Booster Compressor Market Size, Share, Trends and Forecast by Cooling Type, Compression Stage, Power Source, End User, and Region 2025-2033

Booster Compressor Market Size and Share:

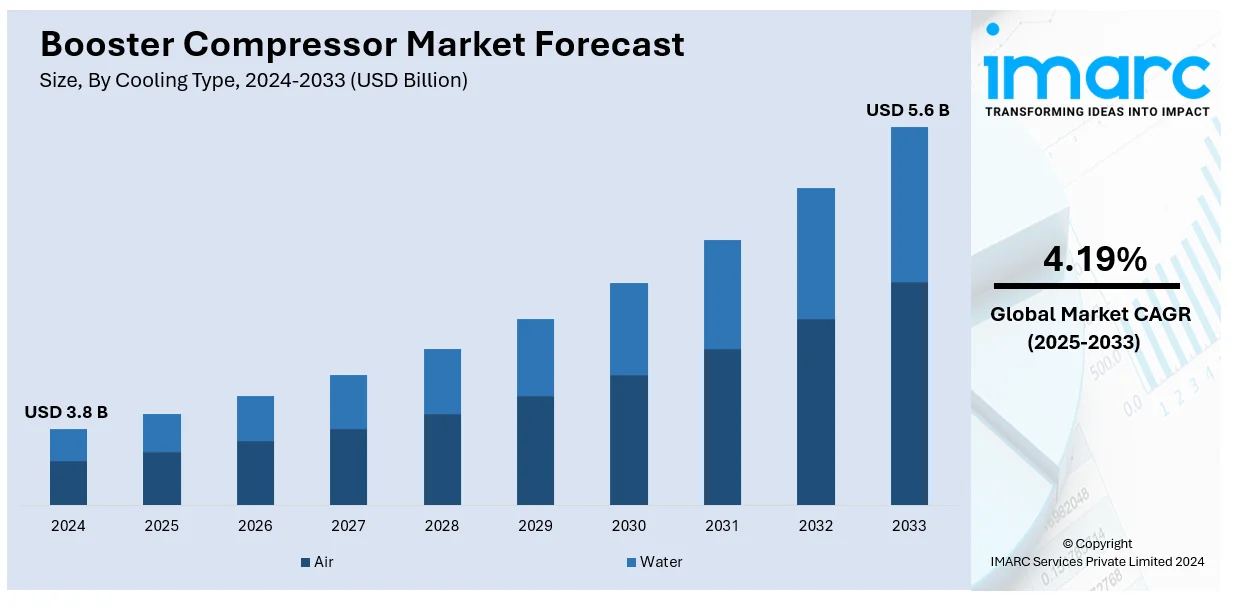

The global booster compressor market size was valued at USD 3.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.6 Billion by 2033, exhibiting a CAGR of 4.19% from 2025-2033. North America currently dominates the market in 2024. The market is driven by the growth of the industrial sector, increasing production sectors, rising demand for energy-efficient solutions, and reliable compressed air systems in automobile, energy, and construction sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Market Growth Rate (2025-2033) | 4.19% |

The booster compressor market is growing due to the increasing demand for efficient energy solutions across various industries. A large increase in oil and gas exploration activities around the world- especially in isolated or offshore environments boosting systems like high-pressure booster compressors to gain more productivity, thereby maintaining better operational performance during such difficult environments. The rising energy consumption in the world demands more advanced compressor systems to enhance the pressure in pipelines and drilling operations. Moreover, industrial automation and digitalization are increasingly driving the demand for smart compressor solutions. The industry is incorporating IoT sensors and predictive maintenance technologies into booster compressors to optimize performance, minimize downtime, and enhance operational efficiency. The growing concern regarding energy efficiency and sustainability is a significant factor driving the market's growth. Industries are targeting the adoption of energy-efficient compressor systems to lower operational costs, comply with rigorous environmental regulations, and minimize carbon footprints.

To get more information on this market, Request Sample

The United States emerged as a key regional market for the booster compressors. The market is growing due to the rising oil and gas sector that is fueled by increased exploration in shale oil and gas fields. Demand for high-pressure compressors is growing as it seeks enhanced efficiency in pipeline operations, well drilling, and natural gas processing. Manufacturing, construction, and industrial testing are pushing the market toward growth due to the need for reliable and efficient compressor systems, especially with respect to different application areas. Along with this drive, regulatory requirements to reduce carbon emissions are a strong driver forcing the adoption of advanced, clean compressor solutions within the U.S. The country's robust infrastructure, technological advancements, and growing industrialization are major contributors to the expanding demand for booster compressors across key sectors.

Booster Compressor Market Trends:

Increased energy efficient compressor consumption

The growing need for energy efficiency is a fundamental booster compressors market trend seen nowadays. More industrial houses, along with an improved focus on minimization of expenses and a limited carbon footprint during operations, create a tremendous appeal for energy-efficient compressors with enhanced performance for lower operating expenditure and decreased footprint on the environment. Manufacturers are reacting with the inclusion of advanced technologies such as variable frequency drives (VFDs) and energy recovery systems in their booster compressors to optimize the energy usage of booster compressors. Energy-efficient compressors help companies comply with strict environmental regulations that mandate a reduction in carbon emissions. This emphasis on sustainability across manufacturing, oil and gas, and construction sectors is creating a need for the development and adoption of energy-efficient compressor systems. The energy-efficient booster compressor market will be in increasing demand, particularly in the Europe and North America regions that have more stringent environmental regulations.

Integration of Smart Technologies and IoT in Compressors

Smart technologies and the Internet of Things (IoT) integration in booster compressors are among the market trends. Real-time monitoring, remote diagnostics, and predictive maintenance of smart compressors equipped with IoT sensors improve the efficiency of their operations. The performance can be continuously monitored, and probable problems can be detected at early stages, which can help save the downtime associated with costly expenses and enhance the overall reliability of a compressor system. Furthermore, IoT-enabled compressors can be integrated into larger industrial automation systems, enabling more systematic optimization of production processes. This is particularly important in production lines of manufacturing, oil and gas, and construction, where a minute of lost time could lead to the loss of millions. The collection and analysis of data on compressor systems helps businesses make informed decisions regarding maintenance schedules, energy usage, and further performance improvement. As industries increasingly adopt Industry 4.0 practices, the demand for smart, connected compressors will continue to rise, driving growth in the booster compressor market.

Increasing Adoption of Portable Compressors in Remote Applications

The rising booster compressor demand is due to the increasing adoption of portable compressors, especially in remote and off-grid locations. Such industries as oil and gas, mining, and construction have grown increasingly reliant on portable booster compressors, due to their portability and versatility, as most work environments in such industries can be harsh. It is more practical to apply the portable boosters to field applications due to infrastructural constraints and requirements for mobility that are otherwise hindered by conventional electrically driven compressors. Portable booster compressors are sometimes powered by combustion engines. Their performance can reach high levels when used in remote areas and can be favored by companies working in exploration, drilling, or any other type of outdoor operations. The mobility and ease with which compressors can be moved make them incredibly useful in projects with tight schedules where efficiency plays a key role. As the demand for energy exploration and infrastructure development grows in remote areas, the adoption of portable booster compressors will continue to expand, contributing to the market's growth in the coming years.

Booster Compressor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global booster compressor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on cooling type, compression stage, power source, and end user.

Analysis by Cooling Type:

- Air

- Water

The water-cooled segment accounts for the highest booster compressor market share due to its superior efficiency in high-performance environments, especially in heavy industries like oil and gas, manufacturing, and construction. Water-cooled compressors offer better cooling capacity, ensuring higher operational reliability and efficiency in environments with continuous operation. They are less sensitive to temperature fluctuations and perform better in demanding conditions. The increasing demand for efficient and long-lasting compressors in oil and gas exploration and large-scale manufacturing is the primary growth driver for this segment. Moreover, water-cooled compressors provide longer lifespans, thereby reducing maintenance costs and enhancing long-term operational performance. As energy efficiency increasingly becomes the sought-after value-added factor, combined with stringent environmental regulations, constant high-volume airflow will maintain its growth and increase demand among industries requiring it.

Analysis by Compression Stage:

- Single Stage

- Double Stage

- Multistage

Double stage compressors contribute to the largest market share of all. With the right proportion of efficiency with power, their applications can be seen across oil and gas, manufacturing, and construction among others. Double-stage compressors have high pressure and efficiency levels, making them the best fit for heavy-duty operations that demand more pressure levels than what a single-stage compressor can deliver. This process offers a better way of heat dissipation, hence lowering the possibility of overheating and ensuring a longer operational lifespan. As energy efficiency standards are raised and industrial applications demand higher precision, double-stage compressors are in higher demand. Double-stage compressors ensure stable performance in application fields such as manufacturing, as high pressure is vital for machinery performance. Energy efficiency and lesser maintenance requirements brought about by advancing technology are adding to the increase in industrial uptake of double-stage systems.

Analysis by Power Source:

- Electric

- Combustion Engine

The combustion engine segment is the largest power source for booster compressors, as it is versatile and widely applied in remote and off-grid locations where electric power infrastructure may be limited. Combustion engine-powered compressors are preferred in sectors such as oil and gas exploration, construction, and mining, where portable, high-power solutions are essential. They have the added benefit of mobility, especially in field operations where electricity may not be readily available. The rugged performance and capability of working in adverse conditions further add to their popularity. Moreover, as energy consumption continues to grow in these industries, combustion engines prove to be an efficient and dependable source of power for high-load applications. Whereas environmental concerns lead to a continuous drift toward electrically powered solutions, the necessity of heavy, stand-alone solutions for oil and gas industries continues to make combustion engine-driven compressors hold the highest share of the market.

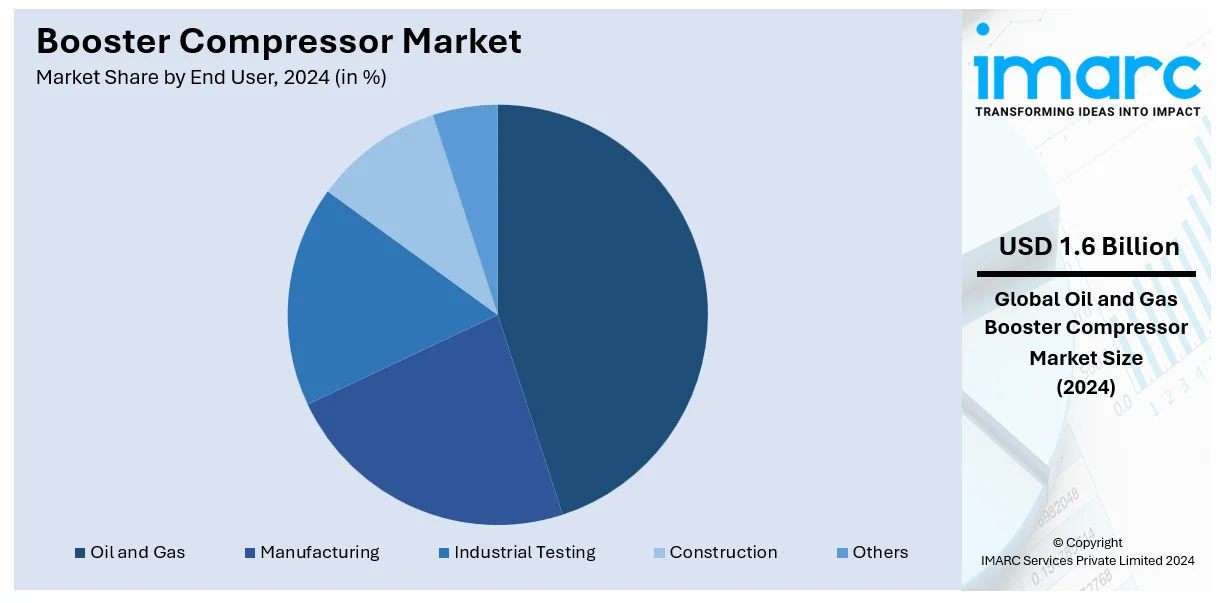

Analysis by End User:

- Oil and Gas

- Manufacturing

- Industrial Testing

- Construction

- Others

The oil and gas industry holds the largest market share driven by the requirement of continuous supplies of high-pressure air and gas for various exploration, production, and refining operations. Several activities are performed through compressor systems within the oil and gas industry, like drilling, well testing, and pipeline operations, which are dependent on very high efficiency and reliability. The growth in demand for natural gas and crude oil, combined with the continuous exploration and production in the harshest conditions, makes them need powerful and efficient compressor systems. Besides, new technologies in compressor fields, targeted toward better fuel efficiency and performance, continue to make compressor technology extremely important to the oil and gas industry. As energy demand continues rising globally, the oil and gas industry remains the leading driver for the growth of the booster compressor market and is expected to continue dominating this sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The demand for booster compressors in North America is significantly high from several industries, including manufacturing, oil and gas, automotive, and HVAC. This region has the best infrastructure and produces a high industrial output, hence requiring efficient and reliable air compression systems. The U.S. and Canada contribute significantly to growth, due to their focus on energy efficiency and reducing costs, which will encourage the demand for booster compressors. Shale gas production is booming in the U.S. while oil exploration in Canada is driving the growing demand for compressors in the energy sector. Further growth in the market is being driven by the need for automation and continuous improvement in manufacturing processes as compressor systems are integral to maintaining efficiency. Increasingly, green technologies, including eco-friendly refrigerants and energy-efficient solutions, are influencing the market. Government regulations aimed at reducing carbon emissions and improving energy efficiency are encouraging companies to invest in advanced compressor systems.

The Asia Pacific region is highly industrializing, and booster compressors are in high demand for manufacturing, oil and gas, and automotive industries. The increasing energy requirements, urbanization, and infrastructure developments in the region boost the demand for efficient compressors. Furthermore, the region hosts major economies such as China, India, and Japan, which focus on increasing industrial production and enhancing energy efficiency, thereby supporting the growth of the market. Government-friendly industrial automation programs along with increasing environmentally friendly technology utilization add up to boost demand in the region for Asia Pacific.

Stricter regulations by European nations about pollution in their air and concern about reducing the consumption of energy fuel have fueled booster compressors' demand. Due to such pressure to produce efficiently by maintaining lesser use of energy while sustaining optimal production output, businesses operating here began incorporating higher-compressor system variants into the mainstream operation, to promote enhanced production within this constraint. Countries like Germany, France, and the UK are key drivers. The countries are major industrial bases and are very aggressive in their efforts to reduce carbon emissions. In addition, Europe's already existing infrastructure and ongoing investments in renewable energy, automotive, and manufacturing sectors continue to fuel market demand for booster compressors.

In Latin America, there is a rising demand for energy efficiency in many industrial applications, mainly in the oil, gas, and mining sectors, that is propelling the booster compressor market. Increased infrastructure projects and government support for industrial growth are driving the demand for reliable and energy-efficient compressors. Brazil, Mexico, and Argentina have focused on the modernization of their industrial infrastructure, which boosts the need for efficient air compression systems. The region's growth toward embracing sophisticated technologies and eco-friendly solutions in food processing and chemicals is an added boost to the market growth.

Booster compressor demand is growing in the Middle East and Africa, driven by increasing oil and gas exploration activities and infrastructure development. Increased industrialization, along with the growing focus on energy efficiency in petrochemicals and manufacturing, is further propelling booster compressor market growth. Countries like Saudi Arabia, UAE, and South Africa are investing in advanced technologies to optimize energy use and enhance production. The demand for high-performance compressors is increasing as industries in the region focus on sustainability and eco-friendly solutions for industrial operations.

Key Regional Takeaways:

United States Booster Compressor Market Analysis

Booster compressors are gaining popularity, especially in the chemical industry, where expansion is driving demand for more efficient processes. The American Chemistry Council, according to Deloitte, projects global chemical production to rise by 3.4% in 2024 and 3.5% in 2025, after increasing just 0.3% in 2023. With the growth of industrial facilities, the demand for reliable and high-performance booster compressors increases to meet the rising demands of air, gas, and fluid compression. These systems contribute to improving chemical production processes as they promote better smoother operation and energy conservation as well as high-output products. With increasing dimensions and capacity, booster compressors support large chemical plants, allowing for meeting greater demands of compressed air and gas. Booster compressor adoption thus allows big-scale production and ensures pressure control for a variety of chemical reactions. This trend is likely to continue as advancements in technology continue to increase the capabilities and reliability of such compressors, which makes booster compressors an integral part of cost-effective operations.

Europe Booster Compressor Market Analysis

In Europe, the demand for booster compressors is growing with increasing industrial testing requirements. The industrial production of the EU reportedly made a strong recovery in 2021 with an 8.5% growth against 2020 and went on to record 0.4% growth in 2022. When the manufacturing sectors grow and scale up, precise control over pressure and gas flow in the testing process becomes very critical. Booster compressors are essential to these testing operations, ensuring the reliability and efficiency of machinery and equipment in the automotive, aerospace, and electronics sectors. With production levels increasing, the importance of testing systems that operate at optimal pressure levels is critical for maintaining quality standards. These compressors are integral in pressurizing fluids and gases for a range of testing scenarios, from equipment endurance to safety checks. As manufacturing technologies advance in other industries, there is bound to be growth in the requirement for booster compressors in industrial testing applications. This trend will continue to rise as industries need more complex testing and quality assurance techniques to meet market needs.

Asia Pacific Booster Compressor Market Analysis

The increasing adoption of liquefied petroleum gas is seen to be boosting the use of booster compressors in various industries. LPG is gaining traction as a cleaner energy source for industrial applications, particularly in sectors such as manufacturing and transportation. Booster compressors are essential for compressing LPG into liquid form for efficient storage and transportation. With growing usage in residential and commercial heating, cooking, and industrial processes, the need for reliable and effective compressors is escalating. Another key factor that influences the growth in booster compressor applications is the rapid growth in compressed natural gas, especially in vehicles. According to the Union Ministry of Road Transport & Highways, there are approximately 180,000 CNG vehicles registered during the 2023 year alone in India. With the increasing usage of vehicles through CNG, the requirement for high-pressure boosting equipment for CNG production and supply is rising dramatically. All these factors are adding to the rise in high-performance booster compressor installation.

Latin America Booster Compressor Market Analysis

Due to fast urbanization and an ever-increasing construction sector, the installation of booster compressors in Latin America is rising. For example, Brazil's construction sector gained in the GDP; its construction sector became around USD 3.14 Billion in Q1 2024 and rose further to USD 3.20 Billion in Q2 2024. This reflects an upward trend in the country's construction sector. With the increased growth of cities and acceleration in infrastructure development, the construction sector exhibits a growing demand for compressed air and gas solutions. One of the prime contributions of booster compressors is to power their array of construction equipment, tools, and machinery, which establishes the eligibility of these compressors to successfully engineer large urban development projects efficiently. A rising demand for residential and commercial buildings along with their extensions in transportation networks and utilities creates the necessity for compressors. Additionally, these compressors play a significant role in energy-efficient solutions in most construction processes from foundation work to structural assembly and help to cater to the increased demands of urbanization.

Middle East and Africa Booster Compressor Market Analysis

The oil and gas sector in the Middle East and Africa is largely driving the adoption of booster compressors due to the increasing industry. The Middle East's oil and gas sector is still booming. Nearly 95% of the region's electricity is generated from natural gas and oil sources. As exploration and production activities expand in the region, efficient gas compression technologies are necessary for maintaining operations in extreme environments. Booster compressors are used more frequently in gas transport, refining, and maintaining high-pressure conditions that prevail in pipelines in oil extraction and transportation. With the growing demand for infrastructure development in the oil and gas industry, coupled with increasing needs for compressed gas solutions in the production of energy, booster compressor adoption in the region will be expected to increase. Booster compressors are becoming vital in meeting operational needs as oil and gas companies strive for more efficient and reliable systems.

Competitive Landscape:

The market players aim at innovation and product development by creating strategic ties in the respective industry. Innovative and developed boosters with integrated smart control will find market applicability with leadership companies focusing their attention on leading-edge technologies variable speed drives as well as efficient and reliable devices. They are expanding their product portfolios by offering different compressor types, including oil-free and oil-lubricated models, to cater to diverse industrial needs. Many key players are enhancing their after-sales services, including installation, maintenance, and repair, to build long-term relationships with customers. Companies are aggressively expanding their worldwide presence through acquisition, partnering, and allied collaboration, specifically in emerging regions, to expand their market as demand increases by leaps and bounds in the oil-gas, manufacturing, and chemical sectors. Yet another area would be sustainability for reducing the carbon imprints of these products and assuring compliance with international environmental protection norms.

The report provides a comprehensive analysis of the competitive landscape in the booster compressor market with detailed profiles of all major companies, including:

- Atlas Copco AB

- Bauer Compressors, Inc.

- Air Research Compressors

- BOGE Compressed Air Systems GmbH & Co. KG

- Generon

- Hitachi, Ltd.

- Ingersoll Rand

- Kaeser Kompressoren

- NiGen International L.L.C.

- Sauer Compressors USA Inc.

- TGT Fuel Technologies Pvt. Ltd

Latest News and Developments:

- December 2024: Global Industrial has introduced the HydroMax Two-Stage Silent Air Compressor, which boasts advanced variable speed and Wi-Fi capabilities. This new compressor is designed to run at low noise levels, making it a safer and more comfortable work environment. The variable-speed motor provides 10 HP while minimizing energy consumption, thus reducing operational costs. Moreover, the water-cooled system prevents overheating, which makes the compressor last longer and be more reliable.

- December 2024: Rotair has introduced the MDVN52 Eco5, a light, high-performance compressor with efficiency and versatility in mind. The 42kW Hatz Stage V diesel engine delivers 5200lpm at 7 bar and 3100lpm at 14 bar. It has a pneumatic control system to optimize fuel efficiency while maintaining performance. The MDVN52 Eco5 is built to withstand extreme conditions, with temperatures ranging from -10°C to +55°C and delivering compressed air temperatures between ambient +8°C and +40°C.

- December 2024: Mitsubishi Electric Corp. will spend USD 143.5 Million to retool its Maysville, Kentucky plant for variable-speed compressor production. The plant, which currently produces automotive electrical equipment, will begin producing compressors in October 2027. This is part of the company's strategy to meet the increasing demand for energy-efficient HVAC solutions in the United States, with an estimated annual production of 1 Million compressors to support low-GWP, high-efficiency heat pumps.

- December 2024: Kaeser Kompressoren presented the Mobilair M44 as a high-performance, portable Stage V-compliant compressor that has a very eco-friendly and compact design. The product is rated to 4.1 m³/min at 7 bar. This positions it in between the two smaller ones Kaeser already offers at 3 m³ and 5 m³ while positioning itself as a power player with eco-friendly performance within the European market.

- December 2024: ELGi Equipments Limited launched PG 850S-290 portable air compressor at bauma CONEXPO INDIA 2024 in Delhi NCR. The device is engineered to cater to mining, and construction applications with its intelligently designed control system that helps drill faster and efficiently, reducing the consumption of fuel. The compressor has dual pressure modes, turbo pre-cleaners, and a compact, energy-efficient structure for better reliability and cost-effectiveness in rugged environments.

Booster Compressor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cooling Types Covered | RF Filters, RF Switches, RF Power Amplifiers, Others |

| Compression Stages Covered | Single Stage, Double Stage, Multistage |

| Power Sources Covered | Electric, Combustion Engine |

| End Users Covered | Oil and Gas, Manufacturing, Industrial Testing, Construction, and Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco AB, Bauer Compressors, Inc., Air Research Compressors, BOGE Compressed Air Systems GmbH & Co. KG, Generon, Hitachi, Ltd., Ingersoll Rand, Kaeser Kompressoren, NiGen International L.L.C., Sauer Compressors USA Inc., TGT Fuel Technologies Pvt. Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the booster compressor market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global booster compressor market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the booster compressor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global booster compressor market was valued at USD 3.8 Billion in 2024.

The booster compressor market is projected to exhibit a CAGR of 4.19% during 2025-2033, reaching a value of USD 5.6 Billion by 2033.

The market is driven by the growth of the industrial sector, increasing production sectors, demand for energy-efficient solutions, and reliable compressed air systems in automobile, energy, and construction sectors.

On a regional level, the market has been classified into North America (United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others), Latin America (Brazil, Mexico and others), and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global booster compressor market include Atlas Copco AB, Bauer Compressors, Inc., Air Research Compressors, BOGE Compressed Air Systems GmbH & Co. KG, Generon, Hitachi, Ltd., Ingersoll Rand, Kaeser Kompressoren, NiGen International L.L.C., Sauer Compressors USA Inc., TGT Fuel Technologies Pvt. Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)