Brain Implants Market Size, Share, Trends, and Forecast by Product, Application, and Region, 2025-2033

Brain Implants Market Size and Share:

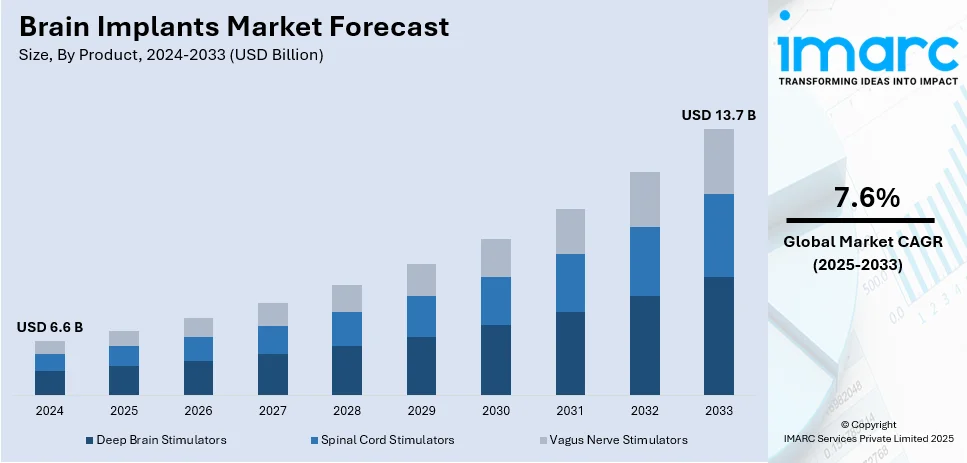

The global brain implants market size was valued at USD 6.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 13.7 Billion by 2033, exhibiting a CAGR of 7.6% during 2025-2033. North America currently dominates the market, holding a significant market share of over 42% in 2024. This leadership is attributed to advanced healthcare systems, strong R&D investments, and high demand for innovative treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.6 Billion |

|

Market Forecast in 2033

|

USD 13.7 Billion |

| Market Growth Rate (2025-2033) | 7.6% |

The rising prevalence of neurological disorders is a significant driver of the brain implants market. As global populations age, conditions, such as Parkinson’s disease, Alzheimer’s, epilepsy, and chronic depression, are becoming more widespread, increasing the demand for advanced treatment solutions. Brain implants, including deep brain stimulation (DBS) and responsive neurostimulation (RNS), offer effective therapeutic options by modulating neural activity and improving patient outcomes. For instance, Illinois Tech recently developed the Intracortical Visual Prosthesis (ICVP), a groundbreaking brain implant that bypasses the retina and optic nerves, directly stimulating the visual cortex to provide artificial vision to individuals with blindness. The implant improves navigation and visually guided task performance, reflecting advancements in neurotechnology and highlighting the importance of ethical, responsible innovation. Additionally, growing awareness, improved healthcare infrastructure, and supportive regulatory policies are accelerating adoption. As neurological diseases impose a greater burden on healthcare systems, the demand for innovative, long-term solutions like brain implants continues to rise.

The United States plays a pivotal role in the brain implants market through advanced research, strong healthcare infrastructure, and significant investments in neurotechnology. Leading biotech firms and academic institutions drive innovation in brain-computer interfaces (BCIs), deep brain stimulation (DBS), and neuroprosthetics. Supportive regulatory frameworks, such as FDA approvals for cutting-edge implants, further enhance market growth. For instance, in 2024, Abbott received FDA approval for the Liberta RC™ DBS system, the world’s smallest rechargeable device for movement disorders, requiring just 10 recharge sessions annually for most users. Additionally, the rising prevalence of neurological disorders, coupled with high healthcare expenditure, fuels demand for brain implant technologies. With continuous research funding, technological advancements, and increasing clinical applications, the U.S. remains a key driver in shaping the future of the global brain implants market.

Brain Implants Market Trends:

Rising Neurological Disorders

Neurological diseases like Alzheimer's, Parkinson's, epilepsy, and multiple sclerosis are increasingly common as people age and because of a changed lifestyle. According to WHO, in 2021, more than 3 billion people, or about 43% of the global population, were living with a neurological condition. Due to increasing numbers of patients, the need for proper treatment procedures also is on the rise, such as brain implants. Traditional remedies for neurological conditions, including drugs, are often narrow in scope and carry side effects. Brain implants, such as deep brain stimulators and neuroprosthetics, provide advanced therapeutic choices that can benefit patients in regulating symptoms and improving lifestyle. Brain implants hold a greater promise than current treatments against the anguish of neurological diseases. They are also being studied for applications such as cognitive improvement and neurorehabilitation, which is further catalyzing its demand.

Growing Research and Development (R&D) Activities

Research and development (R&D) activities are resulting in the development of enhanced brain implant technologies, such as more effective neurostimulators, brain-computer interfaces (BCIs), and neuroprosthetics. These advancements improve the functioning and efficacy of brain implants, making them more desirable to medical professionals and patients. In the future, ongoing studies will explore alternative applications for typical brain implants focusing on neurological remedies. The growing demand for brain implants in cognitive enhancement, mental health therapy, and rehabilitation are driving the market growth. As of June 2022, there were over 23,000 interventional studies and more than 7,900 observational studies on Central Nervous System (CNS) conditions listed on ClinicalTrials.gov. R&D projects aim to improve the biocompatibility, safety, and long-term functioning of brain implants. Research is very important to solve challenges like infection, rejection, and device failure and gain patient and healthcare providers’ trust, which will eventually increase the adoption rate. To prove the safety and efficacy of brain implants, numerous clinical trials are required.

Increasing Acceptance of Neurostimulation Techniques

Parkinson’s disease, epilepsy, and chronic pain are all neurological disorders that can be effectively cured by deep brain stimulation (DBS). According to a research article, DBS has been shown to reduce motor symptoms in Parkinson’s disease by up to 89%. These treatments are widely utilized by healthcare providers because there are several clinical evidence proving their efficacy. It is very important to reduce symptoms and increase the functional capacity of patients to enhance their quality of life and so neurostimulation is highly preferred. This, in turn, is also driving the demand for brain implants because patients are recognizing its actual benefits. Treatment-resistant diseases are creating challenges for healthcare providers and so conventional treatments are taken into consideration as insufficient. To try alternate treatments, neurostimulation approaches have been preferred, as it can be transitioned to more advanced interventions like brain implants. As more patients share their success stories and neurostimulation experiences, the patient community becomes more knowledgeable and accepting. This grassroots advocacy can increase interest and demand for brain implants.

Brain Implants Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global brain implants market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

Analysis by Product:

- Deep Brain Stimulators

- Spinal Cord Stimulators

- Vagus Nerve Stimulators

Deep brain stimulators lead the market with around 37.2% of the market share in 2024. The driving force behind this dominant position is the increasing demand for advanced treatment options for neurological disorders such as Parkinson's disease, epilepsy, and essential tremors. DBS systems have been proven effective in managing symptoms and improving the quality of life of patients through the delivery of electrical impulses to targeted areas of the brain. Technological advancements, including the development of smaller, rechargeable devices and wireless programming capabilities, have enhanced the appeal of DBS systems. Further, because of continuous research and increasing acceptance of DBS as standard therapy, it further enhances its market-leading position. Further innovations can likely increase the deep brain stimulator segment's substantial market share.

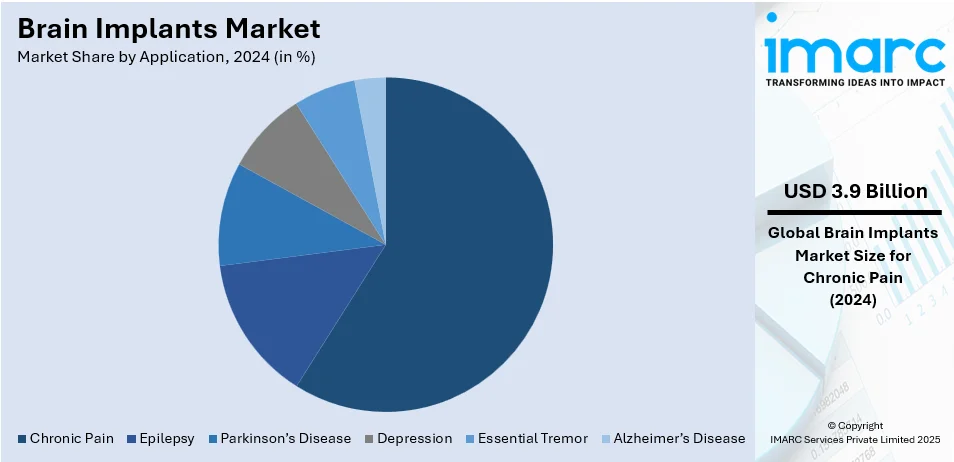

Analysis by Application:

- Chronic Pain

- Epilepsy

- Parkinson’s Disease

- Depression

- Essential Tremor

- Alzheimer’s Disease

Chronic pain leads the market with around 58.9% of the market share in 2024. This dominance is driven by the growing prevalence of chronic pain conditions, such as back pain, neuropathic pain, and fibromyalgia, which affect millions worldwide. Brain implants, particularly spinal cord stimulators (SCS) and deep brain stimulators (DBS) have proven effective in providing relief to patients who do not respond well to conventional treatments like medication or physical therapy. These sophisticated devices act on the signals in the brain or spinal cord, thereby alleviating chronic pain and providing an extended period for treatment. Going forward, since there is still a growing requirement for minimally invasive and permanent pain management alternatives, the segment of chronic pain will continue its leadership in the brain implants market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42%. This market dominance is due to the region's advanced healthcare infrastructure, high levels of research and development, and significant investments in neurotechnology. The presence of leading medical device manufacturers and a growing number of clinical trials contribute to the region's leadership. In addition, the rising incidence of neurological conditions like Parkinson's disease, epilepsy, and chronic pain is contributing to the growing need for brain implants. The U.S. is a market in which the best player is seen favorably with regard to regulatory policies, relatively higher healthcare spending, and a greater orientation towards innovation. With the emergence of new technologies, North America will continue to hold its position in the global brain implants market.

Key Regional Takeaways:

United States Brain Implants Market Analysis

US accounts for 85.2% share of the market in North America. U.S. brain implants market is in a growth trajectory with the recent advances in neuroscience and the increase in demand for neurological conditions-related treatments. As reported by the American Academy of Neurology, in 2019, direct healthcare costs for brain disorders in the United States were estimated at USD 409 billion, indicating that the economic impact of neurological diseases is a serious issue. In addition, the Society for Neuroscience states that neurological diseases and mental health disorders incur costs exceeding USD 760 billion each year in the U.S., making innovative therapies the sole solution to fulfill these treatment needs. It has further spurred more interest in neurostimulation therapies, such as deep brain stimulation (DBS), used for the treatment of Parkinson's disease, epilepsy, and dystonia, among other conditions. As reported by NIH, by 2023, more than 100,000 patients in the United States have undergone DBS implant surgery, and the market is predicted to grow due to the emergence of brain-computer interfaces (BCIs) that provide possible therapies for numerous ailments. Leading companies like Medtronic and Abbott continue to drive innovation, with regulatory bodies ensuring safety and efficiency, which fosters further growth in the sector. Backed by the government, initiatives in neurotechnology provided by the National Institutes of Health are also aiding research. Cut-edge brain implant solutions are hence being developed because of such backings. Being a leader globally in the U.S. Brain Implants market, the substantial investments and high level of awareness remain to be observed.

Europe Brain Implants Market Analysis

Europe has shown robust growth in the market of brain implants. The key driving factors in the growth are advanced technology and rising neurological disorder conditions. The EBC reveals that 1 out of every 3 people living in Europe develops some form of neurological or mental disorder at least once in a lifetime. Currently, it is estimated that approximately 165 million Europeans are experiencing a brain disorder. This condition manifests differently across nations; nonetheless, approximately 60% of the global population experiences a form of neurological disorder. To cater for these rising numbers of patients seeking medical treatment, attention has increasingly shifted towards neurostimulation technologies including deep brain stimulation devices which have become very vital in treating the likes of Parkinson's disease, epilepsy, and chronic pain among other conditions. The market for brain implants is poised to grow since the healthcare system in countries like Germany, France, and UK gives priority neurological care. A recent development here is that the German government has further increased funding towards healthcare innovation that will be further used for advanced medical devices. Companies like Medtronic and Boston Scientific are investing a lot in research and development. Government-backed initiatives such as Horizon 2020 will further innovate neurotechnology. As the demand for brain implants increases, Europe is at a prime position to take up a large market share in the world.

Asia Pacific Brain Implants Market Analysis

Asia Pacific brain implants market is growing rapidly due to investments in healthcare and increased demand for neurological treatments. According to a report released in Frontiers in Public Health, total health spending in China for 2023 was roughly 2,254.2 billion yuan, equating to around USD 315 billion. A significant portion of the spending is allocated to brain health and neurostimulation technologies, contributing to the market's growth. The Indian government also suggested an estimated healthcare budget for 2023 of around INR 86,175 crore, which is roughly USD 11 billion. It has risen by almost 3.4% compared to last year, aimed at advancing infrastructure for neurological health services. As of 2023, the DBS patient population in Japan reportedly grows at a consistent rate; similarly, clinical trials concentrating on neurostimulation treatments have also risen steadily. Neurostimulation device demand is growing across the region. In countries such as South Korea and Australia, demand is more prominent. Some of the prominent companies leading advancements in neurotechnology solutions are Cyberdyne of Japan and Bharat Dynamics of India. The region is experiencing a boost in healthcare infrastructure investment, while neurological diseases awareness is on the rise, contributing to the growth of the Asia Pacific brain implants market at an extremely rapid rate, making it a key player in the global industry.

Latin America Brain Implants Market Analysis

Latin America's brain implants market is showing significant growth as a result of increased healthcare investment and growing demand for neurological treatments. As reported by the International Trade Administration, Brazil allocated approximately USD 161 billion for healthcare in 2023, representing 9.47% of its GDP. Most of this expenditure is being put into upgrading the country's health infrastructure, which includes neurological care. In addition, increasing awareness of brain disorders and neurostimulation therapies is increasing the demand for brain implants in Brazil and other Latin American countries. As Brazil leads the region with substantial healthcare expenditure, countries like Mexico and Argentina are following suit with growing budgets aimed at enhancing medical services. Healthcare budgets continue to rise, with ongoing programs promoting access to better treatments; in this light, the region stands as a coming neurotechnological hub. Investment by both private and governmental funds, international cooperation, and many collaborative efforts further brain-implant-based treatments within the Latin America territory. Brazil, by its consistently strong healthcare spending, particularly by its growing middle class as well as the increasing access to health across the region, is well placed to lead the way.

Middle East and Africa Brain Implants Market Analysis

The demand for brain implants is rapidly increasing in the Middle East and Africa, majorly because the region is faced with an alarming increase in the prevalence of neurological diseases and growing investment in healthcare facilities. A 2019 journal article in Neurology estimated that neurological disorders were responsible for about 14.2% of fatalities in that area. This reflects the high burden of neurological diseases in the region and is fuelling the need for such advanced treatments as neurostimulation and implantation. That is why countries like Saudi and the UAE have increased their budgets for healthcare to meet this growing demand. For example, Saudi Arabia has already focused much on modernizing health, which includes investment in the latest medical devices, such as DBS. Apart from this, health infrastructure in South Africa is increasing accessibility to neurotechnology. Large companies like Medtronic and Boston Scientific are increasing their reach in the region by leveraging the growing demand for neurostimulation therapies. The region is also gaining importance in the global brain implants market due to government support towards the health sector, growing clinical trials, and rising awareness of neurological conditions.

Competitive Landscape:

The brain implants market is highly competitive, with numerous global players focusing on innovation, technological advancements, and strategic partnerships. Key companies lead the market with their deep brain stimulation (DBS) and neurostimulation devices. For instance, in 2024, Synchron integrated OpenAI's ChatGPT into its brain-computer interface (BCI) implants, aimed at improving communication for patients with disabilities like ALS. The ChatGPT-4o integration speeds up text entry by predicting responses and offering selectable options. This enhancement enables easier interaction with devices for individuals with severe motor impairments. Startups and emerging players are also introducing novel brain-computer interfaces (BCIs) and wireless neuroprosthetics, intensifying competition. Organizations are making substantial investments in research and development to broaden their product offerings and enhance the safety and effectiveness of their devices. Strategic collaborations, mergers, and acquisitions are common as firms seek to strengthen their market position, enhance technological capabilities, and address growing patient demand.

The report provides a comprehensive analysis of the competitive landscape in the brain implants market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Aleva Neurotherapeutics SA

- Boston Scientific Corporation

- Medtronic plc

- NeuroPace Inc.

- Nevro Corp.

- Synchron

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Latest and News Developments:

- September 2024: Abbott revealed it will be revitalizing its initiatives to address treatment-resistant depression using its Infinity deep brain stimulation (DBS) system. The new study focuses on patients who have not succeeded with at least four antidepressant medications. Abbott was granted FDA breakthrough device designation in 2022 for this purpose.

- August 2024: Medtronic obtained FDA clearance for Asleep Deep Brain Stimulation (DBS) surgery, a groundbreaking treatment alternative available for patients with Parkinson's disease and essential tremor. Indeed, the groundbreaking FDA approval for Asleep DBS will guarantee a secure and effective procedure, whether conducted under general anesthesia or while the patient is awake.

- January 2024: The Liberta RC™ DBS system, recognized as the world's smallest rechargeable deep brain stimulation device, has received FDA approval. The annual recharge necessity is 10 sessions, and it works seamlessly with Abbott's NeuroSphere Virtual Clinic, enabling remote interaction between the doctor and the patient undergoing treatment for movement disorders.

- January 2024: The brain-computer interface company Neuralink announced that it conducted a second successful surgery for its human implant, allowing the individual to utilize their neurons to manage external devices such as smartphones and computers.

- January 2024: Motif Neurotech, a startup in Houston collaborating with researchers from Rice University and clinicians at UT-Health, secured an investment of USD 18 million to advance its brain implant aimed at treating depression that is resistant to traditional therapies towards clinical application.

Brain Implants Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Deep Brain Stimulators, Spinal Cord, Stimulators, Vagus Nerve Stimulators |

| Applications Covered | Chronic Pain, Epilepsy, Parkinson’s Disease, Depression, Essential Tremor, Alzheimer’s Disease |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Aleva Neurotherapeutics SA, Boston Scientific Corporation, Medtronic plc, NeuroPace Inc., Nevro Corp. and Synchron |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the brain implants market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global brain implants market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the brain implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The brain implants market was valued at USD 6.6 Billion in 2024.

IMARC estimates the brain implants market to reach USD 13.7 Billion by 2033, exhibiting a CAGR of 7.6% during 2025-2033.

Key factors driving the brain implants market include the increasing prevalence of neurological disorders, advancements in neurotechnology, and growing demand for effective treatments like deep brain stimulation. Additionally, the rising adoption of brain-computer interfaces, improved surgical techniques, and regulatory support further propel market growth and innovation.

North America currently dominates the market with a 42% share. This dominance is driven by advanced healthcare infrastructure, high research and development investments, and a significant presence of leading manufacturers. Additionally, the growing prevalence of neurological disorders and supportive regulatory frameworks contribute to the region's strong market position.

Some of the major players in the brain implants market include Abbott Laboratories, Aleva Neurotherapeutics SA, Boston Scientific Corporation, Medtronic plc, NeuroPace Inc., Nevro Corp., Synchron, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)