Brazil Lactose Intolerance Market Size, Share, Trends and Forecast by Product Type, End User, Distribution Channel, and Region, 2026-2034

Brazil Lactose Intolerance Market Overview:

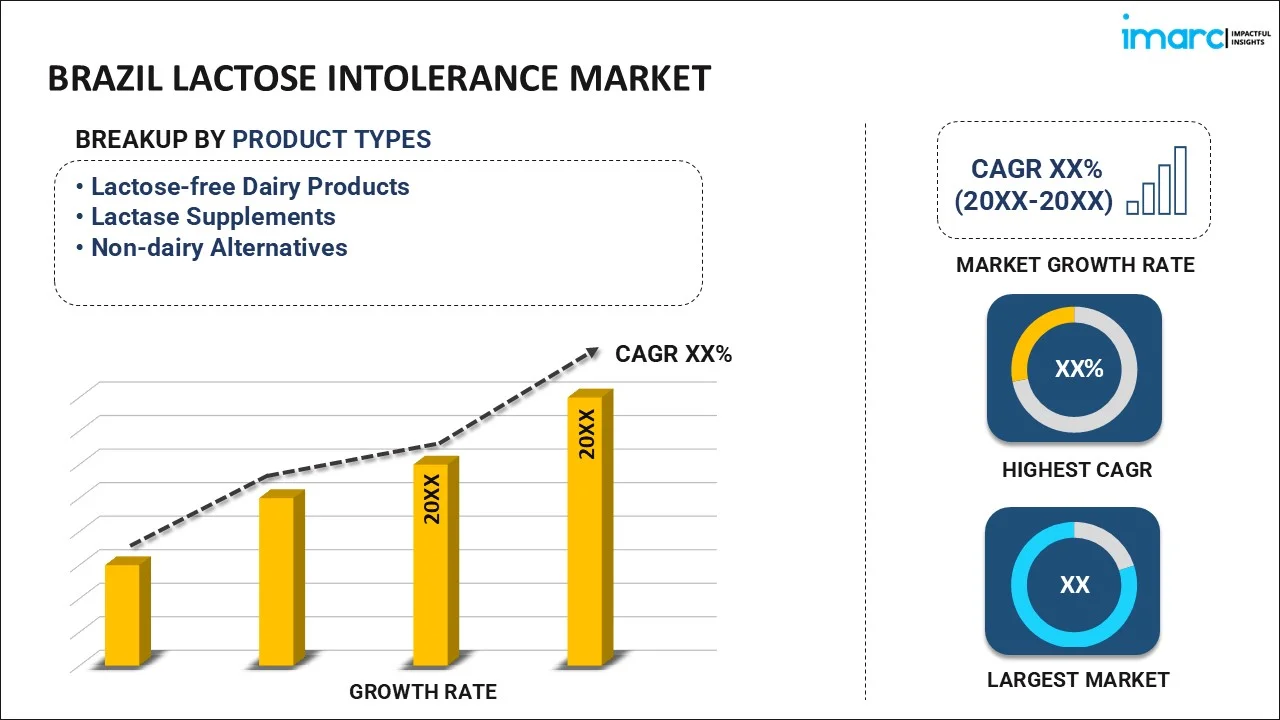

The Brazil lactose intolerance market size reached USD 223.3 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 377.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.00% during 2026-2034. The Brazil lactose intolerance market share is expanding, driven by the rising emphasis on healthcare programs that are educating people about the symptoms of lactose intolerance and its effects, along with the increasing need for dairy alternatives, encouraging companies to innovate and develop items that align with consumer preferences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 223.3 Million |

| Market Forecast in 2034 | USD 377.2 Million |

| Market Growth Rate (2026-2034) | 6.00% |

Brazil Lactose Intolerance Market Trends:

Rising Awareness about Lactose Intolerance

The increasing awareness among the about lactose sensitivity is fueling the Brazil lactose intolerance market growth. Lactose intolerance has traditionally been underacknowledged or misinterpreted, especially in nations where dairy consumption is prevalent. However, people are focusing on the concerns about lactose intolerance. As per industry reports, in 2024, 60% of people were lactose-intolerant in Brazil. In addition to this, improved healthcare access and understanding about lactose intolerance are encouraging people to seek out options that are effective and reliable. Health initiatives, both public and private, are aggressively educating the public about lactose intolerance and its symptoms. This consciousness allows individuals to make more careful food choices, particularly lactose-free or low-lactose alternatives, thereby aiding in market expansion. Moreover, advancements in food processing technology are playing a crucial role. Brands are increasingly developing lactose-free versions of conventional products. These items are often fortified with additional nutrients, such as calcium and vitamins, to ensure that individuals do not miss out on the nutritional aspects.

Increasing Demand for Dairy Alternatives

The rising demand for dairy alternatives is offering a favorable Brazil lactose intolerance market outlook. More people are turning to plant-based options like almond, oat, and soy milk, not just because they are lactose intolerant but also for health, ethical, and environmental reasons. Apart from this, cases of irritable bowel disease (IBD) are rising in Brazil, encouraging more people to avoid dairy to reduce digestive discomfort. According to the Brazilian National Registry of Patients conducted by the GEDIIB in Brazil, from 2022 to 2024, the Southeast region of Brazil, which included the states of São Paulo, Rio de Janeiro, Minas Gerais, and Espírito Santo, had the greatest proportion of IBD patients in the study (72.3%), with the Midwest next (13.8%), Northeast (6.9%), South (4.9%), and North (1.9%). Concerning medical therapy, 72.4% of patients were employing or had earlier been treated with biologics. Many consumers with gut health concerns opt for lactose-free diets, further driving the demand. This is encouraging food brands to invest in better-tasting and nutrient-rich alternatives that appeal to both lactose-intolerant consumers and those simply looking for healthier choices. Moreover, supermarkets and restaurants are offering a wider range of lactose-free products, making them easier to find and more affordable. With more variety and better accessibility, the market in Brazil is set for continued expansion.

Brazil Lactose Intolerance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, end user, and distribution channel.

Product Type Insights:

- Lactose-free Dairy Products

- Lactase Supplements

- Non-dairy Alternatives

The report has provided a detailed breakup and analysis of the market based on the product types. This includes lactose-free dairy products, lactase supplements, and non-dairy alternatives.

End User Insights:

- Adults

- Children

- Infants

A detailed breakup and analysis of the market based on the end users have also been provided in the report. This includes adults, children, and infants.

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Online Retail

- Health Food Stores

- Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channels. This includes supermarkets/hypermarkets, online retail, health food stores, and pharmacies.

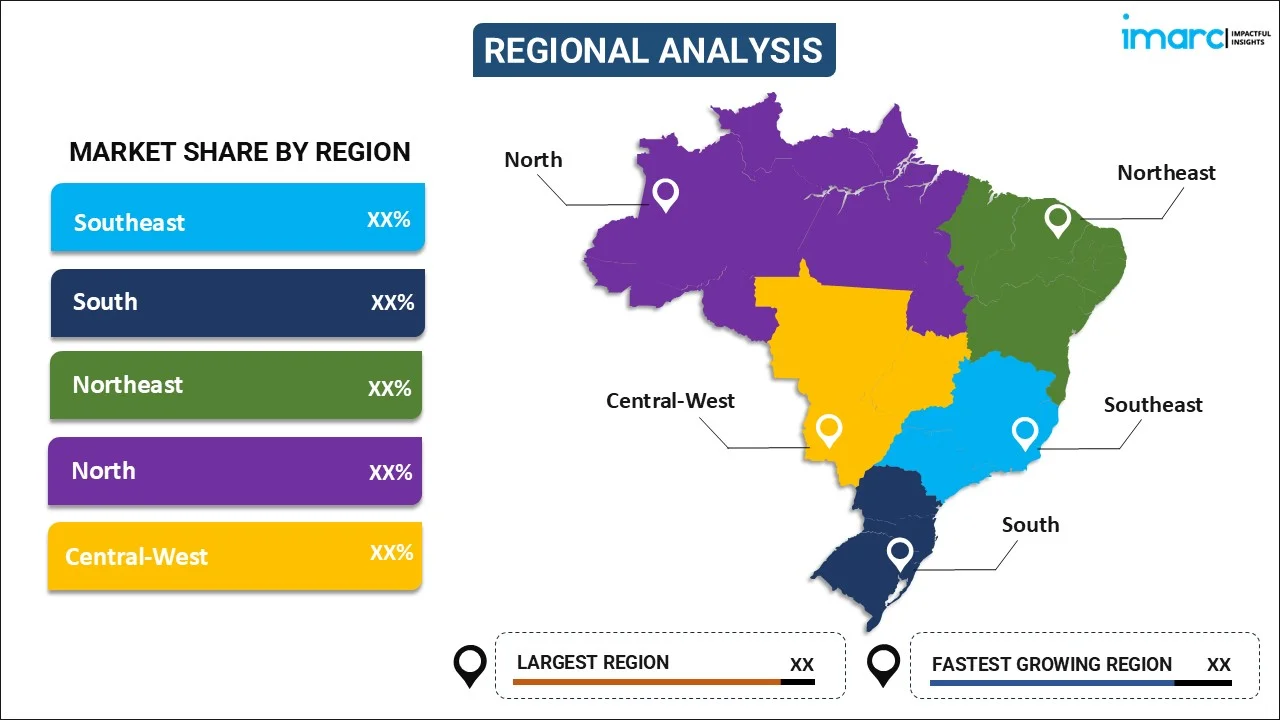

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Lactose Intolerance Market News:

- In July 2024, NotCo, the prominent food-tech company, NotCo introduced "Not Shake Protein," a line of sports beverages enriched with protein. It was only introduced in Brazil, where the company unveiled the new packaging for the item, claiming it to be recyclable. The product line featured unique flavors like ‘Banana Pancakes with Cinnamon’ and ‘Strawberry with Dates’, alongside classic choices, such as chocolate, coffee caramel, and vanilla with coconut. They are free from lactose, cholesterol, and gluten.

- In June 2024, Brazil's Future Cow, a precision fermentation startup scaled up the production of animal-free milk. The startup, established in 2023 by Leonardo Vieira and Rosana Goldbeck, utilized a digital model of cow DNA, microbes, and agro-industrial waste to create milk proteins via fermentation. Future Cow's milk contained no hormones, pesticides, lactose, or antibiotics, and its indoor manufacturing decreased greenhouse gas emissions by 97%, cut water consumption by 99%, and eliminated animal cruelty entirely.

Brazil Lactose Intolerance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lactose-free Dairy Products, Lactase Supplements, Non-dairy Alternatives |

| End Users Covered | Adults, Children, Infants |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Online Retail, Health Food Stores, Pharmacies |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil lactose intolerance market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil lactose intolerance market on the basis of product type?

- What is the breakup of the Brazil lactose intolerance market on the basis of end user?

- What is the breakup of the Brazil lactose intolerance market on the basis of distribution channel?

- What are the various stages in the value chain of the Brazil lactose intolerance market?

- What are the key driving factors and challenges in the Brazil lactose intolerance market?

- What is the structure of the Brazil lactose intolerance market and who are the key players?

- What is the degree of competition in the Brazil lactose intolerance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil lactose intolerance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil lactose intolerance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil lactose intolerance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)