Bottling Line Machinery Market Report by Technology (Automated, Semi-Automated), Application (Glass, Polyethylene Terephthalate (PET), Metal Can), End Use (Beverages, Sauces, Syrups, Healthcare Products, Household Products), and Region 2025-2033

Market Overview:

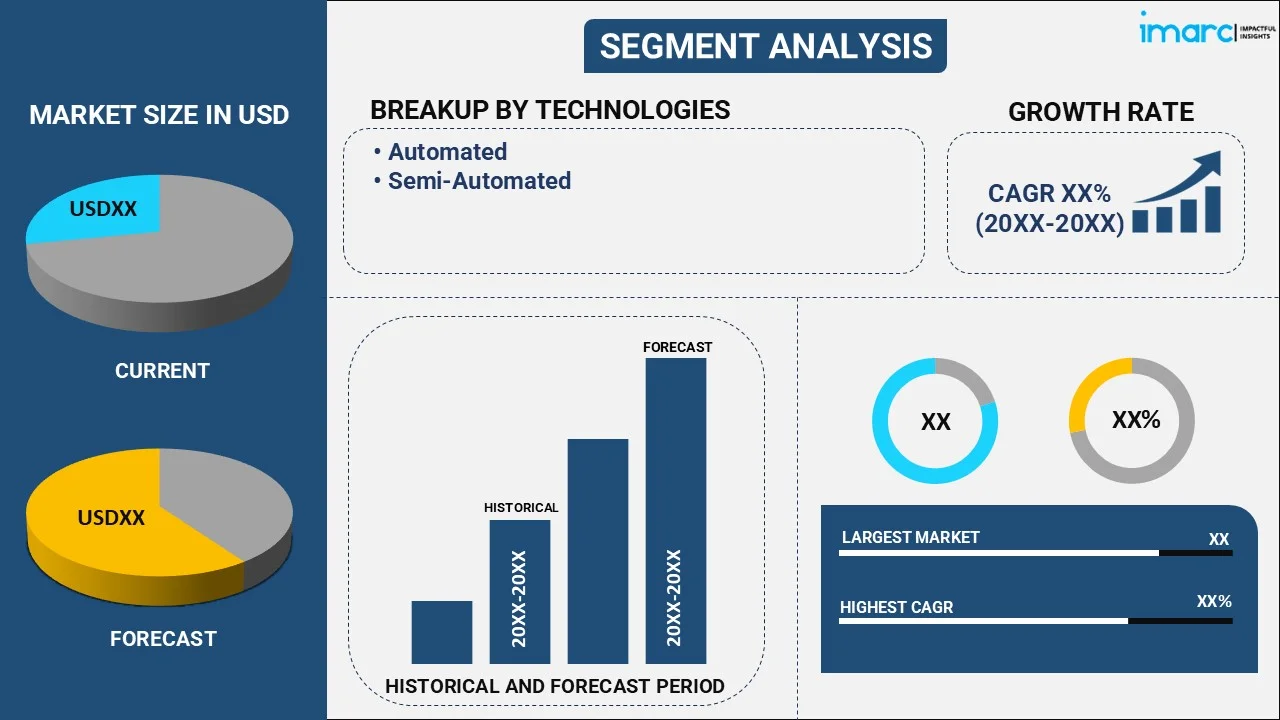

The global bottling line machinery market size reached USD 5.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.6 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The escalating demand for packaged beverages, the imperative of operational efficiency and cost-effectiveness, the industry's strong focus on sustainability through eco-friendly technologies, rapid urbanization, the integration of smart manufacturing practices, and the stringent regulatory standards are factors contributing to the market growth.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.0 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Market Growth Rate (2025-2033) | 4.37% |

Bottling line machinery is a crucial component of the beverage and manufacturing industry, serving as an integrated system for efficiently filling, capping, labeling, and packaging liquids into bottles. It streamlines the production process by automating various tasks, ensuring consistent quality and output. The process begins with bottles being loaded onto the line, followed by precise filling of the liquid product, usually through a combination of sensors and volume meters. Subsequently, capping mechanisms secure the bottles, and labeling units apply branding information. These systems cater to a wide range of industries, including beverages, cosmetics, pharmaceuticals, and household chemicals. The benefits of bottling line machinery encompass heightened production speed, reduced manual labor, and enhanced accuracy in measurements and labeling. Several types of bottling line machinery are available, such as rotary fillers, inline fillers, and monoblock systems, each designed to accommodate different production scales and bottle sizes.

The global bottling line machinery market is influenced by the rising demand for beverages across diverse segments, including soft drinks, alcoholic beverages, and water. Additionally, the escalating demand for enhanced operational efficiency and productivity in the beverage industry propels the adoption of advanced bottling line machinery, thus augmenting the market growth. Furthermore, increasing consumer preferences for convenience and on-the-go consumption is fueling the demand for bottled beverages, bolstering the market growth. In line with this, technological advancements, such as automation and smart packaging solutions, also play a pivotal role in driving market expansion, as they streamline production processes and ensure product integrity. Apart from this, the global shift toward sustainable practices and eco-friendly packaging and burgeoning investments in research and development (R&D) activities by key players are facilitating the market growth.

Bottling Line Machinery Market Trends/Drivers:

Rising demand for beverages

The global bottling line machinery market is strongly influenced by the increasing demand for a wide range of beverages. This demand spans various categories, including soft drinks, alcoholic beverages, and bottled water. As consumer preferences continue to evolve, the need for efficient and reliable bottling solutions becomes paramount. Manufacturers in the beverage industry require machinery that can handle diverse packaging formats and sizes while maintaining high production speeds. This demand surge is attributed to the growing global population, urbanization, and changing lifestyles. As more people opt for ready-to-drink products, bottling line machinery manufacturers are compelled to innovate and offer versatile solutions that cater to the specific needs of each beverage category.

Enhanced operational efficiency

The push for operational efficiency and productivity within the beverage industry serves as a significant driver for the global bottling line machinery market. Manufacturers are constantly seeking ways to optimize production processes, reduce downtime, and minimize waste. Advanced bottling line machinery equipped with automation, robotics, and real-time monitoring capabilities enables streamlined operations and precise control over packaging processes. Improved efficiency not only leads to cost savings but also allows manufacturers to meet increasing consumer demands promptly. As a result, investing in cutting-edge bottling line machinery becomes a strategic imperative for companies aiming to stay competitive in a dynamic and fast-paced market.

Consumer preference for convenience

The global trend of consumers favoring convenience and on-the-go consumption significantly impacts the demand for bottled beverages, shaping the bottling line machinery market. Modern lifestyles and busy schedules drive the need for packaged beverages that offer portability and ease of consumption. Bottled beverages provide a convenient option for consumers to quench their thirst or enjoy their favorite drinks without the need for additional preparation. As a response, bottling line machinery manufacturers focus on developing solutions that accommodate various packaging sizes, designs, and materials to cater to the diverse preferences of consumers. This consumer-driven demand for convenience propels manufacturers to continuously innovate and adapt their machinery offerings, ultimately driving growth in the bottling line machinery market.

Bottling Line Machinery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bottling line machinery market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology, application, and end use.

Breakup by Technology:

- Automated

- Semi-Automated

Automated dominates the market

The report has provided a detailed breakup and analysis of the market based on technology. This includes automated and semi-automated. According to the report, automated accounted for the largest market share.

The automated segment of the bottling line machinery market is driven by the surging demand for operational efficiency. Automation offers precise control over the bottling process, minimizing human error, reducing downtime, and optimizing production throughput. Additionally, the rising demand for consistent product quality plays a crucial role in propelling the adoption of automated bottling solutions. These systems ensure uniform filling, capping, and labeling, leading to reliable and standardized end products. In line with this, the imperative to enhance labor productivity and reduce dependency on manual labor intensifies the demand for automated bottling line machinery. Automation streamlines operations, enabling manufacturers to allocate human resources more strategically and allocate skilled labor to tasks that require intricate decision-making. This leads to overall cost savings and improved resource utilization.

Breakup by Application:

- Glass

- Polyethylene Terephthalate (PET)

- Metal Can

Polyethylene terephthalate (PET) dominates the market

The report has provided a detailed breakup and analysis of the market based on the application. This includes glass, polyethylene terephthalate (PET), and metal can. According to the report, polyethylene terephthalate (PET) accounted for the largest market share.

The polyethylene terephthalate (PET) segment is driven by several key factors, which includes its exceptional transparency and clarity properties, making it an ideal choice for packaging applications where product visibility is crucial, such as beverages and food products. Additionally, PET's lightweight nature contributes to reduced transportation costs and a lower environmental footprint, aligning with sustainability goals. The material's versatility enables the production of various packaging formats, from bottles to jars, further expanding its utility across different industries. PET's resistance to impact and shattering enhances product safety during handling and transportation. Furthermore, its recyclability aligns with the growing emphasis on eco-friendly packaging solutions, driving its adoption as consumers seek more sustainable choices.

Breakup by End Use:

- Beverages

- Sauces

- Syrups

- Healthcare Products

- Household Products

Beverages dominate the market

The report has provided a detailed breakup and analysis of the market based on the end use. This includes beverages, sauces, syrups, healthcare products, and household products. According to the report, beverages accounted for the largest market share.

The beverages segment is accelerated by several key factors, such as the shifting consumer preferences towards healthier and functional drinks, such as natural juices, herbal teas, and functional beverages fortified with vitamins and minerals. Moreover, urbanization and the increasing global middle-class population contribute to the rise in disposable incomes and changing lifestyles, thereby elevating the consumption of packaged and ready-to-drink beverages. In line with this, the expanding influence of digital media and social platforms enables beverage companies to effectively market their products to a broader audience, thereby boosting brand awareness and consumer engagement. Additionally, the growing awareness of environmental sustainability prompts the beverages segment to adopt eco-friendly packaging materials and practices, resonating with environmentally conscious consumers.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific exhibits a clear dominance, accounting for the largest bottling line machinery market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share.

The Asia Pacific region is witnessing robust growth in the bottling line machinery market due to the region's burgeoning population and increasing disposable incomes. This demographic shift fuels the need for efficient bottling line machinery to cater to the rising consumption patterns. In line with this, rapid urbanization and changing lifestyles have influenced consumer preferences toward convenience and on-the-go products. As a result, bottled beverages have gained popularity, prompting manufacturers to invest in advanced bottling line machinery to meet these evolving demands. Furthermore, the push for industrial automation and technological advancements across Asia Pacific economies has led to the adoption of innovative bottling solutions. Manufacturers are keen to enhance production efficiency, reduce manual intervention, and ensure consistent product quality, driving the demand for state-of-the-art bottling line machinery.

Competitive Landscape:

The competitive landscape of the bottling line machinery market is characterized by a dynamic interplay of factors that shape industry dynamics. Manufacturers in this sector vie to deliver cutting-edge solutions tailored to the diverse needs of the beverage industry. Innovations in automation, robotics, and smart technologies have redefined production processes, enabling companies to achieve heightened operational efficiency and product quality. Moreover, the pursuit of sustainable practices and eco-friendly packaging solutions has gained prominence, prompting manufacturers to integrate environmentally responsible features into their machinery offerings. Market players focus on research and development endeavors to stay at the forefront of technological advancements, ensuring they can meet the evolving demands of a competitive market. As the beverage industry continues to experience growth, the competitive landscape of bottling line machinery remains poised for innovation, collaboration, and differentiation among key industry participants.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Apacks

- GEA Group Aktiengesellschaft

- IC Filling Systems Srl

- Krones AG

- PallayPack

- ProMach Inc.

- Sacmi Imola S.C.

- Syntegon Technology GmbH

- Zhangjiagang King Machine Co. Ltd.

Bottling Line Machinery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Automated, Semi-Automated |

| Applications Covered | Glass, Polyethylene Terephthalate (PET), Metal Can |

| End Uses Covered | Beverages, Sauces, Syrups, Healthcare Products, Household Products |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apacks, GEA Group Aktiengesellschaft, IC Filling Systems Srl, Krones AG, PallayPack, ProMach Inc., Sacmi Imola S.C., Syntegon Technology GmbH, Zhangjiagang King Machine Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bottling line machinery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bottling line machinery market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bottling line machinery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bottling line machinery market was valued at USD 5.0 Billion in 2024.

The bottling line machinery market is projected to exhibit a CAGR of 4.37% during 2025-2033.

The bottling line machinery market is driven by rising demand in the food and beverage industry, increased consumer preference for packaged products, and technological advancements in automation and efficiency. Additionally, the growing focus on sustainability, including eco-friendly packaging, and the need for higher production capacities further fuel market growth.

Asia Pacific currently dominates the market driven by the burgeoning population and increasing disposable incomes in the region.

Some of the major players in the bottling line machinery market include Apacks, GEA Group Aktiengesellschaft, IC Filling Systems Srl, Krones AG, PallayPack, ProMach Inc., Sacmi Imola S.C., Syntegon Technology GmbH, Zhangjiagang King Machine Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)