Bioresorbable Polymers Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Bioresorbable Polymers Market Size and Overview:

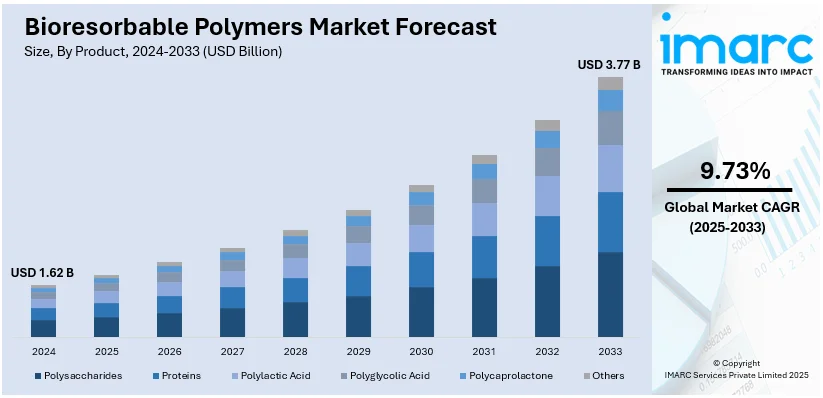

The global bioresorbable polymers market size was valued at USD 1.62 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.77 Billion by 2033, exhibiting a CAGR of 9.37% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.5% in 2024. The market is driven by expansion in the healthcare industry, an increasing prevalence of chronic diseases, and the rising demand for specialized orthopedic and drug delivery applications. Furthermore, advanced polymer development and extensive research and development (R&D) activities represent other key factors increasing the overall bioresorbable polymers market share across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.62 Billion |

|

Market Forecast in 2033

|

USD 3.77 Billion |

| Market Growth Rate (2025-2033) | 9.37% |

The key drivers in the bioresorbable polymers market are the increasing demand for advanced medical devices especially in drug delivery systems, tissue engineering, and surgical implants. The widespread adoption of minimally invasive surgeries and the rise in chronic diseases are further propelling market growth. For instance, in September 2023, Zeus Inc. launched Absorv™ XSE-oriented tubing as a key addition to its bioresorbable product line. This customizable platform enhances medical device design options beyond coronary applications offering improved wall thickness uniformity and greater efficiency. The innovation aims to replace permanent metallic stents in various procedures promising better outcomes for manufacturers and patients alike. Advancements in polymer technology that enhance biodegradability and biocompatibility are contributing to the market's expansion. Regulatory support and rising healthcare expenditure are also acting as significant factors driving the bioresorbable polymers market demand.

Key drivers in the United States bioresorbable polymers market include the rising prevalence of chronic diseases and the growing demand for advanced medical treatments particularly in drug delivery, orthopedic implants, and cardiovascular devices. For instance, in March 2023, Bioretec Ltd received FDA approval for its RemeOs™ trauma screw, making it the first company to introduce bioresorbable metal implants in the United States. The product eliminates the need for removal surgeries and promotes natural bone healing, thereby addressing a significant clinical need in orthopedic fracture treatment. The shift toward minimally invasive procedures is further accelerating the adoption of bioresorbable polymers. Ongoing advancements in polymer science offering improved biocompatibility and biodegradability are enhancing the performance of medical devices. Strong regulatory support and increasing investments in healthcare in the United States are driving the market's growth.

Bioresorbable Polymers Market Trends:

Growing Demand for Medical Applications

Increasing usage of bioresorbable polymers in medicine is being noticed due to the special feature of being naturally degraded within the body and hence not requiring surgical removal. They are most valuable in applications like drug delivery systems, tissue engineering, and surgical sutures. They also have a broad range of applications in orthopedic implants, cardiovascular devices, and wound healing. As the global healthcare market expands with the aging population and its increasing demand for minimally invasive procedures, bioresorbable polymers will see increased demand. According to the National Library of Medicine (NLM), it is estimated that 310 million major surgeries take place worldwide annually. Out of the total of these, 20 million operations are done in Europe and 40 to 50 million in the U.S. So, a huge market is viable for biodegradable medical applications. As surgeons increase their numbers, so will the demand for safe, efficient, and effective medical devices, thus fastening the pace towards adopting bioresorbable polymers. These factors are creating a positive bioresorbable polymers market outlook further across the world.

Advancements in Polymer Technology

Recent innovations in polymer science increase the properties of bioresorbable polymers, such as better mechanical strength, more controlled degradation, and improved biocompatibility. Their applications have diversified across various streams of medicine to an increasing extent of adoption for these polymers. Technologies, such as 3D printing, are adding the possibility for highly customizable patient-specific solutions in personalized medicine to boost demand for bioresorbable polymers. For instance, by the end of 2019, a total of approximately 737,000 cochlear implants had been performed worldwide according to the NIDCD or National Institute on Deafness and Other Communication Disorders. Moreover, the Organization for Economic Cooperation and Development (OECD) has reported a substantial increase in joint replacement surgeries. Hip replacement rates have increased by 22%, and knee replacements have increased by 35% between 2009 and 2019. These trends reflect the increasing dependence on bioresorbable polymers for medical devices, thus making them an integral part of the future of healthcare and driving market bioresorbable polymers market growth.

Increasing Focus on Sustainable and Eco-Friendly Materials

As environmental sustainability continues to gain momentum, bioresorbable polymers are positioned as the new, greener alternative to traditional plastics. The packaging, automotive, and agriculture industries, among others, are looking for sustainable materials that break down in nature, and the answer lies in bioresorbable polymers. Increasing plastic waste concerns and heightened regulatory pressure on environmental impact are pushing these materials into diverse non-medical applications. One such example is the introduction of the Naternal line by Solvay in June 2023, a new portfolio of biodegradable polymers tailored for hair and skincare applications. Such developments point to the growing trend of sustainable solutions that can help drive the growth of the bioresorbable polymers market beyond healthcare and make it more attractive across different industries. These bioresorbable polymers market trends are contributing positively to the market growth across the globe.

Bioresorbable Polymers Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global bioresorbable polymers market, along with forecasts at the global, regional, and country levels from 2025-2033. Our report has categorized the market based on product and application.

Analysis by Product:

- Polysaccharides

- Proteins

- Polylactic Acid

- Polyglycolic Acid

- Polycaprolactone

- Others

Polylactic acid leads the market with around 28.9% of market share in 2024. Polylactic acid (PLA) is the leading bioresorbable polymer in the market due to its excellent biocompatibility, biodegradability and versatile applications across various industries. PLA is widely used in medical devices, drug delivery systems and tissue engineering due to its ability to safely degrade in the body without harmful residues. It offers advantages like controlled degradation rates which are crucial for implantable devices. PLA's renewable sourcing from natural resources like cornstarch or sugarcane aligns with the growing demand for sustainable and ecofriendly materials. Its growing adoption across the healthcare sector is driven by these factors maintaining its dominant position.

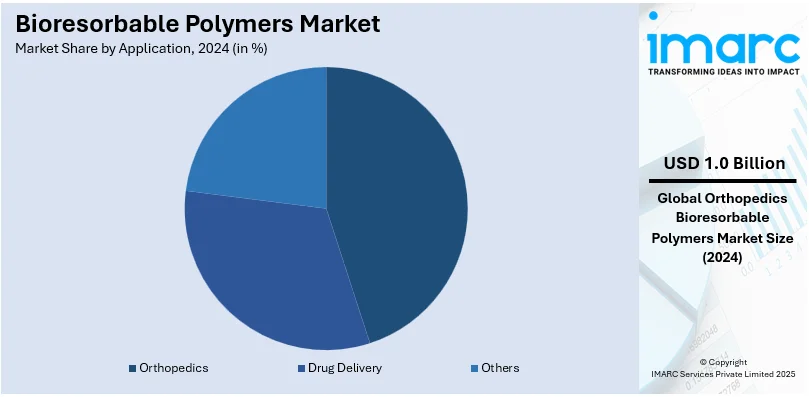

Analysis by Application:

- Drug Delivery

- Orthopedics

- Others

Orthopedics led the market with around 44.5% of bioresorbable polymers market share in 2024. Orthopedics is the leading segment in the bioresorbable polymers market due to the increasing demand for advanced materials in bone fixation devices, implants, and surgical treatments. Bioresorbable polymers like polylactic acid (PLA) and polyglycolic acid (PGA) are widely used in orthopedic applications because they gradually degrade within the body eliminating the need for removal surgeries. These materials provide excellent biocompatibility and support healing by offering mechanical strength during the recovery process. As the prevalence of musculoskeletal disorders rises and the demand for minimally invasive surgeries increases orthopedic applications of bioresorbable polymers are expanding driving market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.5%. North America accounts for the largest market share in the bioresorbable polymers market. Strong healthcare infrastructure, high demand for advanced medical technologies and increasing concern towards minimally invasive surgeries are the primary factors propelling demand in North America. The region has a well-established medical device industry and increasing awareness about the benefits of bioresorbable materials including reduced need for additional surgeries is further driving growth. Bioresorbable polymers are used the most in orthopedics, cardiovascular and drug delivery systems in the U.S. as it continues to make research and development investments that help create innovation. The regulatory support for advanced medical solutions also helps North America maintain its top position in this market.

Key Regional Takeaways:

United States Bioresorbable Polymers Market Analysis

In 2024, the United States captured 82.50% of revenue in the North American market. The U.S. market for bioresorbable polymers is moving forward rapidly by the surging demand for developing innovative medical solutions related to joint replacements and orthopaedic treatments. Total knee arthroplasty, one of the most popular inpatient surgery procedures, totalled 1.37 million cases in the year 2020, for which a consistent rise of annual cases is witnessed up to about 3.48 million from 2030, according to the NIH of the U.S. This increased number of surgeries emphasizes the rising demand for technologies such as bioresorbable polymers, which find applications in medical treatments such as surgical implants, sutures, and tissue engineering. Moreover, with healthcare expenditure being USD 4.3 trillion in 2021, with a 2.7% increase from the previous year, as per reports, ample investments find their way into new technology applications that enhance surgical outcomes and reduce recovery periods. Bioresorbable polymers will become pivotal for forming the future of medical interventions in terms of increasingly sustainable and minimally invasive treatments and further drives the market in the United States.

Europe Bioresorbable Polymers Market Analysis

The market for bioresorbable polymers is growing strongly in Europe, owing to the rapidly increasing demand for innovative medical solutions and the development of the medical device sector. The European market for medical devices has grown annually at a steady rate of 5.4% over the last ten years, which signifies the region's commitment to the adoption of high technologies in healthcare, as per reports. According to the National Institutes of Health (NIH), there are nearly 20 million major surgeries annually; therefore, demand for bioresorbable polymers in medical applications is rising. Such polymers possess distinctive advantages: safe dissolution within the body without necessitating removal and, therefore, suitable for applications in orthopedic implants, surgical sutures, and tissue engineering. Further innovation with healthcare technology continues to increase rising medical spending by making bioresorbable polymers an absolutely essential part in the medical treatment practices of European countries, creating safer and improved treatments.

Asia Pacific Bioresorbable Polymers Market Analysis

The growth potential of the Asia Pacific bioresorbable polymers market is huge, with several initiatives from the government and increased healthcare spending across its various countries. Programs such as India's 'Production Linked Incentive (PLI) Scheme for Medical Devices 2020' look to boost domestic manufacturing and lay down the right foundation for using bioresorbable polymers in medical applications. In addition, the development of medical device parks across the region will streamline production processes and enhance supply chains, fueling the demand for these polymers. The diagnostic equipment market is also on an upward trajectory, with projections indicating it will reach USD 6 Billion by 2027, up from USD 4 Billion in 2023, according to IBEF. This growth is further compounded by the growing demand for innovative medical technologies, including implantable surgery products and drug delivery systems. Going forward, more adoption of bioresorbable polymers in the region can be expected based on improving health infrastructure and new medical technologies developed.

Latin America Bioresorbable Polymers Market Analysis

Brazil happens to be the largest healthcare market in Latin America. According to the International Trade Administration, the country allocates 9.47% of its GDP in healthcare, with estimates being around approximately USD 161 billion. An enormous amount, thus spent upon health care has resulted in tremendous demand for modern medical technologies like that of bioresorbable polymers. This polymer used for different applications including drug delivery, surgical implants, and tissue engineering is also extremely popular these days because it's a highly friendly product as a better substitute to the effective utilization in the health industry. That time, it must be when Brazil needed to incorporate more innovative material in order to modernize their health structure. The growing preference for chronic disease treatment and provision for an older population is bringing in the increasing demand for least invasive and time-efficient treatment avenues. Additionally, the strong spending on healthcare across Brazil creates an attractive scenario to expand the bioresorbable polymers market. Although the trend here is not exclusively limited to Brazil; it is further gaining momentum elsewhere in Latin American countries, where the region constitutes a growing centre for this marketplace.

Middle East and Africa Bioresorbable Polymers Market Analysis

The healthcare sector in Middle East and Africa is growing greatly, with improved focus on preventable care as well as high willingness to employ emerging medical technologies. For the GCC, healthcare spending has been estimated at USD 135.5 Billion by 2027, as per the World Economic Forum report. This rise in investment on healthcare opens wide avenues for better medical solutions; one of such is bioresorbable polymers. These polymers are gaining popularity as they naturally break down in the body, and thus are useful for applications like drug delivery, surgical implants, and tissue engineering. With modernization of the healthcare systems in the region and increasing preference for minimally invasive treatments, the demand for bioresorbable polymers is likely to increase. As the region further develops health care, middle eastern and African countries can expect that bioresorbable polymers will play an important role in addressing the changing medical needs of the region.

Competitive Landscape:

The bioresorbable polymers market is highly competitive with several players focusing on product innovation, strategic collaborations and expanding their market reach. Companies are investing in research and development to enhance the properties of bioresorbable polymers improving their application in medical devices such as sutures, drug delivery systems and orthopedics. Key market players are also exploring partnerships with healthcare providers and regulatory bodies to streamline approval processes and accelerate product commercialization. As demand for minimally invasive surgeries grows and new medical applications emerge firms are increasing production capacities particularly in regions like North America and Europe to capitalize on the growing market opportunities. Innovation in polymer chemistry and sustainable manufacturing practices further intensify competition.

The report provides a comprehensive analysis of the competitive landscape in the bioresorbable polymers market with detailed profiles of all major companies, including:

- Ashland Global Specialty Chemicals Inc.

- Bezwada Biomedical LLC

- Corbion N.V.

- Evonik Industries AG (RAG-Stiftung)

- Foster Corporation

- Nomisma Healthcare Pvt. Ltd.

- Poly-Med Incorporated

- Reva Medical LLC

- Seqens SAS

- Zeus Company Inc.

Recent Developments:

- November 2024: Evonik unveiled flame-retardant PA12 and carbon black-embedded 3D printing materials at Formnext 2024, expanding their high-performance polymer offerings.

- September 2024: Evonik Venture Capital, alongside L'Oréal's venture capital fund BOLD, participated in a €35 million financing round for Abolis Biotechnologies, focusing on sustainable biomanufacturing and microbiome solutions.

- August 2024: Ashland expanded its facility in Ireland to improve the production capabilities of bioresorbable polymers, vital for upcoming demand in advanced pharmaceutical applications. Its new addition offers injectable technologies, long-acting formulations, bioresorbable devices, and tissue engineering solutions to be manufactured here.

- April 2024: Evonik is expanding its RESOMER powder biomaterials capacity at its facility in Germany. The company has added solvent-free micronization technology that enables Evonik to deliver customized medical powders for numerous implant and aesthetic applications.

- March 2023: Evonik and BellaSeno GmbH signed a long-term agreement to utilize Evonik's RESOMER® bioresorbable polymer in innovative breast implant technology.

- August 2021: Evonik acquired the German biotech company JeNaCell, which enables the expansion of its biomaterials portfolio. This acquisition integrates innovative cellulose-based materials used in wound care, dermatology, and medical technologies into Evonik's Health Care division.

Bioresorbable Polymers Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Polysaccharides, Proteins, Polylactic Acid, Polyglycolic Acid, Polycaprolactone, Others |

| Applications Covered | Drug Delivery, Orthopedics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ashland Global Specialty Chemicals Inc., Bezwada Biomedical LLC, Corbion N.V., Evonik Industries AG (RAG-Stiftung), Foster Corporation, Nomisma Healthcare Pvt. Ltd., Poly-Med Incorporated, Reva Medical LLC, Seqens SAS, Zeus Company Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the bioresorbable polymers market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global bioresorbable polymers market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the bioresorbable polymers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioresorbable polymers market was valued at USD 1.62 Billion in 2024.

IMARC estimates the bioresorbable polymers market to exhibit a CAGR of 9.37% during 2025-2033, expecting to reach USD 3.77 Billion by 2033.

Key factors driving the bioresorbable polymers market include the increasing demand for advanced medical devices, the growing prevalence of chronic diseases, the shift toward minimally invasive surgeries, and advancements in polymer technology that enhance biodegradability and biocompatibility, making these materials suitable for a wide range of medical applications.

North America leads the bioresorbable polymers market, capturing over 33.5% of the market share in 2024. This dominance is driven by a robust healthcare infrastructure, high demand for advanced medical technologies, and increasing adoption of minimally invasive surgeries. The region's strong regulatory support and growing investments in healthcare further contribute to its leading position.

Some of the major players in the bioresorbable polymers market include Ashland Global Specialty Chemicals Inc., Bezwada Biomedical LLC, Corbion N.V., Evonik Industries AG (RAG-Stiftung), Foster Corporation, Nomisma Healthcare Pvt. Ltd., Poly-Med Incorporated, Reva Medical LLC, Seqens SAS, Zeus Company Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)