Blood Clot Retrieval Devices Market Report by Stroke Type (Ischemic Stroke (Blood Clot), Hemorrhagic Stroke (Rupturing of Arteries), Transient Ischemic Attack), Device Type (Mechanical Embolus Removal Devices, Penumbra Blood Clot Retrieval Devices, Stent Retrievers, Aspiration Device, Ultrasound Assisted Devices), End User (Hospitals, Diagnostic Centers, Clinics, Ambulatory Surgical Centers), and Region 2025-2033

Blood Clot Retrieval Devices Market Overview:

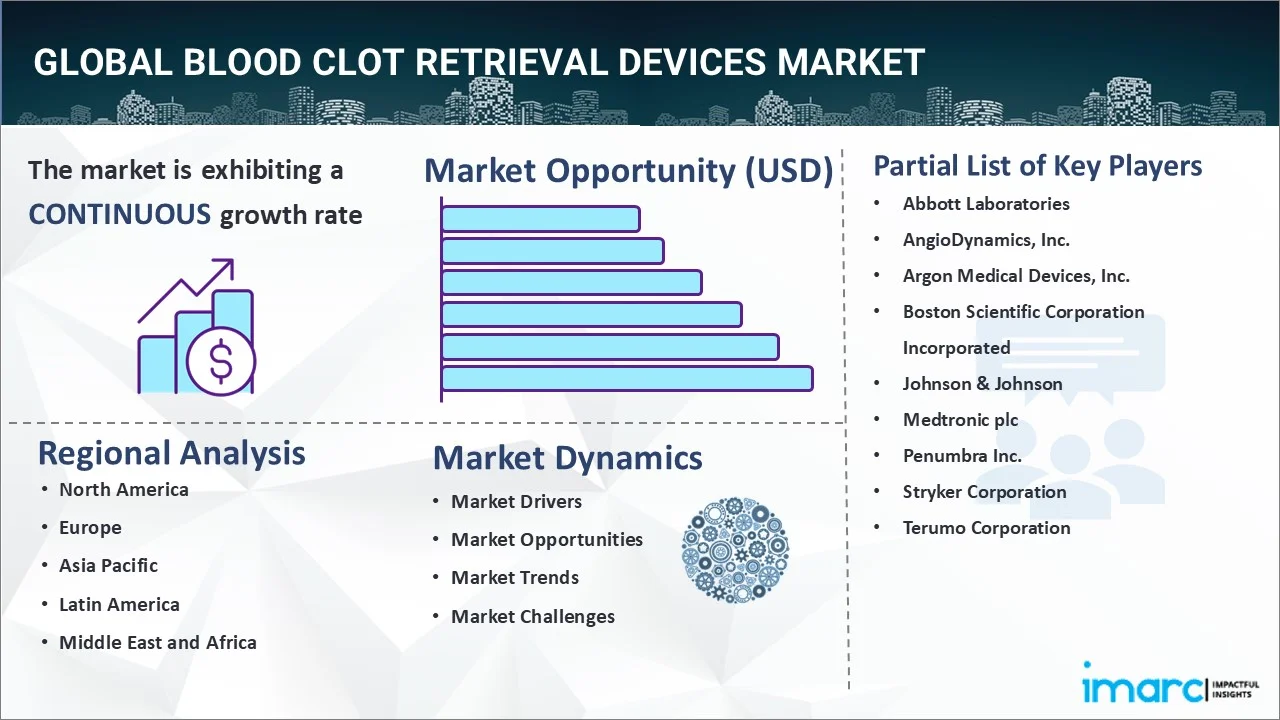

The global blood clot retrieval devices market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13.08% during 2025-2033. The growing prevalence of strokes and other vascular diseases among the masses, rising trend among healthcare professional to choose minimally invasive (MI) treatments over traditional open operations, and ongoing improvements in technology are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate (2025-2033) | 13.08% |

Blood Clot Retrieval Devices Market Analysis:

- Major Market Drivers: The blood clot retrieval devices market value is showing a robust growth owing to the rising incidence of stroke and peripheral artery diseases, which necessitate effective and timely removal of blood clots to prevent severe outcomes and fatalities.

- Key Market Trends: The innovation of more efficient and less invasive clot retrieval devices, with a focus on reducing procedure time and enhancing patient recovery, is strengthening the market growth.

- Geographical Trends: North America dominates the market because of advanced healthcare infrastructure, high healthcare expenditure, and strong presence of leading device manufacturers.

- Competitive Landscape: Some of the major market players in the blood clot retrieval devices industry include Abbott Laboratories, AngioDynamics, Inc., Argon Medical Devices, Inc., Boston Scientific Corporation Incorporated, Johnson & Johnson, Medtronic plc, Penumbra Inc., Stryker Corporation, Terumo Corporation, etc., among many others.

- Challenges and Opportunities: Stringent regulatory requirements for device approval, high device costs, and the need for specialized training for healthcare providers to perform these procedures are influencing the blood clot retrieval devices market revenue. However, opportunities in developing cost-effective devices that can cater to lower-income regions and in expanding the clinical indications for the use of these devices, potentially opening new market segments.

Blood Clot Retrieval Devices Market Trends/Drivers:

Growing Incidence of Stroke and Vascular Diseases

The rising number of strokes and vascular diseases worldwide is a key factor driving the market for blood clot retrieval devices. Stroke is a common cause of disability and death, impacting millions of people every year. According to the data from the Centers for Disease Control and Prevention, stroke was responsible for 1 in 6 deaths from cardiovascular disease in 2021. In the United States, a stroke happens every 40 seconds, with one person dying from a stroke every 3 minutes and 14 seconds. Every year, over 795,000 people in the United States experience a stroke. Roughly 610,000 of these are first-time or new incidents of stroke.

Additionally, an increase in stroke cases can be attributed to the growing prevalence of lifestyle-related risk factors like sedentary behaviors, poor dietary habits, and smoking, as well as an aging population. Besides this, there is a high occurrence of vascular diseases such as deep vein thrombosis (DVT) and pulmonary embolism (PE), which increases the need for efficient clot retrieval products. The emphasis on decreasing the impact of these illnesses is driving the demand for more advanced clot retrieval tools to enhance patient results and elevate the overall standard of stroke and vascular treatment.

Growing Awareness and Education

Increased knowledge and learning about the importance of early intervention in stroke and vascular diseases are greatly driving the need for blood clot retrieval devices. According to CDC data, the most common form of heart disease, coronary heart disease, resulted in the deaths of 375,476 individuals in 2021. Approximately 5% of people ages 20 and above suffer from coronary artery disease (CAD). Nearly 20% of deaths caused by coronary artery disease in 2021 occurred in people who were under the age of 65. Furthermore, effective actions have been taken via public health campaigns, medical conferences, and educational initiatives to inform the public and healthcare professionals about the symptoms of strokes and the need for prompt treatment. Moreover, a growing number of patients are turning to urgent medical care when they notice signs of a stroke, expanding the group of people eligible for clot removal procedures. Additionally, medical professionals are improving their skills in recognizing suitable scenarios for clot retrieval, resulting in an increase in the use of these tools for managing acute ischemic strokes.

Technological Advancements and Innovations

Another important factor driving the market is continuous advancements of medical technology and improvements in devices used for blood clot retrieval. Manufacturers and researchers are always striving to create devices that are more effective, less invasive, and safer. Improvements in imaging technologies like advanced computed tomography (CT) and 3D rotational angiography are allowing for clearer visualization of clots, resulting in more precise retrieval procedures. Furthermore, combining robotics and artificial intelligence (AI) could transform clot retrieval processes by improving efficiency and lowering the likelihood of complications. As these technological improvements continue to develop, healthcare providers are using these devices more to remain at the forefront of stroke and vascular care.

Precision Medical Products unveiled the Circul8 Pro® in November 2021, featuring a battery life of over 20 hours, surpassing industry norms for preventing deep vein thrombosis (DVT). This new development improves patient adherence and movement, in accordance with guidance from industry authorities such as the Association of Perioperative Registered Nurses (AORN) and the American College of Chest Physicians

Blood Clot Retrieval Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blood clot retrieval devices market report, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on stroke type, device type, and end user.

Breakup by Stroke Type:

- Ischemic Stroke (Blood Clot)

- Hemorrhagic Stroke (Rupturing of Arteries)

- Transient Ischemic Attack

Ischemic stroke (Blood Clot) dominates the market

The report has provided a detailed breakup and analysis of the market based on the stroke type. This includes ischemic stroke (blood clot), hemorrhagic stroke (rupturing of arteries), and transient ischemic attack. according to the report, ischemic stroke (Blood Clot) represented the largest segment.

The rising prevalence of ischemic stroke is the main factor driving the demand for blood clot retrieval devices for this type of stroke. As the elderly population grows, the occurrence of ischemic stroke is increasing. Furthermore, progress in medical technology and developments in clot retrieval devices have resulted in better effectiveness and patient results, prompting healthcare providers to embrace these state-of-the-art solutions.

In March 2022, Medtronic introduced PRAAN, which is the first clinical registry in India to evaluate neurothrombectomy devices for stroke patients, with the goal of improving treatment results and knowledge about acute ischemic stroke. The initiative focuses on increasing the use of neurothrombectomy in India to enhance patient care and inform policy decisions by collecting and analyzing thorough data. Moreover, an increasing number of individuals and medical experts are recognizing the advantages of timely intervention in cases of ischemic stroke, leading to a rise in the number of patients eligible for clot retrieval procedures.

On the contrary, the incidence of hemorrhagic stroke, characterized by the rupturing of arteries and bleeding into the brain, is a significant driver for these devices. Hemorrhagic strokes account for a substantial portion of all stroke cases and are associated with high morbidity and mortality rates. As healthcare providers and governments focus on improving stroke care, there is a growing need for advanced clot retrieval devices to effectively manage hemorrhagic stroke cases. Moreover, continuous advancements in medical technology and interventional radiology techniques have led to the development of innovative and minimally invasive devices that can precisely target and remove blood clots, improving patient outcomes and reducing complications.

Breakup by Device Type:

- Mechanical Embolus Removal Devices

- Penumbra Blood Clot Retrieval Devices

- Stent Retrievers

- Aspiration Device

- Ultrasound Assisted Devices

Stent retrievers hold the largest share in the market

A detailed breakup and analysis of the market based on the device type has also been provided in the report. This includes mechanical embolus removal devices, penumbra blood clot retrieval devices, stent retrievers, aspiration device, and ultrasound assisted devices. According to the report, stent retrievers accounted for the largest market share.

Stent retrievers are highly effective in treating ischemic strokes caused by blood clots. They are designed to mechanically remove blood clots from blocked arteries in the brain, restoring blood flow and minimizing potential brain damage. The proven efficacy of stent retrievers in stroke treatment has led to their widespread use as a standard of care. Also, manufacturers are continually investing in research and development to enhance stent retriever designs and materials, improving their performance and safety. This commitment to innovation has further strengthened its position in the market.

On the other hand, Penumbra's innovative technology and dedication to research and development have resulted in the creation of highly effective and specialized devices for blood clot retrieval. These devices have demonstrated superior recanalization rates and positive patient outcomes, earning the trust of healthcare providers and driving their adoption. For instance, in April 2024, Penumbra's Lightning Flash 2.0, FDA-cleared for thrombus removal, improves patient safety and procedure efficiency. Its launch aligns with a growing thrombectomy devices market, bolstering Penumbra's industry standing and business prospects.

Breakup by End User:

- Hospitals

- Diagnostic Centers

- Clinics

- Ambulatory Surgical Centers

Hospitals dominates the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, diagnostic centers, clinics, and ambulatory surgical centers. According to the report, hospitals represented the largest segment.

The hospitals' end use segment is a major driver for the blood clot retrieval devices industry. Hospitals serve as primary care centers for patients suffering from stroke and vascular diseases, making them the key purchasers of clot retrieval devices. As the incidence of these conditions continues to rise, hospitals are increasingly investing in cutting-edge medical technologies to enhance patient care and outcomes. Along with this, the blood clot retrieval devices demand is further bolstered by the growing awareness among healthcare professionals about the benefits of mechanical thrombectomy in treating acute ischemic strokes and other clot-related disorders.

On the contrary, diagnostic centers play a crucial role in the early detection and diagnosis of stroke and vascular diseases, leading to an increasing number of patients being referred for clot retrieval procedures. As these centers focus on providing comprehensive and specialized diagnostic services, the demand for advanced clot retrieval devices is rising to complement their diagnostic capabilities. Diagnostic centers are recognizing the importance of offering comprehensive stroke and vascular care solutions, and the integration of blood clot retrieval devices allows them to expand their service portfolio and enhance patient outcomes.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest blood clot retrieval devices market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for blood clot retrieval devices.

The blood clot retrieval devices industry in North America is driven by the region has high prevalence of stroke and vascular diseases, particularly in the aging population. On the basis of the report provided by the United Nations (UN) in 2023, the global population of people aged above 65 or older is expected to increase more than double from 761 million in 2021 to 1.6 billion in 2050. Moreover, individuals aged above 80 years or older are growing at an even faster pace. Additionally, North America is at the forefront of medical technology and innovation, with significant investments in research and development. This has resulted in the creation of state-of-the-art blood clot retrieval devices with improved efficacy and safety profiles, attracting healthcare providers to adopt these cutting-edge solutions. Moreover, a well-established healthcare infrastructure, along with favorable reimbursement policies, supports the adoption of advanced medical technologies, including clot retrieval devices, further strengthening the blood clot retrieval devices market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the blood clot retrieval devices industry include Abbott Laboratories, AngioDynamics, Inc., Argon Medical Devices, Inc., Boston Scientific Corporation Incorporated, Johnson & Johnson, Medtronic plc, Penumbra Inc., Stryker Corporation, Terumo Corporation, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- Major blood clot retrieval devices companies are introducing cutting-edge devices that meet the specific needs of healthcare professionals and patients. Product launches and upgrades are often accompanied by clinical trials and studies to demonstrate the devices' effectiveness and gain regulatory approvals. In addition, the escalating collaborations of manufacturers with research institutions, medical centers, and other industry players to leverage expertise, resources, and knowledge is positively influencing the market. Apart from this, continuous improvement and post-market surveillance of companies' activities to monitor device performance, identify potential issues, and implement necessary enhancements are offering a favorable blood clot retrieval devices market outlook. In June 2023, MicroVention, a neurovascular company under Terumo Corporation, launched the ERIC Retrieval Device for ischemic stroke treatment, offering thrombus control and procedure efficiency, reinforcing its commitment to advancing stroke therapy.

Blood Clot Retrieval Devices Market News:

- September 2021: Boston Scientific Corporation Incorporated acquired Devoro Medical, Inc., adding the WOLF Thrombectomy® Platform to its peripheral intervention portfolio, enhancing clot management capabilities. This acquisition expands Boston Scientific's offerings for thromboembolic procedures, aiming to improve procedural efficiencies and patient outcomes.

- September 2021: Abbott Laboratories expanded its vascular offerings by acquiring Walk Vascular, LLC, enhancing its portfolio with minimally invasive thrombectomy systems for peripheral blood clot removal. This acquisition strengthened Abbott's position in providing comprehensive endovascular therapy solutions to improve patient care.

- April 2021: Argon Medical Devices, Inc. launched Kodiak™ Dual Port Coaxial Introducer Kit, engineered for precise and streamlined introduction of diagnostic and therapeutic devices into the vasculature. The kit offers versatility for various vascular procedures, including complex ones like IVC filter retrievals, providing reinforced support and flexibility for interventionalists.

Blood Clot Retrieval Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Stroke Types Covered | Ischemic Stroke (Blood Clot), Hemorrhagic Stroke (Rupturing of Arteries), Transient Ischemic Attack |

| Device Types Covered | Mechanical Embolus Removal Devices, Penumbra Blood Clot Retrieval Devices, Stent Retrievers, Aspiration Device, Ultrasound Assisted Devices |

| End Users Covered | Hospitals, Diagnostic Centers, Clinics, Ambulatory Surgical Centers |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, AngioDynamics, Inc., Argon Medical Devices, Inc., Boston Scientific Corporation Incorporated, Johnson & Johnson, Medtronic plc, Penumbra Inc., Stryker Corporation, Terumo Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global blood clot retrieval devices market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global blood clot retrieval devices market?

- What is the impact of each driver, restraint, and opportunity on the global blood clot retrieval devices market?

- What are the key regional markets?

- Which countries represent the most attractive blood clot retrieval devices market?

- What is the breakup of the market based on the stroke type?

- Which is the most attractive stroke type in the blood clot retrieval devices market?

- What is the breakup of the market based on the device type?

- Which is the most attractive device type in the blood clot retrieval devices market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the blood clot retrieval devices market?

- What is the competitive structure of the global blood clot retrieval devices market?

- Who are the key players/companies in the global blood clot retrieval devices market?

Key Benefits for Stakeholders:

- IMARC’s blood clot retrieval devices market research report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blood clot retrieval devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood clot retrieval devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)