Brazil Food Additives Market Report by Type (Preservatives, Sweeteners and Sugar Substitutes, Emulsifiers, Enzymes, Hydrocolloids, Food Flavors and Colorants, and Others), Application (Bakery, Confectionery, Dairy, Beverages, Meat, Poultry and Sea Foods, and Others), and Region 2025-2033

Market Overview:

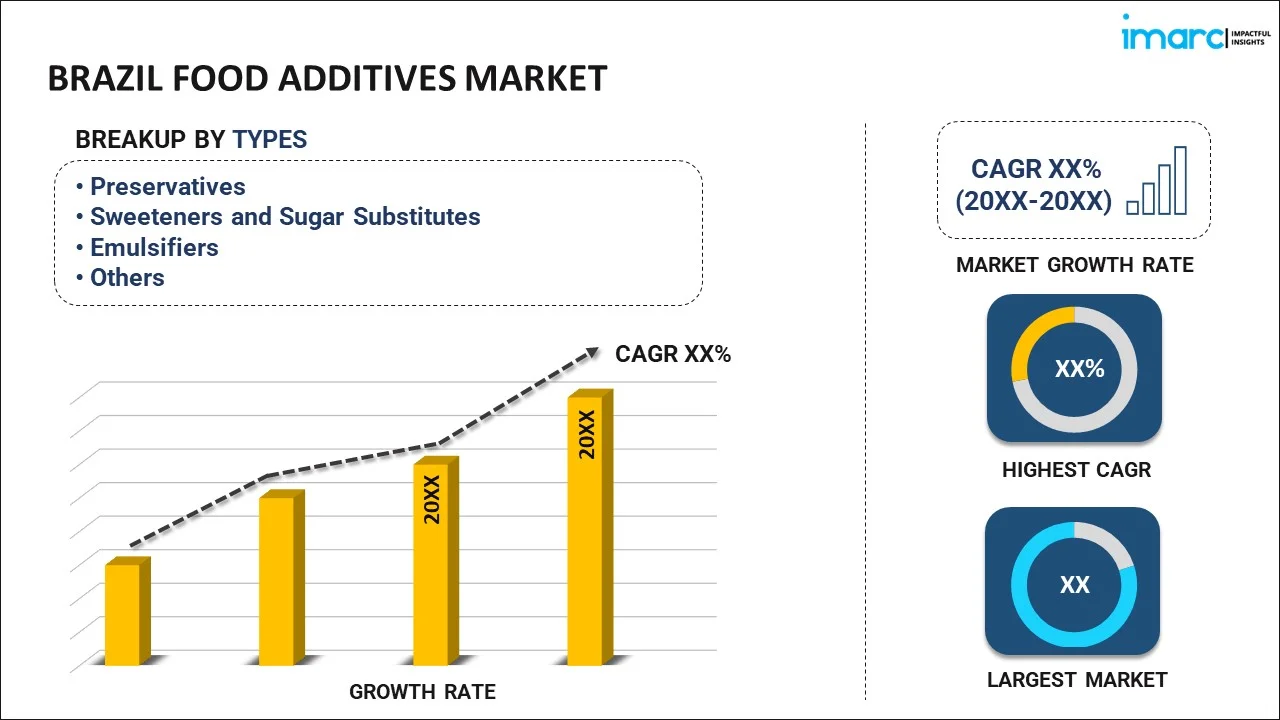

The Brazil food additives market size reached USD 4.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.1% during 2025-2033. The increasing demand for processed and convenience foods, rising preferences for natural food additives due to the growing health consciousness among the masses, and stringent regulatory support represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.6 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Market Growth Rate (2025-2033) | 5.1% |

Food additives are substances added to food to enhance its flavor and appearance or extend its shelf life. These additives play an essential role in the food industry by improving the palatability of products and maintaining their quality. They are usually added to stabilize emulsions, improve texture, and inhibit the growth of spoilage microorganisms. There are different categories of food additives, such as preservatives, sweeteners, colorings, and flavor enhancers. Preservatives like sodium benzoate or potassium sorbate help inhibit bacterial growth, ensuring the food remains safe to eat for a longer period. On the other hand, sweeteners like sucralose or aspartame are used to sweeten foods without the caloric content of sugar. Colorings add visual appeal, and flavor enhancers, such as monosodium glutamate (MSG), intensify the existing flavors in the food. They undergo stringent regulatory tests and are then approved for use in food products. At present, natural food additives are gaining immense traction across Brazil due to the emerging health and wellness trends.

Brazil Food Additives Market Trends:

In Brazil, the rising demand for processed and convenience foods, driven by a fast-paced lifestyle and rapid urbanization, will stimulate the growth of the food additives market during the forecast period. As cities expand and the middle class grows, the inclination toward quick and ready-to-eat (RTE) meals intensifies, subsequently fueling the need for food additives to preserve quality and extend shelf life. Additionally, the growing health consciousness among Brazilian consumers and the heightened focus on healthier diets have led to a higher demand for natural additives like antioxidants, fiber enrichments, and natural sweeteners, as opposed to synthetic compounds. The adoption of these healthier alternatives is gaining momentum, encouraging manufacturers to innovate and diversify their additive offerings. Furthermore, regulatory agencies in Brazil are introducing stringent guidelines for food safety, pushing companies to use approved and effective additives in their products. Along with this, the rising government initiatives toward fortifying staple foods with essential nutrients further contribute to the market growth, prompting the use of mineral and vitamin additives in everyday food items. Apart from this, the country’s strong agricultural sector is another major growth-inducing factor, as the availability of numerous raw materials, such as fruits and grains, allows for the development and adoption of more natural and organic additives. This supports local industries and caters to consumer demand for clean-label and naturally derived ingredients, thus propelling market growth. Moreover, the import of high-quality additives and export of locally manufactured ones are increasing, benefiting both domestic and global markets. In line with this, continuous advancements in food technology, such as the development of new methods of encapsulation and extraction that enable the use of additives in novel applications, are further supporting market growth.

Brazil Food Additives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Preservatives

- Sweeteners and Sugar Substitutes

- Emulsifiers

- Enzymes

- Hydrocolloids

- Food Flavors and Colorants

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes preservatives, sweeteners and sugar substitutes, emulsifiers, enzymes, hydrocolloids, food flavors and colorants, and others.

Application Insights:

- Bakery

- Confectionery

- Dairy

- Beverages

- Meat, Poultry and Sea Foods

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes bakery, confectionery, dairy, beverages, meat, poultry and sea foods, and others.

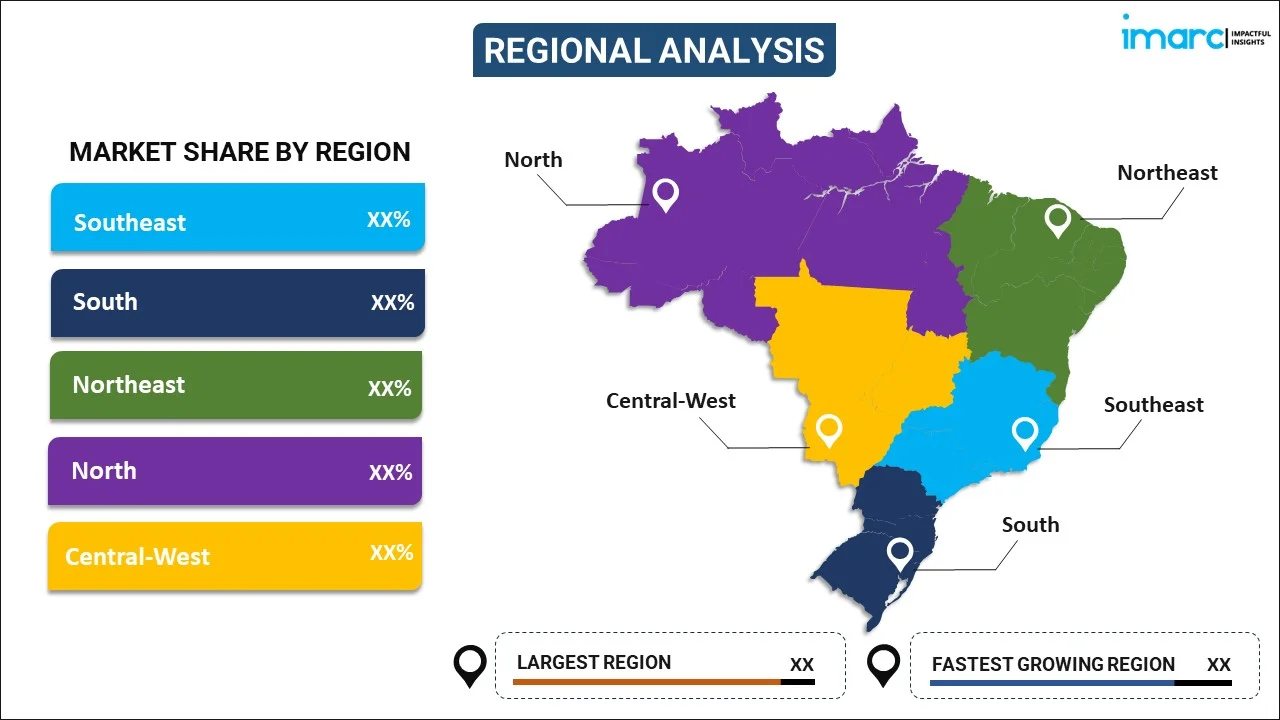

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Food Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Preservatives, Sweeteners and Sugar Substitutes, Emulsifiers, Enzymes, Hydrocolloids, Food Flavors and Colorants, Others |

| Applications Covered | Bakery, Confectionery, Dairy, Beverages, Meat, Poultry and Sea Foods, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil food additives market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-18 on the Brazil food additives market?

- What is the breakup of the Brazil food additives market on the basis of type?

- What is the breakup of the Brazil food additives market on the basis of application?

- What are the various stages in the value chain of the Brazil food additives market?

- What are the key driving factors and challenges in the Brazil food additives?

- What is the structure of the Brazil food additives market and who are the key players?

- What is the degree of competition in the Brazil food additives market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil food additives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil food additives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil food additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)