Brazil Coffee Market Report by Source (Arabica, Robusta), Type (Instant Coffee, Ground Coffee, Whole Grain, and Others), Process (Caffeinated, Decaffeinated), and Region 2026-2034

Brazil Coffee Market Overview:

- The Brazil coffee market size reached 4.4 Million Tons in 2025 and is projected to reach 7.0 Million Tons by 2034.

- The market is estimated to grow at a CAGR of 5.23% from 2026-2034.

- The coffee market in Brazil is driven by a rising preference for high-quality, specialty coffees, as consumers explore unique flavors and origins. Additionally, the increase in at-home brewing, coupled with a focus on sustainability and traceability, has fueled innovation and expanded the availability of premium coffee options.

Brazil Coffee Market Trends:

Optimal Climate and Terrain

Brazil's excellent climate and diverse topography create perfect circumstances for coffee growth, supporting the country's position as a top coffee producer. The country has numerous coffee-growing regions, each with its own microclimate that promotes the production of a wide range of coffee beans, especially Arabica and Robusta. Wherein Arabica coffee, known for its distinct flavors and aromas, thrives in regions with mild temperatures, steady rainfall, and high altitudes, like Minas Gerais, São Paulo, and Bahia while Robusta coffee is cultivated due to its tenacity and powerful taste. These geographical and climatic advantages are allowing Brazilian coffee producers to diversify their offerings and maintain high production levels. As a result, the coffee industry in the country is prospering, owing to a combination of traditional growing practices and modern advancements that maximize yield and quality. The continuous emphasis on Arabica and Robusta varietals ensures a consistent supply to fulfill domestic demand, which remains high because of Brazil's strong coffee culture. As per the PDF published by the United States Department of Agriculture (USDA), Brazil’s National Supply Company (CONAB) in Brazil forecasted that the coffee harvest will reach 58.8 million bags in 2024. Almost 80% of the harvested area is dedicated to Arabica coffee, which is expected to produce 42.11 million bags, while Robusta coffee is estimated to have an output of 16.7 million bags. This steady production helps stabilize Brazil coffee price, ensuring a consistent supply for both local and global markets.

Growing Coffee Consumption

Coffee industry revenue in Brazil saw significant growth in 2023, with 21.7 Million bags of coffee consumed, positioning the country as both the largest producer and one of the largest consumers of coffee. Brazil is the largest producer of coffee worldwide, and ranks as one of the largest consumers, reflecting a deeply ingrained coffee culture. This high per capita consumption rate is resulting from cultural traditions, social habits, and an appreciation for quality coffee. The popularity of coffee spans all demographics, with young and older generations enjoying a range of coffee types, ranging from strong espressos to creamy lattes. The robust domestic demand for coffee is helping stabilize the market and providing a reliable base for Brazilian coffee producers. The large internal market ensures a consistent and substantial demand for coffee, regardless of international market fluctuations. As the coffee industry is evolving and consumer preferences are changing, coffee producers in Brazil are focusing on enhancing quality and diversifying their product offerings to cater to these shifting tastes. They are focusing more on specialty and premium coffees to cater to consumers seeking unique experiences, thereby supporting the growth of the coffee market and boosting the presence of instant Brazilian coffee in global markets.

Rise of Premium Coffee in Brazil

There has been a steady increase in demand for high-grade coffee in Brazil in recent years because of shifting consumer habits and the expansion of the middle class. Previously, Brazilians were traditionally accustomed to mass-market products; however, they are now gravitating towards more quality-driven, specialty coffees. This trend is expressed in the expansion of specialty domestic coffee houses, roasting facilities, and artisanal companies marketing unique blends and single-origin coffees. Brazil, with its extensive coffee production, is placing increased emphasis on high-quality beans, such as Arabica, that are marketed to a more discerning market. Brazilian producers are also placing greater emphasis on sustainability and traceability, consistent with worldwide premium coffee standards. Therefore, the premium market is an emerging sector quickly growing locally and internationally, and Brazil is becoming a major player in the international specialty coffee market. This growth not only amplifies Brazil's coffee exports but also enhances the country's standing as a major exporter of premium-quality coffee beans.

At-Home Coffee Consumption in Brazil

At-home coffee consumption has risen significantly in Brazil, particularly after the pandemic, as consumers gravitate toward affordable and convenient substitutes. The global shift toward home brewing hasn't passed Brazil by, with coffee being deeply embedded in its culture. The country has seen increasing interest in high-end at-home coffee brewing equipment, ranging from espresso machines, coffee grinders, and coffee makers. As consumers become increasingly aware of various brewing methods and coffee origins, they want more customized, premium, in-home coffee experiences. The trend has been driven by the growth of e-commerce, which made online channels offer a wider variety of coffee beans, blends, and home-use equipment. Direct-to-consumer models and coffee subscriptions have gained popularity as well. Such a shift in customer behavior has transformed the Brazilian coffee sector, with more emphasis being put on packaging innovation, convenience, and total at-home coffee experience. In this changing landscape, Brazil instant coffee has also seen a rise in demand, as consumers seek quick, yet high-quality coffee solutions at home.

Brazil Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on source, type, and process.

Source Insights:

To get more information on this market, Request Sample

- Arabica

- Robusta

The report has provided a detailed breakup and analysis of the market based on the source. This includes arabica and robusta.

Type Insights:

- Instant Coffee

- Ground Coffee

- Whole Grain

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes instant coffee, ground coffee, whole grain, and others.

Process Insights:

- Caffeinated

- Decaffeinated

The report has provided a detailed breakup and analysis of the market based on the process. This includes caffeinated and decaffeinated.

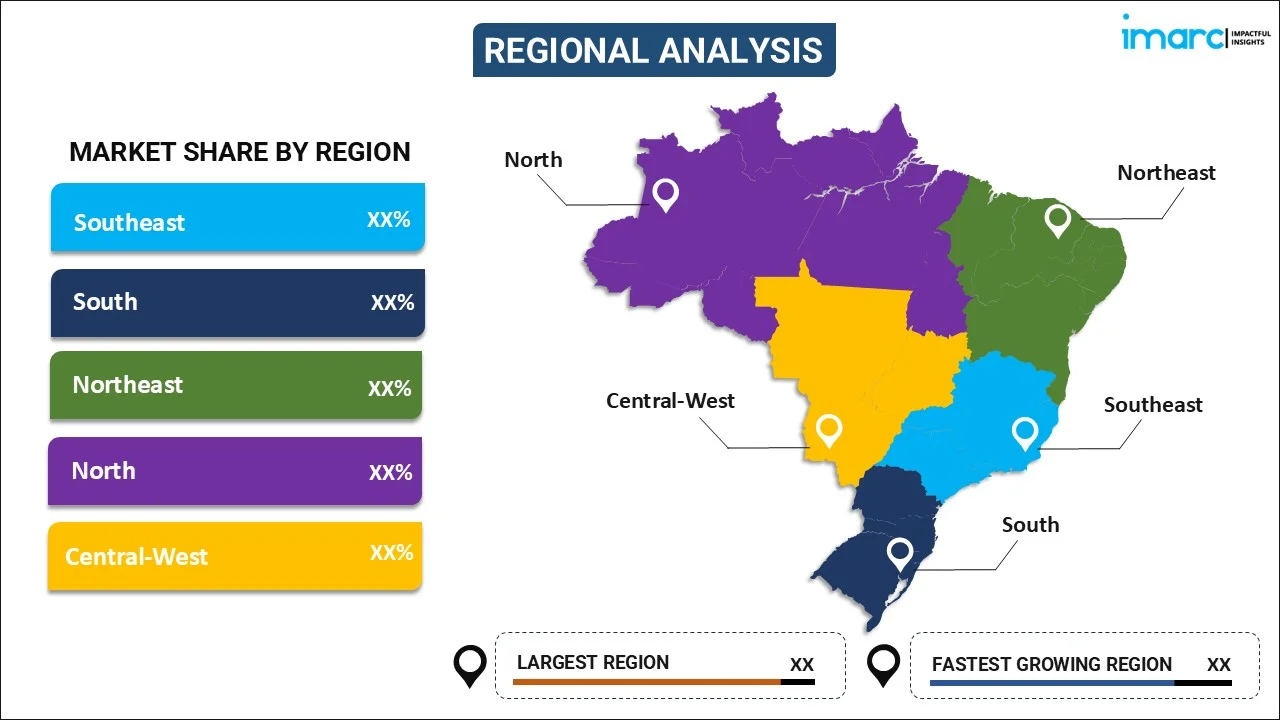

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Top Coffee Companies in Brazil:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report.

The report provides a comprehensive analysis of the competitive landscape in the Brazil coffee market market with detailed profiles of all major companies, including:

- Nestlé Group

- JDE Peet's

- Starbucks Coffee Company

- Strauss Group

- Melitta Group

- Massimo Zanetti Beverage Group

- UCC Ueshima Coffee Co. Ltd.

- Golden Bean Coffee

- Pilão Coffee

- Brazilian Santos Coffee

Brazil Coffee Market Recent News:

- May 2025: Luckin Coffee launched the "Brazil Coffee Culture Festival 2.0" in partnership with various Brazilian organizations, aiming to strengthen ties between China and Brazil. This initiative showcased Brazilian coffee, fostered cultural exchange, and promoted sustainable farming practices, thereby further boosting global demand for Brazilian coffee.

- May 2025: Olam Food Ingredients (ofi) opened an advanced instant coffee facility in Linhares, Espírito Santo. The site, powered by renewable energy, focused on traceable and sustainable coffee production. This expansion strengthened Brazil's position in the global soluble coffee market and boosted local economic value.

- July 2024: Nestlé launched the Star 4 Arabica variety in Brazil, aiming to enhance coffee yields and resilience to pests. Tested in São Paulo and Minas Gerais, it offered higher productivity than local varieties. This innovation contributed to the growth of Brazil's coffee market and its sustainability efforts.

- May 2024: Nestlé's NESCAFÉ brand announced that it will invest 1 Billion reais (US$ 196.5 million) by 2026 to expand production capacity in Brazil by 50% and boost out-of-home sales, in response to the country’s growing coffee consumption trends.

Brazil Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Arabica, Robusta |

| Types Covered | Instant Coffee, Ground Coffee, Whole Grain, Others |

| Processes Covered | Caffeinated, Decaffeinated |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Nestlé Group, JDE Peet's, Starbucks Coffee Company, Strauss Group, Melitta Group, Massimo Zanetti Beverage Group, UCC Ueshima Coffee Co. Ltd., Golden Bean Coffee, Pilão Coffee, Brazilian Santos Coffee, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil coffee market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Brazil coffee market is expected to grow at a CAGR of 5.23% during 2026-2034.

The Brazil coffee market is primarily driven by the country’s dominant role as the largest global coffee producer and exporter. Contributing factors include ideal growing conditions, a strong local coffee culture, rising demand for specialty coffees, and continuous innovations in cultivation and production practices.

The Brazil coffee market experienced disruptions during the COVID-19 pandemic, including delays in harvesting and export logistics due to labor shortages. Despite these challenges, domestic coffee consumption remained robust, with more consumers turning to home brewing and exploring premium coffee options during lockdown periods.

Based on the source, the Brazil coffee market has been segmented into arabica and robusta.

Based on the type, the Brazil coffee market has been segmented into instant coffee, ground coffee, whole grain, and others.

Based on the process, the Brazil coffee market has been segmented into caffeinated and decaffeinatet.

On a regional level, the Brazil coffee market has been segmented Southeast, South, Northeast, North, and Central-West.

Some of the major players in the global Brazil coffee market include Nestlé Group, JDE Peet's, Starbucks Coffee Company, Strauss Group, Melitta Group, Massimo Zanetti Beverage Group, UCC Ueshima Coffee Co. Ltd., Golden Bean Coffee, Pilão Coffee, Brazilian Santos Coffee, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)