Blood Purification Equipment Market Size, Share, Trends and Forecast by Product Type, Indication, End User, and Region, 2025-2033

Blood Purification Equipment Market Size and Share:

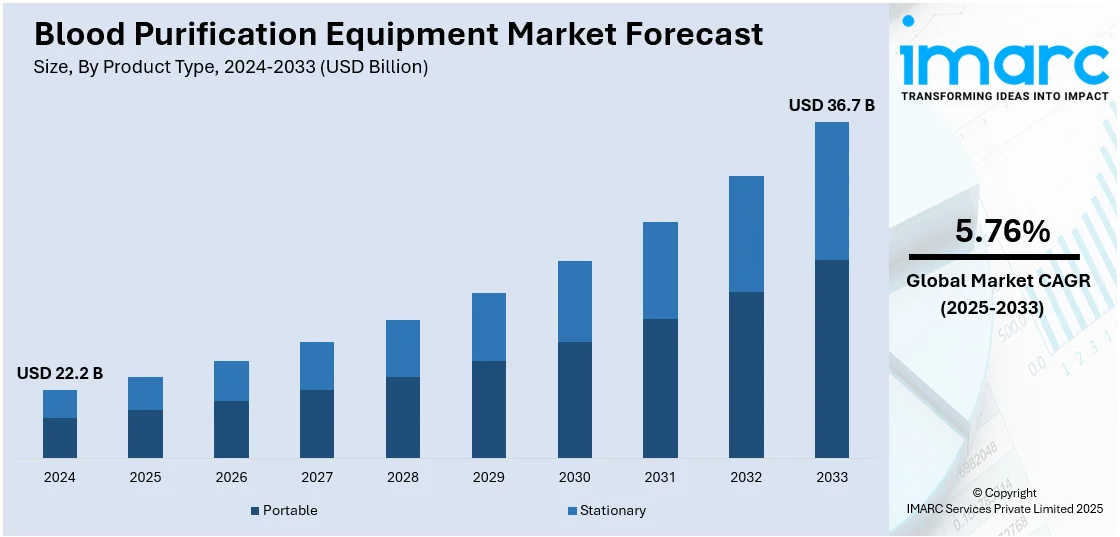

The global blood purification equipment market size was valued at USD 22.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 36.7 Billion by 2033, exhibiting a CAGR of 5.76% during 2025-2033. Asia-Pacific currently dominates the market. The rising incidence of kidney-related ailments, the growing demand for intensive care services, and continuous innovations in medical technologies are significantly contributing to the expansion of this industry. These factors are collectively driving the growth and positively influencing the global blood purification equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.2 Billion |

|

Market Forecast in 2033

|

USD 36.7 Billion |

| Market Growth Rate 2025-2033 | 5.76% |

The market for blood purification equipment is seeing a steady shift toward compact and portable devices. This is mainly due to the growing focus on home-based treatments and the need for flexible care options for patients with chronic illnesses. Portable units offer ease of use, quicker setup, and increased comfort for users, which is especially helpful for elderly patients or those requiring regular dialysis. These devices are becoming more advanced, with features that allow for efficient filtration without compromising on performance. Healthcare providers are also supporting this shift as portable models reduce patient load in hospitals and clinics. A notable development in 2024 was the launch of lightweight models with real-time monitoring features, enhancing safety during use at home. Manufacturers are also focusing on battery life improvements and user-friendly interfaces. The availability of remote support through connected apps is helping users manage treatment with minimal supervision.

The United States stands out as a key market disruptor, driven by the rapid adoption of cutting-edge technologies in blood purification systems and a strong focus on patient-centered care. Healthcare providers in the US are prioritizing efficiency, accuracy, and reduced treatment times, which has encouraged manufacturers to invest in smarter equipment with real-time monitoring and automated controls. The integration of AI-powered diagnostics, improved membrane technologies, and user-friendly interfaces is becoming more common across hospitals and outpatient dialysis centers. In 2024, multiple US-based firms introduced AI-assisted devices that automatically adapt purification cycles based on patient vitals, enhancing treatment precision and safety. There has also been a marked shift toward connectivity, with cloud-based data tracking now being used to manage patient records and device performance remotely. These innovations help clinicians make faster decisions while also supporting remote patient management an important feature as telehealth expands across the country.

Blood Purification Equipment Market Trends:

Increasing Prevalence of Kidney Diseases

The surge in demand for blood purification equipment is primarily driven by the growing prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD). NCBI reports that CKD incidence and prevalence have risen by approximately 40% globally over the last thirty years. As impaired kidneys are unable to eliminate toxins effectively, more patients now rely on dialysis and similar blood-cleansing methods. Factors such as rising CKD cases, global health trends, increasing adoption of hemodialysis and hemofiltration systems, and a growing elderly population who are more vulnerable to kidney-related conditions are boosting market expansion. In response, manufacturers are consistently enhancing device safety, comfort, and efficiency for patient care. The healthcare infrastructure both in the developed and developing countries is expanding the dialysis infrastructure, thereby bringing this type of blood purification technology to a wider population base, that creates a positive blood purification equipment market outlook.

Technological Advancements in Blood Purification

An additional prime factor catalyzing the blood purification equipment market growth is the development of blood purification technologies at a higher level of advancement. Advancements in filtration and adsorption technologies have significantly improved the removal of toxins, immune complexes, and metabolic waste from the bloodstream. Modern systems like high-flux dialyzers and next-generation hemoperfusion cartridges offer enhanced treatment outcomes for patients with sepsis, autoimmune disorders, and multiple organ dysfunctions. As per the World Health Organization, sepsis contributed to 48.9 Million cases and 11 Million deaths globally in 2020—around 20% of all recorded deaths. The introduction of portable and wearable blood purification devices is enhancing patient mobility, especially for those requiring frequent sessions. These evolving solutions are expanding beyond traditional dialysis, enabling treatment for both acute and chronic conditions and creating broader opportunities for healthcare providers and device manufacturers.

Increasing Demand for Critical Care Treatment

The rising number of patients in need of intensive care, especially in ICUs, is fueling the expansion of the blood purification equipment market. Recent studies show that global demand for critical care services has surged by 30–40%, largely due to the aging population, with individuals aged 65 and older making up nearly 60% of ICU admissions in developed nations. Life-threatening conditions such as sepsis, organ failure, and severe inflammation often require blood purification procedures to eliminate harmful agents and stabilize patients. The COVID-19 crisis further underscored the importance of these devices in managing serious complications. Increased recognition of extracorporeal blood purification's effectiveness in critical care, along with public healthcare investments aimed at upgrading ICU capabilities with advanced purification systems, is playing a major role in accelerating market growth.

Blood Purification Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blood purification equipment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, indication, and end user.

Analysis by Product Type:

- Portable

- Stationary

In 2024, the portable segment led the blood purification equipment market, driven by growing demand for home-based and point-of-care treatments among patients with chronic illnesses. The convenience of compact, user-friendly machines enabled wider use beyond hospital settings, particularly for elderly and mobility-restricted individuals. Increasing awareness of personal health management, coupled with advancements in device miniaturization and battery efficiency, encouraged adoption. Telehealth integration further enhanced remote monitoring capabilities. As healthcare systems globally emphasized decentralized care delivery, portable equipment gained preference over bulky, stationary counterparts. Rising prevalence of kidney disorders and sepsis also supported demand for portable blood purification devices in both urban and rural regions.

Analysis by Indication:

- Sepsis

- Renal Diseases

- Others

In 2024, the renal diseases segment led the blood purification equipment market, driven by the rising global burden of chronic kidney disease (CKD), diabetes, and hypertension-related complications. An increasing number of patients progressed to end-stage renal disease (ESRD), requiring long-term blood purification therapies such as hemodialysis and hemofiltration. Early diagnosis efforts and public screening programs expanded patient intake into treatment cycles. The need for effective toxin removal and fluid balance in renal patients heightened demand for advanced purification systems. Additionally, updated clinical guidelines and wider insurance coverage encouraged continuous therapy adoption. The renal disease segment thus became a consistent and high-volume demand source for such equipment.

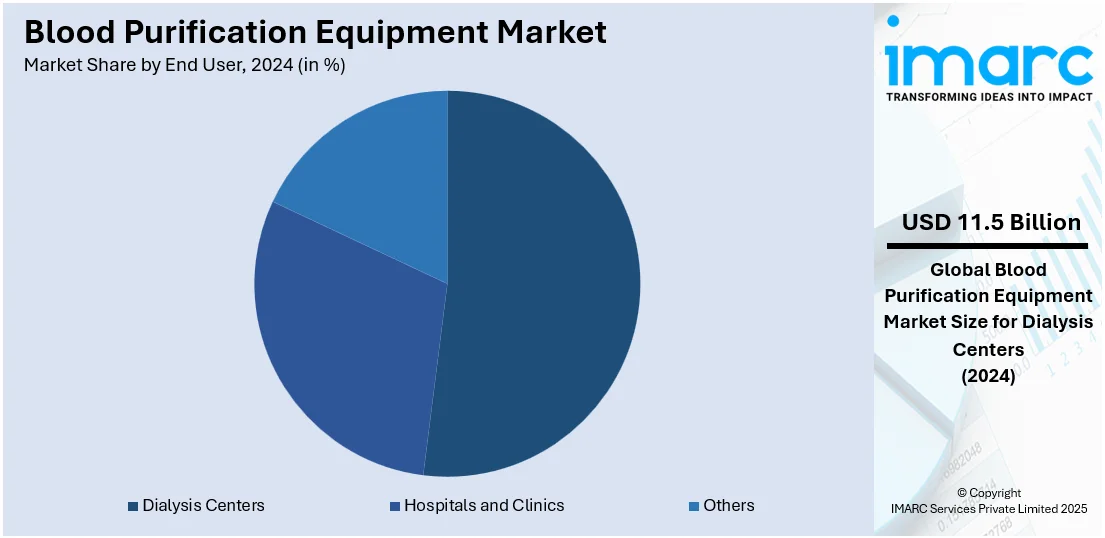

Analysis by End User:

- Hospitals and Clinics

- Dialysis Centers

- Others

In 2024, the dialysis centers segment led the blood purification equipment market, driven by increasing investments in infrastructure, rising patient dependency on outpatient dialysis services, and the centralized management of chronic kidney treatments. Dialysis centers offered scalable care models with cost efficiencies, trained staff, and standardized protocols, making them ideal locations for regular blood purification procedures. Governments and private providers focused on expanding dialysis access, especially in semi-urban areas, supporting the installation of advanced equipment. Higher patient throughput in these centers compared to homecare settings encouraged bulk procurement and long-term service agreements. The growing prevalence of CKD further ensured steady demand across regional dialysis networks.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the Asia-Pacific region dominated the blood purification equipment market, supported by fast-paced urban development, a rising burden of chronic kidney and metabolic disorders, and expanding healthcare infrastructure. Countries such as China and India experienced higher dialysis demand due to the growing number of CKD cases and limited access to organ transplants. Government programs enhanced dialysis accessibility, promoted domestic manufacturing, and encouraged collaboration between public and private sectors. Increased health awareness, better diagnostics, and broader insurance coverage played a role in early detection and consistent treatment uptake. Additionally, the region’s competitive manufacturing capabilities and growing exports of affordable medical devices reinforced its strong position. Furthermore, these factors significantly influence the blood purification equipment market statistics, thereby highlighting Asia-Pacific’s role as a leading growth contributor globally.

Key Regional Takeaways:

United States Blood Purification Equipment Market Analysis

The US market is witnessing strong growth owing to a surge in metabolic disorders, particularly chronic kidney disease (CKD) and end-stage renal failure. These conditions are driving the demand for renal replacement therapies. Nearly 815,000 Americans live with kidney failure, with about 555,000 relying on dialysis treatment. The American Kidney Fund indicates that over 14% of U.S. adults are affected by kidney disease. The rising number of critical care admissions linked to infectious and cardiovascular complications is also contributing to higher demand for blood purification solutions. The adoption of AI and IoT in healthcare devices is enhancing functionality through real-time monitoring and operational optimization. Additionally, modernization of hospital infrastructure and favorable reimbursement frameworks are supporting the uptake of advanced purification systems. Increased investment in biomedical research further strengthens the market outlook.

Europe Blood Purification Equipment Market Analysis

Europe’s market growth is being fueled by a rise in chronic illnesses, particularly among aging populations in countries such as Germany and Italy. According to Germany’s “9th Aging Report,” the population aged 80+ could reach up to 10 Million by 2050. This demographic shift is escalating the need for treatments like blood purification. Patient inclination toward less invasive procedures has led to wider adoption of innovative technologies, including devices with improved biocompatibility and nanomaterials. Enhanced efficiency and durability of these systems are gaining traction. The region is also witnessing increasing investment in healthcare facilities and rising cases of sepsis, demanding swift therapeutic interventions. Regulatory support and heightened awareness about early intervention techniques are further contributing to market development.

Asia Pacific Blood Purification Equipment Market Analysis

The Asia Pacific region is experiencing rapid market expansion, underpinned by ongoing urban development and improved access to quality healthcare services. Rising incidences of acute kidney injuries and liver-related complications in major countries like China and India are creating substantial demand for purification equipment. Government initiatives are increasing healthcare funding and broadening access to modern treatments. New dialysis centers in rural and peri-urban areas are improving treatment availability for wider populations. Additionally, the region's growing medical tourism sector, especially in Thailand and Malaysia, is boosting the market. Thailand alone catered to approximately three Million international patients in 2024. In 2019, the country's medical tourism industry generated around USD 9 Billion in foreign exchange, further emphasizing the sector’s economic impact.

Latin America Blood Purification Equipment Market Analysis

Latin America’s market is expanding due to a rise in CKD and renal failure cases, necessitating advanced blood purification therapies. Healthcare infrastructure improvements in countries like Brazil and Mexico are improving service accessibility. Brazil’s government, for instance, announced over BRL 58 Billion in healthcare investment plans through 2026, including BRL 9.9 Billion earmarked for Ceis under PAC and BNDES funding. Rising public awareness around kidney health and increased international collaborations are accelerating the adoption of sophisticated purification technologies. These efforts are making treatments more accessible across both metropolitan and remote regions, contributing to the overall market momentum.

Middle East and Africa Blood Purification Equipment Market Analysis

This regional market is growing due to escalating healthcare investments and a rise in kidney-related illnesses. Data from NCBI estimates that CKD prevalence in sub-Saharan Africa ranges from 2% to 41%, with South Africa alone reporting rates between 5.9% and 28.9%. Expansion of healthcare services, especially in underserved areas, is improving patient access to purification equipment. Government-led reforms and support for medical research are accelerating the deployment of innovative technologies. With rising healthcare standards and increased policy focus on non-communicable disease management, the demand for blood purification systems continues to grow across the region.

Competitive Landscape:

Ongoing advancements in medical device technology, treatment delivery methods, and patient engagement strategies are driving growth in the blood purification equipment market. Companies in the sector are prioritizing improvements in device accuracy, portability, and treatment efficiency to enhance clinical outcomes and user convenience. Firms compete by offering reliable, high-performance purification systems, remote monitoring capabilities, and customizable features tailored to different patient needs and care settings. Strategic collaborations, international market expansion, and targeted product development are supporting broader adoption. According to blood purification equipment market forecasts, demand is set to increase as healthcare systems focus on chronic disease management, decentralized care, and technology-enabled treatment solutions, encouraging greater investment in innovation, infrastructure, and patient-centric designs.

The report provides a comprehensive analysis of the competitive landscape in the blood purification equipment market with detailed profiles of all major companies, including:

- Aethlon Medical Inc.

- Asahi Kasei Corporation

- B. Braun Melsungen AG

- Baxter International Inc.

- Cerus Corporation

- CytoSorbents Corporation

- Fresenius SE & Co. KGaA

- Healthwell Medical Tech. Co. Ltd.

- Jafron Biomedical Co. Ltd.

- Kaneka Corporation

- Medtronic plc

- Nikkiso Co ltd.

- Spectral Medical Inc.

Latest News and Developments:

- February 2025: Oneject launched Indonesia’s first locally made blood bag (OneBag) and hemodialysis machine, enhancing national healthcare resilience. Backed by global technology, the launch meets domestic demand, reduces imports, and boosts economic impact. This milestone advances Oneject’s vision as Southeast Asia’s leading medical device manufacturer.

- February 2025: Tianyi Medical completed its acquisition of Nikkiso’s CRRT business, expanding its global footprint. The deal enhances Tianyi’s synergy in equipment and consumables, accelerates R&D for next-gen Aquarius devices, and supports its international strategy to build a comprehensive CRRT ecosystem and strengthen global competitiveness in critical care.

- January 2025: Haemonetics completed the sale of its whole blood assets to GVS, S.p.A. for up to USD 67.8 Million. The deal includes proprietary blood collection, processing and filtration technologies and facilities in California and Mexico. Haemonetics will focus on its apheresis solutions while using proceeds to support corporate and growth initiatives.

- September 2024: Argon Medical Devices launched the CLEANER Vac Thrombectomy System in the US, a large-bore aspiration device for removing blood clots from peripheral veins. Designed for precision and ease of use, it offers physicians greater control, aiming to simplify procedures and improve outcomes in venous thrombus treatment.

- June 2024: CytoSorbents launched the PuriFi blood pump in the EU, offering faster, easier use of its CytoSorb blood purification cartridge for critically ill patients. Featuring rapid setup and user-friendly design, PuriFi aims to increase demand, expand market reach, and improve patient outcomes across Europe and globally.

Blood Purification Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Portable, Stationary |

| Indications Covered | Sepsis, Renal Diseases, Others |

| End Users Covered | Hospitals and Clinics, Dialysis Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aethlon Medical Inc., Asahi Kasei Corporation, B. Braun Melsungen AG, Baxter International Inc., Cerus Corporation, CytoSorbents Corporation, Fresenius SE & Co. KGaA, Healthwell Medical Tech. Co. Ltd., Jafron Biomedical Co. Ltd., Kaneka Corporation, Medtronic plc, Nikkiso Co ltd., Spectral Medical Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blood purification equipment market from 2019-2033.

- The blood purification equipment market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood purification equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blood purification equipment market was valued at USD 22.2 Billion in 2024.

The blood purification equipment market is projected to exhibit a CAGR of 5.76% during 2025-2033, reaching a value of USD 36.7 Billion by 2033.

Key factors driving the blood purification equipment market include the rising prevalence of chronic kidney diseases and sepsis, increasing demand for home-based treatments, technological advancements in portable devices, a growing geriatric population, improved healthcare infrastructure, and expanding access to dialysis services in emerging economies.

In 2024, Asia Pacific dominated the blood purification equipment market, driven by rising cases of chronic kidney disease, expanding dialysis infrastructure, increasing healthcare investments, supportive government policies, and growing awareness. Countries like China, India, and Japan witnessed strong demand for advanced, cost-effective treatment solutions and portable devices.

Some of the major players in the global blood purification equipment market include Aethlon Medical Inc., Asahi Kasei Corporation, B. Braun Melsungen AG, Baxter International Inc., Cerus Corporation, CytoSorbents Corporation, Fresenius SE & Co. KGaA, Healthwell Medical Tech. Co. Ltd., Jafron Biomedical Co. Ltd., Kaneka Corporation, Medtronic plc, Nikkiso Co ltd., Spectral Medical Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)