Brazil Facility Management Market Size, Share, Trends and Forecast by Type of Facility Management, Offering Type, End User, and Region, 2026-2034

Brazil Facility Management Market Summary:

The Brazil facility management market size was valued at USD 1,132.27 Million in 2025 and is projected to reach USD 3,520.50 Million by 2034, growing at a compound annual growth rate of 13.43% from 2026-2034.

The market is driven by rapid urbanization and the growing complexity of modern infrastructures, which necessitate professional facility management services across commercial and institutional establishments. Additionally, the rising adoption of outsourced facility management solutions enables organizations to focus on core competencies while benefiting from specialized expertise. Furthermore, the integration of smart building technologies and increasing emphasis on sustainability and energy efficiency are reshaping operational practices, strengthening the Brazil facility management market share.

Key Takeaways and Insights:

- By Type of Facility Management: Outsourced facility management holds the largest market share at 64% in 2025, establishing itself as the go-to method for businesses looking for specialized and affordable facility solutions in Brazil.

- By Offering Type: Soft FM dominates the market with a 57% share in 2025, driven by rising demand for cleaning, security, catering, and support services across commercial and institutional establishments.

- By End User: Commercial leads the market with a 30% share in 2025, driven by the growing number of corporate offices in need of complete facility management solutions as well as the expanding commercial real estate sector.

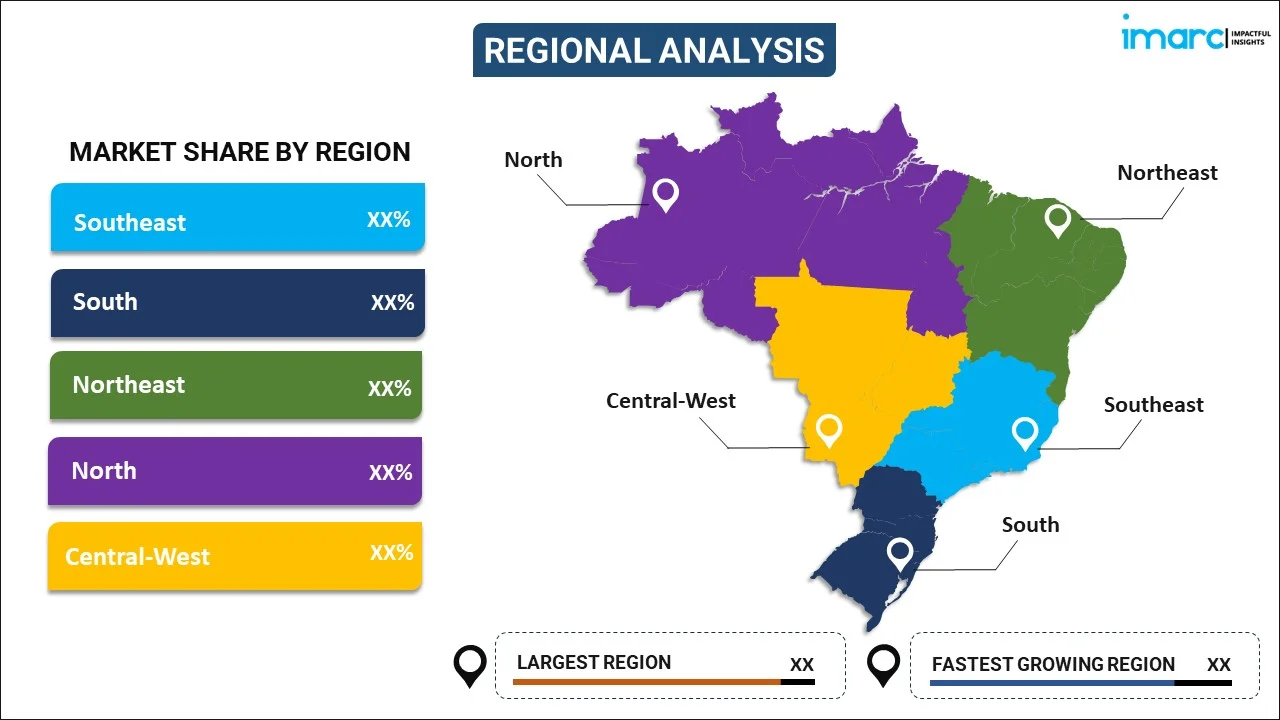

- By Region: Southeast represents leading region with a 35% of the market share in 2025, driven by the concentration of major economic activities, commercial establishments, and population centers in states like São Paulo and Rio de Janeiro.

- Key Players: Key players in the Brazil facility management market drive growth through service diversification, technological integration, and strategic partnerships. Companies compete on pricing, service quality, and sustainability practices, while expanding geographic coverage and developing integrated solutions to meet evolving client demands across commercial and institutional sectors.

The Brazil facility management market is experiencing robust expansion as organizations increasingly prioritize operational efficiency and cost optimization through professional facility services. The market benefits from the country's ongoing urbanization, with a substantial majority of the population residing in urban areas, driving demand for facility management across residential, commercial, and institutional buildings. Major public-private partnerships for institutional infrastructure projects increasingly incorporate professional facility management services such as cleaning, security, and maintenance. This growing integration of FM services in large-scale developments exemplifies the sector's vital role in supporting Brazil's infrastructure modernization efforts and institutional capacity building.

Brazil Facility Management Market Trends:

Accelerated Adoption of Smart Building Technologies

The integration of Internet of Things (IoT), artificial intelligence, and automation technologies is transforming facility management operations across Brazil. Smart building solutions enable real-time monitoring of energy consumption, predictive maintenance, and enhanced operational efficiency. According to industry reports, the Brazil building automation system market is expected to grow, with the facility management system segment projected to have the highest value. These technologies allow facility managers to optimize resource allocation and reduce operational costs significantly.

Rising Focus on Sustainability and Green Building Practices

Environmental consciousness is driving facility management providers to implement eco-friendly practices and sustainable solutions. In February 2025, the US Green Building Council ranked Brazil 9th globally in total LEED-certified space, with 125 projects representing over 2 million gross square meters certified in 2024. Brazil also achieved the world's first LEED v5 certification with the Portobello Jardim Social shop in Curitiba, demonstrating 88% renewable energy procurement and 90% improvement in emissions from building energy use. This sustainability focus is reshaping facility management service offerings and driving the Brazil facility management market growth.

Expansion of Integrated Facility Management Solutions

Organizations are increasingly adopting integrated facility management solutions that consolidate multiple services under single contracts, streamlining operations and reducing administrative burdens. This trend reflects the maturation of Brazil's FM market from basic maintenance services to comprehensive, technology-enabled solutions. Major international players are expanding their presence, bringing global best practices and integrated service models to the Brazilian market, thereby elevating industry standards and service quality across commercial, industrial, and institutional sectors.

Market Outlook 2026-2034:

The Brazil facility management market is poised for sustained growth, driven by continued urbanization, infrastructure development, and increasing corporate focus on operational efficiency. Government investments in commercial and institutional infrastructure, including the New Growth Acceleration Program (PAC), are expected to generate substantial demand for facility management services. The growing adoption of digital technologies, emphasis on sustainability, and rising preference for outsourced solutions will continue to shape market dynamics throughout the forecast period. The market generated a revenue of USD 1,132.27 Million in 2025 and is projected to reach a revenue of USD 3,520.50 Million by 2034, growing at a compound annual growth rate of 13.43% from 2026-2034.

Brazil Facility Management Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type of Facility Management |

Outsourced Facility Management |

64% |

|

Offering Type |

Soft FM |

57% |

|

End User |

Commercial |

30% |

|

Region |

Southeast |

35% |

Type of Facility Management Insights:

To get detailed segment analysis of this market, Request Sample

- Inhouse Facility Management

- Outsourced Facility Management

- Single FM

- Bundled FM

- Integrated FM

Outsourced facility management leads the market with a 64% share of the total Brazil facility management market in 2025.

The outsourced facility management segment dominates the Brazil market as organizations seek cost-effective solutions and specialized expertise for non-core functions. This approach allows businesses to focus on their primary competencies while benefiting from economies of scale offered by professional FM providers. The segment encompasses single FM contracts for specific services, bundled FM combining multiple services, and integrated FM offering comprehensive end-to-end solutions. The growing preference for outsourcing is driven by the need for operational efficiency and access to advanced technologies without significant capital investments.

Brazilian organizations are increasingly recognizing the strategic value of outsourcing facility management functions to professional service providers. This shift reflects a broader corporate transformation toward leaner operational models that prioritize core business activities. Outsourced cleaning, security, and maintenance contracts have experienced substantial growth in recent years, reflecting the broader trend toward professional facility services. International providers are expanding their presence throughout the country, bringing global best practices and driving the adoption of integrated facility management models across commercial, industrial, and institutional sectors nationwide.

Offering Type Insights:

- Hard FM

- Soft FM

Soft FM dominates the market with a 57% share of the total Brazil facility management market in 2025.

Soft FM services have become integral to organizational operations in Brazil, encompassing cleaning, security, catering, waste disposal, and landscaping services. The segment benefits from heightened awareness of health and hygiene standards following the pandemic, with organizations implementing stricter cleaning protocols and sanitation measures. The demand for professional janitorial services continues to grow as commercial spaces expand throughout urban centers. Brazilian businesses increasingly recognize that maintaining clean, safe environments directly impacts employee productivity and customer satisfaction.

The soft FM segment is experiencing technological advancement with the adoption of automated cleaning equipment and eco-friendly cleaning solutions. Companies are investing in green cleaning products and sustainable waste management practices to meet evolving environmental standards and corporate sustainability goals. The hospitality, healthcare, and retail sectors particularly drive demand for specialized soft FM services, with organizations prioritizing service quality and compliance with hygiene regulations to enhance brand reputation and ensure occupant wellbeing across their facilities.

End User Insights:

- Commercial

- Institutional

- Public/Infrastructure

- Industrial

- Others

Commercial represents the largest segment with a 30% share of the total Brazil facility management market in 2025.

Commercial drives substantial demand for facility management services in Brazil, encompassing office buildings, retail centers, shopping malls, and mixed-use developments. São Paulo's Grade-A office market experienced its strongest annual absorption in a decade during 2024, reflecting renewed corporate confidence and workspace expansion. This growth in commercial real estate directly correlates with increased demand for professional facility management services. Organizations occupying premium office spaces require sophisticated FM solutions to maintain building standards and support business operations effectively.

Commercial establishments increasingly prioritize modern amenities, energy efficiency, and sustainable building operations to attract tenants and enhance property values. The recovery of Brazil's commercial real estate market, with vacancy rates in São Paulo trending downward, creates sustained demand for comprehensive facility management solutions that maintain property standards and operational efficiency. Corporate offices and retail environments require specialized services including HVAC maintenance, security systems, cleaning protocols, and energy management to ensure optimal building performance and occupant satisfaction across diverse commercial properties.

Regional Insights:

To get regional segment analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast exhibits a clear dominance with a 35% share of the total Brazil facility management market in 2025.

The Southeast dominates Brazil's facility management market, housing the majority of commercial establishments, corporate headquarters, and institutional facilities. São Paulo, as the country's economic hub, commands a significant share of Brazil's commercial real estate market, with premium office spaces attracting multinational corporations and large domestic enterprises. The concentration of business activity in this metropolitan area creates sustained demand for professional facility management services across office buildings, retail centers, industrial parks, and mixed-use developments throughout the region.

The region benefits from substantial infrastructure investments, technology integration, and the presence of multinational corporations requiring sophisticated facility management solutions. Rio de Janeiro's ongoing development projects, including major public-private partnerships for institutional facilities, further strengthen regional demand. The Southeast Region’s advanced transportation networks established service provider ecosystem, and higher corporate spending on facility services position it as the primary growth engine for Brazil's FM industry. Both São Paulo and Rio de Janeiro continue attracting significant commercial real estate investment, driving expansion of professional facility management services.

Market Dynamics:

Growth Drivers:

Why is the Brazil Facility Management Market Growing?

Rapid Urbanization and Infrastructure Development

Brazil's ongoing urbanization, with majority of the population residing in urban areas, is driving substantial demand for professional facility management services across residential, commercial, and institutional buildings. The country's infrastructure development initiatives, including the New Growth Acceleration Program (PAC), are generating significant investment in commercial and public infrastructure. Brazil construction market size reached USD 156.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 218.2 Billion by 2034, exhibiting a growth rate (CAGR) of 3.80% during 2026-2034. These developments create sustained demand for comprehensive facility management solutions to maintain and operate new buildings and infrastructure projects efficiently.

Rising Preference for Outsourced Facility Management Services

Organizations across Brazil are increasingly outsourcing facility management functions to specialized providers to reduce operational costs and access expertise. This trend enables companies to focus on core business activities while benefiting from economies of scale and professional service delivery. According to industry analysis, 35% of enterprises globally increased FM budgets in 2023 to address operational complexity, a trend reflected in Brazil's market. The growing influence of international FM providers is elevating service standards and accelerating the adoption of integrated facility management solutions.

Technological Advancement and Smart Building Integration

The integration of advanced technologies including IoT, AI, and automation is transforming facility management practices in Brazil. Smart building solutions enable predictive maintenance, energy optimization, and real-time monitoring, reducing operational costs and enhancing service quality. The Brazil smart building market size reached USD 2,780.45 Million in 2025. The market is projected to reach USD 6,118.29 Million by 2034, exhibiting a growth rate (CAGR) of 9.16% during 2026-2034. Companies are implementing computerized maintenance management systems (CMMS) and IoT solutions to optimize resource allocation and improve data-driven decision-making, driving demand for technology-enabled facility management services.

Market Restraints:

What Challenges the Brazil Facility Management Market is Facing?

Shortage of Skilled Workforce

The facility management industry in Brazil faces challenges related to workforce availability and training. The shortage of skilled technicians, particularly in specialized areas such as HVAC, electrical systems, and building automation, constrains service delivery capabilities and increases labor costs for FM providers seeking to meet growing market demand.

Economic Volatility and High Interest Rates

Brazil's economic conditions, including fluctuating interest rates and currency volatility, significantly impact investment decisions and operational budgets across industries. High borrowing costs affect commercial real estate development and can constrain facility management budgets, particularly for capital-intensive technology upgrades, infrastructure improvements, and expansion of professional service offerings that require substantial upfront investments.

Cybersecurity and Data Privacy Concerns

The increasing digitalization of facility management operations introduces significant cybersecurity vulnerabilities that organizations must address. Smart building systems and connected devices create potential entry points for security breaches, requiring FM providers to invest substantially in cybersecurity measures, employee training, and data protection protocols to maintain client trust and ensure regulatory compliance.

Competitive Landscape:

The Brazil facility management market features a competitive landscape with both international players and domestic providers operating across commercial, industrial, and institutional sectors. Major global companies are expanding their presence through strategic acquisitions, partnerships, and service diversification initiatives. Competition is primarily driven by technological integration, service quality, pricing strategies, and sustainability practices. Domestic players leverage local market knowledge and established client relationships to compete effectively against multinational corporations. Companies are increasingly focusing on integrated facility management solutions, combining hard and soft services to deliver comprehensive offerings that address evolving client requirements and operational efficiency goals.

Brazil Facility Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Facility Managements Covered |

|

| Offering Types Covered | Hard FM, Soft FM |

| End Users Covered | Commercial, Institutional, Public/Infrastructure, Industrial, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil facility management market size was valued at USD 1,132.27 Million in 2025.

The Brazil facility management market is expected to grow at a compound annual growth rate of 13.43% from 2026-2034 to reach USD 3,520.50 Million by 2034.

Outsourced facility management holds the market share of 64%, as organizations increasingly delegate non-core functions to specialized providers for cost optimization, operational efficiency, and access to professional expertise.

Key factors driving Brazil facility management market include rapid urbanization, growing preference for outsourced FM services, technological integration including IoT and AI, emphasis on sustainability practices, and continued expansion of commercial real estate developments.

Major challenges include shortage of skilled workforce in specialized technical areas, economic volatility and high interest rates, cybersecurity concerns, and the need for significant investment in technology infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)