Brazil Automotive Engine Oil Market Size, Share, Trends and Forecast by Vehicle Type, and Region, 2026-2034

Brazil Automotive Engine Oil Market Size and Share:

The Brazil automotive engine oil market size was valued at USD 833.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,082.3 Million by 2034, exhibiting a CAGR of 2.95% from 2026-2034. The market is primarily driven by the increasing vehicle production and ownership, advancements in engine technology requiring specialized lubricants, and stricter emission regulations promoting high-quality engine oils. In leading regions like Brazil, industrial expansion, rising disposable incomes, and the growing preference for fuel-efficient and durable automotive solutions further enhance the overall Brazil automotive engine oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 833.5 Million |

| Market Forecast in 2034 | USD 1,082.3 Million |

| Market Growth Rate (2026-2034) | 2.95% |

The market in Brazil is primarily driven by the increasing vehicle ownership and rising interest in high performance lubricants meant to improve performance and durability. Additionally, the growing preference for synthetic and semi-synthetic oils due to their superior performance under extreme conditions is contributing to the market. Furthermore, ongoing advancements in engine technologies requiring specialized oils are further propelling demand in the region. Moreover, the expansion of the automotive sector, supported by economic recovery and infrastructure developments, is significantly fueling Brazil automotive engine oil market growth. For instance, On March 6, 2024, Stellantis announced an investment of €5.6 billion (R$30 billion) in South America from 2025 to 2030, the largest in the region's automotive industry. This investment will support the launch of over 40 new products and the development of Bio-Hybrid technologies, combining electrification with hybrid engines powered by bio-fuels (ethanol). The initiative is to improve Stellantis' leadership in the region and contribute to its Dare Forward 2030 carbon net zero objectives.

Moreover, stringent environmental regulations encouraging the use of low-emission and fuel-efficient engine oils are bolstering the market's growth. The rising popularity of electric and hybrid vehicles, which require specific lubricants for optimal functioning, is also shaping the market landscape. Apart from this, increasing awareness among consumers about regular vehicle maintenance and oil change intervals, thereby propelling the Brazil automotive engine oil market demand. Furthermore, collaborations between automotive manufacturers and lubricant producers to develop customized solutions are fostering innovation, providing significant growth opportunities in Brazil. For instance, On April 4, 2024, FUCHS SE and Mercedes-Benz AG announced a strategic business partnership to further deepen cooperation in the automotive after-sales sector. The agreement signed on March 28, 2024, is aimed at developing innovative engine oil solutions that improve vehicle performance, efficiency, and environmental sustainability. This partnership will leverage FUCHS's expertise as the world's largest independent supplier of lubrication solutions and Mercedes-Benz's extensive global service network.

Brazil Automotive Engine Oil Market Trends:

Trends Towards Bio-Based Engine Oils

The most prominent trend in the market is the increasing adoption of bio-based lubricants due to escalating environmental concerns and governmental regulations. These products, developed from renewable sources such as plant oils, are biodegradable and have lower carbon footprints, thereby expanding the market size. For instance, On December 18, 2024, Stellantis announced that its entire lineup is compatible with green HVO (Hydrotreated Vegetable Oil) fuel, in line with sustainability goals. HVO is a biofuel derived from renewable materials, including used vegetable oils, animal fat, and waste cooking oils. The hydrogenation process produces a cleaner, sulfur-free fuel with reduced aromatic compounds and pollutants, making it an eco-friendly alternative to traditional diesel, alongside eco-friendly engine oils. Brazilian consumers are showing an increasingly growing interest in sustainable alternatives as awareness of environmental impact increases. Apart from this, local production of the raw materials-soybean and palm oil, which are now available in Brazil, is also motivating the bio-based engine oils in terms of lower cost and as an eco-friendly product.

Technological Developments in Engine Oil Formulation

Innovations in engine oil formulations are changing the Brazil automotive engine oils market outlook, as manufacturers introduce oils tailored for high-performance and turbocharged engines. Enhanced formulations focus on reducing sludge, improving thermal stability, and extending oil life, catering to the needs of modern vehicles operating under challenging conditions. For instance, On January 17, 2025, a study published in Heliyon examined that the development of lubricant formulations, where nanotechnology integration has improved the capability of the oil to resist degradation and contamination from extreme conditions. Real-time quality monitoring systems have also been instituted on engine oils so that, during the necessary and timely replacement of oil changes, operators avoid or minimize their machines' dwell times. All this and more target better efficiency in reliability and environmental safety. These advancements also ensure compliance with stringent emission standards, which are becoming increasingly relevant in Brazil. Additionally, the integration of nanotechnology in engine oils is emerging as a trend, providing superior lubrication and wear protection.

Growing Popularity of Multi-Grade Engine Oils

One other important trend of the Brazil automotive engine oils market size is increasing demand for multi-grade engine oils. For instance, on November 11, 2024, LIQUI MOLY introduced an API SP specification for motorcycle multigrade engine oils, which actually exceeds the demands of the most ambitious motorcycle manufacturers while ensuring compliance with future specifications. This innovation ensures enhanced internal engine cleanliness, optimizes the combustion efficiency of the air-fuel mixture, and facilitates strict compliance with the stringent emission standards established for EURO 5+ engines. The API SP spec also provides a backward compatibility factor, which makes this API usable across a wide spread of existing motorcycles. These have a very excellent viscosity across varied temperatures, so it can support Brazil's wide range of climatic conditions. Multi-grade oils are preferred by vehicle owners and fleet operators since they enhance fuel efficiency and minimize engine wear, thereby reducing maintenance costs. Further driving their adoption across the country is the increasing use of multi-grade oils in commercial vehicles to support long-distance transportation and heavy-duty operations.

Brazil Automotive Engine Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil automotive engine oil market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on vehicle type.

Analysis by Vehicle Type:

- Commercial Vehicles

- Motorcycles

- Passenger Vehicles

Commercial vehicles form a significant portion of the Brazil automotive engine oil market, as the growth in transportation and logistics boosts the demand for engine oils. These commercial vehicles include trucks and buses, which function under harsh conditions, thus necessitating high-performance engine oils for durability and efficiency. Freight transportation and infrastructure projects are gaining more importance in Brazil, and hence, the demand for heavy-duty oils to handle heavy loads and long-lasting engine life is rising.

Motorcycles are strategically important for the Brazil automotive engine oil market due to the phenomenal use of motorcycles for personal transportation and for delivery services. Brazil is one of the major motorcycle markets in the world, so demand for two-wheeler-specific engine oils is quite strong. They guarantee excellent performance for their engines, suppress emissions, and save fuel. The growth of urban delivery services, which is fueled by the popularity of e-commerce is also a crucial factor in the demand for motorcycle-specific lubricants.

Passenger vehicles form a large share of the Brazil automotive engine oil market, due to the rising middle-class population and vehicle ownership in the country. Engine oils for passenger cars focus on fuel efficiency, carbon emission reduction, and environmental regulations. Advances in vehicle technology, including turbocharged and hybrid engines, have led to an increase in the use of synthetic and semi-synthetic oils, meeting modern performance demands and longer oil change intervals.

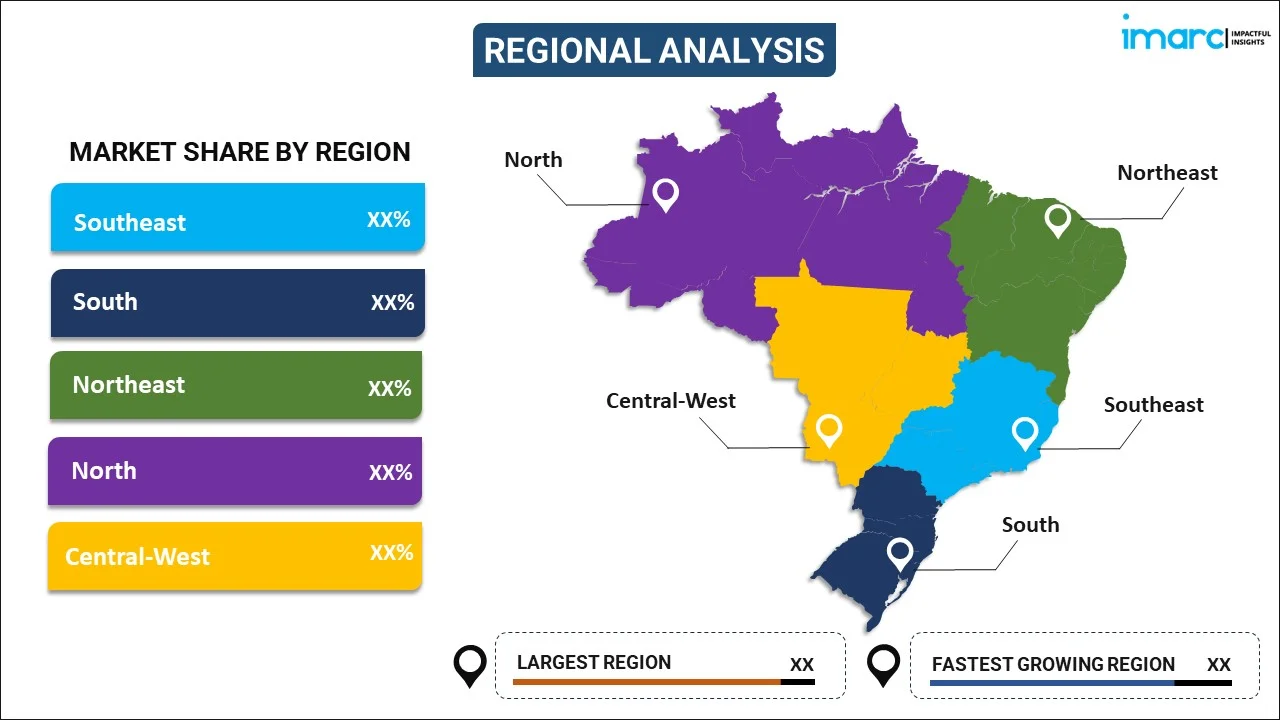

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

The Southeast region dominates the Brazil automotive engine oil market due to its high concentration of industrial hubs and urban centers like São Paulo and Rio de Janeiro. This region accounts for a significant share of vehicle ownership, driving demand for automotive engine oils. In addition, the presence of leading automotive manufacturers and extensive service networks ensures consistent demand for quality lubricants and maintenance products.

The South region is an important contributor to the Brazil automotive engine oil market, with its advanced manufacturing facilities and strong agricultural sector. Curitiba and Porto Alegre are important industrial and logistical centers, supporting the automotive supply chain. The colder climate of the region also creates a steady demand for specialized multi-grade engine oils catering to the needs of different vehicles and enhancing the performance of light and heavy-duty vehicles.

The Northeast region is playing an increasingly significant role in the Brazil automotive engine oil market because of its increasing infrastructure and transportation activities. With this region witnessing increased economic development and growing vehicle ownership, demand for engine oils and lubricants is increasing. Ports and trade activities in cities like Recife and Salvador add to the market by supporting commercial vehicle operations and the distribution of automotive products.

The North region is also one of the biggest contributors to the Brazil automotive engine oil market due to its extensive geography and dependency on long-distance transportation. Heavy commercial vehicle usage for goods movement through dense forested and remote areas in the region creates demand for durable and high-performance engine oils. The unique climate conditions of the region also require specific formulations to maintain efficiency and reliability in challenging operating environments.

The Central-West region is the heart of Brazil's agricultural powerhouse and, therefore, has a considerable influence on the automotive engine oil market due to the extensive use of agricultural machinery and commercial vehicles. This region, which includes cities such as Brasília and Goiânia, needs a steady supply of engine oils to support its farming and transportation sectors. The increased mechanization of agriculture and the growing road network in the region further strengthen the demand for high-quality automotive lubricants.

Competitive Landscape:

The market comprises a mix of regional and global companies, each offering a wide array of products to meet the diverse requirements of passenger and commercial vehicles. Key areas of competition include advancements in product design, competitive pricing models, and well-established distribution frameworks. Companies are allocating substantial resources to research and development, aiming to deliver innovative solutions such as synthetic and environmentally sustainable engine oils. Additionally, forming strategic alliances with automotive manufacturers and broadening service infrastructures has become a crucial approach for maintaining a strong market presence and addressing the changing preferences of consumers.

The report provides a comprehensive analysis of the competitive landscape in the Brazil automotive engine oil market with detailed profiles of all major companies.

Latest News and Developments:

- On October 23, 2024, Moove, a Brazilian lubricant manufacturer, launched its engine oil and automotive chemicals brand, Comma, into the Spanish market. This strategic expansion aims to strengthen Moove's presence in Europe by offering products tailored to meet the specific needs of Spanish workshops and vehicle owners. The launch underscores Moove's commitment to delivering high-quality lubricants and automotive solutions across diverse markets.

- On October 1, 2024, Moove Lubricants, backed by private equity firm CVC Capital Partners, announced that it is targeting a valuation of up to USD 19 Billion through a U.S. IPO. The company, which specializes in engine oil and other automotive fluids, aims to capitalize on its market presence in over 40 countries. This IPO plan underscores Moove's strategic focus on expanding its global footprint and leveraging strong investor interest in the automotive sector.

- On January 1, 2024, Gulf Oil International Ltd. announced the creation of its subsidiary, Gulf Oil Brazil, to expand its presence in Latin America. The subsidiary began operations by purchasing a lubricant manufacturing plant in Iperó, São Paulo, with a production capacity of 3,000,000 liters per month, and will increase it to 4,500,000 liters to fulfill market expansion plans. In addition, Gulf plans to open 200 fuel stations under its brand by the end of the year to further enhance the distribution of its engine oil products throughout Brazil.

- On January 5, 2025, PETRONAS Lubricants International unveiled a comprehensive range of PETRONAS Syntium Hybrid engine oils in Brazil. Designed specifically for hybrid vehicles, the new products aim to enhance engine performance and efficiency while reducing carbon emissions. The launch underscores the company's commitment to sustainable automotive solutions and advancing hybrid technology.

- On January 15, 2025, YPF Brasil and Lucas Oil announced a strategic alliance to expand their lubricants business across South America. The partnership aims to combine YPF's market presence in Brazil with Lucas Oil's innovative lubricant solutions to strengthen their footprint in the region. This collaboration underscores the growing demand for advanced engine oil technologies in Brazil's automotive sector, aligning with the country's expanding vehicle market and sustainability goals.

Brazil Automotive Engine Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Commercial Vehicles, Motorcycles, Passenger Vehicles |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 9-11 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil automotive engine oil market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Brazil automotive engine oil market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil automotive engine oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Brazil automotive engine oil market was valued at USD 833.5 Million in 2025.

The market in Brazil is primarily driven by increasing vehicle ownership, expanding industrialization, rising demand for high-performance lubricants, and strict government regulations on emissions. Advancements in engine technologies and a growing focus on fuel efficiency further foster the demand for premium engine oil products.

Brazil automotive engine oil market is projected to exhibit a CAGR of 2.95% during 2026-2034, reaching a value of USD 1,082.3 Million by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)