Blockchain in Telecom Market Size, Share, Trends and Forecast by Provider, Organization Size, Application, and Region, 2025-2033

Blockchain in Telecom Market Size and Share:

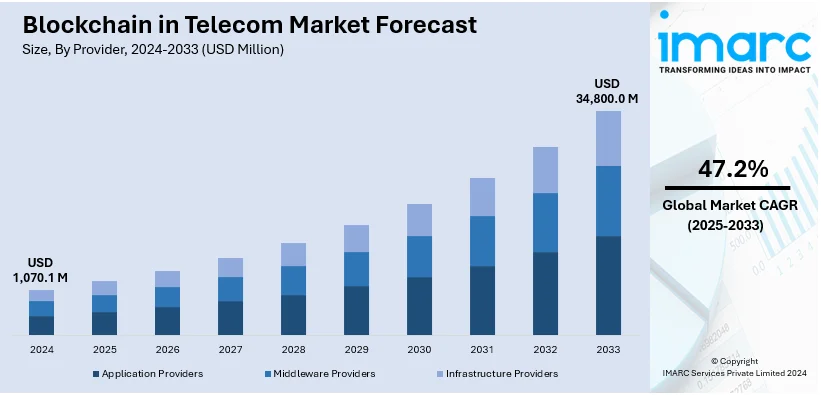

The global blockchain in telecom market size was valued at USD 1,070.1 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 34,800.0 Million by 2033, exhibiting a CAGR of 47.2% during 2025-2033. North America currently dominates the market, holding a significant market share of over 37.4% in 2024. The market is experiencing steady growth driven by the growing need to safeguard networks and protect user information among telecom operators, the rising utilization of Internet of Things (IoT) devices in the agriculture, healthcare, and manufacturing sectors, and the escalating demand for cost reduction and cost-efficiency.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,070.1 Million |

|

Market Forecast in 2033

|

USD 34,800.0 Million |

| Market Growth Rate (2025-2033) | 47.2% |

The global market is driven by increasing demand for secure and transparent communication networks, the growing adoption of 5G technology, and the rising need for fraud mitigation in the telecom sector. Blockchain enhances security by enabling decentralized and tamper-proof systems, addressing issues such as data breaches and unauthorized access. Additionally, the proliferation of Internet of Things (IoT) devices and the need for seamless data exchange further fuel blockchain adoption in telecom. By the end of 2023, connected IoT devices totaled 16.6 billion, up 15% from 2022, and this was according to the report of 2024 from IoT Analytics. The report predicted a further 13% growth in 2024, with a total of 18.8 billion by the end of the year. Projections also revealed that by 2030, the total number of IoT-connected devices could rise to 40 billion. Regulatory compliance requirements and the push for efficient billing systems also contribute to market growth. Furthermore, strategic partnerships and investments by telecom companies in blockchain solutions underline their growing relevance, positioning it as a key enabler of next-generation telecom services and operational efficiency.

The United States stands out as a key regional market, primarily driven by federal and state-level policies aimed at modernizing transportation infrastructure. The push for interoperability among tolling systems across states is fostering the adoption of advanced ETC technologies. The increasing prevalence of cashless transactions and consumer preference for contactless payments have also contributed to the market growth. Furthermore, the rising adoption of public-private partnerships for toll road construction and maintenance is expanding the deployment of ETC systems. Urbanization and population growth are placing greater demands on highway infrastructure, driving the need for efficient toll collection to fund road improvements. Additionally, sustainability goals are encouraging the implementation of ETC systems to reduce vehicle idling and emissions at toll plazas.

Blockchain in Telecom Market Trends:

Enhanced security and data privacy

Blockchain technology is fundamentally altering how telecom companies handle security and data privacy. The decentralized and immutable nature of blockchain ensures that consumer data, transactions, and sensitive information are stored securely. With data breaches becoming increasingly common, telecom operators are turning to blockchain to safeguard their networks and protect user information. According to reports, the average cost of a data breach in India reached an all-time high of INR 195 Million in 2024. This rising security not only enhances customer trust but also helps telecom companies comply with stringent data protection regulations, such as general data protection regulation (GDPR) and central consumer protection authority (CCPA). Moreover, the transparency of blockchain enables people to have more control over their data. They can grant or revoke access to their information, reducing the risk of unauthorized data sharing. Telecom operators are leveraging these advantages to differentiate themselves in a highly competitive market, attracting people who prioritize privacy and security. As data breaches are increasing, the demand for blockchain solutions in telecom is rising around the world.

Cost reduction and operational efficiency

Telecom companies are increasingly adopting blockchain technology to streamline their operations and reduce costs. The decentralized ledger system of blockchain eliminates the need for intermediaries in various processes, including billing and settlements. By automating these operations through smart contracts, telecom operators can significantly reduce administrative overhead and errors associated with traditional methods. Moreover, blockchain facilitates real-time verification of transactions, enabling faster and more accurate billing processes. This not only improves user satisfaction but also reduces revenue leakage. Telecom providers can also benefit from more efficient supply chain management through blockchain, ensuring the timely procurement and delivery of equipment and services. Additionally, blockchain simplifies the management of complex agreements among telecom partners, such as roaming and interconnection agreements. Smart contracts can automatically enforce terms and conditions, reducing disputes and operational disruptions. As telecom companies are seeking ways to enhance their competitiveness and cut operational costs, blockchain emerges as a powerful tool to achieve these goals, driving its adoption across the industry.

Expanding use of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices is propelling the growth of the market. As the number of IoT devices is growing across industries, including agriculture, healthcare, and manufacturing, the need for a secure and efficient data exchange infrastructure is becoming paramount. Blockchain technology provides a decentralized and tamper-resistant platform for IoT data management and communication. Seagate Technology PLC estimated that 2020 was the year when data globally was generated at approximately 47 zettabytes and will grow to about 163 zettabytes in 2025. It helps in maintaining the integrity of data obtained from such devices and also enhances the credibility of the information being generated by the IoT sensors. This is crucial in applications where data accuracy is critical, such as remote patient monitoring, autonomous vehicles, and supply chain management. Telecom operators are capitalizing on this trend by offering blockchain-based IoT connectivity solutions. These solutions enable secure device onboarding, data sharing, and micropayments for IoT services. By integrating blockchain with IoT, telecom companies position themselves to meet the growing demand for reliable and secure IoT communication, thus driving the adoption of blockchain technology in the telecom industry.

Blockchain in Telecom Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blockchain in the telecom market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on provider, organization size, and application.

Analysis by Provider:

- Application Providers

- Middleware Providers

- Infrastructure Providers

Infrastructure providers stand as the largest component in 2024, holding around 62.4% of the market. This can be attributed to their critical role in delivering the foundational technologies that enable blockchain integration. These providers offer essential hardware, software, and cloud-based solutions to support blockchain networks within telecom operations. Their offerings help establish robust and scalable blockchain platforms, ensuring seamless connectivity, data security, and high transaction speeds. As telecom companies increasingly adopt decentralized systems for fraud prevention, billing management, and secure communication, the demand for infrastructure solutions continues to rise. Additionally, the expansion of 5G networks and IoT connectivity further amplifies the need for advanced blockchain infrastructure, solidifying the dominance of infrastructure providers in driving innovation and adoption in the telecom industry.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market with around 71.7% of market share in 2024. Large enterprises in the telecom sector have the financial resources and operational scale to invest in and implement blockchain solutions effectively. They often face complex challenges related to security, data management, and operational efficiency due to their extensive consumer bases and global operations. Large enterprises leverage blockchain to enhance security, streamline billing and settlement processes, and improve consumer trust. They have the capacity to undertake comprehensive blockchain projects and collaborations with other industry leaders, making them the primary contributors to the growth of the blockchain in the telecom market.

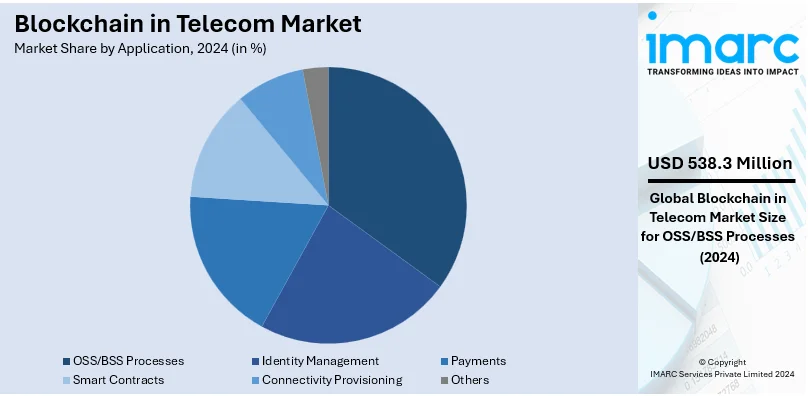

Analysis by Application:

- OSS/BSS Processes

- Identity Management

- Payments

- Smart Contracts

- Connectivity Provisioning

- Others

OSS/BSS processes lead the market with around 50.3% of market share in 2024 due to their pivotal role in managing operational efficiency and business workflows. Blockchain technology enhances OSS (Operational Support Systems) and BSS (Business Support Systems) by providing secure, transparent, and immutable records, reducing errors in billing, provisioning, and fraud detection. Telecom operators leverage blockchain to streamline processes such as inter-carrier settlements, identity management, and real-time monitoring, ensuring greater accuracy and cost-effectiveness. Additionally, blockchain integration addresses challenges such as revenue leakage and complex multi-party transactions. As the telecom sector embraces digital transformation, the need for innovative solutions to optimize OSS/BSS processes drives this segment's growth, making it a cornerstone of blockchain applications in telecommunications.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 37.4% due to early adoption and a strong presence of key players. The advanced telecom infrastructure in the region and commitment to technological innovation make it a fertile ground for blockchain applications. In North America, blockchain is widely used for secure data management, identity verification, and enhancing consumer trust. The presence of major telecom companies and favorable regulatory environments is propelling the growth of the market.

Key Regional Takeaways:

United States Blockchain in Telecom Market Analysis

In 2024, the US accounted for around 77.10% of the total North America blockchain in telecom market. The US market has well established telecom players including Comcast, AT&T, Verizon and more, which has been a major driving factor in the market. Moreover, these telecom operators are embracing blockchain to enhance security, mitigate fraud risks, and ensure transaction integrity, especially in identity management and secure payment systems. For instance, according to Communications Fraud Control Association (CFCA), telecommunications fraud impacted companies with a 12% increase in fraud loss globally in 2023 as compared to 2021 which is equating to an estimated USD 38.95 Billion. Owing to such frauds, telecom operators are researching blockchain to enable them to better manage the volumes of data developed so accurately with reduced errors while increasing the transparency in the storage and sharing of data. The increased adoption of blockchain with 5G infrastructures helps in managing network slicing, data privacy, and the distribution of resources, hence serving the deployment of 5G efficiently. In fact, CTIA indicated that 5G launched in 2018 covered 330 Million Americans. As a result, telecom firms are leveraging blockchain to automate service-level agreements and billing systems through smart contracts, thereby making service provision seamless and transparent. Telecom providers are also using blockchain to manage international roaming and billing in an efficient manner, which is creating a trustworthy environment between operators and customers and thus promoting cross-border telecom services.

Asia Pacific Blockchain in Telecom Market Analysis

Asia Pacific region has large telecom market. Telecom operators in the region are also expanding blockchain usage to facilitate more secure and efficient mobile payment systems, enabling direct peer-to-peer transactions and reducing payment processing costs. According to India Brand Equity Foundation (IBEF), digital payments which also includes mobile payments in India increased to reach USD 162.4 Million transactions in 2023. Additionally, telecom providers are utilizing blockchain to ensure compliance with data privacy regulations. The PIB reports that TSPs block 45 lakh fake overseas calls using Indian phone lines every day. Also, the Telecom Regulatory Authority of India (TRAI) issued an advisory warning about an increase in scam calls where fraudsters impersonated officials. Such rising telecom frauds project the importance of blockchain in the telecom industry, thereby driving the market in Asia Pacific.

Europe Blockchain in Telecom Market Analysis

In European countries, the blockchain in the telecom market is significantly influenced by stringent regulations, such as the General Data Protection Regulation. Moreover, it has been reported that blockchain has the potential to save the telecom industry a whooping USD 8 Billion annually by reducing fraud and administrative overheads. For instance, AAG's article shares that in 2023, 32% of UK companies experienced a cyber incident, with the number jumping to 59% for medium firms and 69% for bigger ones. Owing to such advantages, leading telecom companies in the region are driving the integration of blockchain in the telecom industry, which in turn is driving the regional growth in the market.

Latin America Blockchain in Telecom Market Analysis

Telecom companies are utilizing blockchain to establish secure and immutable digital identities, enhancing the user verification process for services including mobile number portability and mobile payment. With the ongoing rollout of 5G, telecom providers are incorporating blockchain to manage the complexities of 5G networks, including authentication, security, and decentralized management of high-speed data flows. For example, the GSMA predicts that by 2030, 5G would make up about 60% of all mobile connections in Latin America. In line with this, telecom companies are leveraging blockchain for decentralized and secure solutions to expand network coverage in underserved rural areas, making connectivity more affordable and efficient which in turn is also driving the adoption of blockchain to manage the rising data in the telecom industry.

Middle East and Africa Blockchain in Telecom Market Analysis

In the MEA region, telecom companies are continuously using blockchain to improve cybersecurity frameworks, reducing the risks of data breaches and securing customer information in an increasingly connected ecosystem. In this regard, companies are using blockchain to support IoT network management, providing secure device connectivity, and ensuring scalable, low-cost infrastructure for the growing IoT market across the region. In addition, the technology is being used to safeguard mobile top-up services and protect fraud and authenticity for prepaid transactions, which have huge acceptance in the region. According to the Saudi Arabian government, in 2021, electronic payment means were used to process 84% of all business payments within Saudi Arabia. Thus, the rising mobile payments has facilitated the market growth in the region and is expected to continue the trend in the near future.

Competitive Landscape:

The competitive landscape of the blockchain in telecom market is highly innovative and strategic in action by key players. Companies have been focusing on developing advanced blockchain solutions tailored to address challenges in the telecom sector, including fraud prevention, secure sharing of data, and real-time processing of transactions. Collaborations and partnerships are not uncommon, allowing firms to pool their expertise and expand their presence in the market. Many heavy investments are being witnessed in research and development, looking towards creating superior blockchain scalability and interoperability for telecom applications. Besides, companies are starting pilot projects and combining blockchain with new technologies such as 5G and IoT to deliver end-to-end solutions. The race to protect intellectual property rights and offer customized BaaS platforms is also defining the competitive landscape.

The report provides a comprehensive analysis of the competitive landscape in the blockchain in telecom market with detailed profiles of all major companies, including:

- Amazon.com Inc.

- Blockchain Foundry Inc.

- Cegeka

- Deloitte Touche Tohmatsu Limited

- Huawei Technologies Co. Ltd.

- Infosys Limited

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Tbcasoft Inc.

- Wipro Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- February 2022: Under the Airtel Startup Accelerator Program, Bharti Airtel, the leading communications solutions provider in India, announced that, pending the necessary regulatory permissions, it has acquired a strategic position in Aqilliz, a Blockchain as a Service Company. Across its rapidly expanding Adtech, Digital Entertainment, and other Digital Marketplace businesses, Airtel intends to expand the use of Aqilliz's state-of-the-art blockchain technologies.

- March 2021: AWS, the cloud platform provided by Amazon.com Inc., and Ingram Micro Cloud, an AWS distributor and Advanced Consulting Partner, have announced a new worldwide Strategic Collaboration Agreement (SCA). The goal of this multi-year, collaborative investment is to use Ingram Micro Cloud to accelerate the global expansion of AWS Partners.

- July 2020: Leading North American blockchain development company Blockchain Foundry Inc. teamed up with Matic Network ("Matic") to investigate potential interoperability between the Syscoin and Matic networks. Though they have used various approaches, Matic and BCF's Syscoin Ethereum bridge provides scalability for the Ethereum network. Due to their complimentary projects, Blockchain Foundry and Matic will combine cooperative ventures, marketing and business development-focused activities, and research projects.

- November 2020: International Business Machines Corporation announced a definitive agreement to acquire Instana, an application performance monitoring and observability company, to help businesses better manage the complexity of modern applications that spans the hybrid cloud landscape.

Blockchain in Telecom Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Providers Covered | Application Providers, Middleware Providers, Infrastructure Providers |

| Organization Sizes Covered | Small And Medium-Sized Enterprises, Large Enterprises |

| Applications Covered | OSS/BSS Processes, Identity Management, Payments, Smart Contracts, Connectivity Provisioning, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon.com Inc., Blockchain Foundry Inc., Cegeka, Deloitte Touche Tohmatsu Limited, Huawei Technologies Co.Ltd., Infosys Limited, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Tbcasoft Inc., Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blockchain in telecom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global blockchain in telecom market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blockchain in telecom industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Blockchain in telecom refers to the integration of decentralized, tamper-proof ledger technology into telecommunications processes. It enhances security, data integrity, fraud mitigation, and operational efficiency by eliminating intermediaries and enabling transparent, automated operations such as billing, identity management, and data sharing.

The blockchain in telecom market was valued at USD 1,070.1 Million in 2024.

IMARC estimates the global blockchain in telecom market to exhibit a CAGR of 47.2% during 2025-2033.

The market is driven by the need for secure communication networks, the adoption of 5G, increasing IoT device usage, rising concerns about fraud mitigation, and demand for cost-efficient solutions that enhance operational efficiency and transparency.

Infrastructure providers represented the largest segment by provider, driven by their foundational role in delivering scalable blockchain platforms and seamless connectivity.

Large enterprises lead the market by organization size due to their financial resources and the ability to implement complex blockchain solutions for global operations.

The OSS/BSS processes segment is the leading application, driven by the need for accurate billing, fraud detection, and efficient inter-carrier settlements.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the market.

Some of the major players in the global blockchain in telecom market include Amazon.com Inc., Blockchain Foundry Inc., Cegeka, Deloitte Touche Tohmatsu Limited, Huawei Technologies Co.Ltd., Infosys Limited, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Tbcasoft Inc., and Wipro Limited, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)