Brazil Adhesives Market Size, Share, Trends and Forecast by Resins, Technology, End Use Industry, and Region, 2025-2033

Brazil Adhesives Market Size and Share:

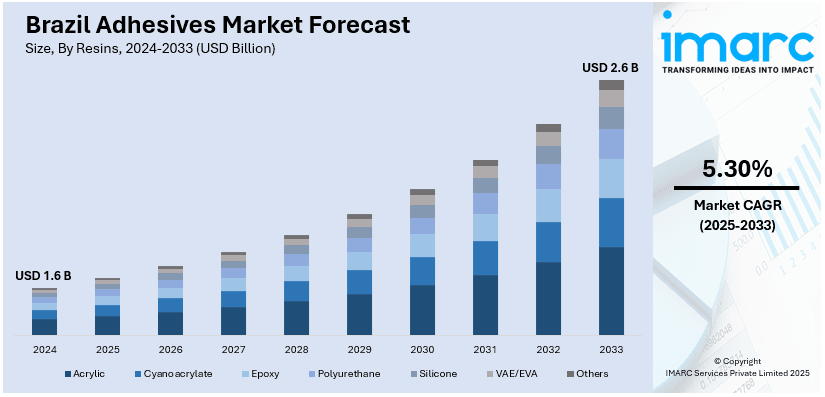

The Brazil adhesives market size was valued at USD 1.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.6 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. The market is primarily driven by the growth in the construction and automotive industries, rising demand in packaging and labeling applications, increased adoption of lightweight materials, advancements in adhesive technologies, and the shift toward eco-friendly and sustainable adhesive solutions across various sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

The market in Brazil is highly influenced by the ever-growing industries in the region that need adhesives for bonding and assembly purposes. The growing preference for customized and modular furniture has further driven the adoption of versatile adhesives. Also, the growing healthcare industry in Brazil is driving the need for medical-grade adhesives. These products are applied in areas like wound care, medical device assembly, and wearable health monitoring systems. For example, on April 26, 2023, Mitsui Chemicals collaborated with SHOFU and SUN MEDICAL to unveil the Super-Bond™ dental adhesive in Brazil. This product's superior adhesiveness aids in enhancing dental treatments in the emergent Brazilian market.

Additionally, the growth in the textile and footwear industries within Brazil also positively influences the need for adhesives used in product production, such as shoes and clothes. Besides that, efforts from the government to propel the growth in the industry provide a favorable environment for the expansion of the adhesives market in Brazil. For example, on October 15, 2024, Brazil's Senate approved Bill No. 6120, a chemical management bill modeled after the European REACH system. The bill mandates the creation of a national chemical registry and requires all chemicals produced or imported in quantities of one ton or more to be registered. It aims to enhance chemical safety and minimize environmental and health risks. Local and global manufacturers are also investing in research and development (R&D) to produce adhesives that align with international standards, making Brazilian products more competitive in the global market.

Brazil Adhesives Market Trends:

Industrial Expansion and Infrastructure Development

The Brazil adhesives market share is heavily influenced by the country's ongoing industrial and infrastructure growth. Major sectors such as automotive, construction, and electronics are rapidly expanding due to increased foreign investments and government-backed infrastructure projects. Adhesives play a pivotal role in ensuring the durability and functionality of materials in these industries. In construction, adhesives are essential for flooring, paneling, and insulation applications. For example, On July 8, 2024, Vollert announced the development of a new housing concept aimed at Brazil's middle class, called Ecoparque Bairros Integrados. The project focuses on sustainable urban development, with affordable, eco-friendly housing in Cascavel, Paraná, designed to alleviate the country's housing. Meanwhile, the automotive sector utilizes advanced adhesive solutions for lightweight materials, promoting fuel efficiency.

Rising Demand in Consumer Goods and Packaging Industries

As consumer spending continues to rise in Brazil, driven by urbanization and a growing middle class, the demand for reliable and aesthetic packaging has risen. Adhesives are critical in maintaining package integrity, particularly for food, beverages, and pharmaceutical products. The expansion of e-commerce leads to increased demand in packaging solutions. These further fuels adhesive consumption, promoting innovations in technologies of adhesives. In this regard, lightweight, flexible, and recyclable packaging materials stimulate a positive Brazil adhesives market outlook. For example, COIM Group announced its expanded range of packaging adhesives at Drupa 2024, taking place from May 28 to June 7, 2024. It introduced cold seal coatings, which are water-based adhesives for rapid product packaging across various sectors, including food and detergents. This expansion addresses the growing demand for sustainable packaging solutions and caters to industries such as dairy, bakery, and frozen foods. Produced at COIM's Italian and Brazilian facilities, these coatings enhance packaging efficiency and energy savings while supporting mechanical recycling processes.

Advances in Technology and Sustainability

Technological and sustainable changes positively influence Brazil's adhesives market growth. The need to be more environmentally friendly is resulting in changes in industries toward developing energy-efficient or green products. Therefore, leading to an adaptation of bio-based and solvent-free formulations in the adhesives. All of these innovations satisfy the demand for green building materials, recyclable packaging, and green automotive products. Sustainable adhesive packaging uses environmentally friendly materials and formulations that are recyclable, biodegradable, or made from renewable resources to reduce environmental impact without sacrificing performance and functionality. For example, on October 29, 2024, Dow and Ambipar strengthened their strategic partnership to revolutionize the plastic recycling market in Brazil. The collaboration will raise polyethylene recycling from 2,000 to 60,000 tons per year by 2030, with a focus on advanced mechanical recycling technologies. This initiative supports the circular economy in Brazil, as it insists on sustainable waste management and high-quality post-consumer resin. These developments help support the growth of sustainable materials that can be used in adhesive formulations. Such progress helps develop adhesives that are environmentally friendly for packaging, as well as other applications requiring recycled content. Additionally, advancements like nanotechnology enhance adhesive performance, enabling stronger bonds and greater versatility across substrates. In the present sustainability context, firms using environmentally friendly adhesives with minimized carbon footprint see great benefits.

Brazil Adhesives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Brazil adhesives market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on resins, technology, and end use industry.

Analysis by Resins:

- Acrylic

- Cyanoacrylate

- Epoxy

- Polyurethane

- Silicone

- VAE/EVA

- Others

Acrylic adhesives are gaining popularity in Brazil as they are practical, strong, and very resistant to weather. These bonding agents are well used in construction, automotive, and electronics, where high strength and endurance to changing environmental conditions are essential. Acrylic adhesives are used in signage and graphics applications as they have transparency and resistance against UV. With growing industrialization and the need for high-performance adhesive solutions, acrylic adhesives continue to be a cornerstone of Brazil's adhesives market across diverse applications.

Cyanoacrylate adhesives, commonly known as superglues, are valued in Brazil for their rapid bonding and precision. These adhesives are greatly used in sectors like medical appliances, electronics, and consumer products where instant adhesion and reliability are of key importance. As these adhesives can adhere to various substrates like metals, plastics, and ceramics, they have a significant level of flexibility. The electronics and automotive industry require lightweight, compact components to grow the need for these adhesives further. Cyanoacrylate occupies a leading position in the Brazilian landscape of adhesives.

Epoxy is of crucial importance in Brazil's industrial sectors, with respect to its exceptional strength, chemical resistance, and versatility. It provides durability and performance under extreme conditions, which is essential in the aerospace, automotive, and construction sectors. Epoxy adhesives are also important in infrastructure projects, such as bridges and high-rise buildings, due to their structural bonding properties. Superior performance that epoxy adhesives provide in critical applications ensures that they will continue to be an important part of Brazil's adhesives market.

Analysis by Technology:

- Hot Melt

- Reactive

- Solvent-borne

- UV Cured Adhesives

- Water-borne

The Brazilian market widely employs hot melt adhesives in the packaging, woodworking, and textile industries. Their speed-setting property qualifies them for high-speed operation of mass manufacturing processes. Some of the eco-friendly advantages of hot melt adhesives are that they are solvent-free and tend to cause the least amount of impact on the environment. As more industries in Brazil focus on efficiency and sustainability, the usage of hot melt adhesive technologies has increased and, therefore, further strengthens its position in the market. The industrial sectors, which are particularly critical for the application of epoxy, are associated with its great strength, excellent resistance to chemicals, and versatile uses.

Reactive adhesives are gaining ground in Brazil due to their excellent bonding properties and flexibility. These adhesives cure chemically to create strong and durable bonds. In applications like the electronics, automotive, and aerospace sectors, their use is therefore unavoidable. Additionally, they play a crucial role in construction as they are applied in structural bonding and waterproofing. The ever-growing demand for lightweight materials and advanced engineering solutions leads to the use of reactive adhesives in Brazil. With their suitability for extreme and long-lasting working conditions, reactive adhesives are a tool for the expansion of industrial advancement in Brazil.

Solvent-based adhesives remain a core part of any business in Brazil, such as footwear and furniture, including automotive, high-performance bonding. These adhesives have tremendous durability, strength, and excellent flexibility and provide resistance to changes in temperature. Despite the rising popularity of environmental solutions, solvent-borne adhesives continue to gain importance due to their reliability and adaptability in demanding applications. Regulatory pressures to reduce volatile organic compound (VOC) emissions are encouraging a slow transition towards water-based and solvent-free systems. Solvent-borne adhesives continue to be an essential part of Brazil's adhesives market, mainly in specialized industrial applications that require strong performance.

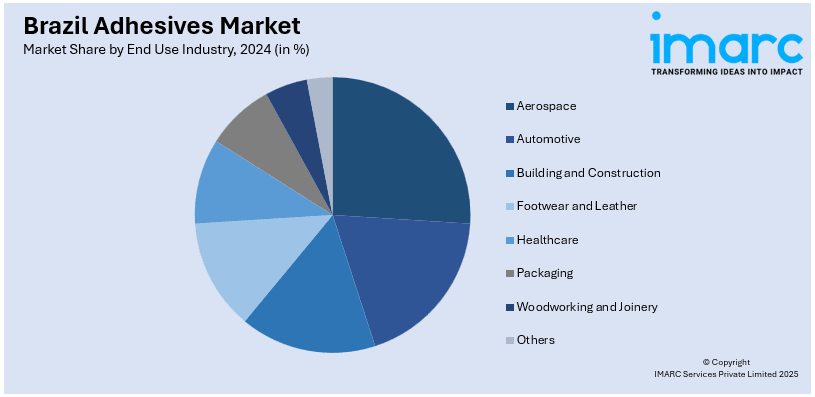

Analysis by End Use Industry:

- Aerospace

- Automotive

- Building and Construction

- Footwear and Leather

- Healthcare

- Packaging

- Woodworking and Joinery

- Others

The aerospace industry in Brazil is a growing segment of the adhesives market. Adhesives are critical in this sector for structural bonding, and vibration resistance. As global demand for aircraft increases, the demand for advanced adhesives, including epoxy and polyurethane, grows for use in interiors, composites, and exterior assemblies. Brazil's aerospace growth is also export-driven, and it requires international quality standards, thus forcing innovation in adhesive solutions. The demand for high-performance adhesives in this industry makes it a critical driver of the adhesives market in Brazil.

Adhesives are a part of the basic automotive manufacturing process; they contribute towards lowering the weight of vehicles, noise reduction, and enhanced safety. Adhesives are significantly applied in electric and conventional vehicles in bonding, sealing, and thermal management applications. As automakers embrace sustainable materials and electric vehicle technologies, innovation in adhesives continues to gain momentum. With its position as a regional leader in automotive production, Brazil's adhesives market benefits significantly from advancements and investments in this sector.

The building and construction sector is of great importance as it contributes to the national GDP and relies on adhesives for improving efficiency and construction speed. Rapid urbanization, large infrastructures, and household development require sustainable, efficient, and durable adhesive solutions. Sustainable development and building green practices expand demand for sustainable adhesives to align with environmental objectives. The building and construction industry, therefore, remains a key driver of Brazil's adhesives market.

Regional Analysis:

- Southeast

- South

- Northeast

- North

- Central-West

The southeast region is the major economy of Brazil. The region comprises states like São Paulo, Rio de Janeiro, and Minas Gerais. This region is significant to the adhesives market as it is a hub for industrial and commercial centers where adhesives are highly required in industries such as automotive, electronic equipment, and consumer goods. São Paulo contributes remarkably to the national GDP and acts as a logistical entry point for all domestic and foreign trade. The region's strong ports and transportation structures further strengthen the market, allowing it to distribute its adhesives to other places in Brazil as well as globally.

The southern region with Paraná, Santa Catarina, and Rio Grande do Sul is an incredibly diverse region that has flourishing industries. It is also notable in agribusiness, food processing, and textiles, and this boosts the demand for specialty adhesives in packaging, labeling, and textile manufacturing. Its location is also near the neighboring export markets like Argentina and Uruguay, so the region stands at an advantage in the market. The region has excellent infrastructure and highly skilled workforces that enhance its role in innovation and promote sophisticated adhesives.

The northeast region with Bahia, Pernambuco, and Ceará is another emerging region in the market for adhesives due to rapid industrialization and urbanization. Construction activities are prominent in the region, with impressive infrastructure projects and a thriving tourism industry. The role of adhesives in these developments is vital, especially for flooring, tiling, and waterproofing. Moreover, the Northeast's growth in agriculture and food processing has a demand for packaging adhesives. The growth potential in this region is a prime attraction for adhesive manufacturers to increase their market footprint further.

The north region has a special position in Brazil's adhesives market, with the Amazon rainforest dominating its economy. The timber and rubber industries are significant, creating demand for adhesives in wood processing and furniture manufacturing. The construction sector, fueled by urban development in cities like Manaus and Belém, also contributes to adhesive consumption. The North's natural resources and growing urban centers make it a vital market for adhesive applications.

The central-west region consists of states such as Goiás, Mato Grosso, and Mato Grosso do Sul, which are the heartlands of Brazilian agriculture. With a wide extent of agribusinesses for soybean and corn production, this region presents a need for adhesives used in agricultural equipment production and packaging. Increased urbanization in Brasília, the country's capital, also boosts demand from the construction industry, further raising the demand for adhesives. Furthermore, the strategic location within the country provides connectivity to other regions; therefore, it is a superior distribution center for adhesive manufacturers.

Competitive Landscape:

The Brazil adhesives market is highly competitive with both domestic and international players offering a wide range of products. Innovation, sustainability, and performance optimization are key aspects for market participants to meet the demands of key industries like packaging, construction, automotive, and healthcare. Market participants focus on the development of bio-based and low-VOC adhesives due to the increasing environmental regulations and consumer preferences for eco-friendly products. Also, technological advancements in lightweight and tough bonding solutions that are used in automotive and construction applications further enhance competition. Strategic collaborations among companies and dealers have developed local manufacturing and improved supply chain efficiencies. For instance, on September 20, 2024, Drytac, an international manufacturer of self-adhesive materials for large-format print and signage markets, appointed Corimpress as its exclusive distributor in Brazil. Based in Não Me Toque, Rio Grande Do Sul, Corimpress will stock and supply Drytac's products to customers throughout Brazil and the broader South American market. This strategic partnership will strengthen Drytac's position in the region, thereby making its range of products, such as laminating films, mounting adhesives, and graphic media, more accessible.

The report provides a comprehensive analysis of the competitive landscape in the Brazil adhesives market with detailed profiles of all major companies.

Brazil Adhesives Market News:

- October 5, 2023: Actega announced the consolidation of all operations in Brazil into one state-of-the-art location in Araçariguama, São Paulo. Here, the corporation is integrating three sites into a 22,500 sqm location that strengthens its production and research and development (R&D) capabilities for South America. The expansion reinforces Actega's position as the region's leading manufacturer of specialty coatings, inks, adhesives, and sealants focused on metal packaging and flexible packaging solutions.

- February 28, 2024: Henkel announced plans to build a new Inspiration Center for Adhesive Technologies in São Paulo, Brazil. The center will enhance the company's collaboration with local customers, driving innovation and sustainable solutions across various industries. It is part of Henkel's broader strategy to expand its capabilities in the Latin American market and strengthen its position in the adhesive sector.

- May 13, 2024: Beontag introduced a variety of self-adhesive wine labels that marked its entrance into the Latin American wine market. The offerings include the Grass Natural and White Martelé labels, which highlight their sustainability by incorporating grass fiber and FSC-certified cellulose. This development supports the prestige winemaking industry in the region while reflecting Beontag's commitment to advanced, sustainable labeling solutions.

- June 12, 2024: Sun Chemical declared that it would prioritize sustainability initiatives at the Flexo and Labels Expo 2024 in Sao Paolo, Brazil. The company will focus on innovations in eco-friendly packaging, energy-efficient technologies, and sustainable inks, coatings, and adhesives that meet its environmental responsibility goals. Through global laboratory networks and dedicated research and development (R&D) investments, Sun Chemical develops tailored solutions for Latin American customers with unique packaging needs.

- June 27, 2024: In Northeastern Brazil, All4Labels opened its first facility in the Conde, João Pessoa metropolitan area. Investment is valued at EUR 3 Million, using the latest flexo technology, which would fuel the fast-growing areas of food, health, and personal care in the region. The new All4Labels location will manufacture adhesive labels, strongly emphasizing sustainable, high-quality solutions for various industries.

Brazil Adhesives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resins Covered | Acrylic, Cyanoacrylate, Epoxy, Polyurethane, Silicone, VAE/EVA, Others |

| Technologies Covered | Hot Melt, Reactive, Solvent-borne, UV Cured Adhesives, Water-borne |

| End Use Industries Covered | Aerospace, Automotive, Building and Construction, Footwear and Leather, Healthcare, Packaging, Woodworking and Joinery, Others |

| Regions Covered | Southeast, South, Northeast, North, Central-West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Brazil adhesives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Brazil adhesives market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Brazil adhesives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Adhesives are substances used to bond materials together by surface attachment, offering strength and durability. They are available in various types, such as epoxy, polyurethane, acrylic, and silicone, catering to industries like construction, automotive, packaging, and healthcare. Applications of adhesives include structural bonding, sealing, and laminating.

The Brazil adhesives market was valued at USD 1.6 Billion in 2024.

IMARC estimates the Brazil adhesives market to exhibit a CAGR of 5.30% during 2025-2033.

The Brazil adhesives market is driven by rising demand in the packaging, construction, and automotive sectors. Rapid urbanization and infrastructure projects boost the need for construction-related adhesives. The automotive industry’s shift toward lightweight materials enhances demand for advanced adhesives, further supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)