Brazil Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Brazil Cement Market Summary:

The Brazil cement market size reached 65.58 Million Tons in 2025 and is projected to reach 88.83 Million Tons by 2034, growing at a compound annual growth rate of 3.43% from 2026-2034.

The Brazil cement market is experiencing a robust recovery driven by substantial government infrastructure investments and resurgent residential construction activity. The nation's commitment to modernizing its transportation networks, expanding sanitation systems, and addressing the housing deficit is generating sustained demand for cement products. The construction sector benefits from favorable employment conditions and strategic public-private partnerships that channel investment into critical infrastructure development. Manufacturers are increasingly adopting sustainable production methods and developing innovative cement formulations to align with environmental objectives while maintaining cost competitiveness across diverse regional markets.

Key Takeaways and Insights:

- By Type: Blended dominates the market with a share of 55.04% in 2025, driven by its superior performance characteristics and lower environmental footprint compared to traditional Portland cement. The segment benefits from growing regulatory emphasis on sustainable construction materials and increasing adoption in infrastructure projects requiring enhanced durability and workability.

- By End Use: Residential leads the market with a share of 40.07% in 2025, propelled by the government's ambitious social housing initiatives and growing urbanization across metropolitan areas. The Minha Casa Minha Vida program continues to drive substantial cement consumption through new housing construction targeting low and middle-income households.

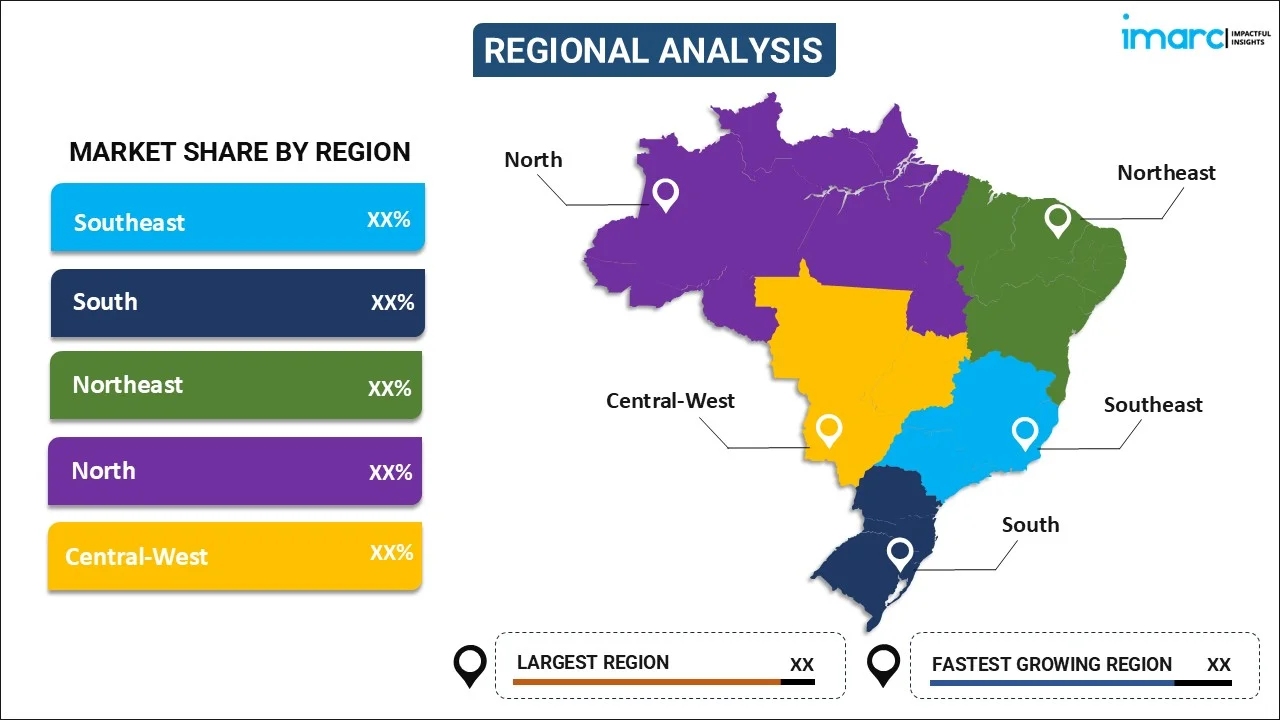

- By Region: Southeast region represents the largest segment with a market share of 46% in 2025, reflecting the concentration of Brazil's industrial activity, population centers, and construction investments in states including São Paulo, Rio de Janeiro, and Minas Gerais, which collectively drive the majority of national cement consumption.

- Key Players: The Brazil cement market exhibits a consolidated competitive structure with domestic and international producers competing across diverse regional markets. Industry participants are investing in capacity expansion, sustainability initiatives, and distribution network optimization to strengthen market positions and capture growth opportunities in infrastructure and housing construction segments.

The Brazilian cement industry operates within a dynamic construction ecosystem characterized by strong government policy support and evolving market dynamics. Federal infrastructure programs are channeling substantial investments into transportation, energy, and sanitation projects across all regions. The reactivation of major construction initiatives under the Novo PAC program has created sustained demand for cement products, particularly in underserved areas requiring infrastructure development. Municipal and state governments are increasingly prioritizing rigid concrete pavement over traditional asphalt for road construction, recognizing the long-term economic advantages of reduced maintenance requirements. The industry demonstrates resilience through diversified demand sources spanning residential, commercial, and infrastructure applications. Construction sector employment has reached record levels, supporting consumer confidence and housing demand. Cement manufacturers are responding to market opportunities by expanding production capacity and enhancing distribution networks to improve regional market coverage. The World Bank's approval of infrastructure improvement projects in states like Bahia, with funding exceeding USD 200 million for sustainable infrastructure development, exemplifies the international support driving market expansion.

Brazil Cement Market Trends:

Rising Infrastructure Development Through Federal Programs

The federal government's comprehensive infrastructure development agenda is transforming cement demand patterns across Brazil. The Novo PAC program, representing the nation's most ambitious infrastructure investment initiative, encompasses transportation networks, energy systems, water infrastructure, and urban development projects spanning all regions. For instance, in August 2023, Brazil’s president launched the New Growth Acceleration Program at an event in Rio de Janeiro, outlining a nationwide investment plan totaling BRL 1.7 trillion. The program combines funding from multiple sources, including BRL 371 billion from the federal budget, BRL 343 billion from state-owned enterprises, BRL 362 billion through financing mechanisms, and BRL 612 billion from private sector investments, supporting infrastructure and development projects across all Brazilian states. This coordinated investment approach is generating sustained cement demand through multi-year construction timelines and project pipelines extending through the decade. State governments are increasingly adopting concrete pavement solutions for highway construction, recognizing superior lifecycle economics despite higher initial costs.

Acceleration of Sustainable Construction Practices

Environmental sustainability is reshaping cement production and consumption patterns throughout Brazil. Manufacturers are investing in low-carbon cement formulations incorporating industrial by-products and alternative raw materials to reduce greenhouse gas emissions. The industry's decarbonization roadmap establishes clear targets for emission reductions through enhanced energy efficiency, alternative fuel utilization, and clinker substitution strategies. Construction companies are increasingly specifying sustainable cement products for projects seeking environmental certifications, creating market incentives for continued innovation in green building materials.

Digital Transformation in Cement Operations

Cement producers are embracing digital technologies to enhance operational efficiency and market responsiveness. Advanced analytics and predictive maintenance systems are optimizing kiln operations and reducing production costs across major manufacturing facilities. Fleet management technologies are improving logistics efficiency and delivery reliability, particularly important given Brazil's geographic diversity and distribution challenges. Digital inventory management systems enable real-time demand forecasting and production planning, allowing manufacturers to better align supply with regional consumption patterns.

Market Outlook 2026-2034:

The Brazil cement market demonstrates favorable long-term growth prospects supported by structural demand drivers and strategic policy initiatives. Infrastructure investment programs are creating sustained multi-year demand visibility, while housing construction responds to demographic trends and government affordable housing commitments. The industry's ongoing transition toward sustainable production methods positions Brazilian manufacturers favorably for evolving environmental requirements and construction specifications. Regional markets are expected to exhibit differentiated growth trajectories, with northeastern and central-western regions demonstrating above-average expansion rates as infrastructure investment addresses historical development gaps. The market size was estimated at 65.58 Million Tons in 2025 and is expected to reach 88.83 Million Tons by 2034, reflecting a compound annual growth rate of 3.43% over 2026-2034.

Brazil Cement Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Blended |

55.04% |

|

End-Use |

Residential |

40.07% |

|

Region |

Southeast |

46% |

Type Insights:

To get more information of this market, Request Sample

- Blended

- Portland

- Others

Blended dominates with a market share of 55.04% of the total Brazil cement market in 2025.

Blended cement has established market leadership through its combination of performance advantages and environmental benefits. The segment encompasses cement formulations incorporating supplementary cementitious materials such as granulated blast furnace slag, fly ash, and limestone, which enhance durability while reducing carbon intensity. Brazilian manufacturers have developed advanced blended cement products specifically engineered for the country's diverse climate conditions and construction requirements, from tropical coastal environments to temperate southern regions.

The regulatory environment increasingly favors blended cement adoption through updated construction standards and public procurement specifications. Infrastructure projects seeking environmental certification preferentially specify low-clinker cement formulations, creating sustained demand growth for blended products. Manufacturers are expanding blended cement production capacity and developing new formulations incorporating locally available supplementary materials to optimize cost structures while meeting performance requirements.

End Use Insights:

- Residential

- Commercial

- Infrastructure

Residential leads with a share of 40.07% of the total Brazil cement market in 2025.

Residential construction represents the primary demand driver for cement consumption in Brazil, encompassing social housing programs, private residential development, and home renovation activities. The Minha Casa Minha Vida program serves as a cornerstone of residential cement demand, with government targets exceeding two million housing units through the current administration. This initiative generates substantial cement consumption through standardized construction methods, favoring concrete block and cast-in-place concrete systems.

The residential segment benefits from favorable demographic trends, including continued urbanization, household formation rates, and income growth among target beneficiary populations. Construction activity extends beyond new housing to encompass renovation and expansion projects as homeowners invest in property improvements. The segment demonstrates resilience through diversified demand sources spanning government-subsidized construction, private market development, and individual homeowner projects distributed across all regions.

Regional Insights:

To get more information of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 46% share of the total Brazil cement market in 2025.

The Southeast region maintains market leadership through its concentration of economic activity, population, and construction investment. States including São Paulo, Rio de Janeiro, Minas Gerais, and Espírito Santo collectively represent Brazil's industrial and commercial heartland, generating proportionally higher cement demand across residential, commercial, and infrastructure applications. Metropolitan areas within this region host major infrastructure projects including transportation network expansion, urban development initiatives, and commercial construction activity.

Regional cement distribution benefits from established manufacturing capacity and logistics infrastructure, enabling competitive supply to construction markets throughout the Southeast. Major cement producers maintain significant production facilities within this region, optimizing transportation costs and delivery reliability. The region's mature construction ecosystem supports sophisticated demand patterns, including ready-mix concrete operations, precast manufacturing, and construction materials distribution networks serving diverse customer segments.

Market Dynamics:

Growth Drivers:

Why is the Brazil Cement Market Growing?

Expansion of Government Infrastructure Investment Programs

Federal infrastructure investment programs are generating substantial and sustained cement demand through comprehensive development initiatives spanning transportation, energy, water, and urban infrastructure. The Novo PAC program represents the centerpiece of national infrastructure development, channeling investments exceeding hundreds of billions of reais into projects distributed across all regions and sectors. Transportation infrastructure receives particular emphasis through highway construction and rehabilitation, railway development, and port modernization projects requiring significant cement volumes. Energy sector investments encompass power generation facilities, transmission infrastructure, and renewable energy installations that utilize cement-intensive foundation systems. Water and sanitation infrastructure development addresses historical deficits through treatment plant construction, distribution network expansion, and sewage system improvements consuming substantial cement quantities.

Acceleration of Social Housing Programs

Government social housing initiatives represent a fundamental demand driver for the cement industry through consistent construction activity targeting residential housing deficits. The Minha Casa Minha Vida program establishes ambitious targets for housing unit delivery, creating predictable multi-year demand visibility for cement manufacturers and construction materials suppliers. Program design emphasizes construction methods utilizing cement-based materials including concrete blocks, cast-in-place concrete, and cement-based mortars that generate sustained consumption across project lifecycles. Geographic distribution of housing construction extends cement demand across all regions, with particular emphasis on urban peripheries and secondary cities experiencing population growth. The program's expansion to include higher income thresholds broadens the eligible beneficiary population and supports increased construction volumes.

Favorable Employment and Economic Conditions

The strength of the labor market offers some basic support to the construction activity and cement demand by operating under a series of transmission processes. There are low rates of unemployment, as it is at a historical low, and registered employment and wage increases are at the highest levels, which have boosted consumer confidence and housing demands. The employment level in the construction sector has proven to be a strong area because of the growth in the activity of projects and hence the self-reinforcing demand forces, since construction workers also contribute to the consumption of housing. An increase in the lower and middle-income households enhances the affordability of home buying, renovation, and consumption of building materials. The consumer confidence indicators represent positive thinking about the state of the economy, which offers confidence in the decisions made by business owners on their own to invest in residential and commercial construction. The growth rate of employment, growth in wages, and consumer confidence make a good combination that will ensure that the cement demand continues to rise.

Market Restraints:

What Challenges the Brazil Cement Market is Facing?

High Interest Rates and Credit Constraints

Elevated benchmark interest rates create challenging conditions for construction financing, particularly affecting private residential and commercial development projects. Mortgage costs increase as monetary policy tightens, constraining housing demand among prospective buyers requiring financing. Credit availability through traditional savings and loan channels has contracted, reducing construction project financing volumes. Private developers face higher capital costs that affect project viability calculations and investment decisions.

Regional Infrastructure Disparities

Geographic disparities in infrastructure development create uneven market conditions across Brazil's diverse regions. Northern and northeastern states face higher logistics costs due to limited transportation infrastructure, constraining cement delivery reach and market development. Remote areas require specialized distribution approaches including micro-terminals and mobile solutions that increase supply chain costs. Infrastructure gaps limit construction activity in underserved regions where development investments could otherwise generate cement demand.

Rising Production and Energy Costs

Cement production costs face upward pressure from energy price volatility and input cost increases. Electricity prices respond to hydrological conditions affecting hydroelectric generation capacity, creating production cost uncertainty. Fuel costs for kiln operations and distribution logistics fluctuate with global energy markets. Labor shortages in skilled construction trades create competitive wage pressures that transmit through construction material pricing. Manufacturers face margin pressure as production costs rise while competitive dynamics limit pricing flexibility.

Competitive Landscape:

The Brazil cement market features a consolidated competitive structure with established domestic producers and international industry participants operating across diverse regional markets. Market participants compete through manufacturing efficiency, distribution network coverage, product innovation, and customer service capabilities. Leading producers maintain vertically integrated operations encompassing raw material extraction, cement manufacturing, and distribution infrastructure to optimize cost structures and market reach. Strategic investments in capacity expansion, modernization, and sustainability initiatives characterize competitive positioning as companies prepare for evolving market requirements. The industry demonstrates active consolidation activity as participants evaluate strategic combinations, asset acquisitions, and portfolio optimization opportunities. Regional market dynamics create differentiated competitive conditions, with manufacturers adapting strategies to address varying demand characteristics, logistics challenges, and customer requirements across Brazil's geographically diverse markets.

Recent Developments:

- October 2024, Buzzi SpA successfully acquired a 50% share in NCPAR, the equal joint venture that Buzzi had been using to conduct business in Brazil since 2018, from Grupo Ricardo Brennand. This transaction gave Buzzi complete control of NCPAR, which operates five fully integrated cement plants and two grinding centers with approximately 7.2 million tons of annual cement production capacity.

- In September 2024, Brazil's CSN announced the investment of approximately USD 530 million in a new cement factory and a limestone processing plant in Paraná state. The cement factory allocation of approximately USD 500 million will support construction in the Itaperuçu municipality, expanding the company's production footprint in southern Brazil.

- In October 2024, Votorantim Cimentos launched Blenture, a new brand of cement and concrete designed to reduce CO₂ emissions and promote sustainable construction practices. Blenture products offer a 30% lower carbon footprint while maintaining quality, strength, and performance standards required for diverse construction applications.

Brazil Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Southeast, South, Northeast, North, and Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil cement market size reached 65.58 Million Tons in 2025.

The Brazil cement market is expected to grow at a compound annual growth rate of 3.43% from 2026-2034 to reach 88.83 Million Tons by 2034.

Blended dominated the market with 55.04% share in 2025, driven by its superior performance characteristics, lower environmental impact, and increasing adoption in infrastructure projects requiring enhanced durability and sustainable construction compliance.

Key factors driving the Brazil cement market include government infrastructure investment programs under the Novo PAC initiative, expansion of social housing through the Minha Casa Minha Vida program, favorable employment conditions supporting construction activity, urbanization trends increasing residential demand, and growing adoption of sustainable construction practices.

Major challenges include high interest rates constraining construction financing and mortgage availability, regional infrastructure disparities limiting market access in remote areas, rising production and energy costs affecting manufacturer margins, skilled labor shortages in the construction sector, and macroeconomic uncertainty affecting private investment decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)