Brazil Food Hydrocolloids Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Brazil Food Hydrocolloids Market Summary:

The Brazil food hydrocolloids market size was valued at USD 126.04 Million in 2025 and is projected to reach USD 183.16 Million by 2034, growing at a compound annual growth rate of 4.24% from 2026-2034.

The Brazil food hydrocolloids market is experiencing steady expansion driven by the rising demand for processed and convenience foods across the country. Growing urbanization and changing consumer lifestyles are increasing the consumption of ready-to-eat meals, sauces, and dairy products that rely on hydrocolloids for texture enhancement. Advancements in food processing technologies and the expanding food and beverage industry are further supporting demand. The growing preference for natural and clean-label ingredients is also shaping product formulations, positioning the region for sustained growth in food hydrocolloids market share.

Key Takeaways and Insights:

- By Type: Gelatin gum dominates the market with a share of 36% in 2025, owing to its versatile gelling and stabilizing properties across dairy, confectionery, and pharmaceutical applications in the Brazilian food industry.

- By Application: Dairy and frozen products lead the market with a share of 30% in 2025, driven by the expanding dairy industry and consumer preference for yogurt, ice cream, and other value-added dairy products requiring texture enhancement.

- Key Players: The Brazil food hydrocolloids market exhibits moderate competitive intensity, with multinational ingredient companies competing alongside regional manufacturers. Leading players are focusing on product innovation, capacity expansion, and development of clean-label solutions to strengthen their market presence and address evolving consumer preferences for natural food ingredients.

The Brazil food hydrocolloids market is advancing as manufacturers increasingly adopt these functional ingredients to enhance product quality, stability, and consumer appeal. Hydrocolloids serve essential roles as thickening agents, stabilizers, emulsifiers, and gelling agents across diverse food categories, from dairy and bakery products to beverages and processed meats. In April 2023, Darling Ingredients acquired Brazilian gelatin and collagen producer Gelnex for approximately USD 1.2 billion, significantly strengthening its presence in the South American hydrocolloids market while expanding capacity to produce 46,000 tonnes of gelatin and collagen products annually across its facilities. This investment underscores the strategic importance of Brazil in the global hydrocolloids supply chain. The market benefits from strong domestic raw material availability, particularly for gelatin derived from the country's substantial livestock industry, enabling competitive production and export capabilities.

Brazil Food Hydrocolloids Market Trends:

Rising Demand for Clean-Label and Natural Ingredients

Brazilian consumers are increasingly prioritizing transparency in food labeling and seeking products with recognizable, minimally processed ingredients. This shift is driving manufacturers to reformulate products using naturally derived hydrocolloids such as pectin, carrageenan, and guar gum that align with clean-label expectations. In September 2024, Coca-Cola Brazil launched Crystal Flavor, a sugar-free sparkling water featuring natural fruit and botanical aromas without artificial additives, reflecting the broader industry movement toward clean-label formulations. This trend is reshaping hydrocolloid selection criteria across the Brazilian food industry, supporting Brazil food hydrocolloids market growth.

Expansion of Processed and Convenience Food Consumption

Urbanization and evolving consumer lifestyles in Brazil are accelerating demand for ready-to-eat meals, packaged foods, and convenience products that rely heavily on hydrocolloids for texture, stability, and shelf-life extension. The Brazilian Food Processors Association reported that the food processing sector reached revenues of BRL 233 billion in 2024, representing a nominal increase of 9.9% over the previous year and processing 62% of the country's agricultural output. Hydrocolloids play critical roles in sauces, dressings, frozen meals, and other convenience categories, ensuring product consistency and quality during storage and distribution across Brazil's extensive retail networks.

Growing Integration of Functional Health Ingredients

Rising health consciousness among Brazilian consumers is boosting demand for functional foods and beverages enriched with beneficial ingredients. Hydrocolloids are valued not only for their texturizing and stabilizing properties but also for potential health benefits, such as dietary fiber and prebiotic effects. This focus on nutrition and functionality is driving innovation, encouraging the development of new hydrocolloid applications across dairy, beverages, and other food segments to meet evolving consumer preferences for healthier, value-added products.

Market Outlook 2026-2034:

The Brazil food hydrocolloids market is poised for continued growth as the country’s food processing industry expands and modernizes. Rising demand from dairy, bakery, and processed meat sectors, along with ongoing investments in production infrastructure, is driving market development. Enhanced facilities for yogurt, dairy beverages, and desserts increasingly rely on hydrocolloid ingredients for texture, stabilization, and consistency, reinforcing their importance across diverse food applications and supporting steady growth in the domestic hydrocolloids market. The market generated a revenue of USD 126.04 Million in 2025 and is projected to reach a revenue of USD 183.16 Million by 2034, growing at a compound annual growth rate of 4.24% from 2026-2034.

Brazil Food Hydrocolloids Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Gelatin Gum |

36% |

|

Application |

Dairy and Frozen Products |

30% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Gelatin Gum

- Pectin

- Xanthan Gum

- Guar Gum

- Carrageenan

- Others

Gelatin gum dominates the Brazil food hydrocolloids market with a 36% share in 2025.

Gelatin continues to hold a leading position in Brazil’s food hydrocolloids market due to its distinctive functional properties, including strong gelling, film-forming, and binding capabilities. The country’s well-established livestock industry ensures a steady raw material supply, supporting domestic production and exports. Gelatin is widely used in confectionery, dairy desserts, and pharmaceutical capsules, where its ability to create smooth textures and improve mouthfeel makes it a preferred choice over alternative hydrocolloids.

The gelatin segment is experiencing growth supported by ongoing investments in production capacity and technological upgrades within Brazilian manufacturing facilities. Consolidation of multiple regional production sites has enhanced efficiency, expanded product offerings, and strengthened Brazil’s role as a key supplier of gelatin and collagen products. These developments enable manufacturers to meet rising domestic and international demand, improve operational productivity, and maintain consistent product quality, driving sustained growth in the gelatin segment across food, beverage, and related industries.

Application Insights:

- Dairy and Frozen Products

- Bakery

- Beverages

- Confectionery

- Meat and Seafood Products

- Oils and Fats

- Others

Dairy and frozen products lead the market with a 30% share of the total Brazil food hydrocolloids market in 2025.

The dairy and frozen products segment represents the largest application area for hydrocolloids, driven by their use in yogurt stabilization, ice cream texture enhancement, and cheese production. These ingredients help manufacturers achieve consistent viscosity, prevent separation, and maintain product quality throughout shelf life. Rising consumer demand for protein-rich and health-focused dairy products continues to expand the market, making hydrocolloids essential for modern formulations that require reliable texture, stability, and extended freshness across a variety of dairy and frozen food products.

Expansion of dairy production capacity is boosting demand for hydrocolloids across the sector. New facilities for yogurt, dairy beverages, and desserts rely heavily on stabilizers, thickeners, and texturizing agents to ensure product quality and consistency. Strong domestic milk production and a robust dairy processing industry provide a solid foundation for ongoing hydrocolloid use, supporting growth in cultured dairy products, frozen desserts, and other value-added dairy applications throughout Brazil.

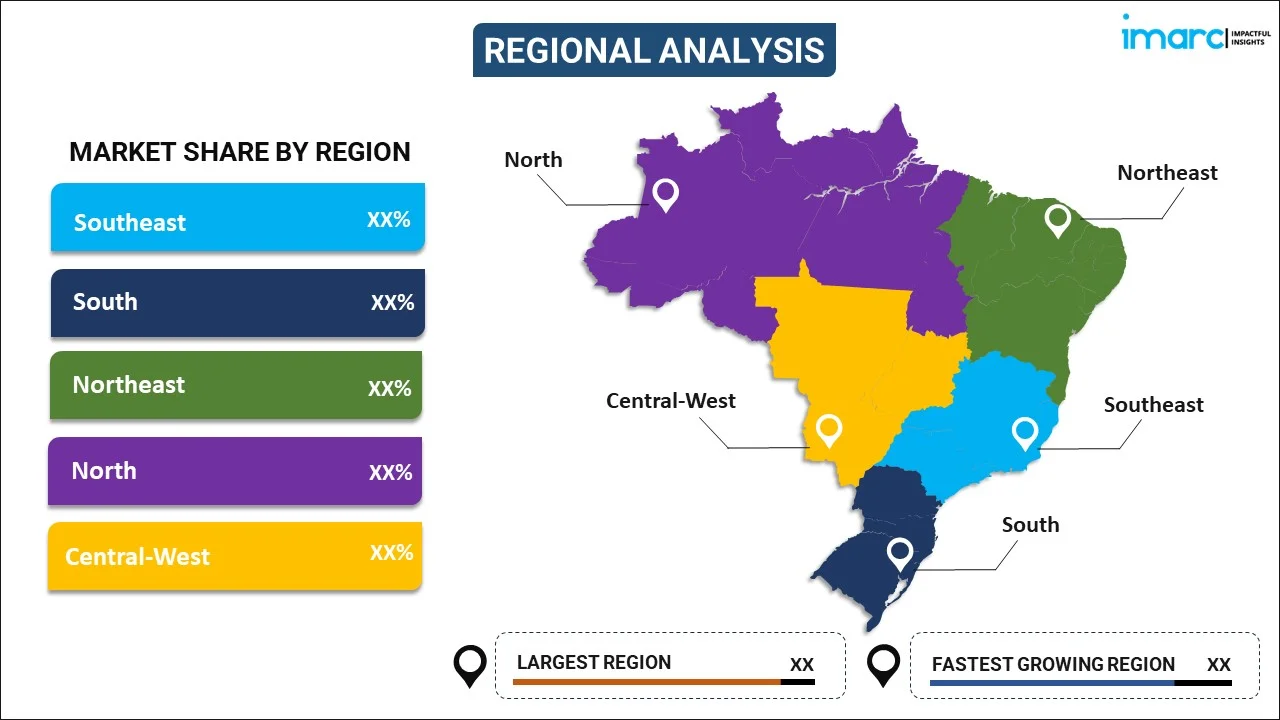

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

In the Southeast region, hydrocolloid demand is supported by a broad range of dairy products, baked goods, and processed foods. Growing yogurt, dessert, and beverage production requires a wider use of hydrocolloid stabilizers, thickeners, and texturizers. Also, the rising number of consumers in urban cities with an affinity for convenience and economic convenience foods boosts hydrocolloid use.

The food processing industry in the South, especially the dairy, meat, and confectionery industries, is a major driver for hydrocolloid consumption in this region. This is due to investment trends in frozen foods and ready-to-eat foods, leading to rising trends towards the use of functionality when it comes to texture, stability, and shelf-life extension functions.

Hydrocolloid demand in the Northeast is supported by growing fruit processing, juice, and beverage production. Expansion of regional food processing units and government incentives for agribusinesses enhance the use of stabilizers, gelling agents, and thickeners. Localized production of tropical fruit-based products also contributes to rising ingredient consumption.

In the North, hydrocolloid usage is driven by the processing of tropical fruits, juices, and dairy alternatives. Emerging food and beverage facilities rely on thickeners and gelling agents to maintain product consistency and stability. The region’s increasing focus on value-added and shelf-stable products supports hydrocolloid adoption.

The Central-West sees hydrocolloid demand growth from expanding processed foods, dairy, and beverage production linked to large-scale agricultural outputs. Increasing investment in convenience and ready-to-eat foods, along with growth in fruit and vegetable processing, boosts the need for stabilizers, texturizers, and gelling agents to improve product quality and shelf life.

Market Dynamics:

Growth Drivers:

Why is the Brazil Food Hydrocolloids Market Growing?

Expanding Dairy and Frozen Products Industry

Brazil's dairy industry is experiencing robust expansion, driving substantial demand for hydrocolloids used in yogurt stabilization, ice cream manufacturing, and cheese production. The Brazil dairy products market size reached USD 12.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 17.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.61% during 2026-2034. A major dairy producer in Brazil is expanding operations in Paraná, focusing on yogurt, dairy beverages, and dessert production that rely on hydrocolloid ingredients. The country’s substantial milk production provides a strong foundation for dairy-based hydrocolloid applications, supporting ongoing growth in cultured dairy products, frozen desserts, and other value-added dairy segments, while driving steady demand for functional ingredients across the food industry.

Rising Processed Meat and Seafood Exports

Brazil's position as the world's leading meat exporter creates substantial demand for hydrocolloids used in processed meat products to enhance texture, moisture retention, and shelf stability. Brazilian beef exports reached a record 2.89 million tonnes in 2024, representing a 26% increase over the previous year and generating USD 12.8 billion in revenue. Chicken exports similarly achieved historic levels at 5.294 million tonnes. Hydrocolloids including carrageenan and xanthan gum are essential ingredients in processed meat formulations for both domestic consumption and export markets, ensuring product quality meets international standards while maintaining competitive pricing across global markets.

Investment in Local Production Capacity

The major hydrocolloid manufacturing companies are also increasing local manufacturing capacities in Brazil to cater to increasing domestic as well as regional demands, leveraging the abundance of raw material resources available in Brazil. Boosting manufacturing capacities will enhance the reliability of their supply chain, making them less dependent on imported supplies and facilitating quicker deliveries to serve their customers’ demands in Latin America. Such steps will also help ensure continuous market growth through better Hydrocolloids availability, quality, and pricing.

Market Restraints:

What Challenges the Brazil Food Hydrocolloids Market is Facing?

Raw Material Price Volatility

Seasonal changes and climate conditions strongly influence the supply and cost of plant-based hydrocolloids like pectin, guar gum, and carrageenan. These price fluctuations pose challenges for manufacturers in managing consistent production expenses and maintaining competitive pricing, which can impact profit margins and limit accessibility for applications sensitive to ingredient costs.

Stringent Regulatory Compliance Requirements

Navigating Brazil's regulatory framework for food additives requires significant investment in compliance documentation and testing. ANVISA regulations mandate thorough safety assessments for new ingredients, creating barriers for innovative hydrocolloid applications and extending time-to-market for new product formulations. Meeting both domestic and international quality standards adds complexity for export-oriented manufacturers.

Competition from Alternative Texturizing Solutions

Modified starches and other functional ingredients offer an economical alternative to hydrocolloids in some applications. Cost-conscious food manufacturers are likely to take an even harder look at these options when economic conditions slow demand. This dynamic put pressure on the companies selling hydrocolloids to innovate, as they must show value to justify higher prices to stay relevant in the marketplace.

Competitive Landscape:

The Brazil food hydrocolloids market exhibits moderate competitive intensity characterized by the presence of multinational ingredient companies alongside regional manufacturers. Leading players are focused on expanding production capacity, developing clean-label solutions, and strengthening distribution networks to capture growing demand. Competition is driven by product innovation, technical support capabilities, and pricing strategies tailored to diverse customer segments. Strategic acquisitions and partnerships are reshaping the competitive landscape as companies seek to consolidate market positions and expand product portfolios. Manufacturers are increasingly investing in research and development to address evolving consumer preferences for natural, sustainable ingredients while maintaining cost-effective solutions for food processors.

Recent Developments:

- March 2025: Lactalis announced a BRL 313 million investment to expand its dairy production operations in Paraná state, Brazil. The investment includes a new UHT milk line at the Londrina plant and expansion of the Carambeí facility to boost yogurt, dairy beverage, and dessert production capacity requiring hydrocolloid ingredients.

- March 2023: Tate & Lyle PLC, a global leader in ingredient solutions for healthier foods and beverages, appointed IMCD as its exclusive distributor in Brazil. This partnership aims to broaden the company’s portfolio of sweeteners, texturizing agents, stabilizers, and fortification ingredients, making them more accessible to the country’s food, beverage, nutrition, and supplement sectors.

Brazil Food Hydrocolloids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gelatin Gum, Pectin, Xanthan Gum, Guar Gum, Carrageenan, Others |

| Applications Covered | Dairy and Frozen Products, Bakery, Beverages, Confectionery, Meat and Seafood Products, Oils and Fats, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil food hydrocolloids market size was valued at USD 126.04 Million in 2025.

The Brazil food hydrocolloids market is expected to grow at a compound annual growth rate of 4.24% from 2026-2034 to reach USD 183.16 Million by 2034.

Gelatin gum represents the largest market share at 36% in 2025, driven by its versatile functional properties across dairy, confectionery, and pharmaceutical applications, supported by Brazil's abundant raw material supply from its substantial livestock industry.

Key factors driving the Brazil food hydrocolloids market include expanding dairy and processed food industries, rising demand for clean-label ingredients, growing meat and seafood exports, increased health consciousness among consumers, and investments in local production capacity.

Major challenges include raw material price volatility affecting production costs, stringent regulatory compliance requirements for food additives, competition from alternative texturizing solutions, and economic conditions impacting consumer purchasing power for premium food products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)