Biotechnology Reagents Market Report by Technology (Life Science Reagents, Analytical Reagents), Application (Protein Synthesis and Purification, Gene Expression, DNA and RNA Analysis, Drug Testing, and Others), and Region 2025-2033

Biotechnology Reagents Market Size:

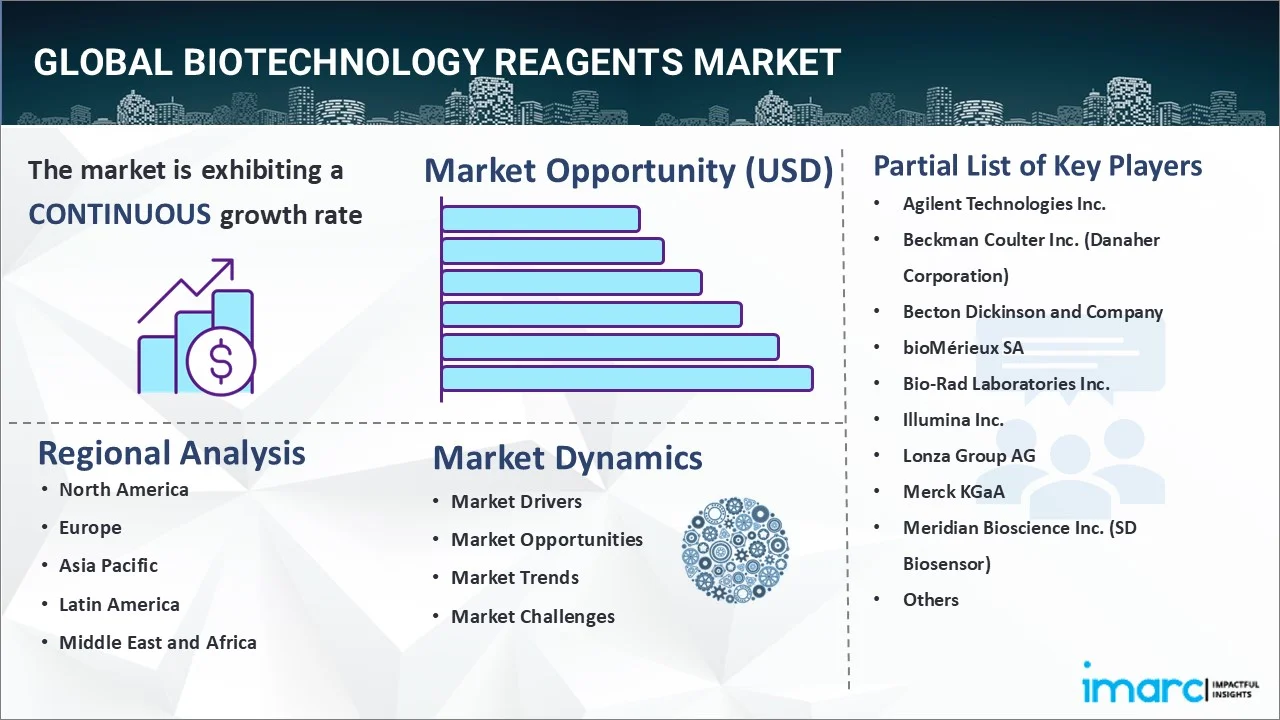

The global biotechnology reagents market size reached USD 91,748.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,74,735.4 Million by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033. The market is experiencing robust growth, driven by increasing investment in research and development (R&D) activities, rising demand in healthcare diagnostics and drug development, the heightened prevalence of chronic diseases and genetic disorders, and rapid technological advancements in production and automation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 91,748.0 Million |

|

Market Forecast in 2033

|

USD 1,74,735.4 Million |

| Market Growth Rate 2025-2033 | 7.05% |

Biotechnology Reagents Market Analysis:

- Major Market Drivers: The market is driven by the increase in global healthcare demands, particularly in diagnostics and therapeutic development, which necessitates extensive use of biotechnology reagents across various applications, heightened spending on research and development (R&D), and growing cases of chronic conditions and genetic disorders.

- Key Market Trends: There is a notable trend towards the automation of biotechnological processes, which increases the demand for specialized reagents that are compatible with automated systems, enhancing the speed and accuracy of biotechnological assays.

- Geographical Trends: North America remains the dominant region due to its advanced research infrastructure, significant research and development (R&D) investments, and robust regulatory environment supporting biotechnology innovations. Other regions are also expanding, fueled by increased healthcare spending, rising research activities, and governmental support to boost biotechnology as a part of national development.

- Competitive Landscape: Some of the major market players in the biotechnology reagents industry include Agilent Technologies Inc., Beckman Coulter Inc. (Danaher Corporation), Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories Inc., Illumina Inc., Lonza Group AG, Merck KGaA, Meridian Bioscience Inc. (SD Biosensor), PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific Inc., and Waters Corporation, among many others.

- Challenges and Opportunities: A major challenge in the market is the high cost and complexity that is involved in producing and maintaining high-quality reagents. However, this also presents an opportunity for market players to innovate in cost-effective production techniques and distribution strategies to make biotechnology reagents more accessible worldwide.

Biotechnology Reagents Market Trends:

Increasing Spending on Research and Development (R&D) in the Biotechnology Sector

The increase in research and development (R&D) spending within the biotechnology sector by governments and private entities is boosting the growth of the biotechnology reagents industry. This investment is driven by the recognition of biotechnology’s potential to provide solutions in healthcare, agriculture, and environmental conservation. Also, increased funding allows for more extensive and intensive research projects, which, in turn, is responsible for raising the demand for reagents used in many experiments and processes. For example, in the Union Budget 2023-24, the Department of Biotechnology (DBT), India was allotted US$ 162.7 million (Rs. 1,345 crores) to promote R&D, agriculture biotechnology, and many more, according to the latest 2024 update by the India Brand Equity Foundation (IBEF).

Rising Prevalence of Chronic Diseases and Genetic Disorders

The increase in chronic diseases and genetic disorders has motivated the biotechnology industry to develop new and improved diagnostic and therapeutic solutions. 6 in 10 adults in the US are suffering from chronic diseases. And 4 out of 10 people have more than two chronic conditions, based on the report by the Centers for Disease Control and Prevention. About 21% of the older adults in India reportedly have at least one chronic disease. 17% of geriatric people in rural areas and 29% in urban areas suffer from at least one chronic disease. Hypertension and diabetes account for about 68% of all chronic diseases. This medical need is driving the demand for biotechnology reagents. They are vital in diagnosing conditions at the molecular level and creating genetic therapies.

Growing Applications in the Pharmaceutical and Healthcare Sectors

Biotechnology reagents are essential in the pharmaceutical industry as they are being utilized in drug discovery, pharmacogenomics, and toxicological testing. Growth in this sector is also contributing to the increased biotechnology reagent market revenue. The pharmaceutical sector is growing at an astonishing rate due to increased healthcare spending, better infrastructure, and greater awareness. For instance, by 2030, this sector in India is projected to grow to $130 billion. Additionally, India exports many medications to more than 200 nations. The country supplies over 50% of Africa’s requirement for generics, 40% of generic demand in the US, and 25% of all medicine in the UK. Also, the pharmaceutical industry in the UK has a turnover of 40.8 billion pounds. The growing demand for effective therapeutic drugs and the rising emphasis on accurate diagnostics are key drivers of the rising biotechnology reagents market share.

Biotechnology Reagents Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on technology and application.

Breakup by Technology:

- Life Science Reagents

- PCR

- Cell Culture

- Hematology

- In-Vitro Diagnostics

- Others

- Analytical Reagents

- Chromatography

- Mass Spectrometry

- Electrophoresis

- Flow Cytometry

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes life science reagents (PCR, cell culture, hematology, In-Vitro diagnostics, and others) and analytical reagents (chromatography, mass spectrometry, electrophoresis, flow cytometry, and others).

As per the biotechnology reagent market analysis and outlook, the life science reagents segment is a significant part of the market, encompassing products used in molecular biology, cell biology, genetics, and other biomedical research fields. They are essential for a variety of applications, including deoxyribonucleic acid (DNA)/ribonucleic acid (RNA) synthesis and purification, protein analysis, gene expression, and cell culture operations. Moreover, the increasing focus on research and development (R&D) in genomics and proteomics, advancements in molecular diagnostics, and the rising prevalence of chronic diseases that require novel therapeutic approaches are boosting the biotechnology reagents industry demand.

Based on the biotechnology reagents market trends and overview, analytical reagents form another crucial market segment and are predominantly used in chemical analysis, quality control, and clinical diagnostics. They are vital for spectrometry, chromatography, electrophoresis, and microscopy techniques. Analytical reagents benefit from the stringent regulatory requirements for product quality and safety in industries such as pharmaceuticals, food and beverage (F&B), and environmental testing.

Breakup by Application:

- Protein Synthesis and Purification

- Gene Expression

- DNA and RNA Analysis

- Drug Testing

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes protein synthesis and purification, gene expression, DNA and RNA analysis, drug testing, and others.

As per the biotechnology reagent market segmentation, the protein synthesis and purification segment addresses the high demand for specialized reagents required in various processes involved in producing and isolating specific proteins. They are crucial in biotechnological applications such as enzyme production, pharmaceuticals, research pertaining to cellular functions, and diseases. Moreover, the widespread expansion of proteomics research and the increasing importance of biologic drugs in treatments, which rely heavily on the precise synthesis and purification of proteins, is favoring the market growth.

Based on the biotechnology reagents industry research, the gene expression segment encompasses reagents used in analyzing and quantifying gene expression levels within various cell types and conditions. It is essential in research areas like developmental biology, cancer research, and genetic disorder studies, where understanding gene activity is pivotal. Moreover, rapid advances in high-throughput technologies and the growing use of gene expression in personalized medicine to tailor treatments based on an individual's genetic makeup are enhancing the biotechnology reagent market value.

The deoxyribonucleic acid (DNA) and ribonucleic acid (RNA) analysis segment includes reagents used in genomic studies, such as sequencing, polymerase chain reaction (PCR) amplification, and molecular diagnostics. It is critical for advancing genetic research, identifying infectious diseases, and developing genetic markers in clinical diagnostics. Furthermore, the rapid advancements in genomic technologies, decreased sequencing costs, and the broader adoption of next-generation sequencing techniques across various fields, including forensic science, oncology, and microbiology, are bolstering the market growth.

Based on the biotechnology reagent market research report, the drug testing segment involves reagents used in pharmacological research to analyze the efficacy, stability, and safety of new drug compounds. It is vital in the preclinical and clinical stages of drug development. Additionally, the increasing global pharmaceutical R&D expenditures, the rising demand for new therapeutic drugs, and stringent regulatory standards requiring comprehensive drug testing are favoring the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest biotechnology reagents market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for biotechnology reagents.

According to the biotechnology reagent market forecast, North America is the largest segment, driven by robust research infrastructure, substantial investments in biotechnology and pharmaceutical sectors, and the presence of leading biotech and healthcare companies. Moreover, the strong governmental support through funding and favorable regulatory policies aimed at advancing biotechnological research and healthcare innovations is catalyzing the market growth. Additionally, the rising adoption of advanced technologies, such as clustered regularly interspaced short palindromic repeats (CRISPR), next-generation sequencing (NGS), and personalized medicine, is boosting the market growth. Besides this, the presence of a well-established academic and research environment, coupled with collaborations between research institutes and the biotechnology industry, is enhancing the market growth.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the biotechnology reagents industry include Agilent Technologies Inc., Beckman Coulter Inc. (Danaher Corporation), Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories Inc., Illumina Inc., Lonza Group AG, Merck KGaA, Meridian Bioscience Inc. (SD Biosensor), PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific Inc., Waters Corporation, etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The top biotechnology reagent industry companies are engaging in a variety of strategic initiatives to strengthen their market position and drive growth. They are investing in research and development (R&D) to innovate and improve the quality, efficiency, and application range of their reagents. For instance, they are focusing on developing more specialized reagents for advanced research areas, such as genomics, proteomics, and personalized medicine. Additionally, major players are expanding their global presence through mergers and acquisitions, partnerships with biotechnological and pharmaceutical companies, and collaborations with academic and research institutions. Moreover, they are emphasizing regulatory approvals across different regions to ensure that their offerings meet the stringent standards required in critical research and clinical applications.

Biotechnology Reagents Market News:

- In June 2022, Agilent Technologies Inc. announced that previously CE-IVD marked instruments, kits, and reagents were released as IVDR Class A on May 26, 2022. This is in compliance with the new EU In Vitro Diagnostic Regulation (IVDR) regulation.

- In January 2022, Thermo Fisher completed the acquisition of PeproTech for a total cash purchase price of approximately USD 1,850.00 million. PeproTech's recombinant proteins portfolio complements Thermo Fisher's cell culture media products and will enable Thermo Fisher to provide customers significant benefits through an integrated offering.

Biotechnology Reagents Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Protein Synthesis and Purification, Gene Expression, DNA and RNA Analysis, Drug Testing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agilent Technologies Inc., Beckman Coulter Inc. (Danaher Corporation), Becton Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories Inc., Illumina Inc., Lonza Group AG, Merck KGaA, Meridian Bioscience Inc. (SD Biosensor), PerkinElmer Inc., Promega Corporation, Thermo Fisher Scientific Inc., Waters Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global biotechnology reagents market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global biotechnology reagents market?

- What is the impact of each driver, restraint, and opportunity on the global biotechnology reagents market?

- What are the key regional markets?

- Which countries represent the most attractive biotechnology reagents market?

- What is the breakup of the market based on technology?

- Which is the most attractive technology in the biotechnology reagents market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the biotechnology reagents market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global biotechnology reagents market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biotechnology reagents market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biotechnology reagents market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biotechnology reagents industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)