Brazil Chocolate Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Brazil Chocolate Market Size and Share:

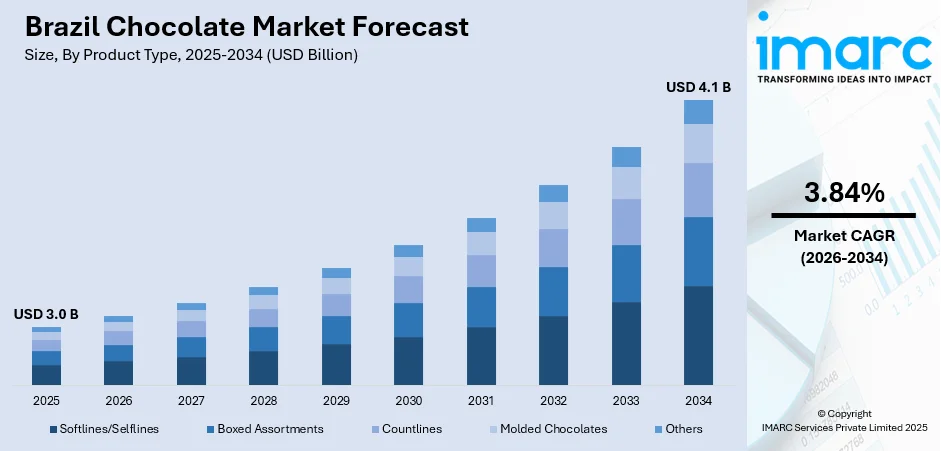

The Brazil chocolate market size was valued at USD 3.0 Billion in 2025. The market is projected to reach USD 4.1 Billion by 2034, exhibiting a CAGR of 3.84% from 2026-2034. Southeast Brazil is dominating the market with a share of 44.3% owing to the changing consumer taste, innovation in products, and strong retail and online distribution. Companies are increasingly diversifying products and connecting with consumers through distinctive flavor, festive offerings, and customized experiences. Having both local and international players competing among themselves makes it a highly competitive industry, although niche segments such as artisanal and specialty chocolate are on the rise. The enhanced popularity of premium items and growing online availability are also contributing factors toward growth, which in turn adds to the growing Brazil chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.0 Billion |

| Market Forecast in 2034 | USD 4.1 Billion |

| Market Growth Rate 2026-2034 | 3.84% |

Urbanization and lifestyles of consumers are strong drivers driving the Brazil chocolate market. As urban migration increases, more people are exposed to new-style retail formats and varied product offerings. Urban shoppers are generally subject to international food trends and prefer indulgence driven by convenience, which has led chocolate to be widely preferred for convenience-based snacking or as a gift. The prevalence of supermarkets, hypermarkets, and specialty stores in urban areas has also made the products of chocolate more accessible across all consumer groups. The urban lifestyle in Brazil is equally conducive to the consumption of ready-to-eat and emotionally fulfilling food products, making chocolate a favorable choice. This changing urban culture has favored the rise in demand for both conventional and new forms of chocolate, making market growth possible. For instance, in October 2023, Magnum launched its ruby chocolate flavor in the Brazilian market with a major flavor innovation in the form of a berry-flavored pink chocolate shell aimed at up-scale ice cream consumers nationwide. Furthermore, chocolate's fit with current consumption patterns, together with growing distribution infrastructure, will continue to drive the development and diversification of the chocolate business across Brazil's urban areas.

To get more information on this market, Request Sample

Educational marketing campaigns and media pressures building consciousness regarding the mood and sensory advantages of chocolate are another crucial Brazil chocolate market growth drivers. Consumers are increasingly linking chocolate to emotional health, frequently looking at it as a comforting and mood-enhancing food. Health and nutrition specialists, along with lifestyle bloggers, reinforce this perception by emphasizing cocoa's intrinsic characteristics that trigger serotonin levels and offer temporary stress alleviation. Media coverage, both online and offline, reinforces these connections by placing chocolate as a wanton indulgence at emotive times like celebrations, stress, or relaxation. For example, in June 2024, Nestlé Brazil launched three seasonal KITKAT flavors—Hot, Pumpkin Pie with Coconut, and Canjica—celebrating traditional June festivals in São Paulo and Rio de Janeiro with limited-time regional offerings. Moreover, this psychological alignment fosters repeated usage and cultivates consumer affection with chocolate products. Further, the increase in content focused on wellness has enabled differentiation of types of chocolate, promoting knowledgeable choice for consumers looking for indulgence paired with emotional fulfillment. With boosting levels of awareness of the good effects of chocolate through educative and promotional campaigns, the market enjoys increased levels of consumption frequency and brand loyalty across various age and income categories.

Brazil Chocolate Market Trends:

Premiumization Redefining Chocolate Expectations

The chocolate category is undergoing a significant shift as consumers increasingly seek refined quality and origin-focused offerings. This movement, centered on premiumization, is marked by a willingness to pay more for products that offer superior taste, traceability, and craftsmanship. The demand for premium chocolate is not limited to special occasions; it is extending into routine consumption. Brands are responding by highlighting high cacao content, emphasizing careful ingredient sourcing, and adopting minimalist recipes that focus on purity. Plant-based options are playing a key role in this shift, as non-dairy formulations are now meeting elevated flavor expectations. Consumers no longer associate plant-based chocolate with compromise but view it as a sophisticated alternative. Organic certification often supports this trend, offering reassurance about sustainable and ethical practices. These elements combined are creating a new standard for what qualifies as high-quality chocolate. Attention to texture, flavor intensity, and responsible sourcing is becoming essential. The expectation is no longer just indulgence but thoughtful indulgence, where production quality, ethical values, and sensory appeal intersect to meet the evolving demands of an increasingly informed and selective audience.

Plant-Based Innovation Expanding Chocolate Appeal

The rapid growth of plant-based consumption is significantly influencing the chocolate sector. What began as a niche offering for dietary restrictions is now becoming a preferred choice for a wider group of consumers. This expansion is driven by improved formulations that enhance flavor, texture, and inclusivity without relying on dairy. Companies are investing in new ingredient technologies and production methods to ensure plant-based chocolate meets the expectations of both taste and nutrition. In this context, sugar free chocolate has emerged as a complementary development, appealing to consumers focused on reducing sugar intake while maintaining a full flavor profile. The intersection of plant-based and sugar-free innovation reflects a broader market interest in health and wellness. Premiumization also plays a supporting role, as many plant-based chocolates now occupy higher price tiers and deliver on quality expectations. Organic sourcing remains a valuable attribute, though not always essential, especially when the plant-based claim is strong. The chocolate category is expanding its reach, with plant-based options offering relevance across age groups, lifestyles, and dietary choices while contributing to a more inclusive and forward-looking product landscape.

Organic Certification Strengthening Consumer Trust

Transparency, sustainability, and ingredient integrity are becoming primary drivers of consumer behavior in the chocolate industry. In response, brands are incorporating verified sourcing practices and clean label commitments to build trust and differentiate themselves. The presence of organic chocolate is growing steadily as consumers seek reassurance regarding agricultural practices and the absence of synthetic inputs. Organic certification signals both environmental responsibility and health consciousness, which resonates with a large and expanding segment of the market. This development aligns closely with the growth of plant-based offerings, as many consumers who prioritize organic also look for dairy-free alternatives. Premiumization further elevates this space, where consumers associate organic claims with enhanced quality, taste, and ethical sourcing. Makers of artisanal chocolate are particularly well-positioned in this environment, offering small-batch production, transparent ingredient lists, and detailed supply chain narratives. These elements appeal to shoppers who are increasingly careful about what they buy and why. As organic becomes more central to the chocolate category, it contributes to a redefinition of value, where trust, production methods, and origin carry equal weight alongside flavor and packaging.

Brazil Chocolate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil chocolate market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product type, category, and distribution channel.

Analysis by Product Type:

- Softlines/Selflines

- Boxed Assortments

- Countlines

- Molded Chocolates

- Others

Softlines such as pralines and filled bars continue to be favorites due to their rich textures and decadent tastes. Found on shelves throughout Brazil, these chocolates appeal to impulse shoppers and regular users, and play a substantial role in overall volume growth through mainstream and premium channels in base and seasonal buying cycles.

Boxed multipack assortments are popular for giving during holidays such as Easter and Christmas. They are popular because they appeal to visual presentation, flavor variety, and upscale positioning. Middle to high-income customers looking for elegant, ready-to-gift products drive this category and add to overall category value with seasonal marketing support throughout Brazil.

Countlines, like individual chocolate bars, are a on-the-go snacking staple. Inexpensive and widely available in supermarkets and convenience stores, they have consistent daily sales. Their application as impulse purchases and lunchbox additions guarantees continued popularity, especially among young people and working adults looking for quick indulgence.

Shaped chocolates in playful shapes or holiday designs pick up steam around holiday seasons, particularly Easter. Their look, plus tactically seasonal packaging, makes them a best seller during times of peak demand. The items frequently appeal to children and households, reinforcing cultural ascriptions between celebration and chocolate in the Brazilian marketplace.

These other chocolate formats, such as sugar-free, organic, and novelty chocolates, appeal to niche groups. Rising health awareness and ethical consumption patterns propel demand for these ranges. Although smaller in terms of volume, these chocolates reflect the increasing diversity and premiumization of products within Brazil's evolving confectionery market space.

Analysis by Category:

- Milk/White Chocolate

- Dark Chocolate

Milk and white chocolate lead with broad-based popularity based on their smooth texture and sugary taste profiles. Sought after by consumers of all ages, these flavors are perfect for both gifting purposes and personal consumption. Affordability and steady availability in all channels maintain high market penetration across Brazil.

Dark chocolate is being favored by health-oriented consumers who are looking for high cocoa content and less sugar. Growing awareness of its antioxidant properties underpins rising demand. Although smaller in size, the segment is exhibiting robust growth, particularly in urban areas where consumers focus on wellness and premium taste profiles.

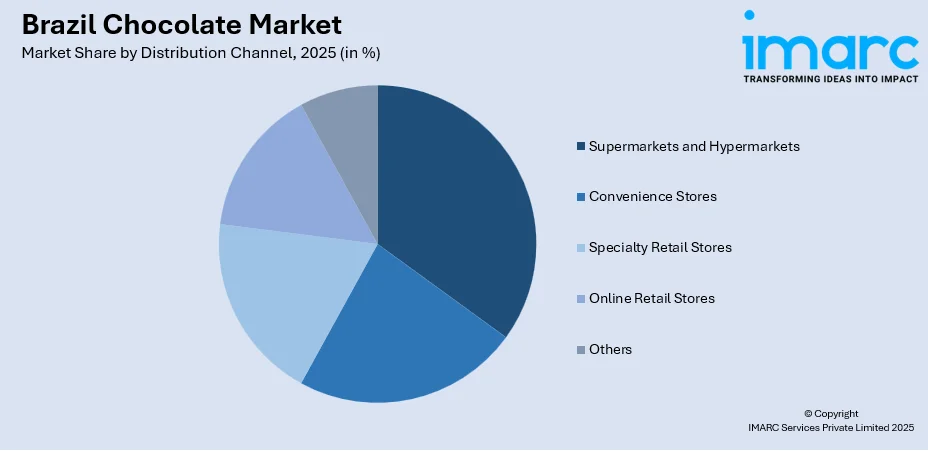

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Retail Stores

- Online Retail Stores

- Others

Supermarkets and hypermarkets dominate chocolate sales in Brazil through large assortments, high brand visibility, and compelling promotional campaigns. Their nationwide coverage and visibility during festival seasons make them pivotal for volume distribution, meeting both price-sensitive and premium product buyers in all regions.

Convenience stores are used for impulse buying and target urban customers with busy lives who need quick snacks. They facilitate constant sales of regular chocolates through reduced pack sizes and location choices. Convenience stores strengthen their position in the chocolate sector by reaching consumers in transit points and neighborhoods.

Upscale retail shops specialize in high-end and imported chocolates, targeting customers looking for unique products. They tend to provide customized gift suggestions as well as distinct flavor profiles. Their niche positioning justifies the movement toward artisanal and luxury chocolate consumption in Brazil's large urban areas.

Online stores provide convenience, choice, and access to high-end and imported chocolates. E-commerce facilitates broader reach, particularly in rural and under-serve areas. Growing gifting, subscription boxes, and direct-to-consumer channels are making digital platforms an integral part of Brazil's retail chocolate ecosystem.

Other outlets, such as vending machines and duty-free shops, add to niche sales in certain environments. These structures tend to target impulse shoppers and tourists, with possibilities for speedy consumption. Less voluminous though they may be, they add to market presence and convenience in out-of-center retailing.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region is the highest consumer of chocolate because of its huge population, advanced infrastructure, and high-income groups. Urban cities such as São Paulo and Rio de Janeiro have diverse retail formats with a complete range of chocolate products from economy to premium segments in all classes.

The South shows robust per capita chocolate consumption driven by European food traditions. Cooler temperatures and local artisanal producers further underpin demand on a year-round basis. City retailers such as Curitiba and Porto Alegre enjoy a customer base loyal to both quality and innovation in chocolate products.

The Northeast is experiencing heightening demand for chocolate as urbanization and disposable income increase. While price sensitivity is still a feature, greater retail penetration and cultural gifting habits support seasonal spikes. Growth of supermarkets and focused marketing campaigns are promoting market depth in this rising region.

The North only makes a limited contribution owing to logistical issues and lower population levels. But spreading city areas and supermarket chains are enhancing product availability. Further investment in shopping infrastructure could drive long-term sales growth of chocolate, especially in regional capitals and transport centers.

Central-West Brazil exhibits increasing demand linked to urbanization and advancing affluence. Brasília is among the cities that are emerging as significant retail hubs, accommodating both domestic and foreign chocolate brands. Enhanced infrastructure and consumer knowledge underpin growing market engagement across various income levels.

Competitive Landscape:

The Brazil chocolate market outlook is defined by a dynamic combination of domestic manufacturers and global companies with an extensive range of products across various price points. Market players proactively work to boost their portfolios to encompass a variety of chocolate products ranging from milk, dark, white, and filled chocolates in order to satisfy wide-ranging consumer tastes. Product innovation along the lines of flavor, texture, and packaging continues to be the principal discriminator, as manufacturers continue to update their lines to keep consumers engaged. Strength in distribution through retail chains, convenience stores, and online platforms also dictates market positioning. Private labels and craft brands are also increasingly popular, targeting specialist segments with distinctive ingredients and localized appeal. Marketing channels involving emotional advertising, celebratory promotions, and online engagement further exacerbate competition. The market continues to be vibrant and consumer-led, with consumers attempting to reconcile affordability, quality, and brand loyalty within a rapidly changing confectionery marketplace.

The report provides a comprehensive analysis of the competitive landscape in the Brazil chocolate market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Hershey’s collaborated with ADT in Brazil to launch Special Dark chocolate bars embedded with Bluetooth Low Energy (BLE) trackers. This innovative packaging, featuring ADT’s logo, aimed to deter petty theft and protect consumers’ treats, combining confectionery with security technology in a unique brand initiative targeting everyday candy-related frustrations.

- March 2025: Nestlé expanded its Chocobakery range to Mexico after a strong performance in Brazil. The portfolio, including Choco Trio, Choco Cookies, and Choco Biscuit, showcased Nestlé’s innovation in combining textures and flavors. The Brazil launch influenced strategic growth decisions, reinforcing the brand’s success and Brazilal expansion efforts in Latin America.

- March 2025: BerryBites, a Brazilian brand, diversified beyond chocolate-covered frozen fruit by launching protein bites and frozen Easter eggs to avoid overdependence on one product. Inspired by Franuí’s entry, the company expanded its production and retail presence in Brazil, targeting 5-million-unit sales in 2025 while planning global expansion and investor engagement.

- February 2025: NotCo launched its limited-edition Dubai Style NotSquare chocolate bar, featuring a plant-based coating, 7g protein, and no sugar. The product followed the success of its NotSquares line and supported its snack category expansion. NotCo prioritized Latin American growth, including Brazil, while shifting North American sales to Kraft Heinz.

- In November 2024: Dengo Chocolates launched fully recyclable truffle packaging, using aluminum bands and no plastic. After two years of R&D and 19 test materials, it developed a solution meeting Anvisa standards without affecting quality. Made from kraft paper and aluminum, the design preserves freshness and flavour. This move supports Dengo’s 2030 goal of becoming plastic-free, highlighting its commitment to sustainability in Brazil’s premium chocolate market.

- In June 2024: Nestlé launched its travel retail exclusive "Sustainably Sourced" chocolate range, featuring Rainforest Alliance-certified cocoa from the Nestlé Cocoa Plan. Targeted at eco-conscious travellers, the range highlights responsible sourcing and supports over 170,000 cocoa-farming families. With 71% of airport shoppers valuing sustainability in purchases, Nestlé aims to meet growing demand for ethical products while reinforcing its legacy in chocolate and environmental responsibility.

Brazil Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Softlines/Selflines, Boxed Assortments, Countlines, Molded Chocolates, Others |

| Categories Covered | Milk/White Chocolate, Dark Chocolate |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Retail Stores, Online Retail Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil chocolate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chocolate market in the Brazil was valued at USD 3.0 Billion in 2025.

The Brazil chocolate market is projected to exhibit a CAGR of 3.84% during 2026-2034, reaching a value of USD 4.1 Billion by 2034.

Growing demand for premium and artisanal chocolates, rising health awareness favoring dark and organic variants, expanding middle-class income, strong retail distribution, seasonal gifting trends, and influence from international brands are driving Brazil chocolate market. E-commerce, new product launches, and marketing aligned with local tastes also contribute to its growth.

Premium chocolates in Brazil show steady growth, driven by rising disposable income, urbanization, and consumer interest in quality and origin. Younger buyers seek unique flavors and ethical sourcing. Demand spikes during holidays. Though niche, the segment is expanding as brands invest in upscale packaging, storytelling, and retail experiences targeting affluent consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)