Blood Collection Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2025-2033

Blood Collection Market Size and Share:

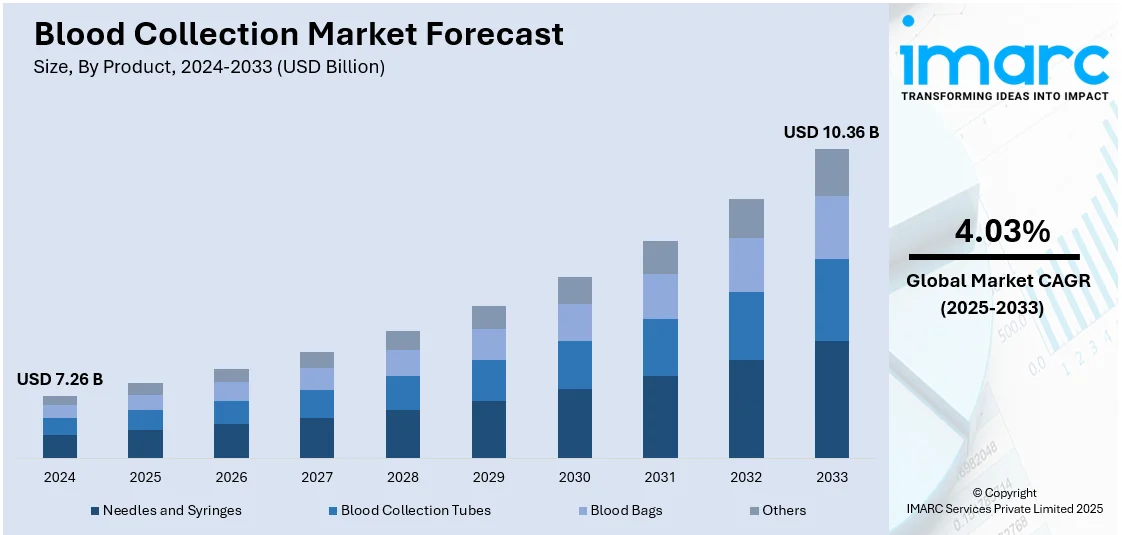

The global blood collection market size was valued at USD 7.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.36 Billion by 2033, exhibiting a CAGR of 4.03% during 2025-2033. North America currently dominates the market, holding a significant market share of 41.2% in 2024. The global market is expanding due to the increasing healthcare needs among the masses, the rising demand for affordable and precise diagnostic tests, and continual advancements in collection technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.26 Billion |

|

Market Forecast in 2033

|

USD 10.36 Billion |

| Market Growth Rate 2025-2033 | 4.03% |

The market is primarily driven by the rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, which require frequent blood testing and monitoring. Increasing healthcare infrastructure investments, particularly in emerging economies, and growing demand for advanced diagnostic techniques also contribute to the market growth. The increasing blood donation campaigns and awareness programs against blood shortages are positively influencing the demand. Technological advancement in blood collection devices, such as minimally invasive techniques, enhances patient comfort and safety, which in turn promotes adoption. In addition, the growing geriatric population across the globe and the increasing surgical procedures and personalized medicine are enhancing the requirement for blood collection services. Regulatory support and funding for research and healthcare innovations are further driving market expansion.

The United States stands out as a key regional market, primarily driven by the rising prevalence of chronic diseases, including diabetes, cancer, and cardiovascular conditions among the population, necessitating frequent blood diagnostics and monitoring. According to a 2024 research report by the National Center for Chronic Disease Prevention and Health Promotion, about 129 million Americans have one or more major chronic conditions, of whom 42% have two or more, and 12% have five or more. Five of the top 10 leading causes of death are strongly related to preventable and treatable chronic conditions. Chronic diseases account for 90% of the annual USD 4.1 Trillion U.S. health care costs, and their prevalence has been increasing steadily for the past two decades. The well-established healthcare infrastructure across the country with advanced medical technologies are driving innovation and adoption of efficient blood collection systems. Increased awareness regarding the importance of blood donations, supported by government initiatives and nonprofit campaigns, is further fueling the market growth. Rising surgical procedures, especially in aging population, coupled with the growing emphasis on early disease detection and personalized medicine, are contributing significantly to overall market demand.

Blood Collection Market Trends:

Rising Number of Surgeries Amid Chronic Disease Growth

The global blood collection market is witnessing significant growth driven by the rising number of surgical procedures in hospitals, such as C-sections and complex surgeries. According to the National Institutes of Health (NIH), the rate of C-sections in India rose from 17.2% in 2016 to 21.5% in 2021, highlighting the growing demand for blood collection products. Besides, the diseases caused by sedentary lifestyles and chronic diseases are also increasing, thereby creating a requirement for frequent health checkups and blood tests. For example, in the UK, over 385,000 new cancer cases are reported every year, thereby emphasizing the significance of blood collection in disease diagnosis. This pattern indicates that the importance of blood collection products in both curative and diagnostic healthcare is increasing with the growing burden of non-communicable diseases, which is also propelling the market.

Government Initiatives and Awareness Programs Bolstering Blood Donation

Favorable government initiatives across the globe are playing a crucial role in stimulating the growth of the blood collection market. Various campaigns are being initiated to spread awareness about the need for blood donation, which is positively influencing the market. This initiative promotes voluntary donations and ensures adequate blood and related components for medical requirements. Public health initiatives are promoting the lifesaving capability of routine blood donation, creating a culture of community-based care. In this regard, through campaigns that focus on blood collection for emergencies, and management of chronic diseases, and disasters, the programs are able to fill gaps in supply chains, especially in the underserved areas. Such initiatives by governments are fueling the global growth of the market with sustainable flows of blood resources for routine as well as critical applications.

Technological Advancements Revolutionizing Blood Collection

Technological innovations are transforming the blood collection market by enhancing efficiency and patient comfort. For instance, the push-button blood collection system for HbA1c testing in diabetic and prediabetic patients. These innovations reduce sample collection time, decrease patient discomfort, and improve diagnostic accuracy. As a result of advancements in automation, several blood collection systems integrate with diagnostic platforms for a seamless transfer of data in real-time. In addition, these technologies address a growing need for preventive care and personalized medicine, as quick and precise diagnostics serve as an important factor for such practices. In addition, advancements that reduce errors and increase workflow efficiency are increasing the adoption of advanced blood collection tools. Extensive research and development (R&D) activities are impelling the market for innovative products that serve to meet the changing demands of modern healthcare systems.

Blood Collection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global keyword market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use.

Analysis by Product:

- Needles and Syringes

- Blood Collection Tubes

- Serum-separating

- EDTA

- Heparin

- Plasma-separating

- Blood Bags

- Others

Needles and syringes stand as the largest component in 2024, holding around 29.2% of the market. Needles and syringes are the leading products across the globe in terms of market share as they find extensive application in healthcare institutions. They are used to carry out blood sampling, transfusion, and diagnostic procedures. They play an important role in a multitude of medical procedures such as carrying out routine blood tests and emergency care and managing long-term diseases such as diabetes, and cancer. They are preferred by medical personnel due to their reliability and ease of use along with being cost-effective. Apart from these, improvements in the technology used in needles include ultra-slim needles and safety-engineered devices, that aid in lowering the risks for needlestick injuries. Increased rates of chronic conditions, an increasing rate of surgical intervention, and more thrust toward preventive care are creating demand for needles and syringes.

Analysis by Application:

- Diagnostics

- Treatment

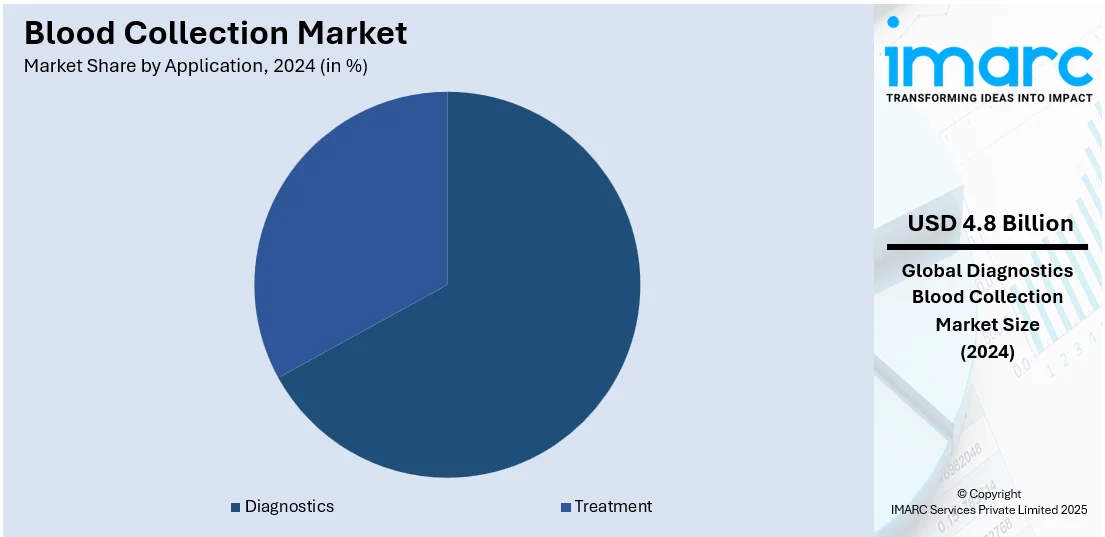

Diagnostics leads the market with around 66.7% of market share in 2024. The largest product segment is diagnostics in the global blood collection market, led by a rise in chronic diseases and the resultant increase in the demand for early and accurate diagnosis of these diseases. In modern medicine, blood diagnostics help identify a variety of conditions including cancer, diabetes, cardiovascular and infectious diseases. The increasing trend of regular health check-ups, which are being increasingly conducted to check lifestyle-related conditions, is also increasing the demand for diagnostic tools. Technological developments, including automated analyzers and rapid diagnostic kits, are enhancing the speed and accuracy of blood tests and are strengthening their dominance in the market.

Analysis by End Use:

- Hospitals

- Diagnostics Centers

- Blood Banks

- Others

Hospitals lead the market with around 37.2% of market share in 2024. Hospitals constitute the largest percentage in the world market as it performs most of the diagnostic and therapeutic procedures in-house. A medical center primarily for surgery, trauma, chronic conditions, and emergency interventions requires blood collection products to diagnose conditions as promptly as possible and to treat the patients correctly. Increasing surgical procedures involving complicated organ transplantations and cancer surgery are expanding the requirement for blood collection solutions. Hospitals also act as important centers for blood banks and transfusion services; therefore, they play a key role in the supply chain of blood and blood components. Additionally, the rising prevalence of chronic diseases and lifestyle-related diseases also calls for regular testing of blood in hospital labs, thus consolidating its position in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 41.2%. North America accounts for the largest share of the market on account of its well-developed healthcare infrastructure, higher incidence of chronic diseases, and increasing penetration of advanced diagnostic technologies. High lifestyle-related disorders such as diabetes, cardiovascular diseases, and cancer further result in increased demand for blood collection products in the region. The increasing number of surgical procedures, coupled with the strong blood donation culture in the region, supports the demand for efficient blood collection solutions. Government campaigns encouraging blood donation and high regulatory standards ensure the quality and safety of blood collection processes, thereby contributing to market growth. Furthermore, technological advancement in North America leads it to the forefront of innovative practices.

Key Regional Takeaways:

United States Blood Collection Market Analysis

In 2024, United States accounted for 82.50% of the North America blood collection market. The blood collection market in the United States is expanding as healthcare providers are adopting advanced technologies to enhance their diagnostic capabilities. Hospitals, diagnostic centers, and clinics focus on improving the efficiency and accuracy of blood collection processes through the integration of automated blood collection systems, reduced human errors, and patient discomfort. The growing emphasis on preventive healthcare is prompting an increased demand for regular blood tests, which are being utilized to monitor chronic conditions and ensure early diagnosis. According to American Diabetes Association, 38.4 million people have diabetes in the United States which is 11.6% of the U.S. population. The continuous trend toward minimally invasive blood collection, such as capillary blood collection and fingerstick technologies, is mainly driven by the increasing demand for personalized health care. Increasingly, health care providers are also investing in point-of-care testing solutions that enable quicker and more accessible blood collection in remote and underserved areas. Health-conscious consumers and increasing awareness of bloodborne diseases also enhance the demand for blood donation and testing services. Rising cases of chronic diseases such as diabetes, cardiovascular disease, and cancer are continually driving the need for blood tests in monitoring and controlling the progression of these diseases. Along with these, other factors such as improvement in equipment and consumables for collecting blood continue to influence the growth of the U.S. blood collection market.

Asia Pacific Blood Collection Market Analysis

The blood collection market is growing in Asia Pacific due to investments in the healthcare infrastructure of emerging economies, such as India and China, which are developing medical facilities and diagnostic capabilities. Hospitals and diagnostic centers are also rapidly adopting automated blood collection devices, improving efficiency and reducing human error. The initiatives in the government area related to the betterment of the public health systems are also on an uptrend, which emphasizes that there should be a reasonable price and easy access to diagnostic services. With this growth in chronic diseases and with age, the elderly population, the demand for check-up on health and blood tests has increased. According to United Nations Population Fund (UNFPA), the elderly population is 153 million (aged 60 and above) in the year 2023 across India. Simultaneously, rising awareness about the importance of early disease detection is leading to greater patient participation in routine medical examinations. The growth of medical tourism, especially in countries like Thailand and Singapore, is also contributing to the expansion of the market, as international patients look for advanced diagnostic services. There is also a growing trend toward less invasive, safer, and more comfortable blood collection methods, which further drives the adoption of new technologies in the blood collection sector. These developments are collectively fueling the ongoing growth of the blood collection market in the Asia Pacific region.

Europe Blood Collection Market Analysis

The market for blood collection in Europe is showing growth, as healthcare service providers have become more focused on improving their capabilities to diagnose and ultimately improve patient outcomes. Improved technologies for blood collection, especially vacuum blood collection tubes, are being adopted by hospitals and diagnostic labs to make these processes much more streamlined and comfortable for patients. The demand for less invasive procedures is increasing, which directs the trend toward such products. An increased prevalence of chronic diseases like diabetes and cardiovascular diseases leads to increased blood test frequency, therefore propelling the market's growth. According to Eurostat, the number of in-patients with diseases of the circulatory system discharged from hospitals across the EU was 8.6 million in 2021. Additionally, healthcare regulations and the push for better patient safety are encouraging the use of safer, more reliable blood collection systems, reducing the risk of needle-stick injuries. Manufacturers are increasingly responding to a need for solutions that are bio-friendly, sustainable, biodegradable, or reusable blood collection products. Moreover, health and wellness among individuals in the region as well as the aging population are fuelling healthier preventive care outcomes, with an increase in demand for collecting blood services, governments are promoting public health infrastructures in the region. They further support research towards developing innovations in blood-collecting technologies, propelling growth within the regions.

Latin America Blood Collection Market Analysis

The blood collection market in Latin America is currently expanding due to several specific factors. Healthcare providers are increasingly adopting advanced diagnostic technologies, which are driving the demand for high-quality blood collection devices. Regulatory bodies in countries like Brazil and Mexico are strengthening health standards and guidelines, ensuring more stringent requirements for blood collection and testing procedures. In addition, the ongoing efforts to improve healthcare infrastructure across the region are promoting the expansion of blood banks and diagnostic centers, contributing to higher demand for collection supplies. Growing awareness about early disease detection and preventive healthcare is further fuelling the need for blood tests. Urbanization is also playing a crucial role, with more people gaining access to healthcare services in metropolitan areas, thus driving the usage of blood collection products. According to the Brazilian Institute of Geography and Statistics, in 2019, Brazil had 45,945 km 2 of urbanized areas, the equivalent to 0.54% of the Brazilian area. Moreover, the rise in non-communicable diseases, such as diabetes and cardiovascular conditions, is prompting an increased frequency of medical checkups and blood tests, significantly boosting demand. Additionally, governments and non-profit organizations are investing in programs that focus on improving blood donation drives and transfusion services, which are directly enhancing the demand for blood collection tools in the region. These factors are collectively fuelling the growth of the blood collection market in Latin America.

Middle East and Africa Blood Collection Market Analysis

The blood collection market in the Middle East and Africa (MEA) is witnessing robust growth as healthcare systems are increasingly prioritizing blood donation and collection services. Governments and healthcare authorities are enhancing their focus on improving healthcare infrastructure, which is driving the demand for modernized blood collection systems. Additionally, hospitals and diagnostic centers are adopting automated blood collection technologies to improve efficiency and reduce errors, contributing to market growth. With rising awareness about blood donation campaigns and the critical need for blood during emergencies, the market is expanding as donors are being increasingly encouraged through awareness programs. Healthcare facilities are actively investing in advanced blood collection devices such as blood collection tubes, needles, and vacutainers to ensure safe and sterile processes. The spike in chronic diseases such as anemia, cancer, and diabetes are also driving the demand for regular blood tests and blood transfusions. According to the International Diabetes Federation, in 2021, 990,900 adults were affected with diabetes across UAE. Furthermore, the ongoing global health challenges, including the COVID-19 pandemic, are compelling governments and NGOs to focus on establishing more organized blood donation systems to support treatment needs. These developments are accelerating innovation in blood collection techniques, thus making blood collection more efficient and accessible across the MEA region.

Competitive Landscape:

The market is highly competitive, with key players emphasizing innovations focused on improving the efficiency and safety of blood collection processes. They are investing in research and development (R&D) activities to create advanced devices such as automated blood collection systems, minimally invasive tools, and needle-free technologies. Strategic partnerships and acquisitions are being pursued to expand product portfolios and reach untapped markets. Several companies are also focusing on sustainability by developing eco-friendly and disposable products to reduce medical waste. In addition to this, digital solutions such as data integration to track and manage blood samples better are being implemented by the leading companies. Apart from this, the players are also expanding their production capacities while conducting awareness campaigns and training programs to improve the adoption of modern blood collection techniques to meet the growing demand.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Abbott Laboratories

- Becton Dickinson and Company

- FL MEDICAL s.r.l

- Greiner AG

- Haemonetics Corporation

- McKesson Corporation

- Medtronic plc

- Nipro Corporation

- Qiagen N.V.

- Quest Diagnostics

- Sarstedt AG & Co. KG

- Terumo Corporation

Latest News and Developments:

- November 2023: BD (Becton, Dickinson and Company, a leading global medical technology company, launched new needle-free blood draw technology compatible with integrated catheters, helping to further enable the company's vision of a "One-Stick Hospital Stay."

- January 2024: Babson Diagnostics is a health care technology company based in Austin that has developed a new method of collecting and analyzing blood samples to make it significantly easier for patients and pharmacists to conduct blood tests at retail locations.

- April 2024: BD (Becton, Dickinson, and Company) launched the BD Vacutainer® UltraTouch™ Push Button Blood Collection Set in India to minimize patient discomfort and pain while providing a safer single puncture during blood drawing.

- October 2024: Husky Technologies™ and Kriya Medical Technologies Pvt. Ltd. have achieved a significant milestone with the deployment of India’s first ICHOR™ integrated medical system. This collaboration marks a new chapter for Kriya’s Chennai facility, which will now produce both 13×100 and 13x75mm blood collection tubes.

- October 2024: RedDrop Dx, Inc., a division of the Innosphere Fund and innovative, patient-centric clinical-grade blood collection solutions leader, announced partnering with Unilab Health. With more than 35 years of experience, Unilab Health is a highly rated laboratory partner with expertise in reproductive health testing. Their menu of at-home tests currently includes AMH (ovarian reserve) and Total Testosterone. Through this partnership, they will be able to expand their testing by adding more at-home tests.

Blood Collection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Diagnostics, Treatment |

| End Uses Covered | Hospitals, Diagnostics Centers, Blood Banks, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Becton Dickinson and Company, FL MEDICAL s.r.l., Greiner AG, Haemonetics Corporation, McKesson Corporation, Medtronic plc, Nipro Corporation, Qiagen N.V., Quest Diagnostics, Sarstedt AG & Co. KG, Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blood collection market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global blood collection market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood collection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Blood collection refers to the process of obtaining blood samples from individuals for medical testing, transfusion, or research purposes. It is a critical procedure in healthcare, facilitating diagnostics, disease monitoring, and therapeutic interventions using specialized devices and techniques.

The global blood collection market was valued at USD 7.26 Billion in 2024.

IMARC estimates the global blood collection market to exhibit a CAGR of 4.03% during 2025-2033.

The rising prevalence of chronic diseases such as diabetes and cardiovascular disorders, advancements in blood collection technologies, increased healthcare infrastructure investments, the growing demand for diagnostic tests, and government initiatives to promote blood donations are the major factors driving the global market.

Needles and syringes represented the largest segment by product, driven by their widespread use in routine blood draws and diagnostic applications.

Diagnostics leads the market by application due to the increasing prevalence of chronic and infectious diseases, necessitating frequent blood tests for early detection and disease management.

Hospitals are the leading segment by end use, driven by their role in surgeries, emergency care, and transfusion services requiring a consistent blood supply.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global blood collection market include Abbott Laboratories, Becton Dickinson and Company, FL MEDICAL s.r.l., Greiner AG, Haemonetics Corporation, McKesson Corporation, Medtronic plc, Nipro Corporation, Qiagen N.V., Quest Diagnostics, Sarstedt AG & Co. KG and Terumo Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)