Brazil Aluminum Casting Market Size, Share, Trends and Forecast by Process, Application, and Region, 2026-2034

Brazil Aluminum Casting Market Summary:

The Brazil aluminum casting market size was valued at USD 1.27 Billion in 2025 and is projected to reach USD 1.99 Billion by 2034, growing at a compound annual growth rate of 5.07% from 2026-2034.

The market is driven by the expanding automotive sector prioritizing lightweight materials for enhanced fuel efficiency and environmental compliance, alongside robust construction industry growth demanding sustainable aluminum components for infrastructure projects. Rising industrialization, advancements in casting technologies, and the country's exceptional aluminum recycling capabilities further accelerate market expansion. Government initiatives supporting manufacturing modernization and increasing demand from aerospace applications contribute to sustained growth in the Brazil aluminum casting market share.

Key Takeaways and Insights:

- By Process: Die casting dominates the market with a share of 82% in 2025, driven by its capability to produce complex, high-precision components with tight tolerances, superior surface finishes, and cost-effective high-volume production.

- By Application: Transportation leads the market with a share of 54% in 2025, owing to the automotive industry's shift toward lightweight aluminum components for engine blocks, transmission housings, and structural parts.

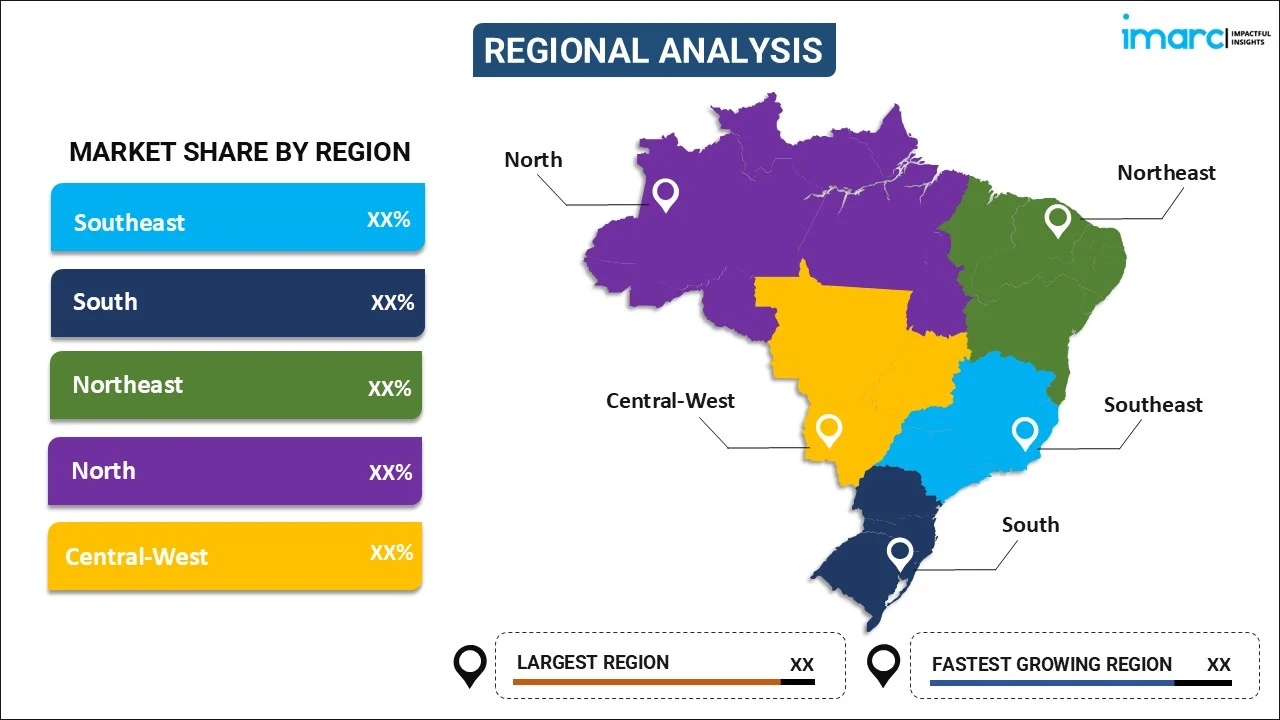

- By Region: Southeast represents the market with a share of 50% in 2025, driven by concentration of automotive manufacturing hubs in São Paulo, established infrastructure, skilled workforce, and comprehensive supply chain networks.

- Key Players: The Brazil aluminum casting market exhibits a moderately competitive landscape, with established domestic manufacturers competing alongside international players. Companies are focusing on technological advancements, sustainable manufacturing practices, and strategic partnerships to strengthen market positioning.

The Brazil aluminum casting market is experiencing robust growth propelled by multiple converging factors reshaping the industrial landscape. The automotive sector remains the primary demand driver, with manufacturers increasingly adopting aluminum castings to achieve vehicle weight reduction goals and meet evolving emission standards. According to reports, in 2024, Brazil’s foundry production increased 3.4% year on year to 2.79 Million Tons, including 169,951 Tons of aluminum castings, supported by rising domestic demand, according to ABIFA. Moreover, Brazil's construction industry expansion creates substantial demand for aluminum castings in architectural applications, structural components, and infrastructure projects. The country's leadership in aluminum recycling, supported by well-established circular economy practices and the National Solid Waste Policy, positions manufacturers to leverage cost-effective secondary aluminum for production. Technological advancements in die casting processes, including automation and precision engineering improvements, enhance manufacturing capabilities while reducing operational costs.

Brazil Aluminum Casting Market Trends:

Adoption of Advanced Die Casting Technologies

Brazilian manufacturers are increasingly investing in high-pressure die casting equipment and automated production systems to enhance manufacturing efficiency and product quality. These technological upgrades enable the production of complex, thin-walled components with superior dimensional accuracy and surface finish requirements. As per sources, Nemak’s aluminum casting facility in Betim, Brazil, received Aluminium Stewardship Initiative (ASI) Performance Standard V3 certification, reinforcing the adoption of advanced, traceable, and quality-driven die casting practices. Moreover, the integration of real-time monitoring systems and digital twin technologies allows foundries to optimize casting parameters, reduce defect rates, and minimize scrap generation. Such advancements position Brazilian producers to compete effectively in demanding automotive and aerospace supply chains requiring consistent quality and traceability standards.

Expansion of Electric Vehicle Component Manufacturing

The transition toward electric mobility in Brazil is creating new opportunities for specialized aluminum casting applications in battery housings, motor casings, and structural components. Electric vehicle platforms require lightweight, thermally efficient castings that support battery performance optimization and extended driving range capabilities. According to reports, Volkswagen announced one Billion Euros investment in South America through 2026, including the launch of multiple electric vehicle models in Brazil, reinforcing demand for locally sourced lightweight aluminum components. Furthermore, the regions foundries are developing expertise in producing large-format structural castings and integrated multi-functional components that reduce assembly complexity for EV manufacturers. This emerging application segment represents a significant growth avenue as domestic and international automakers expand electric vehicle production in the region.

Integration of Sustainable Manufacturing Practices

Environmental sustainability has become a central focus for Brazilian aluminum casting producers seeking to align with international standards and customer requirements. Companies are implementing renewable energy sourcing, waste heat recovery systems, and closed-loop recycling processes to minimize environmental footprint while reducing operational costs. According to sources, Brazil recycled 850,000 Tons of aluminum scrap, equivalent to about 60% of the country’s total aluminum consumption, highlighting the industry’s commitment to circular economy principles and low-carbon production. Furthermore, the adoption of low-carbon aluminum and increased utilization of secondary recycled material reflects the industry's commitment to circular economy principles. Certification programs and sustainability audits are becoming standard requirements as manufacturers demonstrate environmental responsibility to automotive and industrial customers.

Market Outlook 2026-2034:

The Brazil aluminum casting market is experiencing robust growth propelled by multiple converging factors reshaping the industrial landscape. The automotive sector remains the primary demand driver, with manufacturers increasingly adopting aluminum castings to achieve vehicle weight reduction goals and meet evolving emission standards. Brazil's construction industry expansion creates substantial demand for aluminum castings in architectural applications and infrastructure projects. The country's leadership in aluminum recycling, supported by circular economy practices, positions manufacturers to leverage cost-effective secondary aluminum. Technological advancements in die casting processes enhance manufacturing capabilities while reducing operational costs. The market generated a revenue of USD 1.27 Billion in 2025 and is projected to reach a revenue of USD 1.99 Billion by 2034, growing at a compound annual growth rate of 5.07% from 2026-2034.

Brazil Aluminum Casting Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Process |

Die Casting |

82% |

|

Application |

Transportation |

54% |

|

Region |

Southeast |

50% |

Process Insights:

.webp)

To get detailed segment analysis of this market, Request Sample

- Die Casting

- Pressure Die Casting

- Others

- Permanent Mold Casting

- Others

Die casting dominates with a market share of 82% of the total Brazil aluminum casting market in 2025.

Die casting has established itself as the leading process segment in the Brazil aluminum casting market, commanding substantial market share through its unmatched combination of production efficiency and component quality. The pressure die casting method enables manufacturers to produce intricately designed parts with exceptional dimensional consistency and surface characteristics that minimize post-processing requirements. According to sources, in 2024, the Brazil aluminum die casting market generated USD 878.7 Million in revenue, with pressure die casting accounting for 81.59 % of the segment, highlighting its dominance in automotive and industrial applications.

The dominance of die casting reflects broader manufacturing trends toward high-volume, automated production systems that deliver consistent quality at competitive costs. Investment in modern die casting equipment has accelerated across Brazilian foundries seeking to meet increasing customer demands for complex, lightweight components. The process offers superior material utilization rates compared to alternative casting methods, reducing waste and supporting sustainability objectives. Technological enhancements in thermal management, vacuum assistance, and squeeze casting variations continue expanding the capabilities and applications suitable for die cast aluminum production.

Application Insights:

- Transportation

- Industrial

- Building and Construction

- Others

The transportation leads with a share of 54% of the total Brazil aluminum casting market in 2025.

Transportation dominates the Brazil aluminum casting market, driven by lightweight vehicle architectures. Aluminum castings replace ferrous components across engines, chassis, and interiors. As per sources, in May 2024, Stellantis invested R$14 Billion in its Betim plant, expanding engine production and bio-hybrid technology, reinforcing aluminum-intensive manufacturing. Furthermore, the automakers and suppliers continue investing in casting capabilities to meet domestic production and export demands, underscoring the sector’s pivotal role in advancing advanced, lightweight, and sustainable vehicle platforms.

The transportation’s dominance extends beyond passenger vehicles to include commercial trucks, buses, and specialty vehicles that benefit from weight reduction and improved operational efficiency. Brazil's vehicle production recovery and modernization efforts create sustained demand for sophisticated aluminum castings meeting international quality standards. The increasing complexity of vehicle designs, including integrated structural castings, favors aluminum die casting's versatility. Growing electrification trends further reinforce demand as manufacturers develop platforms requiring specialized aluminum components for battery systems.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast dominates with a market share of 50% of the total Brazil aluminum casting market in 2025.

Southeast leads Brazil aluminum casting market through its concentration of automotive manufacturing facilities, industrial infrastructure, and skilled workforce resources. São Paulo state represents the epicenter of Brazilian automotive production, hosting major assembly plants and extensive supplier networks that drive substantial aluminum casting consumption. The region's established industrial ecosystem provides manufacturers with access to raw materials, technical expertise, and logistics networks essential for efficient production operations.

Southeast market leadership reflects decades of industrial development and investment that created competitive advantages difficult to replicate in other areas. Proximity to major consumption centers reduces transportation costs and enables responsive customer service for just-in-time manufacturing requirements. The concentration of research institutions and technical training facilities supports ongoing workforce development and technological advancement within the regional aluminum casting industry. Infrastructure improvements and industrial park developments continue strengthening the Southeast's position as Brazil's premier aluminum casting production hub.

Market Dynamics:

Growth Drivers:

Why is the Brazil Aluminum Casting Market Growing?

Rising Automotive Production and Lightweighting Initiatives

The Brazilian automotive industry's recovery and modernization drive substantial growth in aluminum casting demand as manufacturers prioritize lightweight materials for next-generation vehicle platforms. Automakers are systematically replacing traditional iron and steel components with aluminum castings to achieve significant weight reduction targets that improve fuel efficiency and reduce operational emissions. In March 2024, Toyota announced 11 Billion reais investment plan in Brazil between 2023 and 2030, focused on expanding hybrid‑flex vehicle production capacity, including local assembly of batteries, reinforcing lightweight material adoption. Moreover, this material substitution trend spans multiple vehicle systems including powertrains, suspensions, and body structures where aluminum's strength-to-weight ratio delivers measurable performance benefits.

Construction Sector Expansion and Infrastructure Development

Brazil's construction industry growth generates increasing demand for aluminum castings used in architectural applications, building systems, and infrastructure projects. Aluminum components are favored for facades, window frames, structural fittings, and electrical enclosures due to their corrosion resistance, design flexibility, and sustainable material characteristics. According to reports, in 2025, the Brazilian government reported infrastructure investment of BRL 277.9 Billion under the New Growth Acceleration Program (PAC), covering urban, transport, and energy projects, supporting demand for aluminum castings in construction applications. Moreover, government investment in infrastructure modernization and urban development creates additional demand for industrial aluminum castings supporting the construction equipment and building systems.

Exceptional Aluminum Recycling Infrastructure and Circular Economy Leadership

Brazil's world-leading aluminum recycling capabilities provide significant competitive advantages for domestic casting manufacturers through reliable access to cost-effective secondary aluminum. Furthermore, the country's established collection networks, processing facilities, and circular economy practices ensure consistent recycled aluminum supply that reduces production costs and environmental impact compared to primary aluminum consumption. Secondary aluminum requires substantially less energy to produce while maintaining quality characteristics suitable for demanding casting applications across automotive and industrial sectors. This recycling infrastructure supports Brazil's positioning as a sustainable manufacturing destination while enabling foundries to meet increasing customer requirements for low-carbon and environmentally responsible materials.

Market Restraints:

What Challenges the Brazil Aluminum Casting Market is Facing?

Volatile Raw Material Prices and Energy Costs

Aluminum casting manufacturers face ongoing challenges from price fluctuations in primary and secondary aluminum markets that create planning uncertainty and margin pressure. Energy costs represent substantial operating expenses for casting operations requiring high temperature melting and processing, with electricity price volatility directly impacting production economics. These cost pressures intensify competitive challenges for Brazilian producers serving price-sensitive domestic and export markets.

Infrastructure Limitations and Logistics Challenges

Regional infrastructure disparities create logistics challenges and increased transportation costs for aluminum casting manufacturers serving customers across Brazil's extensive geography. Transportation network limitations affect raw material delivery reliability and finished goods distribution efficiency, particularly for manufacturers located outside established industrial centers. These infrastructure constraints require additional investment and operational planning that increases overall cost structures.

Technical Workforce Availability and Training Requirements

The aluminum casting industry requires specialized technical expertise for equipment operation, quality control, and process optimization that faces availability constraints in certain regions. Training programs must continuously evolve to address advancing technologies in automation, digital manufacturing, and specialized casting techniques. Workforce development represents an ongoing investment requirement for manufacturers seeking to maintain competitive capabilities.

Competitive Landscape:

The Brazil aluminum casting market features a competitive structure characterized by a mix of established domestic foundries and international manufacturers serving diverse end-use applications. Competition centers on technological capabilities, quality certifications, production capacity, and customer service excellence that differentiate suppliers in demanding automotive and industrial markets. Market participants are investing in modernization initiatives including automated production systems, digital quality management, and sustainable manufacturing practices to strengthen competitive positioning. Strategic partnerships between casting suppliers and major OEM customers create integrated supply chain relationships that influence competitive dynamics. The industry trend toward sustainability certification has become an important competitive differentiator as customers increasingly prioritize suppliers demonstrating commitment to circular economy principles.

Brazil Aluminum Casting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered |

|

| Applications Covered | Transportation, Industrial, Building and Construction, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil aluminum casting market size was valued at USD 1.27 Billion in 2025.

The Brazil aluminum casting market is expected to grow at a compound annual growth rate of 5.07% from 2026-2034 to reach USD 1.99 Billion by 2034.

Die casting held the largest Brazil aluminum casting share driven by its ability to produce complex, high-precision components with excellent dimensional accuracy and surface finishes ideal for automotive and industrial applications.

Key factors driving the Brazil aluminum casting market include rising automotive production emphasizing lightweight materials, construction sector expansion, advanced recycling infrastructure supporting circular economy practices, and technological advancements in casting processes.

Major challenges include volatile raw material and energy prices affecting production costs, infrastructure and logistics limitations across certain regions, technical workforce availability constraints, competition from alternative materials, and evolving quality requirements demanding continuous investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)