Brazil Cane Sugar Market Report by Type (Crystallized Sugar, Liquid Sugar), Application (Food and Beverage, Pharmaceuticals, Industrial, and Others), and Region 2025-2033

Brazil Cane Sugar Market:

The Brazil cane sugar market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 2.76% during 2025-2033. The market is driven by rising demand for natural sweeteners, ethanol production, and government support for renewable energy. Investments in infrastructure, adoption of advanced farming technologies, and regional agricultural expansion further fuel market growth despite climate-related challenges.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 5.2 Billion |

| Market Growth Rate 2025-2033 | 2.76% |

Brazil Cane Sugar Market Analysis:

- Major Market Drivers: The growing inclination towards natural sweeteners in various food applications is one of the factors augmenting the market.

- Key Market Trends: Government support and favorable policies for renewable energy encourage sugarcane-based ethanol production, which fuels the market expansion in Brazil.

- Competitive Landscape: Some of the prominent market companies include Agro Betel, Copersucar SA, DWL International Foods Inc, Louis Dreyfus Company, São Martinho, and Tereos SA, among many others.

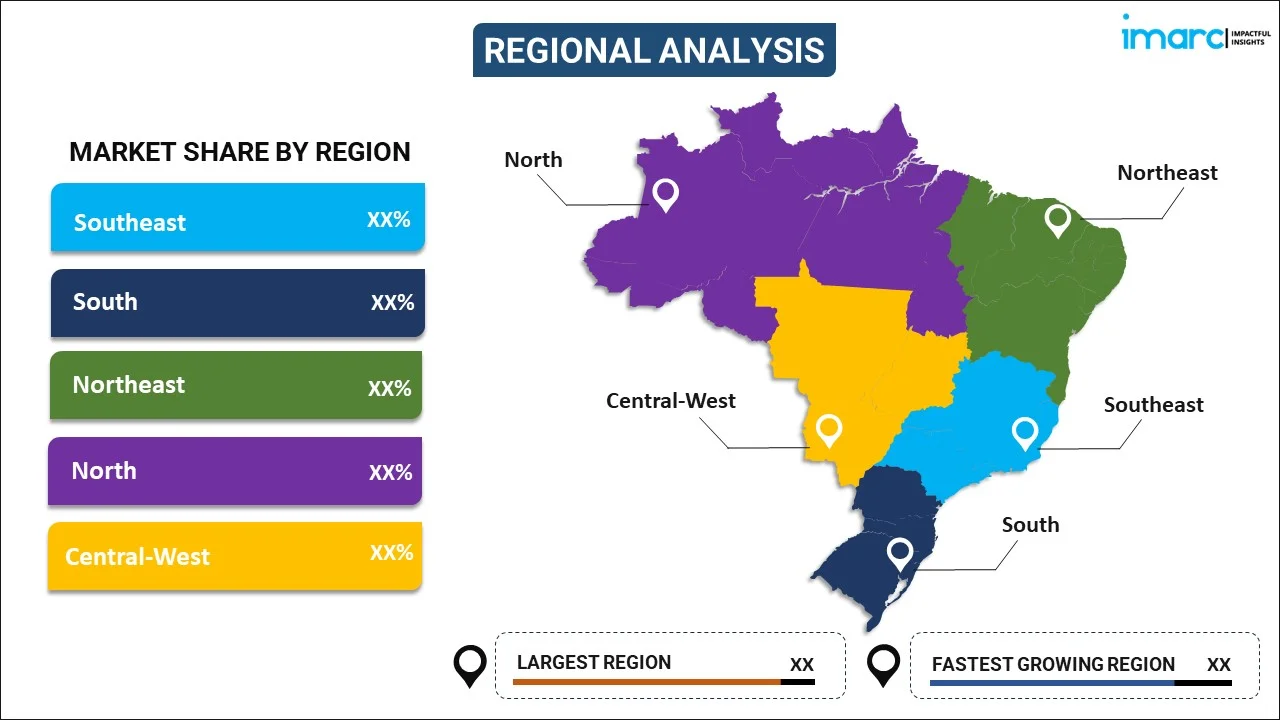

- Geographical Trends: In this country, the Southeast and Central-West regions, sugarcane production thrives due to favorable climate and advanced infrastructure. In contrast, the Northeast focuses on smaller-scale production with growing potential. Moreover, the South and North regions are expanding gradually, driven by new investments and emerging agricultural developments.

- Challenges and Opportunities: The fluctuating weather conditions affecting crop yields are hampering the market. However, adopting advanced farming technologies and implementing sustainable agricultural practices to enhance productivity will continue to strengthen the market growth over the foreseeable future.

Brazil Cane Sugar Market Trends:

Significant Investments in Processing Infrastructure

In Brazil, substantial investments in industry infrastructure enhance processing efficiency and capacity. Modern facilities and advanced equipment support higher production rates and improved quality, thereby positioning sugarcane industry for sustained growth and competitiveness. For example, in April 2024, Conab reported Brazil's sugarcane production reached approximately 713.2 million metric tons for the 2023-24 crop year, surpassing previous estimates.

Increased Demand for Ethanol

Brazil's rising demand for ethanol drives sugarcane processing. This surge in ethanol consumption leads to increased production volumes, fostering growth within Brazil's cane sugar industry and strengthening its position in international trade. For instance, in September 2024, General Motors began producing its first-ever hybrid-flex vehicles that can run on 100% ethanol or petrol alongside their batteries in Brazil. This growth boosts exports and attracts further investment in agricultural technologies. According to Brazil cane sugar market analysis report, it is acting as a significant growth-inducing factor.

Adoption of Advanced Agricultural Technologies

In Brazil, adopting advanced agricultural technologies enhances sugarcane productivity by improving pest control and crop management. This innovation boosts yield and sustainability, addresses agricultural challenges, and meets the rising Brazil cane sugar market demand while maintaining its competitive edge. For example, in August 2024, Syngenta launched FRONDEO, a new insecticide in Brazil designed to control the sugarcane borer. Using PLINAZOLIN technology, the product offers prolonged control, operational efficiency, and compatibility with biological products, thereby improving pest management before the sugarcane harvest.

Brazil Cane Sugar Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the Brazil cane sugar market forecast at the country and regional levels for 2025-2033. Our report has categorized the market based on the type and application.

Breakup by Type:

To get more information on this market, Request Sample

- Crystallized Sugar

- Liquid Sugar

The report has provided a detailed breakup and analysis of the market based on the type. This includes crystallized sugar and liquid sugar.

In 2023, Brazil produced over 40 million metric tons of crystallized sugar, accounting for more than 20% of global sugar exports. Crystallized sugar is primarily used in food processing, beverages, and confectionery products. Beverage manufacturers and the food industry mainly use liquid sugar for easier blending into liquid products.

Breakup by Application:

- Food and Beverage

- Pharmaceuticals

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverage, pharmaceuticals, industrial, and others.

Cane sugar across the country is vital across various sectors, as it aids in enhancing food and beverages with sweetness. Moreover, it aids in serving as an excipient in pharmaceuticals, fueling industrial processes like ethanol production, and finding applications in numerous other fields. This significantly impacts Brazil cane sugar market share.

Breakup by Region:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

According to Brazil cane sugar market outlook, the Southeast and South regions feature robust infrastructure and favorable conditions for large-scale production. In contrast, the Northeast, sugarcane thrives in the region's warmer, drier climate. Moreover, the North and Central-West regions are increasingly significant as they develop new cultivation areas and enhance their agricultural practices. This regional diversity reflects Brazil's extensive and varied approach to sugarcane farming.

Competitive Landscape:

The Brazil cane sugar market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Agro Betel

- Copersucar SA

- DWL International Foods Inc

- Louis Dreyfus Company

- São Martinho

- Tereos SA

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Brazil Cane Sugar Market Recent Developments:

- September 2024: General Motors began producing its first-ever hybrid-flex vehicles that can run on 100% ethanol or petrol alongside their batteries in Brazil.

- August 2024: Syngenta launched FRONDEO, a new insecticide in Brazil designed to control the sugarcane borer.

- April 2024: According to a Bloomberg news report, Brazilian-grown cane sugar ethanol shipments began arriving at a U.S. plant in Georgia to supply sustainable aviation fuel (SAF).

Brazil Cane Sugar Market Report:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Crystallized Sugar, Liquid Sugar |

| Applications Covered | Food and Beverage, Pharmaceuticals, Industrial, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Companies Covered | Agro Betel, Copersucar SA, DWL International Foods Inc, Louis Dreyfus Company, São Martinho, Tereos SA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Brazil cane sugar market performed so far, and how will it perform in the coming years?

- What is the breakup of the Brazil cane sugar market on the basis of type?

- What is the breakup of the Brazil cane sugar market on the basis of application?

- What are the various stages in the value chain of the Brazil cane sugar market?

- What are the key driving factors and challenges in Brazil cane sugar?

- What is the structure of the Brazil cane sugar market, and who are the key players?

- What is the degree of competition in the Brazil cane sugar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil cane sugar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil cane sugar market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil cane sugar industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)