies, which are pushing the market towards adopting specialized nutrient solutions.

Supportive Government Policies and Agricultural Financing Programs

Government policies supporting agricultural modernization and environmentally sound farming practices are strongly fueling market development in Brazil. Fiscal bonuses, reduced taxes, and preferential credit programs are enhancing farmer adoption of advanced micronutrient fertilizers. The Plano Safra agricultural credit program is further enhancing farmer buying power through adequate credit disbursements for input purchase. Government policies favorable to precision farming adoption and environmentally sound nutrient practices are also encouraging investments in innovative high-quality micronutrient fertilizer development that is more efficient while being environment friendly.

Market Restraints:

What Challenges the Brazil Micronutrient Fertilizer Market is Facing?

Strong Reliance on Imported Raw Materials

Brazil's significant reliance on imported micronutrient raw materials exposes the market to variations in global prices and generates supply chain risks. Advanced fertilizer components are mostly sourced from overseas, which raises prices and restricts home production capacity. This reliance impacts product availability in regional markets and makes procurement planning more difficult.

Price Volatility of Global Commodity Markets

The cost of micronutrient fertilizer and farmer purchase decisions are greatly impacted by fluctuations in global commodity prices. Farm margins are compressed by currency devaluation and freight cost hikes, especially for smaller businesses with less capacity for hedging. This volatility disrupts ideal nutrient management plans by causing uncertainty in input planning and delaying fertilizer purchases during crucial application windows.

Limited Infrastructure in Remote Agricultural Regions

In rural farming areas, inadequate distribution and transportation infrastructure raises delivery costs and prevents market penetration. Liquid and specific micronutrient goods that need to be handled and stored carefully are especially impacted by underdeveloped logistics networks. Small and medium-sized farms in the nation's frontier agricultural regions have less access to products due to these infrastructure constraints.

Competitive Landscape:

The Brazil micronutrient fertilizer market faces a competitive environment wherein MNCs are competing with local players in terms of innovation in products, such as chelated micronutrient fertilizers, controlled-release micronutrient fertilizers, and liquid micronutrient fertilizer appropriate for precision farming. Upcoming technologies in these fields are expected to bring a huge positive impact on these local players. Organizations are also starting to deliver specific nutrient mixes in accordance with local climatic necessities, thereby enabling their products to stand apart from their competitors in terms of agricultural advice.

Brazil Micronutrient Fertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Boron, Copper, Iron, Manganese, Molybdenum, Zinc, Others |

| Application Modes Covered | Fertigation, Foliar, Soil |

| Crop Types Covered | Field Crops, Horticultural Crops, Turf and Ornamental |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil micronutrient fertilizer market size was valued at USD 132.13 Million in 2025.

The Brazil micronutrient fertilizer market is expected to grow at a compound annual growth rate of 8.74% from 2026-2034 to reach USD 280.87 Million by 2034.

Zinc dominated the market with a share of 31%, owing to its critical role in addressing widespread soil deficiencies across Brazilian agricultural regions, particularly in the Cerrado, and its importance in enzyme activation for high-value crops.

Key factors driving the Brazil micronutrient fertilizer market include expanding agricultural production, rising awareness of soil micronutrient deficiencies, supportive government policies, increasing adoption of precision agriculture technologies, and growing demand for high-quality agricultural exports.

Major challenges include high dependency on imported raw materials, global commodity price volatility affecting input costs, limited distribution infrastructure in remote agricultural regions, currency fluctuations impacting purchasing power, and competition from conventional fertilization practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)