Brazil Aspartic Acid Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Brazil Aspartic Acid Market Overview:

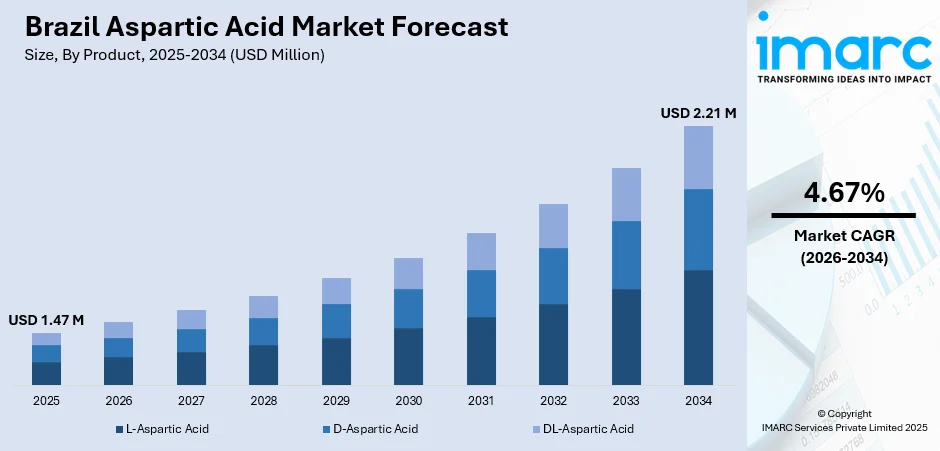

The Brazil aspartic acid market size reached USD 1.47 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2.21 Million by 2034, exhibiting a growth rate (CAGR) of 4.67% during 2026-2034. The growing use as a chelating agent in fertilizers and agrochemicals, rising adoption in biofuel production for enhancing the efficiency of the fermentation process, and increasing incorporation in beauty products for improving skin health and appearance are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.47 Million |

| Market Forecast in 2034 | USD 2.21 Million |

| Market Growth Rate (2026-2034) | 4.67% |

Brazil Aspartic Acid Market Trends:

Growing Applications in Agriculture Sector

The rising importance of aspartic acid as a chelating agent in fertilizers and agrochemicals represents one of the key factors supporting the market growth. Farmers are using new agrochemical solutions that contain amino acids, such as aspartic acid, to enhance crop production and efficiency. The compound improves the absorption of nutrients in plants, enhancing the efficiency of fertilizers, and promoting sustainable farming methods. The increasing agricultural output is resulting in the adoption of products like aspartic acid that improve productivity and crop resilience in large-scale farming operations. According to the estimates from the National Supply Company (Conab), a federal entity owned by the state in 2024, Brazil is expected to reach a record grain harvest of 322.47 million tons for the 2024-2025 season. If this forecast proves true, it would indicate an 8.3% rise compared to the harvest of 2023-2024. Moreover, there is an expectation for the cultivated land to increase by 1.9%, reaching a total of 81.34 million hectares.

To get more information on this market Request Sample

Rising Adoption in Biofuel Production

Biofuel production, particularly bioethanol derived from sugarcane, is a key component of the energy strategy of the country, and aspartic acid plays a crucial role in enhancing the efficiency of the fermentation process. Its ability to improve fermentation yields and optimize bioethanol production makes it an essential ingredient for biofuel manufacturers seeking to increase productivity and reduce costs. The growing demand for sustainable energy sources is leading to higher usage of aspartic acid in biofuel production, positioning it as a valuable contributor to the biofuel industry, where efficiency and sustainability are key to maintaining its competitive edge. Additionally, the 2024 Brazilian Statistical Yearbook of Petroleum, Natural Gas, and Biofuels, published by the National Agency of Petroleum, Natural Gas, and Biofuels (ANP), reported a new record in biofuel production in 2023. The year witnessed the production of more than 7.5 billion liters of biodiesel due to the rise in the required blending ratio of biodiesel in diesel to 12% (B12), starting on April 1, 2023.

Increasing Demand in Cosmetics and Personal Care

Aspartic acid is becoming popular in the cosmetics and personal care sector in Brazil because of its strong skin-conditioning properties and its use in anti-aging products. Aspartic acid, known for promoting skin hydration and aiding cellular regeneration, is becoming a preferred ingredient in a variety of skincare products, including moisturizers, anti-wrinkle creams, and serums. Its capacity to improve the inherent healing mechanisms of the skin and increase collagen synthesis makes it ideal for products designed for skin firmness, elasticity, and overall revitalization. The flexibility of this amino acid is resulting in its usage in different skincare and personal care items, as it enhances moisture retention and combats aging indicators. The rising need for personal care products in Brazil is driving the demand for aspartic acid for improving skin health and appearance. In 2023, the market size for beauty and personal care products in Brazil was US$ 28.71 Billion, as per the data provided by the IMARC Group.

Brazil Aspartic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- L-Aspartic Acid

- D-Aspartic Acid

- DL-Aspartic Acid

The report has provided a detailed breakup and analysis of the market based on the product. This includes L-aspartic acid, D-aspartic acid, and DL-aspartic acid.

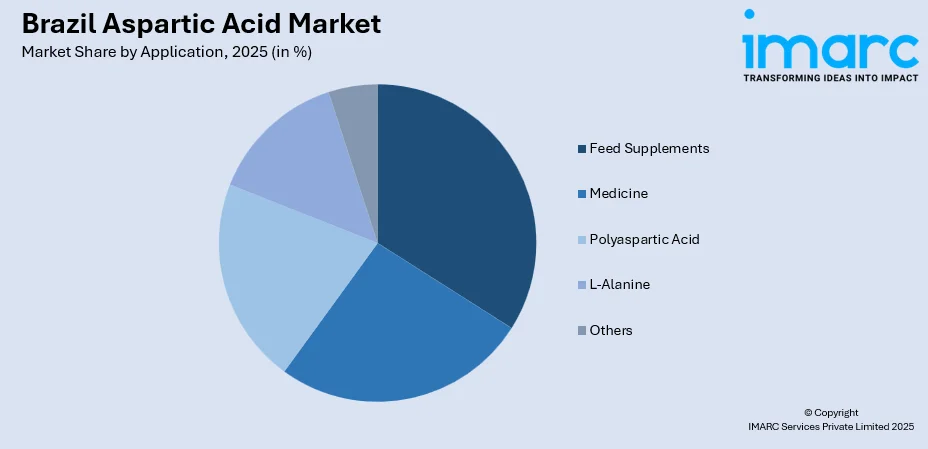

Application Insights:

Access the comprehensive market breakdown Request Sample

- Feed Supplements

- Medicine

- Polyaspartic Acid

- L-Alanine

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes feed supplements, medicine, polyaspartic acid, L-alanine, and others.

Regional Insights:

- Southeast

- South

- Northeast

- North

- Central-West

The report has also provided a comprehensive analysis of all the major regional markets, which include Southeast, South, Northeast, North, and Central-West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Brazil Aspartic Acid Market News:

- In July 2024, Fufeng Group plans to invest around USD 400 million in its inaugural bio-fermentation facility in Brazil, with the goal of manufacturing amino acids from corn. The facility is expected to handle 660,000 tons of corn every year, with Mato Grosso as a potential site.

- In May 2023, CJ do Brasil completed a R$1.1 billion upgrade of its Piracicaba plant, achieving self-sufficiency in producing Lysine, Threonine, and Tryptophan for Brazil’s animal feed sector. The InvestSP-backed initiative aimed to generate 650 jobs and enhance exports to Latin America, the US, and Europe.

Brazil Aspartic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | L-Aspartic Acid, D-Aspartic Acid, DL-Aspartic Acid |

| Applications Covered | Feed Supplements, Medicine, Polyaspartic Acid, L-Alanine, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil aspartic acid market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Brazil aspartic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil aspartic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aspartic acid market in Brazil was valued at USD 1.47 Million in 2025.

The Brazil aspartic acid market is projected to exhibit a CAGR of 4.67% during 2026-2034, reaching a value of USD 2.21 Million by 2034.

The Brazil aspartic acid market is driven by growing demand from the pharmaceutical, food, and biodegradable polymer industries. Increased health awareness, rising protein supplement consumption, and expanding industrial applications support market growth. Additionally, advancements in fermentation-based production methods enhance supply efficiency and promote the adoption of aspartic acid in Brazil.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)