Biscuits Market Size, Share, Trends and Forecast by Product Type, Ingredient, Packaging Type, Distribution Channel, and Region, 2026-2034

Biscuits Market Size and Share:

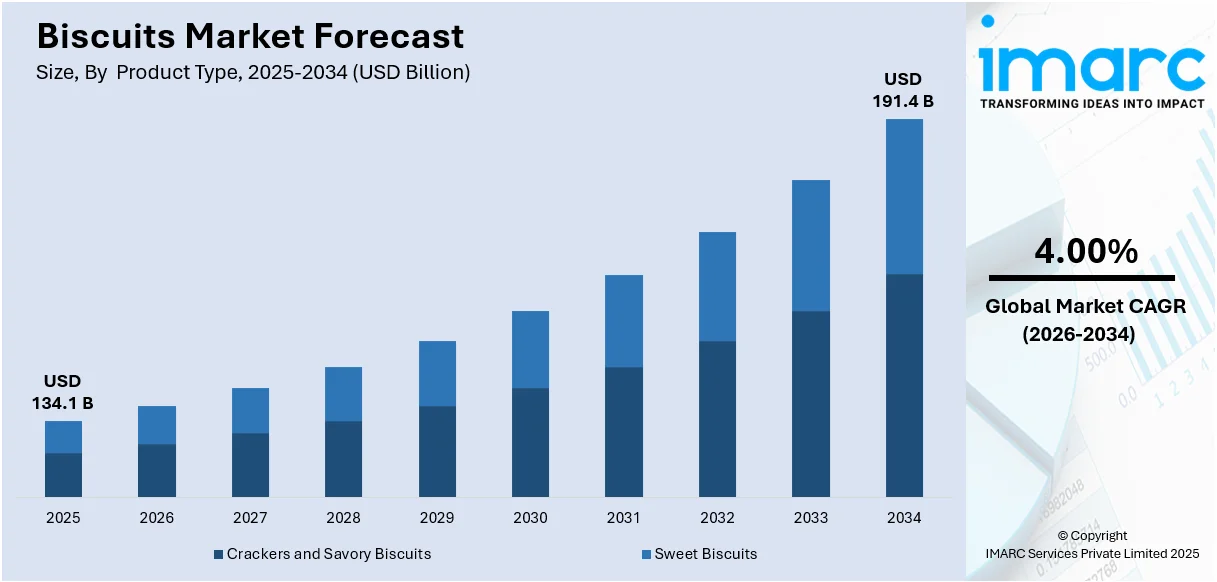

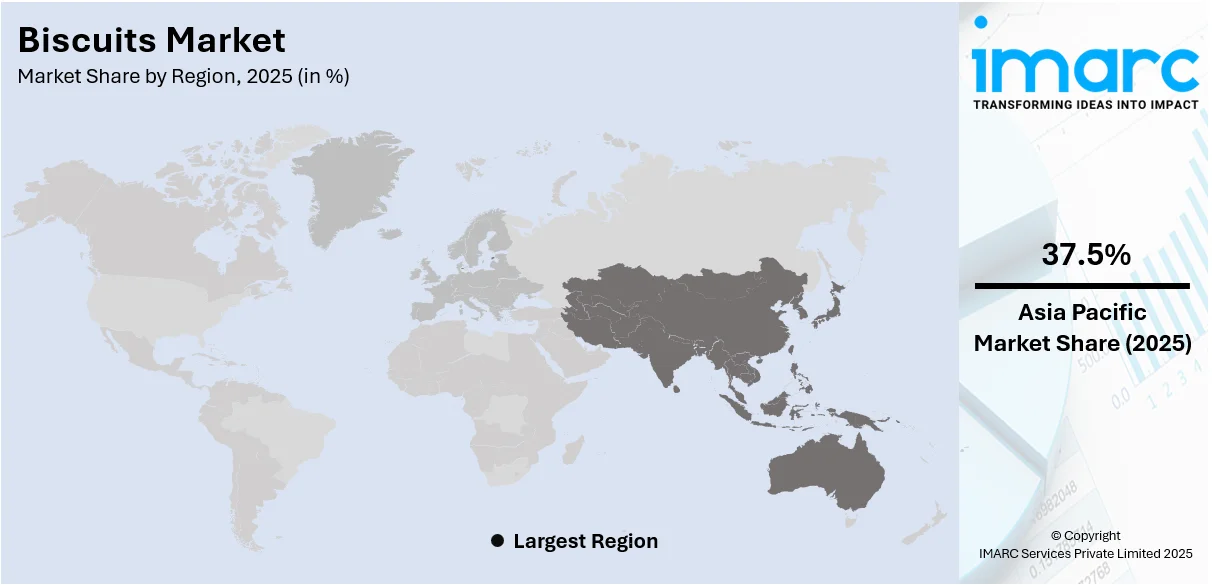

The global biscuits market size was valued at USD 134.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 191.4 Billion by 2034, exhibiting a CAGR of 4.00% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 37.5% in 2025. The market is driven by rising preference toward convenience snacking options, the introduction of innovative products in various flavors, textures, and shapes, and the easy product availability on online platforms are some of the major factors propelling the biscuits market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 134.1 Billion |

|

Market Forecast in 2034

|

USD 191.4 Billion |

| Market Growth Rate 2026-2034 | 4.00% |

One of the key drivers in the biscuits industry is growing demand for on-the-go and convenience snacking. With increasingly busy lives and urbanization on the rise worldwide, consumers are looking for quick, easy-to-carry foods that do not need to be prepared. Biscuits, with their long shelf life and diversity of flavors, formats, and nutritional levels, efficiently satisfy this need. Also, the increasing popularity of portion-pack and single-serve products further adds to their popularity among working professionals and students. This changing food habit of consumers due to time scarcity and convenience-seeking nature further fuels biscuit consumption in developed as well as emerging markets.

To get more information on this market Request Sample

The US biscuits market continues to expand, aligning with the broader growth of food retail sales, which reached USD 717 billion in 2019. Consumer demand for indulgent yet convenient snacks has positioned biscuits as a staple across various eating occasions, from breakfast to dessert. Innovation in flavors, organic and gluten-free variants, and premium offerings caters to health-conscious and gourmet consumers. The rise of portion-controlled packaging and on-the-go snacking further drives sales, while e-commerce and retail expansion enhance accessibility. Clean-label ingredients and unique textures are key differentiators, shaping purchasing decisions. With evolving consumer preferences and a strong retail landscape, biscuits remain a vital segment of the growing snack food industry in the US, with a market share of 87.50%, contributing to the dynamic food retail sector.

Biscuits Market Trends:

Impact of Growing Urban Population on Biscuit Consumption

Snacking has become a regular part of daily life, especially in fast-paced urban settings. As people juggle work, travel, and personal responsibilities, many turn to snacks that are quick, satisfying, and easy to carry. This shift is changing how and when people eat, with more choosing to snack throughout the day instead of sitting down for full meals. Biscuits fit well into this routine; they’re portable, don’t require preparation, and often come in portion-controlled packs that suit busy lifestyles. According to an industry report, 91% of global consumers snack daily, and 61% snack at least twice a day. Mindful eating is important to 96% of consumers, and 81% are drawn to snacks that offer a strong sensory experience. When it comes to indulgent options, 76% prioritize enjoyment over ingredients, while 75% look for variety and adventure in new flavors. These preferences are shaping the snack market, with biscuits gaining popularity for their versatility and convenience.

Evolving Lifestyles Driving Demand for Innovative Biscuit Options

Customers are drawn to products that offer something new or different from the usual. Introducing fresh flavors, unique ingredient blends, or innovative formats captures attention and helps boost sales while encouraging repeat purchases. By offering creative biscuit varieties, companies are also tapping into previously untapped market segments. Options like gluten-free, vegan, and organic biscuits are gaining traction as more people adopt specific dietary habits. At the same time, the release of premium and gourmet biscuits, featuring distinctive ingredients, handcrafted appeal, or upscale packaging, is adding to the overall demand, especially among consumers looking for a more refined snacking experience. A key development is the inauguration of Mondelēz International’s USD 5 Million Biscuit and Baked Snacks Lab and Innovation Kitchen in Singapore, on May 28, 2024. Strengthening its 2006-established Singapore Technical Centre, the expansion enhances product innovation, mindful snacking, and co-innovation, targeting Asia-Pacific’s premium snack market, leveraging Singapore’s strategic food ecosystem and skilled workforce.

Convenient Access to Biscuit Products Online

The 2024 UNCTAD report confirms that, in 2021, sales via e-commerce reached USD 25 Trillion in 43 economies, up 15% from 2019 and reaching USD 27 Trillion in 2022. Digitally ordered exports accounted for USD 2.5 Trillion. Online shopping prospered, with China, the UK, and South Korea topping at 25-30% of retail sales. Digital platform transactions also grew 55%. Online platforms have made it easier for consumers to explore and buy biscuit products without visiting a store. With a few clicks, people can browse different brands, check prices, read reviews, and place orders from home or on the go. This level of convenience is especially valuable in areas where access to physical stores or product variety is limited. E-commerce also supports the visibility of smaller and niche biscuit brands that may not have shelf space in traditional retail. Products like gluten-free, vegan, organic, or international biscuits can reach a wider audience through online listings. These platforms give such items a direct path to consumers who are actively looking for specific preferences or dietary needs. As a result, the biscuit market is seeing more activity, with greater consumer reach and exposure for a broader range of products. The convenience of online shopping continues to strengthen this trend and expand market opportunities.

Diverse Choices and Competitive Pricing Boost Biscuit Consumption

Consumers are increasingly looking for variety in their snack options, and biscuits are keeping up with this demand through a wide range of flavors, formats, and price points. From classic options to filled, coated, savory, or health-focused variants, the category continues to expand, appealing to different age groups and taste preferences. This variety allows consumers to switch between products without leaving the category, keeping interest high and encouraging frequent purchases. Alongside product diversity, competitive pricing plays a key role in driving volume. Manufacturers often offer biscuits in multiple pack sizes to cater to different budgets, from affordable single-serve options to family packs. Promotional deals and discounts, especially on online platforms and in modern retail, make biscuits even more accessible. The combination of product variety and price flexibility makes biscuits a dependable and appealing snack choice across income groups, further supporting growth in the category.

Product Innovations Reshaping Consumer Appeal

Ongoing innovation in the biscuit category is helping brands stay relevant and appealing in a crowded market. Companies are experimenting with bold flavor pairings, fusion recipes, and new textures to keep consumers engaged. Limited-edition launches, seasonal variants, and region-specific flavors are also being used to create buzz and encourage trial purchases. Beyond taste, changes in format, such as bite-sized options, sandwich-style biscuits, or protein-enriched and probiotic biscuits, are gaining popularity. Packaging innovations, including resealable packs and eco-friendly materials, are improving convenience and brand perception. These product upgrades not only draw attention but also help build a sense of novelty that encourages repeat buying. Such developments reflect a deeper shift in how consumers engage with everyday snacks: they want excitement, variety, and added value. Biscuit brands that invest in thoughtful innovation are better positioned to attract new customers and strengthen brand loyalty.

Biscuits Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biscuits market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, ingredient, packaging type, and distribution channel.

Analysis by Product Type:

- Crackers and Savory Biscuits

- Plain Crackers

- Flavored Crackers

- Sweet Biscuits

- Plain Biscuits

- Cookies

- Sandwich Biscuits

- Chocolate-coated Biscuits

- Others

Sweet biscuits dominate the market demand with 63.6% market shares owing to their wide consumer appeal, diverse flavor profiles, and suitability for various consumption occasions. Their versatility makes them a popular choice for snacks, breakfast alternatives, and indulgent treats. Sweet biscuits offer a broad range of options, including cream-filled, chocolate-coated, fruit-flavored, and butter-rich variants, catering to different age groups and taste preferences. Their long shelf life and affordability enhance accessibility across urban and rural markets. Additionally, continuous product innovations such as low-sugar, fortified, and gluten-free biscuits attract health-conscious consumers. Effective branding, attractive packaging, and promotional campaigns further boost their popularity. The emotional and comfort value associated with sweet treats also plays a significant role in driving sustained consumer demand globally.

Analysis by Ingredient:

- Wheat

- Oats

- Millets

- Others

Wheat holds the largest biscuits market share of 55.2% in the biscuits market driven by its widespread availability, cost-effectiveness, and nutritional value. As a staple grain, wheat is a preferred ingredient due to its high carbohydrate content and ability to provide a desirable texture, taste, and structure to biscuits. Its versatility allows it to be used in a variety of biscuit types, from sweet to savory, appealing to a broad consumer base. Moreover, wheat-based biscuits are easily digestible and familiar to consumers across different cultures and age groups. The growing popularity of whole wheat and high-fiber biscuits, driven by rising health awareness, further boosts wheat’s dominance. Its compatibility with other ingredients and adaptability to innovation continues to strengthen its market position.

Analysis by Packaging Type:

- Pouches/Packets

- Jars

- Boxes

- Others

Pouches and packets account for the majority of shares of 48.6% in the biscuits market due to their convenience, practicality, and consumer-friendly design. These packaging formats are lightweight, compact, and easy to handle, making them ideal for both home consumption and on-the-go snacking. They help maintain product freshness, extend shelf life, and allow portion control, which appeals to both individual consumers and families. Pouches and packets also offer cost-effective solutions for manufacturers in terms of production and transportation. Additionally, they provide ample space for attractive branding and product information, enhancing shelf visibility and consumer engagement. The availability of various sizes—ranging from single-serve to bulk packs caters to different purchasing behaviors, further reinforcing their dominance in the market.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Independent Bakery

- Online Stores

- Others

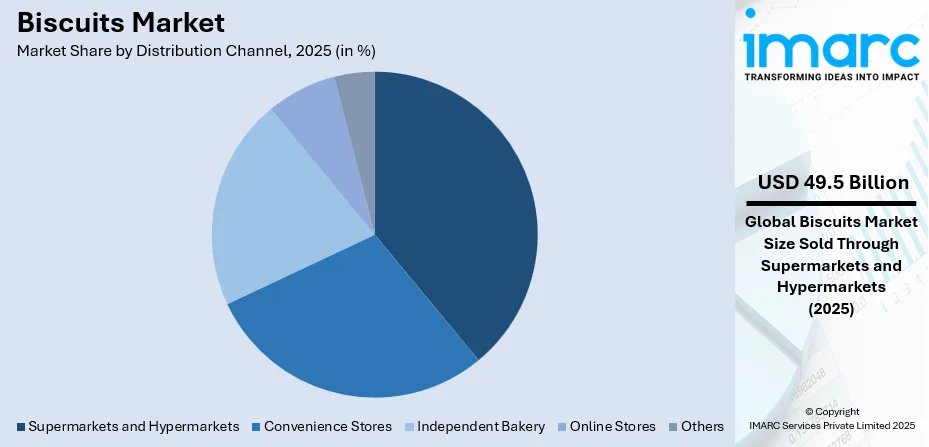

According to the biscuits market forecast, supermarkets and hypermarkets represent the largest market share of 38.5% in the biscuits market owing to their wide product assortment, strong brand visibility, and convenient shopping experience. These retail formats offer consumers access to a broad range of biscuit types, flavors, and price points under one roof, enhancing customer convenience and choice. Attractive in-store promotions, discounts, and product displays further drive impulse buying and consumer engagement. Their established supply chains and extensive geographical presence make them a preferred distribution channel for both global and regional manufacturers. Additionally, the ability to physically examine products before purchase builds consumer trust. The growth of urban centers and the increasing preference for one-stop shopping experiences continue to strengthen the dominance of this retail segment.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific is the leading segment in the biscuits market with a 37.5% share due to its large and rapidly growing population, rising disposable incomes, and increasing urbanization. The region’s expanding middle-class population is driving demand for convenient and affordable snack options like biscuits. Changing lifestyles and busy routines are further boosting consumption, especially among younger demographics and working professionals. Additionally, strong retail infrastructure development, including supermarkets and online platforms, has improved product accessibility. Cultural preferences for both sweet and savory snacks also contribute to high biscuit consumption. Localized flavors, innovative packaging, and affordable pricing strategies resonate well with regional consumers, strengthening market penetration. Moreover, growing awareness of health and wellness is pushing demand for fortified, low-sugar, and organic biscuit variants across key countries.

Key Regional Takeaways:

North America Biscuits Market Analysis

The market for biscuits in North America is dominated by high customer demand, fueled by changing snacking behavior, product innovation, and increasing inclination for convenience foods. Biscuits are consumed extensively by all sections of the population as an instant snack, breakfast food, or treat. The market is experiencing uniform growth as a result of increased demand for healthy variants, such as whole grain, low-sugar, gluten-free, and high-fiber biscuits. Customers increasingly prefer clean-label products made of natural ingredients, driving the industry to remake classical products. Innovation in the fields of taste, texture, and packaging sizes also supports the expansion of the market, and high-end and craft biscuit brands are winning acceptance. Online business and internet shopping platforms further expanded product accessibility and reach into customer bases. Supermarkets, hypermarkets, and convenience stores are still dominant retail channels with wide ranges and price promotions. Strong marketing campaigns and brand loyalty also significantly contribute to the momentum in the market. Also, well-established food processing infrastructure, efficient supply chains, and robust retail structures underpin growth in the market. Trends around sustainability such as recyclable packs and sustainable sources of ingredients continue to influence purchases, thereby keeping the North American biscuits market extremely dynamic and competitive.

United States Biscuits Market Analysis

The US biscuit market is changing with increasing demand for convenience, indulgence, and health-conscious snacking. Premiumization is a key trend, with consumers favoring artisanal, organic, and functional biscuits, including gluten-free, high-protein, and sugar-reduced variants. Similarly, indulgent offerings like chocolate-coated and filled biscuits remain popular, while private labels expand, competing with established brands, which is propelling the market growth. The e-commerce sector plays a crucial role in market expansion, allowing brands to reach wider audiences through direct-to-consumer models. The US Census Bureau reported Q4 2024 e-commerce sales at USD 308.9 Billion, reflecting a 2.7% increase from Q3 and 9.4% growth from Q4 2023. Furthermore, the increasing importance of sustainability, with brands investing in recyclable packaging and responsibly sourced ingredients, is impelling the market. Besides this, growth in multicultural flavors, driven by the expanding Hispanic and Asian populations, is influencing product development. As market competition intensifies, innovation in flavors, formats, and ingredient transparency is key to maintaining relevance in the shifting industry.

Europe Biscuits Market Analysis

The biscuit market in Europe continues to flourish, balancing strong consumer loyalty to traditional brands with growing demand for innovative and healthier options. In line with this, the rise in consumers seeking functional biscuits enriched with fiber, protein, and digestive benefits, while premium offerings featuring Belgian chocolate and European butter is propelling the market growth. Furthermore, an increase in sustainability is playing a crucial role in shaping purchasing decisions, pushing brands to adopt carbon-neutral production methods and eco-friendly packaging, thereby supporting the market demand. For example, the 2024 EU Food Biofuture programme aimed to position Europe as a leader in deep food biotechnology, with innovations like mycology, precision fermentation, and cellular agriculture projected to transform up to 40% of food production by 2040. These technologies provided sustainable, healthier, and cost-effective solutions, strengthening the EU food system’s resilience. Additionally, growth in e-commerce and direct-to-consumer models, making premium and specialty biscuits more accessible, is reshaping the market trends. Moreover, seasonal and festive biscuit sales remain a major growth driver, with themed products generating strong demand in markets like Germany, France, and the United Kingdom.

Asia Pacific Biscuits Market Analysis

The Asia Pacific market is expanding rapidly due to urbanization, rising disposable incomes, and increasing demand for convenient snacking. The World Bank projected that between 2022 and 2023, 7 Million people in the region would escape poverty at the lower-middle income poverty line (USD 3.65/day, 2017 PPP), while 37 Million would rise above the upper-middle income level (USD 6.85/day, 2017 PPP). This economic shift is driving demand for both mass-market and premium biscuits. Additionally, the rise in local flavors like matcha, mochi, and black sesame influences product innovation, while health-conscious consumers preferring whole grain, sugar-free, and fortified biscuits, particularly in Japan and China, is impelling the market. India remains a dominant mass-market, led by Parle and Britannia, while Southeast Asia sees a rise in premium offerings. Apart from this, growth in e-commerce platforms is expanding accessibility, and Western brands are localizing products to cater to evolving regional preferences, thereby positively influencing the market.

Latin America Biscuits Market Analysis

In Latin America, the biscuits market is propelled by the region’s strong local brands and affordability-driven consumer behavior, with major companies leading in Brazil, Mexico, and Argentina. Similarly, traditional flavors like dulce de leche, coconut, and vanilla remain popular, while low-sugar and fiber-enriched biscuits gain traction. Furthermore, rice sensitivity influences purchasing decisions, but the growing middle class is driving demand for premium and imported biscuits. E-commerce is expanding, with Brazil’s USD 56 Billion market projection by 2028, fueled by live commerce (33% preference), WhatsApp Business (70M downloads), and cross-border shopping (68% of consumers buying internationally). Additionally, heightened on-the-go consumption, leading to greater demand for single-serve and portion-controlled packaging, is making convenience a key growth driver in the market.

Middle East and Africa Biscuits Market Analysis

The market in the Middle East and Africa is experiencing growth driven by rapid urbanization, rising incomes, and changing diets. According to reports, two-thirds of the MENA population lives in urban areas, surpassing the 55% global average, and by 2050, the population is expected to double. Furthermore, traditional and western-style biscuits are in demand, with Ulker and Tiffany competing alongside international brands. The Middle East favors indulgent biscuits with dates, honey, and nuts, while Africa’s market is driven by affordable, energy-packed options for lower-income consumers. Moreover, the rise in health-conscious trends, with sugar-free and whole-grain biscuits gaining popularity, especially in the UAE and South Africa, is impelling the market. Besides this, e-commerce and modern retail are expanding accessibility, while government regulations on nutrition labeling are shaping innovation and competition in the region.

Competitive Landscape:

The competitive landscape is characterized by intense rivalry, driven by constant innovation, evolving consumer tastes, and price competitiveness. Players focus on differentiating their products through unique flavors, healthier formulations, and appealing packaging formats. The market includes a mix of traditional, artisanal, and modern offerings, catering to various consumer segments such as health-conscious, indulgence-seeking, and convenience-oriented buyers. Private-label brands are also gaining traction, adding further pressure on pricing strategies. Companies invest heavily in marketing, branding, and distribution channels, including e-commerce, to enhance market reach. The demand for premium and functional biscuits is encouraging continuous product development, while sustainability and clean-label trends are influencing manufacturing practices and consumer perception, shaping future competition in the sector.

The report provides a comprehensive analysis of the competitive landscape in the biscuits market with detailed profiles of all major companies, including:

- Bahlsen GmbH & Co. KG

- Britannia Industries Limited

- ITC Limited

- Lotus Bakeries Corporate

- Mondelez International Inc.

- Parle Products Pvt. Ltd.

- Pladis Global

- The Ferrero Group

- Walker's Shortbread

- Yildiz Holding

Latest News and Developments:

- September 2024: Integrated Industries Ltd announced that its subsidiary, Nurture Well Foods, launched a new biscuit range. The company acquired a 3,400 MT biscuit plant in Neemrana, Rajasthan. With 75% sales growth, Q1 2024 revenue surged to INR 1,401.4 Million. RICHLITE biscuits expand distribution across North India.

- August 2024: ITC Sunfeast launched Sunfeast Super Egg & Milk Biscuit, combining protein-rich egg and milk for children's nutrition. Introduced at INR 5, INR 10, and INR 30 across South and East India, the product aims to offer a convenient, nutritious snack, aligning with ITC’s ‘Help India Eat Better’ initiative.

- July 2024: McVitie’s announced the launch of its Signature range, featuring Caramel Chocolate Rounds, Chocolate Cream Swirls, and Chocolate Caramel Biscuits. Designed for indulgence, the range debuts in Waitrose on July 22, with wider availability soon. The biscuits offer premium ingredients, rich textures, and a luxurious snacking experience.

- July 2024: ITC Sunfeast SuperMilk launched the "Nalladhu Thedi Varum" campaign featuring Tamil superstars Sneha and Simran. Set in a village, the campaign highlights Sunfeast SuperMilk Biscuits' goodness, made with desi cow milk, emphasizing that good things come to you naturally, creating a heartwarming family experience.

- June 2024: Mondelēz International and Lotus Bakeries announced a partnership to expand Biscoff in India and develop co-branded chocolates with Cadbury and Milka in Europe. Mondelēz will manufacture and distribute Biscoff in India, while the first co-branded products will launch in early 2025, with global expansion potential.

Biscuits Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Wheat, Oats, Millets, Others |

| Packaging Types Covered | Pouches/Packets, Jars, Boxes, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Independent Bakery, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bahlsen GmbH & Co. KG, Britannia Industries Limited, ITC Limited, Lotus Bakeries Corporate, Mondelez International Inc., Parle Products Pvt. Ltd., Pladis Global, The Ferrero Group, Walker's Shortbread, Yildiz Holding, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biscuits market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global biscuits market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biscuits industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global biscuits market reached a value of USD 134.1 Billion in 2025 and is expected to reach USD 191.4 Billion by 2034, exhibiting a CAGR of 4.00% during 2026-2034.

The biscuit market is leaning toward health and indulgence. In India, 70% of urban consumers prefer biscuits as a daily snack, with 40% choosing varieties labeled as “healthy” or “digestive.” Chocolate and cream-filled biscuits hold over 35% market share by value. In the UK, 45% of sweet baked goods launches claim vegetarian status.

The biscuit market serves a broad global audience across age groups and income levels. In India, the organized sector holds 60% of production, led by Britannia and Parle, while rural demand is rising due to low-cost packs. Globally, cookies dominate sales, with North America holding over 30% market share.

Key factors driving the biscuits market include rising demand for convenient and on-the-go snacks, growing health awareness prompting product innovation, and expanding retail infrastructure. Additionally, evolving consumer preferences for diverse flavors, clean-label ingredients, and premium offerings, along with increasing urbanization and disposable incomes, significantly contribute to market growth globally.

Asia Pacific currently dominates the biscuits market with a market share of 37.5% due to its large population, rapid urbanization, and increasing disposable incomes. Rising demand for affordable, convenient snacks and expanding retail networks further drive consumption. Local flavor preferences, product innovations, and the growing popularity of packaged food also contribute significantly to the region’s market leadership.

Some of the major players in the biscuits market include Bahlsen GmbH & Co. KG, Britannia Industries Limited, ITC Limited, Lotus Bakeries Corporate, Mondelez International Inc., Parle Products Pvt. Ltd., Pladis Global, The Ferrero Group, Walker's Shortbread, Yildiz Holding, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)