Brazil Drug Delivery Devices Market Size, Share, Trends and Forecast by Route of Administration, Application, End User, and Region, 2026-2034

Brazil Drug Delivery Devices Market Summary:

The Brazil drug delivery devices market size was valued at USD 771.36 Million in 2025 and is projected to reach USD 1,371.39 Million by 2034, growing at a compound annual growth rate of 6.60% from 2026-2034.

The Brazil drug delivery devices market is experiencing robust expansion driven by escalating chronic disease prevalence, technological innovations, and strengthening healthcare infrastructure across the nation. The growing geriatric population and increasing incidence of diabetes, cardiovascular disorders, and cancer necessitate advanced drug administration solutions that ensure precise dosing and improved therapeutic outcomes. The shift toward patient-centric care models and self-administration capabilities is fostering demand for user-friendly, portable devices that enable home-based treatment regimens. Pharmaceutical companies are increasingly developing biologic drugs and targeted therapies requiring sophisticated delivery mechanisms, further propelling market momentum. Additionally, favorable regulatory frameworks and expanding telemedicine adoption are enhancing accessibility to advanced drug delivery technologies across urban and emerging regional markets, positioning Brazil as a leading healthcare destination in Latin America and contributing to sustained Brazil drug delivery devices market share expansion.

Key Takeaways and Insights:

- By Route of Administration: Injectable dominates the market with a share of 51% in 2025, driven by widespread application in diabetes management, oncology treatments, and immunization programs. Rising demand for self-injection devices and prefilled syringes supports sustained segment leadership across therapeutic categories.

- By Application: Cancer leads the market with a share of 30% in 2025, reflecting intensifying oncological drug development and adoption of targeted therapies requiring precise drug delivery mechanisms. Growing clinical trial activities and expanding access to innovative cancer treatments reinforce segment prominence.

- By End User: Hospitals represent the largest segment with a market share of 63% in 2025, due to specialized infrastructure for intricate therapeutic interventions, concentrated patient volumes, and extensive clinical capabilities that support sophisticated drug delivery procedures.

- Key Players: Key players drive the Brazil drug delivery devices market by expanding product portfolios, enhancing device precision and patient comfort, and strengthening distribution networks. Their investments in research partnerships, affordability initiatives, and collaborations with healthcare providers accelerate adoption and ensure product availability across diverse consumer segments.

The Brazil drug delivery devices market continues advancing as healthcare stakeholders embrace innovative administration solutions addressing diverse therapeutic requirements. The injectable segment maintains clear dominance owing to extensive applications spanning chronic disease management, vaccination campaigns, and biologic therapies. Cancer treatment applications command significant market presence, driven by heightened oncology research investments and growing adoption of precision medicine approaches. Hospitals remain primary end users given their comprehensive capabilities for administering complex drug regimens under professional supervision. The market benefits from Brazil's robust pharmaceutical ecosystem, with the National Bank for Economic and Social Development reporting credit approvals reaching USD 270 Million for pharmaceutical and pharma chemical industries by mid-July 2024, demonstrating sustained sector investment. Technological advancements in smart drug delivery systems, wearable devices, and connected health technologies are revolutionizing patient care experiences while enhancing treatment adherence and outcomes across the nation.

Brazil Drug Delivery Devices Market Trends:

Rising Adoption of Self-Administration and Home Healthcare Devices

The trend toward patient-centric care and self-administration is gaining substantial momentum across Brazil, driven by consumer preference for convenient treatment options and cost-effective healthcare delivery. Drug delivery devices enabling independent medication management are witnessing heightened demand, particularly among patients managing chronic conditions. In October 2024, Novo Nordisk announced a USD 158 Million investment to modernize its Montes Claros insulin production facility in Minas Gerais, strengthening capacity for injectable devices supporting home-based diabetes care.

Integration of Smart Technologies and Connected Drug Delivery Systems

Technological integration is transforming drug delivery landscapes with IoT-enabled systems offering real-time monitoring, dosage reminders, and data sharing capabilities with healthcare providers. Smart insulin pens, connected inhalers, and digital health platforms are enhancing treatment adherence while enabling remote patient monitoring. The Brazilian Ministry of Health allocated USD 84 Million in 2024 for digital health infrastructure development, particularly benefiting North and Northeast regions, accelerating Brazil drug delivery devices market growth through enhanced technological accessibility.

Expansion of Biologic Therapies and Targeted Drug Delivery Solutions

The proliferation of biologic drugs and biosimilars requiring specialized delivery mechanisms is reshaping market dynamics across therapeutic categories. Advanced carriers, nanoparticle formulations, and sustained-release systems are gaining prominence for delivering complex molecules with enhanced efficacy and reduced side effects. In March 2024, Brazil's Fiocruz announced an agreement with Boehringer Ingelheim to manufacture generic empagliflozin, demonstrating expanding partnerships aimed at improving therapeutic accessibility through advanced drug delivery formulations.

Market Outlook 2026-2034:

The Brazil drug delivery devices market outlook remains strongly positive through the forecast period, underpinned by favorable demographic trends, healthcare modernization initiatives, and technological innovation trajectories. Chronic disease burdens are anticipated to intensify as population aging accelerates, generating sustained demand for efficient medication delivery solutions across therapeutic domains. The market generated a revenue of USD 771.36 Million in 2025 and is projected to reach a revenue of USD 1,371.39 Million by 2034, growing at a compound annual growth rate of 6.60% from 2026-2034. Government commitment to universal healthcare access through the Sistema Único de Saúde combined with expanding private healthcare investments positions Brazil for continued market expansion. Regulatory modernization efforts and international partnerships are expected to facilitate faster device approvals and broader technology transfers.

Brazil Drug Delivery Devices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Route of Administration |

Injectable |

51% |

|

Application |

Cancer |

30% |

|

End User |

Hospitals |

63% |

Route of Administration Insights:

To get detailed segment analysis of this market Request Sample

- Injectable

- Topical

- Ocular

- Others

Injectable dominates with a market share of 51% of the total Brazil drug delivery devices market in 2025.

Injectable drug delivery devices constitute the predominant segment within Brazil's market, reflecting their critical role in administering therapeutic agents across diverse medical applications. These devices enable direct bloodstream or tissue delivery, ensuring rapid drug absorption and precise dosing essential for treating acute and chronic conditions. Injectable formats support administration of biologics, vaccines, hormones, and various pharmaceutical formulations requiring parenteral delivery routes. Growing biologic drug adoption and expanding immunization programs continue reinforcing segment leadership across healthcare settings nationwide, with hospitals, clinics, and home healthcare environments increasingly relying on injectable technologies.

The injectable segment benefits significantly from rising diabetes prevalence and expanding insulin delivery device adoption throughout Brazil. Insulin pens are widely used within insulin delivery devices owing to their convenience and dosing accuracy. Self-injection systems and prefilled syringes are witnessing accelerating demand as patients increasingly prefer home-based chronic disease management solutions. These devices reduce dependency on clinical settings while empowering patients to maintain treatment regimens independently. Technological innovations including smart injection pens with connectivity features enhance treatment adherence while enabling healthcare providers to monitor patient compliance remotely, further strengthening injectable device market positioning.

Application Insights:

- Cancer

- Cardiovascular

- Diabetes

- Infectious Diseases

- Others

Cancer leads with a share of 30% of the total Brazil drug delivery devices market in 2025.

Cancer treatment applications represent the largest application segment, driven by Brazil's escalating oncological burden and expanding access to innovative therapeutic interventions. Drug delivery devices enabling targeted chemotherapy administration, immunotherapy delivery, and supportive care medications are experiencing heightened adoption across hospital oncology departments. The complexity of cancer treatment protocols necessitates precise drug delivery mechanisms ensuring optimal therapeutic concentrations while minimizing systemic toxicity. Infusion pumps, injectable systems, and implantable devices support multifaceted oncological care requirements throughout treatment journeys.

The cancer application segment benefits from Brazil's emergence as a significant clinical research hub for oncological drug development in Latin America. Major pharmaceutical companies maintain active oncology trial programs, exploring combination therapies, immunotherapies, and targeted treatments requiring sophisticated drug delivery mechanisms. Non-small cell lung cancer, breast cancer, and colorectal cancer represent primary focus areas attracting substantial clinical development resources. Investigational therapies frequently demand specialized delivery platforms accommodating novel formulations and dosing regimens. The establishment of networks supporting domestic anti-cancer drug innovation further positions Brazil for sustained oncology-related device market expansion throughout the forecast period as therapeutic pipelines advance toward commercialization.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

- Others

Hospitals exhibit a clear dominance with 63% share of the total Brazil drug delivery devices market in 2025.

Hospitals constitute the predominant end-user segment, attributable to their comprehensive infrastructure supporting complex therapeutic interventions and high patient volumes requiring diverse drug administration solutions. As of 2024, Brazil maintains approximately 500,253 hospital beds across public and private facilities, providing extensive platforms for device deployment. The Unified Healthcare System serves approximately 72% of Brazil's population, generating substantial institutional demand for cost-effective yet efficient drug delivery technologies. Major tertiary hospitals in São Paulo and Rio de Janeiro increasingly adopt robotic-assisted systems and AI-powered diagnostic equipment alongside advanced delivery devices.

Hospital segment dominance reflects the concentration of specialized medical expertise, regulatory compliance frameworks, and comprehensive patient monitoring capabilities essential for administering complex drug regimens. Inpatient oncology, cardiovascular interventions, and acute care treatments necessitate professional supervision and immediate adverse event management available within hospital settings. Private hospital chains continue upgrading their imaging, monitoring, and drug delivery systems, while regional hospitals adopt portable diagnostic tools expanding healthcare accessibility across underserved populations.

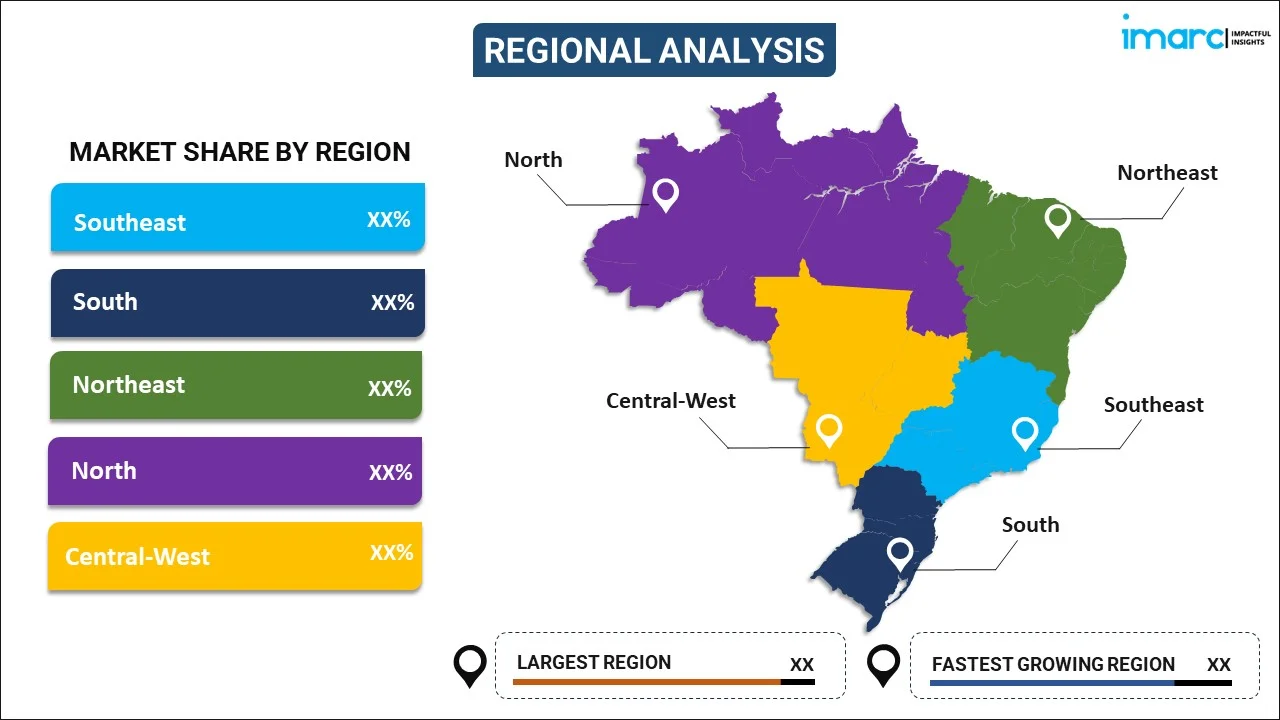

Regional Insights:

To get detailed segment analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast Region dominates the Brazil drug delivery devices market, driven by major metropolitan centers including São Paulo, Rio de Janeiro, and Minas Gerais housing advanced public and private healthcare institutions. The region benefits from superior infrastructure, concentrated pharmaceutical manufacturing activities, highest healthcare expenditure allocations, and presence of internationally accredited hospitals providing comprehensive therapeutic services across diverse medical specialties.

The South Region represents a significant contributor to the Brazil drug delivery devices market, characterized by well-developed healthcare systems and efficient service delivery networks. States including Paraná, Santa Catarina, and Rio Grande do Sul maintain strong medical infrastructure supporting advanced drug administration technologies. The region benefits from higher education levels, organized healthcare networks, and growing demand for sophisticated therapeutic solutions.

The Northeast Region demonstrates expanding potential within the Brazil drug delivery devices market as healthcare infrastructure development accelerates through government initiatives. Growing population healthcare needs and increasing investments in medical facilities are driving device adoption across the region. Improving accessibility to healthcare services and expanding hospital networks are creating emerging opportunities for drug delivery technology deployment throughout northeastern states.

The North Region represents an emerging market for drug delivery devices as healthcare accessibility initiatives expand across remote and underserved communities. Government programs targeting healthcare infrastructure improvements are gradually enhancing medical service availability throughout the region. Telemedicine integration and portable diagnostic technologies are facilitating healthcare delivery expansion, creating nascent opportunities for drug delivery device adoption in previously inaccessible areas.

The Central-West Region demonstrates steady growth potential within the Brazil drug delivery devices market, supported by developing healthcare infrastructure and expanding urban populations. Agricultural economic prosperity enables increasing healthcare investments across major urban centers. The region benefits from strategic geographic positioning and growing private healthcare sector presence, fostering gradual adoption of advanced drug delivery technologies across therapeutic applications.

Market Dynamics:

Growth Drivers:

Why is the Brazil Drug Delivery Devices Market Growing?

Rising Prevalence of Chronic Diseases and Aging Population Demographics

The escalating burden of chronic diseases represents a primary catalyst propelling market expansion across Brazil. Diabetes, cardiovascular disorders, respiratory conditions, and oncological diseases require continuous medication management through efficient drug delivery mechanisms. These conditions necessitate regular therapeutic interventions delivered through various device formats ensuring optimal bioavailability and patient compliance. The growing patient population affected by lifestyle-related and hereditary chronic conditions generates sustained demand for reliable drug administration solutions across healthcare settings. The aging population demographic further intensifies demand as elderly individuals frequently require multiple medications and may experience difficulties with conventional administration methods. Geriatric patients often face challenges including reduced dexterity, visual impairments, and cognitive considerations that complicate traditional drug administration approaches. Drug delivery devices offering user-friendly operation, accurate dosing capabilities, and enhanced comfort are gaining preference among this growing patient demographic segment. Healthcare providers increasingly recommend advanced delivery technologies that simplify treatment regimens while ensuring therapeutic efficacy for patients managing long-term health conditions.

Technological Advancements and Smart Device Integration

Continuous technological innovation is transforming drug delivery landscapes, introducing intelligent systems with enhanced functionality, connectivity, and patient engagement capabilities. Smart drug delivery devices incorporating IoT sensors, mobile application connectivity, and automated dosing reminders are revolutionizing treatment adherence and enabling remote patient monitoring. Healthcare providers can track medication compliance, adjust treatment regimens, and intervene promptly when deviations occur. The integration of artificial intelligence capabilities for diagnostic support and personalized dosing recommendations further enhances device value propositions. Wearable injectors, needle-free delivery systems, and connected health platforms represent frontier technologies attracting significant research investment and commercial interest throughout the nation.

Government Healthcare Initiatives and Infrastructure Investments

Brazilian government commitment to healthcare accessibility through the Sistema Único de Saúde and complementary private sector investments are strengthening drug delivery device adoption nationwide. Public healthcare programs promoting vaccination coverage, chronic disease management, and preventive care generate substantial institutional demand for diverse administration technologies. The government maintains active immunization campaigns reaching broad population segments, driving demand for syringes, needles, and injection devices. Healthcare infrastructure modernization extending across underserved regions expands market addressability while regulatory frameworks ensuring product safety and efficacy enhance adoption confidence.

Market Restraints:

What Challenges the Brazil Drug Delivery Devices Market is Facing?

High Costs of Advanced Drug Delivery Technologies

Advanced drug delivery devices incorporating sophisticated technologies remain expensive, limiting accessibility among price-sensitive consumers and resource-constrained healthcare facilities. Smart injection systems, wearable devices, and connected health platforms carry premium pricing that restricts widespread adoption despite their clinical advantages. Economic fluctuations and currency depreciation further impact affordability of imported medical technologies throughout Brazilian markets.

Stringent Regulatory Requirements and Approval Timelines

The drug delivery device industry faces rigorous regulatory requirements ensuring safety, efficacy, and quality compliance. Navigating ANVISA approval processes can prove time-consuming and costly, particularly for innovative technologies requiring extensive clinical documentation. Small and medium-sized manufacturers may encounter barriers to market entry due to regulatory compliance complexities. Extended approval timelines can delay product launches and limit patient access to beneficial therapeutic innovations.

Regional Healthcare Infrastructure Disparities

Significant disparities in healthcare infrastructure between urban centers and rural or remote regions create uneven market penetration opportunities. While major metropolitan areas in the Southeast possess advanced facilities and trained personnel, peripheral regions often lack adequate healthcare resources for sophisticated device deployment. Supply chain logistics and technical support limitations in remote areas further constrain market expansion potential.

Competitive Landscape:

The Brazil drug delivery devices market exhibits moderate fragmentation with established multinational corporations and domestic manufacturers competing across product categories. Companies focus on diversifying device portfolios, enhancing user experience, and strengthening distribution partnerships to expand market presence. Strategic collaborations between pharmaceutical companies and device manufacturers are fostering integrated product-device solutions addressing specific therapeutic requirements. Investment in research and development enables continuous innovation in delivery technologies, improving patient comfort, dosing accuracy, and treatment adherence. Competitive dynamics encourage ongoing product improvements while maintaining affordability considerations for broader market accessibility.

Brazil Drug Delivery Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Route of Administrations Covered | Injectable, Topical, Ocular, Others |

| Applications Covered | Cancer, Cardiovascular, Diabetes, Infectious Diseases, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil drug delivery devices market size was valued at USD 771.36 Million in 2025.

The Brazil drug delivery devices market is expected to grow at a compound annual growth rate of 6.60% from 2026-2034 to reach USD 1,371.39 Million by 2034.

Injectable dominated the market with a share of 51%, driven by extensive applications in diabetes management, oncology treatments, immunization programs, and the rising adoption of self-injection devices and prefilled syringes across healthcare settings.

Key factors driving the Brazil drug delivery devices market include rising chronic disease prevalence, technological innovations in smart delivery systems, growing geriatric population, expanding biologic drug adoption, and government healthcare investment initiatives.

Major challenges include high costs of advanced drug delivery technologies, stringent regulatory requirements and extended approval timelines, regional healthcare infrastructure disparities, supply chain complexities, and limited reimbursement coverage for innovative device categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)