Blister Packaging Market Size, Share, Trends and Forecast by Product Type, Technology, Raw Material, End-Use, and Region, 2025-2033

Blister Packaging Market Size and Share:

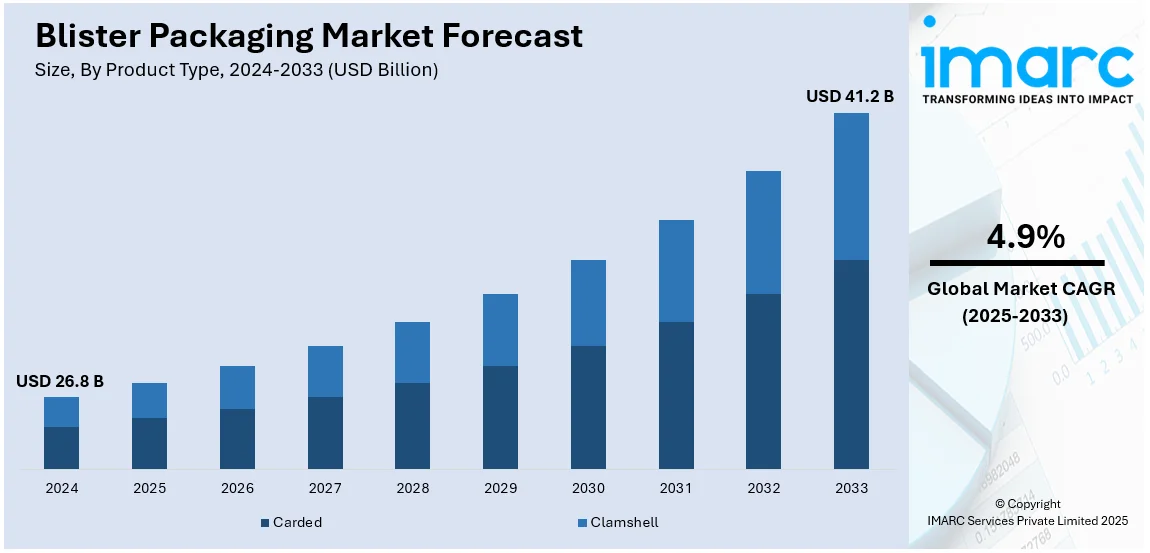

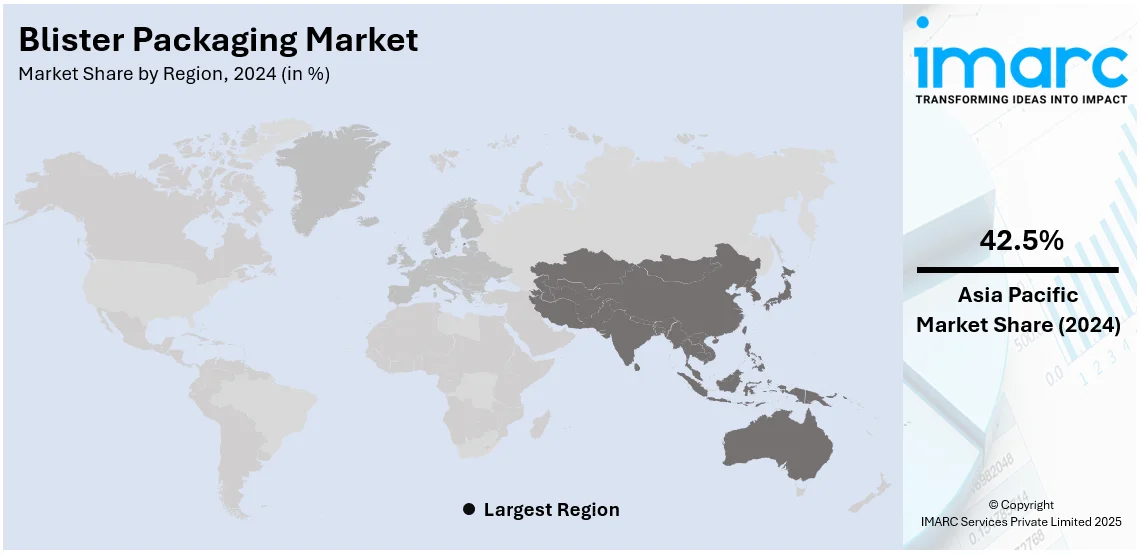

The global blister packaging market size reached USD 26.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 41.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.9% during2025-2033. Asia Pacific currently dominates the market, holding a market share of over 4.9% in 2024. The expanding product demand in the healthcare sector, stringent pharmaceutical packaging standards, advancements in packaging technology, significant growth in the e-commerce industry, increasing per capita income, enhanced product visibility, and rising retail competition are some of the factors providing a thrust to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 26.8 Billion |

|

Market Forecast in 2033

|

USD 41.2 Billion |

| Market Growth Rate 2025-2033 | 4.9% |

Blister packaging is gaining momentum due to the rising demand from different end-use sectors for safe and efficient packaging system at cost-effective terms. Moisture and light being an environmentally hostile exposure factor blister packaging maintains product integrity for a longer time during the shelf life. The industrial growth of the food and beverage industry is another factor as they provide excellent control on portioning and visibility with tamper-proofness ideal for consumables like snacks intended for single use by the consumer. Sustainability is another major growth-inducing factor. It emphasizes eco-friendliness through recyclable plastics to install biodegradable substitutes in accordance with consumer-sought governmental demands. The need for lightweight, customized and appealing packaging propels markets across various industries.

The United States has emerged has a key regional market for blister packaging. This is due to the major demand from industries like pharmaceuticals and healthcare. It protects from moisture, contamination and tampering that eventually keeps medicines in integrity over a lengthy shelf life. Due to increasing stringent regulations regarding drug safety such blister packaging has been adopted by pharmaceutical companies to fulfill the established standards for product labeling and traceability. Blisters pack offer easy-to-use designs into better portability for over-the-counter drugs and dietary supplements. Environmental aspects are also transforming trends as manufacturers require sustainable resources with recyclable plastics and biodegradable films among others.

Blister Packaging Market Trends:

Escalating product demand in the healthcare sector

The blister packaging market on a global scale is determined by the increasing demand for products in the healthcare sector. Given the growing population of elderly people and the increased focus on healthcare across the globe, it is becoming essential to pack pharmaceuticals and medical devices efficiently and safely. According to the World Population Prospects 2022, a higher percentage of the global population above 65 years of age is projected to be growing faster than that of the younger age group and would rise from 10% in 2022 to 16% by the year 2050. Some benefits typically associated with blister packing are product protection, prevention from contamination, shelf life, and patient care via a dosage control and patient compliance information right on the packaging. The sector's transformation toward personalized medicine, along with the increase in chronic diseases, has propelled the requirement of blister packaging by this particular need to provide more precise and customized method application wherein medications can now be packed more accurately and in a tailored way.

Pharmaceutical industry's packaging requirements

In the pharmaceutical industry, there is a demand for blister packaging owing to its reliability and tamper-evident features. The global pharmaceutical drug delivery market size is estimated to be about USD 1,465.2 Billion by the year 2024. The primary task of packaging is to protect products from moisture, gas, and light, thus enhancing the efficacy of the products. The strong sealed nature of blister packs also protects against contamination, thereby ensuring the integrity of the drug. Blister packs provide immense patient safety benefits, such as minimizing drug errors, as well as sufficient labeling and instructions. For these reasons, the versatility of medication types, tablets, capsules, and liquid types, makes blister packaging a first choice among the pharmaceutical industries in addition to these benefits.

Advancements in packaging technology

The blister packaging market has advanced enormously due to the new technological advancements. Packaging materials and designs continue to increase strength, weight reduction, and use capacities, and are more cost-efficient packaging solutions. The modern blister packs are made safer for the user with features like child-resistance and easy access opening facilities that now make it accessible to a much broader class of consumers. Smart technologies such as QR codes and NFC tags have also been used in interactivity and traceability regarding products. The global near-field communication (NFC) market size reached USD 24.0 Billion in 2023. These advantages accrue to manufacturers in terms of greater production efficiencies and differentiation from their brands and also to improved consumer experience on convenience and accessibility to information.

Rising demand for consumer goods in emerging economies

The blister packaging is widely used in consumer goods. The growth of emerging economies has increased the consumption on various goods, from electronics to personal care and pharmaceuticals. According to an article in Business Standard, India's middle class will increase in size from 432 Million in 2020-21031 to reach 715 Million in 2030-31 and by 2047 will surpass 1.02 billion. Blister packaging is well known for its protective and aesthetic properties, making it the best option for carrying these products. It ensures the safe transport and storage of products while displaying them for better shelf appeal. The super ability of blister packaging to hold a variety of products in their respective shapes and sizes makes it the perfect choice for such markets as well.

Blister Packaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global blister packaging market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, technology, raw material, and end-use.

Breakup by Product Type:

- Carded

- Clamshell

Carded represents the largest segment as the demand for cost-effective yet secure packaging solutions is on the rise. The carded approach provides a clear view of the product which increases consumer trust and appeal. It is affordable and easy to produce making it popular in consumer electronics, pharmaceuticals, and personal care products. The segment benefits from the upsurge demand for tamper-evident and child-resistant packaging bringing safety and a compliance with all regulatory standards. The advancement of printing technology enhanced more attractive carded blister packs which fuels its adoption.

The growing demand for solid and theft-proof packaging methods is responsible for the increase in the clamshell segment. Clamshell packaging is also used because of its tough and compact design that offers maximum protection against damage and tampering of products. This kind of packaging suits high-value or fragile items. It is quite flexible and can be designed for wide ranges of shapes and sizes-so suitable for nearly every product. Innovations in ecofriendly materials continue to propel the growth in this segment since they are also being used for addressing environmental issues and also appealing to sustainability conscious consumers.

Analysis by Raw Material:

- Polyvinyl Chloride (PVC)

- Aclar

- Polyvinylidene Chloride (PVDC)

- Cyclic Olefin Copolymer (COC)

- Polypropylene (PP)

The market is dominated by polyvinyl chloride (PVC). The segment is driven by the increasing demand for cost-effective and versatile packaging solutions. PVC is known for its durability and flexibility is widely used in various packaging applications including blister packaging. Its ability to form easily, excellent barrier properties against moisture and gases and compatibility with various printing technologies make it a preferred choice for manufacturers. Other factors driving the growth of this segment are ongoing innovations that make PVC more environmentally friendly and the development of phthalate-free PVC compounds.

The aclar segment is growing due to the increasing demand for high-barrier packaging materials in the pharmaceutical sector. Aclar is brand of Polychlorotrifluoroethylene, or PCTFE offering excellent moisture and gas barrier properties which make it suitable for sensitive pharmaceutical products. The emphasis on product safety and shelf stability in the pharmaceutical sector as well as the need for high-quality packaging for sensitive drugs are driving the segment.

The increasing demand for advanced barrier coatings in packaging is driving the polyvinylidene chloride (PVDC) segment. PVDC provides excellent moisture, aroma and oxygen barrier properties which are critical for food products and pharmaceuticals to be preserved in quality and shelf life. The increasing demand from consumers for packaged goods with a longer shelf life and the stringent regulations for pharmaceutical packaging are major drivers for the growth of the segment.

The demand for high-performance, clear and lightweight packaging materials is driving the cyclic olefin copolymer (COC) segment. The trend of sustainable packaging solutions and the requirement of materials compatible with emerging drug formulations are contributing to the growth of the COC segment in the packaging industry.

The polypropylene (PP) segment is mainly driven by the increasing demand for lightweight, heat-resistant and recyclable packaging materials. It can resist chemicals, heat and moisture allowing it to be molded easily in various shapes hence, it is very versatile in food packaging, consumer goods as well as pharmaceutical applications. The growing trend towards sustainable packaging solutions and continuous improvements in the processes for recycling PP are significant factors that are driving growth in the PP segment in the blister packaging market.

Analysis by Technology:

- Thermoforming

- Cold Forming

Thermoforming leads the market mainly driven by increasing demand for cost effective and versatile packaging solutions. Thermoforming is favored because of its efficiency in producing large quantities of packaging and is favored for its ability to create lightweight and durable products. It is particularly appealing because of its flexibility in design which allows for the creation of custom shapes and sizes essential in sectors like food, pharmaceuticals and consumer goods. Thermoforming technology has become more accurate and faster over time which increases its efficiency and popularity in the packaging industry.

The cold forming segment is propelled by the growing demand for superior barrier protection in packaging especially in the pharmaceutical industry. Cold forming blister packaging is renowned for its exceptional barrier properties which effectively protects products from moisture, oxygen and light. This is highly suitable for sensitive products like pharmaceuticals and certain food items. The growing demand for high-quality packaging that ensures product integrity and extends shelf life benefits the segment.

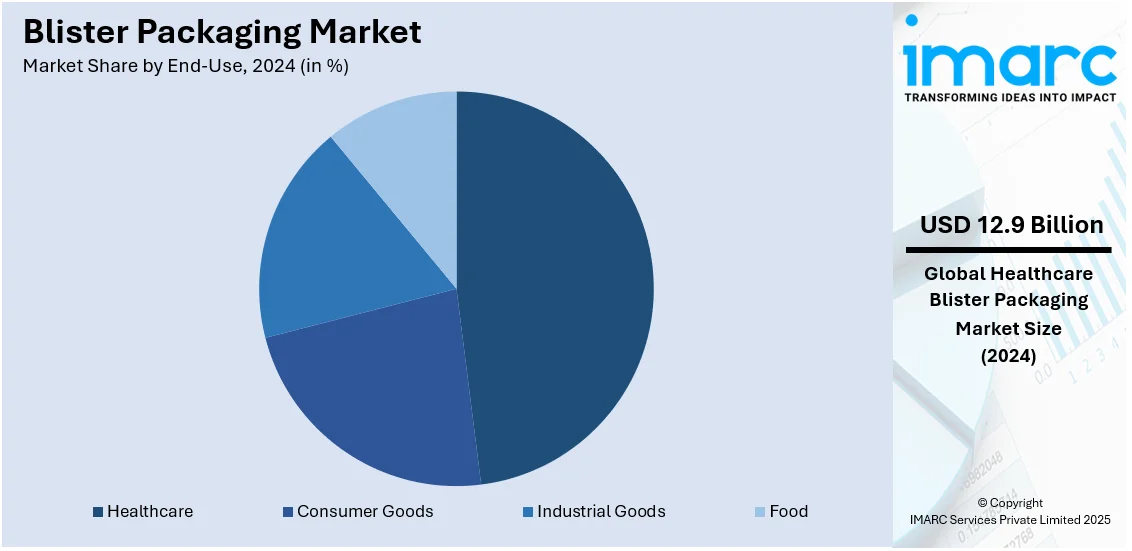

Analysis by End-Use:

- Healthcare

- Consumer Goods

- Industrial Goods

- Food

Healthcare dominates the market due to the increasing demand for secure and reliable packaging to ensure product integrity and patient safety. Blister packaging with its tamper-evident design is ideal for protecting medications from contamination and degradation. It also offers dosage control and easy-to-follow medication schedules enhancing patient compliance. The growth in personalized medicine and the expansion of over-the-counter medications further boost the demand for blister packaging in this segment.

The consumer goods segment is driven by the increasing need for durable and visually appealing packaging. Blister packaging is favored for its ability to provide product visibility protection against damage and ease of display in retail settings. The segment benefits from the adaptability of blister packaging accommodating a wide range of products from electronics to cosmetics.

The industrial goods segment is driven by the increasing requirement for robust and efficient packaging solutions. Blister packaging with its protective features is ideal for the safe transportation and storage of industrial products. The segment also values the customization capabilities of blister packaging allowing for specific designs to accommodate various industrial goods thus ensuring their integrity during handling and shipping.

The food segment is driven by the increasing demand for packaging that ensures food safety and extends shelf life. Blister packaging is becoming popular in this segment for its ability to maintain the freshness and quality of food products. The convenience of portion control and the ease of opening and closing make blister packs a preferred choice for consumers. The segment also benefits from innovations in ecofriendly and biodegradable materials aligning with the growing consumer trend towards sustainable packaging solutions.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share. The Asia Pacific blister packaging segment is driven by the increasing demand from the pharmaceutical and consumer goods sectors fueled by a large and growing population, urbanization and rising disposable incomes. The region's booming healthcare industry due to an aging population and increased health awareness significantly contributes to the demand for blister packaging.

The North America blister packaging segment is driven by the increasing demand for child-resistant and senior friendly packaging stringent regulatory standards in pharmaceuticals and a growing emphasis on sustainable and innovative packaging solutions. The region’s advanced healthcare infrastructure and the high prevalence of chronic diseases contribute to the demand for pharmaceutical blister packaging.

The Europe blister packaging segment is driven by the increasing emphasis on patient safety and medication adherence in the pharmaceutical industry, strict regulatory compliance and the adoption of ecofriendly packaging materials. The region's advanced healthcare system and the high demand for pharmaceutical products necessitate effective packaging solutions. Europe’s focus on sustainability leads to innovation in biodegradable and recyclable blister packaging materials.

The Latin America blister packaging segment is driven by the increasing healthcare expenditure growth in the pharmaceutical industry and rising consumer awareness about product quality and safety. The region's growing middle-class population and urbanization have led to a higher demand for consumer goods driving the need for reliable and attractive packaging.

The Middle East and Africa blister packaging segment is driven by the increasing investment in healthcare infrastructure, growth in the pharmaceutical and consumer goods sectors and the rising demand for quality packaging in retail. The region's growing population along with an increasing focus on healthcare and wellness contributes to the demand for pharmaceutical blister packaging.

Key Regional Takeaways:

United States Blister Packaging Market Analysis

The blister packaging market in the United States is primarily driven by the increasing demand for child-resistant and senior friendly packaging solutions especially in the pharmaceutical sector. With an estimated 129 Million people in the U.S. living with at least one major chronic disease such as heart disease, cancer, diabetes, obesity or hypertension the need for secure and convenient medication packaging is crucial to ensure patient safety and adherence. Stringent regulatory requirements particularly in the pharmaceutical and healthcare industries demand innovative packaging solutions that comply with federal standards contributing to the market's growth. Technological advancements in packaging design and materials such as the integration of smart packaging features are helping drive the sector forward. Sustainability is also a growing concern with increasing pressure to adopt environment friendly packaging solutions including recyclable and biodegradable blister packs. The rise of ecommerce has further boosted demand for durable and lightweight packaging that ensures product integrity during shipping.

Asia Pacific Blister Packaging Market Analysis

The blister packaging market in the Asia Pacific region is experiencing significant growth driven by increasing demand from the pharmaceutical and consumer goods sectors. East Asia and the Pacific, according to the World Bank, is the world’s most rapidly urbanizing region with an average annual urbanization rate of 3%. This rapid urbanization along with a large and growing population and rising disposable incomes fuels the need for efficient and reliable packaging solutions. The region’s booming healthcare industry driven by an aging population and heightened health awareness also plays a major role in the demand for pharmaceutical blister packaging. The rise of ecommerce has heightened the need for durable and lightweight packaging to ensure product safety during transit. The growing retail sector further accelerates the demand for attractive and secure packaging.

Europe Blister Packaging Market Analysis

In Europe, the blister packaging market is largely driven by the pharmaceutical industry’s focus on patient safety and medication adherence. According to Eurostat, on 1 January 2023, the EU population was estimated at 448.8 Million, with more than one-fifth (21.3%) of it aged 65 years and over. This aging population creates an increased demand for packaging solutions that ensure convenience, safety, and proper medication management. Strict regulatory standards in the region require packaging that meets high safety and quality standards, especially for pharmaceuticals. Additionally, the rise in healthcare expenditure and the adoption of advanced healthcare systems further boost the need for effective blister packaging. Sustainability is also a key factor driving market growth, with European countries emphasizing the adoption of eco-friendly packaging materials. This has led to the development of biodegradable and recyclable blister packs, catering to both regulatory requirements and consumer preferences for sustainable products.

Latin America Blister Packaging Market Analysis

The blister packaging market in Latin America is driven by the increasing healthcare expenditure and growth in the pharmaceutical industry. According to PubMed Central, Brazil experiences an estimated 928,000 deaths annually due to chronic diseases. This growing health burden is spurring demand for packaging solutions that ensure medication safety and adherence. Consumers are becoming more aware of product quality and safety, contributing to the growth of the blister packaging market in the region as healthcare and consumer awareness increase.

Middle East and Africa Blister Packaging Market Analysis

The blister packaging market in the Middle East and Africa is driven by increasing investments in healthcare infrastructure, growth in the pharmaceutical and consumer goods sectors, and rising demand for quality packaging in retail. According to PubMed Central, the prevalence of self-reported chronic diseases in the UAE is 23.0%, with obesity, diabetes, and asthma/allergies being the most common (12.5%, 4.2%, and 3.2%, respectively). This growing burden of chronic diseases, coupled with an increasing focus on healthcare and wellness, is fueling the demand for secure and effective pharmaceutical packaging.

Competitive Landscape:

Companies are focusing on developing innovative and sustainable solutions to meet changing consumer preferences and regulatory demands. For example, in the blister packaging market, firms are introducing recyclable and biodegradable materials to cater to the growing emphasis on eco-friendly packaging. Besides, industry leaders are forging alliances with raw material suppliers, technology providers, and distribution networks to streamline operations, reduce costs, and expand their market reach. Collaborations also enable them to leverage expertise in emerging technologies like smart packaging.

The report provides a comprehensive analysis of the competitive landscape in the blister packaging market with detailed profiles of all major companies, including:

- Amcor Limited

- Bemis Company, Inc.

- The DOW Chemical Company

- Westrock Company

- Sonoco Products Company

- Constantia Flexibles GmbH

- E.I.Du Pont De Nemours and Company

- Honeywell International Inc.

- Tekni-Plex, Inc.

- Display Pack, Inc.

- Pharma Packaging Solutions

Latest News and Developments:

- October 2024: Bayer, in partnership with Liveo Research, has introduced polyethylene terephthalate (PET) blister packaging for its Aleve brand, reducing the packaging's carbon footprint by 38% and eliminating polyvinyl chloride (PVC). Initially launched in the Netherlands, Bayer plans to transition all blister packaging to sustainable alternatives in the coming years.

- January 2024: TekniPlex Healthcare, in collaboration with Alpek Polyester, showcased a pharmaceutical-grade PET blister film that incorporates 30% postconsumer recycled (PCR) monomers at the Pharmapack Paris 2024. This product aims to provide a fully recyclable option for pharmaceutical companies while adhering to stringent safety and quality standards. The film's development positions TekniPlex as a leader in sustainable packaging solutions, addressing growing environmental concerns. Combined with Teknilid Push polyester lidding, the system is fully recyclable in polyester recycling streams. The PCR plastic undergoes chemical recycling to produce a resin with properties equivalent to virgin material, meeting stringent pharmaceutical standards outlined by European and U.S. Pharmacopoeias. This innovation addresses growing demand for sustainable pharmaceutical packaging solutions.

Blister Packaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Carded, Clamshell |

| Technologies Covered | Polyvinyl Chloride (PVC), Aclar, Polyvinylidene Chloride (PVDC), Cyclic Olefin Copolymer (COC), Polypropylene (PP) |

| Raw Materials Covered | Thermoforming, Cold Forming |

| End-Uses Covered | Healthcare, Consumer Goods, Industrial Goods, Food |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amcor Limited, Bemis Company, Inc., The Dow Chemical Company, Westrock Company, Sonoco Products Company, Constantia Flexibles GmbH, E.I.Du Pont De Nemours and Company, Honeywell International Inc., Tekni-Plex, Inc., Display Pack, Inc., Pharma Packaging Solutions, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the blister packaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global blister packaging market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the blister packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The blister packaging market was valued at USD 26.8 Billion in 2024.

The blister packaging market is projected to exhibit a CAGR of 4.9% during 2025-2033, reaching a value of USD 41.2 Billion by 2033.

The blister packaging market is primarily driven by the expanding product demand in the healthcare sector, stringent pharmaceutical packaging standards, advancements in packaging technology, significant growth in the e-commerce industry, increasing per capita income, enhanced product visibility, and rising retail competition.

Asia Pacific currently dominates the market, accounting for a share of 42.5%. The dominance is driven by the expanding product demand in the healthcare sector, stringent pharmaceutical packaging standards, and advancements in packaging technology.

Some of the major players in the blister packaging market include Amcor Limited, Bemis Company, Inc., The Dow Chemical Company, Westrock Company, Sonoco Products Company, Constantia Flexibles GmbH, E.I.Du Pont De Nemours and Company, Honeywell International Inc., Tekni-Plex, Inc., Display Pack, Inc., and Pharma Packaging Solutions, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)