Brazil Ceramic Tiles Market Size, Share, Trends and Forecast by Product, Application, Construction Type, End User, and Region, 2026-2034

Brazil Ceramic Tiles Market Size and Share:

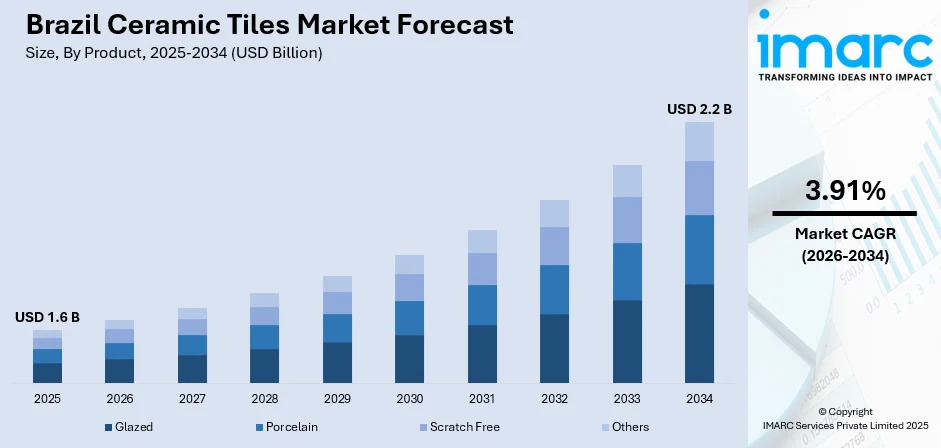

The Brazil ceramic tiles market size was valued at USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 2.2 Billion by 2034, exhibiting a CAGR of 3.91% during 2026-2034. Southeast dominated the market, holding a significant market share of 40.8% in 2025. The growing need for durable and aesthetically pleasing flooring, increasing preference for eco-friendly and sustainable tile options, and the rising number of infrastructure development projects, such as hospitals and malls, represent some of the key factors contributing to the Brazil ceramic tiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.6 Billion |

| Market Forecast in 2034 | USD 2.2 Billion |

| Market Growth Rate 2026-2034 | 3.91% |

The market is primarily driven by rapid urbanization and expansion in the residential and commercial construction sectors. Government initiatives promoting affordable housing and infrastructure projects have significantly increased tile demand. Consumers prefer ceramic tiles due to their durability, low maintenance, and cost-effectiveness. Design trends also play a major role, with digital printing technology enabling a wide range of aesthetic finishes that appeal to style-conscious buyers. Environmental concerns have led to higher demand for eco-friendly, recyclable tile options. Brazil’s strong raw material base and competitive production costs support exports, especially within Latin America. Technological improvements in manufacturing, such as automation and energy efficiency, enhance product quality and production speed. Retail expansion and rising disposable income also contribute to the growing preference for ceramic tiles across both urban and semi-urban markets, reinforcing Brazil ceramic tiles market growth.

To get more information on this market, Request Sample

Brazilian ceramic tile makers are stepping into international markets with collections that blend local identity and global appeal. New product lines reflect design influences from abroad while maintaining regional character, supporting wider export reach. This movement highlights a push toward cultural fusion in tile aesthetics and broader geographic presence. For instance, in September 2024, Portobello launched Bossa On The Road, marking its first global collection and a significant achievement for the company. After its preview at Cersaie, the line made its official debut at Portobello America’s showroom in Baxter, Tennessee, capturing the spirit of American living with an international touch. By October, it was available in more than 60 countries and in Portobello Shops throughout Brazil. The Bossa On The Road campaign represents the brand’s move into new markets, merging its Brazilian heritage with global inspirations from places like Italy and the United States.

Brazil Ceramic Tiles Market Trends:

Rising Building Costs Shaping Tile Choices

A recent uptick in Brazil’s construction cost index signals ongoing building activity despite higher expenses. As developers and contractors navigate tighter budgets, there's growing interest in ceramic tiles that offer a balance between cost and performance. Materials that are easy to install, durable, and low-maintenance are gaining favor, especially in large-scale residential and commercial projects. This has led manufacturers to focus on practical innovations, like thinner formats, modular sizing, and surface finishes that reduce upkeep. With construction moving steadily ahead, the preference is leaning toward solutions that help control spending without sacrificing visual appeal or functionality. These patterns reflect broader Brazil ceramic tiles market trends, shaping product development, purchasing behavior, and supply strategies across the country. This shift is supported by a rise in construction costs, as highlighted by the IBGE, which reported a 0.51% increase in the National Index of Civil Construction (SINAPI) in January 2025, indicating sustained construction activity.

Growing Preference for Eco-Certified Building Materials

Based on the Brazil ceramic tiles market outlook, the country is seeing a noticeable move toward environmentally responsible construction. With dozens of homes and residential buildings now registered for green certification, demand for products that align with sustainable standards is picking up. Ceramic tile manufacturers are adapting by offering lines that meet energy efficiency and emissions goals. Consumers and developers alike are prioritizing low-impact materials, especially those produced with reduced water use and recycled content. This shift is reshaping product portfolios and influencing supplier choices across the construction value chain. The momentum is strongest in urban centers where certification adds market value and appeals to younger, environmentally conscious buyers. This behavior signals lasting changes in material selection and manufacturing direction within the country. According to the World Green Building Council, Brazil currently has 37 homes and 17 residential buildings registered for green certification, which underscores a growing shift toward sustainable building practices.

Brazil Ceramic Tiles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil ceramic tiles market, along with forecasts at the regional levels from 2026-2034. The market has been categorized based on product, application, construction type, and end user.

Analysis by Product:

- Glazed

- Porcelain

- Scratch Free

- Others

Porcelain stood as the largest component in 2025, holding around 54.3% of the market. This is mainly because consumers are showing a strong preference for porcelain tiles due to their durability, low water absorption, and ability to imitate premium materials like marble or wood. These tiles work well in both residential and commercial settings, especially in areas exposed to moisture or heavy foot traffic. Developers and contractors are favoring porcelain over traditional ceramic because it helps meet long-term performance and aesthetic needs. The growing focus on high-end finishes in urban housing and commercial projects is also increasing demand. With local manufacturers expanding capacity and offering more design options, porcelain tiles are becoming a top choice, making this segment a primary driver of market growth in Brazil.

Analysis by Application:

- Floor Tiles

- Wall Tiles

- Others

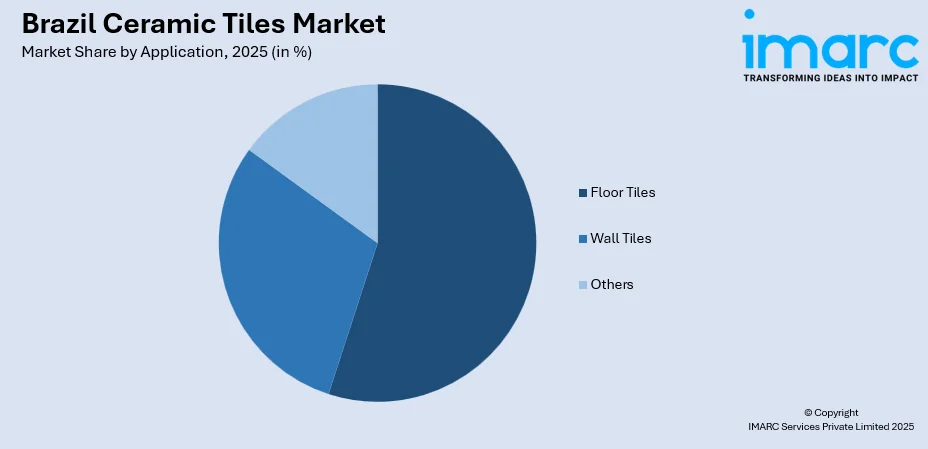

Floor tiles led the market with around 59.7% of market share in 2025. Rapid urbanization, rising residential construction, and growth in commercial real estate have led to increased use of floor tiles in both new builds and renovations. Consumers and developers prefer ceramic floor tiles for their strength, ease of maintenance, and wide range of design options. In regions with hot climates like Brazil, tiled flooring is especially valued for keeping interiors cooler. Affordable pricing and availability in various finishes have made floor tiles a standard choice for living rooms, kitchens, and outdoor areas. As housing demand rises and infrastructure projects expand, floor tile consumption continues to rise, pushing this segment ahead of others in the ceramic tiles market.

Analysis by Construction Type:

- New Construction

- Replacement and Renovation

New construction led the market in 2025. Government-backed housing programs like Minha Casa Minha Vida have increased the demand for affordable housing, leading to a surge in residential construction. Urbanization and infrastructure development, including commercial projects such as offices and shopping centers, are also contributing to this growth. Ceramic tiles are favored in these projects for their durability, low maintenance, and cost-effectiveness. As per the Brazil ceramic tiles market forecast. Brazil's strong domestic manufacturing capabilities ensure a steady supply of tiles, reducing reliance on imports. As cities expand and new buildings rise, the need for ceramic tiles in flooring and wall applications continues to grow, solidifying the new construction segment as a key driver in the market.

Analysis by End User:

- Residential Replacement

- Construction

Residential replacement led the market with around 62.2% of market share in 2025. Homeowners are increasingly investing in renovations to modernize interiors, enhance property value, and improve energy efficiency. Ceramic tiles are favored for their durability, ease of maintenance, and variety of designs, making them ideal for updating floors and walls. The demand is especially strong in urban areas like São Paulo and Rio de Janeiro, where aging housing stock and a growing middle class are driving remodeling activities. Local manufacturers are responding with innovative tile designs and sustainable options, catering to the evolving preferences of consumers seeking both functionality and aesthetic appeal in their home improvements.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

In 2025, Southeast accounted for the largest market share of over 40.8% due to several key factors. It includes major urban and industrial centers such as São Paulo and Rio de Janeiro, which drive strong demand through extensive residential, commercial, and infrastructure development. The region's high population density leads to continuous construction activities, further increasing the consumption of ceramic tiles for flooring and wall applications. Southeast Brazil also hosts a well-established ceramic tile manufacturing cluster, especially in Santa Gertrudes, São Paulo, known for its large-scale production and innovation in design and technology. The availability of raw materials, skilled labor, and efficient logistics supports large output and nationwide distribution. Additionally, economic concentration and higher consumer purchasing power in this region contribute to its leading position in the country’s ceramic tiles market.

Competitive Landscape:

The Brazil ceramic tiles market is experiencing a resurgence, driven by government initiatives like Minha Casa Minha Vida and infrastructure projects such as the Plano Decenal de Expansão de Energia 2026. Manufacturers are embracing digital printing technologies and sustainable production methods, including energy-efficient kilns and water recycling systems. Collaborations are also on the rise; notably, the Tile Council of North America and ANFACER have agreed to align testing standards for porcelain tiles. International trade promotion, supported by ApexBrasil, continues to be a strategic focus. Among these developments, sustainability and technological innovation are currently the most prevalent practices in the industry.

The report provides a comprehensive analysis of the competitive landscape in the Brazil ceramic tiles market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Cerbras, a ceramic tile company from Brazil, introduced over 100 products at Coverings 2025 to emphasize the innovation and quality of Brazilian design. Highlighting lines like Studio C and Cerbras, the brand reinforced Brazil’s industrial strength and aimed to expand its global presence and partnerships across 33 export markets.

- January 2024: Cedasa Group, a prominent player in the Latin American flooring and covering industry with over 30 years of experience, revealed its 2024 ceramic collections that were in line with the latest trends in interior design. Based on research from data gathered from around 482 million users, the company highlighted the most prominent design styles for 2024, including Boho, Retro, Metallic, and Affectionate styles. With a portfolio that included well-known brands such as Ágata Cerâmica, Cedasa, Helena Porcelanato, Lorenzza, Majopar, and Vista Bella, Cedasa Group offered ceramic models that were aligned with these emerging trends, catering to a diverse range of tastes and interior design preferences for the upcoming year.

Brazil Ceramic Tiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Glazed, Porcelain, Scratch Free, Others |

| Applications Covered | Floor Tiles, Wall Tiles, Others |

| Construction Types Covered | New Construction, Replacement and Renovation |

| End Users Covered | Residential Replacement, Construction |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil ceramic tiles market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil ceramic tiles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil ceramic tiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ceramic tiles market in Brazil was valued at USD 1.6 Billion in 2025.

The Brazil ceramic tiles market is projected to exhibit a CAGR of 3.91% during 2026-2034, reaching a value of USD 2.2 Billion by 2034.

The Brazil ceramic tiles market is driven by urbanization, government-backed housing and infrastructure projects, and rising demand for durable, low-maintenance flooring. Eco-conscious consumers favor sustainable tiles, while digital printing and design innovations attract style-focused buyers. Strong export performance and technological upgrades further boost industry growth.

Southeast accounted for the largest share, holding around 40.8% of the market in 2025 due to its dense population, rapid urbanization, and robust construction activities in major cities like São Paulo and Rio de Janeiro. This area also hosts significant tile manufacturing centers, notably in Santa Gertrudes, São Paulo, contributing to its market dominance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)