Brazil Food Flavor and Enhancer Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Brazil Food Flavor and Enhancer Market Summary:

The Brazil food flavor and enhancer market size was valued at USD 358.49 Million in 2025 and is projected to reach USD 540.59 Million by 2034, growing at a compound annual growth rate of 4.67% from 2026-2034.

The market is influenced by the developing consumer preference in terms of taste, processed and convenient foods, and urbanization in the key cities of the world. The rising requirement for clean-label and natural ingredients has changed the way product development takes place, and the growth in the food processing sectors leads to a requirement in the market for new flavoring options. The baking and confectionery and the drinks segments are fundamental in the growth of the market in the Brazil food flavor and enhancer market share.

Key Takeaways and Insights:

- By Type: Food flavors dominate the market with a share of 56% in 2025, driven by widespread application across beverages, bakery products, snacks, and dairy items, alongside growing preference for natural flavors.

- By End User: Bakery and confectionery lead the market with a share of 25% in 2025, owing to growing consumer demand for flavored baked goods and continuous product innovation in flavor profiles.

- Key Players: The Brazil food flavor and enhancer market exhibits moderate competitive structure, with multinational corporations competing alongside regional manufacturers across product categories. Market participants focus on research and development investments, strategic acquisitions, and portfolio diversification to strengthen market positioning.

The Brazil food flavor and enhancer market is experiencing robust growth, underpinned by fundamental shifts in consumer behavior and lifestyle patterns across the country. Rapid urbanization and the emergence of a growing middle class have significantly altered food consumption habits, with consumers increasingly seeking convenient, ready-to-eat meals that deliver appealing taste experiences. The expansion of dual-income households has accelerated demand for processed foods, driving manufacturers to incorporate sophisticated flavoring solutions that enhance product appeal. Additionally, Brazil's diverse culinary traditions and openness to international cuisines create sustained demand for varied flavor profiles, while regulatory developments encouraging clean-label products push innovation toward natural and transparent ingredient formulations. In April 2025, Duas Rodas showcased natural flavors, botanical extracts, and taste-enhancing technologies for supplements at NIS 2025 in São Paulo, highlighting rising demand for clean-label, sensory-optimized nutrition products. Furthermore, the growing foodservice sector and expanding retail distribution networks further support market expansion across metropolitan and secondary urban centers throughout the country.

Brazil Food Flavor and Enhancer Market Trends:

Rising Demand for Natural and Clean-Label Ingredients

Brazilian buyers give a high preference to health-conscious food consumption, consequently drawing considerable demand for natural flavors sourced from botanical sources, fruits, and spices. This trend reflects broader wellness trends in which transparency of ingredients and minimal processing are becoming determinant purchase criteria. Moreover, the reformulation by food manufacturers that is eliminating artificial additives and replacing them with clean-label positioning through which the authenticity of ingredients will be communicated. The preference for natural flavors cuts through into various categories, forcing flavor suppliers to invest in extraction technologies that protect natural taste profiles while complying with regulatory standards for natural designation.

Growing Popularity of Ethnic and Regional Flavor Profiles

The Brazilian market is witnessing heightened interest in diverse culinary experiences, with consumers exploring flavors inspired by international cuisines and regional Brazilian traditions. In 2025, Anuga Select Brazil showcased over 510 brands, including Duque Envasadora’s Amazon-inspired jambu and banana liqueurs, reflecting Brazilian consumers’ growing interest in regional and international flavor innovations. Furthermore, this trend manifests in product development featuring Asian-inspired umami notes, Mediterranean herb combinations, and authentic regional taste profiles from various Brazilian states. Food manufacturers leverage this curiosity by introducing limited-edition products and fusion flavors that blend traditional Brazilian ingredients with global influences. The trend particularly resonates with younger demographics seeking novel taste experiences that differentiate products in competitive retail environments.

Advancement in Flavor Encapsulation Technologies

Technological innovation in flavor delivery systems is transforming product development capabilities across the Brazilian food industry. Encapsulation technologies enable controlled release of flavors during consumption, enhancing sensory experiences while protecting volatile compounds during processing and storage. These advancements support the development of functional foods where flavors mask undesirable tastes of nutritional ingredients without compromising health benefits. Manufacturers increasingly adopt microencapsulation and spray-drying techniques to create stable flavor solutions that maintain intensity throughout product shelf life and withstand various processing conditions.

Market Outlook 2026-2034:

The Brazil food flavor and enhancer market is positioned for sustained revenue growth through the forecast period, driven by expanding food processing capabilities and evolving consumer preferences toward premium taste experiences. Revenue expansion will be supported by continued urbanization, rising disposable incomes among middle-class consumers, and increasing adoption of convenience foods across metropolitan and secondary cities. Strategic investments in natural flavor development and clean-label innovations will differentiate market participants, while the bakery, confectionery, and beverage sectors remain primary revenue contributors throughout the projection period. The market generated a revenue of USD 358.49 Million in 2025 and is projected to reach a revenue of USD 540.59 Million by 2034, growing at a compound annual growth rate of 4.67% from 2026-2034.

Brazil Food Flavor and Enhancer Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

| Type | Food Flavors |

56% |

| End User | Bakery and Confectionery |

25% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Food Flavors

- Natural Flavor

- Synthetic Flavor

- Natural Identical Flavors

- Enhancers

Food flavors dominate with a market share of 56% of the total Brazil food flavor and enhancer market in 2025.

The food flavors command the leading market position, encompassing natural flavors, synthetic flavors, and nature-identical flavoring compounds utilized across diverse food applications. Natural flavors are experiencing accelerated demand as health-conscious consumers prioritize ingredient transparency and clean-label products throughout their purchasing decisions. This segment benefits from versatile applications across beverages, bakery items, dairy products, snacks, and confectionery, where distinctive taste profiles drive consumer purchase decisions and enable effective brand differentiation in competitive retail environments.

Food flavors play a critical role in product development strategies, enabling manufacturers to create signature taste experiences that resonate with consumer preferences and build brand loyalty. The growing demand for exotic and regional flavor variants encourages suppliers to expand sourcing networks and develop proprietary extraction techniques that preserve aromatic complexity and deliver consistent quality across production batches. In July 2025, Solina acquired Brazilian food expert New Max, expanding its savory solutions and flavoring systems capabilities, strengthening R&D and supporting advanced flavor delivery for Brazil’s evolving food industry.

End User Insights:

- Bakery and Confectionery

- Dairy

- Meat and Meat Products

- Soups, Pastas, and Noodles

- Beverages

- Alcoholic Beverages

- Non-alcoholic Beverages

- Sauces, Dressings, and Condiments

- Others

Bakery and confectionery leads with a share of 25% of the total Brazil food flavor and enhancer market in 2025.

The bakery and confectionery represent the primary end-use category, driven by Brazil's strong cultural affinity for baked goods and sweet treats across all consumer demographics. Product innovation in this segment focuses on premium flavor experiences, including artisanal vanilla variants, exotic fruit combinations, and indulgent chocolate profiles that elevate product positioning. Rising consumer interest in specialty bakery items and premium confectionery products supports sustained demand for sophisticated flavoring solutions that differentiate brands in increasingly competitive marketplace environments.

Bakery and confectionery manufacturers leverage flavor innovation to refresh product portfolios and respond to evolving taste preferences among Brazilian consumers seeking novel sensory experiences. Seasonal and limited-edition flavor launches drive consumer engagement and trial purchases, while traditional favorites maintain steady demand across retail and foodservice channels. In May 2025, Duas Rodas’ Mix brand launched 50 new confectionery products at Celebra Show in São Paulo, highlighting innovative, versatile, and high-performance solutions for Brazil’s bakery and confectionery market.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

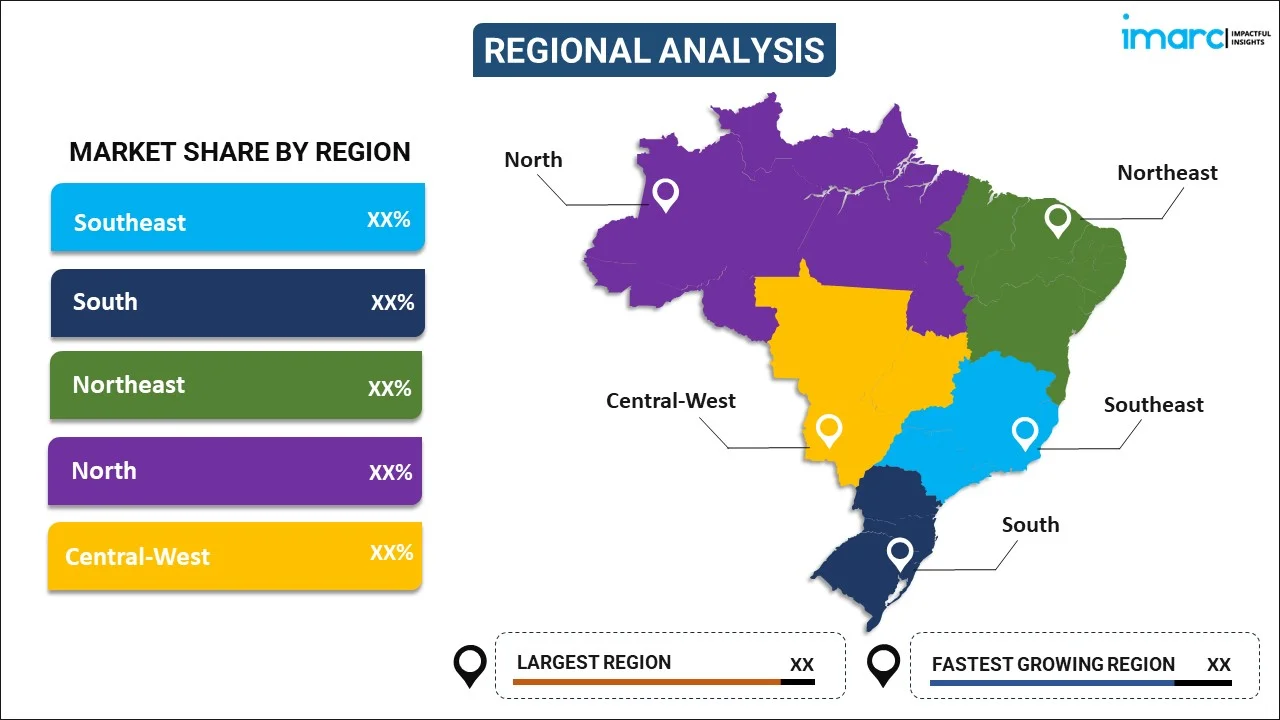

Southeast dominates the Brazil food flavor and enhancer market as the nation’s primary economic and industrial hub. Anchored by São Paulo and Rio de Janeiro, the region hosts most food processing plants, corporate headquarters, and dense consumer bases, generating sustained demand for flavoring solutions across beverages, snacks, dairy, and packaged foods.

South represents a significant market shaped by European cultural influences and strong agricultural traditions. States such as Paraná, Santa Catarina, and Rio Grande do Sul maintain advanced food processing sectors in meat, dairy, and bakery products, ensuring stable demand for flavor enhancers that support quality, consistency, and regional taste preferences nationwide.

Northeast offers expanding opportunities supported by rising food processing investments and a growing consumer population. Its rich culinary heritage, influenced by African and indigenous traditions, fuels demand for distinctive flavors such as tropical fruits, seafood seasonings, and regional spice blends that resonate strongly with local consumption habits and evolving urban preferences.

North provides emerging potential through Amazon-sourced natural ingredients and indigenous culinary knowledge. Although holding a smaller market share, the region supplies unique botanical extracts and natural flavors that attract manufacturers seeking authenticity, sustainability, and clean-label positioning within premium food and beverage product development for differentiated offerings targeting health-conscious consumers globally.

Central-West shows steady growth supported by agribusiness expansion and Brasília’s urban consumer base. Extensive livestock production drives demand for savory flavor enhancers and meat seasonings, while growing cities stimulate broader food and beverage consumption, reinforcing consistent regional demand for flavor solutions across packaged foods beverages snacks and foodservice channels nationwide markets.

Market Dynamics:

Growth Drivers:

Why is the Brazil Food Flavor and Enhancer Market Growing?

Expanding Food Processing Industry and Urbanization

The continuous expansion of Brazil's food processing industry serves as a fundamental growth catalyst for the flavor and enhancer market. Urbanization across major metropolitan areas and secondary cities has transformed consumption patterns, with consumers increasingly relying on processed, packaged, and convenience food products that require sophisticated flavoring solutions. In September 2025, JBS’s Seara launched Seara Protein, a ready-to-eat meal line with 30 g protein per portion, targeting health-conscious Brazilian consumers seeking convenient, nutritious daily meals. Furthermore, the proliferation of quick-service restaurants, food delivery services, and retail channels distributing prepared foods has intensified demand for consistent, appealing flavor profiles.

Rising Consumer Preference for Natural and Health-Conscious Products

Growing health awareness among Brazilian consumers is driving substantial demand for natural flavoring ingredients and clean-label formulations. Consumers increasingly scrutinize ingredient lists, preferring products with recognizable, naturally derived components over synthetic alternatives. This preference extends across demographic segments, with strength among urban consumers and younger populations. Flavor manufacturers are responding by investing in natural extraction technologies, expanding botanical sourcing capabilities, and developing formulations that meet clean-label positioning requirements. The trend supports premium pricing strategies and creates differentiation opportunities for products emphasizing natural and organic credentials.

Product Innovation and Diverse Flavor Portfolio Development

Continuous product innovation across food and beverage categories fuels sustained demand for diverse and sophisticated flavoring solutions. Manufacturers compete through flavor differentiation, introducing limited-edition products, seasonal offerings, and fusion concepts that capture consumer attention and drive trial purchases. As per sources, in, DaVinci Gourmet launched its Pistachio Flavored Syrup and other new portfolio items at International Coffee Week (SIC) in Belo Horizonte, enhancing creativity across beverages and desserts. Furthermore, the beverage industry particularly exemplifies this dynamic, with continuous launches of new flavor variants across carbonated drinks, juices, energy drinks, and alcoholic beverages. Bakery and confectionery manufacturers similarly leverage flavor innovation to refresh product portfolios and respond to evolving taste preferences, creating ongoing opportunities for flavor suppliers to collaborate on development initiatives.

Market Restraints:

What Challenges the Brazil Food Flavor and Enhancer Market is Facing?

Stringent Regulatory Standards and Compliance Requirements

The Brazilian regulatory environment imposes rigorous standards on food additives, including flavors and enhancers, requiring extensive documentation, testing, and approval processes. Regulatory compliance increases operational costs and extends product development timelines, particularly for novel ingredients or formulations. Evolving regulations regarding labeling, permissible usage levels, and safety assessments create ongoing compliance challenges that require dedicated resources and expertise.

Raw Material Price Volatility and Supply Chain Constraints

Fluctuations in raw material costs, particularly for natural flavor sources, create margin pressures and pricing uncertainties throughout the value chain. Agricultural commodity price volatility, currency exchange rate movements, and supply disruptions affect input costs for flavor manufacturers. Limited availability of certain natural flavor sources and seasonality factors in botanical harvesting further complicate supply chain management and cost planning.

Consumer Skepticism Toward Synthetic Ingredients

Increasing consumer awareness and skepticism regarding artificial additives constrain demand for synthetic flavoring compounds in certain product categories. Negative perceptions about artificial ingredients, amplified through social media and health advocacy, encourage reformulation toward natural alternatives. This transition requires investment in reformulation activities and may affect product economics where synthetic options previously offered cost advantages.

Competitive Landscape:

The Brazil food flavor and enhancer market features a moderately consolidated competitive structure with multinational corporations and regional manufacturers serving diverse customer segments. Market participants differentiate through research and development capabilities, technical service offerings, and portfolio breadth across natural and synthetic flavor categories. Strategic acquisitions enable market expansion and capability enhancement, while partnerships with food manufacturers support co-development initiatives. Regional producers compete through customization capabilities, local market knowledge, and competitive pricing strategies. Innovation investment, sustainable sourcing practices, and clean-label product development increasingly influence competitive positioning as consumer preferences continue evolving toward natural and transparent formulations.

Recent Developments:

- In October 2025, BR Spices, Kraft Heinz Brazil’s brand, introduced six new products, including traditional Farofa, high-protein Salada Crunch, Airfryer seasoning, and Mossoró Whole Sea Salt. The launches target health-conscious and convenience-focused Brazilian consumers, offering flavorful, nutritious, and practical solutions for everyday meals.

- In June 2024, Specialitá and Selecta, brands of DR Aromas & Ingredientes, launched 18 innovative ice cream products at Fispal Sorvetes in São Paulo, featuring unique flavors, indulgent inclusions, and premium formulations. New offerings include Chocolate Paste with Marshmallow, White Chocolate Cream with Blackberry, and Pistachio-flavored pastes, targeting Brazil’s growing gourmet dessert market.

Brazil Food Flavor and Enhancer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| End Users Covered |

|

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil food flavor and enhancer market size was valued at USD 358.49 Million in 2025.

The Brazil food flavor and enhancer market is expected to grow at a compound annual growth rate of 4.67% from 2026-2034 to reach USD 540.59 Million by 2034.

Food flavors held the largest Brazil food flavor and enhancer market share, driven by widespread application across beverages, bakery, dairy, and confectionery products, alongside growing consumer preference for natural, exotic, and clean-label flavor ingredients supporting product differentiation strategies.

Key factors driving the Brazil food flavor and enhancer market include include expanding food processing industry operations, rising consumer demand for natural and clean-label products, increasing urbanization and convenience food consumption, and continuous product innovation across food and beverage categories.

Major challenges include stringent regulatory compliance requirements for food additives, raw material price volatility affecting production costs, limited availability of certain natural flavor sources, consumer skepticism toward synthetic ingredients, and competitive pressures requiring continuous innovation investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)