Brazil Airbag Systems Market Size, Share, Trends and Forecast by Airbag Type, Automobile Type, End Consumer, and Region, 2026-2034

Brazil Airbag Systems Market Summary:

The Brazil airbag systems market size was valued at USD 630.98 Million in 2025 and is projected to reach USD 1,144.51 Million by 2034, growing at a compound annual growth rate of 6.84% from 2026-2034.

The Brazil airbag systems market is experiencing substantial growth driven by increasing vehicle production, rising consumer safety awareness, and stringent government regulations mandating airbag installation in new vehicles. The expanding middle-class population with higher disposable incomes is fueling demand for safer automobiles equipped with advanced safety features. Growing urbanization and increased vehicle usage across major metropolitan centers are further accelerating market expansion, while automotive manufacturers continue investing in sophisticated airbag technologies to enhance occupant protection and meet evolving Brazil airbag systems market share requirements.

Key Takeaways and Insights:

- By Airbag Type: Front dominates the market with a share of 46% in 2025, owing to mandatory government safety regulations requiring front airbags in all new vehicles. Front airbags provide essential protection during frontal collisions, which represent the most common accident type, making them the primary safety requirement for automakers.

- By Automobile Type: Passenger vehicle leads the market with a share of 57% in 2025. This dominance reflects passenger cars accounting for the largest share of vehicle production and sales in Brazil, with government safety mandates specifically targeting passenger vehicles and ensuring widespread airbag installation.

- By End Consumer: OEMs represent the largest segment with a market share of 81% in 2025, as airbags are primarily installed at the manufacturing stage to comply with strict government safety regulations. OEM-fitted airbags ensure proper system integration, higher reliability, and adherence to safety standards preferred by consumers.

- By Region: Southeast comprises the largest region with 43% share in 2025, driven by the concentration of Brazil's vehicle manufacturing facilities in Sao Paulo and surrounding states, coupled with higher population density and greater automotive demand in metropolitan areas.

- Key Players: Key players drive the Brazil airbag systems market by expanding production capacities, investing in advanced safety technologies, and strengthening partnerships with domestic automakers. Their focus on developing innovative solutions including smart airbags and adaptive deployment systems accelerates market growth and enhances occupant protection standards.

The Brazil airbag systems market is advancing as vehicle manufacturers and consumers increasingly prioritize occupant safety amid rising road traffic incidents. The country experiences significant traffic fatalities, underscoring the critical importance of passive safety systems. The government's National Road Safety Plan targets substantial reductions in traffic fatalities, driving enhanced safety feature adoption across the automotive sector. Growing awareness about vehicle safety and regulatory emphasis on occupant protection continue supporting market expansion. In March 2024, Stellantis announced a €5.6 Billion investment plan for South America through 2030, representing the largest automotive investment in regional history and supporting expanded vehicle production with comprehensive safety systems.

Brazil Airbag Systems Market Trends:

Integration of Advanced Sensor Technologies

The integration of sophisticated sensor technologies is transforming airbag deployment capabilities across the Brazilian automotive sector. Manufacturers are incorporating artificial intelligence and machine learning algorithms to enhance collision detection accuracy and optimize deployment timing based on crash severity and occupant positioning. These advanced systems analyze real-time data from multiple sensors to determine optimal airbag inflation force, reducing injury risks and improving overall vehicle safety performance. In July 2024, ZF Friedrichshafen developed a pre-crash dual stage side airbag that triggers deployment milliseconds before impact, pushing occupants away from expected collision points.

Rising Adoption of Multi-Airbag Configurations

Vehicle manufacturers in Brazil are increasingly adopting comprehensive multi-airbag configurations beyond the mandatory front airbags, including side-impact, curtain, and knee airbags. This trend reflects heightened consumer expectations for enhanced protection across all seating positions and crash scenarios, supporting the Brazil airbag systems market growth. Latin NCAP crash testing programs have demonstrated significant reductions in driver fatality risk with curtain airbags, driving automaker investments in expanded airbag coverage. Premium vehicle segments are leading this adoption with comprehensive airbag configurations becoming increasingly standard across new model launches.

Development of Sustainable Airbag Materials

Environmental sustainability considerations are driving innovation in airbag material development, with manufacturers exploring recycled and bio-based materials without compromising safety performance. This trend aligns with broader automotive industry decarbonization goals and growing consumer preference for environmentally responsible products. Advanced fabric technologies enable lighter, more efficient airbag systems while reducing manufacturing carbon footprints. In June 2024, Autoliv announced the development of airbag cushions made from 100% recycled polyester, reducing greenhouse gas emissions by approximately 50% at the polymer level while maintaining equivalent safety functionality.

Market Outlook 2026-2034:

The Brazil airbag systems market outlook remains strongly positive through the forecast period, supported by robust automotive production growth and expanding safety regulations. Brazil's vehicle sales have demonstrated strong recovery, returning the country to its position among the largest global automotive markets, with projections indicating continued growth. The government's Mover program provides substantial incentives for automotive companies investing in safety and decarbonization technologies, attracting record investments and commitments. Increasing foreign direct investment in Brazil's automotive sector and rising consumer demand for vehicles equipped with comprehensive safety features will continue driving market expansion. The market generated a revenue of USD 630.98 Million in 2025 and is projected to reach a revenue of USD 1,144.51 Million by 2034, growing at a compound annual growth rate of 6.84% from 2026-2034.

Brazil Airbag Systems Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Airbag Type |

Front |

46% |

|

Automobile Type |

Passenger Vehicle |

57% |

|

End Consumer |

OEMs |

81% |

|

Region |

Southeast |

43% |

Airbag Type Insights:

To get detailed segment analysis of this market, Request Sample

- Curtain

- Front

- Knee

- Sire

- Others

Front dominates with a market share of 46% of the total Brazil airbag systems market in 2025.

The front airbag segment maintains its dominant position in the Brazil airbag systems market, driven by mandatory government regulations requiring front airbags in all new vehicles manufactured or sold in the country. These regulations, implemented since 2014, ensure that driver and passenger front airbags are standard equipment across all vehicle categories, creating sustained demand from automotive manufacturers. Front airbags provide critical protection during frontal collisions, which represent the most common type of road accidents, making them essential safety components that automakers prioritize during vehicle design and production processes.

The cost-effectiveness and established manufacturing infrastructure for front airbag systems further support their market dominance in Brazil. Front airbags are simpler to integrate into vehicle designs compared to more advanced airbag types, enabling automakers to achieve regulatory compliance efficiently while managing production costs. The Volkswagen T-Cross, produced in Brazil, achieved five stars in Latin NCAP 2024 testing with its comprehensive six-airbag configuration, demonstrating how front airbags serve as the foundation for broader safety system packages that enhance overall occupant protection.

Automobile Type Insights:

- Passenger Vehicle

- Commercial Vehicle

- Bus

- Truck

Passenger vehicle leads with a share of 57% of the total Brazil airbag systems market in 2025.

The passenger vehicle segment dominates the Brazil airbag systems market, reflecting the substantial share of passenger car production and sales in the country's automotive sector. Brazil produced approximately 2.55 million vehicles in 2024, with passenger cars accounting for the majority of output, directly driving airbag demand from manufacturers. Government safety regulations specifically mandate airbag installation in passenger vehicles, ensuring comprehensive market coverage across domestic production and imports alike.

Rising consumer awareness about road safety and increasing preference for vehicles equipped with comprehensive safety features continue supporting passenger vehicle segment growth. Brazilian consumers are increasingly seeking vehicles with multiple airbags, electronic stability control, and advanced driver assistance systems. Major automakers are responding to this demand by announcing substantial investments in Brazilian manufacturing facilities to build new generation vehicles for the local market, incorporating enhanced safety systems that meet evolving consumer expectations and regulatory requirements while strengthening their competitive positioning.

End Consumer Insights:

- OEMs

- After-Market

OEMs exhibit a clear dominance with an 81% share of the total Brazil airbag systems market in 2025.

The OEM segment commands overwhelming market share in Brazil, as airbags are predominantly installed during the vehicle manufacturing stage to comply with mandatory government safety regulations. Factory-installed airbag systems ensure proper integration with vehicle crash structures and electronic systems, delivering optimal performance during collision events. Consumers strongly prefer OEM-fitted safety features due to their certified performance, warranty coverage, and seamless compatibility with overall vehicle design. This preference reinforces manufacturer focus on comprehensive factory-installed safety configurations.

Major airbag manufacturers maintain dedicated production facilities in Brazil to supply domestic OEM requirements efficiently. Leading companies operate manufacturing plants in the country, with facilities concentrated in the southern region producing the majority of total domestic airbag output. These established production capabilities enable manufacturers to meet automaker delivery schedules while reducing import dependencies. Ongoing facility expansions by major suppliers demonstrate continued commitment to strengthening regional supply chain capabilities and supporting growing demand from domestic vehicle manufacturers.

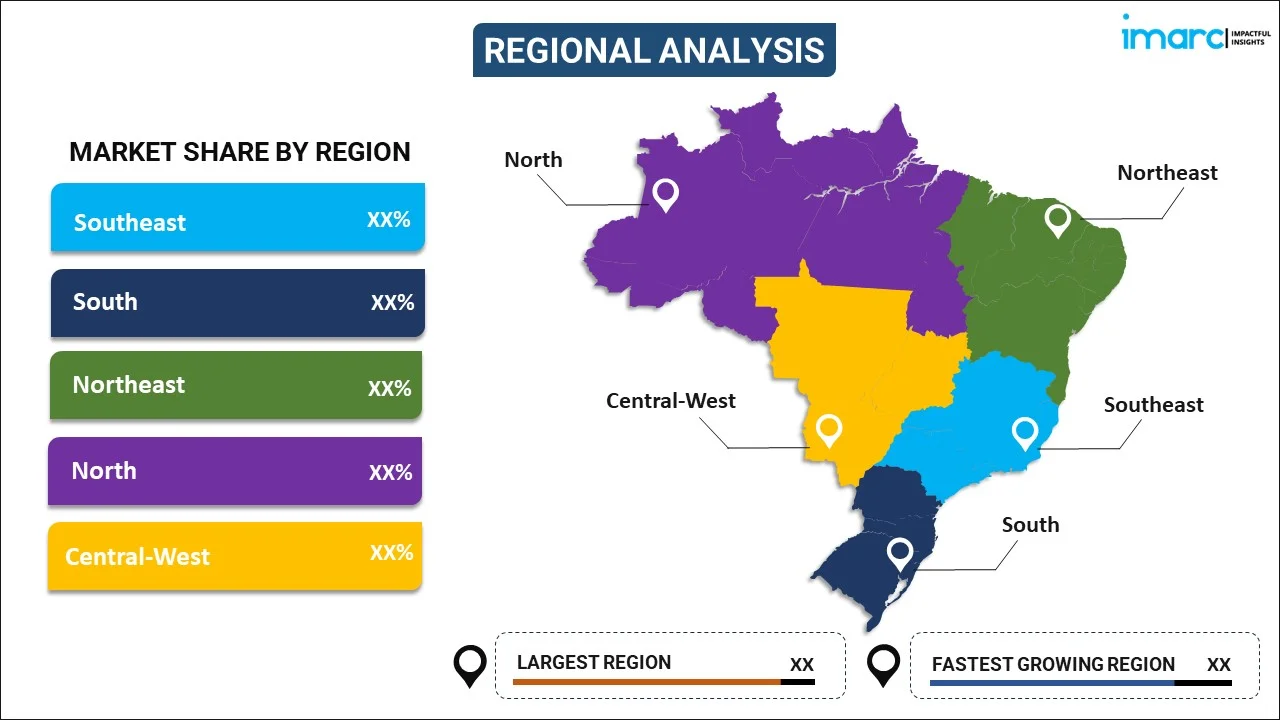

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast represents the leading region with a 43% share of the total Brazil airbag systems market in 2025.

The Southeast dominates the Brazil airbag systems market, driven by the concentration of the country's automotive manufacturing infrastructure in Sao Paulo, Minas Gerais, and surrounding states. This region houses major vehicle assembly plants operated by Stellantis, Volkswagen, General Motors, and other leading automakers, creating substantial localized demand for airbag systems from OEM suppliers. The presence of established automotive clusters and supplier networks facilitates efficient supply chain operations, enabling airbag manufacturers to serve regional OEM requirements with reduced logistics costs and improved delivery responsiveness.

The region's economic strength and higher population density further support market dominance, as Southeast states account for the largest share of vehicle registrations and consumer demand in Brazil. Major automakers continue announcing significant investment commitments for their Southeast manufacturing facilities, supporting expanded production capacities that require comprehensive safety systems including advanced airbag configurations. This sustained investment reinforces the region's position as Brazil's automotive manufacturing hub while driving continued growth in airbag systems demand from domestic vehicle production operations.

Market Dynamics:

Growth Drivers:

Why is the Brazil Airbag Systems Market Growing?

Expanding Automotive Production and Vehicle Sales

The sustained expansion of automotive production and vehicle sales in Brazil serves as a fundamental driver of airbag systems market growth, directly correlating increased manufacturing output with safety component demand. Brazil's automotive sector has demonstrated remarkable resilience and recovery, with vehicle sales reaching their highest levels in a decade and returning the country to its position among the largest global automotive markets. This production growth creates proportional demand for airbag systems as every vehicle manufactured requires regulatory-compliant safety equipment. The Brazilian Automotive Manufacturers Association projects continued growth toward 2.8 million total vehicle production in 2025, with an 8.4% increase expected in light vehicle output.

Stringent Government Safety Regulations and Standards

Government regulatory requirements mandating airbag installation in vehicles represent a critical market driver, ensuring baseline demand regardless of economic conditions or consumer preferences. Brazilian regulations have required front airbags and antilock braking systems as standard equipment in all new vehicles, creating a regulatory foundation that supports sustained market growth. The Brazilian Traffic Code requires completion of safety recalls before vehicle licensing, strengthening enforcement mechanisms and ensuring compliance with safety standards across the national vehicle fleet. The government's National Road Safety Plan, approved in September 2021, targets a 50% reduction in traffic fatalities by 2030, driving enhanced safety requirements across the automotive sector. Latin NCAP crash testing programs provide independent assessment of vehicle safety performance, creating competitive pressure for automakers to exceed minimum regulatory requirements and incorporate comprehensive airbag configurations.

Rising Consumer Safety Awareness and Purchasing Preferences

Growing consumer awareness about vehicle safety and increasing willingness to pay for vehicles equipped with comprehensive safety features significantly drive market expansion beyond regulatory minimums. Brazilian consumers are increasingly educated about the life-saving capabilities of airbag systems and actively seek vehicles with multiple airbags, electronic stability control, and advanced driver assistance systems. This awareness is reinforced by insurance industry incentives offering premium discounts for vehicles equipped with additional safety features. The expanding middle-class population with higher disposable incomes demonstrates preferences for premium safety equipment, supporting automaker investments in advanced airbag technologies. Consumer organizations and safety advocacy groups actively promote vehicle safety awareness, creating market pressure for continuous improvement in occupant protection standards and driving demand for sophisticated airbag systems beyond regulatory requirements.

Market Restraints:

What Challenges the Brazil Airbag Systems Market is Facing?

High Manufacturing and Integration Costs

The substantial costs associated with advanced airbag system manufacturing, integration, and quality assurance present challenges for market expansion, particularly in price-sensitive vehicle segments. Sophisticated airbag technologies including adaptive deployment systems and multi-airbag configurations require significant engineering investment and precision manufacturing, increasing vehicle production costs that must be balanced against competitive pricing pressures.

Limited Aftermarket Adoption Constraints

Technical complexity and safety certification requirements significantly limit aftermarket airbag installation opportunities, constraining market growth beyond OEM channels. Retrofit airbag installations require extensive vehicle modifications, specialized expertise, and rigorous testing to ensure proper integration with existing crash structures and electronic systems, making aftermarket adoption economically impractical for most vehicle owners.

Supply Chain Dependencies and Material Costs

Dependency on imported components and fluctuating raw material costs create supply chain vulnerabilities affecting airbag system production economics. Limited local battery and electronic component manufacturing capabilities require substantial imports, exposing the market to currency exchange fluctuations and international supply disruptions that impact production planning and pricing stability.

Competitive Landscape:

The Brazil airbag systems market exhibits a moderately concentrated competitive landscape, with established global suppliers maintaining significant market positions through domestic manufacturing capabilities and long-term OEM partnerships. Major international players dominate the market through integrated supply relationships with vehicle manufacturers operating in Brazil. These companies leverage extensive research and development capabilities to introduce advanced airbag technologies while maintaining cost-competitive production. Strategic investments in local manufacturing facilities enable suppliers to meet OEM delivery requirements efficiently while reducing import dependencies. Competition increasingly centers on technological differentiation, with suppliers developing smart airbag systems, sustainable materials, and integrated safety solutions that address evolving regulatory requirements and consumer expectations.

Brazil Airbag Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Airbag Types Covered | Curtain, Front, Knee, Sire, Others |

| Automobile Types Covered | Passenger Vehicle, Commercial Vehicle, Bus, Truck |

| End Consumers Covered | OEMs, After-Market |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil airbag systems market size was valued at USD 630.98 Million in 2025.

The Brazil airbag systems market is expected to grow at a compound annual growth rate of 6.84% from 2026-2034 to reach USD 1,144.51 Million by 2034.

Front dominated the market with a share of 46%, driven by mandatory government regulations requiring front airbags in all new vehicles and their essential role in protecting occupants during frontal collisions.

Key factors driving the Brazil airbag systems market include expanding automotive production and vehicle sales, stringent government safety regulations mandating airbag installation, rising consumer safety awareness, and increasing investments in advanced safety technologies.

Major challenges include high manufacturing and integration costs for advanced airbag systems, limited aftermarket adoption due to technical complexity, supply chain dependencies on imported components, and fluctuating raw material costs affecting production economics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)