Brazil Crop Protection Pesticides Market Report by Origin (Synthetic, Bio-Based), Product (Herbicides, Insecticides, Fungicides, Nematicides, and Others), Application (Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, and Others), and Region 2026-2034

Market Overview:

Brazil crop protection pesticides market size reached USD 213.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 278.1 Million by 2034, exhibiting a growth rate (CAGR) of 2.98% during 2026-2034. The growing population and escalating the demand for food production, the increasing awareness among farmers about the benefits of using crop protection pesticides, and continuous research and development (R&D) to create environmentally friendly formulations represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 213.5 Million |

|

Market Forecast in 2034

|

USD 278.1 Million |

| Market Growth Rate 2026-2034 | 2.98% |

Crop protection pesticides are chemical substances used in agriculture to safeguard crops from various pests, diseases, and weeds that can threaten their health and yield. These pesticides are essential in modern agriculture, helping farmers maintain healthy and productive crops. There are various types of crop protection pesticides, each developed to combat specific threats. For instance, insecticides target insects that feed on crops, herbicides control unwanted weeds, and fungicides combat fungal diseases that can damage plants. Additionally, some bactericides protect against bacterial infections. It requires careful consideration and responsible application by farmers and agricultural experts while assessing the specific needs of their crops and the potential risks posed by pests and diseases, which helps determine the appropriate type and dosage of pesticide. It is an essential tool in agriculture, and its use should be carried out following safety guidelines to reduce environmental impact and protect human health.

Brazil Crop Protection Pesticides Market Trends:

The market is primarily driven by the growing agricultural sector. In addition, the increasing use of crop protection pesticides in Brazil by farmers across the country engaged in large-scale commercial farming or small family-owned operations to protect their crops from pests and diseases is influencing market growth. Moreover, the growing population and continued expansion of its agricultural production to meet the growing global food demand is escalating the demand for crop protection pesticides, representing another major growth-inducing factor. Also, farmers rely on these products to safeguard their crops from pests, diseases, and weeds, thereby ensuring higher yields and profitability. Along with this, the government is supportive of the agricultural sector, providing incentives and subsidies to farmers, which facilitates access to crop protection products, making them more affordable and accessible to a larger number of growers, propelling the market growth. Apart from this, farmers in Brazil are recognizing the benefits of using crop protection pesticides to safeguard the health and productivity of their crops which is also augmenting the market growth. Also, the growing chemical industry and the rising production and distribution of crop protection pesticides due to the escalating demand for these products and investment in research and development (R&D) to create effective and environmentally friendly formulations are augmenting the market growth. Furthermore, the agribusiness sector, with several companies involved in crop processing, distribution, and export, relies on a consistent and high-quality supply of agricultural products, resulting in the adoption of crop protection pesticides and ensuring that these companies can maintain their production standards and meet the demands of domestic and international markets, is also creating a positive market outlook.

Brazil Crop Protection Pesticides Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country levels for 2026-2034. Our report has categorized the market based on origin, product, and application.

Origin Insights:

To get more information on this market, Request Sample

- Synthetic

- Bio-Based

The report has provided a detailed breakup and analysis of the market based on the origin. This includes synthetic and bio-based.

Product Insights:

- Herbicides

- Insecticides

- Fungicides

- Nematicides

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes herbicides, insecticides, fungicides, nematicides, and others.

Application Insights:

- Grains and Cereals

- Pulses and Oilseeds

- Commercial Crops

- Fruits and Vegetables

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and others.

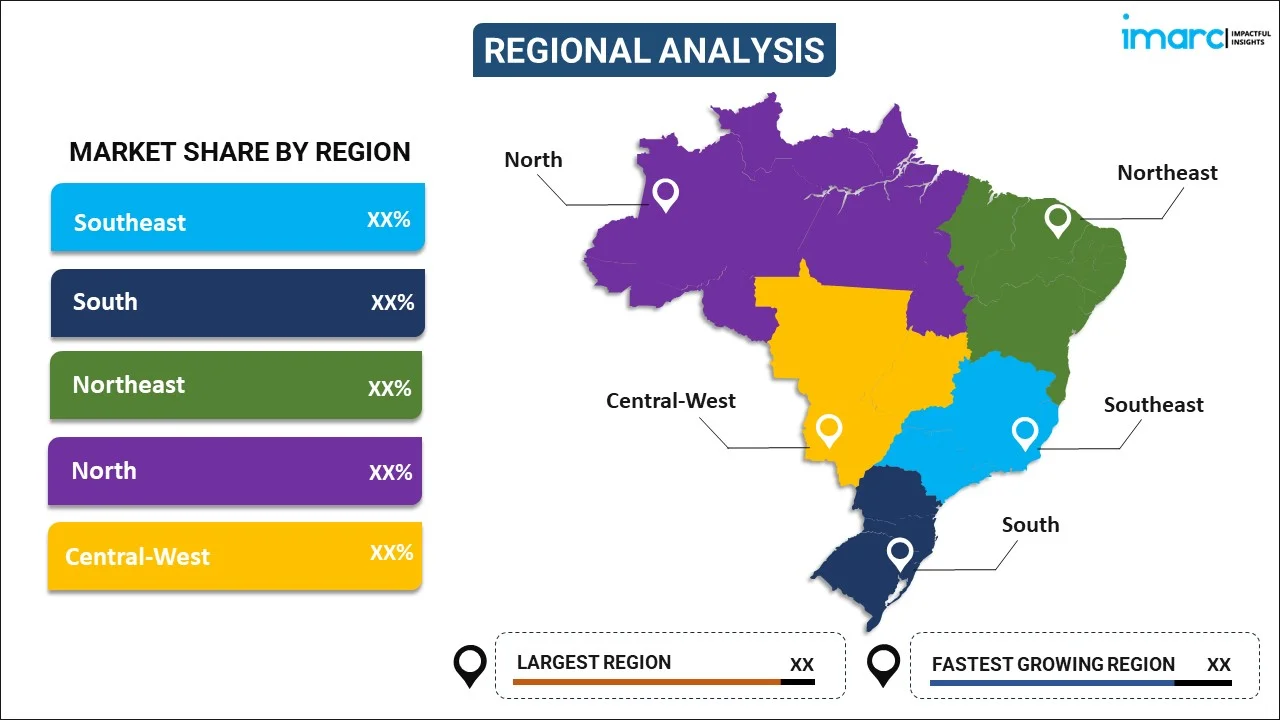

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- BASF S.A.

- Bayer SA

- Corteva Agriscience

- FMC Corporation

- Rotam Brasil (Albaugh LLC)

- Sipcam Nichino

- Syngenta Protecao de Cultivos Ltda.

- UPL Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Brazil Crop Protection Pesticides Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Origins Covered | Synthetic, Bio-Based |

| Products Covered | Herbicides, Insecticides, Fungicides, Nematicides, Others |

| Applications Covered | Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | BASF S.A., Bayer SA, Corteva Agriscience, FMC Corporation, Rotam Brasil (Albaugh LLC), Sipcam NichinoSyngenta Protecao de Cultivos Ltda., UPL Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil crop protection pesticides market performed so far and how will it perform in the coming years?

- What is the breakup of the Brazil crop protection pesticides market on the basis of origin?

- What is the breakup of the Brazil crop protection pesticides market on the basis of product?

- What is the breakup of the Brazil crop protection pesticides market on the basis of application?

- What are the various stages in the value chain of the Brazil crop protection pesticides market?

- What are the key driving factors and challenges in the Brazil crop protection pesticides?

- What is the structure of the Brazil crop protection pesticides market and who are the key players?

- What is the degree of competition in the Brazil crop protection pesticides market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil crop protection pesticides market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil crop protection pesticides market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil crop protection pesticides industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)