Brazil Agriculture Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

Brazil Agriculture Market Summary:

The Brazil agriculture market size was valued at USD 130.97 Billion in 2025 and is projected to reach USD 175.17 Billion by 2034, growing at a compound annual growth rate of 3.28% from 2026-2034.

The Brazil agriculture market benefits from extensive arable land, favorable climatic conditions, and advanced farming technologies. The sector plays a pivotal role in the national economy, contributing significantly to employment and export revenues. Rising domestic and global food demand, coupled with government support programs and infrastructure investments, continues to drive agricultural output expansion across diverse crop segments and regional production centers throughout the country.

Key Takeaways and Insights:

-

By Type: Food crops/cereals dominate the market with a share of 36.01% in 2025, owing to the essential role of staple grains in both domestic consumption and export portfolios. Brazil's favorable climate and vast agricultural land support large-scale cereal production, with soybeans, corn, and rice leading output volumes.

-

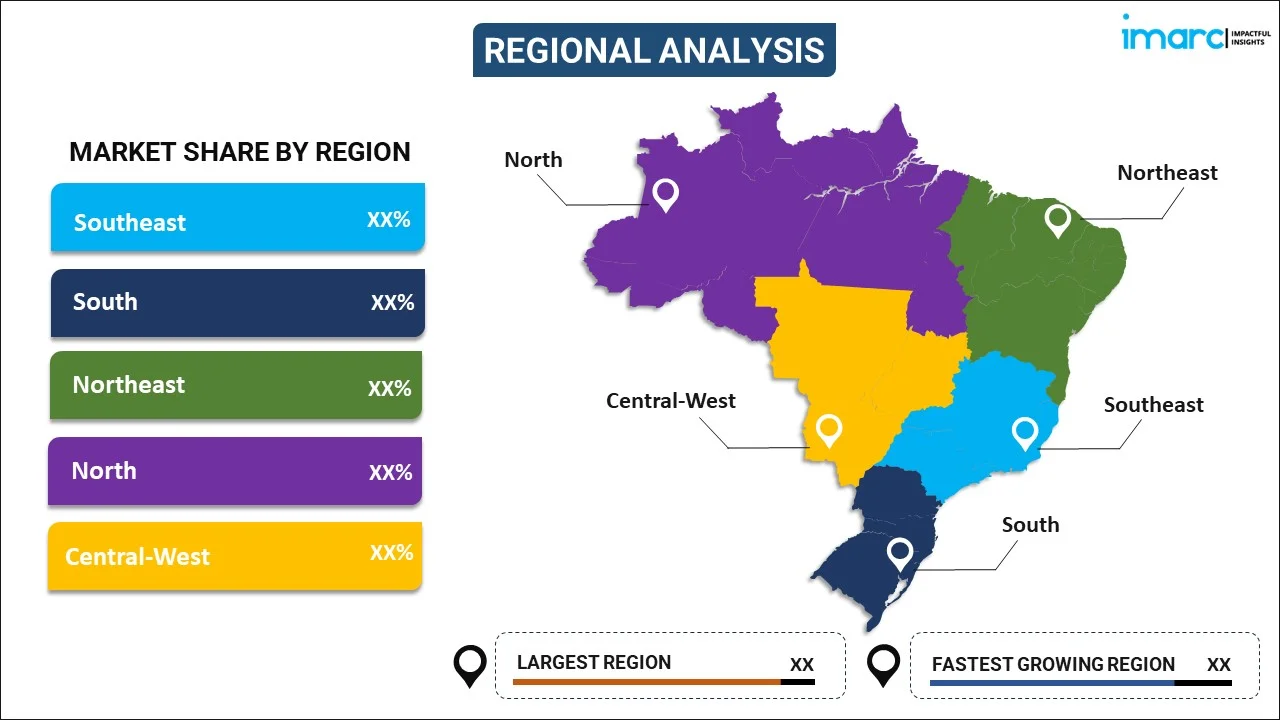

By Region: Southeast represents the largest region with 24% share in 2025, driven by advanced agricultural infrastructure, proximity to major consumption centers, and technological innovations. The region's established sugarcane and coffee industries contribute substantially to agricultural value generation.

-

Key Players: Key players drive the Brazil agriculture market by investing in sustainable farming practices, expanding precision agriculture technologies, and strengthening distribution networks. Their focus on crop innovations, mechanization, and export diversification enhances productivity and market competitiveness nationwide.

The Brazil agriculture market demonstrates robust growth fundamentals supported by a combination of favorable natural endowments, technological advancements, and proactive government policies. The sector benefits from expanded arable land, enabling large-scale production of cereals, oilseeds, fruits, and vegetables. Precision agriculture adoption has reached significant penetration levels, enhancing operational efficiency and yield optimization. In June 2024, Brazil’s President Luís Inácio Lula da Silva declared R$ 475.5 Billion (approximately USD 88.2 Billion) for the nation’s Crop Plan 2024/25 (Plano Safra, in Portuguese). This announcement signified a nine percent rise relative to 2023/24’s R$ 435.8 Billion (USD 80.9 Billion). This financing supports modernization initiatives, sustainable farming transitions, and infrastructure improvements. Growing international demand, particularly from Asian markets, continues to strengthen Brazil's position as a leading global food supplier.

Brazil Agriculture Market Trends:

Accelerating Digital Agriculture and Precision Farming Adoption

Brazilian agriculture is experiencing rapid digitalization, with farmers increasingly adopting precision agriculture technologies to optimize resource utilization and enhance productivity. Advanced tools, including global positioning system (GPS)-guided machinery, variable-rate application systems, and drone-based monitoring are becoming standard practice across large-scale farming operations. The integration of artificial intelligence (AI) and machine learning (ML) enables data-driven decision-making for crop management, pest control, and irrigation scheduling. As per IMARC Group, the Brazil AI market size reached USD 2,499.81 Million in 2024. This technological transformation supports both operational efficiency improvements and environmental sustainability goals across diverse agricultural operations.

Expansion of Sustainable and Regenerative Farming Practices

Sustainability has emerged as a central focus in Brazilian agriculture, with growing adoption of regenerative farming methods and integrated crop-livestock-forestry systems. Farmers are increasingly implementing no-till cultivation, cover cropping, and biological nitrogen fixation to enhance soil health and reduce environmental impact. The expansion of sustainable certification programs responds to evolving consumer preferences and international trade requirements demanding verified environmental compliance. Government initiatives provide financial incentives for producers transitioning to low-carbon agricultural practices.

Growing Export Activities

Rising export activities are significantly driving the Brazil agriculture market, as the country strengthens its position as a leading global supplier of soybeans, sugar, coffee, and meat. In Brazil, agricultural exports reached USD 164.4 Billion in 2024. Expanding international demand, particularly from China, the EU, and the Middle East, encourages higher production volumes and adoption of advanced farming practices to meet quality and quantity standards. Government support for export infrastructure, including ports, logistics, and trade facilitation, further enhances competitiveness. Consequently, increased export opportunities stimulate investments in technology, mechanization, and supply chain efficiency across the Brazil agriculture sector.

Market Outlook 2026-2034:

The Brazil agriculture market outlook remains positive, supported by continued expansion of cultivated area, technological modernization, and strengthening export relationships. The market generated a revenue of USD 130.97 Billion in 2025 and is projected to reach a revenue of USD 175.17 Billion by 2034, growing at a compound annual growth rate of 3.28% from 2026-2034. Government commitment to agricultural development through enhanced credit access, infrastructure investments, and trade promotion activities reinforces sector growth prospects. The ongoing integration of sustainable practices and digital technologies positions Brazilian agriculture for improved productivity and competitiveness in global markets. Increasing demand for soybeans, meat, and sugarcane continues to create strong export opportunities, further supporting market expansion.

Brazil Agriculture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Food Crops/Cereals | 36.01% |

| Region | Southeast | 24% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Food Crops/Cereals

- Fruits

- Vegetables

- Oilseeds and Pulses

Food crops/cereals dominate with a market share of 36.01% of the total Brazil agriculture market in 2025.

Food crops/cereals form the foundation of Brazilian agricultural production, encompassing major commodities, including soybeans, corn, rice, wheat, and beans. The segment benefits from Brazil's extensive arable land resources, favorable tropical and subtropical climatic conditions, and established agricultural infrastructure. Brazil's 2024/25 grain harvest was estimated at 322,3 Million Tons, with soybeans accounting for 166,33 Million Tons and corn production exceeding 119,6 Million Tons. Advanced farming techniques and mechanization support high productivity levels.

The segment also benefits from strong domestic consumption and growing international demand, particularly from China and Middle Eastern countries. Investments in precision agriculture, improved seed varieties, and integrated pest management enhance yield quality and resilience to climatic fluctuations. Infrastructure developments, including storage silos, grain terminals, and efficient transport networks, reduce post-harvest losses and improve supply chain efficiency. Furthermore, government support through various programs provides financial incentives, credit facilities, and technical assistance, encouraging farmers to expand cultivation areas.

Regional Insights:

To get detailed regional analysis of this marketRequest Sample

- Southeast

- South

- Northeast

- North

- Central-West

Southeast exhibits a clear dominance with a 24% share of the total Brazil agriculture market in 2025.

Southeast leads the agriculture market in Brazil due to its highly fertile soils, favorable climate, and well-established farming infrastructure. States, such as São Paulo, Minas Gerais, and Paraná, benefit from a combination of rich soil profiles, adequate rainfall, and advanced irrigation systems, supporting the cultivation of key crops like coffee, sugarcane, soybeans, and corn. The report from the Economic Department of the Federation of Agriculture and Livestock of São Paulo (Faesp), utilizing data from the National Supply Company (Conab), showed that the grain harvest in São Paulo for 2024/25 was projected to rise by 19.4%, totaling 10.7 Million Tons. The region also hosts a dense network of agribusiness enterprises, processing facilities, and research institutions, enabling efficient production, value addition, and supply chain integration.

Southeast’s superior transportation and logistics infrastructure further strengthens its agricultural dominance. Well-connected roadways, rail lines, and proximity to major ports in Santos and Rio de Janeiro facilitate efficient export of commodities to international markets. Additionally, high investment levels in technology adoption, mechanization, and crop management practices enhance productivity and yield stability. Government support, including credit programs and rural development initiatives, further incentivizes large-scale cultivation, solidifying Southeast’s position as the nation’s leading agricultural hub.

Market Dynamics:

Growth Drivers:

Why is the Brazil Agriculture Market Growing?

Strong Government Support and Agricultural Credit Programs

The Brazilian government provides substantial financial support to the agricultural sector through comprehensive credit programs and policy incentives. The government has committed record funding levels to support farmers across all production scales. Family farmers benefit from preferential credit lines through dedicated programs offering reduced interest rates for sustainable production practices. Environmental compliance incentives encourage producers to adopt low-carbon agricultural methods by providing interest rate reductions for those meeting sustainability criteria. Investment credit supports mechanization, irrigation infrastructure, and technology adoption, enabling productivity improvements across farming operations. The agricultural insurance program provides risk mitigation coverage for millions of hectares, protecting producers against weather-related losses and market volatility. These coordinated policy measures strengthen farmer confidence, facilitate modernization investments, and support the sector's continued expansion and competitiveness in global agricultural markets.

Expanding Export Markets and Trade Diversification

Brazil's agriculture sector benefits from growing international demand and successful market diversification strategies. In the initial six months of 2025, Brazilian agribusiness reported exports totaling USD 82 Billion, demonstrating the sector's critical role in national economic performance. With significant demand for meat, soybeans, and other commodities driving bilateral trade volumes, China continues to be one of the main markets for Brazilian agricultural exports. Hundreds of new market access opportunities in a variety of product categories and geographical locations have been made possible by government trade promotion initiatives. Brazilian agricultural products have seen a notable increase in sales in the Middle East and Africa, owing to concerted marketing initiatives and restored diplomatic connections. Brazil continues to export a lot of agricultural products to Europe, and negotiations for a trade agreement are improving the country's chances of gaining market access. Higher-value goods like processed foods, specialty crops, and certified sustainable products are examples of export diversification that goes beyond conventional bulk commodities.

Technological Advancements and Productivity Improvements

Significant productivity gains in the Brazil agriculture sector are fueled by technological advancements, which allow existing planted lands to increase yield. Optimized input usage and yield improvements are made possible by precision agriculture technology like remote sensing, variable-rate application systems, and GPS-guided equipment. Data-driven decision-making for planting, crop protection, and harvest activities is supported by the extensive use of digital farm management platforms. Improved crop varieties with increased production potential, disease resistance, and climate adaptability traits have been made possible by developments in biotechnology. Innovations specific to Brazilian growing environments and production systems are facilitated by investments in agricultural research and development (R&D) activities. Improvements in connectivity provide access to the advantages of precision agriculture by bringing digital tools to previously underserved rural areas. Emerging technologies, including AI, ML, and autonomous equipment, represent the next frontier of agricultural advancement.

Market Restraints:

What Challenges the Brazil Agriculture Market is Facing?

Climate Variability and Weather-Related Production Risks

Extreme weather events and climate unpredictability have a major impact on crop yields and production stability in Brazilian agriculture. While excessive rains and flooding create agricultural damage and logistical difficulties, drought conditions in key producing regions can significantly diminish output. Growing conditions in many agricultural zones are uncertain due to El Niño and La Niña weather patterns. Certain crops are more susceptible to localized weather events that impact national production levels due to their geographic concentration.

High Production Costs and Input Price Volatility

Brazilian farming enterprises face challenges to agricultural viability due to high production costs and changes in input prices. High interest rates restrict producers' ability to make investments and their operational flexibility by raising their borrowing expenses. The economics of product distribution and input procurement are impacted by rising fuel and transportation costs, which reduce farm profits and limit expansion efforts.

Infrastructure Limitations and Logistics Challenges

In particular areas, inadequate logistics and transportation infrastructure hinder agricultural productivity and competitiveness. Transportation costs and delivery delays from production areas to processing facilities and export ports are increased by deteriorating road quality and a lack of rail network coverage. Post-harvest losses and marketing difficulties result from storage capacity deficiencies, compared to production expansion. During the busiest export seasons, port congestion increases expenses and delays that impact producer returns and access to foreign markets.

Competitive Landscape:

The Brazil agriculture market features a diverse competitive landscape, encompassing multinational corporations, domestic agribusiness enterprises, cooperatives, and family farming operations. Large-scale commercial producers leverage advanced technologies, economies of scale, and direct market access to maintain competitive advantages in commodity production. Cooperatives play a significant role in aggregating smallholder production, providing technical assistance, and enabling market participation for member farmers. Input suppliers, including seed companies, fertilizer manufacturers, and crop protection providers, compete on product innovations, technical support, and distribution network coverage. Agricultural machinery manufacturers invest in local production facilities and precision technology offerings tailored to Brazilian farming conditions.

Recent Developments:

-

In October 2025, Brazil declared that it was set to host the Conference of Ministers of Agriculture of the Americas, where attendees would address crucial topics concerning the ongoing and future state of agriculture and food security in the hemisphere, emphasizing science, technology, and innovations in transforming production. The event would be organized by the Inter-American Institute for Cooperation on Agriculture (IICA) and the Brazilian government, occurring in the capital, Brasilia, from November 3 to 5.

Brazil Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Crops/Cereals, Fruits, Vegetables, Oilseeds and Pulses |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Brazil agriculture market size was valued at USD 130.97 Billion in 2025.

The Brazil agriculture market is expected to grow at a compound annual growth rate of 3.28% from 2026-2034 to reach USD 175.17 Billion by 2034.

Food crops/cereals dominated the market with a share of 36.01%, driven by the essential role of staple grains in both domestic consumption and export portfolios, supported by favorable climatic conditions and established agricultural infrastructure.

Key factors driving the Brazil agriculture market include strong government support through agricultural credit programs, expanding export markets with trade diversification, technological advancements and precision farming adoption, and favorable natural endowments.

Major challenges include climate variability and weather-related production risks, high production costs and input price volatility, infrastructure limitations affecting logistics efficiency, currency exchange rate fluctuations, and elevated interest rates impacting financing costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)