Brazil LED Market Report by Product Type (Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, and Others), Application (Commercial, Residential, Institutional, Industrial), Installation Type (New Installation, Retrofit Installation), and Region 2025-2033

Market Overview:

The Brazil LED market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.65% during 2025-2033. The Brazil LED market is growing due to rising demand for energy-efficient, cost-effective, and environmentally friendly lighting solutions. Government policies, urban development, and consumer awareness drive adoption across residential, commercial, and industrial segments, making LEDs a preferred choice for sustainable and economical illumination.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.8 Billion |

|

Market Forecast in 2033

|

USD 7.3 Billion |

| Market Growth Rate 2025-2033 | 10.65% |

A key factor driving the LED lighting industry in the country is the government’s focus on energy efficient lighting products. Brazil represents South America's largest energy consumer and the Brazilian government has made several initiatives to increase energy efficiency in the lighting Industry. For instance, in its national policy framework, the government has committed to increase energy efficiency in the country by 10% by 2030. This is expected to drive the demand of LED lighting products in Brazil. Moreover, recent regulatory changes require all Brazillian cities to take full responsibility of their public lighting assets, giving them incentives to reduce rising energy costs. Additionally, ban of incandescent bulbs, infrastructure growth and declining prices of LED products represent some of the other key factors driving the LED market in Brazil.

This report provides a deep insight into the Brazil LED market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for LED manufacturers, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Brazil LED market in any manner.

Brazil LED Market Trends:

Energy Efficiency Boosting Demand

Brazil’s push for lower utility bills fuels growing demand for high-performance lighting. People now expect fixtures to cut costs and carbon without sacrificing quality. The LED Brasil segment thrives on this switch. Cities swap old bulbs for LEDs to shrink public spending on power. Homes and shops see quick payback, keeping replacement cycles brisk. Efficiency also means fewer blackouts in stressed grids. As bills stay unpredictable, families and companies rely on LEDs to lock in savings. Local suppliers benefit too, tapping rising orders for retrofits. This steady flow secures jobs and keeps the market moving despite swings in the economy.

Government Backing Spurring Expansion

Federal and state incentives keep Brazil’s LED wave alive. Rebates, tax perks, and energy standards make swapping old lighting easier. Public works projects, rural grid rollouts, and smart city plans often rely on solar LED systems for off-grid areas. Street upgrades cut costs long-term for cities trying to balance tight budgets. Local manufacturing rules push brands to build parts closer to home, boosting jobs and cutting import bills. This clear policy support gives contractors confidence to bid on large retrofits. National targets for carbon cuts mean more public tenders, so manufacturers see steady bulk orders year after year.

Smart LEDs Redefining Spaces

Connected lighting is gaining a foothold in Brazil. As more households buy smart plugs and speakers, lighting is the next step. A smart LED bulb controlled by phone or voice fits the new lifestyle. Offices use connected fixtures to cut waste and manage large spaces remotely. Hotels and malls test sensors that dim lights in empty zones. Better broadband makes this shift easier outside big cities, too. New buildings often come wired for smart upgrades. Startups offer kits to convert old fittings without big rewiring. This mix of ease and tech appeal keeps smart LEDs climbing the adoption curve.

Falling Prices Widening Reach

Affordable LEDs keep Brazil’s switch alive. Local plants expand capacity to lower costs. Sourcing parts at home cuts currency risks on imports. The commercial LED sector sees steady bulk buys as prices drop, letting smaller shops and industries upgrade old tubes. Builders now use LEDs as standard in retail units and small factories. Cost savings remain a main selling point for new buyers who want simple tech without extra features. Mid-sized towns now access better pricing too, moving beyond big-city showrooms. With payback periods shrinking, many buyers skip CFLs entirely and leap straight to LEDs.

Infrastructure Push Brightening Outlook

Public works upgrades help LEDs shine in new projects. Highway expansions, airports, and stadiums demand better lighting that lasts. Planners rely on Brasil LED brands for reliable supply and service. Cities add thousands of new streetlights every year. Better fixtures cut power bills and crime rates by lighting up neglected spots. Contractors bundle supply and maintenance into bids, locking in repeat business for suppliers. Major events like tournaments or festivals spark upgrades for public spaces. Private developers also lean on modern lighting for malls and business parks. All this ties Brazil’s infrastructure boom tightly to steady LED demand.

Awareness Shaping Choices

Better knowledge makes people pick quality over cheap bulbs that fail fast. Public utility campaigns explain energy labels and payback times. Social media groups share deals and swap stories of good brands. This groundswell feeds steady growth for the Brazilian LED market, especially among first-time buyers in small towns. Schools and local councils run demos to show savings. Buyers look for trusted names and clear lifespan data. Good word of mouth helps local players gain ground on imports. As more homes finish basic upgrades, replacements drive repeat sales. Awareness means buyers demand real value, keeping quality in focus.

Sustainability Anchoring Growth

Green goals push LEDs into the spotlight. Companies track carbon footprints, cities sign climate pledges. Builders now want fixtures that last, use safe materials, and recycle well. Sustainable buildings rely on better bulbs to hit efficiency targets. Buyers expect suppliers to prove they cut waste and source parts responsibly. Local governments include lifetime costs in bids to ensure longer paybacks. Suppliers showing strong green credentials win contracts faster. In this climate, the Brazil LED sector positions itself as a smart fix for high emissions and wasteful grids, a small swap that signals Brazil’s shift to cleaner cities.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Brazil LED market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, application and installation type.

Breakup by Product Type:

To get more information on this market, Request Sample

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

Breakup by Application:

- Commercial

- Residential

- Institutional

- Industrial

Breakup by Installation Type:

- New Installation

- Retrofit Installation

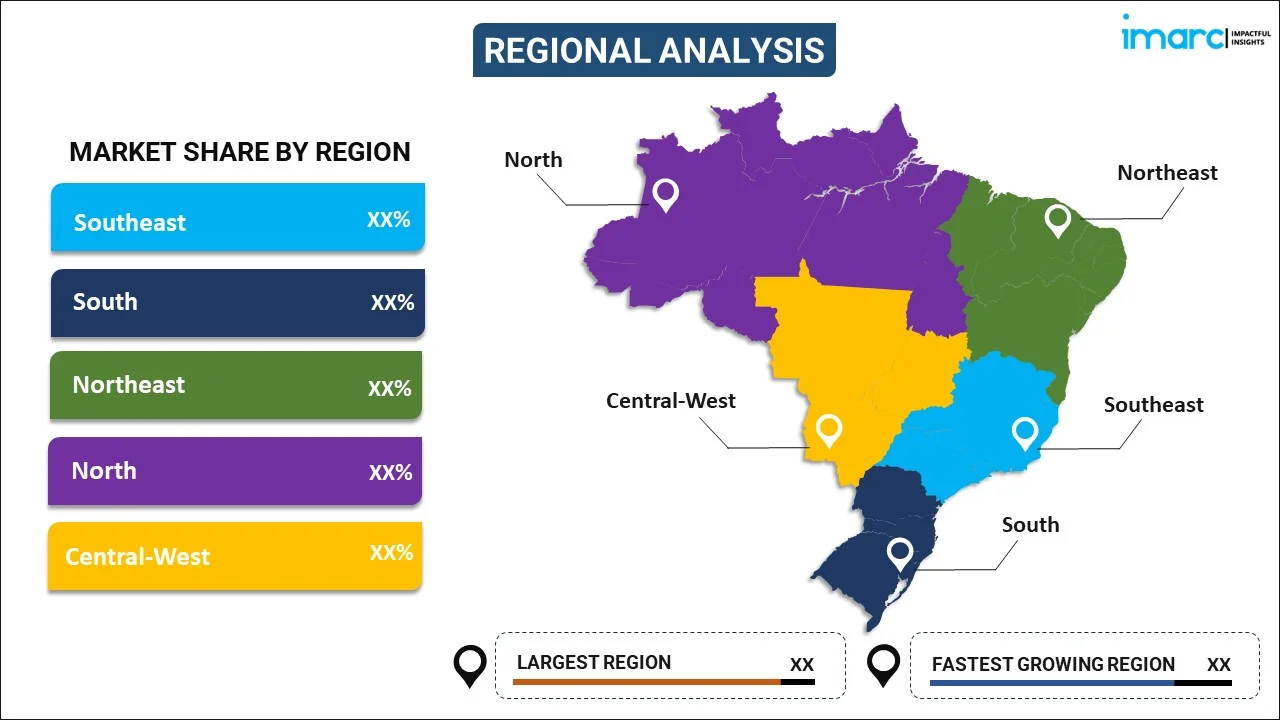

Breakup by Region:

- North

- Northeast

- Center-West

- Southeast

- South

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape

- Competitive Structure

- Key Player Profiles

Brazil LED Market News:

- 2025: Digital solutions company The LED expanded its presence in Brazil’s digital visual communication sector and grew 70% in 2024. It issued a second debenture worth BRL 25 Million, maturing in 2029, to fund new projects. Founder Richard Albanesi confirmed the company invested BRL100 Million in 2024, surpassing the BRL 80 Million spent in 2023, boosting its LED panel business.

- April 2024: The Brazilian government’s “Light for Everyone” program reached 9,803 families across seven states between January and March 2024. Managed by the Ministry of Mines and Energy, this effort brought electricity, and with it, efficient LED lighting, to about 39,200 people in remote areas, mainly in the Legal Amazon.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Application, Installation Type, Region |

| Region Covered | North, Northeast, Center-West, Southeast, South |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The LED market in Brazil was valued at USD 2.8 Billion in 2024.

The Brazil LED market is projected to exhibit a CAGR of 10.65% during 2025-2033, reaching a value of USD 7.3 Billion by 2033.

Government policies phasing out inefficient bulbs, rising awareness about energy saving, better affordability, and ongoing urban development push demand for LEDs in Brazil. Companies invest in smart lighting and local production, meeting a shift toward sustainable choices across residential, commercial, and public infrastructure projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)