Brazil Baby Care Products Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, and Region, 2026-2034

Brazil Baby Care Products Market Summary:

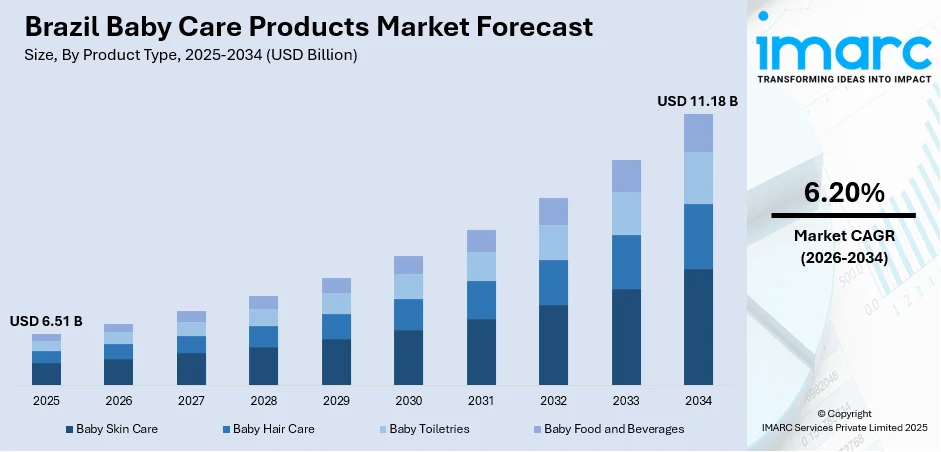

The Brazil baby care products market size was valued at USD 6.51 Billion in 2025 and is projected to reach USD 11.18 Billion by 2034, growing at a compound annual growth rate of 6.20% from 2026-2034.

The Brazil baby care products market is experiencing robust expansion driven by heightened consumer awareness of infant hygiene and wellness. Rising urbanization across major metropolitan areas is reshaping purchasing behaviors, with parents increasingly seeking premium and specialized products. The growing participation of women in the workforce has accelerated demand for convenient, time-efficient solutions that ensure quality care without compromising safety. Expanding e-commerce platforms and modern retail channels are enhancing product accessibility, while the shift toward organic and natural formulations reflects evolving parental preferences for gentler, chemical-free options in the Brazil baby care products market share.

Key Takeaways and Insights:

- By Product Type: Baby skin care dominates the market with a share of 37.6% in 2025, driven by increasing parental emphasis on gentle, dermatologically tested formulations that protect delicate infant skin from environmental factors and common irritations.

- By Category: Mass category leads the market with 75% share in 2025, reflecting Brazilian consumers' preference for affordable yet quality products that balance effectiveness with household budget considerations.

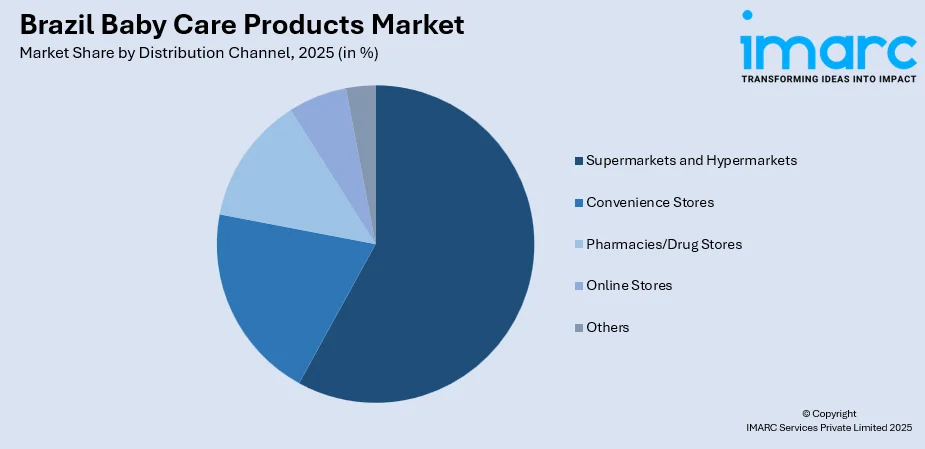

- By Distribution Channel: Supermarkets and hypermarkets hold the largest share at 58.8% in 2025, offering extensive product variety, competitive pricing, and the convenience of one-stop shopping for essential baby care items.

- By Region: Southeast region represents the largest segment with 45.9% market share in 2025, attributed to high population density, elevated disposable incomes, and concentration of urban families in São Paulo and Rio de Janeiro.

- Key Players: The Brazil baby care products market exhibits moderate to high competitive intensity, with multinational corporations competing alongside regional manufacturers across various price segments and product categories.

To get more information on this market Request Sample

The Brazil baby care products market is evolving as parents increasingly prioritize safety, quality, and convenience when selecting items for their children. Rising consumer awareness about health and wellness is driving demand for innovative formulations, including plant-based, hypoallergenic, and gentle ingredients. In line with this shift, in May 2024 Soft N Dry Diapers Corp., via its Latin‑American subsidiary, began operations in Brazil, launching “tree‑free” disposable baby diapers and setting up a “last mile” retail network to serve sustainability‑conscious consumers. Digital retail channels are expanding, offering parents convenient access to a wide variety of products and competitive pricing. Sustainability is becoming a key focus, with companies adopting eco-friendly materials, packaging, and production practices. Overall, the market reflects a shift toward responsible, health-conscious, and environmentally aware choices among Brazilian families.

Brazil Baby Care Products Market Trends:

Rising Demand for Natural and Organic Formulations

Brazilian parents are increasingly prioritizing natural, organic, and hypoallergenic baby care products formulated without harsh chemicals, parabens, or synthetic fragrances. This consumer shift reflects heightened awareness of ingredient safety and environmental responsibility. In 2024, Dermobaby expanded its distribution in Brazil by entering the shelves of major pharmacy chain Drogaria São Paulo — offering natural, dermatologically tested, paraben‑free and dye‑free baby care products aimed at parents seeking gentle and safe hygiene and skincare for their infants. Manufacturers are responding by developing plant-based formulations using botanical extracts and essential oils that provide gentle care for sensitive infant skin while meeting evolving parental expectations for transparency and product purity in the Brazil baby care products market growth.

Expansion of Digital Commerce Channels

E-commerce is emerging as a rapidly growing distribution channel for baby care products in Brazil, driven by increasing internet penetration and changing shopping habits among millennial parents. Online platforms offer extensive product variety, detailed ingredient information, customer reviews, and doorstep delivery convenience. In 2023 alone, sales of children’s products (including baby care items) on e‑commerce platforms rose by 54%, with over 1.4 million orders recorded via the major local platform Nuvemshop. The digital transformation is enabling smaller brands to compete effectively alongside established players while providing consumers with greater access to premium and imported baby care products previously unavailable in traditional retail settings.

Sustainable and Eco-Friendly Product Innovation

Environmental consciousness is driving innovation in sustainable baby care products across Brazil. Consumers are actively seeking eco-friendly alternatives featuring biodegradable materials, recyclable packaging, and reduced plastic content. In 2024, Huggies Eco Protect, a brand owned by Kimberly‑Clark, introduced a hybrid diaper in Brazil: a washable cloth diaper paired with a disposable, plant‑based absorbent pad. This design cuts waste by up to 28 % compared with conventional disposable diapers, a concrete development showing how major players are responding to demand for more sustainable baby‑care options. Manufacturers are developing reusable diaper systems, plant-derived absorbent materials, and products that minimize environmental impact throughout their lifecycle. This sustainability trend aligns with broader societal values as Brazilian families seek to balance effective baby care with environmental stewardship.

Market Outlook 2026-2034:

The Brazil baby care products market is positioned for continued expansion through the forecast period, supported by favorable demographic trends and evolving consumer preferences. Ongoing urbanization, rising disposable incomes, and increasing female workforce participation will sustain demand for convenient, premium baby care solutions. Innovation in natural formulations and sustainable products will reshape competitive dynamics as manufacturers address growing environmental concerns. The market generated a revenue of USD 6.51 Billion in 2025 and is projected to reach a revenue of USD 11.18 Billion by 2034, growing at a compound annual growth rate of 6.20% from 2026-2034.

Brazil Baby Care Products Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Baby Skin Care | 37.6% |

| Category | Mass | 75% |

| Distribution Channel | Supermarkets and Hypermarkets | 58.8% |

| Region | Southeast | 45.9% |

Product Type Insights:

- Baby Skin Care

- Baby Hair Care

- Baby Toiletries

- Baby Bath Products and Fragrances

- Baby Diapers and Wipes

- Baby Food and Beverages

The baby skin care dominates with a market share of 37.6% of the total Brazil baby care products market in 2025.

The baby skin care segment maintains market leadership driven by increasing parental awareness regarding infant skincare needs and protection from environmental factors. Given Brazil's tropical climate, parents actively seek hydrating lotions, protective creams, and gentle sunscreens formulated specifically for delicate infant skin. Products enriched with natural ingredients such as shea butter, chamomile, and almond oil are particularly favored by consumers seeking gentle yet effective solutions for common conditions including heat rashes and dryness.

The preference for fragrance-free, pH-balanced, and dermatologically tested formulations continues to strengthen as Brazilian parents become more ingredient-conscious. In 2023, Dermobaby, a newly launched baby‑care brand in Brazil, debuted a full line of baby‑skincare products with natural, paraben‑free, dye‑free, and dermatologically tested formulas, explicitly targeting infant skin sensitivity and parental demand for safer care. Manufacturers are expanding portfolios with hypoallergenic options and plant-based alternatives that align with growing demand for safe, chemical-free skincare. This segment benefits from repeat purchase patterns as parents establish consistent skincare routines for their infants throughout various developmental stages.

Category Insights:

- Premium

- Mass

The mass leads with a share of 75% of the total Brazil baby care products market in 2025.

The mass category maintains substantial market dominance reflecting Brazilian consumers' emphasis on value-oriented purchasing decisions. Parents across socioeconomic segments seek products that deliver reliable quality and effectiveness while remaining accessible within household budgets. Manufacturers in this segment successfully balance product innovation with competitive pricing strategies, enabling widespread adoption across diverse consumer demographics throughout the country.

The strength of mass market products is reinforced by extensive distribution through supermarkets, hypermarkets, and pharmacy chains that offer convenient accessibility. Promotional activities, bundle offers, and loyalty programs further enhance consumer appeal within this segment. While premium products are gaining traction among affluent urban consumers, the mass category continues to serve as the foundation of Brazil's baby care market due to its broad accessibility and trusted brand presence.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmacies/Drug Stores

- Online Stores

- Others

The supermarkets and hypermarkets dominates with a market share of 58.8% of the total Brazil baby care products market in 2025.

Supermarkets and hypermarkets maintain distribution leadership by offering comprehensive product assortments, competitive pricing, and convenient one-stop shopping experiences for Brazilian families. For instance, Carrefour Brasil, the country’s top‑ranking supermarket chain, generated R$120.5 billion in revenue in 2024, underscoring the continued strength of large retail chains in Brazil. These retail formats provide extensive shelf space for diverse baby care brands spanning skincare, toiletries, and nutrition categories. Regular promotional campaigns, bulk purchasing options, and strategic store locations in urban residential areas strengthen consumer preference for this channel.

The ability to physically examine products, compare options, and receive in-person guidance contributes to consumer confidence in supermarket purchases. Major retail chains continue expanding baby care sections with dedicated aisles featuring organized product displays and informational signage. While e-commerce is growing rapidly, traditional retail formats retain substantial market presence through established consumer relationships and immediate product availability.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The southeast exhibits a clear dominance with a 45.9% share of the total Brazil baby care products market in 2025.

The Southeast region commands market leadership driven by its substantial population concentration in major metropolitan areas including São Paulo and Rio de Janeiro. According to a 2022 census, the Southeast Region, Brazil accounted for about 41.8% of Brazil’s population. Higher disposable incomes among urban families enable greater spending on premium and specialized baby care products. The region benefits from advanced retail infrastructure, extensive e-commerce penetration, and proximity to major manufacturing and distribution centers that ensure product availability and competitive pricing.

Urban lifestyle patterns in the Southeast create strong demand for convenient, time-efficient baby care solutions suited to working parents. The concentration of dual-income households and higher educational attainment contribute to informed purchasing decisions favoring quality products. Modern retail formats, specialty baby stores, and robust online delivery networks support diverse consumer preferences across this economically significant region.

Market Dynamics:

Growth Drivers:

Why is the Brazil Baby Care Products Market Growing?

Increasing Female Workforce Participation

The growing participation of women in Brazil’s workforce is reshaping demand for convenient baby care solutions. In November 2025, Johnson’s Baby relaunched in Brazil with improved formulas, 50 % recycled packaging, and a new mascot, targeting modern parents seeking convenient, high-quality, and sustainable baby-care products. As mothers balance professional careers with childcare responsibilities, the need for time-saving products such as disposable diapers, ready-to-use baby food, and portable skincare items is rising. Working parents increasingly seek reliable, high-quality products that simplify daily routines while ensuring infant wellbeing. This shift encourages manufacturers to develop innovative solutions tailored to modern families, emphasizing ease of use, efficiency, and safety to support parents juggling professional and caregiving roles.

Rapid Urbanization and Changing Consumer Lifestyles

Brazil’s urbanization is transforming baby care consumption patterns across the country. Families living in cities are increasingly exposed to modern lifestyles, evolving preferences, and greater awareness of specialized products. Urban consumers show higher willingness to invest in premium baby care offerings and are more responsive to brand marketing and innovation. In 2024, the Brazilian government, via the Ministry of Health, launched Rede Alyne, a maternal‑child health program to reduce maternal mortality and improve prenatal, birth, and newborn‑care services nationwide. Expanding retail networks and e-commerce platforms enhance product accessibility, making it easier for families to obtain high-quality items. The concentration of young, urban households with disposable income creates favorable conditions for sustained market growth.

Growing Awareness of Infant Health and Hygiene

Increasing parental awareness of infant health, hygiene, and developmental needs is driving demand for quality baby care products in Brazil. Parents are becoming more informed about ingredient safety, product efficacy, and the importance of age-appropriate formulations through digital platforms and healthcare guidance. This knowledge influences choices across nutrition, skincare, and hygiene products, as caregivers seek comprehensive solutions to support infant wellbeing. For instance, the government‑run Programa Criança Feliz (Happy Child Program), one of the world’s largest early‑childhood home‑visitation schemes, had by 2022 completed more than 58 million home visits to families with infants and young children, providing guidance on hygiene, nutrition, health‑care access, and early childhood care for vulnerable households. Manufacturers are responding with innovations designed to meet these informed expectations, ensuring safety, gentle care, and convenience across a wide range of baby care offerings.

Market Restraints:

What Challenges the Brazil Baby Care Products Market is Facing?

Premium Product Price Sensitivity

The higher price points of premium, organic, and specialized baby care products present adoption challenges among price-sensitive consumer segments. While demand for natural and eco-friendly alternatives is growing, many Brazilian families prioritize affordability over premium features when making purchasing decisions. Economic constraints and budget limitations restrict market penetration of higher-priced products despite growing awareness of their benefits.

Regional Economic Disparities

Significant socioeconomic disparities across Brazilian regions create uneven market development and consumption patterns. Lower-income areas face challenges accessing quality baby care products due to limited retail infrastructure and reduced purchasing power. These disparities affect distribution strategies and require manufacturers to develop diverse product portfolios addressing varied economic realities across different geographic markets.

Competition from Unbranded and Counterfeit Products

The presence of low-cost unbranded products and counterfeit goods in certain market segments poses challenges for established brands seeking to maintain quality standards and consumer trust. Price-driven purchasing decisions in some consumer segments may favor cheaper alternatives despite potential quality compromises. Manufacturers must invest in consumer education and brand differentiation to address competitive pressures from informal market participants.

Competitive Landscape:

The Brazil baby care products market exhibits a moderately consolidated competitive structure with multinational corporations maintaining significant market presence alongside regional manufacturers. Leading players compete through product innovation, brand differentiation, pricing strategies, and distribution network expansion. Companies are increasingly focusing on sustainable product development, natural formulations, and eco-friendly packaging to address evolving consumer preferences. Strategic partnerships, acquisitions, and localized manufacturing investments strengthen market positions as participants seek to capture growing demand across diverse product segments and geographic regions throughout Brazil.

Recent Developments:

- In November 2025: JOHNSON’S Baby Brazil revamped its product line, adding vitamin B5 to glycerin shampoo and “head-to-toe” soap while retaining its “No More Tears” formula. Baby lotion now offers twice the hydration with up to 72 hours moisturization. Packaging uses ~50% recycled resin, and a new mascot was introduced to strengthen brand connection.

Brazil Baby Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Categories Covered | Premium, Mass |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Stores, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil baby care products market size was valued at USD 6.51 Billion in 2025.

The Brazil baby care products market is expected to grow at a compound annual growth rate of 6.20% from 2026-2034 to reach USD 11.18 Billion by 2034.

Baby skin care, holding the largest revenue share of 37.6%, leads the Brazil baby care products market, driven by increasing parental emphasis on gentle, dermatologically tested formulations and growing awareness of infant skincare needs.

Key factors driving the Brazil baby care products market include increasing female workforce participation, rapid urbanization, growing awareness of infant health and hygiene, expanding e-commerce channels, and rising demand for natural and organic products.

Major challenges include premium product price sensitivity among budget-conscious consumers, regional economic disparities affecting market penetration, competition from unbranded alternatives, and infrastructure limitations in rural distribution networks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)