Brazil In-Vitro Diagnostics Market Report by Test Type (Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, and Others), Product (Instrument, Reagent, and Others), Usability (Disposable IVD Devices, Reusable IVD Devices), Application (Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, and Others), End User (Diagnostic Laboratories, Hospitals and Clinics, and Others), and Region 2025-2033

Brazil In-Vitro Diagnostics Market:

Brazil in-vitro diagnostics market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.40% during 2025-2033. The rising awareness towards preventive healthcare, along with next-generation sequencing (NGS) technologies, are bolstering the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 3.4 Billion |

| Market Growth Rate 2025-2033 | 5.40% |

Brazil In-Vitro Diagnostics Market Analysis:

- Major Market Drivers: Government healthcare initiatives are improving access to advanced testing tools, which is augmenting the market growth.

- Key Market Trends: The rising healthcare awareness among the population is leading to more regular health screenings, thereby accelerating the market growth.

- Competitive Landscape: The report has provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: The Southeast and South regions show higher adoption of diagnostics due to advanced healthcare infrastructure. In contrast, the growing demand for diagnostic services is acting as a significant growth-inducing factor in the Northeast and North. At the same time, the Central West sees steady growth driven by the increasing access to healthcare technologies and services.

- Challenges and Opportunities: The limited access to advanced diagnostics in rural areas of Brazil is hindering the market. However, the expanding healthcare infrastructure and the elevating investments in mobile testing units to reach underserved populations will continue to strengthen the market growth in the coming years.

Brazil In-Vitro Diagnostics Market Trends:

Growing Adoption of Advanced Genetic Testing Technologies

Brazil is witnessing a surge in genetic testing adoption due to the availability of advanced platforms. This development supports quicker data analysis for rare diseases and cancer, thereby improving diagnosis as well as treatment. It also accelerates precision medicine efforts, transforming patient care across the country. For example, in January 2024, Bioma4me adopted the SOPHiA DDM platform to advance genetic testing in Brazil. This platform helps quickly analyze data for rare diseases and cancer, enabling faster, more personalized care and strengthening the capabilities of Brazil's in-vitro diagnostics industry.

Regulatory Advancements Supporting Streamlined Diagnostics Approvals

New regulations are simplifying submission processes and aligning with standards, enabling faster approval of diagnostic technologies. These changes improve compliance, enhance access to innovative in-vitro diagnostic solutions, and foster greater collaboration with international stakeholders, driving Brazil in-vitro diagnostics market demand within the healthcare sector. For instance, in December 2023, Brazil's ANVISA approved RDC N° 830/2023 to streamline in-vitro diagnostics regulations. This aligns with international standards, allowing regulatory submissions, simplifying compliance, and promoting collaboration, enhancing Brazil's IVD industry.

Increasing Focus on Molecular Diagnostics

The rising importance of molecular diagnostics in Brazil is driving innovation in disease detection and management. Laboratories are investing in specialized testing tools for transplant panels and emerging diseases, which enhances patient outcomes and healthcare efficiency. For example, in April 2024, altona Diagnostics shifted its focus on molecular diagnostics. The company serves large private laboratories with a strong emphasis on transplant panels and emerging diseases, thereby driving advancements in Brazil's in-vitro diagnostics sector.

Brazil In-Vitro Diagnostics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the Brazil in-vitro diagnostics market forecast at the country and regional levels for 2025-2033. Our report has categorized the market based on the test type, product, usability, application, and end user.

Breakup by Test Type:

To get more information on this market, Request Sample

- Clinical Chemistry

- Molecular Diagnostics

- Immunodiagnostics

- Hematology

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes clinical chemistry, molecular diagnostics, immunodiagnostics, hematology, and others.

In-vitro diagnostics covers diverse areas like clinical chemistry for analyzing body fluids, molecular diagnostics for detecting genetic conditions, immunodiagnostics for immune response testing, hematology for blood analysis, and other specialized tests. It aids in enhancing disease detection and patient care, thereby significantly impacting the Brazil in-vitro diagnostics market share.

Breakup by Product:

- Instrument

- Reagent

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes instrument, reagent, and others.

In-vitro diagnostics instruments, reagents, and other components are essential for accurate disease detection and monitoring. Instruments analyze samples, reagents facilitate chemical reactions, and other tools support testing, enabling precise diagnostics and advancing healthcare outcomes across various medical settings.

Breakup by Usability:

- Disposable IVD Devices

- Reusable IVD Devices

The report has provided a detailed breakup and analysis of the market based on usability. This includes disposable IVD devices and reusable IVD devices.

In-vitro diagnostics includes both disposable and reusable devices. Disposable IVD devices, such as test strips, offer convenience and prevent contamination, while reusable IVD devices, like analyzers, provide long-term cost savings and consistent performance for diagnostic laboratories, contributing to Brazil in-vitro diagnostics market outlook.

Breakup by Application:

- Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, and others.

In-vitro diagnostics are critical in detecting infectious diseases, diabetes, cancer, cardiology, autoimmune disorders, and nephrology conditions. These technologies enable early diagnosis, personalized treatment, and effective disease management, thereby improving patient outcomes across various medical fields. According to Brazil in-vitro diagnostics market analysis report, this is bolstering the growth of this segment.

Breakup by End User:

- Diagnostic Laboratories

- Hospitals and Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes diagnostic laboratories, hospitals and clinics, and others.

In-vitro diagnostics are essential in diagnostic laboratories, hospitals, clinics, and other healthcare settings. They enable accurate disease detection, monitoring, and treatment decisions, improving patient care by providing precise and timely results across various medical settings.

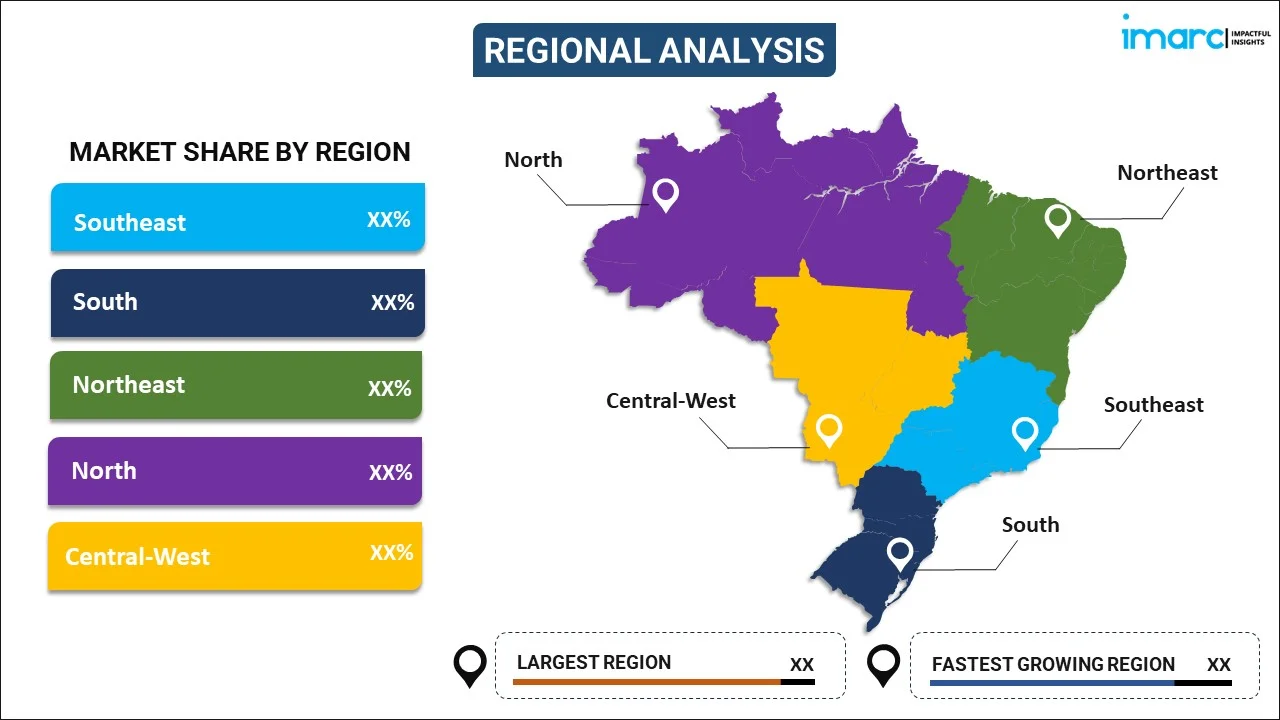

Breakup by Region:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

The Southeast and South regions lead with advanced healthcare infrastructure, driving greater adoption of diagnostics technologies. In contrast, in the Northeast and North, growing investments in healthcare are expanding access to diagnostic services, addressing regional disparities. Moreover, the Central-West sees steady growth as healthcare facilities increasingly integrate modern diagnostic tools. Overall, these regions are all experiencing advancements, with a collective focus on improving healthcare access and diagnostic capabilities across the country.

Competitive Landscape:

The Brazil in-vitro diagnostics market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil In-Vitro Diagnostics Market Recent Developments:

- June 2024: The government in Brazil consolidated existing regulations on clinical trials and established a national ethics system.

- April 2024: Altona Diagnostics emphasized transplant panels and emerging diseases, driving advancements in Brazil's in-vitro diagnostics sector.

- January 2024: Bioma4me adopted the SOPHiA DDM platform to advance genetic testing in Brazil. This platform helps quickly analyze data for rare diseases and cancer, enabling faster, more personalized care.

Brazil In-Vitro Diagnostics Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Test Types Covered | Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, Others |

| Products Covered | Instrument, Reagent, Others |

| Usabilities Covered | Disposable IVD Devices, Reusable IVD Devices |

| Applications Covered | Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Others |

| End Users Covered | Diagnostic Laboratories, Hospitals and Clinics, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

- How has the Brazil in-vitro diagnostics market performed so far, and how will it perform in the coming years?

- What is the breakup of the Brazil in-vitro diagnostics market on the basis of test type?

- What is the breakup of the Brazil in-vitro diagnostics market on the basis of product?

- What is the breakup of the Brazil in-vitro diagnostics market on the basis of usability?

- What is the breakup of the Brazil in-vitro diagnostics market on the basis of application?

- What is the breakup of the Brazil in-vitro diagnostics market on the basis of end user?

- What are the various stages in the value chain of the Brazil in-vitro diagnostics market?

- What are the key driving factors and challenges in Brazil in-vitro diagnostics?

- What is the structure of the Brazil in-vitro diagnostics market, and who are the key players?

- What is the degree of competition in the Brazil in-vitro diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil in-vitro diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil in-vitro diagnostics market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil in-vitro diagnostics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)