Brazil Alpha Olefins Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Brazil Alpha Olefins Market Summary:

The Brazil alpha olefins market size was valued at USD 187.38 Million in 2025 and is projected to reach USD 307.03 Million by 2034, growing at a compound annual growth rate of 5.64% from 2026-2034.

The Brazil alpha olefins market is experiencing robust growth, driven by the expanding petrochemical sector and rising demand for polyethylene production across the packaging, construction, and automotive industries. The country's strategic position as Latin America's one of the largest petrochemical producers, coupled with increasing investments in industrial modernization and sustainable feedstock diversification, supports consistent market expansion. Growing consumption of synthetic lubricants and detergent alcohols further reinforces demand dynamics across diverse end use applications.

Key Takeaways and Insights:

-

By Product: 1-butene dominates the market with a share of 28% in 2025, owing to its extensive utilization as a comonomer in linear low-density polyethylene production and superior compatibility with ethylene oligomerization processes. Rising demand from flexible packaging applications fuels expansion.

-

By Application: Polyethylene leads the market with a share of 41% in 2025. This dominance is driven by escalating demand for lightweight, durable packaging materials across food, beverage, and consumer goods sectors, supported by expanding e-commerce and retail infrastructure throughout Brazil.

-

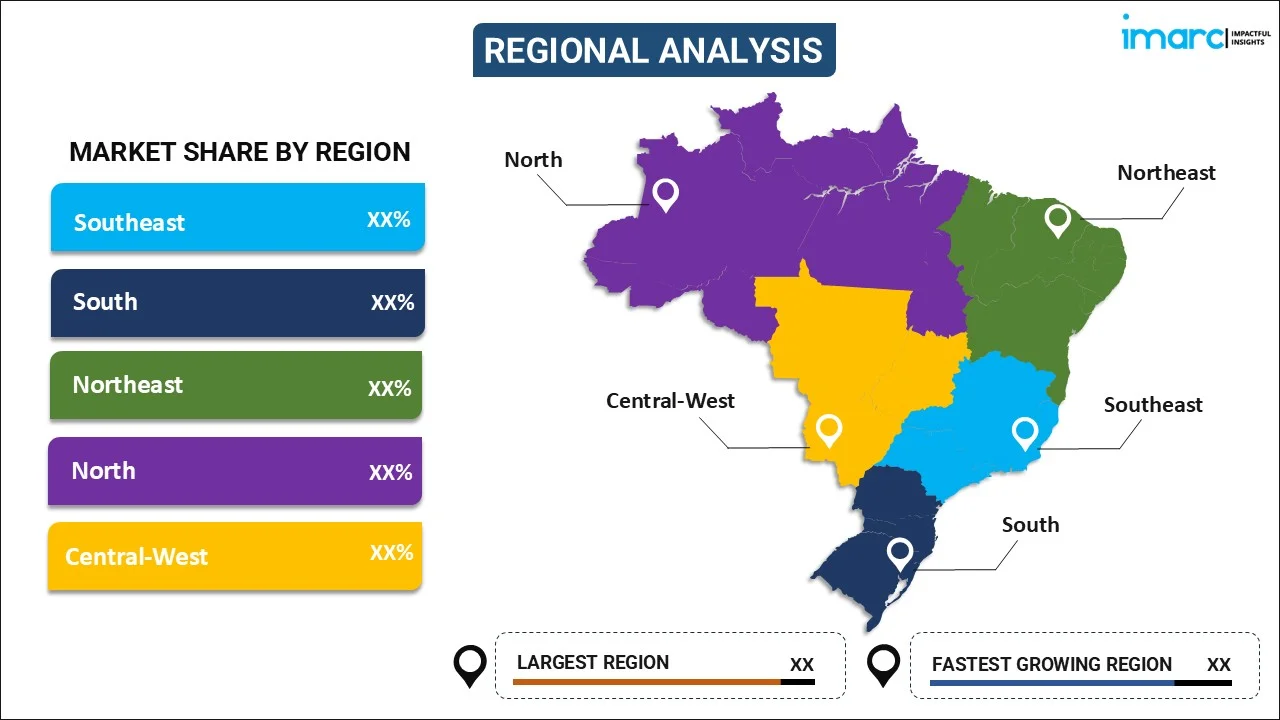

By Region: Southeast comprises the largest region with 35% share in 2025, driven by the concentration of Brazil's major petrochemical complexes in São Paulo and Rio de Janeiro, superior industrial infrastructure, and proximity to key manufacturing and distribution networks.

-

Key Players: Key players drive the Brazil alpha olefins market by expanding production capacities, investing in advanced oligomerization technologies, and strengthening feedstock supply agreements. Their focus on sustainable production methods, bio-based alternatives, and strategic partnerships with downstream processors enhances market penetration and supports long-term growth across polyethylene, lubricant, and specialty chemical segments.

The Brazil alpha olefins market is propelled by multiple interconnected growth drivers that collectively strengthen demand across the value chain. The expanding polyethylene production sector remains the primary catalyst, with increasing consumption in packaging, agricultural films, and construction materials creating sustained requirements for high-quality comonomers. As per IMARC Group, the Brazil packaging market size reached USD 23.4 Billion in 2024. Brazil's position as South America's leading petrochemical hub, characterized by integrated production complexes and established distribution networks, provides a competitive foundation for market expansion. The automotive and industrial sectors' growing preference for synthetic lubricants, which offer superior thermal stability and extended equipment longevity compared to conventional alternatives, amplifies demand for higher alpha olefins. Concurrently, the household and industrial cleaning products market's steady expansion drives consumption of detergent alcohols derived from alpha olefins. Government initiatives supporting domestic manufacturing, including tax incentives and infrastructure investments, further enhance the operational environment.

Brazil Alpha Olefins Market Trends:

Transition Towards Gas-Based Feedstock Flexibility

The Brazil alpha olefins market is witnessing a significant shift towards gas-based feedstock utilization, as producers seek enhanced cost competitiveness and reduced emissions. This strategic transition involves adapting industrial infrastructure to accommodate ethane and propane alongside traditional naphtha feedstocks. The diversification enables greater operational flexibility, allowing producers to respond effectively to global commodity price fluctuations while maintaining consistent output levels. This feedstock optimization trend aligns with broader energy transition goals and strengthens the domestic petrochemical sector's international competitiveness.

Integration of Bio-Based Production Technologies

Sustainability-focused initiatives are reshaping production methodologies within the Brazil alpha olefins market as manufacturers integrate bio-based feedstock technologies. The utilization of sugarcane-derived ethanol for bio-ethylene production demonstrates the sector's commitment to renewable resource adoption. This trend responds to increasing consumer and industrial demand for environmentally responsible products while leveraging Brazil's abundant agricultural resources. The development of bio-attributed polyethylene and related derivatives creates differentiated product offerings that command premium positioning in both domestic and international markets.

Expansion of Specialty Applications in High-Performance Lubricants

The Brazil alpha olefins market is experiencing growing demand for polyalphaolefins in specialty lubricant formulations, as industrial and automotive sectors prioritize equipment performance and longevity. These high-performance synthetic lubricants offer superior viscosity characteristics, thermal stability, and oxidation resistance compared to conventional mineral-based alternatives. The expanding automotive fleet and increasing mechanization across agricultural and manufacturing sectors drive consumption growth. As per CEIC, passenger car sales were recorded at 1,948,681.000 units in December 2024. This application segment benefits from rising awareness regarding maintenance cost reduction and environmental compliance requirements.

Market Outlook 2026-2034:

The Brazil alpha olefins market outlook remains positive through the forecast period, supported by sustained investments in petrochemical infrastructure modernization and expanding downstream applications. The market generated a revenue of USD 187.38 Million in 2025 and is projected to reach a revenue of USD 307.03 Million by 2034, growing at a compound annual growth rate of 5.64% from 2026-2034. Strategic feedstock supply agreements between major producers and state oil enterprises provide operational stability and cost visibility for capacity expansion projects. The ongoing reindustrialization initiatives, supported by government incentive programs, create favorable conditions for domestic production growth. Rising consumption across polyethylene, synthetic lubricants, and surfactant applications ensures diversified demand sources.

Brazil Alpha Olefins Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | 1-Butene | 28% |

| Application | Polyethylene | 41% |

| Region | Southeast | 35% |

Product Insights:

.webp)

To get detailed segment analysis of this market, Request Sample

- 1-Butene

- 1-Hexene

- 1-Octene

- 1-Decene

- 1-Dodecene

- Others

1-butene dominates with a market share of 28% of the total Brazil alpha olefins market in 2025.

1-butene maintains its dominant position within the Brazil alpha olefins market due to its critical role as a comonomer in polyethylene production, particularly for manufacturing linear low-density polyethylene and high-density polyethylene variants. The product's molecular structure provides enhanced mechanical properties, including improved impact resistance, flexibility, and processability in final polymer applications. Brazil's expanding packaging sector, which requires high-performance plastic films for food preservation and consumer goods protection, sustains robust demand for 1-butene-based polyethylene grades. The domestic petrochemical infrastructure supports efficient production and distribution channels.

The 1-butene segment benefits from Brazil's strategic investments in polyethylene manufacturing capacity expansion, with major producers allocating resources to increase output capabilities. In October 2025, Brazil's largest petrochemical producer, Braskem, approved an investment of R$4.2 Billion to expand ethylene and polyethylene production capacity by 220,000 tons annually at its Rio de Janeiro facility. This capacity enhancement directly increases domestic 1-butene consumption as comonomer requirements scale proportionally with polyethylene output. The integration of cost-competitive feedstocks further strengthens the segment's growth trajectory.

Application Insights:

- Polyethylene

- Detergent Alcohol

- Synthetic Lubricant

- Others

Polyethylene leads with a share of 41% of the total Brazil alpha olefins market in 2025.

Polyethylene production represents the dominant application segment within the Brazil alpha olefins market, driven by extensive consumption across packaging, construction, agricultural films, and consumer goods manufacturing sectors. Alpha olefins serve as essential comonomers that modify polyethylene properties, enabling the production of linear low-density polyethylene and metallocene-based grades with superior performance characteristics. The Brazilian packaging industry's continuous expansion, fueled by e-commerce growth and evolving consumer preferences for convenient product formats, sustains strong demand for polyethylene resins requiring alpha olefin inputs.

The polyethylene application segment receives substantial support from Brazil's integrated petrochemical value chain and strategic infrastructure investments. Ongoing capacity expansions and feedstock diversification initiatives position the segment for sustained growth while meeting evolving sustainability requirements through bio-attributed production pathways. Growing demand for high-performance agricultural films and geomembranes further strengthens polyethylene consumption, as these applications require enhanced durability, flexibility, and resistance to environmental stress. Additionally, rising adoption of recyclable and downgauged packaging solutions encourages the use of advanced polyethylene grades, reinforcing long-term alpha olefins demand.

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 35% share of the total Brazil alpha olefins market in 2025.

The Southeast region commands the largest share of the Brazil alpha olefins market, reflecting the concentration of major petrochemical complexes and manufacturing infrastructure in São Paulo and Rio de Janeiro states. This region hosts integrated production facilities that combine cracking operations with downstream polymer manufacturing, creating efficient value chains for alpha olefin consumption. The presence of established port infrastructure, including Santos, facilitates both domestic distribution and export activities. Superior logistics networks and skilled workforce availability further strengthen the region's competitive advantages.

The Southeast's dominance is reinforced by ongoing infrastructure investments and strategic industrial initiatives. Major producers continue to allocate capital toward capacity expansion and feedstock flexibility improvements within this region. The proximity to Brazil's largest consumer markets supports efficient distribution of polyethylene, lubricants, and other alpha olefin derivatives while minimizing transportation costs and supply chain complexities. Additionally, strong demand from automotive, packaging, and construction industries located in the Southeast sustains consistent offtake for alpha olefin derivatives.

Market Dynamics:

Growth Drivers:

Why is the Brazil Alpha Olefins Market Growing?

Expanding Polyethylene Production and Packaging Industry Demand

The Brazil alpha olefins market derives substantial growth momentum from the expanding polyethylene production sector, which serves as the primary consumption channel for alpha olefin comonomers. High-performance polyethylene grades are becoming more necessary, as the nation's packaging industry is evolving in response to shifting consumer habits, urbanization trends, and retail modernization. As food and beverage (F&B) manufacturers place a higher priority on product safety, shelf life extension, and customer convenience, flexible packaging formats, such as films, pouches, and wraps, show significant growth. The growing usage of plastic films in the agricultural sector for irrigation systems, greenhouse applications, and crop protection increases the need for polyethylene throughout Brazil's extensive farming regions. Polyethylene pipes, insulation, and protective membranes are employed in the construction industry, which adds to the amount of consumption. This diversified demand base across multiple end-use sectors ensures resilient growth for alpha olefin producers, while ongoing capacity investments in polyethylene manufacturing strengthen long-term consumption prospects throughout the domestic market.

Growing Synthetic Lubricants and Specialty Chemicals Applications

The Brazil alpha olefins market experiences accelerating demand from synthetic lubricants and specialty chemicals applications as industrial and automotive sectors increasingly prioritize equipment performance optimization and operational efficiency. When compared to traditional mineral-based lubricant substitutes, polyalphaolefins created from higher alpha olefins provide greater viscosity properties, thermal stability, and oxidation resistance. In manufacturing, mining, and transportation applications, these performance benefits result in longer equipment service intervals, lower maintenance costs, and increased energy efficiency. Adoption of high-performance lubricant formulations is fueled by the modernization of the automobile industry, which is marked by more advanced engine technologies and stricter pollution regulations. Synthetic lubricant applications also assist industrial machinery used in manufacturing and agriculture. Alcohols generated from alpha olefins are crucial ingredients in the formulation of home and industrial cleaning products. Demand growth for these specialized applications is sustained by the thriving consumer goods market and increased awareness about hygiene.

Infrastructure Development and Construction Activities

Infrastructure expansion and construction activities across Brazil are catalyzing alpha olefins demand through increased consumption of plastic pipes, insulation materials, geomembranes, and construction chemicals. Alpha olefins play a vital role in producing polyethylene resins used for water distribution systems, gas pipelines, and protective coatings. Government-led investments in housing, transportation networks, sanitation, and energy infrastructure are boosting demand for durable plastic materials with long service lives. These applications require polymers with enhanced flexibility, chemical resistance, and stress-crack performance, characteristics enabled by alpha olefin comonomers. Urban expansion and industrial zone development further support usage of plastic-based construction solutions that reduce installation time and maintenance costs. The World Bank's collection of development indicators stated that Brazil's urban population was 186,592,664 in 2024. Additionally, the push for lightweight, corrosion-resistant materials in infrastructure projects favors polymer solutions over traditional materials. As construction activity remains a strategic economic priority, demand for alpha olefin–derived polymers continues to grow steadily within Brazil’s infrastructure ecosystem.

Market Restraints:

What Challenges the Brazil Alpha Olefins Market is Facing?

Feedstock Price Volatility and Supply Chain Vulnerabilities

Feedstock price instability, especially with regard to naphtha sourced from petroleum and imported ethane supplies, continues to be a problem for the Brazilian alpha olefins market. Global crude oil price fluctuations have a direct effect on production costs, putting pressure on domestic manufacturers' margins. Production schedule and operational changes may result from supply chain disruptions that influence the availability of raw materials. Cost structures for imported feedstocks are further complicated by fluctuations in currency exchange rates.

Import Competition and Trade Pressure Dynamics

The Brazil alpha olefins market encounters competitive pressures from imported products originating from regions with lower production costs, particularly those benefiting from abundant shale gas resources. Price disparities between domestic and imported materials can influence purchasing decisions among downstream consumers. While protective tariff measures provide some insulation, global trade dynamics continue to shape market competition. Sustaining domestic production competitiveness requires ongoing efficiency improvements and strategic investments.

Infrastructure Limitations and Logistics Complexities

The Brazil alpha olefins market confronts infrastructure constraints that impact distribution efficiency and market access across the country's extensive geographic territory. Transportation network limitations, particularly in regions distant from major petrochemical production centers, increase logistics costs and delivery timeframes. Port congestion and capacity constraints can affect both import and export operations. Storage and handling infrastructure requirements demand substantial capital investments that influence market development timelines.

Competitive Landscape:

The Brazil alpha olefins market features a concentrated competitive landscape, characterized by established domestic petrochemical producers operating integrated manufacturing complexes. Market participants focus on capacity optimization, feedstock flexibility enhancement, and production efficiency improvements to maintain competitive positioning. Strategic partnerships with upstream feedstock suppliers and downstream polymer manufacturers strengthen value chain integration and market presence. Investments in advanced production technologies and process innovations enable participants to enhance product quality and operational reliability. The pursuit of sustainability initiatives, including bio-based production pathways and emissions reduction programs, creates differentiation opportunities while addressing evolving regulatory requirements and customer preferences.

Brazil Alpha Olefins Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | 1-Butene, 1-Hexene, 1-Octene, 1-Decene, 1-Dodecene, Others |

| Applications Covered | Polyethylene, Detergent Alcohol, Synthetic Lubricant, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil alpha olefins market size was valued at USD 187.38 Million in 2025.

The Brazil alpha olefins market is expected to grow at a compound annual growth rate of 5.64% from 2026-2034 to reach USD 307.03 Million by 2034.

1-butene dominated the market with a share of 28%, driven by its extensive utilization as a comonomer in linear low-density polyethylene production and superior compatibility with ethylene oligomerization processes for packaging applications.

Key factors driving the Brazil alpha olefins market include expanding polyethylene production capacity, growing demand for synthetic lubricants, strategic feedstock diversification initiatives, and increasing consumption of detergent alcohols in household and industrial cleaning applications.

Major challenges include feedstock price volatility affecting production costs, import competition from regions with lower production costs, infrastructure limitations impacting distribution efficiency, currency exchange rate fluctuations, and supply chain complexities across Brazil's extensive geographic territory.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)