Boat Rental Market Report by Boat Type (Yachts, Sailing Boat, Catamaran, Motorboat, and Others), Power Source (IC Engine, Electric), Length (Up To 28 Feet, 28-45 Feet, More Than 45 Feet), Activity Type (Fishing, Sailing, and Others), and Region 2025-2033

Boat Rental Market Size:

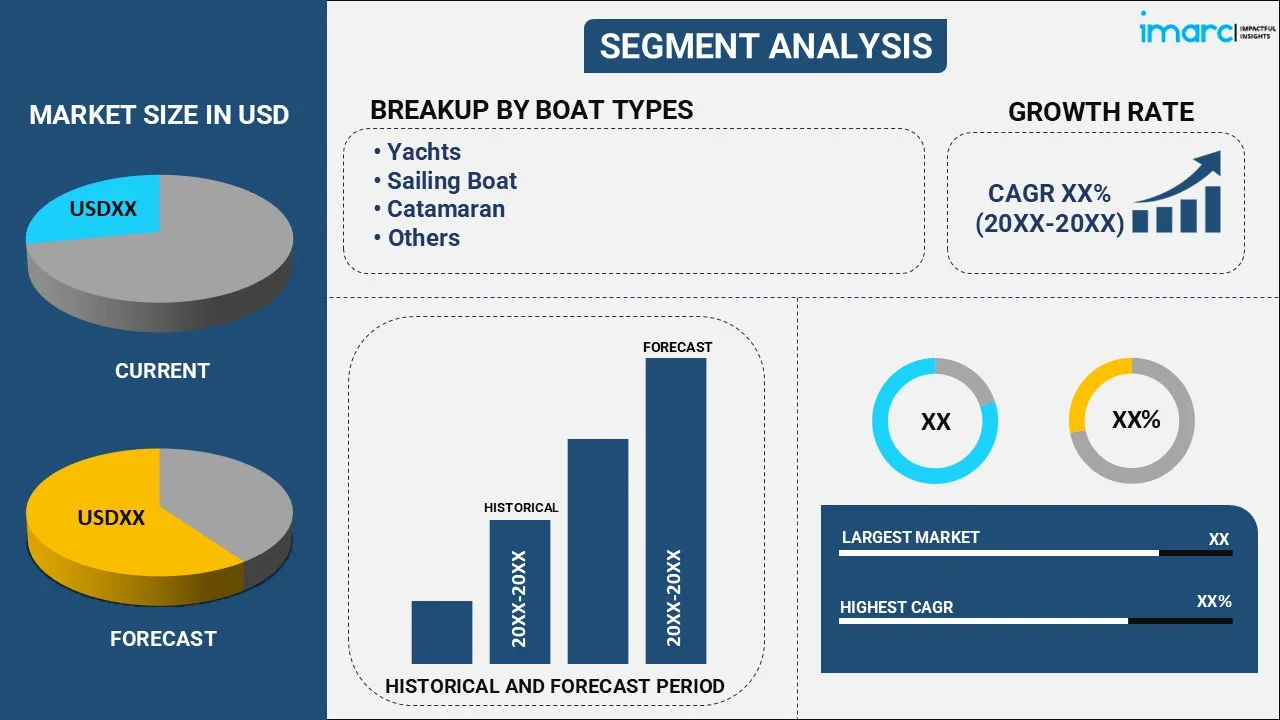

The global boat rental market size reached USD 20.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 30.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.39% during 2025-2033. The market is experiencing steady growth driven by the increasing participation in recreational activities, the emergence of peer-to-peer boat rentals that offer insurance, the expansion of online rental services, and the easy availability of luxury boats for rent.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 20.3 Billion |

|

Market Forecast in 2033

|

USD 30.5 Billion |

| Market Growth Rate 2025-2033 | 4.39% |

Boat Rental Market Analysis:

- Market Growth and Size: The global market is experiencing robust growth, driven by the increasing demand for unique and personalized water-based experiences. The market size is expanding as more consumers seek leisure activities and tourism opportunities centered around boating.

- Major Market Drivers: Key drivers include the rising trend of tourism and leisure activities, the popularity of recreational boating, and the transformative impact of the sharing economy. These factors contribute to a growing customer base and increased utilization of boat rental services.

- Technological Advancements: Technological advancements are shaping the industry, with online platforms and mobile applications facilitating easy access to boat rentals. The integration of digital tools enhances customer experiences, streamlines booking processes, and supports the industry's overall efficiency.

- Industry Applications: The service finds applications across various segments, including yachts, sailing boats, catamarans, and motorboats. The versatility of boat rentals caters to a wide range of activities, from luxury cruising to adventurous sailing and recreational fishing.

- Key Market Trends: Key trends include a focus on sustainability, with an increasing shift towards electric-powered boats. Additionally, there is a growing emphasis on experiential offerings, such as themed cruises and unique on-water events, reflecting changing consumer preferences.

- Geographical Trends: Geographical trends highlight the significance of coastal and inland waterway tourism. Regions with abundant natural water resources are witnessing higher market traction, while emerging markets show increasing demand for boat rental services.

- Competitive Landscape: The competitive landscape is characterized by key players investing in technology, expanding their fleets, and forming strategic partnerships. Major industry players are enhancing their online platforms, collaborating with tourism entities, and diversifying their boat offerings to maintain a competitive edge.

- Challenges and Opportunities: Challenges include regulatory hurdles and environmental concerns related to traditional fuel-powered boats. However, opportunities arise from the growing interest in sustainable boating options and the untapped potential in emerging markets.

- Future Outlook: The future of the market appears promising, with sustained growth anticipated. Ongoing technological innovations, coupled with a focus on sustainability and unique customer experiences, are expected to drive the market forward. As the industry continues to change, challenges present opportunities for innovation, making the boat rental market a dynamic and resilient sector in the broader recreational and tourism landscape.

Boat Rental Market Trends:

Increasing tourism and leisure activities

The market is experiencing significant growth due to the increasing trend of tourism and leisure activities. More individuals are seeking unique and personalized experiences, and renting boats provides an exciting option. Coastal and inland waterway tourism has gained popularity, with individuals and families looking for memorable water-based adventures. The desire for leisure activities such as fishing, sightseeing, and water sports contributes to the rising demand for boat rentals. As global travel becomes more accessible, the market stands to benefit from a diverse range of customers seeking enjoyable and scenic water experiences.

Rise in recreational boating

The growing interest in recreational boating is another key factor propelling the market forward. Several individuals are drawn to the idea of exploring water bodies on their terms, without the commitment to own a boat. Renting provides an affordable and convenient option for those who may not want the responsibilities associated with boat ownership, such as maintenance and storage costs. The rise in popularity of recreational boating events, boat clubs, and water-based festivals further fuels the demand for boat rentals as individuals seek temporary access to vessels for various social and recreational purposes.

Sharing economy and digital platforms

The advent of the sharing economy and the growth of digital platforms have transformed the industry. Online platforms and mobile applications connect boat owners with potential renters, making it easier for individuals to access and book boats seamlessly. This convenience factor, coupled with user reviews and transparent pricing, enhances the overall customer experience. The sharing economy model encourages boat owners to monetize their assets by renting them out when not in use, fostering a more sustainable and resource-efficient approach to boat usage. As technology continues to advance and the sharing economy expands, the market is likely to see sustained growth driven by increased accessibility and efficiency.

Boat Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on boat type, power source, length, and activity type.

Breakup by Boat Type:

- Yachts

- Sailing Boat

- Catamaran

- Motorboat

- Others

Motorboat accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the boat type. This includes yachts, sailing boat, catamaran, motorboat, and others. According to the report, motorboat represented the largest segment.

Motorboats, dominating the market, cater to a diverse range of boaters seeking speed, convenience, and versatility. This segment includes a wide array of boats, from small runabouts to larger cruisers, providing options for various activities such as water sports, fishing, and leisurely cruising. The dominance of motorboats reflects the widespread appeal of these vessels, meeting the diverse needs of both seasoned boaters and newcomers to the maritime lifestyle.

Yachts, synonymous with luxury and opulence, constitute a significant segment of the market, attracting a clientele seeking a sophisticated and exclusive maritime experience. Typically characterized by their size, amenities, and design, yachts cater to those desiring a lavish escape on the water, making them an integral part of the boat rental industry's premium offerings.

Sailing boats appeal to enthusiasts who seek a more traditional and hands-on approach to boating. This segment embodies the spirit of adventure and skillful navigation, attracting individuals and groups passionate about harnessing the power of the wind for an authentic seafaring experience. Sailing boats offer a unique connection with the sea and are often chosen by those valuing the serenity of wind-powered travel.

Catamarans, with their distinct dual-hull design, have gained popularity for their stability and spacious layouts. This segment appeals to a broad audience, including families and groups, seeking a balance between comfort and performance. Catamarans offer a stable and smooth sailing experience, making them a preferred choice for those looking to explore coastal waters and enjoy extended cruises.

Breakup by Power Source:

- IC Engine

- Electric

IC engine holds the largest share of the industry

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes the IC engine and electric. According to the report, the IC engine accounted for the largest market share.

The IC Engine segment within the market represents vessels powered by internal combustion engines, typically fueled by gasoline or diesel. These boats are known for their robust performance and are well-suited for a wide range of water activities, offering high speed and long-range capabilities. Boaters often prefer IC engine-powered boats for their familiarity, reliability, and ability to handle various water conditions. However, there is a growing awareness of environmental concerns associated with traditional fuel sources, leading to a gradual shift towards more sustainable alternatives in the boat rental industry.

The Electric segment in the market pertains to watercraft powered by electric propulsion systems, which can include battery-electric or hybrid setups. Electric boats are gaining popularity due to their eco-friendly nature, offering a cleaner and quieter boating experience. These vessels contribute to the industry's sustainability goals by reducing emissions and minimizing the environmental impact on water ecosystems. The Electric segment is witnessing increased interest from environmentally conscious consumers and regulatory initiatives promoting cleaner energy sources in the marine industry. As technology advances, electric boats are becoming more competitive in terms of performance, range, and accessibility, driving further adoption within the market.

Breakup by Length:

- Up To 28 Feet

- 28-45 Feet

- More Than 45 Feet

Up to 28 feet represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the length. This includes up to 28 feet, 28-45 feet, and more than 45 feet. According to the report, up to 28 feet represented the largest segment.

The segment comprising boats with a length of up to 28 feet caters to a diverse range of water enthusiasts seeking smaller and more maneuverable vessels. Boats in this category are often chosen for recreational activities such as fishing, day trips, and water sports due to their agility and ease of handling. They are popular among beginners and families looking for a cost-effective and accessible option for short excursions. Boats in this length range typically provide an intimate and cozy experience on the water, making them suitable for various inland waterways and coastal areas.

The 28-45 feet segment represents a versatile category of boats suitable for a wide range of boating activities. Boats in this length range offer a balance between space, performance, and functionality, appealing to boaters looking for a more substantial and comfortable experience. These boats are often chosen for cruising, fishing, and extended vacations on the water, providing ample room for amenities and accommodating larger groups of passengers. The 28-45 feet category is popular among boaters who seek a blend of maneuverability and comfort, making them well-suited for both inland and offshore waters.

The segment encompassing boats with a length exceeding 45 feet represents the larger and more luxurious vessels in the market. These boats are designed to offer a premium and spacious experience, making them ideal for upscale events, long-range cruising, and luxury vacations. Boats in this category often come equipped with advanced amenities, including multiple cabins, entertainment systems, and expansive deck spaces. While they require experienced operators, these larger vessels provide unparalleled comfort and style, catering to those who prioritize luxury and leisure on the water. The more than 45-foot segment is favored by those seeking a high-end boating experience with all the comforts of a floating home.

Breakup by Activity Type:

- Fishing

- Sailing

- Others

Sailing represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the activity type. This includes fishing, sailing, and others. According to the report, sailing represented the largest segment.

The sailing segment in the market is tailored for individuals who are drawn to the art and thrill of sailing. Sailing boats come in different types, including dinghies, catamarans, and keelboats, offering a variety of experiences for both novices and experienced sailors. These boats harness the power of the wind for propulsion, providing a unique and environmentally friendly way to explore the water. Sailing boats are popular for recreational outings, sailing lessons, and even competitive racing. This segment of the boat rental market appeals to those who appreciate the serenity and skill involved in harnessing the wind to navigate and enjoy the open water.

The segment dedicated to fishing in the market caters to enthusiasts who seek vessels specifically designed and equipped for fishing activities. Boats within this category are typically designed with features such as specialized fishing platforms, rod holders, livewells, and fish finders to enhance the angling experience. Fishing boats come in various sizes, ranging from smaller, more maneuverable vessels for inland waterways to larger offshore models capable of handling deep-sea fishing. This segment addresses the diverse needs of anglers, providing them with the appropriate equipment and settings to enjoy a successful and enjoyable fishing excursion.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest boat rental market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

The North American segment within the market is a dominant region, reflecting the robust boating culture and recreational activities across the United States and Canada. Boating destinations such as coastal areas, lakes, and rivers attract a significant number of boaters, contributing to a thriving boat rental industry. North America's diverse geography provides opportunities for various water activities, from sailing on the Great Lakes to cruising along the coastlines, fostering a dynamic and vibrant market for boat rentals.

The Asia Pacific region is emerging as a notable segment in the market, driven by the growing interest in water-based recreational activities across countries like Australia, China, and Southeast Asian nations. Boasting an extensive coastline, numerous islands, and picturesque water bodies, the Asia Pacific region offers diverse opportunities for boat rentals. Increasing disposable income, urbanization, and a rising middle class contribute to the growing popularity of boating as a leisure activity, making the Asia Pacific a promising market for these rental services.

Europe stands as a significant segment in the market, characterized by a rich maritime history, numerous navigable waterways, and a strong boating culture. Countries such as Italy, France, Greece, and the United Kingdom attract boaters from around the world, seeking diverse experiences from sailing in the Mediterranean to navigating scenic rivers and canals. The European market for boat rentals reflects a combination of cultural affinity for boating, tourism, and a wide array of water-based activities, contributing to a thriving and well-established industry.

Latin America is an emerging segment in the market, showcasing growth potential driven by its coastal areas, lakes, and rivers. Countries like Mexico, Brazil, and Colombia offer diverse landscapes and climates, creating opportunities for various water activities. As disposable incomes rise and tourism increases, Latin America is witnessing a rise in the popularity of boating as a recreational pursuit. The boat rental market in this region is changing to meet the demand for both local and international boaters seeking unique and memorable experiences on the water.

The Middle East and Africa segment in the market is characterized by a mix of coastal regions, expansive deserts, and inland water bodies. Countries such as the United Arab Emirates, South Africa, and Egypt are becoming increasingly popular destinations for boating enthusiasts. Boating events, luxury yacht charters, and leisure cruising contribute to the growth of the boat rental market in this region. The Middle East, in particular, is recognized for its luxury yacht charters and high-end boating experiences, attracting a discerning clientele seeking opulent and exclusive adventures on the water.

Leading Key Players in the Boat Rental Industry:

The key players in the market are driving growth through strategic initiatives, innovative service offerings, and a focus on customer-centric experiences. These players are investing in technology to enhance online platforms and mobile applications, making it easier for customers to discover and book boat rentals seamlessly. By leveraging the sharing economy model, these rental platforms facilitate efficient asset utilization, allowing boat owners to monetize their vessels when not in use. Additionally, major players are expanding their fleets to cater to diverse preferences, offering a wide range of boat types, lengths, and activities. Marketing efforts are tailored to promote the experiential aspects of boating, emphasizing unique offerings such as luxury yachts, sailing adventures, and fishing expeditions. Collaborations with tourism agencies, resorts, and other travel-related businesses are also common strategies to expand market reach.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Bluewater Yachting

- Boatjump SL

- Boatsetter Inc.

- GetMyBoat

- Globe Sailor

- Le Boat

- Nautal (Click&Boat)

- Sailo Inc.

- SamBoat

- Yachtico

- Zizooboats GmbH

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- October 20, 2017: Bluewater Yachting opened yacht management in the USA.

- January 11, 2023: Boatsetter Inc. announced that it has expanded its leadership team with the addition of Michael Farb as CEO.

- May 3, 2023: GetMyBoat announced its partnership with Fetii in DFW and Austin.

Boat Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Boat Types Covered | Yachts, Sailing Boat, Catamaran, Motorboat, Others |

| Power Sources Covered | IC Engine, Electric |

| Lengths Covered | Up To 28 Feet, 28-45 Feet, More Than 45 Feet |

| Activity Types Covered | Fishing, Sailing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bluewater Yachting, Boatjump SL, Boatsetter Inc., GetMyBoat, Globe Sailor, Le Boat, Nautal (Click&Boat), Sailo Inc., SamBoat, Yachtico, Zizooboats GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the boat rental market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global boat rental market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the boat rental industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the global boat rental market to exhibit a CAGR of 4.39% during 2025-2033.

Th growing marine tourism, along with the rising demand for boat rental services to provide personalized experience with zero maintenance costs, is primarily driving the global boat rental market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in the temporary halt in numerous recreational activities, thereby negatively impacting the global market for boat rental services.

Based on the boat type, the global boat rental market has been divided into yachts, sailing boat, catamaran, motorboat, and others. Currently, motorboat exhibits a clear dominance in the market.

Based on the power source, the global boat rental market can be categorized into IC engine and electric, where IC engine currently accounts for the majority of the global market share.

Based on the length, the global boat rental market has been segregated into up to 28 feet, 28-45 feet, and more than 45 feet. Among these, up to 28 feet holds the largest market share.

Based on the activity type, the global boat rental market can be bifurcated into fishing, sailing, and others. Currently, sailing exhibits a clear dominance in the market.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global boat rental market include Bluewater Yachting, Boatjump SL, Boatsetter Inc., GetMyBoat, Globe Sailor, Le Boat, Nautal (Click&Boat), Sailo Inc., SamBoat, Yachtico, and Zizooboats GmbH.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)