Brazil Contraceptive Devices Market Size, Share, Trends and Forecast by Type, Gender, and Region, 2026-2034

Brazil Contraceptive Devices Market Summary:

The Brazil contraceptive devices market size was valued at USD 352.89 Million in 2025 and is projected to reach USD 746.62 Million by 2034, growing at a compound annual growth rate of 8.68% from 2026-2034.

The Brazil contraceptive devices market is driven by increasing awareness of family planning and sexual health, supported by robust government healthcare initiatives through the Unified Health System (SUS). Rising urbanization and workforce participation among women are catalyzing demand for effective contraception methods, while growing concerns over sexually transmitted infections (STIs) including HIV are amplifying the adoption of barrier contraceptive methods across the Brazil contraceptive devices market share.

Key Takeaways and Insights:

- By Type: Condoms dominate the market with a share of 54% in 2025, owing to their dual functionality in preventing both pregnancy and sexually transmitted infections. Widespread availability through pharmacies, retail outlets, and government distribution programs, combined with affordability and ease of use without medical intervention, continues fueling market expansion.

- By Gender: Male leads the market with a share of 58% in 2025, reflecting the established preference for male condoms as a primary contraceptive method. Government-sponsored awareness campaigns promoting male responsibility in family planning and STI prevention, alongside the straightforward application of male contraceptive devices, sustain this segment's prominence.

- Key Players: Key players drive the Brazil contraceptive devices market by expanding product portfolios, enhancing product quality and safety profiles, and strengthening nationwide distribution networks. Their investments in marketing initiatives, partnerships with healthcare providers, and collaborations with government family planning programs accelerate adoption and ensure consistent product availability across diverse consumer segments.

The Brazil contraceptives market remains dynamic, with demographic changes and improvement in modern health infrastructure driving demand for different family planning methods. The Unified Health System in Brazil offers free access to different forms of contraception, such as condoms, copper intrauterine devices, diaphragms, and emergency contraception. Urbanization patterns in Brazil include more women being part of the labor force, along with postponing childbearing, thereby increasing the need for long-acting reversible contraceptives. The public health commitment in Brazil, including country partnerships with agencies such as the United Nations Fund for Population, aims to improve reproductive health infrastructure, focusing on areas in Brazil that lack health infrastructure, including integrating SRH into primary health care. New medical technologies are also making available new safe forms of contraceptives with better safety profiles, including mHealth increasing access to family planning in remote Brazil.

Brazil Contraceptive Devices Market Trends:

Growing Adoption of Long-Acting Reversible Contraceptives

The Brazilian population of women is increasingly showing a preference for Long Acting Reversible Contraceptives (LARCs), including intrauterine devices and implants. The medical fraternity is supporting the use of LARCs as first-choice methods since they have been proved to be effective in preventing unwanted pregnancies. Professional bodies like the Brazilian Federation of Associations of Gynecology and Obstetrics have been encouraging the use of LARCs and offering training programs for health personnel on insertion and counseling skills for patients.

Digital Health Integration in Reproductive Services

Telemedicine platforms are transforming contraceptive access in remote and underserved Brazilian regions. Digital health solutions like the Sisters' Health initiative operating across several municipalities in Pará state connect women with telemedical reproductive healthcare services including family planning consultations. These technological innovations address geographic barriers, reduce stigma associated with contraceptive discussions, and enable comprehensive sexual and reproductive health education reaching previously inaccessible populations throughout Brazil's vast territory. According to UNFPA Brazil, the Saúde das Manas (Sisters' Health) project has delivered more than 5,000 telemedicine consultations across the Marajó Archipelago, with a total investment of R$1.5 million to strengthen reproductive health services for women in the region.

Shift Toward Safer Contraceptive Formulations

Pharmaceutical innovation is delivering contraceptive products with improved safety profiles addressing historical concerns about hormonal side effects. New formulations featuring native estrogens and advanced progestin combinations are designed to minimize metabolic and hemostatic impacts while maintaining contraceptive effectiveness. Regulatory approval of next-generation oral contraceptives with reduced thromboembolism risk represents a significant advancement, enabling healthcare providers to offer safer options that encourage sustained contraceptive utilization among Brazilian women. These developments reflect growing emphasis on patient-centered contraceptive care that prioritizes both efficacy and tolerability, expanding choices for women seeking hormonal contraception with fewer adverse effects.

Market Outlook 2026-2034:

The Brazil contraceptive devices market demonstrates a promising growth trajectory supported by favorable demographic shifts, government healthcare investments, and technological advancements in contraceptive product development. Expanding healthcare infrastructure through the Unified Health System ensures widespread contraceptive accessibility across socioeconomic segments, while rising female workforce participation drives demand for effective family planning solutions. Additionally, increasing awareness campaigns targeting adolescent populations and educational initiatives promoting reproductive health are expected to sustain market momentum throughout the forecast period, fostering continued adoption of modern contraceptive methods. The market generated a revenue of USD 352.89 Million in 2025 and is projected to reach a revenue of USD 746.62 Million by 2034, growing at a compound annual growth rate of 8.68% from 2026-2034.

Brazil Contraceptive Devices Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Condoms |

54% |

| Gender | Male |

58% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Condoms

- Diaphragms

- Cervical Caps

- Sponges

- Vaginal Rings

- Intra Uterine Device (IUD)

- Others

Condoms dominate with a market share of 54% of the total Brazil contraceptive devices market in 2025.

Condoms hold a leading market position due to their well-known status as dual-protection tools that prevent both unintended pregnancies and sexually transmitted infections. Widespread distribution via pharmacies, supermarkets, and convenience stores, along with competitive pricing, guarantees that condoms are the most easily obtainable contraceptive choice for all socioeconomic groups in Brazil. Government distribution initiatives within the Unified Health System strengthen market dominance by offering free condoms at public health centers across the country, enhancing access for marginalized communities.

Cultural acceptance and ongoing public awareness initiatives have made condom use commonplace among Brazilian communities. Government-supported educational programs aimed at young people and high-risk groups successfully convey the significance of regular condom use for preventing sexually transmitted infections. The non-prescription status removes purchasing obstacles, allowing consumers to effortlessly obtain products at supermarkets and retail stores. Moreover, a wide range of products featuring different sizes, textures, and materials caters to changing consumer tastes, improving user experience and broadening market reach among various demographic segments in Brazil.

Gender Insights:

- Male

- Female

Male leads with a share of 58% of the total Brazil contraceptive devices market in 2025.

Male contraceptive devices lead the market mainly due to the extensive use of male condoms as the favored barrier approach. Government family planning initiatives actively endorse joint contraceptive responsibility among partners, fostering male involvement via focused awareness campaigns and complimentary condom distribution programs. The Unified Health System provides hundreds of millions of male condoms each year through public health centers, enhancing availability in both urban and rural areas. In Brazil, there is a steady demand for male contraceptive techniques due to growing awareness of the need to prevent STDs.

The male demographic gains from streamlined application processes that do not need medical advice or prescriptions, thereby eliminating obstacles to healthcare access. Leading manufacturers' marketing efforts have effectively established male condoms as vital personal care items accessible through various retail outlets such as pharmacies and supermarkets. Increasing awareness regarding male reproductive health responsibilities and the prevention of sexually transmitted infections is boosting the demand for male contraceptive devices, especially among younger groups adopting proactive family planning perspectives.

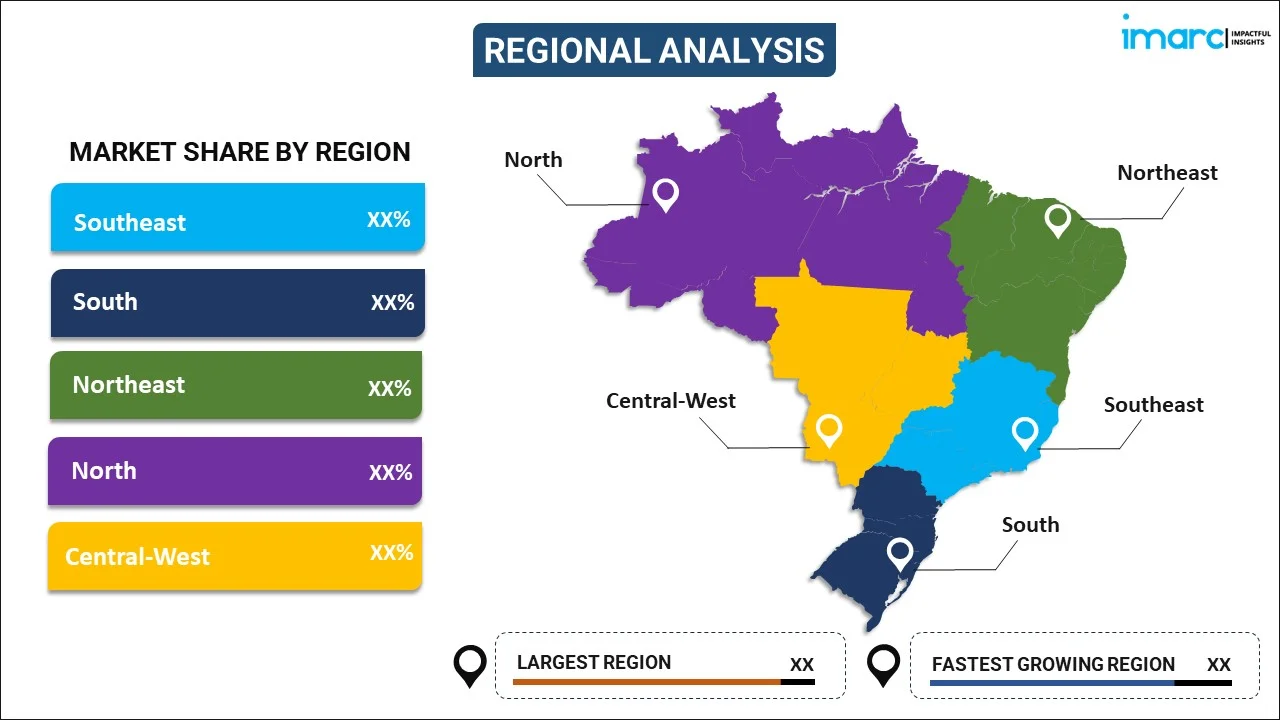

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast is leading in Brazil’s market for contraceptive devices due to large populations found in São Paulo and Rio de Janeiro metropolitan regions. Well-organized healthcare systems, greater disposable incomes, and a high number of pharmacies contribute to high contraceptive use and availability against other regions.

The South has strong market performance due to its relatively high levels of education and well-developed healthcare infrastructure. Progressive values for family planning, along with well-established distribution networks and quality healthcare infrastructure, are some factors that contribute to the steady demand for contraceptive devices.

Northeast holds prominence for its substantial growth opportunity due to the increase in access to reproductive health care provided through government programs for underserved people. Rising investments in public health infrastructure and educational programs for family planning have finally begun to show signs of improvement in the usage of contraceptives.

North poses peculiar challenges in access to contraceptives in relation to its geography and scattered settlements in the Amazon region. Telemedicine initiatives are being developed in response to fill the gaps in access to family planning services in these distant localities.

Central-West presents a healthy market growth pulse that is well in line with the rapid pace of urbanization and the economic expansion of the farm sectors. The growing urban population is an impetus for the improvement of the healthcare infrastructure, and new population flows are resulting in rising demands for accessible contraceptive services and products.

Market Dynamics:

Growth Drivers:

Why is the Brazil Contraceptive Devices Market Growing?

Rising Sexually Transmitted Infection Prevalence

Brazil faces substantial public health challenges from sexually transmitted infections, creating sustained demand for barrier contraceptive methods that provide disease prevention alongside pregnancy prevention. The country experiences elevated HIV prevalence particularly among key populations, driving government investment in condom distribution and awareness programs. Healthcare authorities including the Ministry of Health and state health departments actively promote consistent condom use through educational campaigns targeting sexually active populations. Research indicates that among adolescents, nearly one-third do not use condoms during sexual encounters, highlighting opportunities for expanded intervention programs and increased contraceptive device adoption. According to the Brazilian Ministry of Health's Epidemiological Bulletin, Brazil recorded 46,495 new HIV infection cases in 2023, representing a 4.5% increase over 2022.

Government Healthcare Initiatives and Universal Access Programs

Brazil's Unified Health System provides comprehensive contraceptive coverage, offering nine types of contraception free of charge to all citizens. This universal access model significantly expands the addressable market by removing financial barriers to contraceptive adoption. An increasing number of nations are leading the way in funding and overseeing their reproductive health initiatives. Government investments including the Ministry of Health's allocation for IUD placement procedures demonstrate sustained public sector commitment to expanding contraceptive device accessibility across all socioeconomic segments and geographic regions.

Increasing Female Workforce Participation and Delayed Childbearing

Demographic transitions in Brazil show increasing numbers of women entering the workforce and pursuing higher education, leading to delayed childbearing and heightened demand for effective contraception. Female labor force participation in Brazil reached approximately 53% in 2024, reflecting evolving social norms around women's economic participation. Urbanization continues accelerating this trend as metropolitan lifestyles prioritize career development and economic independence before family formation. These demographic shifts drive demand for convenient, effective contraceptive methods that enable women to exercise reproductive autonomy while maintaining workforce participation and educational pursuits. According to industry report indicators, Brazil's female labor force participation rate was 53.03% in 2024, higher than the global average of 52.22%, demonstrating the country's continued progress in women's economic integration.

Market Restraints:

What Challenges the Brazil Contraceptive Devices Market is Facing?

Limited Long-Acting Reversible Contraceptive Availability in Public Healthcare

The only form of long-acting reversible contraception currently available within the Brazilian public healthcare system is copper IUDs; hormonal IUDs and implants are not available through government facilities except at a few teaching hospitals. This limitation restricts access to highly effective LARC methods for the population dependent on public healthcare services, creating socioeconomic disparities in contraceptive choice.

Healthcare Provider Training Gaps in Device Insertion

Even while these techniques are theoretically accessible, their practical availability is limited since many healthcare workers lack sufficient training in intrauterine device and implant insertion techniques. Family planning education is not always offered by medical residency programs, and healthcare professionals frequently point to workload constraints as obstacles to providing time-consuming contraceptive counseling and device placement services.

Geographic Disparities in Healthcare Access

Brazil's large geographic area makes it difficult to guarantee equal access to contraception in every area. Healthcare facilities are difficult to reach for rural and isolated communities, and the logistics of the contraceptive supply chain make it challenging to maintain steady product availability. There are specific deficiencies in the availability of qualified staff and reproductive healthcare infrastructure in the Amazon region and northeastern states.

Competitive Landscape:

The market for contraceptive devices in Brazil is moderately competitive, with a number of foreign pharmaceutical and medical device companies continuing to have a sizable market share. To gain market dominance across consumer categories, major players use a variety of product portfolios that include hormonal delivery systems, intrauterine devices, and barrier techniques. Product innovation, regulatory approval for safer formulations, distribution network development, and strategic alliances with government initiatives and healthcare providers are all key components of competitive strategy. To increase market penetration throughout Brazil, companies pursue partnerships with family planning groups and invest in marketing campaigns aimed at consumers and healthcare professionals.

Brazil Contraceptive Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Condoms, Diaphragms, Cervical Caps, Sponges, Vaginal Rings, Intra Uterine Device (IUD), Others |

| Genders Covered | Male, Female |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil contraceptive devices market size was valued at USD 352.89 Million in 2025.

The Brazil contraceptive devices market is expected to grow at a compound annual growth rate of 8.68% from 2026-2034 to reach USD 746.62 Million by 2034.

Condoms dominated the market with a share of 54%, driven by their dual functionality in preventing pregnancy and sexually transmitted infections, widespread availability through pharmacies and government distribution programs, and ease of use without requiring medical consultation.

Key factors driving the Brazil contraceptive devices market include rising STI prevalence increasing demand for barrier contraceptives, government healthcare initiatives providing free contraceptive access, increasing female workforce participation driving demand for family planning solutions, and growing awareness campaigns targeting adolescent populations.

Major challenges include limited availability of long-acting reversible contraceptives in public healthcare facilities, healthcare provider training gaps in device insertion techniques, geographic disparities in healthcare access particularly in remote and rural regions, and inconsistent contraceptive supply chain logistics across Brazil's vast territory.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)