Blood Bank Market Size, Share, Trends and Forecast by Product Type, Bank Type, Function, End User, and Region, 2026-2034

Blood Bank Market Size and Share:

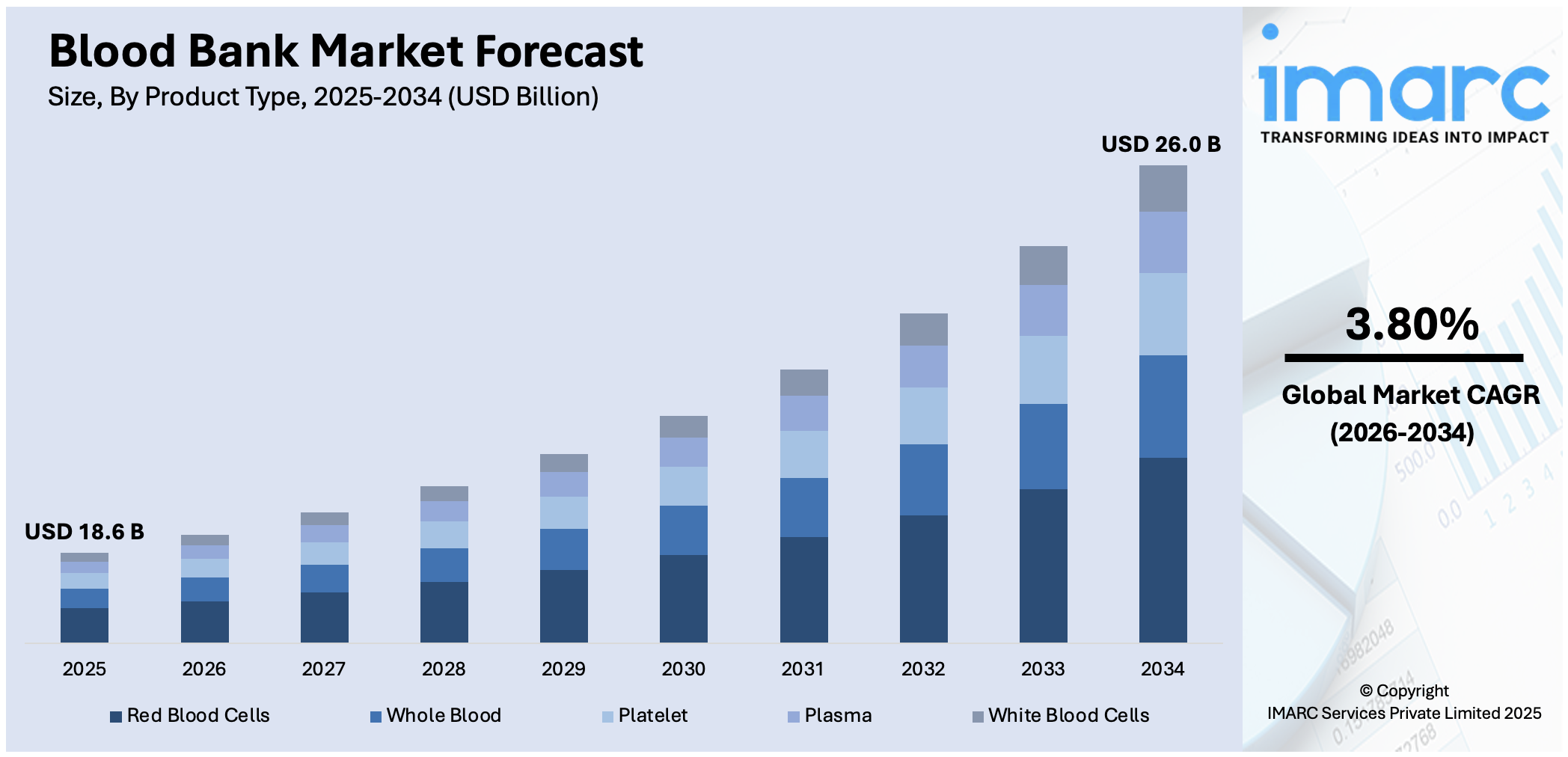

The global blood bank market size was valued at USD 18.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 26.0 Billion by 2034, exhibiting a CAGR of 3.80% during 2026-2034. North America currently dominates the market, holding a significant market share of over 45% in 2025, driven by advanced healthcare infrastructure, high blood donation rates, strong regulatory policies, and increasing demand for blood transfusions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 18.6 Billion |

|

Market Forecast in 2034

|

USD 26.0 Billion |

| Market Growth Rate (2026-2034) | 3.80% |

One major driver of the blood bank market is the increasing prevalence of chronic diseases and surgical procedures requiring blood transfusions. The rising incidence of conditions such as cancer, cardiovascular diseases, and hematological disorders has significantly escalated the demand for blood and blood components. Additionally, the growing number of complex surgical interventions, including organ transplants and trauma care, further necessitates a reliable and efficient blood supply. For instance, in 2024, independent blood suppliers, including the largest in the New York City area, provide 60% of the U.S. blood supply, according to America’s Blood Centers, a nonprofit representing donation centers nationwide. Government initiatives and awareness campaigns promoting voluntary blood donation are strengthening collection networks, ensuring a steady supply. Advancements in blood storage, screening, and transfusion technologies are also enhancing the efficiency and safety of blood banking services.

To get more information on this market Request Sample

The United States plays a critical role in the blood bank market through a well-established network of blood collection centers, advanced transfusion services, and stringent regulatory oversight. Organizations such as the American Red Cross and AABB ensure a steady supply through nationwide donor programs. The U.S. leads in innovations, including pathogen reduction technologies and automated blood processing systems, enhancing safety and efficiency. Federal initiatives, including FDA regulations and funding for blood research, support quality standards and inventory management. For instance, in 2025, OneBlood became the first U.S. blood center to receive FDA approval for licensed high-titer COVID-19 convalescent plasma to treat immunocompromised patients, who comprise 3% of the population and 20% of COVID-19 hospitalizations. The growing adoption of digital platforms for donor recruitment and real-time inventory tracking further strengthens the country’s contribution to global blood banking.

Blood Bank Market Trends:

Rising Number of Patients Diagnosed with Chronic Diseases

The rising number of patients diagnosed with chronic diseases such as cardiovascular issues, cancer, and autoimmune diseases are propelling the market. According to a report by the WORLD HEALTH ORGANIZATION (WHO), chronic diseases are responsible for 41 million deaths each year. The report also states that 17 million individuals succumb to this disease before the age of 70. These diseases require continuous medical interference such as chemotherapy, surgeries, and blood transfusions. For instance, a cancer patient often requires blood transfusions in order to manage the chances of anaemia, similarly individuals diagnosed with heart diseases may need surgeries including coronary artery bypass grafting, which makes the procedure of blood transfusion vital. Other than this, the rapidly changing demography across the globe is further driving the blood bank market growth. With the rising age, the chances of being diagnosed with these chronic illnesses rises exponentially, thereby fuelling market growth.

Increasing Number of Government Initiatives

Governments across the globe are working toward increasing awareness in respect to the importance of blood donation. The increasing number of public awareness campaigns, educational initiatives and community outreach programs are further driving the market growth. For instance, on 14th June each year, WORLD DONOR DAY is observed acting as a worldwide stage to increase awareness about the growing need for safe blood and blood products. This day also acknowledges the contributions made by voluntary blood donors. Other than this, governments across the globe also offer tax incentives, national blood donor registries in order to encourage the donation of blood. These initiatives of health organizations and governments collectively have led to a rise in the number of donors. According to the WORLD HEALTH ORGANIZATION (WHO), an increase of 10.7 million blood donations from unpaid donors has been recorded from the year 2008-2018.

Implementation of Strict Quality Standards

Stringent regulations and quality standards related to blood collection are one of the key blood bank industry trends. Regulatory bodies across the globe implement strict guidelines regarding the efficacy, safety, and quality of blood products. These regulations are meant to administer numerous facets of blood banking operations, such as blood collection, donor screening and eligibility, storage, processing, and distribution practices. For instance, in the United States region, the FOOD AND DRUG ADMINISTRATION (FDA) has been deemed responsible for the governance of blood establishments under the Code of Federal Regulations (CRF) Title 21. This includes the requirements for good manufacturing practices (GMP), donor testing, screening, labelling, and adverse event reporting. In case of non-compliance with these requirements may result in license revocation, severe penalties and fines, and reputational damage. This ensures a rise in safe blood donations and blood products.

Blood Bank Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blood bank market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, bank type, function, and end user.

Analysis by Product Type:

- Whole Blood

- Red Blood Cells

- Platelet

- Plasma

- White Blood Cells

Red blood cells lead the market in 2025. Red blood cells hold the largest blood bank market share on account of its vital role in transfusion therapy, particularly in patients with anaemia, surgical procedures, and blood disorders. According to the AMERICAN RED CROSS ORGANIZATION, approximately 29,000 units of red blood cells are required each day in the United States. Another major factor driving the demand for red blood cells is the increasing number of unpaid voluntary blood donors across the globe. Moreover, the limited shelf life of red blood cells is further creating a rising demand, according to the aforementioned organization, utilization of red blood cells within 42 days or less is suggested.

Analysis by Bank Type:

- Private

- Public

Private leads the market in 2025. The private banks hold the maximum number of shares in the market on account of their well-built infrastructure, large presence, and competitive edge in catering to the increasing demand for blood-related services and products. Additionally, private blood banks are also easily accessible to a wide range of healthcare communities and facilities. According to the PRESS INFORMATION BUREAU, DELHI March 2022, the number of private blood banks in the state of UTTAR PRADESH alone are 322. This widespread network of these blood banks allows them to collect blood efficiently, further process it, and distribute it at a large scale, thus catering to the vast needs of healthcare organizations and patients, while ensuring quality and safety.

Analysis by Function:

- Collection

- Processing

- Testing

- Storage

- Transportation

Testing leads the market in 2025. Testing dominates the market in account of its important role in assuring compatibility, quality and safety of the blood products. Additionally, another vital factor driving to the eminence of testing is the consecutively rising number of blood donations globally. For instance, according to a report published by the WORLD HEALTH ORGANIZATION (WHO), approximately 118.54 million blood donations are collected across the globe. This large volume makes it necessary for testing protocols to scrutinize for infectious diseases, blood type compatibility, and numerous other factors in order to combat the risk of transfusion-transmitted diseases and adverse reactions.

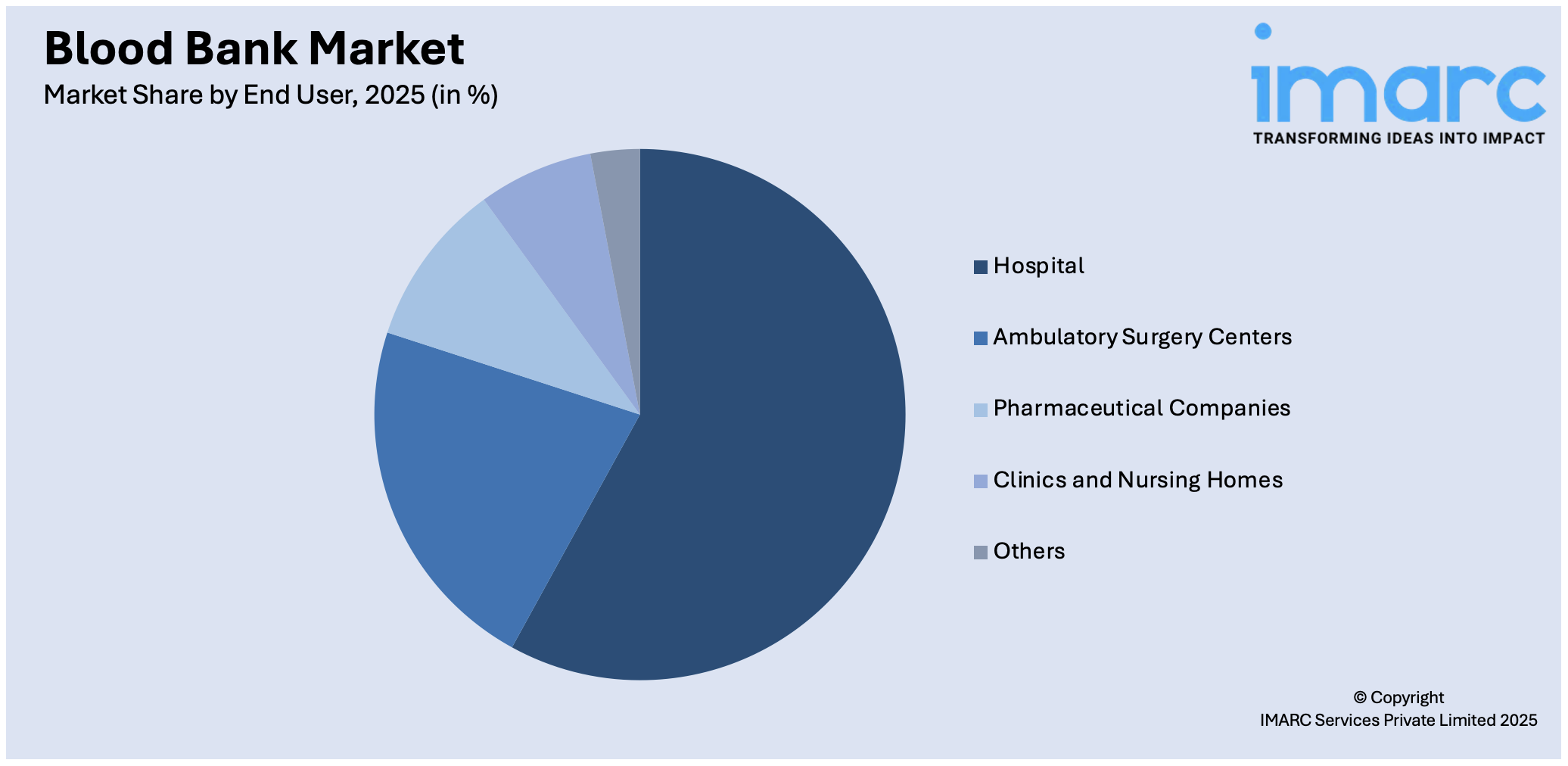

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Hospital

- Ambulatory Surgery Centers

- Pharmaceutical Companies

- Clinics and Nursing Homes

- Others

Hospitals leads the market with around 55.7% of market share in 2025. Hospitals hold the maximum number of shares on account of their core role in serving the population as healthcare providers and the primary source for patient care and medical interventions. Another factor building up a positive blood bank market forecast is the exponential rise in the number of medical procedures and treatments which require blood transfusions. According to the NATIONAL INSTITUTE OF HEALTH, the United States alone performs almost 64 million surgical procedures each year, from tooth extractions to open heart surgeries. The increasing number of these procedures is leading to a significant increase in the demand for blood banks.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 45%. One of the most prominent reasons of North America holds the maximum number of shares in this segment is the strong healthcare infrastructure of the region. Additionally, the rising number of donations across the region is also fostering market growth. Other than this, the rising number of chronic diseases across the region is also propelling the market growth. According to the CENTER FOR DISEASE CONTROL AND PREVENTION (CDC), 6 in 10 adults in the United Nations are diagnosed with one chronic disease, whereas 4 in 10 are diagnosed with 2 or more such diseases. These substantial figures make procedures such as blood transfusion regular, thereby creating a positive market outlook.

Key Regional Takeaways:

United States Blood Bank Market Analysis

US accounts for 85.7% share of the market in North America. The United States blood bank market is experiencing heavy growth due to the daily huge demand for blood and its by-products. In the United States, it has been estimated by the American Red Cross that some 29,000 units of red blood cells, 5,000 units of platelets, and 6,500 units of plasma must be collected and distributed every day to meet all patient needs around the country. Such a market demand has been influenced by conditions like trauma, surgeries, and chronic diseases necessitating the periodic administration of transfusions. Further, rare blood disorders, for instance, hemophilia, influence market growth as a result of managing these diseases. The National Institutes of Health, in 2020, report that an estimated one in 5,000 male births are afflicted with hemophilia. In general, the report stated that there were four cases of hemophilia A than the one case of hemophilia B. An increasing trend in the requirements of blood supplies and specialized treatment underscores the imperative need for unbroken supply conditions that drive this market expansion.

Europe Blood Bank Market Analysis

The growth of Europe blood bank market is witnessed as the incidence rate of anemia in hospitalized patients increases. The study by NHS conducted in 13 medical and surgical wards of the United Kingdom, reported in May 2021, shows that 52% of 267 patients admitted were anemic on admission. Of those admitted with no anemia at the onset, 62.2% developed anemia during the period of study while 16% had hospital-acquired anemia. These findings demonstrate the high need for blood transfusions and products in the treatment of anemia in medical and surgical practices.

The increasing prevalence of anemia due to chronic illnesses, surgeries, and other conditions requiring blood transfusions further drives the need for efficient blood bank services. This growing reliance on blood products to manage anemia-related complications underscores the critical role of blood banks in the region, promoting their expansion and adoption to meet healthcare demands across Europe.

Asia Pacific Blood Bank Market Analysis

The Asia Pacific blood bank market has a potential growth prospect mainly attributed to an aged population, particularly in this region, where a large increase in surgical operations has been forecasted. According to Asian Development Bank estimates, the percentage of Asia's and Pacific populations aged over 60 is estimated to grow up to one-quarter by 2050 and more than treble from levels at 2010 to stand around 1.3 billion. With these demographic shifts, the likelihood of increased demands for blood transfusions is great since elderly people have higher risks for chronic diseases, surgical procedures, and other diseases requiring blood product replacement. Moreover, India, a market major in the geography, experiences an estimated 30 million surgical procedures each year. What is more, 85 percent of those practices are conducted in smaller and mid-size hospitals, while only 15 percent in corporate hospitals, which can be seen from the industry analysis conducted in 2024. This calls for the implementation of integral blood bank infrastructures regarding the rising healthcare demands in various hospital settings within this region.

Latin America Blood Bank Market Analysis

The Latin America market for blood banks is expected to grow significantly in light of cancer burden growing in that region. According to the European Society for Medical Oncology, new cases of cancer in Latin America and the Caribbean will increase to 2.4 million per year if the current rate prevails, which is a 67% increase from 2040. This increase, therefore, underscores the rising trend of blood transfusions that have become an indispensable part of the treatment of cancers, especially chemotherapy and surgeries.

The components in blood - which include red blood cells, platelets, and plasma - are extremely important for the management of cancer-related anemia, bleeding complications, and to provide immune support. The increasing incidence of cancer requires a sophisticated and efficient blood bank infrastructure to meet the health care demands in this region. In addition, awareness towards blood donation and governmental initiatives regarding health care access are expected to strengthen the construction of blood banks in the region.

Middle East and Africa Blood Bank Market Analysis

High prevalence of anemia in the region, especially among women and children, is one of the primary reasons for growth in the Middle East and Africa blood bank market. The World Health Organization estimated that 106 million women and 103 million children in Africa suffer from anemia. The high burden requires more blood transfusions, mainly in pregnant women, children, and patients undergoing surgeries or chronic disease management.

The high anemia incidence level along with the ongoing health infrastructure development of this region is likely to increase demand for expanded blood bank capacity. Blood banks play a pivotal role in reducing anemia level through blood transfusion; therefore, vital support is provided to control anemia-related complications. This will be further supported by awareness pertaining to the need for blood donations and continuous efforts in providing better access to healthcare facilities, leading to a more solid and responsive blood bank network in the region.

Competitive Landscape:

The blood bank industry is fiercely competitive, with leading companies emphasizing innovations in technology, forming strategic alliances, and expanding their presence across various regions. Major organizations dominate the U.S. market, while global entities contribute to innovation in blood processing and storage. For instance, in June 2024, Versiti Blood Center of Wisconsin opened a first-of-its-kind permanent blood and community resource center to address healthcare disparities in Milwaukee’s historically underserved communities on the North Side. Companies are investing in automated blood collection, pathogen reduction systems, and AI-driven inventory management to enhance efficiency. Government regulations and accreditation standards create barriers to entry, favoring established institutions. Additionally, increasing collaborations between hospitals, research institutions, and biopharmaceutical companies are intensifying competition and driving market growth.

The report provides a comprehensive analysis of the competitive landscape in the blood bank market with detailed profiles of all major companies, including:

- American Association of Blood Banks

- Blood Bank of Alaska

- Canadian Blood Services

- Haemonetics Corporation

- Japanese Red Cross Society

- New York Blood Center

- NHS Blood and Transplant

- Sanquin Bloedvoorziening

- Terumo Corporation

- The American National Red Cross

- Vitalant

Latest News and Developments:

- June 2024: Fresenius Kabi organized blood donation camps across different cities of China and continued similar activities across several countries. This campaign was more focused on the awareness and necessity of blood donation.

- December 2023: BD received the FDA approval of its MiniDraw Capillary Blood Collection System to expand its list of products for the market.

- April 2022: The Scottish National Blood Transfusion Services announced the launch of an advertising campaign “PEOPLE LIKE YOU”, which acknowledges blood donors across the region of Scotland.

- September 2021: The Illinois Medical District (IMD), Chicago partnered with the American Red Cross to inspire individuals from ethnic and racial minorities to donate blood.

Blood Bank Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Whole Blood, Red Blood Cells, Platelet, Plasma, White Blood Cells |

| Bank Types Covered | Private, Public |

| Functions Covered | Collection, Processing, Testing, Storage, Transportation |

| End Users Covered | Hospital, Ambulatory Surgery Centers, Pharmaceutical Companies, Clinics and Nursing Homes, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Association of Blood Banks, Blood Bank of Alaska, Canadian Blood Services, Haemonetics Corporation, Japanese Red Cross Society, New York Blood Center, NHS Blood and Transplant, Sanquin Bloedvoorziening, Terumo Corporation, The American National Red Cross, Vitalant, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blood bank market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blood bank market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blood bank industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blood bank market size reached USD 18.6 Billion in 2025.

IMARC estimates the blood bank market to reach USD 26.0 Billion by 2034, exhibiting a CAGR of 3.80% during 2026-2034.

Key factors driving the blood bank market include rising demand for blood due to chronic diseases and surgeries, increasing trauma cases, government initiatives for blood donation, advancements in storage and transfusion technology, growing awareness about voluntary donation, and strategic collaborations between healthcare institutions, blood centers, and biotechnology companies.

North America currently dominates the market with a 45% share, driven by a well-established healthcare infrastructure, high blood donation rates, advanced transfusion technologies, strong regulatory frameworks, and major players like the American Red Cross. Increasing demand for blood components in surgeries, trauma care, and chronic disease management further strengthens its market position.

Some of the major players in the blood bank market include American Association of Blood Banks, Blood Bank of Alaska, Canadian Blood Services, Haemonetics Corporation, Japanese Red Cross Society, New York Blood Center, NHS Blood and Transplant, Sanquin Bloedvoorziening, Terumo Corporation, The American National Red Cross, Vitalant, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)