Borage Oil Market Size, Share, Trends and Forecast by Application, and Region, 2025-2033

Borage Oil Market Size and Share:

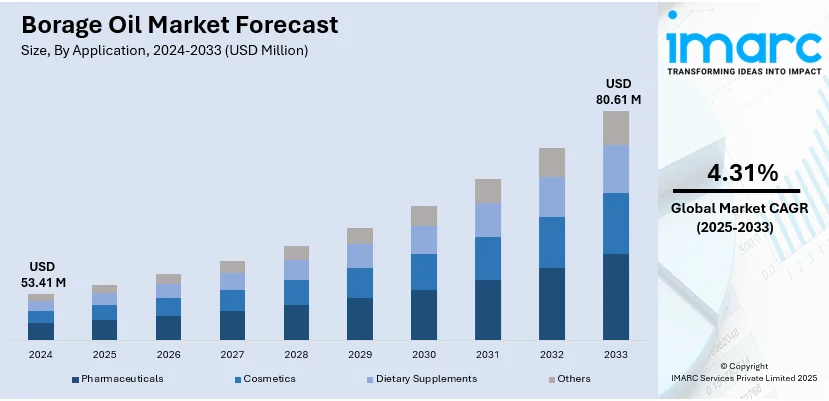

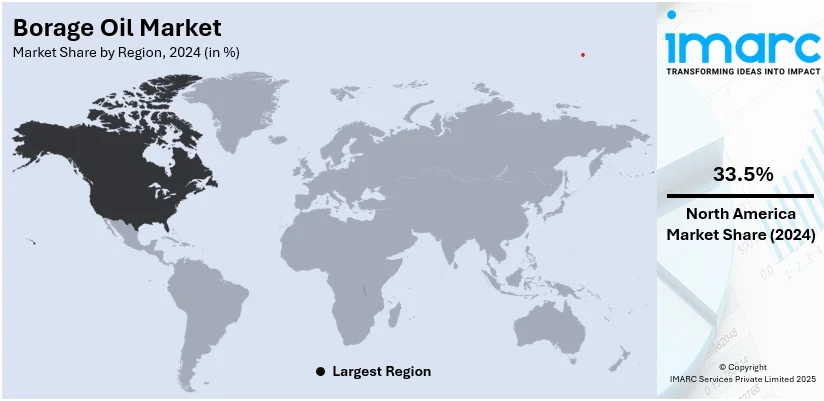

The global borage oil market size was valued at USD 53.41 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 80.61 Million by 2033, exhibiting a CAGR of 4.31% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024, driven by increasing consumer demand for natural health products. The region’s strong pharmaceutical and cosmetic industries, coupled with rising awareness of borage oil's health benefits, contribute significantly to its market leadership.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 53.41 Million |

| Market Forecast in 2033 | USD 80.61 Million |

| Market Growth Rate (2025-2033) | 4.31% |

The borage oil industry is currently undergoing substantial expansion, primarily attributed to its heightened requirement in various critical segments, chiefly encompassing food and beverages, cosmetics, and pharmaceuticals. Borage oil, prominently acknowledged for its richness in gamma-linolenic acid (GLA), a kind of omega-6 fatty acid, exhibits exceptional attributes like skin health booster and anti-inflammatory. This, in turn, aided in comprehensive acceptance of borage oil across cosmetics segment, mainly due to its heavy utilization in soothing both inflamed and dry skin as well as enhancing skin elasticity. In addition to this, accelerating awareness regarding the health advantages of borage oil, especially its ability to significantly minimize symptoms of certain inflammatory disorders, including rheumatoid arthritis, has bolstered its purchase as a dietary supplement. For instance, studies revealed that 6–11 grams of borage oil intake on a daily basis can notably enhance symptoms of rheumatoid arthritis within a month with prolonged benefits. Moreover, as customers are rapidly gaining more health-consciousness, requirement for organic as well as natural products is constantly propelling the market demand.

In the United States, the borage oil market is witnessing an uptick, primarily driven by increasing consumer preference for natural remedies and holistic health solutions. The rise in chronic conditions, such as arthritis and cardiovascular diseases, has heightened the demand for anti-inflammatory and heart-healthy supplements. Moreover, as the U.S. has a well-established personal care market, borage oil’s inclusion in premium skincare products contributes significantly to market expansion. For instance, in September 2023, FarmHouse Fresh, a U.S based cosmetics company, partnered with The Smurfs to launch a limited-edition skincare collection, featuring Berry Blue Juicy Organic Lip Therapy Balm, formulated with blue borage oil. The robust retail distribution networks, alongside growing consumer trust in natural ingredients, are further enhancing the market outlook.

Borage Oil Market Trends:

The Growing Popularity of Alternative and Complementary Medicine Practices

The rapid amplification in popularity of complementary and alternative medicine practices is significantly fueling the market prospects. With several customers currently navigating for holistic or natural methods to boost their health and wellness profile, the requirement for herbal supplements as well as remedies is notably heightening. As per the National Center for Complementary and Integrative Health (NCCIH), on the basis of the National Health Interview Survey’s recent data, almost 36.7% of the adult population across the United States utilize some kind of complementary health approaches. Furthermore, in alternative medicine, borage oil is typically prominent for its therapeutic attributes, especially its elevated content of GLA that is observed to foster the reduction in inflammation, along with bolstering skin health. Besides this, complementary medicine specialists generally prefer this oil as a natural treatment for inflammatory disorders, variety of skin conditions, and imbalance in hormonal level. In addition to this, the utilization of alternative medicine by key healthcare ecosystem and the encouragement by healthcare professionals to leverage natural remedies have further proliferated the acceptance as well as validity of this oil amongst customers. As the trend for holistic well-being heightens actively, borage oil is established to experience amplified requirement, primarily boosted by the appeal efficient, natural, and safe solutions to aid overall health and cater to the particular health challenges.

Expansion of the Cosmetics and Personal Care Industry

The expansion of the cosmetics and personal care industry is fostering the market. The Food and Drug Administration (FDA) has estimated that majority of Americans utilize around 6 to 12 cosmetic products on a daily basis. The requirement for natural and pioneering components in both personal care and cosmetics products has elevated significantly with the intensifying focus on beauty routines, self-care, and overall health-being. In addition to this, the surplus content of gamma-linolenic acid (GLA) and other requisite fatty acids in the product positions it as an essential addition to skincare compositions. Its anti-inflammatory attributes and robust advantages for skin health have attained notable appeal from cosmetic enterprises currently striving for natural and high-efficacy ingredients. The oil is currently being heavily utilized in a broad range of products, mainly encompassing creams, moisturizers, facial oils, and serums. Its adaptability also expands to several products in hair care category, facilitating hair shine as well as health. Besides this, the proliferating awareness amongst the customers regarding the key adverse impacts of anthropogenic chemicals has inclined preferences toward natural or clean beauty products. As the personal care and cosmetics sector expands, oil's position as an ideal natural ingredient is anticipated to further solidify.

Increasing Demand for Plant-based Oils in the Aromatherapy and Natural Healing Sectors

The increasing demand for plant-based oils in aromatherapy and natural healing is strengthening the market. For instance, as per industry reports, tea tree oil demand is anticipated to grow up to 8 kilotons by 2024 and is well known to be used as a home remedy for acne and fungal infections. Aromatherapy, a holistic healing practice that utilizes essential oils, has gained widespread popularity due to its therapeutic benefits for mental and emotional well-being. Borage oil, with its high gamma-linolenic acid (GLA) content and anti-inflammatory properties, has found a place among these sought-after essential oils. It is valued in natural healing for its potential health benefits, including skin nourishment and hormonal balance. As consumers seek natural alternatives to support their physical and mental health, the demand for this oil for various ailments and wellness applications has grown. With its diverse applications in aromatherapy, massage oils, and topical treatments, it has established itself as a valuable and versatile plant-based oil in the natural healing and wellness industries, fueling its market expansion in these sectors.

Borage Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global borage oil market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application.

Analysis by Application:

- Pharmaceuticals

- Cosmetics

- Dietary Supplements

- Others

Pharmaceuticals lead the market with around 45.9% of market share in 2024, driven by its rich gamma-linolenic acid (GLA) content, which offers various health benefits. Borage oil is widely used in treating inflammatory conditions, skin disorders, and hormonal imbalances. Its ability to alleviate symptoms of rheumatoid arthritis, eczema, and premenstrual syndrome (PMS) makes it a preferred ingredient in therapeutic formulations. Additionally, borage oil’s potential in enhancing cardiovascular health and supporting immune function further boosts its demand in the pharmaceutical sector. As consumers increasingly seek natural remedies, the pharmaceutical industry's reliance on borage oil continues to grow.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.5%, owing to its highly established demand across a number of industries, notably personal care, pharmaceuticals, and dietary supplements. The rising interest in the region for natural, plant-based ingredients used in skincare products and wellness solutions has helped boost the market's growth. Greater consciousness about borage oil's benefits for health, including its anti-inflammatory action and role in promoting skin health, has also propelled its uptake. In addition, the strong distributional networks in North America, alongside a solid customer base that centers on health and wellness, render the region the leading force on the global market for borage oil.

Key Regional Takeaways:

United States Borage Oil Market Analysis

In 2024, United States accounted for 85.70% of the market share in North America. Increasing consumer demand for natural health supplements and functional foods is, on the other hand, contributing to the growth of U.S. borage oil markets. As indicated by the Organic Trade Association (OTA), the organic food market of the United States, in 2023, reached around USD 69 billion, representing greater interest in products made from plants that can restore wellness, of which borage oil is one. According to the National Center for Complementary and Integrative Health, omega-6 fatty acids, including GLA found in borage oil, are now being added to dietary supplements due to their anti-inflammatory functions. The cosmetics industry also places borage oil in skincare formulations through FDA regulations on botanical ingredients in personal care products. Major domestic manufacturers, such as AOS Products and Connoils, invest in advanced extraction techniques to comply with quality and sustainability standards. Online retailing expansion and direct-to-consumer channels further open up access to the product.

Europe Borage Oil Market Analysis

The European borage oil market is growing because of the increasing demand for plant-based wellness products and regulatory support for natural health ingredients. Organic food sales in the EU have been reported to reach approximately EUR 58 billion (USD 59.62 Billion) by the European Commission's Directorate-General for Agriculture and Rural Development in 2023, indicating a strong consumer preference for natural ingredients. European Medicines Agency, the borage oil finds itself at an exciting therapeutic horizon as botanical extracts, with possible application in conditions involving the skin and inflammation, drive the demand even more. Among these nations are Germany, France, and the UK; in addition to their consumer population, it also supports demand. In terms of omega-6 fatty acids, European Food Safety Authority's regulatory provisions drive further the cosmetics sector that fuels the growth through sustainability sourcing and organic certification. Nature's Aid and Avestia Pharma lead the pack focusing on quality of formulations. This, combined with government-sponsored research, further develops the market of botanical extracts.

Asia Pacific Borage Oil Market Analysis

The Asia Pacific borage oil market is developing fast, thanks to the increase in nutraceutical applications and use of traditional medicines. In fact, China reported that, as of 2023, sales of organic foods reached USD 14 billion and ranked it the third biggest market for the consumption of organic products in the globe. The main reason is consumers' increased affinity for health plant-based products like borage oil. India's Ministry of AYUSH reported a steady rise in borage oil as an Ayurvedic formulation. Its anti-inflammatory and cardiovascular effects have driven such trends. Gamma-linolenic acid is being studied as part of research into functional foods by Japan's Pharmaceuticals and Medical Devices Agency (PMDA), which continues to further fortify its role in the country. Aromex Industries and Sanmark Corp, among other companies, continue to source and process the commodity with the support of advanced technologies for rising demand. Additionally, government initiatives promoting natural health products are expected to drive further market expansion.

Latin America Borage Oil Market Analysis

The Latin American borage oil market is growing steadily, driven by increased awareness of herbal supplements and functional foods. According to the Global Organic Trade Guide, in 2023, Brazil's organic food sales for packaged food and beverages were USD 92.3 million, and USD 38.1 million for organic beverages. This indicates that consumers are preferring more natural and organic products, including plant-derived oils such as borage oil. Mexico's Federal Commission for the Protection against Sanitary Risk (COFEPRIS) stated that there have been growing approval orders of botanical extracts in the development of functional food and skincare products. There is also expansion in Argentina within the natural cosmetic industry, under government policies emphasizing organic and responsible raw materials. Companies like Bunge Loders Croklaan, local manufacturers, are focused on sustainable sources and state-of-the-art extraction processes to service consumers. Further expansion by e-commerce platforms and direct-to-consumer brands is furthering accessibility and raising awareness of borage oil in the region.

Middle East and Africa Borage Oil Market Analysis

The Middle East and Africa borage oil market is growing due to the increasing demand for natural health products and government-supported agricultural policies. According to an industrial report, in 2023, the UAE had 74 organic farms located throughout the country. Among these, 47 are found in Abu Dhabi, a sign of the increased interest in organic farming and sustainability. This change in consumer interest aligns with a higher turnout towards plant-based supplements, such as borage oil, for its anti-inflammatory and skincare purposes. Saudi Arabia's Food and Drug Authority (SFDA) has established regulatory guidelines to facilitate the functional food industry, thus reinforcing the incorporation of botanical oils into dietary supplement lines. South Africa's natural cosmetics market is also on the rise, with greater consumption of borage oil in topical skincare products. The firms are also focusing on local manufacturing and advanced extraction methodologies and make to perform better within the premium wellness space, while e-commerce brings higher viability across the region.

Competitive Landscape:

Top borage oil companies are supporting the market through their commitment to quality, innovation, and customer satisfaction. These companies invest in state-of-the-art extraction and processing technologies to produce high-quality borage oil with optimal levels of gamma-linolenic acid (GLA) and other essential fatty acids. They actively engage in research and development efforts to discover new applications and potential health benefits of borage oil, expanding its use in pharmaceuticals, cosmetics, and dietary supplements. These companies prioritize sustainable and ethical sourcing practices, ensuring a consistent and reliable supply of raw materials while promoting environmental responsibility. By maintaining stringent quality control standards and obtaining relevant certifications, these companies instill confidence in consumers and business partners regarding the efficacy and safety of their products. For instance, in November 2024, ShiKai, a plant-based personal care company, earned the National Eczema Association (NEA) Seal of Acceptance for two of its lotions infused with borage oil, in recognition of their compatibility with eczema skin. In addition, leading companies engage in international trade and networking platforms, building partnerships with distributors, retailers, and other key players to extend their market presence and boost brand visibility. Their commitment to innovation, environmental responsibility, and focusing on customer needs drives the expansion of the market.

The report provides a comprehensive analysis of the competitive landscape in the borage oil market with detailed profiles of all major companies, including:

- AOS Products Pvt. Ltd.

- Aromex Industry

- Avestia Pharma

- ConnOils LLC

- Deve Herbes

- Gustav Heess GmbH

- Icelandirect LLC

- Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG)

- Nordic Naturals Inc.

- Parchem Fine & Specialty Chemicals

- Premium Crops Ltd (Cefetra Ltd)

- Soyatech International Pty Ltd

- William Hodgson and Co

Latest News and Developments:

- In July 2023, Almora Botanica launched with seven skincare products to prevent and repair damage. The product range contains 98.5% to 100% natural ingredients, including adaptogens like borage seed and centella asiatica, helping to strengthen collagen, smooth skin, and maintain balance.

- In August 2024, Cefetra and Premium Crops partnered to cultivate and harvest borage seeds for high-quality borage oil, enhancing sustainability and local cooperation.

Borage Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Pharmaceuticals, Cosmetics, Dietary Supplements, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AOS Products Pvt. Ltd., Aromex Industry, Avestia Pharma, ConnOils LLC, Deve Herbes, Gustav Heess GmbH, Icelandirect LLC, Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG), Nordic Naturals Inc., Parchem Fine & Specialty Chemicals, Premium Crops Ltd (Cefetra Ltd), Soyatech International Pty Ltd, William Hodgson and Co, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the borage oil market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global borage oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the borage oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The borage oil market was valued at USD 53.41 Million in 2024.

IMARC estimates the global borage oil market to reach USD 80.61 Million in 2033, exhibiting a CAGR of 4.31% during 2025-2033.

The market is primarily driven by increasing consumer demand for natural and organic products, particularly in the skincare and wellness sectors. Borage oil's rich content of gamma-linolenic acid (GLA) offers significant anti-inflammatory and moisturizing benefits, which further fuels its popularity in cosmetics, dietary supplements, and pharmaceuticals.

North America currently dominates the market, holding a market share of over 33.5% in 2024. This competitive edge is due to high consumer demand for natural skincare products and increasing awareness of borage oil's health benefits. The region's strong presence of key industry players and growing wellness trends further contribute to its market dominance.

Some of the major players in the borage oil market include AOS Products Pvt. Ltd., Aromex Industry, Avestia Pharma, ConnOils LLC, Deve Herbes, Gustav Heess GmbH, Icelandirect LLC, Nature's Way Products LLC (Dr. Willmar Schwabe GmbH & Co. KG), Nordic Naturals Inc., Parchem Fine & Specialty Chemicals, Premium Crops Ltd (Cefetra Ltd), Soyatech International Pty Ltd, William Hodgson and Co, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)