Blood Gas and Electrolyte Analyzer Market Report by Product Type (Analyzers, Consumables), Modality (Benchtop, Portable), End User (Hospitals, Clinics, Ambulatory Surgical Centers, and Others), and Region 2025-2033

Blood Gas and Electrolyte Analyzer Market Overview:

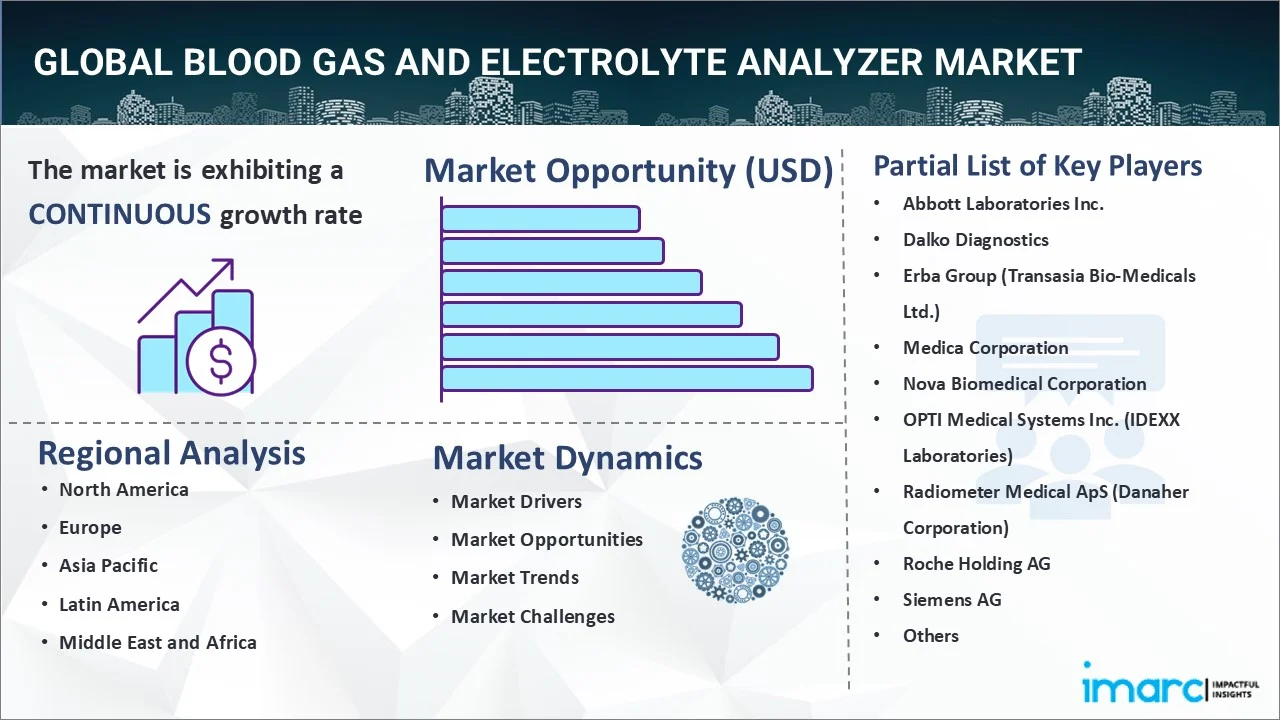

The global blood gas and electrolyte analyzer market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.37% during 2025-2033. The growing occurrence of various chronic illnesses like cardiovascular complications, cancer, and diabetes, increasing integration of advanced technologies to decrease the size of devices and enhance accuracy, and rising adoption of point-of-care (POC) testing services are some of the factors impelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.2 Billion |

|

Market Forecast in 2033

|

USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 5.37% |

Blood Gas and Electrolyte Analyzer Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth due to the increasing occurrence of chronic diseases among the masses. The aging global population, which is more susceptible to chronic diseases, is also contributing to the market growth.

- Key Market Trends: Major trends include the integration of advanced technologies into blood gas analyzers to improve their functionalities and accuracy. Moreover, the heightened adoption of point-of-care (POC) testing is supporting the market growth.

- Geographical Trends: North America represents the largest segment owing to the heightened occurrence of chronic ailments among the masses and the presence of strong healthcare facilities to provide proper treatment to patients.

- Competitive Landscape: Some of the major market players in the blood gas and electrolyte analyzer industry include Abbott Laboratories Inc., Dalko Diagnostics, Erba Group (Transasia Bio-Medicals Ltd.), Medica Corporation, Nova Biomedical Corporation, OPTI Medical Systems Inc. (IDEXX Laboratories), Radiometer Medical ApS (Danaher Corporation), Roche Holding AG, Siemens AG, and WerfenLife S.A., among many others.

- Challenges and Opportunities: Challenges include the high cost of advanced analyzers, which is a barrier for small healthcare facilities. Nonetheless, the high demand for frequent and accurate diagnostic testing is expected to overcome these challenges.

Blood Gas And Electrolyte Analyzer Market Trends:

Growing Adoption of Point-of-Care Testing

Heightened demand for point-of-care (POC) testing to produce rapid diagnostic results at bedside, which is imperative for making immediate clinical decisions in critical care settings is bolstering the market growth. POC testings has the considerable value to decrease central labs load and provides faster and easier testing options that healthcare providers want. With more healthcare systems focused on faster turnaround times and better patient outcomes, the portable and easy-to-use blood gas and electrolyte analyzer demand is rising. This trend is growing further as healthcare organizations search for additional diagnostic tools to improve efficiency and patient care. The IMARC Group predicts that the POC testing market is expected to reach US$ 99.5 billion by 2032.

Technological Advancements in Diagnostic Devices

Increasing improvements in diagnostic devices are key factors propelling the market growth. Modern and efficient analyzers are becoming more compact, user friendly, and efficient, providing rapid results with minimal sample volumes. These advancements include the addition of automated systems, wireless connectivity, and enhanced data management facilities, which streamline workflows in healthcare settings. The development of portable analyzers which allows for POC testing, further driving their adoption in emergency and home care settings. In 2024, Sensa Core launched the ST 200 Blood Gas analyzer with advanced accuracy and connectivity aspects for critical blood, gas, and electrolyte analysis. It integrates conventional long lasting maintenance free ISE electrodes and solid-state thick film technology for hematocrit, metabolites, and dissolved oxygen.

Increasing Prevalence of Chronic Diseases

Demand for blood gas and electrolyte analyzers is primarily driven by increasing prevalence of chronic diseases. All these conditions require a regular monitoring of blood gas levels in the patients, so that appropriate management can be instituted on time. This trend is also leading to a requirement for routine testing, primarily in critical care areas which has boosted the sales of blood gas and electrolyte analyzers product. The need for routine testing, especially in intensive care settings is propelling the blood gas and electrolyte analyzer market growth. This trend is also fueled by the aging global population who suffer from chronic diseases that can be more quickly and affordably diagnosed with these technologies. Furthermore, the 2023 World Population Data Sheet indicated ten percent of all human beings alive are aged sixty-five and over.

Blood Gas and Electrolyte Analyzer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product type, modality, and end user.

Breakup by Product Type:

- Analyzers

- Consumables

Consumables account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product type. This includes analyzers and consumables. According to the report, consumables represented the largest segment.

The consumables used in blood gas and electrolyte analyzers hold the largest share of this market. The high demand for consumables is driven by the need for regular replacement and replenishment to maintain the accuracy and functionality of the analyzers. The increasing number of diagnostic tests being conducted owing to the escalating burden of chronic diseases such as cardiovascular disorders, cancer, and chronic respiratory conditions also improves the blood gas and electrolyte analyzer market revenue. On the basis of a report published by the World Health Organization (WHO) in 2023, cardiovascular diseases accounted for most non-communicable disease (NCD) deaths or 17.9 million people annually.

Breakup by Modality:

- Benchtop

- Portable

Portable holds the largest share of the industry

A detailed breakup and analysis of the market based on the modality have also been provided in the report. This includes benchtop and portable. According to the report, portable accounted for the largest market share.

The popularity of portable analyzers is on the rise because of their mobility, user-friendly nature, and capability to provide quick results at the location of care. These portable gadgets can be conveniently moved to various areas in a healthcare facility, like intensive care units (ICUs) and homecare settings, enabling quick testing and decision-making. As healthcare providers are prioritizing speed and convenience in patient care, the portable segment is maintaining its leading position in the market and presenting blood gas and electrolyte analyzer market recent opportunities. In 2023, B&E Bio-Tech launched i-Check handheld blood gas electrolyte analyzer, which adopts microfluidic and electrochemical detection technology.

Breakup by End User:

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

Hospitals represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, clinics, ambulatory surgical centers, and others. According to the report, hospitals represented the largest segment.

Hospitals represent the largest segment, due to the high volume of critical care services provided by hospitals. Complex clinical sites such as emergency departments, intensive care units (ICUs), and operating rooms may need a wide array of diagnostic tools to accommodate the variety in patient needs. Hospitals will continue to account for the largest share of blood gas and electrolyte analyzers because they serve as a focal point in the healthcare delivery structure, with significant investment in advanced medical technologies.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest blood gas and electrolyte analyzer market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for blood gas and electrolyte analyzer.

The North America blood gas and electrolyte analyzer market is experiencing steady growth, driven by several key factors. The growing adoption of point-of-care testing in hospitals, clinics, and ambulatory surgical centers is further offering a favorable blood gas and electrolyte analyzer market outlook as healthcare providers prioritize quick and efficient diagnostics to improve patient outcomes. One of the primary drivers is the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions, which require regular monitoring of blood gas levels. The aging population in the region also contributes to the demand for these diagnostic tools, as older adults are more susceptible to chronic illnesses that necessitate frequent testing. As per a research paper published on the Center for Disease Control and Prevention (CDC) in 2024 by collecting data from the American Community Survey, the American Hospital Association Survey, and the Centers for Disease Control and Prevention’s PLACES, as estimated 129 million people in the USA have at least 1 chronic disease. Additionally, blood gas and electrolyte analyzer market recent developments, such as the creation of portable, user-friendly devices that offer rapid and accurate results, are positively influencing the market.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the blood gas and electrolyte analyzer industry include Abbott Laboratories Inc., Dalko Diagnostics, Erba Group (Transasia Bio-Medicals Ltd.), Medica Corporation, Nova Biomedical Corporation, OPTI Medical Systems Inc. (IDEXX Laboratories), Radiometer Medical ApS (Danaher Corporation), Roche Holding AG, Siemens AG, WerfenLife S.A., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Key players are taking several strategic initiatives to enhance their business and maintain a competitive edge. They are expanding their product portfolios through acquisitions and partnerships, enabling them to offer comprehensive solutions to healthcare providers. By collaborating with other companies, they can leverage each other's strengths and enter new markets more effectively. Blood gas and electrolyte analyzer companies are heavily investing in research and development to introduce technologically advanced products that offer improved accuracy, faster processing times, and enhanced user interfaces. These innovations often include features such as wireless connectivity, integrated data management systems, and compact, portable designs that cater to the growing demand for point-of-care testing. For instance, in 2024, IDEXX Laboratories, Inc. announced the launch of the IDEXX inVue Dx™ Cellular Analyzer, a unique slide-free cellular analyzer to examine certain common cytologic changes found in ear and blood samples.

Blood Gas and Electrolyte Analyzer Market News:

- July 2024: Werfen introduced the GEM Premier 7000 integrated with intelligent quality management 3, the first POC blood gas testing system with hemolysis detection at the Association for Laboratory Medicine (ADLM) Annual Meeting

- October 2023: Nova Biomedicals announced that the U.S. Food and Drug Administration (FDA) granted 510 (k) clearance for a microcapillary sample mode on the Stat Profile Prime Plus® Critical Care analyzer. The Prime Plus can perform an 11-test panel including pH, PCO2, PO2, Na, K, iCa, iMg, Cl, glucose, lactate, and hematocrit with only 90 microliters of capillary blood, or a complete 22-test profile on just 135 microliters of blood.

Blood Gas and Electrolyte Analyzer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Analyzers, Consumables |

| Modalities Covered | Benchtop, Portable |

| End Users Covered | Hospitals, Clinics, Ambulatory Surgical Centers, and Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories Inc., Dalko Diagnostics, Erba Group (Transasia Bio-Medicals Ltd.), Medica Corporation, Nova Biomedical Corporation, OPTI Medical Systems Inc. (IDEXX Laboratories), Radiometer Medical ApS (Danaher Corporation), Roche Holding AG, Siemens AG, WerfenLife S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, global blood gas and electrolyte analyzer market forecasts, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood gas and electrolyte analyzer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blood gas and electrolyte analyzer market was valued at USD 2.2 Billion in 2024.

We expect the global blood gas and electrolyte analyzer market to exhibit a CAGR of 5.37% during 2025-2033.

The introduction of portable blood gas and electrolyte analyzers with easy-to-use features and minimum maintenance requirements that aid to streamline work processes and minimize errors, is primarily driving the global blood gas and electrolyte analyzer market.

The sudden outbreak of the COVID-19 pandemic has led to the growing demand for blood gas and electrolyte analyzers to determine abnormal electrolyte levels in the blood and oxygen of the coronavirus-infected patients.

Based on the product type, the global blood gas and electrolyte analyzer market can be bifurcated analyzers and consumables. Currently, consumables hold the majority of the total market share.

Based on the modality, the global blood gas and electrolyte analyzer market has been segmented into benchtop and portable, where portable currently exhibits a clear dominance in the market.

Based on the end user, the global blood gas and electrolyte analyzer market can be divided into hospitals, clinics, ambulatory surgical centers, and others. Currently, hospitals account for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global blood gas and electrolyte analyzer market include Abbott Laboratories Inc., Dalko Diagnostics, Erba Group (Transasia Bio-Medicals Ltd.), Medica Corporation, Nova Biomedical Corporation, OPTI Medical Systems Inc. (IDEXX Laboratories), Radiometer Medical ApS (Danaher Corporation), Roche Holding AG, Siemens AG, and WerfenLife S.A.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)