Brazil Endoscopy Devices Market Size, Share, Trends and Forecast by Type of Device, Application, and Region, 2026-2034

Brazil Endoscopy Devices Market Summary:

The Brazil endoscopy devices market size reached USD 1.09 Billion in 2025 and is projected to reach USD 1.74 Billion by 2034, growing at a compound annual growth rate of 5.27% from 2026-2034.

The Brazil endoscopy devices market is experiencing sustained growth driven by the rising prevalence of gastrointestinal disorders, including colorectal cancer and inflammatory bowel diseases, which has created substantial demand for diagnostic and therapeutic endoscopic procedures. The expanding geriatric population and increasing healthcare awareness among Brazilians are further accelerating the adoption of advanced endoscopy technologies. Additionally, significant investments in healthcare infrastructure modernization across public and private sectors, combined with technological innovations in high-definition imaging and minimally invasive procedures, are strengthening the Brazil endoscopy devices market share.

Key Takeaways and Insights:

- By Type of Device: Endoscopes dominated the market with approximately 52% revenue share in 2025, driven by their essential role in all endoscopic procedures across gastroenterology, pulmonology, urology, and gynecology specialties, with growing adoption of flexible, HD, and disposable endoscope variants.

- By Application: Gastroenterology led the market with a revenue share of 37% in 2025, owing to the high prevalence of gastrointestinal disorders including colorectal cancer, gastritis, ulcers, and inflammatory bowel diseases, requiring diagnostic and therapeutic endoscopic interventions.

- By Region: Southeast represents the largest revenue share of approximately 40% in 2025, attributed to the concentration of advanced healthcare facilities in São Paulo and Rio de Janeiro metropolitan areas, higher disposable incomes, and greater healthcare accessibility.

- Key Players: The Brazil endoscopy devices market exhibits moderate competitive intensity with established multinational medical technology corporations leveraging technological expertise and distribution networks. Market participants are focusing on strategic initiatives including product innovations, partnerships with healthcare institutions, and geographic expansion to strengthen their market presence.

The Brazil endoscopy devices market comprises medical instruments used for the visual examination and diagnosis of internal organs and body cavities. These devices support minimally invasive procedures, reducing the reliance on traditional open surgeries while offering real-time visualization for clinicians. The market is advancing through continuous innovations in optics, imaging systems, and surgical techniques, enhancing diagnostic accuracy and procedural efficiency. Healthcare providers across Brazil are increasingly integrating sophisticated endoscopy technologies to manage the growing prevalence of gastrointestinal and related conditions, improve patient outcomes, and meet evolving standards of care. The adoption of advanced equipment reflects a broader trend toward technology-driven, patient-centric diagnostic and therapeutic solutions throughout the country’s diverse healthcare landscape.

Brazil Endoscopy Devices Market Trends:

Integration of Artificial Intelligence and High-Definition Imaging Technologies

The Brazil endoscopy devices market is undergoing a technological transformation with the growing adoption of artificial intelligence and high-definition imaging, which improve diagnostic accuracy and procedural efficiency. Advanced visualization systems equipped with AI-assisted detection enable clinicians to identify subtle lesions and polyps more reliably. These intelligent technologies support gastroenterologists in analyzing complex conditions, enhancing early detection and patient care. The integration of AI and cloud-based platforms reflects a broader trend toward smarter, data-driven endoscopy solutions, driving innovation and efficiency across clinical workflows in Brazil’s healthcare facilities. For instance, in April 2024, AI MEDICAL SERVICE INC. (AIM), a start-up developing AI-based endoscopic diagnostics, announced the first Brazilian approval for its stomach-focused system, gastroAI (model G). Authorized by ANVISA on April 1, 2024, the AI assists physicians in detecting potential neoplastic lesions for biopsy or further evaluation, marking Brazil’s first regulatory approval for endoscopic support software in the upper gastrointestinal tract.

Growing Adoption of Disposable Endoscopic Components

Healthcare facilities across Brazil are increasingly transitioning toward disposable endoscopic components to minimize cross-contamination risks and reduce reprocessing costs associated with traditional reusable equipment. This trend aligns with enhanced infection control protocols implemented following the global pandemic and reflects growing emphasis on patient safety standards. Single-use endoscopes and accessories eliminate sterilization complexities while ensuring consistent performance across procedures. Brazilian regulatory frameworks through ANVISA continue evolving to support safer medical device practices, encouraging manufacturers to expand disposable product portfolios.

Expansion of Bariatric Endoscopy Procedures

The development of specialized endoscopic procedures for weight management has created a significant niche market within Brazil's broader endoscopy landscape. Endoscopic sleeve gastroplasty and other minimally invasive bariatric interventions are gaining traction as effective alternatives to traditional surgical approaches, utilizing sutures to restructure stomach anatomy and achieve weight reduction outcomes. These procedures offer advantages, including reduced recovery times, lower complication rates, and improved patient acceptance compared to conventional bariatric surgery. The growing obesity prevalence and increasing awareness of metabolic health management are driving demand for bariatric endoscopy services. For instance, in November 2025, Allurion Technologies, Inc. revealed a strategic distribution alliance with ProSurg Medical aimed at expanding its weight management program in Brazil. Despite facing financial challenges, the company is pursuing international growth opportunities.

Market Outlook 2026-2034:

The Brazil endoscopy devices market outlook remains positive through the forecast period as healthcare modernization initiatives accelerate across public and private sectors. Government investments in smart hospital infrastructure, including the Ministry of Health's announced plans for a national network of intelligent hospitals with AI and robotic surgery capabilities starting in 2026, will create substantial opportunities for advanced endoscopy equipment adoption. The aging demographic profile, with individuals aged 65 and older now constituting approximately 11% of Brazil's population, continues driving demand for diagnostic procedures addressing age-related gastrointestinal conditions. The market generated a revenue of USD 1.09 Billion in 2025 and is projected to reach a revenue of USD 1.74 Billion by 2034, growing at a compound annual growth rate of 5.27% from 2026-2034.

Brazil Endoscopy Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Device | Endoscopes | 52% |

| Application | Gastroenterology | 37% |

| Region | Southeast | 40% |

Type of Device Insights:

To get detailed segment analysis of this market Request Sample

- Endoscopes

- Rigid Endoscope

- Flexible Endoscope

- Capsule Endoscope

- Robot-assisted Endoscope

- Endoscopic Operative Device

- Irrigation/Suction System

- Access Device

- Wound Protector

- Insufflation Device

- Others

- Visualization Equipment

- Endoscopic Camera

- SD Visualization System

- HD Visualization System

Endoscopes dominate with a market share of 52% of the total Brazil endoscopy devices market in 2025.

Endoscopes represent the foundational and most frequently utilized instruments across all endoscopic procedures, serving as essential tools in gastroenterology, pulmonology, urology, and gynecology specialties. Their high utilization rates, requirements for multiple units per healthcare facility, and regular replacement cycles generate substantial and consistent demand throughout Brazil's healthcare system. The segment continues benefiting from technological evolution as healthcare providers increasingly adopt flexible, high-definition, and disposable endoscope variants to enhance diagnostic capabilities and patient safety standards.

Growing investment in advanced endoscope technologies reflects the broader market transition toward precision diagnostics. Brazilian hospitals and diagnostic centers are prioritizing equipment upgrades that offer enhanced visualization, improved maneuverability, and integrated digital capabilities. The expansion of ambulatory surgery centers and specialty clinics across urban areas is further driving endoscope procurement as these facilities establish comprehensive diagnostic service portfolios to meet rising patient demand for minimally invasive evaluation procedures.

Application Insights:

- Gastroenterology

- Pulmonology

- Orthopedic Surgery

- Cardiology

- Gynecology

- Others

Gastroenterology segment leads with a share of 37% of the total Brazil endoscopy devices market in 2025.

Gastroenterology applications dominate the Brazil endoscopy devices market due to the high prevalence of gastrointestinal disorders affecting the Brazilian population, including colorectal cancer, gastritis, ulcers, and inflammatory bowel diseases. According to the Brazilian National Cancer Institute (INCA), approximately 45,000 new colorectal cancer cases are estimated annually between 2023 and 2025, positioning colorectal cancer as the second most common malignancy among both men and women in the country. This substantial disease burden generates sustained demand for colonoscopies, gastroscopies, and therapeutic endoscopic interventions.

The gastroenterology segment benefits from expanding screening program initiatives aimed at early cancer detection and prevention. The Março Azul (Blue March) campaign actively promotes colorectal cancer awareness and encourages regular screening among individuals aged 45 and above, while healthcare facilities implement fecal immunochemical testing programs followed by colonoscopy for positive cases. These public health efforts, combined with growing consumer awareness of gastrointestinal health, continue driving procedural volumes and equipment utilization across Brazil's gastroenterology service network.

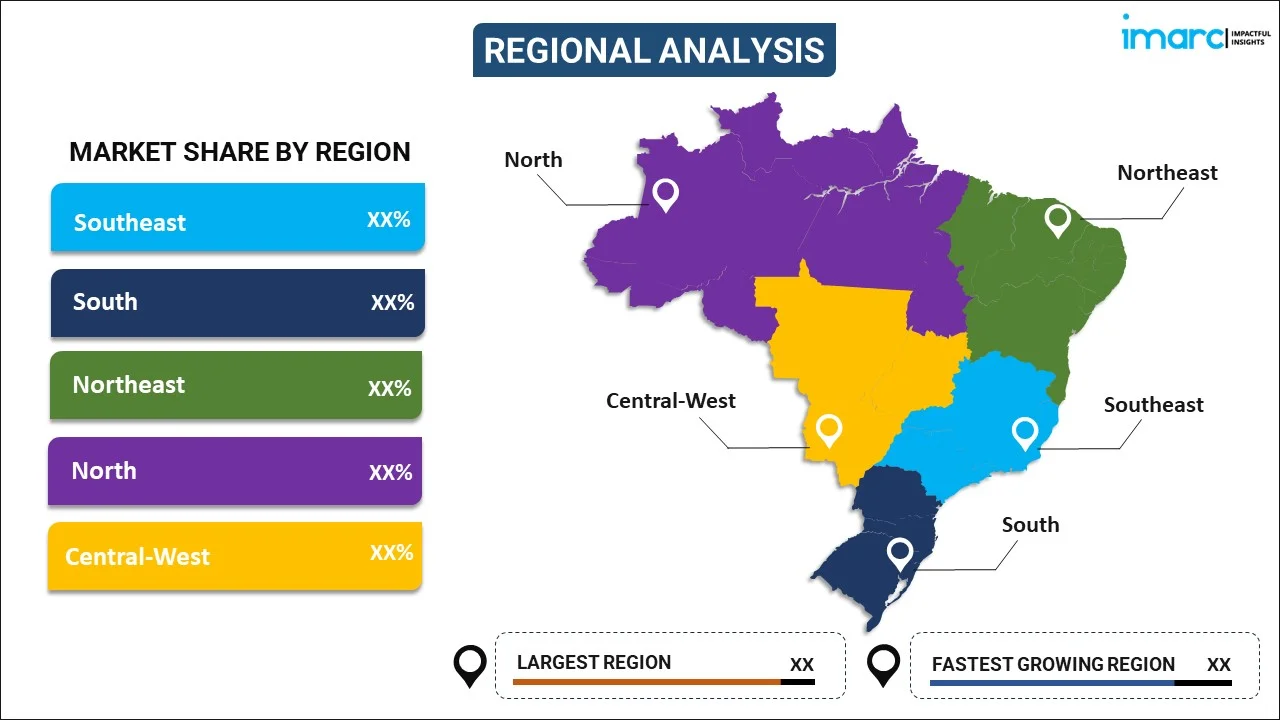

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast exhibits clear dominance with a 40% share of the total Brazil endoscopy devices market in 2025.

The Southeast region commands the largest share of Brazil's endoscopy devices market, driven by the concentration of advanced healthcare infrastructure in São Paulo and Rio de Janeiro metropolitan areas. The region houses the majority of private hospitals, including internationally certified institutions such as Hospital Israelita Albert Einstein and Hospital Sírio-Libanês, which maintain sophisticated endoscopy capabilities and readily adopt emerging technologies. Higher disposable incomes, greater private health insurance penetration, and established referral networks facilitate patient access to specialized endoscopic services throughout the region.

Ongoing healthcare infrastructure investments are reinforcing the Southeast region’s market position. Expansion of hospitals, specialty centers, and diagnostic facilities is enhancing access to advanced medical services, including endoscopy and other specialized care. Regional development initiatives and public-private partnerships are helping extend healthcare capabilities to previously underserved areas, improving service coverage and quality. These efforts strengthen the Southeast’s role as a key healthcare hub, supporting both patient care and related industries, including medical equipment and packaging solutions, while driving long-term regional growth and market consolidation.

Market Dynamics:

Growth Drivers:

Why is the Brazil Endoscopy Devices Market Growing?

Rising Prevalence of Gastrointestinal Disorders and Colorectal Cancer

The escalating burden of gastrointestinal disorders across Brazil represents a primary catalyst driving endoscopy devices market expansion. Colorectal cancer ranks as the second most common malignancy among Brazilian adults, with the National Cancer Institute estimating approximately 704,000 total cancer cases between 2023 and 2025, creating substantial demand for diagnostic and therapeutic endoscopic interventions. Changing dietary patterns characterized by increased consumption of processed foods, sedentary lifestyles, and elevated alcohol consumption have contributed to rising gastrointestinal disease incidence. Inflammatory bowel diseases, gastroesophageal reflux disorders, and peptic ulcers further drive procedural volumes, while healthcare awareness campaigns encourage earlier detection and intervention for gastrointestinal conditions.

Expanding Geriatric Population Driving Diagnostic Demand

Brazil’s demographic shift is driving steady growth in endoscopy device use, as an aging population faces higher rates of conditions that require diagnostic evaluation. Older adults are particularly vulnerable to gastrointestinal cancers, cardiovascular disorders, and respiratory illnesses, making endoscopic procedures essential for accurate diagnosis and disease staging. In response, healthcare providers are adapting service delivery models to meet the rising demand for minimally invasive evaluations, focusing on approaches that reduce surgical risks, enhance patient safety, and support faster recovery for elderly patients across the country.

Government Healthcare Infrastructure Investments and Modernization

Government-led efforts at both the federal and state levels to upgrade Brazil’s healthcare infrastructure are fostering a supportive environment for the growth of the endoscopy devices market. The Ministry of Health has announced plans for a National Network of Hospitals and Intelligent Services featuring artificial intelligence integration, robotic surgery capabilities, and advanced diagnostic equipment, with operations projected to commence in 2026 and investments totaling approximately BRL 1.7 billion. Brazilian states unveiled significant investments in health infrastructure through public-private partnerships, reflecting a strong focus on expanding healthcare capacity. The Ministry of Health’s allocation to digital health initiatives, particularly targeting underserved regions in the North and Northeast, highlights a commitment to improving access to advanced medical technologies and modernizing healthcare delivery across the country.

Market Restraints:

What Challenges the Brazil Endoscopy Devices Market is Facing?

High Equipment Acquisition and Maintenance Costs

The substantial capital investment required for advanced endoscopy systems presents significant barriers to market expansion, particularly for smaller healthcare facilities and institutions in economically constrained regions. Equipment procurement costs, combined with ongoing maintenance requirements, consumable expenses, and periodic technology upgrades, create financial challenges that limit adoption rates across segments of Brazil's healthcare infrastructure.

Shortage of Skilled Endoscopy Professionals

The limited availability of adequately trained endoscopists and technical personnel constrains market growth potential in certain geographic regions. Specialized training requirements for advanced endoscopic procedures, combined with geographic concentration of qualified professionals in major metropolitan centers, create service accessibility disparities between urban and rural healthcare settings throughout Brazil.

Regional Healthcare Infrastructure Disparities

Significant variations in healthcare infrastructure development across Brazil's geographic regions impede uniform market expansion. While Southeast and South regions maintain advanced facilities with comprehensive endoscopy capabilities, North and Northeast areas face infrastructure limitations, connectivity challenges, and resource constraints that restrict access to modern endoscopic diagnostic services for substantial population segments.

Competitive Landscape:

The Brazil endoscopy devices market exhibits moderate competitive intensity, featuring a mix of multinational medical technology companies, regional distributors, and emerging local players. Competition is primarily driven by continuous advancements in visualization systems, integration of artificial intelligence, and improvements in procedural efficiency. Companies focus on strategic initiatives such as product innovation, clinical collaborations with healthcare institutions, and expansion into new regions to sustain growth. The regulatory framework overseen by ANVISA plays a critical role in shaping the market by enforcing quality standards and product approval requirements, ensuring patient safety while influencing competitive dynamics among manufacturers.

Recent Developments:

- September 2024: Olympus Latin America announced the Brazilian launch of the EVIS X1 endoscopy system, featuring advanced visualization technologies for colorectal cancer detection and treatment. Launch events included demonstrations in Rio de Janeiro, Curitiba, and Brasilia with presentations on prevention of colorectal cancer development using the enhanced imaging capabilities.

- September 2024: EziSurg Medical officially launched its powered endoscopic staplers, easyEndo™ E-lite, in Brazil, representing a major milestone as the company broadens its footprint across South America. Following nearly a year of preparation, the distributor has opted to switch to the EziSurg brand after the product successfully received ANVISA registration, enabling its formal entry into the Brazilian market.

Brazil Endoscopy Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Devices Covered |

|

| Applications Covered | Gastroenterology, Pulmonology, Orthopedic Surgery, Cardiology, Gynecology, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil endoscopy devices market size was valued at USD 1.09 Billion in 2025.

The Brazil endoscopy devices market is expected to grow at a compound annual growth rate of 5.27% from 2026-2034 to reach USD 1.74 Billion by 2034.

Endoscopes dominated the market with 52% revenue share in 2025, driven by their essential role across all endoscopic procedures and growing adoption of flexible, HD, and disposable variants for enhanced diagnostic capabilities.

Key factors driving the Brazil endoscopy devices market include rising prevalence of gastrointestinal disorders and colorectal cancer, expanding geriatric population requiring diagnostic procedures, government healthcare infrastructure investments, and technological advancements in AI-powered imaging and minimally invasive techniques.

Major challenges include high equipment acquisition and maintenance costs, shortage of skilled endoscopy professionals particularly in non-metropolitan regions, regional healthcare infrastructure disparities between Southeast and other areas, and regulatory compliance requirements that may extend product approval timelines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)