Botanicals and Acupuncture Market Size, Share, Trends and Forecast by Intervention, Distribution Method, and Region, 2025-2033

Botanicals and Acupuncture Market Size and Share:

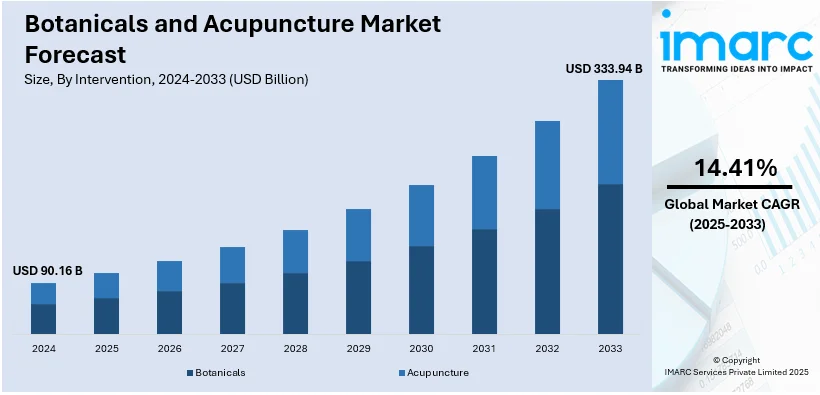

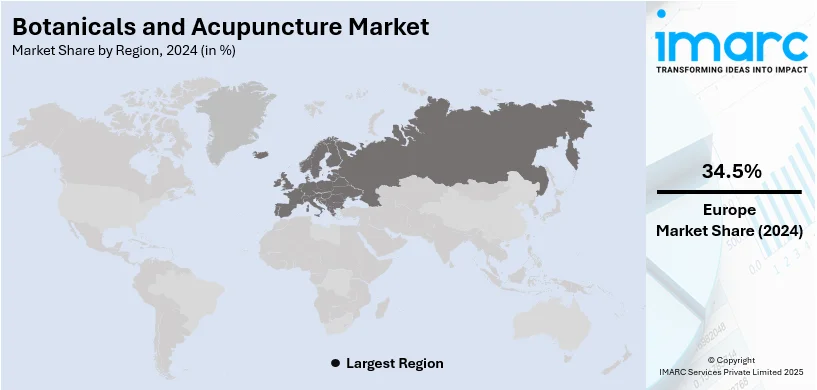

The global botanicals and acupuncture market size was valued at USD 90.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 333.94 Billion by 2033, exhibiting a CAGR of 14.41% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 34.5% in 2024, driven by increasing demand for natural therapies, preventive healthcare, and the adoption of alternative health practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 90.16 Billion |

| Market Forecast in 2033 | USD 333.94 Billion |

| Market Growth Rate (2025-2033) | 14.41% |

One major driver of the botanicals and acupuncture market growth is the rising consumer demand for natural and alternative healthcare solutions. As individuals increasingly seek non-pharmaceutical treatments for managing chronic conditions, stress, and wellness, botanical products and acupuncture are gaining popularity due to their perceived safety, efficacy, and minimal side effects. This trend is particularly prevalent among health-conscious consumers who are looking for holistic approaches to healthcare. Additionally, rising awareness of the benefits of preventive care and the growing inclination toward sustainable and organic products further contribute to the market's expansion and consumer adoption. For instance, in January 2025, The Scientific Association for Botanical Education and Research (SABER) announced its plans to advance botanical science, research, and education through evidence-based practices and advocating for safety and responsibility.

The United States plays a pivotal role in serving the botanicals and acupuncture market by fostering innovation, regulation, and accessibility. The U.S. is home to numerous manufacturers of botanical supplements, herbal products, and wellness solutions, ensuring a wide range of offerings to meet consumer demand. For instance, in November 2024, Herb Pharm announced the launch of its U.S.-grown Mushroom Wellness™ line, entering the rapidly growing functional mushroom market, blending science, sustainability, and heritage in mushroom-based health supplements. Regulatory bodies, such as the FDA, provide oversight to maintain product safety and efficacy. Additionally, the growing acceptance of acupuncture as a complementary treatment has led to increased integration of acupuncture practices into mainstream healthcare settings, supported by trained professionals and insurance coverage in some cases. This combination of innovation and regulation positions the U.S. as a key market player.

Botanicals and Acupuncture Market Trends:

Rising popularity of natural therapies

The use of botanicals and acupuncture is highly sought after since people increasingly develop a penchant for natural therapies. It has been commonly observed that the consumers have been taking to natural approaches and holistic ways towards health and wellness. Moreover, naturally, most people tend to shy away from the effects that conventional drugs may have on them in the long term; thus, there is a currently skyrocketing demand for natural treatment options. According to reports, the average one-year prevalence of herbal medicine use across surveys on CAM methods was 64.2% (range: 36–92.4%), while the lifetime prevalence of homeopathy use was 70% (range: 70–70%). They are traditional healing practices that are non-invasive and potentially effective remedies for various health conditions. Apart from this, the rising consumer demand for therapies that have lower side effects is contributing to the growth of the market.

Increasing prevalence of various chronic health conditions

There is a rise in the adoption of botanicals and acupuncture due to the increasing prevalence of chronic health conditions, such as chronic pain, stress-related disorders, and mental health issues, among the masses across the globe. According to reports, globally, about 33% of all adults suffer from multiple chronic conditions (MCCs). In addition, consumers are rapidly seeking natural therapies as conventional medical treatments may not always provide satisfactory outcomes. Botanicals have a wide variety of herbal remedies that offer natural alternatives for pain management and stress reduction among individuals. Apart from this, acupuncture assists in alleviating pain, improving overall well-being, and effectively addressing several chronic conditions. People are exploring non-pharmaceutical options for managing their health, which is bolstering the growth of the market.

Growing number of research and clinical studies

There is a rise in the number of research and clinical studies related to botanicals and acupuncture across the globe. According to WHO, clinical trials registered on ICTRP steadily increased, peaking in 2021, with a decline in 2022-2023 in most regions, except South-East Asia. Clinical trials in Europe, Americas, and Western Pacific grew faster, with the Western Pacific registering 23,250 trials in 2023, 14 times more than Africa's 845. These techniques are viable healthcare options for treating various health conditions. In addition, researchers and medical institutions are continuously investigating to evaluate the safety and efficacy of these therapies. These therapies have the capability to cure various health conditions, such as pain management, anxiety reduction, and support for certain chronic diseases. Apart from this, healthcare professionals are increasingly integrating these techniques into their treatment protocols due to their enhanced effectiveness. Furthermore, the positive outcomes of research and clinical studies encourage consumers to explore these therapies as part of their healthcare journey.

Botanicals and Acupuncture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global botanicals and acupuncture market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on intervention and distribution method.

Analysis by Intervention:

- Botanicals

- Ayurveda

- Naturopathy

- Homeopathy

- Acupuncture

Botanicals stand as the largest component in 2024, holding around 68.8% of the market. Botanicals are products and services related to herbal medicine and plant-derived substances that are used for therapeutic purposes. It includes a wide range of herbal remedies, dietary supplements, herbal teas, tinctures, essential oils, and other botanical-based products. Additionally, it involves the services of herbalists, naturopathic practitioners, and holistic healthcare providers who specialize in prescribing and administering botanical treatments. The rising acceptance of herbal medicine as a complementary approach to conventional healthcare is contributing to the growth of the market.

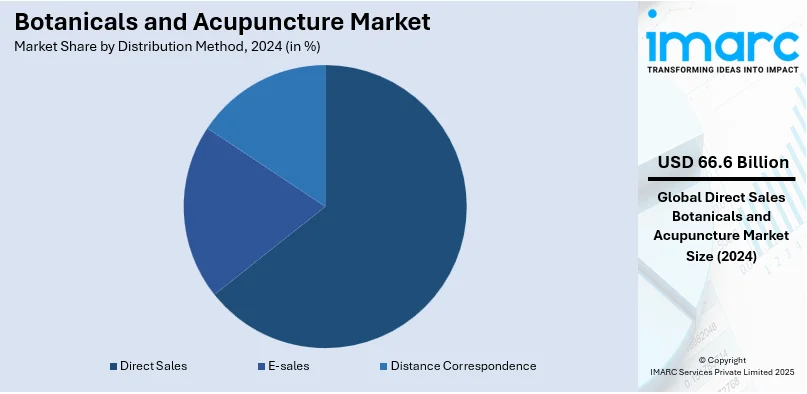

Analysis by Distribution Method:

- Direct Sales

- E-sales

- Distance Correspondence

Direct Sales leads the market with around 73.9% of market share in 2024. Direct sales involve the distribution of botanicals and related products and acupuncture services through traditional brick-and-mortar channels. This includes physical retail stores, wellness centers, herbal shops, and acupuncture clinics. In direct sales, consumers can directly purchase herbal remedies, supplements, herbal teas, essential oils, and other botanical-based products from physical locations. Moreover, individuals seeking acupuncture treatments can visit licensed clinics of acupuncturists for in-person sessions. This traditional approach is popular among customers who prefer face-to-face interactions and personalized recommendations.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest botanicals and acupuncture market share of over 34.5%. This shift towards holistic health options is encouraging a rise in demand for alternative and complementary healthcare solutions. The increasing acceptance of botanicals and acupuncture, coupled with advancements in healthcare infrastructure, has further supported market expansion in the region. Additionally, there is a rising emphasis on preventive healthcare, as individuals seek more proactive approaches to well-being. This shift in consumer preferences and the broader focus on wellness is significantly contributing to the growth of the healthcare market in Europe, reinforcing its leading position globally.

Key Regional Takeaways:

United States Botanicals and Acupuncture Market Analysis

US accounts for 87.9% share of the market in North America. The U.S. botanicals and acupuncture market is driven by a growing consumer shift toward natural and holistic healthcare solutions. Increasing awareness of the side effects of conventional treatments has prompted a surge in demand for alternative therapies, including botanical supplements and acupuncture. According to the CDC, between 2015 and 2018, 10.7% of adults aged 20 and over in the U.S. used one or more prescription pain medications (opioid or nonopioid) in the past 30 days, showing how much Americans are dependent on pharmaceuticals for pain management. This has led many consumers to seek non-invasive, natural alternatives. The rise of preventive healthcare, along with a focus on wellness, further supports this trend. A greater understanding of the therapeutic benefits of botanicals—such as stress relief, pain management, and immune support—has fueled their popularity. Regulatory support, such as the FDA's oversight of dietary supplements, enhances consumer confidence. The growing prevalence of chronic conditions, including arthritis and back pain, has also contributed to the higher adoption of acupuncture. Furthermore, the increasing number of trained acupuncture practitioners, alongside positive clinical outcomes, strengthens the market's expansion. The integration of botanical ingredients in mainstream products, from skincare to dietary supplements, plays a pivotal role in this growth.

North America Botanicals and Acupuncture Market Analysis

The North America botanicals and acupuncture market is experiencing steady growth, driven by rising consumer demand for natural and alternative healthcare solutions. As individuals seek non-pharmaceutical treatments for managing stress, chronic conditions, and overall wellness, both botanicals and acupuncture are gaining popularity, thereby representing one of the key botanicals and acupuncture market trends. For instance, in February 2025, Nautilus Botanicals, a hybrid medical and recreational cannabis dispensary, announced the opening of a new store in New Haven, offering a unique, folksy vibe, distinguishing itself from other Connecticut cannabis stores. The increasing focus on preventive healthcare, along with a growing awareness of the benefits of holistic approaches, has significantly fueled market demand. Furthermore, the rising trend of sustainable and organic products has created a thriving market for plant-based supplements and natural therapies. The U.S. holds a dominant share in this market due to its established healthcare infrastructure, consumer education, and strong presence of botanical product manufacturers and acupuncture practitioners. The market is expected to expand as interest in holistic well-being continues to rise.

Asia Pacific Botanicals and Acupuncture Market Analysis

The Asia-Pacific botanicals and acupuncture market is primarily fueled by cultural traditions and the rising interest in natural health solutions. Countries like China, Japan, and South Korea have deep-rooted practices in acupuncture and the use of botanicals for wellness, which continue to influence market trends. The increasing prevalence of lifestyle diseases, such as stress, anxiety, and chronic pain, has encouraged greater reliance on alternative therapies.The WHO states that noncommunicable diseases (NCDs), primarily cardiovascular diseases, chronic respiratory conditions, diabetes, and cancer, represent the main causes of death in the South-East Asia region, resulting in roughly 8.5 million deaths each year This has led to a higher demand for natural treatments like acupuncture. Additionally, the shift toward natural remedies is growing among younger, health-conscious populations. Advancements in acupuncture training and government recognition contribute to the market's expansion, while the accessibility of botanicals further drives demand in the region.

Europe Botanicals and Acupuncture Market Analysis

In Europe, the botanicals and acupuncture market is experiencing significant growth driven by increasing consumer interest in alternative and complementary medicine. The rise in chronic diseases, such as pain, stress-related disorders, and sleep problems, has pushed consumers toward non-invasive treatments like acupuncture. According to reports, more than a third (35.0%) of people in the EU reported having a long-standing (chronic) health problem in 2023, highlighting the growing need for effective, natural therapies. Acupuncture’s recognition by healthcare systems, particularly in countries like Germany, the UK, and France, has contributed to its mainstream acceptance. Furthermore, the growing demand for plant-based products, driven by the trend toward sustainability and organic living, has bolstered the popularity of botanical-based remedies. With the increasing adoption of herbal supplements for stress reduction, immune support, and skin health, the botanical sector has seen an uptick in sales. Another key driver is the rising awareness of the potential side effects of pharmaceutical drugs, which has encouraged consumers to seek out natural alternatives. Regulatory frameworks, such as the European Medicines Agency’s (EMA) approval of certain herbal medicines, have improved the credibility and trust surrounding botanical products. Additionally, acupuncture’s integration into physical therapy and wellness clinics across Europe has further fueled its growth.

Latin America Botanicals and Acupuncture Market Analysis

In Latin America, the botanicals and acupuncture market is driven by the increasing preference for natural and traditional medicine. According to industry reports, more than 400 Million people in the region use traditional, natural, and/or complementary/alternative medicine (TN-CAM), highlighting the widespread acceptance of these therapies. The rising awareness of the benefits of botanical supplements for managing chronic conditions like stress, digestive disorders, and pain has contributed to market growth. Additionally, acupuncture’s effectiveness in treating musculoskeletal pain and stress-related ailments has led to its growing adoption. Increased healthcare spending and a growing middle class further support market expansion.

Middle East and Africa Botanicals and Acupuncture Market Analysis

The botanicals and acupuncture market in the Middle East and Africa is influenced by the region’s rich heritage in traditional medicine, where natural therapies have been used for centuries. Growing consumer awareness of the side effects of pharmaceuticals and a shift toward alternative treatments drive demand for botanical remedies. According to reports, in the UAE, the prevalence of self-reported chronic diseases was 23.0%, with obesity, diabetes, and asthma/allergies being the most common (12.5%, 4.2%, and 3.2%, respectively). This has increased the demand for effective, natural alternatives like acupuncture and botanical-based treatments, especially for chronic conditions.

Competitive Landscape:

The competitive landscape of the botanicals and acupuncture market is characterized by a diverse mix of established companies, small-scale manufacturers, and independent practitioners. Key players in the botanical sector include large herbal product manufacturers and supplement brands that focus on quality, sustainability, and innovation. In acupuncture, competition is driven by both individual practitioners and clinics, with a growing number of medical professionals incorporating acupuncture into their practice. Companies and practitioners differentiate themselves through specialized offerings, such as organic or plant-based botanicals and holistic acupuncture therapies. Additionally, advancements in research and development, consumer education, and partnerships with wellness platforms enhance market competition.

The report provides a comprehensive analysis of the competitive landscape in the botanicals and acupunture market with detailed profiles of all major companies, including:

- ARC Acupuncture & Physical Therapy

- Ayush Ayurvedic Pte Ltd

- Chiropuncture, Inc.

- Herb Pharm, LLC

- Herbal Hills

- LKK Health Products Group Ltd. (Lee Kum Kee Group)

- Modern Acupuncture

- NatureKue, Inc.

- Nordic Nutraceuticals UK Ltd

- Sheng Chang Pharmaceutical Company

Latest News and Developments:

- February 2025: The first Indian skincare brand to showcase at NYC's New York Fashion Week is Herbaria-Modern Botanicals on 6th February. Gunjan Agnihotri and Raghav Bhatia created the brand "Herbaria" because it had a zero-plastic botanical-based formulation in skincare. With this said, during the pair-up with NYFW, Herbaria was a backstage skincare partner of the models and also with the exclusive beauty bag gift partner.

- January 2025: Loyalist also has started Pharmacy Technician and Acupuncture, which are the other programs in health found within a college-wide expansion of health programs toward training many more health practitioners within Ontario systems for client care. This allows graduates to collaborate more closely with primary healthcare providers, providing greater service accessibility and improve community wellbeing.

- January 2025: Blue Toad Botanicals presented You've Got Some NERVE, a botanical preparation with Vanizem (an extract from Aframomum melegueta, developed by Nektium Pharma), marketed by PLT Health Solutions. The preparation contains Feverfew, passionflower, skullcap, NeuroAGARIC (a proprietary terpene stack), together with acetyl-L-carnitine.

- October 2024: A newly introduced auricular acupuncture for weight management by Champneys day spas around the UK has been developed by Steve Peat and skin care specialist Jennifer Young. This 50-minute therapy has been marketed as a natural alternative to "anorexigenic" medication by stimulating 12 acupuncture points that connect with 14 hormones linked with hunger, metabolism, and pleasure. It is meant to treat hormonal imbalances believed to be responsible for weight control.

- September 2024: Recently, Evonik has also introduced CapilAcid and Oleobiota, both innovations in botanical actives for sustainable beauty and personal care. The application of CapilAcid is to offer antioxidant protection for hair, as derived from Maqui fruit, while Oleobiota, sourced from the Misiones rainforest, will help sebum regulation in skincare.

Botanicals and Acupuncture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Interventions Covered |

|

| Distribution Methods Covered | Direct Sales, E-sales, Distance Correspondence |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ARC Acupuncture & Physical Therapy, Ayush Ayurvedic Pte Ltd, Chiropuncture, Inc., Herb Pharm, LLC, Herbal Hills, LKK Health Products Group Ltd. (Lee Kum Kee Group), Modern Acupuncture, NatureKue, Inc., Nordic Nutraceuticals UK Ltd, Sheng Chang Pharmaceutical Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the botanicals and acupuncture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global botanicals and acupuncture market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the botanicals and acupuncture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The botanicals and acupuncture market was valued at USD 90.16 Billion in 2024.

IMARC estimates the botanicals and acupuncture market to reach USD 333.94 Billion by 2033, exhibiting a CAGR of 14.41% during 2025-2033.

Key factors driving the botanicals and acupuncture market include growing consumer demand for natural, non-pharmaceutical treatments, rising awareness of preventive healthcare, the increasing popularity of holistic wellness, and a shift toward sustainable, organic products. Additionally, advancements in research, education, and consumer understanding further fuel market growth and adoption.

Europe currently dominates the market with 34.5% share, driven by increasing consumer interest in natural and holistic health solutions, a well-established healthcare system, and growing demand for organic and sustainable products. Additionally, regulatory support and strong research initiatives in botanical sciences contribute significantly to the market's expansion.

Some of the major players in the botanicals and acupuncture market include ARC Acupuncture & Physical Therapy, Ayush Ayurvedic Pte Ltd, Chiropuncture, Inc., Herb Pharm, LLC, Herbal Hills, LKK Health Products Group Ltd. (Lee Kum Kee Group), Modern Acupuncture, NatureKue, Inc., Nordic Nutraceuticals UK Ltd, Sheng Chang Pharmaceutical Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)